Bank of Baroda PO Mock Test - 5 - Bank Exams MCQ

30 Questions MCQ Test - Bank of Baroda PO Mock Test - 5

Directions: In this question below is given a statement followed by two assumptions numbered I and II. Consider the statement and decide which of the given assumptions is implicit.

Statement:

People do not know what they want until you show it to them.

Assumptions:

I. People are stupid.

II. A great inventor always trusts his instincts over market research.

Statement:

People do not know what they want until you show it to them.

Assumptions:

I. People are stupid.

II. A great inventor always trusts his instincts over market research.

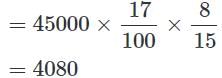

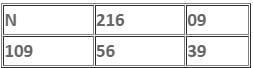

Directions: In this question, two rows are given and to find out the resultant of a particular row, you need to follow the steps given below. Give answer to the question asked accordingly. The operations on numbers progress from left to right.

Step 1: If an odd number is followed by an even number, then the second number is to be subtracted from the first number.

Step 2: If an even number is followed by a composite odd number, then they are to be multiplied.

Step 3: If an even number is followed by a number which is a perfect Cube, then the even number is to be subtracted from perfect cube.

Step 4: If an even number is followed by a prime odd number, then the first number is to be divided by the second number.

Step 5: If an odd number is followed by another composite (a non-prime number) odd number, then they are to be added.

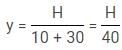

Q. Find the resultant of the first row if N is the resultant of the second row.

Step 2: If an even number is followed by a composite odd number, then they are to be multiplied.

Step 3: If an even number is followed by a number which is a perfect Cube, then the even number is to be subtracted from perfect cube.

Step 4: If an even number is followed by a prime odd number, then the first number is to be divided by the second number.

Step 5: If an odd number is followed by another composite (a non-prime number) odd number, then they are to be added.

Directions: Read the following information carefully and answer the question given below.

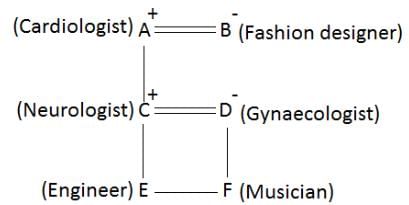

In a family there are six members and they are fashion designer, musician, neurologist, engineer, gynaecologist and cardiologist by profession. The cardiologist is the grandfather of F, who is a musician. A is married to B, the fashion designer. D who is a gynaecologist is married to the neurologist. C is the father of E and F. There are two married couples in this family.

Q. How is F related to A?

Directions: A word and number arrangement machine, when given an input line of words and numbers, rearranges them following a particular rule in each step. The following is an example of input and rearrangement.

Input: jack 35 and 80 riya 45 play 70

Step 1: 35 jack and 80 riya 45 play 70

Step 2: 35 45 jack and 80 riya play 70

Step 3: 35 45 70 jack and 80 riya play

Step 4: 35 45 70 80 jack and riya play

Step 5: 35 45 70 80 riya jack and play

Step 6: 35 45 70 80 riya play jack and

Now, following the same rules, rearrange the given input of words and numbers, and answer the question given below.

Input: jack 88 sell 70 his 87 apple 90 tree

Q. Which of the following is Step 4?

Directions: A word and number arrangement machine, when given an input line of words and numbers, rearranges them following a particular rule in each step. The following is an example of input and rearrangement.

Input: jack 35 and 80 riya 45 play 70

Step 1: 35 jack and 80 riya 45 play 70

Step 2: 35 45 jack and 80 riya play 70

Step 3: 35 45 70 jack and 80 riya play

Step 4: 35 45 70 80 jack and riya play

Step 5: 35 45 70 80 riya jack and play

Step 6: 35 45 70 80 riya play jack and

Now, following the same rules, rearrange the given input of words and numbers, and answer the question given below.

Input: jack 88 sell 70 his 87 apple 90 tree

Q. Which step would give the following output?

70 87 88 90 tree jack sell his apple

Directions: A word and number arrangement machine, when given an input line of words and numbers, rearranges them following a particular rule in each step. The following is an example of input and rearrangement.

Input: jack 35 and 80 riya 45 play 70

Step 1: 35 jack and 80 riya 45 play 70

Step 2: 35 45 jack and 80 riya play 70

Step 3: 35 45 70 jack and 80 riya play

Step 4: 35 45 70 80 jack and riya play

Step 5: 35 45 70 80 riya jack and play

Step 6: 35 45 70 80 riya play jack and

Now, following the same rules, rearrange the given input of words and numbers, and answer the question given below.

Input: jack 88 sell 70 his 87 apple 90 tree

Q. In Step 3, which one of the following words/numbers would be 5th from the right?

Directions to Solve

Choose the correct alternative that will continue the same pattern and replace the question mark in the given series.

Question -

2, 15, 4, 12, 6, 7, ?, ?

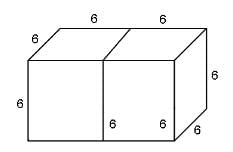

Two cubes, each of edge length 6 cm, are joined end to end. The surface area of the resulting cuboid is

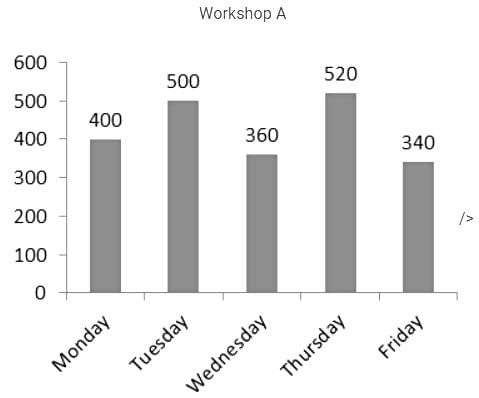

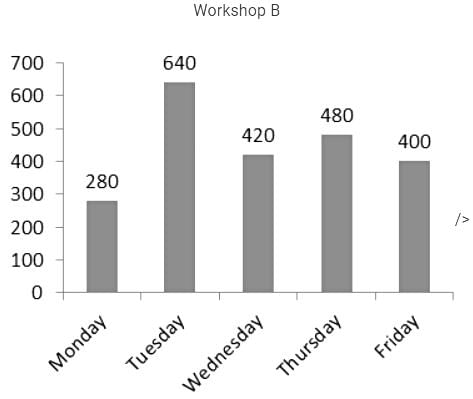

Directions: Study the following bar charts carefully and answer the questions given beside.

The following graph shows the number of people who attended the workshop A and B on 5 different days of a week.

Q. What is the ratio of the number of people who attended the workshop A and B together on Monday to that of A and B together on Wednesday?

Directions: Study the following information carefully and answer the questions given beside.

Mr. Dexter has four kids and all were born on same date of different years. They all have birthday today. Mr. Dexter wants to buy chocolates for all his kids. But he don’t want to give each kid equal number of chocolates.

He decides to do the following thing:

He will divide the height (in centimeters) by the sum of age number with weight (in kilogram).

He arrive at this formula –

Number of chocolate = height in centimeters/(weight in kilogram + age)

The number that will come is the number of chocolates that a particular kid gets.

His second youngest kid is twice the age of the youngest kid whose age is one-third the oldest kid. The second oldest kid is three year younger than the oldest kid. Weight of oldest kid is 36 kg which is numerically three times the age of second oldest kid, whose weight is four times the age of second youngest kid. Weight of the youngest kid is 40% less than the second oldest kid. Sum of weight of all four kids is 129 kg.

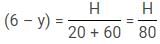

Q. After 5 years from this birthday, Mr. Dexter repeat the same method of distributing the chocolates. After five years, his youngest kid has gained 25% weight while the oldest kid has weight twice the youngest kid. He distribute 6 chocolates between youngest and the oldest kid. If their heights are equal then choose the correct option.

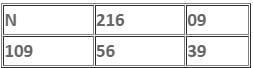

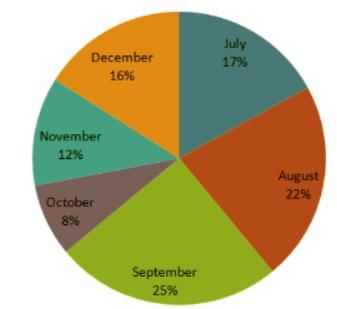

Directions: Study the following pie-chart and table carefully and answer the questions given below:

Percentage-wise Distribution of the Number of Mobile phones Sold by a Shopkeeper During Six Months. Ratio of mobile phones sold of Company A & Company B.

Q. The number of mobile phones sold of Company A during July is approximately what percent of the number of mobile phones sold of company A during December?

Ancestors and dead relations were believed to punish…(11)… for sins, both of commission and …(12) …. . The ancestors were the guardians of….(13)…society’s morality, and they chastised those…..(14)…failed in their duty. The explanation….(15)..heard was: ‘He told lies about the ….(16)….and the ancestors killed him,’ or ’…(17).. uncle’s ghost killed him because he…(18)…. to look after his children or his…(19)… felt disgraced by his conduct, ….(20)…killed him’.

Q. Find the word most appropriate for Blank no. 12

DIRECTIONS: The following question contains an idiom and its usage in a sentence, followed by five possible meanings labelled A, B, C, D and E. Pick out the right meaning of the idiom in question and mark your answer accordingly.

Q.

A bolt from the blue.

His partner cheating him can to him as "a bolt from the blue".

Directions: The following question has two blanks. In each blank a preposition has been omitted. Choose the set of prepositions for each blank that best fits in the context of the sentence.

The government is taking several measures to _______________ parents to admit their children in schools instead of sending them for jobs.

I. Motivate

II. Encourage

II. Persuade

Directions: The following question has a paragraph from which one sentence has been deleted. From the given options, choose the one that completes the paragraph in the most appropriate way.

Land and housing rights have been a contentious topic in Kyrgyzstan since the country achieved independence following the collapse of the Soviet Union in 1991. Although under Kyrgyz law the state is supposed to provide a free plot of land to every citizen, as Eurasianet notes, “In reality, a land-allocation process thick with corruption and bureaucratic obstacles awaits anyone attempting to claim his share.” As a result, while elites and those with access to them have acquired more than their fair share of land for housing and construction projects, the majority of the population has been left to fend for themselves, vulnerable to elite power plays and manipulation. __________.

Directions: The following question has a paragraph from which one sentence has been deleted. From the given options, choose the one that completes the paragraph in the most appropriate way.

That old access road was once a sealed highway that sliced through wilderness connecting Isaan with Bangkok. However, in the 1980s this forest block was declared a national park and a contiguous forest to the south was gazetted as a national park the following year. The road was then decommissioned in favor of wildlife, forming part of what is now known as the Dong Phayayen-Khao Yai Forest Complex, a UNESCO World Heritage site. ________. This sprawling tropical forest dodged a bullet with the closure of that road, though a highway, set to widen and upgrade, and a bullet train whizzing down from Yunnan, China will one day pass close.

Directions: The following question has a paragraph from which one sentence has been deleted. From the given options, choose the one that completes the paragraph in the most appropriate way.

The government launched the “Housing For All by 2022” programme in 2015, with the Pradhan Mantri Awas Yojana (Pmay) as a key anchor scheme. ____________________________. Global examples indicate that affordable housing activities generate direct and indirect employment in the medium term and sustained consumption in the long term. A 2014 study by the National Council of Applied Economic Research indicates that every additional rupee of capital invested in the housing sector adds Rs1.54 to the gross domestic product (GDP) and every Rs1 lakh invested in residential housing creates 2.69 new jobs in the economy.

Directions: Read the passage and answer the questions that follow:

The deadline for the completion of the resolution process under the Insolvency and Bankruptcy Code (IBC), 2016 for the first set of cases taken up has neared or even passed. The IBC provides for a time limit of 180 days (extendable by 90 days) once a case of default is brought and If no resolution plan drawn up under the supervision of a resolution professional can be agreed upon, liquidation must follow to recover whatever sums are possible. While the NCLT has considered a number of cases since its constitution, its role assumed importance when, on 13 June 2017, the Reserve Bank of India (RBI) mandated proceedings against 12 large defaulters, holding accounts with outstanding amounts of more than Rs 5,000 crore, of which at least 60% had been classified as non-performing as of 31 March 2016. These bad loans accounted for around 25% of the non-performing assets (NPAs) recognised at that time.

In most cases, the estimated value of assets on liquidation is low, and does not capture the true value of the company. Put simply, the aggregate of the individual value of a set of stripped assets tends to be much lower than the value of those assets when combined for production. So, if the IBC process and the intervention of the NCLT lead, through bidding, to an offer of a takeover by a third party which is acceptable to the creditors, the recovery against bad loans technically written off by financial creditors would be much higher. Since this was to occur in a time-bound fashion, it seemed to be a significant initiative to address the NPA problem in the banking system. The IBC was combined with legislative amendments that strengthened the powers of the RBI to order the launch of proceedings to recover the loans gone bad. These measures, it was argued, through enforced resolution or liquidation if necessary, offered a way in which the abysmal record of recovery could be corrected and the pressure on the government to bail out banks with taxpayers’ money could be reduced. In the case of 11 public sector banks out of a total of 21, of the loans technically written-off between April 2014 and December 2017, recovery rates varied from nil to just above 20%, and in the case of another three, the rate ranged between 23% and 29%. The average recovery rate for all 21 banks was a pathetic 10.8%. By facilitating and accelerating the recovery effort, the IBC process was expected to raise the rate significantly.

The context in which this new strategy was launched needs recalling. Unlike the period prior to the 1990s, the NPAs that accumulated in the books of banks in recent years were not equitably distributed across different categories of borrowers, big and small, priority and non-priority. Rather, because of a change in the lending strategy during the period of the credit boom after 2003, the NPAs are now concentrated in the hands of large borrowers, primarily corporate borrowers.

The initial experience with the first phase of this multistep process involving the recognition, technical write-off and provisioning, and recovery of NPAs, is revealing for a number of reasons. First, in cases where the assets on offer were of special interest to particular bidders, the rates of recovery have been rather high. This was true of the acquisition of Bhushan Steel by Tata Steel and of Electrosteel by Vedanta. Bhushan Steel owed its financial creditors around Rs 56,000 crore, whereas the Tata Steel bid returned Rs 35,200 crore upfront to the financial creditors, besides giving them a 12.3% stake in the company in lieu of returning the remaining debt. That was substantial relative to the estimated liquidation value of Rs 15,000 crore to Rs 20,000 crore, and far better than the average 10% recovery rate reported on aggregate write-offs in the recent past. The Tatas clearly had a special interest in the deal since its valuation of the company was far higher than that of JSW Group, the other keen bidder. The latter offered the creditors only Rs 29,700 crore.

The evidence that the assets were valuable despite the defaults emerged also from the battle between bidders who were often taken to the courts. Essar Steel, one of the largest defaulters with around Rs 44,000 crore in questionable debt, when put up for sale, elicited expressions of interest from five bidders. Interestingly, besides Tata Steel, Arcelor Mittal, Vedanta, Sumitomo, and Steel Authority of India, the interested parties include the Ruias, who are the original promoters of Essar Steel.

This effort of the defaulting promoters to regain control of the companies concerned at a discount did muddy the water. The original IBC bill did not prevent promoters from making bids for resolution at the NCLT. Some justified the Ruia bid on the grounds that extraneous factors may have led to distress for no fault of the original promoters. But, if the Committee of Creditors (CoC) has taken the firm to the NCLT, it is clearly because they saw the incumbent management as incapable of resolving the crisis faced by the firm. And, if promoters regain control, much of the debt their company owes will be forgiven, with the losses being carried by the financial and operational creditors. Recognising the travesty involved, the government was forced to amend the IBC bill to prohibit promoters from bidding under the NCLT process.

Q. What was the experience of the IBC process for companies which were of special interest to bidders?

I. The rate of recovery was much better than the average recovery rate.

II. Competition between bidders to take over the defaulting company.

III. The liquidation value of the assets would have been higher than the recovered value.

Directions: Read the passage and answer the questions that follow:

The deadline for the completion of the resolution process under the Insolvency and Bankruptcy Code (IBC), 2016 for the first set of cases taken up has neared or even passed. The IBC provides for a time limit of 180 days (extendable by 90 days) once a case of default is brought and If no resolution plan drawn up under the supervision of a resolution professional can be agreed upon, liquidation must follow to recover whatever sums are possible. While the NCLT has considered a number of cases since its constitution, its role assumed importance when, on 13 June 2017, the Reserve Bank of India (RBI) mandated proceedings against 12 large defaulters, holding accounts with outstanding amounts of more than Rs 5,000 crore, of which at least 60% had been classified as non-performing as of 31 March 2016. These bad loans accounted for around 25% of the non-performing assets (NPAs) recognised at that time.

In most cases, the estimated value of assets on liquidation is low, and does not capture the true value of the company. Put simply, the aggregate of the individual value of a set of stripped assets tends to be much lower than the value of those assets when combined for production. So, if the IBC process and the intervention of the NCLT lead, through bidding, to an offer of a takeover by a third party which is acceptable to the creditors, the recovery against bad loans technically written off by financial creditors would be much higher. Since this was to occur in a time-bound fashion, it seemed to be a significant initiative to address the NPA problem in the banking system. The IBC was combined with legislative amendments that strengthened the powers of the RBI to order the launch of proceedings to recover the loans gone bad. These measures, it was argued, through enforced resolution or liquidation if necessary, offered a way in which the abysmal record of recovery could be corrected and the pressure on the government to bail out banks with taxpayers’ money could be reduced. In the case of 11 public sector banks out of a total of 21, of the loans technically written-off between April 2014 and December 2017, recovery rates varied from nil to just above 20%, and in the case of another three, the rate ranged between 23% and 29%. The average recovery rate for all 21 banks was a pathetic 10.8%. By facilitating and accelerating the recovery effort, the IBC process was expected to raise the rate significantly.

The context in which this new strategy was launched needs recalling. Unlike the period prior to the 1990s, the NPAs that accumulated in the books of banks in recent years were not equitably distributed across different categories of borrowers, big and small, priority and non-priority. Rather, because of a change in the lending strategy during the period of the credit boom after 2003, the NPAs are now concentrated in the hands of large borrowers, primarily corporate borrowers.

The initial experience with the first phase of this multistep process involving the recognition, technical write-off and provisioning, and recovery of NPAs, is revealing for a number of reasons. First, in cases where the assets on offer were of special interest to particular bidders, the rates of recovery have been rather high. This was true of the acquisition of Bhushan Steel by Tata Steel and of Electrosteel by Vedanta. Bhushan Steel owed its financial creditors around Rs 56,000 crore, whereas the Tata Steel bid returned Rs 35,200 crore upfront to the financial creditors, besides giving them a 12.3% stake in the company in lieu of returning the remaining debt. That was substantial relative to the estimated liquidation value of Rs 15,000 crore to Rs 20,000 crore, and far better than the average 10% recovery rate reported on aggregate write-offs in the recent past. The Tatas clearly had a special interest in the deal since its valuation of the company was far higher than that of JSW Group, the other keen bidder. The latter offered the creditors only Rs 29,700 crore.

The evidence that the assets were valuable despite the defaults emerged also from the battle between bidders who were often taken to the courts. Essar Steel, one of the largest defaulters with around Rs 44,000 crore in questionable debt, when put up for sale, elicited expressions of interest from five bidders. Interestingly, besides Tata Steel, Arcelor Mittal, Vedanta, Sumitomo, and Steel Authority of India, the interested parties include the Ruias, who are the original promoters of Essar Steel.

This effort of the defaulting promoters to regain control of the companies concerned at a discount did muddy the water. The original IBC bill did not prevent promoters from making bids for resolution at the NCLT. Some justified the Ruia bid on the grounds that extraneous factors may have led to distress for no fault of the original promoters. But, if the Committee of Creditors (CoC) has taken the firm to the NCLT, it is clearly because they saw the incumbent management as incapable of resolving the crisis faced by the firm. And, if promoters regain control, much of the debt their company owes will be forgiven, with the losses being carried by the financial and operational creditors. Recognising the travesty involved, the government was forced to amend the IBC bill to prohibit promoters from bidding under the NCLT process.

Q. Why was the IBC Bill amended to stop promoters from regaining control of their companies?

I. The Committee of Creditors did not see the original management fit enough to carry on functioning.

II. The losses would be carried by the financial and operational creditors.

III. It would have led to the promoters regaining control of their companies without repaying the full amount of the loans taken.

Consider the following statements regarding the various measures of atmospheric humidity:

1. Generally Absolute humidity does not change with increase or decrease of temperature, if no additional vapour is added through additional evaporation.

2. Specific humidity is affected by changes in air pressure or air temperature because it is measured in units of weight (grams)

Q. Select the correct answer using the codes given below.

Which English county did batting sensation Virender Sehwag join in the 2003 season?

Which bank is the first bank to introduce a savings account in India?

The primary function of Bharatiya Reserve Bank Note Mudran Private Ltd. (BRBNMPL)is to print the banknotes for the Reserve Bank of India (RBI). It operates with 2 presses. What are they?

Which of the following are the objectives of financial inclusion?

Which of the following is not one among the Types of ATMs found in India?

APBS is used for crediting DBT transactions for Government/ Government agency disbursements. What is the full form of APBS?

What is the minimum transaction limit under the National Electronic Funds Transfer (NEFT)?

Who won the maiden ATP doubles title at the Mallorca Championships?