MCQ: Line Charts - 1 - SSC CGL MCQ

15 Questions MCQ Test - MCQ: Line Charts - 1

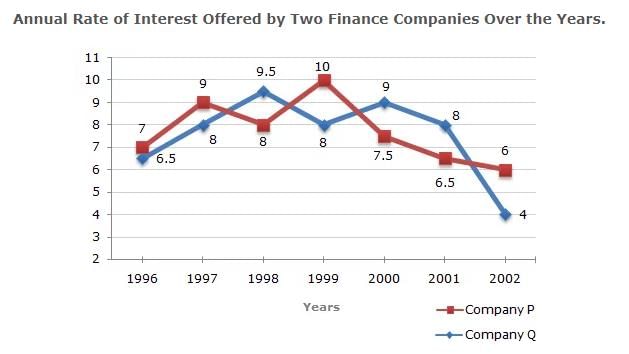

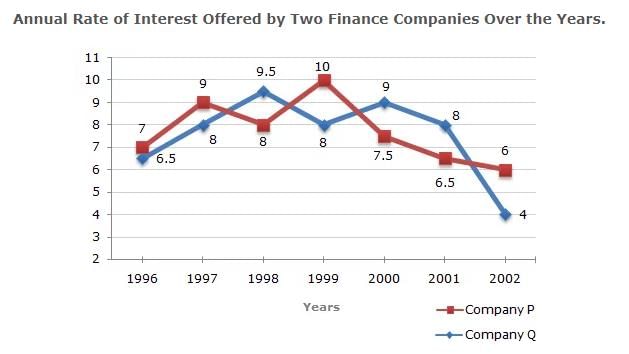

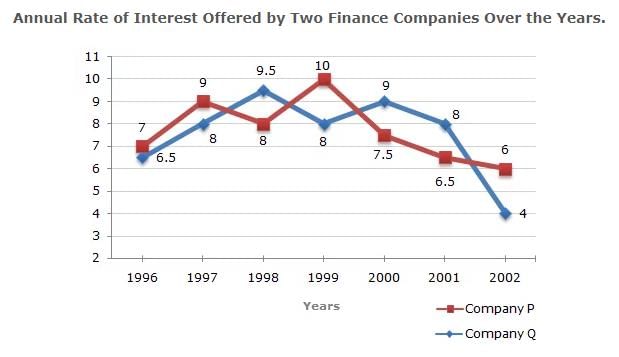

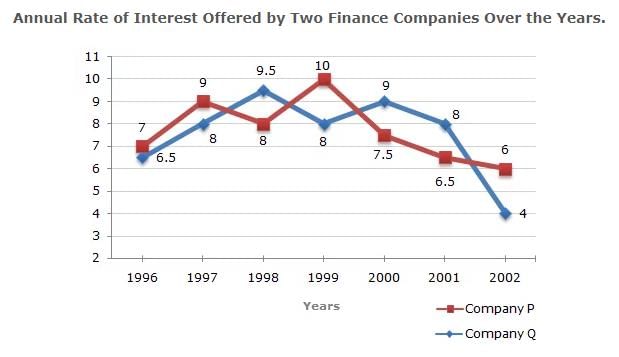

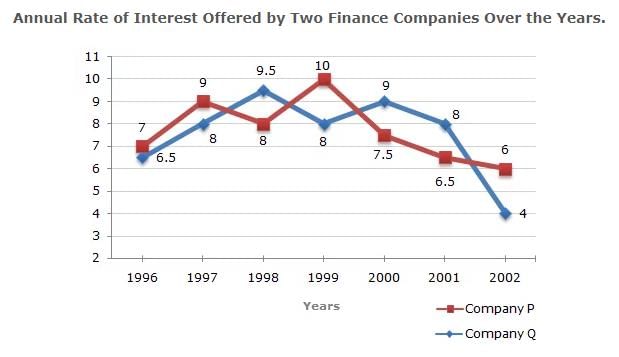

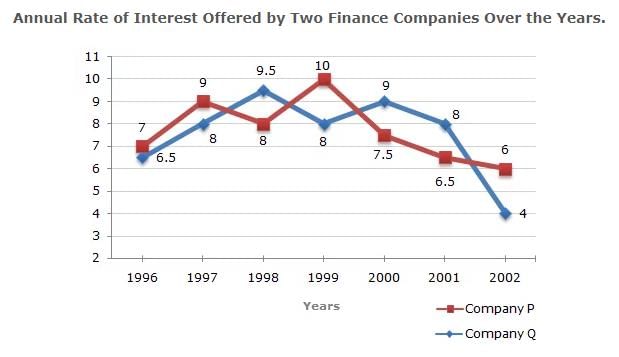

Direction: Two different finance companies declare fixed annual rate of interest on the amounts invested with them by investors. The rate of interest offered by these companies may differ from year to year depending on the variation in the economy of the country and the banks rate of interest. The annual rate of interest offered by the two Companies P and Q over the years are shown by the line graph provided below.

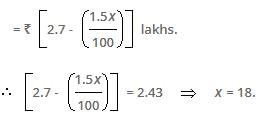

Q. In 2000, a part of ₹ 30 lakhs was invested in Company P and the rest was invested in Company Q for one year. The total interest received was ₹ 2.43 lakhs. What was the amount invested in Company P?

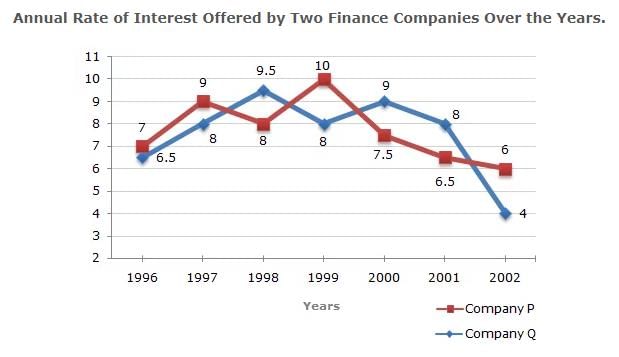

Direction: Two different finance companies declare fixed annual rate of interest on the amounts invested with them by investors. The rate of interest offered by these companies may differ from year to year depending on the variation in the economy of the country and the banks rate of interest. The annual rate of interest offered by the two Companies P and Q over the years are shown by the line graph provided below.

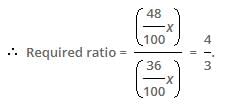

Q. If two different amounts in the ratio 8:9 are invested in Companies P and Q respectively in 2002, then the amounts received after one year as interests from Companies P and Q are respectively in the ratio?

Direction: Two different finance companies declare fixed annual rate of interest on the amounts invested with them by investors. The rate of interest offered by these companies may differ from year to year depending on the variation in the economy of the country and the banks rate of interest. The annual rate of interest offered by the two Companies P and Q over the years are shown by the line graph provided below.

Q. An investor invested ₹ 5 lakhs in Company Q in 1996. After one year, the entire amount along with the interest was transferred as investment to Company P in 1997 for one year. What amount will be received from Company P, by the investor?

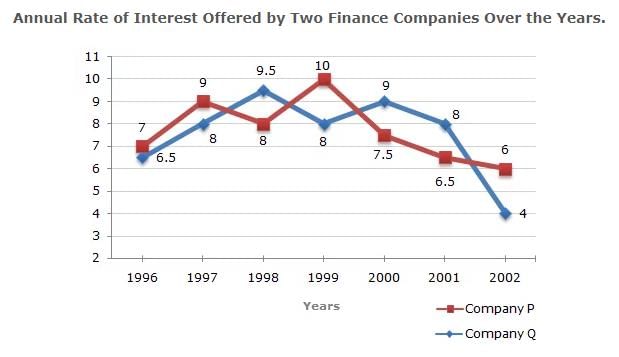

Direction: Two different finance companies declare fixed annual rate of interest on the amounts invested with them by investors. The rate of interest offered by these companies may differ from year to year depending on the variation in the economy of the country and the banks rate of interest. The annual rate of interest offered by the two Companies P and Q over the years are shown by the line graph provided below.

Q. An investor invested a sum of ₹ 12 lakhs in Company P in 1998. The total amount received after one year was re-invested in the same Company for one more year. The total appreciation received by the investor on his investment was?

Direction: Two different finance companies declare fixed annual rate of interest on the amounts invested with them by investors. The rate of interest offered by these companies may differ from year to year depending on the variation in the economy of the country and the banks rate of interest. The annual rate of interest offered by the two Companies P and Q over the years are shown by the line graph provided below.

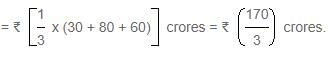

Q. A sum of ₹ 4.75 lakhs was invested in Company Q in 1999 for one year. How much more interest would have been earned if the sum was invested in Company P?

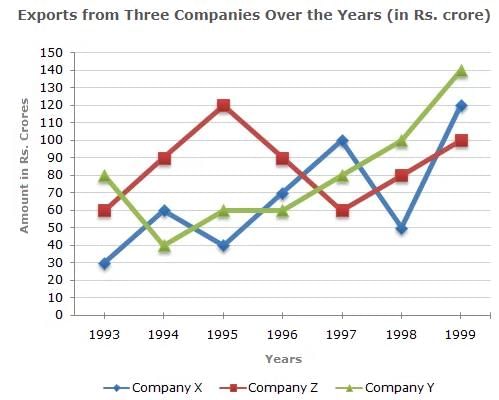

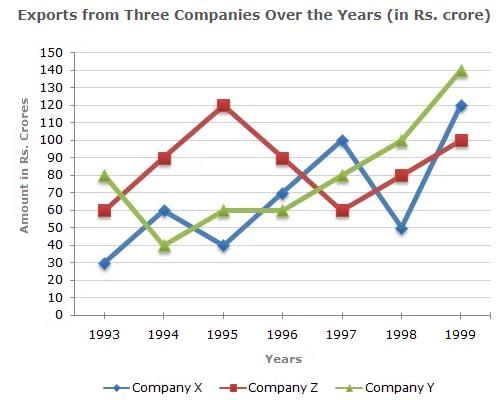

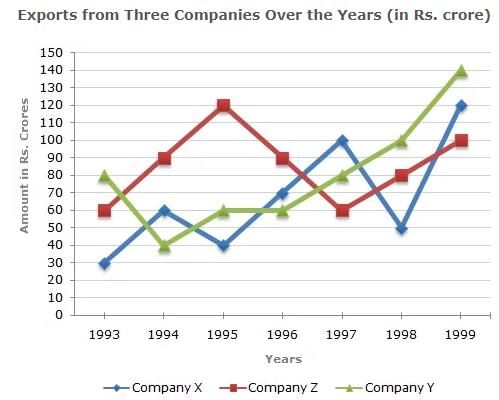

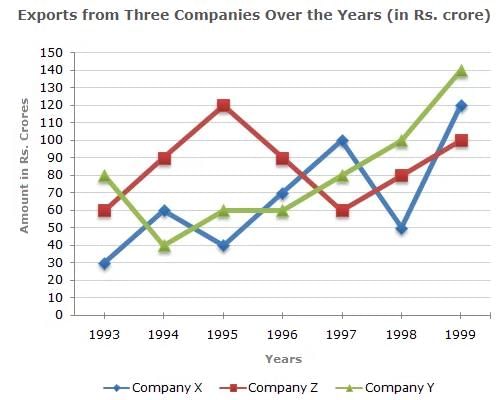

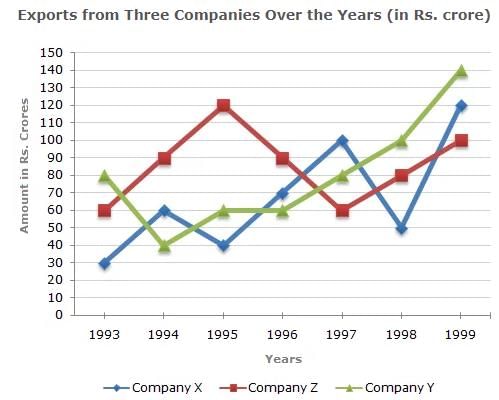

Study the following line graph and answer the questions.

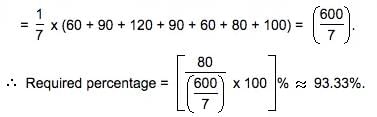

Q. Average annual exports during the given period for Company Y is approximately what percent of the average annual exports for Company Z?

Study the following line graph and answer the questions.

Q. For which of the following pairs of years the total exports from the three Companies together are equal?

Study the following line graph and answer the questions.

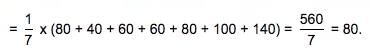

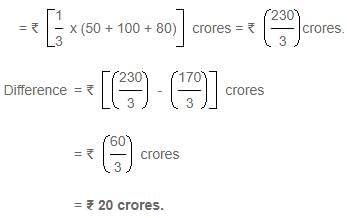

Q. What was the difference between the average exports of the three Companies in 1993 and the average exports in 1998?

Study the following line graph and answer the questions.

Q. In how many of the given years, were the exports from Company Z more than the average annual exports over the given years?

Study the following line graph and answer the questions.

Q. In which year was the difference between the exports from Companies X and Y the minimum?

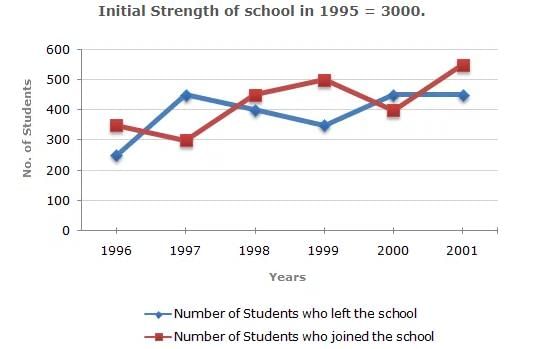

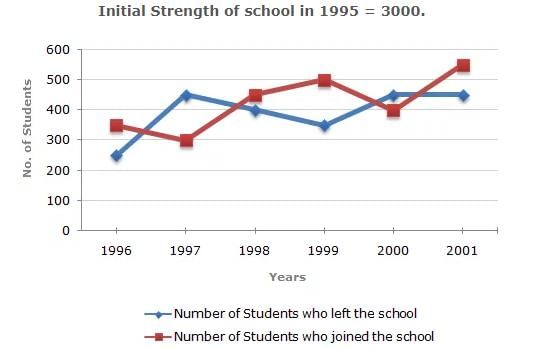

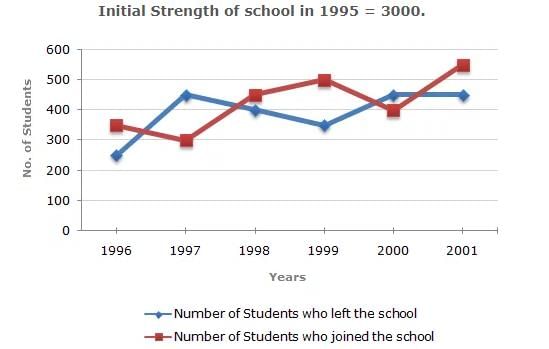

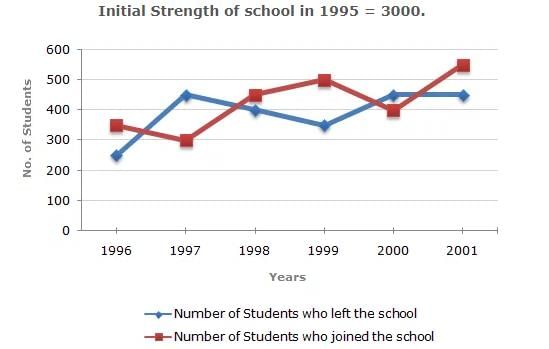

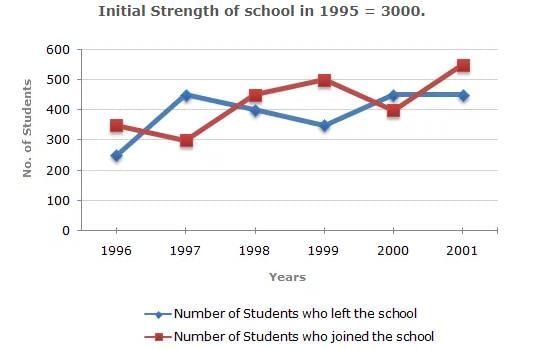

Direction: Study the following line graph which gives the number of students who joined and left the school in the beginning of year for six years, from 1996 to 2001.

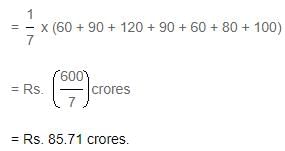

Q. For which year, the percentage rise/fall in the number of students who left the school compared to the previous year is maximum?

Direction: Study the following line graph which gives the number of students who joined and left the school in the beginning of year for six years, from 1996 to 2001.

Q. The number of students studying in the school in 1998 was what percent of the number of students studying in the school in 2001?

Direction: Study the following line graph which gives the number of students who joined and left the school in the beginning of year for six years, from 1996 to 2001.

Q. The strength of school increased/decreased from 1997 to 1998 by approximately what percent?

Direction: Study the following line graph which gives the number of students who joined and left the school in the beginning of year for six years, from 1996 to 2001.

Q. The number of students studying in the school during 1999 was?

Direction: Study the following line graph which gives the number of students who joined and left the school in the beginning of year for six years, from 1996 to 2001.

Q. The ratio of the least number of students who joined the school to the maximum number of students who left the school in any of the years during the given period is?