Test: Indian Economy -2 - UPSC MCQ

30 Questions MCQ Test - Test: Indian Economy -2

Which of the following statements is not true with regard to the monetisation of deficit ?

Consider the following statements :

1. The primary deficit is the difference between the total expenditure and total receipts except for borrowing and other liabilities.

2. Off-budget borrowings are the loans raised by the special purpose vehicle on the direction of the government.

3. The several income tax slabs of the new tax regime are an example of proportional taxation.

Which of the statements given above is/are correct ?

| 1 Crore+ students have signed up on EduRev. Have you? Download the App |

Which of the following is/are forming part of the revenue expenditure of the Government of India?

1. Administrative expenditure

2. Loans given to the state governments

3. Interest payments on market loans

Select the correct answer from the code given below :

Consider the following :

1. Public Sector Banks

2. Life Insurance Corporation

3. Central Government-owned companies

4. State Government owned companies

5. Private owned companies

Which of the above-mentioned category of an institution is/are granted 'Ratna status' based on their performance ?

Consider the following statements with respect to poverty in India :

1. The headcount ratio is the percentage of the population living below the poverty line

2. The official data on poverty is estimated on the basis of data collected by NITI Aayog.

Which of the statements given above is/are correct ?

Consider the following :

1. Investment on health

2. Firms spending on the job training

3. Budget allocation on agriculture subsidies

4. Buying an S-400 air defense missile system from Russia

5. Investment in education

Which of the scenarios mentioned above are the source of Human Capital Formation ?

In the Indian context, consider the following statements :

1. Cheques are examples of fiat money but not legal tender, i.e., the other party can refuse to accept it as a mode of payment.

2. To become a ‘legal tender’, a given coin/currency must be issued by order of the government or central bank.

Which of the statements given above is/are correct ?

Under the RBI Act of 1934, which among the following is responsible for approving the design, form and material of bank notes ?

Consider the following :

1. Bharat QR code

2. MyFASTag app

3. FASTag Partner

4. National Electronic Toll Collection technology

Which of the above-mentioned technologies is/are developed by the National Payment Corporation of India (NPCI) ?

A fee has to be paid by the merchant to his/her bank for every credit/debit card transaction by the name Merchant Discount Rate (MDR). The amount received is shared among which of the following ?

1. Card issuing bank of customer

2. Acquiring the bank of the merchant

3. Payment gateway provider

Select the correct answer using the code given below :

The first blockchain bond in the world, ‘Bond-i’ was launched by which among the following?

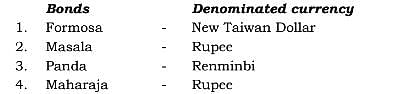

Consider the following :

How many pairs given above is/are correctly matched ?

The Government of India’s plan to borrow Rs.16,000cr by issuing Sovereign green bonds is meant to be used for which of the following purposes ?

1. Grants for renewable energy sources

2. Tax cuts for the usage of electric vehicles

3. Landfill projects

4. Equity investment in metro projects

5. Palm oil industries

6. Waste water management

7. Pollution control projects

Select the correct answer from the code given below :

Which of the following statements is an appropriate description of Runaway inflation ?

In the context of the Balance of Payments, consider the following :

1. External commercial borrowing

2. Government transfers

3. Balance of invisibles

4. Global depository receipt

Which of the above comes under Capital Account ?

With reference to the Global Depository Receipt (GDR), consider the following statements :

1. GDR is a negotiable instrument issued by a depository bank in international markets.

2. Indian companies can list their global depository receipts at the International Financial Services Centre in Gujarat.

3. It can be issued in more than one country.

Which of the above statements is/are correct ?

With reference to Digital Security Infrastructure in India, consider the following statements :

1. The Information Technology Act 2000 provides legal sanctity to digital signatures in India.

2. Certifying Authorities licensed by the Controller of Certifying Authorities (CCA) issue Digital Signature Certificates.

3. The electronic documents that have been digitally signed are not treated at par with paper documents.

4. The Data Security Council of India (DSCI), set up by the Ministry of electronics, is committed to making cyberspace safe and secure.

Which of the statements given above are correct?

Consider the following with reference to Trademarks :

1. A Trademark is a unique sign used by businesses to distinguish themselves.

2. It provides the owner exclusive rights and is protected by Intellectual Property rights.

3. Once registered, it has perpetual validity.

4. The Ministry of Corporate Affairs manages trademarks.

Which of the above statements are correct ?

With reference to the Grievance Redressal Index (GRI), consider the following statements :

1. GRI is published by the Ministry of Home Affairs every month.

2. It ranks Ministries, Departments and Autonomous Bodies.

Which of the statements given above is/are correct ?

Which of the following indicators gives the best picture of the international trade competitiveness of a country’s economy ?

Which of the following functions are carried out by the Reserve Bank of India to lower inflation?

1. Purchase of G Secs

2. Increasing Standing Deposit Facility

3. Increasing Cash Reserve Ratio

4. Decreasing Marginal Standing Facility

Choose the correct answer using the code given below :

When inflation in the economy is rising, which of the following are the likely consequences ?

1. Increase in bond yield

2. Increase in bond prices in the secondary market

3. The cost of borrowing may increase

Choose the correct answer using the code given below :

Which of the following statements best describes the ‘head count ratio’?

In the context of the functions of the central bank, the Reserve Bank of India carries out sterilization to

In order to arrive at the market price of the product, which of the following are added to the factor cost of the product?

1. Total direct taxes

2. Total indirect taxes

3. Total subsidies

Select the correct answer using the code given below.

Under which of the following types of unemployment more people are doing work than actually required?

A decision of the Reserve Bank of India to increase the Cash Reserve Ratio (CRR) is most likely to result in

Consider the following statements:

1. The Indian Technical Textiles market is the 5th largest in the world .

2. The Technical Textile segment accounts for around 15% of the overall textile and Apparel market in India.

3. National Technical Textiles Mission (NTTM) was launched to achieve a market size of 80 billion dollars by 2024-25.

Which of the statements given above is/are correct?

With reference to the Indian economy, consider the following statements:

1. Total tax revenue which is used for GDP compilation, excludes the Non-GST Revenue.

2. Quarterly Estimates of GDP are released by the Department of Economic Affairs, Ministry of Finance.

Which of the statements given above is/are correct?