SSC GD Constable Mock Test - 8 - SSC MTS / SSC GD MCQ

30 Questions MCQ Test - SSC GD Constable Mock Test - 8

Directions to Solve

In each of the following questions, four words have been given out of which three are alike in some manner, while the fifth one is different. Choose the word which is different from the rest.

Question -

Choose the word which is different from the rest.

Directions to Solve

In each of the following questions find out the alternative which will replace the question mark.

Question -

PASS : QBTT :: FAIL : ?

Directions to Solve

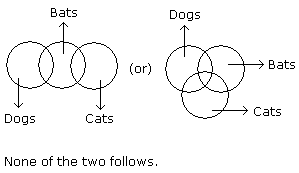

In each of the following questions two statements are given and these statements are followed by two conclusions numbered (1) and (2). You have to take the given two statements to be true even if they seem to be at variance from commonly known facts. Read the conclusions and then decide which of the given conclusions logically follows from the two given statements, disregarding commonly known facts.

Question -

Statements: Some dogs are bats. Some bats are cats.

Conclusions:

- Some dogs are cats.

- Some cats are dogs.

Directions to Solve

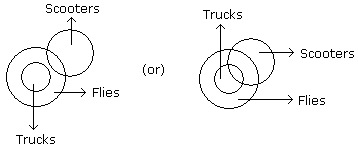

In each of the following questions two statements are given and these statements are followed by two conclusions numbered (1) and (2). You have to take the given two statements to be true even if they seem to be at variance from commonly known facts. Read the conclusions and then decide which of the given conclusions logically follows from the two given statements, disregarding commonly known facts.

Question -

Statements: All the trucks are flies. Some scooters are flies.

Conclusions:

- All the trucks are scooters.

- Some scooters are trucks.

DEER = 12215 and HIGH = 5654, how will you code HEEL?

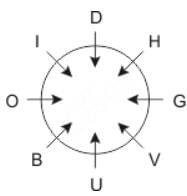

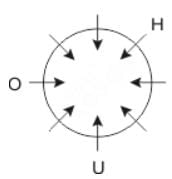

Directions: Study the following information carefully and answer the question given below.

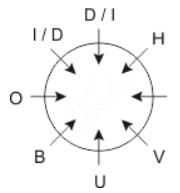

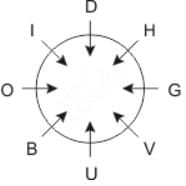

Eight people O, H, U, V, I, D, B and G are sitting around a circular table facing the centre.

O is sitting second to the left of U and third to right of H. D and I are immediate neighbors of each other and one of them is an immediate neighbor of O. V is sitting second to the right of B. G is sitting second to the left of D.

Q. Which of the following persons sitting between H and V?

Practice Quiz or MCQ (Multiple Choice Questions) with solutions are available for Practice, which would help you prepare for "Line Charts" under LR and DI. You can practice these practice quizzes as per your speed and improvise the topic. The same topic is covered under various competitive examinations like - CAT, GMAT, Bank PO, SSC and other competitive examinations.

Q.

The following line graph gives the ratio of the amounts of imports by a company to the amount of exports from that company over the period from 1995 to 2001.

If the imports in 1998 was Rs. 250 crores and the total exports in the years 1998 and 1999 together was Rs. 500 crores, then the imports in 1999 was ?

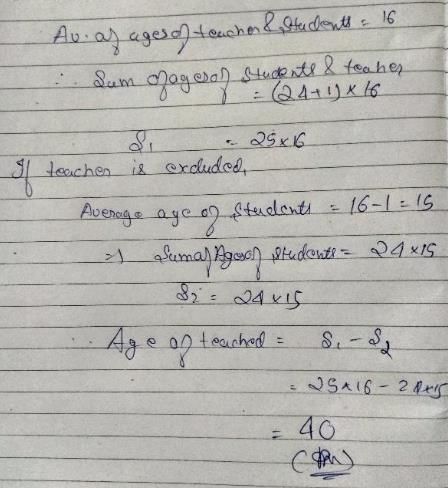

The average age of 24 students and the class teacher is 16 years. If the age of the class teacher is excluded the average reduces by 1 year. What is the age of the class teacher?

There are 20 students in Mr Rahul Ghosh’s class. He conducts an examination out of 100 and then arranged the marks in an ascending order. He found Chandan, the topper of the class, had slipped to the tenth position. When he was adding the scores of the last 11 students the average was 64 and that of the top 10 was 67. If the average marks obtained by all the students of his class was 65, how many marks did Chandan score?

Sum of eight consecutive odd numbers is 656. Average of four consecutive even numbers is 87. What is the sum of the largest even number and largest odd number?

In an election contested by two parties A and B, party A secured 25 percent of the total votes more than Party B. If party B gets 15000 votes. By how much votes does party B loses the election?

A shopkeeper marks his goods at 40% above the cost price and allows a discount of 40% on the marked price.

What is his loss or gain percentage?

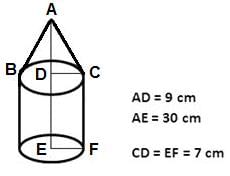

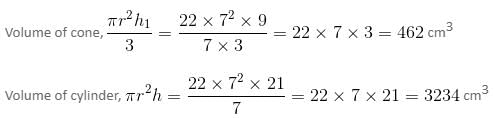

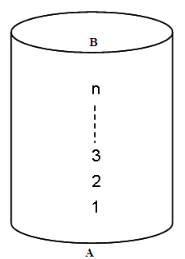

Consider a cylinder of height h cm and radius r = 2/π cm, as shown in the figure (not drawn to scale). A string of a certain length, when bound on its cylindrical surface starting at point A and ending at point B, gives a maximum of n turns (in other words, the string's length is the minimum length required to wind n turns). What is the vertical spacing in cm between the two consecutive turns?

Consider the following statements:

- The discussions in the Third Round Table Conference eventually led to the passing of the Government of India Act of 1935

- The government of India Act of 1935 provided for the establishment of an All India Federation to be based on a Union of the provinces of British India and the Princely States. Which of the statements given above is/are correct?

How many centuries in Tests did Sunil Gavaskar bag when he retired?

Which commission made the recommendations which formed the basis for the Punjab Reorganisation Act which created the states Punjab and Haryana?

Well preferred tree fossil supposed to be from Jurasic Age in India is reported from:

The 'Atal Jyoti Yojana' recently seen in the news is related to:

Which organization became the first Central Public Sector Enterprise (CPSE) to receive certification for its Anti-Bribery Management System (ABMS)?

Which state recently launched the Mobile Dost App for mobile-based delivery of citizen-centric services?

Directions: Rearrange the following five sentences in the proper sequence to form a coherent paragraph, and then answer the question given below.

(i) If no evil had existed in this world, man would never have dreamt of those numerous divinities to which he has rendered such various modes of worship.

(ii) The man, always contented, would only have occupied himself with satisfying his wants; with enjoying the present, with feeling the influence of objects, that would unceasingly warn him of his existence in a mode that he must necessarily approve; nothing would alarm his heart; everything would be analogous to his existence.

(iii) These feelings can only be the consequence of some troublesome sensation, which must have previously affected him, or which by disturbing the harmony of his machine, has interrupted the course of his happiness; which has shown him he is naked.

(iv) He would neither know fear, experience distrust, nor have in quietude for the future.

(v) If nature had permitted him easily to satisfy all his regenerating wants, if she had given him none but agreeable sensations, his days would have uninterruptedly rolled on in perpetual uniformity; he would never have discovered his own nakedness.

Q. Which of the following should be the FIFTH sentence after rearrangement?

Directions: Read the passage carefully and answer the questions that follow:

There is now no denying that the new government takes office amid a clear economic slowdown. The first macro data set released showed an under-performing economy with GDP growth falling to 5.8% in the fourth quarter of 2018-19 and pulling down the overall growth for the fiscal to a five-year low of 6.8%. Growth in gross value added (GVA), which is GDP minus taxes and subsidies, fell to 6.6% in 2018-19, pointing to a serious slowdown. If further confirmation were needed, the growth in core sector output — a set of eight major industrial sectors — fell to 2.6% in April, compared to 4.7% in the same month last year. And finally, unemployment data, controversially suppressed by the Union government so far, showed that joblessness was at a 45-year high of 6.1% in 2017-18. These numbers highlight the challenges ahead in drafting the Budget for 2019-20. The economy is beset by a consumption slowdown as reflected in the falling sales of everything from automobiles to consumer durables, even fast-moving consumer goods. Private investment is not taking off, while government spending, which kept the economy afloat during the last NDA government, was cut back in the last quarter of 2018-19 to meet the fiscal deficit target of 3.4%.

The good news is that inflation is undershooting the target and oil prices are on the retreat again. But the rural economy remains in distress, as seen by the 2.9% growth in agriculture last fiscal; the sector needs a good monsoon this year to bounce back. Overall economic growth in the first quarter of this fiscal is likely to remain subdued, and any improvement is unlikely until the late second quarter or the early third. There are not too many options before the new Finance Minister. In the near term, she has to boost consumption, which means putting more money in the hands of people. That, in turn, means cutting taxes, which is not easy given the commitment to rein in the fiscal deficit. In the medium term, Ms. Sitharaman has to take measures to boost private investment even as she opens up public spending again. These call for major reforms, starting with land acquisition and labour, corporate taxes by reducing exemptions and dropping rates, and nursing banks back to health. On the table will be options such as further recapitalisation of the ailing banks, and consolidation. The question, though, is where the money will come from. With tax revenues likely to be subdued owing to the slowdown, the Centre will have to look at alternative sources such as disinvestment. There may be little choice but to go big on privatisation. A rate cut by the Reserve Bank of India, widely expected this week, would certainly help boost sentiment. But it is the Budget that will really set the tone for the economy

Q. As per the passage, which of the following would lead to ‘putting more money in the hands of people’?

I. Decrease in tax rates.

II. Increase in inflation

III. Increase in private investment

Directions: Read the passage carefully and answer the questions that follow:

There is now no denying that the new government takes office amid a clear economic slowdown. The first macro data set released showed an under-performing economy with GDP growth falling to 5.8% in the fourth quarter of 2018-19 and pulling down the overall growth for the fiscal to a five-year low of 6.8%. Growth in gross value added (GVA), which is GDP minus taxes and subsidies, fell to 6.6% in 2018-19, pointing to a serious slowdown. If further confirmation were needed, the growth in core sector output — a set of eight major industrial sectors — fell to 2.6% in April, compared to 4.7% in the same month last year. And finally, unemployment data, controversially suppressed by the Union government so far, showed that joblessness was at a 45-year high of 6.1% in 2017-18. These numbers highlight the challenges ahead in drafting the Budget for 2019-20. The economy is beset by a consumption slowdown as reflected in the falling sales of everything from automobiles to consumer durables, even fast-moving consumer goods. Private investment is not taking off, while government spending, which kept the economy afloat during the last NDA government, was cut back in the last quarter of 2018-19 to meet the fiscal deficit target of 3.4%.

The good news is that inflation is undershooting the target and oil prices are on the retreat again. But the rural economy remains in distress, as seen by the 2.9% growth in agriculture last fiscal; the sector needs a good monsoon this year to bounce back. Overall economic growth in the first quarter of this fiscal is likely to remain subdued, and any improvement is unlikely until the late second quarter or the early third. There are not too many options before the new Finance Minister. In the near term, she has to boost consumption, which means putting more money in the hands of people. That, in turn, means cutting taxes, which is not easy given the commitment to rein in the fiscal deficit. In the medium term, Ms. Sitharaman has to take measures to boost private investment even as she opens up public spending again. These call for major reforms, starting with land acquisition and labour, corporate taxes by reducing exemptions and dropping rates, and nursing banks back to health. On the table will be options such as further recapitalisation of the ailing banks, and consolidation. The question, though, is where the money will come from. With tax revenues likely to be subdued owing to the slowdown, the Centre will have to look at alternative sources such as disinvestment. There may be little choice but to go big on privatisation. A rate cut by the Reserve Bank of India, widely expected this week, would certainly help boost sentiment. But it is the Budget that will really set the tone for the economy

Q. Which of the following, as per the passage, indicate a slowdown in the Indian economy?

I. Fall in sale levels of consumer durables

II. Negative growth in the core sector output

III. Fall in inflations levels

Directions: Read the passage carefully and answer the questions that follow:

There is now no denying that the new government takes office amid a clear economic slowdown. The first macro data set released showed an under-performing economy with GDP growth falling to 5.8% in the fourth quarter of 2018-19 and pulling down the overall growth for the fiscal to a five-year low of 6.8%. Growth in gross value added (GVA), which is GDP minus taxes and subsidies, fell to 6.6% in 2018-19, pointing to a serious slowdown. If further confirmation were needed, the growth in core sector output — a set of eight major industrial sectors — fell to 2.6% in April, compared to 4.7% in the same month last year. And finally, unemployment data, controversially suppressed by the Union government so far, showed that joblessness was at a 45-year high of 6.1% in 2017-18. These numbers highlight the challenges ahead in drafting the Budget for 2019-20. The economy is beset by a consumption slowdown as reflected in the falling sales of everything from automobiles to consumer durables, even fast-moving consumer goods. Private investment is not taking off, while government spending, which kept the economy afloat during the last NDA government, was cut back in the last quarter of 2018-19 to meet the fiscal deficit target of 3.4%.

The good news is that inflation is undershooting the target and oil prices are on the retreat again. But the rural economy remains in distress, as seen by the 2.9% growth in agriculture last fiscal; the sector needs a good monsoon this year to bounce back. Overall economic growth in the first quarter of this fiscal is likely to remain subdued, and any improvement is unlikely until the late second quarter or the early third. There are not too many options before the new Finance Minister. In the near term, she has to boost consumption, which means putting more money in the hands of people. That, in turn, means cutting taxes, which is not easy given the commitment to rein in the fiscal deficit. In the medium term, Ms. Sitharaman has to take measures to boost private investment even as she opens up public spending again. These call for major reforms, starting with land acquisition and labour, corporate taxes by reducing exemptions and dropping rates, and nursing banks back to health. On the table will be options such as further recapitalisation of the ailing banks, and consolidation. The question, though, is where the money will come from. With tax revenues likely to be subdued owing to the slowdown, the Centre will have to look at alternative sources such as disinvestment. There may be little choice but to go big on privatisation. A rate cut by the Reserve Bank of India, widely expected this week, would certainly help boost sentiment. But it is the Budget that will really set the tone for the economy

Q. Which of the following is / are true as per the passage?

I. There is going to be a definite rate cut by the RBI in the coming week.

II. The rural economy is in better shape than the urban economy.

III. Government spending has increased in the last quarter of 2018-19.

Directions: Read the passage carefully and answer the questions that follow:

There is now no denying that the new government takes office amid a clear economic slowdown. The first macro data set released showed an under-performing economy with GDP growth falling to 5.8% in the fourth quarter of 2018-19 and pulling down the overall growth for the fiscal to a five-year low of 6.8%. Growth in gross value added (GVA), which is GDP minus taxes and subsidies, fell to 6.6% in 2018-19, pointing to a serious slowdown. If further confirmation were needed, the growth in core sector output — a set of eight major industrial sectors — fell to 2.6% in April, compared to 4.7% in the same month last year. And finally, unemployment data, controversially suppressed by the Union government so far, showed that joblessness was at a 45-year high of 6.1% in 2017-18. These numbers highlight the challenges ahead in drafting the Budget for 2019-20. The economy is beset by a consumption slowdown as reflected in the falling sales of everything from automobiles to consumer durables, even fast-moving consumer goods. Private investment is not taking off, while government spending, which kept the economy afloat during the last NDA government, was cut back in the last quarter of 2018-19 to meet the fiscal deficit target of 3.4%.

The good news is that inflation is undershooting the target and oil prices are on the retreat again. But the rural economy remains in distress, as seen by the 2.9% growth in agriculture last fiscal; the sector needs a good monsoon this year to bounce back. Overall economic growth in the first quarter of this fiscal is likely to remain subdued, and any improvement is unlikely until the late second quarter or the early third. There are not too many options before the new Finance Minister. In the near term, she has to boost consumption, which means putting more money in the hands of people. That, in turn, means cutting taxes, which is not easy given the commitment to rein in the fiscal deficit. In the medium term, Ms. Sitharaman has to take measures to boost private investment even as she opens up public spending again. These call for major reforms, starting with land acquisition and labour, corporate taxes by reducing exemptions and dropping rates, and nursing banks back to health. On the table will be options such as further recapitalisation of the ailing banks, and consolidation. The question, though, is where the money will come from. With tax revenues likely to be subdued owing to the slowdown, the Centre will have to look at alternative sources such as disinvestment. There may be little choice but to go big on privatisation. A rate cut by the Reserve Bank of India, widely expected this week, would certainly help boost sentiment. But it is the Budget that will really set the tone for the economy

Q. Which of the following is the closest in meaning to the word beset?