Test: Final Accounts Of Manufacturing Entities - 3 - Commerce MCQ

30 Questions MCQ Test - Test: Final Accounts Of Manufacturing Entities - 3

Units produced 5,000 @ 20/- Direct Expenses – Rs. 5,000 4/5th of the units were sold @ 25%/- per unit. What will be the profit?

Profit or loss on sale of fixed assets is transferred to:

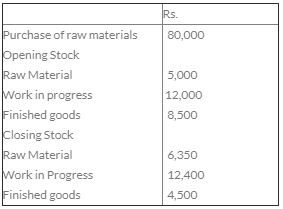

From the following information, calculate the cost of raw material consumed:

If Depreciation is Excess charged by Rs. 500 and closing stock is under valued by Rs. 500 the net profit will be _______ due to these errors.

On 31st March, 2011, the books of Ajit showed a net profit of Rs. 84,000. Later it was discovered that the closing stock was overvalued, by Rs. 4,000 and the discount received or Rs. 1,500 was treated as an expense. What was the correct net profit of Ajit?

Goods worth Rs. 5,000 were supplied to Mr. X at an invoice price of 20% above Cost and allowed trade discount at 10% on invoice price. At what price were the goods sold to X?

The opening stock is understated by Rs. 20,000 and closing stock is overstated by Rs. 25,000. The net profit the current year is _________ by ________.

An item of furniture was destroyed by fire whose cost was Rs. 18,000 against which a claim of Rs. 12,000 was accepted by the insurance company. The depreciation provision up to date of fire was Rs. 2,700. What amount to be recorded in account as loss by fire?

Sundry Debtors on 31st March, 2006 are Rs.55,200. Further Bad debts are Rs.200:Provision for doubtful debts are to be made on debtors @ 5% and also provision of discount is to be made on debtors @ 2%. The amount of provision of discount in debtors will be:

An increase in the provision for doubtful debts would result in ________ in working capital and _______ in net profit:

Which of the following statement is not correct?

Bills payable is shown on the liability side of the Balance Sheet under the head:

If opening stock is Rs. 69,500, closing stock is Rs. 83,500, sales less return is Rs. 1, 60,000 and purchases is Rs. 1,10,00. The Gross Profit margin on Sales would be?

X sold goods to Y at a profit of 10% on cost, and Y sold the goods to Z at a profit of 20% on sale value. If the cost of goods to X is Rs. 50,000, then at what value Y has sold the goods to Z?

Mr. A invest Rs. 10,00,000 to start a cloth business on 1st April, 2011. During the year he purchases goods of Rs. 7,10,000 and his sales for the year was Rs. 8,42,000. He pays shop rent for the financial year 2011-12 Rs. 20,000 and other expenses Rs. 75,000 and finds that he has goods worth Rs. 45,000 in hand. What would be the gross profit for the year ended 31st March, 2012?

On March 31. 2013, Prepaid Expenses A/c (2012 – 13) Shows a closing balance of Rs. 5,000. It means

Sale of the Scrap of raw materials appearing in the trial balance are shown on the credit side of :

Calculate amount of Salary debited to profit and loss A/c for the year ending 31.03.2013 Salary outstanding as on 31.03.2012 Rs. 25,000 Salary outstanding as on 31.03.2013 Rs. 10,000 Prepaid Salary on 31.03.2012 Rs. 10,000 Salary paid in cash during the year Rs. 3,00,000

On March 31. 2013, Prepaid Expenses A/c (2012 – 13) Shows a closing balance of Rs. 5,000. It means

Which of the following is not a “Miscellaneous Expenditure” a shown in assets die or Balance Sheet?

Which of the following are current assets?

1. Accounts receivable

2. Salary paid in advance

3. Bank loan for three years

4. Preliminary expenses

Calculate amount of Salary debited to profit and loss A/c for the year ending 31.03.2013 Salary outstanding as on 31.03.2012 Rs. 25,000 Salary outstanding as on 31.03.2013 Rs. 10,000 Prepaid Salary on 31.03.2012 Rs. 10,000 Salary paid in cash during the year Rs. 3,00,000

In Journal, the entries which pertain to outstanding expenses, prepaid expenses or depreciation are called

In Journal, the entries which pertain to outstanding expenses, prepaid expenses or depreciation are called

At the end of the financial year 2011-12 the gross profit of Ram’s business is Rs. 1,75,000. During the year carriage inward Rs. 15,000, Ram’s personal expenses Rs. 75,000 and carriage outward Rs. 17,500 were paid by Ram. Bad debts for the year were Rs. 12,000. The net profit earned by Ram for the year 2011-12 would be:

At the end of the financial year 2011-12 the gross profit of Ram’s business is Rs. 1,75,000. During the year carriage inward Rs. 15,000, Ram’s personal expenses Rs. 75,000 and carriage outward Rs. 17,500 were paid by Ram. Bad debts for the year were Rs. 12,000. The net profit earned by Ram for the year 2011-12 would be:

A company wishes to earn a 20% profit margin on selling price _______ is the profit marks up on cost, which will achieve the required profit margin ?