Test: Sources of Business Finance- Case Based Type Questions - Commerce MCQ

15 Questions MCQ Test - Test: Sources of Business Finance- Case Based Type Questions

Direction: Read the following text and answer the questions on the basis of the same:

Faulad Steel Ltd. is a multi-product company, manufacturing steel pipes in wide range for wide spectrum of application. Recently the company received a big order from an MNC for which it requires additional funds. The finance manager reported that the company is not in a position to bear extra burden of explicit cost and equity shareholders insisted not to issue more shares as it can affect their control consideration. Now, the company has only one option, i.e., ploughing back of profit.

Q. ‘Company is not in a position to bear extra burden of explicit cost.’ Identify the meaning of explicit cost in the context of equity shares.

Direction: Read the following text and answer the questions on the basis of the same:

Faulad Steel Ltd. is a multi-product company, manufacturing steel pipes in wide range for wide spectrum of application. Recently the company received a big order from an MNC for which it requires additional funds. The finance manager reported that the company is not in a position to bear extra burden of explicit cost and equity shareholders insisted not to issue more shares as it can affect their control consideration. Now, the company has only one option, i.e., ploughing back of profit.

Q. Right to control is enjoyed by which of the following sources of finance?

Direction: Read the following text and answer the questions on the basis of the same:

Faulad Steel Ltd. is a multi-product company, manufacturing steel pipes in wide range for wide spectrum of application. Recently the company received a big order from an MNC for which it requires additional funds. The finance manager reported that the company is not in a position to bear extra burden of explicit cost and equity shareholders insisted not to issue more shares as it can affect their control consideration. Now, the company has only one option, i.e., ploughing back of profit.

Q. ’.............. can affect their control consideration.’ What is the meaning of control consideration in this context?

Direction: Read the following text and answer the questions on the basis of the same:

Faulad Steel Ltd. is a multi-product company, manufacturing steel pipes in wide range for wide spectrum of application. Recently the company received a big order from an MNC for which it requires additional funds. The finance manager reported that the company is not in a position to bear extra burden of explicit cost and equity shareholders insisted not to issue more shares as it can affect their control consideration. Now, the company has only one option, i.e., ploughing back of profit.

Q. In the above case, which of the following sources of finance is most suitable?

Direction: Read the following text and answer the questions that follow:

Saksham Ltd., a firm manufacturing textiles, needs to finance its day-to-day expenses, like, wages, rent, maintain stock of raw material, etc. Other than this, the company also decides to set up a new plant at an estimated cost of ` 5 crores. The finance manager of the company, Mr. Ramakant was asked by the management to do the financial planning by identifying most suitable source of raising long-term funds for financing the investment decision and short-term sources for working capital decision. As per the suggestions of Mr. Ramakant, the company approached their raw material supplier to give them credit for three months, so that the company can get cloth for making garments without making immediate payment. For long-term investment, the company had issued equity and preference shares to meet its requirement. This decision resulted in payment of large amount of taxes to government as dividend on shares is not deducted from total income of the company before calculating income tax. But this situation could be avoided if company had chosen borrowed funds as a source of finance.

Q. State the source of finance, suggested by Mr. Ramakant to finance working capital decision.

Direction: Read the following text and answer the questions that follow:

Saksham Ltd., a firm manufacturing textiles, needs to finance its day-to-day expenses, like, wages, rent, maintain stock of raw material, etc. Other than this, the company also decides to set up a new plant at an estimated cost of ` 5 crores. The finance manager of the company, Mr. Ramakant was asked by the management to do the financial planning by identifying most suitable source of raising long-term funds for financing the investment decision and short-term sources for working capital decision. As per the suggestions of Mr. Ramakant, the company approached their raw material supplier to give them credit for three months, so that the company can get cloth for making garments without making immediate payment. For long-term investment, the company had issued equity and preference shares to meet its requirement. This decision resulted in payment of large amount of taxes to government as dividend on shares is not deducted from total income of the company before calculating income tax. But this situation could be avoided if company had chosen borrowed funds as a source of finance.

Q. State the factors which have not been kept in mind for selecting source of long-term finance.

Direction: Read the following text and answer the questions that follow:

Saksham Ltd., a firm manufacturing textiles, needs to finance its day-to-day expenses, like, wages, rent, maintain stock of raw material, etc. Other than this, the company also decides to set up a new plant at an estimated cost of ` 5 crores. The finance manager of the company, Mr. Ramakant was asked by the management to do the financial planning by identifying most suitable source of raising long-term funds for financing the investment decision and short-term sources for working capital decision. As per the suggestions of Mr. Ramakant, the company approached their raw material supplier to give them credit for three months, so that the company can get cloth for making garments without making immediate payment. For long-term investment, the company had issued equity and preference shares to meet its requirement. This decision resulted in payment of large amount of taxes to government as dividend on shares is not deducted from total income of the company before calculating income tax. But this situation could be avoided if company had chosen borrowed funds as a source of finance.

Q. State the source of finance which can give the benefit of tax saving.

Direction: Read the following text and answer the questions that follow:

Saksham Ltd., a firm manufacturing textiles, needs to finance its day-to-day expenses, like, wages, rent, maintain stock of raw material, etc. Other than this, the company also decides to set up a new plant at an estimated cost of ` 5 crores. The finance manager of the company, Mr. Ramakant was asked by the management to do the financial planning by identifying most suitable source of raising long-term funds for financing the investment decision and short-term sources for working capital decision. As per the suggestions of Mr. Ramakant, the company approached their raw material supplier to give them credit for three months, so that the company can get cloth for making garments without making immediate payment. For long-term investment, the company had issued equity and preference shares to meet its requirement. This decision resulted in payment of large amount of taxes to government as dividend on shares is not deducted from total income of the company before calculating income tax. But this situation could be avoided if company had chosen borrowed funds as a source of finance.

Q. Identify the fund needed for the day-to-day operations of business.

Equity shares are long term sources of Business Finance.

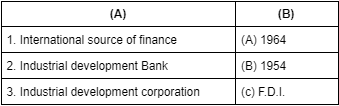

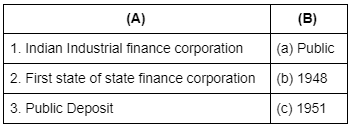

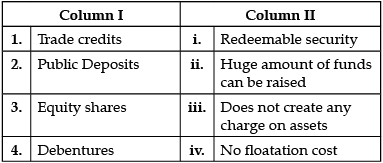

Direction: Match the following sources of finance given in column I with their merits given in column II.

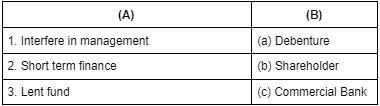

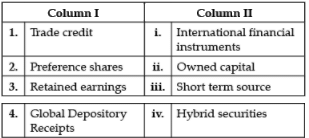

Direction: Match the following sources of funds given in column I with their salient features given in column II.

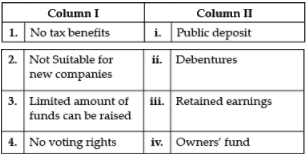

Direction: Match the following demerits given in column I with related sources of funds given in column II.