Test: Economy - 2 - UPSC MCQ

25 Questions MCQ Test - Test: Economy - 2

Consider the following statements regarding Dumping:

It refers to a practice when the export price of a product is less than the cost of production in the home country.

Union Ministry of Finance is the nodal agency responsible for investigating the cases of dumping in India.

Which of the statements given above is/are correct?

It refers to a practice when the export price of a product is less than the cost of production in the home country.

Union Ministry of Finance is the nodal agency responsible for investigating the cases of dumping in India.

With reference to Viability Gap Funding (VGF), consider the following statements:

It is a grant provided to support projects which are economically justified but lack financial viability.

A private sector company shall be eligible for VGF only if it is selected on the basis of open competitive bidding.

Which of the statements given above is/are correct?

It is a grant provided to support projects which are economically justified but lack financial viability.

A private sector company shall be eligible for VGF only if it is selected on the basis of open competitive bidding.

| 1 Crore+ students have signed up on EduRev. Have you? Download the App |

Which of the following constitute a part of the Revenue Receipts of the Government of India?

Interest receipts on loans by the government

Dividends earned by the government on investments

Receipts through PSU disinvestments

Cash grants-in-aid from foreign countries

Select the correct answer using the code given below.

Interest receipts on loans by the government

Dividends earned by the government on investments

Receipts through PSU disinvestments

Cash grants-in-aid from foreign countries

Which of the following may lead to an increase in Personal Income in an economy?

Increase in national income

Increase in undistributed profits

Increase in corporate taxes

Select the correct answer using the code given below.

Which of the following fall within the purview of Capital account under the Balance of Payments?

Dividends on foreign assets which are abroad

Gifts from abroad

Foreign institutional investment

Select the correct answer using the code given below.

Which of the following statements is/are correct regarding Peer to peer (P2P) lending?

P2P lending is a form of crowdfunding used to raise loans without pledging security.

The interest rate is fixed by way of a mutual agreement between the borrower and lender.

Select the correct answer using the code given below.

In the context of the money supply in an economy, High Powered Money includes

In India, Know Your Customer (KYC) verifications are mandatory for which of the following sectors?

Banking

Equity Trading

Pension

Insurance services

Select the correct answer using the code given below.

With reference to Wholesale Price Index (WPI), consider the following statements:

It covers both services as well as goods.

It includes indirect taxes to account for the impact of fiscal policy.

Which of the statements given above is/are correct?

Which of the following sectors/categories fall under Priority Sector Lending (PSL)?

Loan to minorities

Education Loans

Loans for renewable energy

Overdraft under Pradhan Mantri Jan- Dhan Yojana

Select the correct answer using the code given below.

Which of the following services can be provided by a Small Finance Bank?

Pension products

Mutual fund services

Bank Deposits

F oreign Exchange

Select the correct answer using the code given below.

Which of the following was/were the outcomes of the Bretton Woods Conference held in 1944?

Setting up of International Monetary Fund (IMF) and the World Bank

Setting up of World Trade Organisation

Establishment of international gold exchange standard

Select the correct answer using the code given below.

The marginal productivity of labour force becomes zero in which of the following types of unemployment?

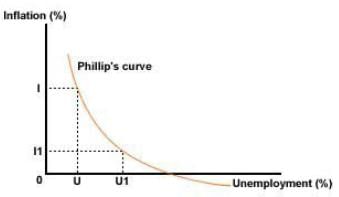

Which of the following curve shows that inflation and unemployment have a stable and inverse relationship?

Mumbai Inter-Bank Bid Rate (MIBID) is the benchmark rate at which banks:

Consider the following statements:

The sum of exports and imports as a proportion of GDP is an indicator of the degree of openness of an economy.

In an open economy, an increase in export can lead to an increase in the aggregate demand in domestic economy.

Which of the statements given above is/are correct?

With reference to Cash Reserve Ratio (CRR), consider the following statements:

CRR is the percentage of deposits which a bank must keep with itself in the form of any liquid asset.

Higher the CRR requirement, lower will be the credit creation in the economy.

Which of the statements given above is/are correct?

In an open economy, for the barter system to operate successfully, which of the following principles must be completely satisfied?

Which of the following changes are implemented after the merger of Railway Budget with the Union Budget?

Ministry of Railways receives Gross Budgetary support from Government of India.

The appropriations for Railways form a part of the main Appropriation Bill.

Railways are liable for dividend payments to the Government on their profits.

Select the correct answer using the code given below.

Which of the following fiscal policy statements are required to be laid before the Parliament under the Fiscal Responsibility and Budget Management Act, 2003 (FRBMA)?

Medium-term F iscal Policy

Fiscal Policy Strategy

Outcome Budget

Medium-term Expenditure Framework

Select the correct answer using the code given below.

Consider the following statements regarding

Deemed Exports Benefit Scheme:

Deemed Exports refers to those transactions in which goods supplied do not leave the country but the payment for such supplies is received only in foreign exchange.

The scheme violates the principle of import substitution.

The scheme is applicable to the units in Petroleum refinery and Nuclear Power Projects.

Which of the statements given above is/are correct?

Which of the following statements best describes the term Triffin dilemma?

With reference to methods of GDP estimation, consider the following statements regarding ’basic prices’:

It includes the payment to factors of production but does not include any tax.

The Gross Value added at basic prices will always be less than Gross Value added at market prices.

Select the correct answer using the code given below:

Consider the following statements regarding the differences between Proportional and Progressive taxation:

In progressive taxation, tax rate increases with an increase in the income whereas, in proportional taxation same percentage of tax is levied on all taxpayers.

As compared to progressive taxation, proportional taxation makes disposable income less sensitive to fluctuations in GDP.

Which of the statements given above is/are correct?