Test: Valuation Of Goodwill And Shares - 1 - B Com MCQ

10 Questions MCQ Test - Test: Valuation Of Goodwill And Shares - 1

If the intrinsic value of a share of common stock is less than its market value, which of the following is the most reasonable conclusion?

Market-based methods of valuation should not be adopted when –

Market value method is generally the most preferred method in case of –

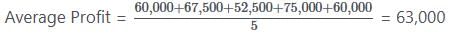

The profits of last 5 years are ₹ 60,000; ₹ 67,500; ₹ 52,500; ₹ 75,000 & ₹ 60,000. Find the value of goodwill, if it is calculated on average profits of last 5 years on the basis of 3 years of purchase.

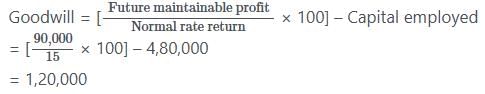

Find the goodwill of the firm using the capitalization method from the following information:

Capital employed = ₹ 4,80,000.

Rate of normal return = 15%.

Profits for the year = ₹ 90,000

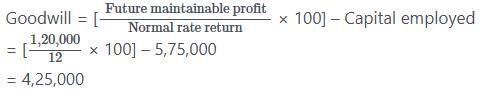

The average profit of a firm is ₹ 1,20,000. The rate of capitalization is 12%. Assets and liabilities of the company are ₹ 10,00,000 & ₹ 4,25,000 respectively.

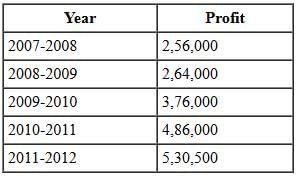

The net profits after tax of Z Ltd. for the past 5 years are as follows:

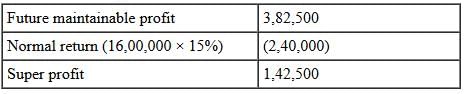

The capital employed is ₹ 16,00,000. The rate of normal return is 15%. Calculate the value of the goodwill on the basis of the annuity method on a super-profits basis, taking the present value of an annuity of ₹ 1 for the 4 years at 15% as ₹ 2.855.

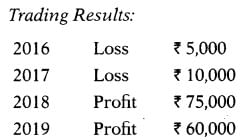

The following particulars are available in respect of the business carried on by X Ltd.:

You are required to compute the value of goodwill on the basis of 5 years purchase of average profit.