Test: Bank Reconciliation Statement - 4 - Commerce MCQ

14 Questions MCQ Test - Test: Bank Reconciliation Statement - 4

When the balance as per Cash Book is the starting point, direct deposits by customers are:

The main purpose of preparing a bank reconciliation statement is?

When balance as per Pass Book is the starting point, interest allowed by Bank is

A Bank Reconciliation Statement is prepared with the help of:

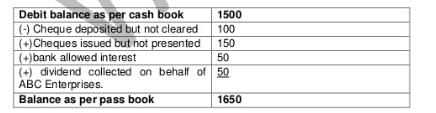

Debit balance as per Cash Book of ABC Enterprises as on 31.3.2006 is Rs. 1,500.Cheques deposited but not cleared amounts to Rs. 100 and Cheques issued but not presented of Rs. 150. The bank allowed interest amounting Rs. 50 and collected dividend Rs. 50 on behalf of ABC Enterprises. Balance as per pass book should be

The cashbook showed an overdraft of Rs. 2,000 as cash at bank, but the pass book,made up tothe same date showed that cheques of Rs. 200, Rs. 150 and Rs. 175 respectively had not been presented for payments; and the cheque of Rs. 600 paid into account had not been cleared. The balance as per the pass book will be

When drawing up a Bank Reconciliation Statement, if you start with a debit balance as per the Bank Statement, the unpresented cheques should be:

A debit balance in the depositor’s Cash Book will be shown as:

When preparing a Bank Reconciliation Statement, if you start with a debit balance as per the Cash Book, cheques issued but not presented within the period should be:

When the balance as per Pass Book is the starting point, direct payment by bank are:

When balance as per Cash Book is the starting point, uncollected cheques are:

A Bank Reconciliation Statement is prepared to know the causes for the difference between:

When the balance as per Pass Book is the starting point, uncollected cheques are:

When the balance as per Cash Book is the starting point, direct deposits by customers are