Test: Indian Economy -8 - UPSC MCQ

25 Questions MCQ Test - Test: Indian Economy -8

Which of the following is/are the components of high-powered money?

- Currency held by public

- Currency held by commercial banks

- Foreign Exchange reserves held by RBI

Select the correct answer using the code given below.

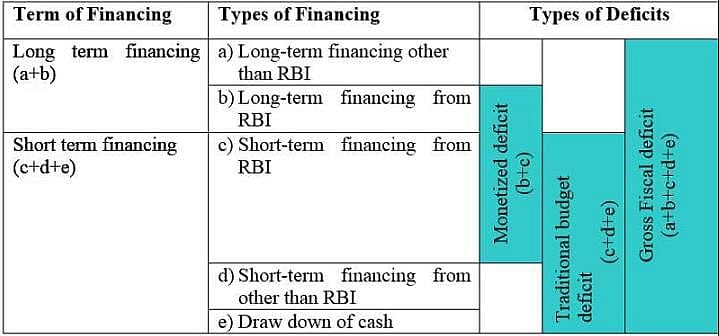

Consider the following statements with reference to Monetized deficit of the Government of India:

- It is that part of the government deficit which is financed solely by borrowing from the Reserve Bank of India.

- It involves only printing of high value currency notes by the RBI.

Which of the statements given above is/are correct?

A government cuts taxes and runs a budget deficit in order to stimulate consumer spending. However, consumer responds to it by increasing savings instead of spending more. The forward looking approach of consumers is based on the fact that increased borrowings by the government will be repaid by taxes in future. This will lead to a similar impact on the economy as borrowing by the government today. Which of the following is best described in the passage given above?

Consider the following statements regarding NIPUN Bharat Mission:

- It covers children in the age group of 6-14 years.

- NITI Aayog is the nodal agency for implementing this scheme.

Which of the statements given above is/are correct?

Consider the following statements about the Livestock Census:

- It has been conducted in the country once every 5 years, since 1919-20.

- It covers all domesticated animals and their headcounts.

- It is conducted by the Union Ministry of Statistics and Program Implementation.

Which of the statements given above is/are correct?

Arrange the following renewable sources of energy in increasing order of their contribution to total installed capacity in India.

- Solar Power

- Wind Power

- Bio Power

Select the correct answer using the code given below.

Consider the following statements with reference to Agriculture sector during 1950- 1990:

- Indian agricultural productivity had increased during this period

- The proportion of GDP contributed by agriculture increased significantly.

- The proportion of the population working/depending on agriculture declined significantly.

Which of the statements given above is/are correct?

Consider the following statements with reference to the cost-push inflation:

- It is inflation caused by an increase in prices of inputs like labour and raw material.

- This inflation is always a strong indicator of an expanding economy.

Which of the statements given above is/are correct?

Consider the following statements:

- Autonomous transactions are independent of the deficit or surplus in the Balance of Payments.

- Accommodating transactions refer to transactions that take place to cover deficit or surplus arising from autonomous transactions.

Which of the statements given above is/are correct?

With reference to Small Finance Banks (SFB), consider the following statements:

- They are subject to the norms of Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR).

- At least 25 percent of its branches shall be in unbanked rural centers.

- Priority sector must comprise 75% of their net credit.

Which of the statements given above is/are correct?

With reference to Ways and Means Advances (WMA), consider the following statements:

- It is a facility for both the Centre and states to borrow from the RBI, to balance temporary mismatches in cash flows.

- Normal Ways and Means Advances are provided at lower interest rate than the repo rate.

- The interest levied for Special Drawing Facilities/Special WMA is equal to the repo rate.

Which of the statements given above is/are correct?

Which of the following are excluded from the National Income to calculate Personal Income?

- Corporate Tax

- Personal Tax payments

- Transfer payments to the households from the Government

- Undistributed profits

Select the correct answer using the code given below.

In the context of the types of Inflation, consider the following statements:

- Headline Inflation refers to the change in the value of all goods in the basket including food and fuel.

- Core Inflation is more volatile than headline inflation.

Which of the statements given above is/are correct?

Consider the following statements about the Micro Small and Medium Enterprises (MSMEs):

- This sector is the largest employer of human resources in India.

- It generates more employment opportunities per unit of capital invested compared to large industries.

Which of the statements given above is/are correct?

Aedes aegypti mosquito is an important vector that spreads many diseases. In this context which of the following diseases are spread by the Aedes aegypti mosquito?

- Zika Virus

- Chikungunya

- Dengue

- Yellow fever

Select the correct answer using the code given below.

In the context of Indian economy, which of the following measures is regarded as the National Income?

Consider the following statements:

- The Nominal effective exchange rate (NEER) is a multilateral rate representing the basket of foreign currencies, each weighted by its importance to the domestic country in international trade.

- The Real Effective exchange rate (REER) is interpreted as the quantity of domestic goods required to purchase one unit of a given basket of foreign goods.

- The nominal exchange rate is the true measure of a country’s international competitiveness.

Which of the statements given above is/are correct?

Consider the following statements regarding Pre-paid Payment Instruments (PPIs) in India:

- These are payment instruments that facilitate the purchase of goods and services.

- Only those companies incorporated in India can issue PPIs in India.

- These instruments do not permit cash withdrawal or redemption.

Which of the statements given above is/are correct?

With reference to India's foreign trade on the eve of Independence, consider the following statements:

- More than half of India’s foreign trade was restricted to Britain.

- During the colonial period, India often recorded a huge trade deficit.

Which of the statements given above is/are correct?

Consider the following statements with reference to the voting shares in International Monetary Fund (IMF):

- United States has the maximum voting share followed by United Kingdom.

- India occupies the fourth position with a voting share of above 5%.

Which of the statements given above is/are correct?

With reference to Outright Open Market Operations (OMO), consider the following statements:

- Outright OMO are conducted without any promise to buy/sell the securities at a later stage.

- Outright OMO are conducted for managing overnight liquidity mismatches.

Which of the statements given above is/are correct?

Which of the following characterise a situation of a 'liquidity trap' in an economy?

- Decline in bond prices

- Lower interest rates

- High savings rates

Select the correct answer using the code given below.

Which of the following taxes are subsumed within the Goods and Service Tax (GST)?

- Central Excise Duty

- Stamp Duty

- Octroi Tax

- Luxury Tax

Select the correct answer using the code given below.

Recently, India has exported various Geographical Indication (GI) certified products. In this context which of the following is/are GI-tagged products?

- Bhalia Wheat

- Madurai Malli

- Malda Fazli Mango

Select the correct answer using the code given below.

Consider the following statements with respect to the Association of Southeast Asian Nations (ASEAN):

- ASEAN was established in 1967 with the signing of the Bangkok Declaration by the ten ASEAN member states.

- The ASEAN Charter is a legally binding agreement on its member states.

Which of the statements given above is/are not correct?