Test: Economic Survey 2021 (Volume I)- 1 - UPSC MCQ

15 Questions MCQ Test - Test: Economic Survey 2021 (Volume I)- 1

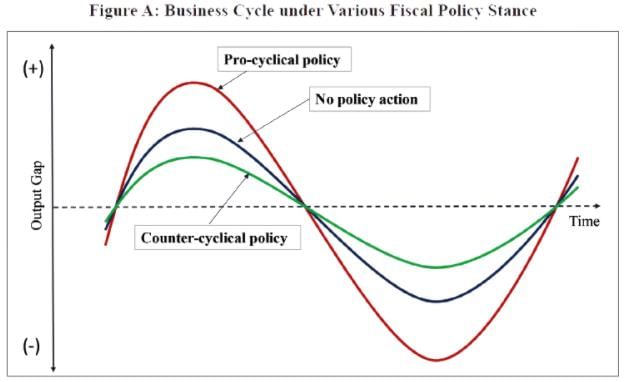

With reference to the Counter-cyclical Fiscal Policy Stance during the recession, consider the following statements:

- In an expansionary fiscal policy, the government expenditure is increased and taxes are reduced.

- The expansionary fiscal policy helps the government to deal with the recession in an economy.

Which of the statements given above is/are correct?

With reference to the GINI Coefficient, consider the following statements:

- It can be used to measure the wealth distribution among a population.

- The score of 0 represents perfect inequality and the score of 1 represents perfect equality.

Which of the statements given above is/are correct?

| 1 Crore+ students have signed up on EduRev. Have you? Download the App |

The World Rule of Law Index is released by:

The World Governance Index is released by:

Which of the following organizations is not a co-publisher of the Global Innovation Index?

1. World Intellectual Property Organization (WIPO)

2. Office of the United States Trade Representative (USTR)

3. World Trade Organization (WTO)

4. INSEAD

Select the correct answer using the code given below:

With reference to the Pradhan Mantri Ujjwala Yojana (PMUY), consider the following statements:

- Under this scheme, the LPG connection is provided in the name of an adult woman member of the family.

- The existing beneficiary with a 14.2 kg LPG cylinder has an option to swap with a 5 kg cylinder also.

Which of the statements given above is/are correct?

With reference to the structure of India’s debt, consider the following statements:

- Among the G-20 OECD Countries, India’s debt-to-GDP ratio is one of the highest.

- India’s total external debt is less than 3 percent of GDP.

- State government has 30 percent share in India’s total debt.

Which of the statements given above is/are correct?

As per the Economic Survey 2020-21, consider the following statements:

- Poverty concentration in urban areas of India has increased after post-liberalization in 1991 as compared to the 1950's.

- In the post-liberalisation period urban growth and non-agricultural growth has emerged as a major factor in poverty reduction including rural poverty.

Which of the statements given above is/are correct?

Consider the following statements about SPICe+ portal:

- This portal was launched by the Ministry of Ministry of Micro, Small and Medium Enterprises.

- Generation of Direct Identification Number is one of the features of this portal.

Which of the statements given above is/are correct?

Consider the following statements:

- Regulatory forbearance reduces the spillover effect of the crisis in the financial sector to other sectors.

- Due to regulatory Forbearance the restructured assets are also classified as Non-Performing Assets.

Which of the statements given above is/are correct?

Which of the following has launched GIS-enabled Land Bank System:

Consider the following statements:

- The Primary sector employs less than 50% of the workforce in India.

- The Gross Value Added by the primary sector in GDP is below 15%.

Which of the statements given above is/are correct?

Consider the following statements about the PM-eVIDYA:

- It is an initiative for multi-mode access to digital/online education.

- Special needs of the visually impaired have been considered under this initiative.

Which of the statements given above is/are correct?

Which of the following is responsible for implementation of PM-Jan Arogya Yojana?

Consider the following statements:

- The Fiscal Responsibility and Budget Management Act set the target to limit the fiscal deficit upto 3% of the GDP by 2021.

- The NK Singh committee was formed to create a roadmap for fiscal consolidation for the Center and the States.

Which of the statements given above is/are correct?