Test: Accounts from Incomplete Records- Case Based Type Questions - SSC CGL MCQ

10 Questions MCQ Test - Test: Accounts from Incomplete Records- Case Based Type Questions

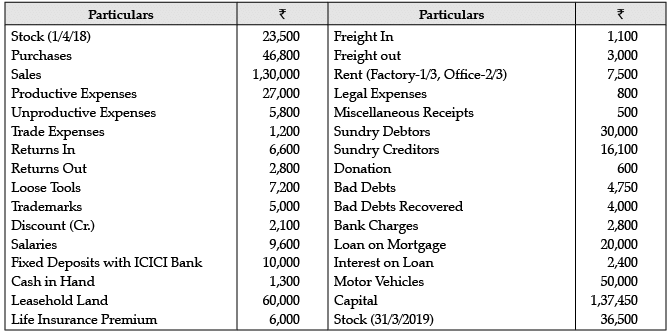

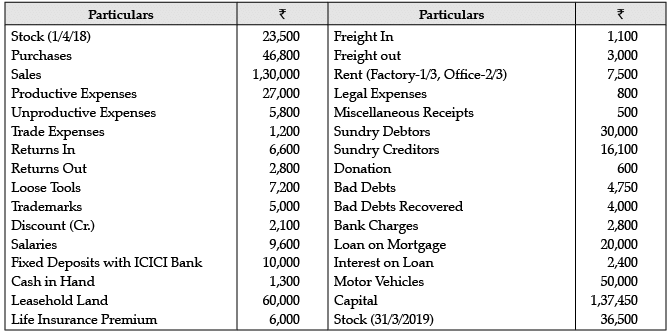

Read the following hypothetical Case Study and answer the given questions:

The accountant of M/s Rakhi Enterprises wrote the following balance on 31st March 2019. She wants to prepare the final accounts, but she has certain doubts in her mind.

Q. The Gross Profit earned by the firm is _________.

Read the following hypothetical Case Study and answer the given questions:

The accountant of M/s Rakhi Enterprises wrote the following balance on 31st March 2019. She wants to prepare the final accounts, but she has certain doubts in her mind.

Q. The Returns Inwards will be recorded in ______________.

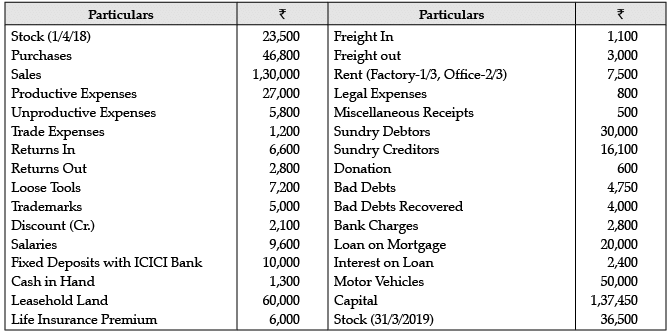

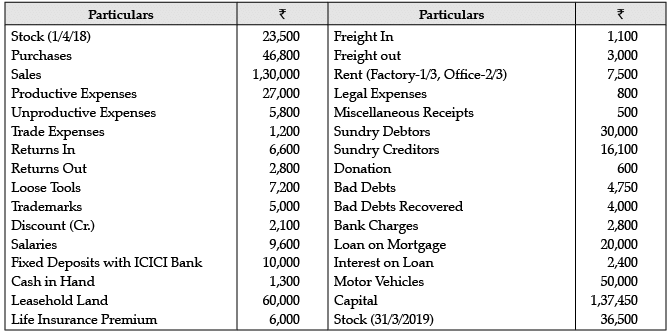

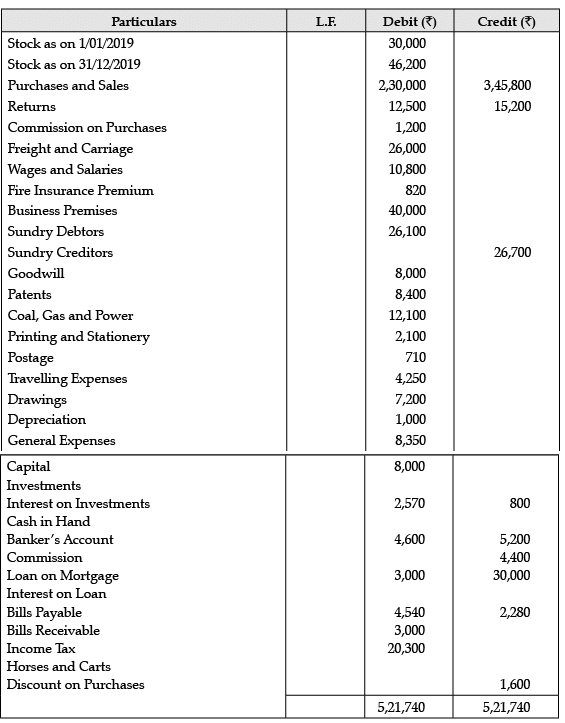

Read the following hypothetical Trial Balance extracted from the books of Sh. Agneshwar Som and answer the given questions:

In the Books of Sh. Agneshwar Som

Trial Balance as on 31/12/2019

Q. What is the amount of gross profit earned by the firm?

Read the following hypothetical Trial Balance extracted from the books of Sh. Agneshwar Som and answer the given questions:

In the Books of Sh. Agneshwar Som

Trial Balance as on 31/12/2019

Q. Where will the postage be recorded in the Final Accounts?

If the capital at the end of the year is Rs. 40,000, the capital introduced during the year is Rs. 30,000, the year’s drawings are Rs. 20,000, and the year’s loss is Rs. 60,000, so the capital at the start of the year was:

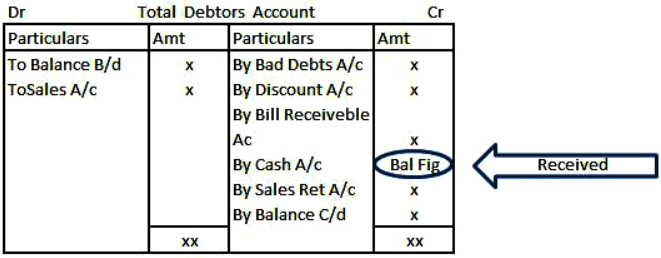

Given the opening and closing balances of debtors and the figure of credit sales, the balancing figure of Total Debtors Account will give

If Closing Capital Rs. 40,000, with Additional Capital during the year of Rs. 30,000, Drawings of Rs. 20,000, and a loss of Rs. 60,000, so Opening Capital was:

If Capital at the end of the year is Rs.40,000; Capital introduced during the year Rs.30,000; drawings for the year Rs.20,000 and loss for the year is Rs.60,000, then Capital at the beginning of the year was :

If Closing Capital is Rs. 50,000, Additional Capital introduced during the year Rs. 30,000; Drawings Rs. 20,000 and Profit is Rs. 30,000; then Opening Capital is _.

If Capital at the beginning is Rs. 24,000, Closing capital is Rs. 40,000, drawing is Rs. 7,000, and additional capital is Rs. 8,000. Make a benefit or loss calculation.