Test: Indian Economy -3 - UPSC MCQ

30 Questions MCQ Test - Test: Indian Economy -3

In the context of Indian economy, the term 'Twin Deficit refers to

Consider the following statements in the context of proportional taxation:

In this, taxing authority charges the same rate of tax from each taxpayer, irrespective of income.

The objective of redistribution of resources by government is achieved through this system of taxation.

Which of the statements given above is/are correct?

In this, taxing authority charges the same rate of tax from each taxpayer, irrespective of income.

The objective of redistribution of resources by government is achieved through this system of taxation.

| 1 Crore+ students have signed up on EduRev. Have you? Download the App |

Which of the following are accounted for in the Current Account of 'Balance of Payment' in India?

Exports

Private Transfers

Net Commercial Borrowings

Foreign Direct Investment

Select the correct answer using the code given below.

Exports

Private Transfers

Net Commercial Borrowings

Foreign Direct Investment

Consider the following statements with reference to inflation:

Inflation reduces the purchasing power of the currency.

Producers are worst affected by inflation.

Which of the statements given above is/are correct?

Which of the following is/are correct with reference to the National Disposable Income?

It gives an idea of what is the maximum amount of goods and services the domestic economy has at its disposal.

It includes transfers from the rest of the world such as aids and gifts.

Select the correct answer using the code given below.

Which of the following statements is/are correct with reference to Stagflation?

Stagflation refers to a state of an economy that is experiencing a simultaneous increase in inflation and rising unemployment.

The occurrence of stagflation proves the theory behind the Philips curve.

Select the correct answer using the code given below.

Which of the following statements is/are correct?

National Crime Records Bureau (NCRB) was established on recommendations of the National Police Commission (1977-1981).

Bureau has been entrusted to maintain National Database of Sexual Offenders (NDSO).

Select the correct answer using the code given below:

Which of the following provisions were emphasized upon by the Industrial Policy Resolution 1956 (IPR 1956)?

Complete state monopoly of the industrial sector

Promotion of regional equality

Surplus industrial production

Select the correct answer using the code given below.

Which of the following is/are known as the Bretton Woods Institutions (BWIs)?

International Monetary Fund (IMF)

World Bank

World Economic Forum (WEF)

Select the correct answer using the code given below.

Consider the following statements regarding ‘DNA Testing’:

Forcing someone who refuses to undergo a DNA test would be a breach of his or her personal liberty and right to privacy.

DNA tests can be used to confirm relationships with a high level of accuracy for parent/child relationships.

Which of the statements given above is/are correct?

Which of the following have a bearing on the exchange rate of a currency of a country?

Prevailing interest rates in the domestic economy.

Speculation in the foreign currency market.

Increase in the imports of a country.

Select the correct answer using the code given below.

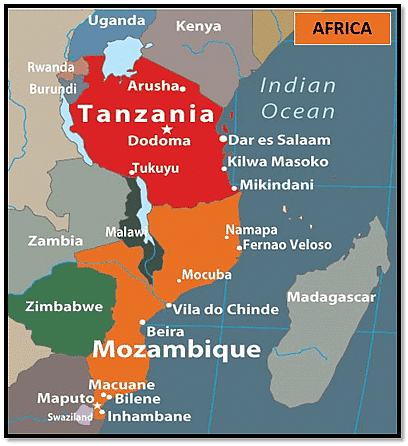

Tanzania with whom the Indian Navy conducted the first edition of India-Mozambique-Tanzania Trilateral Exercise (IMT TRILAT) is bordered by which of the following countries?

Consider the following statements with reference to 'New Space India Limited', recently seen in the news:

It is set up as a Public-Private Partnership company for easy access and transfer of technical knowledge among participating members.

It will replace Antrix Corporation Ltd., the marketing arm of the Indian Space Research Organisation (ISRO).

Which of the statements given above is/are correct?

Consider the following statements regarding Viability Gap Funding:

It is a financial grant to support infrastructure projects that are economically justified but fall short of financial viability.

Funding is subject to a maximum of 50% of the total project cost.

Which of the statements given above is/are correct?

Consider the following statements regarding Glyphosate:

It is a key herbicide used in sugarcane and maize.

In India, its consumption is highest in the state of Maharashtra.

Recently, India has become the first country to ban Glyphosate.

Which of the statements given above is/are correct?

Consider the following statements regarding India Brand Equity Foundation (IBEF):

It is an Investment Promotion Agency to create awareness about the Made in India label in overseas markets.

IBEF is fully funded, owned, and controlled by the Union Government.

Which of the statements given above is/are correct?

If inflation in country A is higher than in country B, and the exchange rate between the two countries is fixed, which of the following is likely to happen to the trade balance between the two countries assuming the initial prices of the basket is same in both the countries?

With reference to the management of the exchange rate system in India, consider the following statements:

-

Post-independence the Indian rupee was pegged to the pound sterling due to its historical links with the Britain.

-

At present, the dirty floating exchange rate system is being followed in India.

Which of the statements given above is/are correct?

Gross National Product is obtained from the Gross Domestic Product by adjusting it for

Which one of the following statements correctly explains Yotta D1?

With reference to 'Medicines Patent Pool', consider the following statements:

It is a United Nations backed public health organisation.

It works to increase access and facilitate development of life-saving medicines for low and middle-income countries.

Which of the statements given above is/are correct?

With reference to e-National Agricultural Market (NAM), consider the following statements:

It is a pan-India electronic trading portal to integrate the existing Agricultural Produce Market Committees (APMCs) mandis.

It is implemented as a Central Sector Scheme through Agri-Tech Infrastructure Fund (ATIF).

Which of the statements given above is/are correct?

Consider the following statements in the context of derivatives:

Derivatives are securities that derive their value from an underlying asset or benchmark.

Derivatives in India are regulated both by the Reserve Bank of India and the Securities and Exchange Board of India (SEBI).

Which of the statements given above is/are correct?

When the government increases spending by borrowing today, which will be repaid by taxes in the future, it will have the same impact on the economy as an increase in government expenditure that is financed by a tax increase today. Effectively, taxation and borrowing are equivalent means of financing the expenditure of the government.

Which of the following is best described in the passage given above?

Consider the following statements about ‘red herrings’:

A red herring is something that confuses or diverts attention away from a relevant or crucial subject by use of social media.

The Election Commission has the authority to control the media in terms of red herrings.

Which of the statements given above is/are correct?

Which of the following is/are the features of Hydrocarbon Exploration and Licensing Policy (HELP)?

The provision of separate licenses for each kind of hydrocarbons.

Profit-sharing between the Government and the contractor after recovery of cost.

Freedom to select exploration blocks throughout the year.

Select the correct answer using the code given below.

In the context of budgetary deficits, consider the following statements with reference to Primary Deficit:

Primary Deficit is the total government borrowings available to utilise after interest payments.

Primary Deficit in India is always higher than the Fiscal Deficit.

Which of the statements given above is/are correct?

In the context of macroeconomics, 'Transfer Payments' refers to:

Consider the following:

Disinvestment

Reducing expenditures

Raising tax rates

Rationalizing subsidies

Which of the actions mentioned above if adopted by Government would reduce its deficit?