Test: Bank Reconciliation Statement - 1 - Commerce MCQ

30 Questions MCQ Test - Test: Bank Reconciliation Statement - 1

When check is not paid by the bank, it is called?

If balance as per Pass Book is the starting point, then uncollected cheques are:

The Cash book showed an overdraft of Rs.1,500 but the pass book made up to same date should that cheques of Rs. 100, Rs. 50 and Rs. 125 had not been presented for payment and a cheque of Rs. 400 had not been cleared. The balance as per the Cash Book will be:

The balance as per passbook is Rs. 20,000, out of which Rs. 4,000 were directly deposited by a customer into the bank. Then the balance as per cash book is:

The credit balance of Rs. 2,000 in the bank column of the cash book was carried forwarded as its debit balance. When overdraft as per pass book is starting point:

Favourable balance as per Cash Book means:

When favourable balance as per cash book is the starting point, wrong debit by the bank to the firm will be:

A trader issued cheques worth Rs. 7,800 out of which cheques worth Rs. 6,500 only presented into bank then on reconciling the Cash Book with the Pass Book, the amount to be added will be :

On 31.3.09 the balance of the cash book is Rs. 7,074 (credit) and Balance as per Bank statement is Rs. 3,159 (debit). On scrutiny it was found that the difference was due to cheques issued but yet not presented for payment. The Bank Balance as on 31.3.09 to be shown in Balance Sheet as :-

If we take balance as per Pass book which of the following will be deducted to get balance as per cash book :

The balance as per Cash Book (overdraft ) is 1,500. Cheques for Rs. 400 were deposited but were not collected. The cheques issued but not presented were Rs. 100, Rs. 125, Rs. 50. Balance as per Pass Book is :

When overdraft as per Cash Book is the starting point, a cheque of Rs. 500 deposited into bank but not recorded in cash book will be :

The payment side of Cash Book is under cast by Rs. 250. If the starting point of BRS is the Overdraft Balance as per Pass Book, then what would be the treatment to reach to Overdraft Balance of Cash Book ?

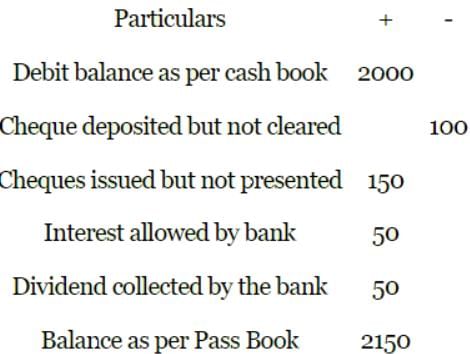

Debit balance as per cash book Rs.2000

Cheques deposited but not cleared Rs. 100

Cheques issued but not presented Rs. 150

Bank allowed interest Rs. 50

Bank collected dividend Rs. 50

Balance as per Pass Book will be:

The main purpose of preparing a bank reconciliation statement is?

Which of these types of errors are not detected during Bank Reconciliation’ :

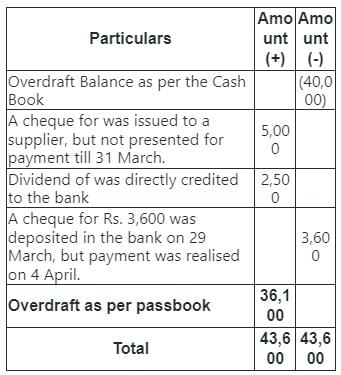

Aman Brothers has an overdraft of Rs. 40,000 as per the Cash Book on 31 March. On 22 March, a cheque for Rs. 5,000 was issued to a supplier, but not presented for payment till 31 March. Dividend of Rs. 2,500 was directly credited to the bank on 27 March but was informed to Aman Brothers on 2 April. A cheque for Rs. 3,600 was deposited in the bank on 29 March, but payment was realised on 4 April. The overdraft as per passbook is:

Credit balance as per cash Book Rs. 10,000

Bank charged interest Rs. 150

Cheques issued but not presented for payment Rs. 2,500

Balance as per pass Book will be :

In arriving at adjusted cash balance which of the following is not taken into account:

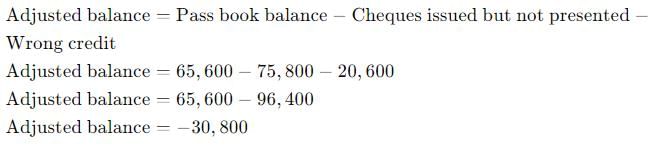

The credit balance as per pass book of Mr. X was Rs. 65,600. Cheques issued but not presented for payment Rs. 75,800. Cheques deposited by one of the customers of the bank but wrongly credited in Mr. X account Rs. 20,600. The balance as per cash book will be:-

If the balance as per Pass Book is the starting point, so the treatment of undercasting of receipt side of Cash Book will be :

A Bank Reconciliation Statement is prepared to Know the causes for the difference between:

When Money is withdrawn from bank the bank:

The balance as per Cash Book is Rs. 10,000 Cheques for Rs. 2,000 were issued but not presented for payment. What would be the balance as per Pass Book?

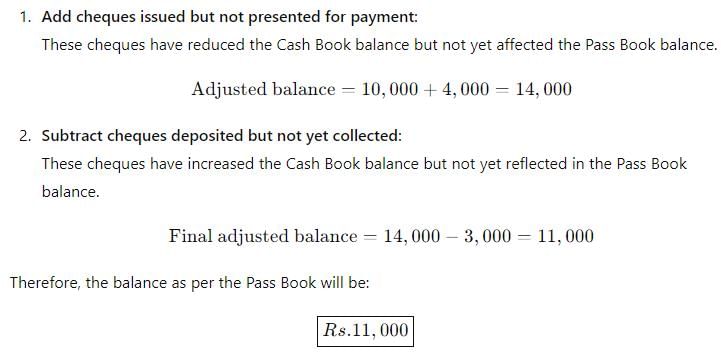

Balance shown by Cash Book Rs. 10,000

Cheques issued but not presented for payment Rs. 4,000

Cheques deposited but not yet collected Rs 3,000

Balance as per Pass Book will be :

For preparing Bank Reconciliation statement the documents statements required are: