Accountancy: CUET Mock Test - 7 - CUET MCQ

30 Questions MCQ Test - Accountancy: CUET Mock Test - 7

Given below are two statements, one labelled as Assertion (A) and the other labelled as Reason (R).

Assertion (A): A company has postponed paying suppliers, so that the period-end cash balance appears higher in the books of the company. This is an example of window dressing.

Reason (R): Through window dressing, a company can present a better financial position of the firm than the actual position.

In the context of the above statements, which one of the following is correct?

Which method evenly allocates the cost of an asset over its useful life?

Identify the advantage of Computerized Accounting system.

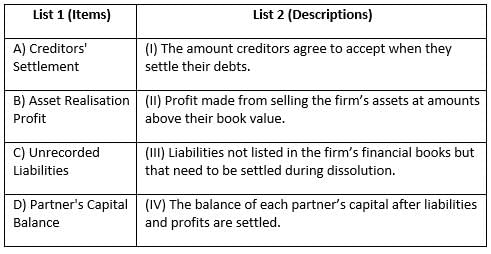

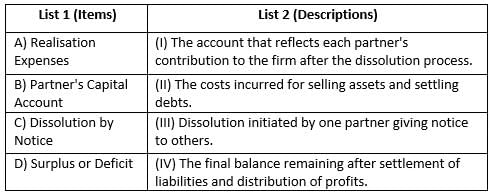

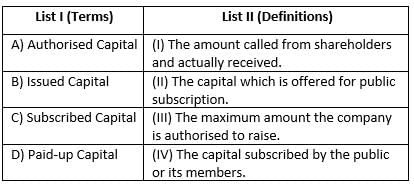

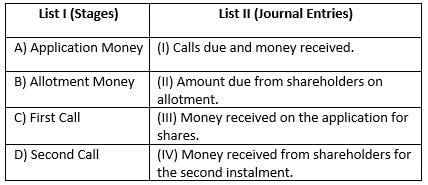

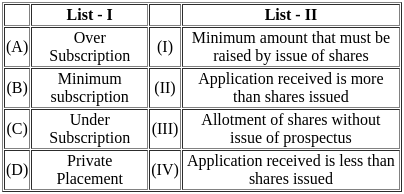

Match List - I with List - II.

Choose the correct answer from the options given below :

Which of the following statements are correct?

(A) Goodwill must be shared between remaining partners when a partner retires.

(B) The capital of the new firm after a partner's retirement is always fixed by the remaining partners.

(C) The retiring partner’s capital account is credited with their share of goodwill.

(D) Revaluation of assets and liabilities is necessary when a partner retires.

(E) The balance due to the retiring partner is always paid immediately in cash.

Choose the correct answer from the options below:

Which of the following statements are correct?

(A) The retiring partner’s share of goodwill is always paid in cash.

(B) The gaining ratio is used to determine how the share of goodwill is adjusted between the remaining partners.

(C) The new profit-sharing ratio is always calculated after the retirement of a partner.

(D) If a partner dies, the amount due is transferred to their legal representatives' account.

(E) The balance sheet of the new firm is prepared after the adjustments for revaluation and goodwill.

Choose the correct answer from the options below:

Which of the following statements are correct?

(A) The retiring partner’s capital account will reflect their share of profits till the date of retirement.

(B) Any unrecorded assets and liabilities are included in the revaluation account at the time of retirement.

(C) When goodwill does not appear in the books, it is credited directly to the capital accounts of the remaining partners.

(D) The new capital of the firm is decided based on the old ratio of profits.

(E) In case of death, the deceased partner’s capital account is transferred to their legal representatives' account.

Choose the correct answer from the options below:

Who uses financial analysis to assess a firm's performance?

Financial analysis can help assess which of the following?

How does financial analysis differ for different users?

What does financial analysis help in decision-making?

What does comparative financial statement analysis help in understanding?

Which financial statements are typically compared in comparative analysis?

What does comparative analysis of financial statements allow firms to identify?

In comparative financial statement analysis, what does the comparison include?

What is calculated in comparative financial statements to understand variations?