All Exams >

Commerce >

4 Months Preparation for Commerce Class 12 Boards >

All Questions

All questions of Reconstitution of a Partnership Firm: Admission of a Partner for Commerce Exam

Money withdrawn by a partner on 1st July Rs. 20,000 and interest on drawings is fixed @ 6% p.a. (Books are closed on 31st March.) The amount of interest will be Rupees:

- a)900

- b)1200

- c)600

- d)No interest will be charged.

Correct answer is option 'A'. Can you explain this answer?

Money withdrawn by a partner on 1st July Rs. 20,000 and interest on drawings is fixed @ 6% p.a. (Books are closed on 31st March.) The amount of interest will be Rupees:

a)

900

b)

1200

c)

600

d)

No interest will be charged.

|

|

Arun Yadav answered |

Correct Answer :- A

Explanation : Loan interest to be provided @ 6% p.a.

Loan Amount = ₹ 20,000

Time (from 1st July to 31st March) = 9 months

A’s loan interest = 20,000 * 6/100 * 9/12

= 900

This a MCQ (Multiple Choice Question) based practice test of Chapter 1 - Fundamentals of partnership and Goodwill of Accountancy of Class XII (12) for the quick revision/preparation of School Board examinationsQ Which Section of the Partnership Act defines partnership as the relation between persons who have agreed to share the profits of a business carried on by all or any of them acting for all?- a)Section 61

- b)Section 13

- c)Section 48

- d)Section 4

Correct answer is 'D'. Can you explain this answer?

This a MCQ (Multiple Choice Question) based practice test of Chapter 1 - Fundamentals of partnership and Goodwill of Accountancy of Class XII (12) for the quick revision/preparation of School Board examinations

Q Which Section of the Partnership Act defines partnership as the relation between persons who have agreed to share the profits of a business carried on by all or any of them acting for all?

a)

Section 61

b)

Section 13

c)

Section 48

d)

Section 4

|

|

Nandini Iyer answered |

Section 4 in The Indian Partnership Act, 1932

Definition of “partnership”, “partner”, “firm” and “firm name”.—’’Partnership” is the relation between persons who have agreed to share the profits of a business carried on by all or any of them acting for all. Persons who have entered into partnership with one another are called individually “partners” and collectively a “firm”, and the name under which their business is carried on is called the “firm name”.

It is better to have the agreement in writing to avoid any ___- a)Dispute

- b)Audit

- c)Loss

- d)Case

Correct answer is option 'A'. Can you explain this answer?

It is better to have the agreement in writing to avoid any ___

a)

Dispute

b)

Audit

c)

Loss

d)

Case

|

Gaurav Saini answered |

Partnership deed plays important role in regulating the duties and responsibilities of each partner. A written partnership deed is useful to resolve disputes and misunderstanding among partners because every thing is in written form.

A and B are partners in a firm sharing profits in the ratio of 2 : 1. They admit C as a new partner for 1/5 share. New Ratio of A and B will be 1 : 2. Sacrificing ratio will be:- a)Sacrificing ratio 1 : 1

- b)Sacrificing ratio 2 : 1

- c)A’s Sacrifice 6/15 and B’s Gain 3/15

- d)Sacrificing ratio 3 : 5

Correct answer is 'C'. Can you explain this answer?

A and B are partners in a firm sharing profits in the ratio of 2 : 1. They admit C as a new partner for 1/5 share. New Ratio of A and B will be 1 : 2. Sacrificing ratio will be:

a)

Sacrificing ratio 1 : 1

b)

Sacrificing ratio 2 : 1

c)

A’s Sacrifice 6/15 and B’s Gain 3/15

d)

Sacrificing ratio 3 : 5

|

Akshara Chopra answered |

Calculation of sacrificing ratio of partners:

Old Ratio = 2:1

New Ratio of A and B = 1:2

New Ratio of A, B and C will be : 1 – 1/5 = 4/5

A’s new share = 1/3 × 4/5 = 4/15

B’s new share = 2/3 × 4/5 = 8/15

C’s Share 1/5 OR 3/15

New Ratio 4 : 8: 3

Sacrificing Ratio = A : 2/3 – 4/15= 6/15

B : 1/3 – 8/15 = 3/15 Gain

Old Ratio = 2:1

New Ratio of A and B = 1:2

New Ratio of A, B and C will be : 1 – 1/5 = 4/5

A’s new share = 1/3 × 4/5 = 4/15

B’s new share = 2/3 × 4/5 = 8/15

C’s Share 1/5 OR 3/15

New Ratio 4 : 8: 3

Sacrificing Ratio = A : 2/3 – 4/15= 6/15

B : 1/3 – 8/15 = 3/15 Gain

This a MCQ (Multiple Choice Question) based practice test of Chapter 3 - Admission of a Partner of Accountancy of Class XII (12) for the quick revision/preparation of School Board examinationsQ Why a new partner is admitted in the firm?- a)To Increase the Number of partners

- b)To Increase the Capital of the firm.

- c)To Increase the Profit sharing Ratio

- d)To increase the goodwill of the firm

Correct answer is 'B'. Can you explain this answer?

This a MCQ (Multiple Choice Question) based practice test of Chapter 3 - Admission of a Partner of Accountancy of Class XII (12) for the quick revision/preparation of School Board examinations

Q Why a new partner is admitted in the firm?

a)

To Increase the Number of partners

b)

To Increase the Capital of the firm.

c)

To Increase the Profit sharing Ratio

d)

To increase the goodwill of the firm

|

Pooja Nair answered |

The main purpose of admission of a new partner is to increase the capital of the firm. When old partners feel that the capital they have employed in the business is not enough for the future growth of the business. They may admit a new partner to maintain or to build up the financial strength of the business.

From the following, what is important for a partnership?- a)Capital more than 15 Crore

- b)Registration

- c)Sharing of Profits

- d)More than 10 Persons

Correct answer is 'C'. Can you explain this answer?

From the following, what is important for a partnership?

a)

Capital more than 15 Crore

b)

Registration

c)

Sharing of Profits

d)

More than 10 Persons

|

Arshiya Datta answered |

Sharing of profits is must for a partnership business. Profits earned by a partnership firm should be divided amongst partners in the agreed profit sharing ratio. If profit sharing ratio is not mentioned in the partnership deed or partnership deed is silent on the distribution of profits, in such a case profits will be shared equally.

Registration of partnership firm is _________- a)Not Allowed

- b)Compulsory

- c)Optional

- d)Under Companies Act 2013

Correct answer is option 'C'. Can you explain this answer?

Registration of partnership firm is _________

a)

Not Allowed

b)

Compulsory

c)

Optional

d)

Under Companies Act 2013

|

|

Arjun Singhania answered |

Partnerships in India are governed by the Indian Partnership Act, 1932. As per the Partnership Act, Registration of Partnership Firms is optional and is entirely at the discretion of the partners. The Partners may or may not register their Partnership Agreement.

Below are listed Content of partnership Deed except:- a)Interest on Debentures

- b)Interest on Partners capital and drawings

- c)Name of the firm.

- d)Ratio in which profit or losses shall be share

Correct answer is option 'A'. Can you explain this answer?

Below are listed Content of partnership Deed except:

a)

Interest on Debentures

b)

Interest on Partners capital and drawings

c)

Name of the firm.

d)

Ratio in which profit or losses shall be share

|

Sankar Bose answered |

Interest paid on debentures is a charge against the profit. Partnership Deed is mainly concerned with the appropriations and some charge. Main contents of partnership deed are interest on capital, interest on drawings, name of the firm, partners, their names and address etc.

Goodwill Given in the old Balance Sheet will be:- a)Written off by the Sacrificing partners

- b)Distributed by Gainer partners

- c)Credited to old Partners Capital accounts

- d)Written off by the old partners

Correct answer is option 'D'. Can you explain this answer?

Goodwill Given in the old Balance Sheet will be:

a)

Written off by the Sacrificing partners

b)

Distributed by Gainer partners

c)

Credited to old Partners Capital accounts

d)

Written off by the old partners

|

|

Neha Sharma answered |

Goodwill existing in the old balance sheet of a partnership firm before admitting a new partner will be written off by the old partners in their old profit sharing ratio. A new partner cannot be debited for the same.

Good will of the firm is valued Rs. 30000. C an incoming partner purchase ¼ share of total profit Good will be raised in the books.- a)Rs. 30000

- b)Rs. 7500

- c)Rs. 120000

- d)Rs. 7000

Correct answer is option 'A'. Can you explain this answer?

Good will of the firm is valued Rs. 30000. C an incoming partner purchase ¼ share of total profit Good will be raised in the books.

a)

Rs. 30000

b)

Rs. 7500

c)

Rs. 120000

d)

Rs. 7000

|

Anirudh Gupta answered |

A 1/4th share in the firm for Rs. 10000?

It depends on the terms of the partnership agreement. If the agreement allows for the sale of partnership shares and specifies a method for valuing the firm's goodwill, then the incoming partner would need to follow that process to determine the value of their share. If the agreement does not address the sale of shares or the valuation of goodwill, then the partners would need to negotiate a fair price based on the current value of the firm's assets and liabilities.

It depends on the terms of the partnership agreement. If the agreement allows for the sale of partnership shares and specifies a method for valuing the firm's goodwill, then the incoming partner would need to follow that process to determine the value of their share. If the agreement does not address the sale of shares or the valuation of goodwill, then the partners would need to negotiate a fair price based on the current value of the firm's assets and liabilities.

Premium brought by the new partner will be shared by the existing partners in:- a)New Ratio

- b)Gain Ratio

- c)Sacrificing Ratio

- d)Old Ratio

Correct answer is option 'C'. Can you explain this answer?

Premium brought by the new partner will be shared by the existing partners in:

a)

New Ratio

b)

Gain Ratio

c)

Sacrificing Ratio

d)

Old Ratio

|

|

Kiran Mehta answered |

When a new partner is admitted into the partnership firm, he brings some amount of premium for goodwill which will be shared/distributed by the sacrificing partners in their sacrificing ratio

When a partner withdraws ?4000 at the beginning of each quarter, the interest on his drawings @ 6% p.a. will be ?:- a)240

- b)960

- c)480

- d)600

Correct answer is 'D'. Can you explain this answer?

When a partner withdraws ?4000 at the beginning of each quarter, the interest on his drawings @ 6% p.a. will be ?:

a)

240

b)

960

c)

480

d)

600

|

|

Ishan Choudhury answered |

Correct Answer :- d

Explanation : If a fixed amount is withdrawn on the first day of every quarter, then the interest is calculated on the amount withdrawn for a period of seven and half months.

Total drawings made by the partner during the whole year is 4000 * 4 = 16000

Interest on drawings = 16000 * 6/100 * 7.5/12

= 600

If dates of the withdrawal of drawings are not given then interest on drawings should be charged- a)For 12months

- b)For 0 months

- c)For 6 months

- d)For 8 months

Correct answer is option 'C'. Can you explain this answer?

If dates of the withdrawal of drawings are not given then interest on drawings should be charged

a)

For 12months

b)

For 0 months

c)

For 6 months

d)

For 8 months

|

|

Cute Priyanshu answered |

If the dates of the withdrawal of drawings are not given then interest on drawing should be charged for 6 months.

A and B are partners in a firm sharing profits and losses in the ratio 1:2.They admitted C into the partnership and decided to give him 1/3rd share of the future profits. Find the new ratio of the partners.- a)It is 3:2:1

- b)It is 2:4:3

- c)It is 3:4:2

- d)It is 4:2:3

Correct answer is option 'B'. Can you explain this answer?

A and B are partners in a firm sharing profits and losses in the ratio 1:2.They admitted C into the partnership and decided to give him 1/3rd share of the future profits. Find the new ratio of the partners.

a)

It is 3:2:1

b)

It is 2:4:3

c)

It is 3:4:2

d)

It is 4:2:3

|

Maheshwar Chawla answered |

Given:

- A and B are partners with profit-sharing ratio 1:2.

- C is admitted into the partnership and given 1/3rd share of future profits.

To find: New ratio of the partners.

Solution:

Let the total profit be x.

Then, profit shares of A and B will be (1/3)x and (2/3)x respectively.

Let the share of C be y.

Then, y = (1/3)x/3 = (1/9)x

Thus, the new profit-sharing ratio will be:

A : B : C

= (1/3)x : (2/3)x : y

= (1/3)x : (2/3)x : (1/9)x

= 3x : 6x : x

= 3 : 6 : 1

= 2 : 4 : 1 (by dividing each term by the lowest term)

Therefore, the new ratio of partners is 2:4:1, which is option (b).

- A and B are partners with profit-sharing ratio 1:2.

- C is admitted into the partnership and given 1/3rd share of future profits.

To find: New ratio of the partners.

Solution:

Let the total profit be x.

Then, profit shares of A and B will be (1/3)x and (2/3)x respectively.

Let the share of C be y.

Then, y = (1/3)x/3 = (1/9)x

Thus, the new profit-sharing ratio will be:

A : B : C

= (1/3)x : (2/3)x : y

= (1/3)x : (2/3)x : (1/9)x

= 3x : 6x : x

= 3 : 6 : 1

= 2 : 4 : 1 (by dividing each term by the lowest term)

Therefore, the new ratio of partners is 2:4:1, which is option (b).

The Balance Sheet shows land and building Rs. 90,300. But after the change in agreement land and building be brought up to Rs.1, 19,700. By what amount land and building account should be recorded in revaluation account- a)Rs.119700

- b)Rs.29400

- c)Rs.90300

- d)Rs.90200

Correct answer is option 'B'. Can you explain this answer?

The Balance Sheet shows land and building Rs. 90,300. But after the change in agreement land and building be brought up to Rs.1, 19,700. By what amount land and building account should be recorded in revaluation account

a)

Rs.119700

b)

Rs.29400

c)

Rs.90300

d)

Rs.90200

|

|

Poonam Reddy answered |

The correct answer is B.

Land and building is an asset. Revaluation account considers only the changes in assets and liabilities. So since land and building was ₹90300 earlier and now it is to be brought up to ₹119700. This means the value of land and building is increased. So revaluation will consider only the increased amount and not the whole value of building . So increased amount is 119700-90300=₹29400

Sometimes the value of goodwill is not given at the time of admission of a new partner. In such a situation it has to be inferred from the arrangement of the capital and profit sharing ratio. This concept is called- a)Premium for Goodwill

- b)Average Goodwill

- c)Hidden Goodwill

- d)Purchased Goodwill

Correct answer is option 'C'. Can you explain this answer?

Sometimes the value of goodwill is not given at the time of admission of a new partner. In such a situation it has to be inferred from the arrangement of the capital and profit sharing ratio. This concept is called

a)

Premium for Goodwill

b)

Average Goodwill

c)

Hidden Goodwill

d)

Purchased Goodwill

|

Tanya Mishra answered |

Yup its hidden g/w as u have to calculate it frm given capital n the profit sharing ratio

Partners have decided to provide jobs to the women of economically backward society. What values can be depicted from the decision of partners.

- a)Financial Security to the weaker section of society

- b)Right to Education

- c)Social Responsibility

- d)Both Financial Security to the weaker section of society and Social Responsibility

Correct answer is option 'D'. Can you explain this answer?

Partners have decided to provide jobs to the women of economically backward society. What values can be depicted from the decision of partners.

a)

Financial Security to the weaker section of society

b)

Right to Education

c)

Social Responsibility

d)

Both Financial Security to the weaker section of society and Social Responsibility

|

|

Aryan Khanna answered |

The partners has taken a decision to provide employment to the women of economically backward section of the society. By this decision, partners are communicating the valued to the society i.e. financial security to the weaker section of society and social responsibility.

Out of the following, which is the main right of a partner?- a)Right to Stop other partners for drawings

- b)Right to Share the Assets of the firm.

- c)Right to share the old profits of the firm

- d)Right to Say no for Goodwill

Correct answer is option 'B'. Can you explain this answer?

Out of the following, which is the main right of a partner?

a)

Right to Stop other partners for drawings

b)

Right to Share the Assets of the firm.

c)

Right to share the old profits of the firm

d)

Right to Say no for Goodwill

|

|

Pj Commerce Academy answered |

When a new partner is admitted into a partnership business. He gets following rights:

1.Right to share future profits of the firm

2.Right to share in the assets of the firm

New partner is not entitled to the profits and other incomes earned by a partnership business before his admission

1.Right to share future profits of the firm

2.Right to share in the assets of the firm

New partner is not entitled to the profits and other incomes earned by a partnership business before his admission

Salary paid to the manager will be shown in:- a)Profit and loss appropriation account

- b)Partners current account only

- c)Profit and loss account

- d)Partners capital account only

Correct answer is 'C'. Can you explain this answer?

Salary paid to the manager will be shown in:

a)

Profit and loss appropriation account

b)

Partners current account only

c)

Profit and loss account

d)

Partners capital account only

|

|

Naina Sharma answered |

Salary paid to manager is a charge against the profit. It means this transaction will reduce the profit of the firm. All charge items are shown in profit and loss account only. That’s why salary paid to manager is shown in profit and loss account.

Rent paid to a partner comes under:- a)Profit and Loss Account

- b)Profit and Loss appropriation Account

- c)Partners capital Account

- d)Partners current Account

Correct answer is option 'A'. Can you explain this answer?

Rent paid to a partner comes under:

a)

Profit and Loss Account

b)

Profit and Loss appropriation Account

c)

Partners capital Account

d)

Partners current Account

|

Mansi Mukherjee answered |

Rent paid to a partner is a charge against the profit. It means it will reduce the profit. That’s why it is shown in Profit and Loss Account instead of Profit and Loss Appropriation Account.

A and B are partners sharing profit and losses in the ratio of 3:5. On 1st July, 2012 A and B advanced loan to the business of ?40,000 and ?20,000 respectively at the agreed @ 5% p.a. Calculate Interest on loan. When accounting books are closed on 31st December every year and partnership deed allows interest on loan to the partners.- a)A= ?1,000 and B= ?500

- b)A= ?2,000 and B= ?500

- c)A= ?1,000 and B= ?1500

- d)A= ?1,500 and B=?500

Correct answer is option 'A'. Can you explain this answer?

A and B are partners sharing profit and losses in the ratio of 3:5. On 1st July, 2012 A and B advanced loan to the business of ?40,000 and ?20,000 respectively at the agreed @ 5% p.a. Calculate Interest on loan. When accounting books are closed on 31st December every year and partnership deed allows interest on loan to the partners.

a)

A= ?1,000 and B= ?500

b)

A= ?2,000 and B= ?500

c)

A= ?1,000 and B= ?1500

d)

A= ?1,500 and B=?500

|

Abhiram Choudhary answered |

Calculation of Interest on loan:

Interest on A’s Loan = 40,000 × 5/100 × 6/12 = 1,000

Interest on B’s Loan = 20,000 × 5/100 × 6/12 = 500

Interest on A’s Loan = 40,000 × 5/100 × 6/12 = 1,000

Interest on B’s Loan = 20,000 × 5/100 × 6/12 = 500

Sacrificing ratio is differ from new profit sharing ratio- a)It is related to old partners

- b)It is related to all partners

- c)It is related to new partners

- d)It is related to all partners (including new)

Correct answer is option 'A'. Can you explain this answer?

Sacrificing ratio is differ from new profit sharing ratio

a)

It is related to old partners

b)

It is related to all partners

c)

It is related to new partners

d)

It is related to all partners (including new)

|

Naveen Choudhary answered |

Sacrificing ratio is concerned with the old partners who are sacrificing their share in favor of a new partner. New ratio means, new ratio of all the partners (including new and old partners).

The persons who have entered into a partnership business with one another are individually called- a)Firm

- b)Co-operatives

- c)Partner

- d)Company

Correct answer is option 'C'. Can you explain this answer?

The persons who have entered into a partnership business with one another are individually called

a)

Firm

b)

Co-operatives

c)

Partner

d)

Company

|

|

Arjun Singhania answered |

Indian Partnership Act, 1932

Sec 4. Definition of "partnership", "partner", "firm" and "firm name"

"Partnership" is the relation between persons who have agreed to share the profits of a business carried on by all or any of them acting for all.

Persons who have entered into partnership with one another are called individually "partners" and collectively a "firm", and the name under which their business is carried on is called the "firm name".

Partnership is established by ___________- a)Lawful Business

- b)Agreement

- c)Law

- d)Section 4

Correct answer is option 'B'. Can you explain this answer?

Partnership is established by ___________

a)

Lawful Business

b)

Agreement

c)

Law

d)

Section 4

|

Saumya Desai answered |

The beginning of partnership is always because of an agreement. There should be an agreement among the partners to start a partnership business. Agreement can be written or oral that does not matter.

Indian Partnership Act year is- a)1934

- b)1935

- c)1933

- d)1932

Correct answer is option 'D'. Can you explain this answer?

Indian Partnership Act year is

a)

1934

b)

1935

c)

1933

d)

1932

|

|

Rajat Patel answered |

The Indian Partnership Act, 1932. An Act to define and amend the law relating to partnership. 1 October 1932 except section 69 which came into force on the 1st day of October 1933.

When liabilities of partners are unlimited that implies- a)Not liable for any loss in the partnership

- b)Only to the extent of capital introduced

- c)Only 50 % of Loss occurred

- d)His private assets can also be used for paying off the firm’s debt

Correct answer is option 'D'. Can you explain this answer?

When liabilities of partners are unlimited that implies

a)

Not liable for any loss in the partnership

b)

Only to the extent of capital introduced

c)

Only 50 % of Loss occurred

d)

His private assets can also be used for paying off the firm’s debt

|

|

Poonam Reddy answered |

Mostly, the liability of the partners of a firm is unlimited. Their personal properties can be disposed off to pay the debts of the firm if required. The creditors can claim their dues from any one of the partner or from all of them, meaning partners are liable:

• Individually

• Collectively

• Individually

• Collectively

Interest on capital to be given to X & Y when Profits shown by P/L A/C Rs. 1500 and capitals invested by X & Y are Rs. 30,000 and 20,000 (rate of interest is 10% p.a.).- a)900 and 600

- b)300 and 200

- c)600 and 900

- d)3000 and 2000

Correct answer is option 'A'. Can you explain this answer?

Interest on capital to be given to X & Y when Profits shown by P/L A/C Rs. 1500 and capitals invested by X & Y are Rs. 30,000 and 20,000 (rate of interest is 10% p.a.).

a)

900 and 600

b)

300 and 200

c)

600 and 900

d)

3000 and 2000

|

Mrinalini Bose answered |

Interest due to X and Y is ?3,000 and ?2,000 (total Rs.5,000) but profit is only ?1,500. In this case Ratio of appropriation will be 3 : 2 (3,000 : 2,000). Now divide profit ?1,500 in Ratio of appropriation i.e. 3:2.

General Reserve at the time of admission of a partner is transferred to ____________ . - a)Revaluation Account

- b)Capital Accounts of all partners, including new partner

- c)None of the these

- d)Old Partner's Capital Account

Correct answer is option 'D'. Can you explain this answer?

General Reserve at the time of admission of a partner is transferred to ____________ .

a)

Revaluation Account

b)

Capital Accounts of all partners, including new partner

c)

None of the these

d)

Old Partner's Capital Account

|

Srsps answered |

Sometimes a firm may have accumulated reserves not yet transferred to the partner's capitals accounts. These are in the form of general reserve, reserve fund etc. The new partner is not entitled to share in these reserves. Hence, at the time of admission, these reserves are transferred to the old partner's capital accounts in their profit sharing ratio.

Which of the following is not a content of partnership deed?- a)Interest on Bank Loan

- b)Interest on Partner’s Loan

- c)Interest on Capital

- d)Interest on Drawings

Correct answer is option 'A'. Can you explain this answer?

Which of the following is not a content of partnership deed?

a)

Interest on Bank Loan

b)

Interest on Partner’s Loan

c)

Interest on Capital

d)

Interest on Drawings

|

|

Poonam Reddy answered |

Interest on bank loan will be fixed by the bank and not by the partners or partnership deed. A partnership deed can show only those contents which are concerned with partners or firm. Interest on bank loan is a charge against the profit. It means it will be paid in all conditions whether there is profit or loss in the business.

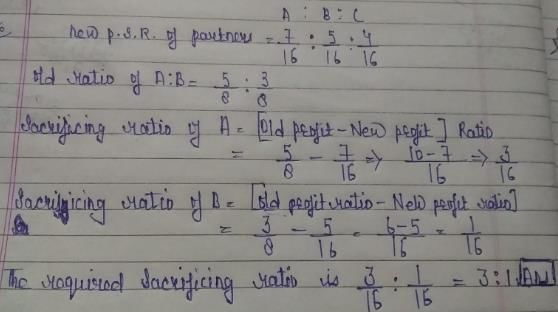

A and B are partner sharing profits and losses in the ration 5 : 3. On admission, C brings Rs. 70,000 cash and Rs. 48,000 against goodwill. New profit sharing ratio between A, B, C is 7:5:4. The sacrificing ratio among A and B is :- a)3:1

- b)4:7

- c)5:4

- d)2:1

Correct answer is option 'A'. Can you explain this answer?

A and B are partner sharing profits and losses in the ration 5 : 3. On admission, C brings Rs. 70,000 cash and Rs. 48,000 against goodwill. New profit sharing ratio between A, B, C is 7:5:4. The sacrificing ratio among A and B is :

a)

3:1

b)

4:7

c)

5:4

d)

2:1

|

Sai Kulkarni answered |

The members of the partnership firm are called- a)Partners

- b)Managers

- c)Directors

- d)Proprietors

Correct answer is option 'A'. Can you explain this answer?

The members of the partnership firm are called

a)

Partners

b)

Managers

c)

Directors

d)

Proprietors

|

|

Priya Patel answered |

The members of the Partnership firm are called as Partners. The members of the company are called as shareholders of a company. Partnership Form of business is governed by "The Indian Partnership Act, 1932." Option (A) is Correct.

Partners collectively are called :- a)Firm’s name

- b)Company

- c)Business

- d)Firm

Correct answer is option 'D'. Can you explain this answer?

Partners collectively are called :

a)

Firm’s name

b)

Company

c)

Business

d)

Firm

|

Manik Sodhi answered |

Partners are collectively known as firm and individually known as partners.

What is the status of partnership from an accounting viewpoint- a)Not separate from the owners.

- b)a separate business entity.

- c)Both a separate business entity and Not separate from the owners

- d)None of these

Correct answer is option 'B'. Can you explain this answer?

What is the status of partnership from an accounting viewpoint

a)

Not separate from the owners.

b)

a separate business entity.

c)

Both a separate business entity and Not separate from the owners

d)

None of these

|

|

Alok Mehta answered |

From an accounting viewpoint, partnership is a separate business entity. From legal viewpoints, however, a Partnership, like a sole proprietorship, is not separate from the owners.

If ?3,000 withdrawn by a partner on the first day of every quarter, interest on drawings will be calculated for:- a)4.5 months

- b)6 months

- c)5.5 months

- d)7.5 months

Correct answer is option 'D'. Can you explain this answer?

If ?3,000 withdrawn by a partner on the first day of every quarter, interest on drawings will be calculated for:

a)

4.5 months

b)

6 months

c)

5.5 months

d)

7.5 months

|

Anshu Singh answered |

When a partner draws a fixed amount in the beginning of each quarter for his personal use then average period will be calculated as : Time after first drawing 12 months + Time after last drawing 3 months, and average period will be = 15/2 = 7.5.

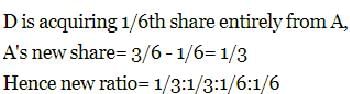

Can you explain the answer of this question below:A and B are partners in a firm sharing profits in the ratio of 2 : 1. They admit C as a new partner for 1/5 share. New Ratio will be 3 : 1 : 1. Sacrificing ratio will be:

- A:

2 : 1

- B:

1 : 7

- C:

3 : 5

- D:

1 : 2

The answer is D.

A and B are partners in a firm sharing profits in the ratio of 2 : 1. They admit C as a new partner for 1/5 share. New Ratio will be 3 : 1 : 1. Sacrificing ratio will be:

2 : 1

1 : 7

3 : 5

1 : 2

|

Surbhi Mishra answered |

Calculation of sacrificing ratio of partners:

Old Ratio = 2:1

New Ratio = 3:1:1

Sacrificing Ratio = A : 2/3 – 3/5 = 1/15

B : 1/3 – 1/5 = 2/15

Old Ratio = 2:1

New Ratio = 3:1:1

Sacrificing Ratio = A : 2/3 – 3/5 = 1/15

B : 1/3 – 1/5 = 2/15

REPORT ERROR

If partners are running a business without a partnership deed how much interest on their capitals will be given?- a)Only for 6 months @ 6% p.a.

- b)6% p.a. on capital

- c)No interest on capital

- d)10 % p.a. on capital

Correct answer is option 'C'. Can you explain this answer?

If partners are running a business without a partnership deed how much interest on their capitals will be given?

a)

Only for 6 months @ 6% p.a.

b)

6% p.a. on capital

c)

No interest on capital

d)

10 % p.a. on capital

|

Anushka Desai answered |

Partners are entitled to interest on capital only if rate of interest is mentioned in the partnership deed. But in this case business is continued without partnership deed. As per the Partnership Act, 1932, partners are enttiled to interest on capital only when there is partnership deed and rate of interest is mentioned in it.

If the partnership agreement is silent as to Interest on capital- a)6% interest on capital is allowed

- b)No interest on capital is allowed

- c)2% interest on capital is allowed

- d)5% interest on capital is allowed

Correct answer is option 'B'. Can you explain this answer?

If the partnership agreement is silent as to Interest on capital

a)

6% interest on capital is allowed

b)

No interest on capital is allowed

c)

2% interest on capital is allowed

d)

5% interest on capital is allowed

|

Vaishnavi Bajaj answered |

When rate of interest on capital is not mentioned in partnership deed, partners cannot claim for interest on capital. Interest on capital will be allowed to the partners only if rate of interest is mentioned in the partnership deed.

According to Section 30 of Partnership Act 1932:- a)New partner will bring capital and goodwill in cash

- b)New partner will inspect the books of accounts

- c)New partner is allowed to share old profits

- d)New partner is admitted by the consent of all partners

Correct answer is option 'D'. Can you explain this answer?

According to Section 30 of Partnership Act 1932:

a)

New partner will bring capital and goodwill in cash

b)

New partner will inspect the books of accounts

c)

New partner is allowed to share old profits

d)

New partner is admitted by the consent of all partners

|

|

Nandini Iyer answered |

According to Section 30 of Partnership Act 1932,

Minors admitted to the benefits of partnership. A person who is a minor according to the law to which he is subject may not be a partner in a firm, but, with the consent of all the partners for the time being, he may be admitted to the benefits of partnership.

Under fluctuating Capital method how many accounts of each partner is maintained- a)1

- b)2

- c)3

- d)4

Correct answer is option 'A'. Can you explain this answer?

Under fluctuating Capital method how many accounts of each partner is maintained

a)

1

b)

2

c)

3

d)

4

|

Nandini Chakraborty answered |

When accounts are prepared under fluctuating capital method, only one account is prepared for the partners i.e. partners capital account. All items related to partners i.e. capital, interest on capital, interest on drawings, salary, commission etc. are shown in partners capital account.

A and B are partners C is admitted with 1/5th share C brings Rs. 1,20,000 as his share towards capital. The total net worth of the firm is : - a)Rs. 1,00,000

- b)Rs. 4,00,000

- c)Rs. 1,20,000

- d)Rs. 6,00,000

Correct answer is option 'D'. Can you explain this answer?

A and B are partners C is admitted with 1/5th share C brings Rs. 1,20,000 as his share towards capital. The total net worth of the firm is :

a)

Rs. 1,00,000

b)

Rs. 4,00,000

c)

Rs. 1,20,000

d)

Rs. 6,00,000

|

Maheshwar Sharma answered |

Given, A and B are partners and C is admitted with 1/5th share. C brings Rs. 1,20,000 as his share towards capital.

Let's assume the total capital of the firm be x.

A and B have a share of 4/5th in the firm. So, their total capital will be 4/5 x.

C has a share of 1/5th in the firm. So, his capital will be 1/5 x.

Given, C brings Rs. 1,20,000 as his share towards capital.

Therefore, 1/5 x = Rs. 1,20,000.

Solving this equation, we get x = Rs. 6,00,000.

Hence, the total net worth of the firm is Rs. 6,00,000.

Therefore, the correct answer is option 'D' - Rs. 6,00,000.

Let's assume the total capital of the firm be x.

A and B have a share of 4/5th in the firm. So, their total capital will be 4/5 x.

C has a share of 1/5th in the firm. So, his capital will be 1/5 x.

Given, C brings Rs. 1,20,000 as his share towards capital.

Therefore, 1/5 x = Rs. 1,20,000.

Solving this equation, we get x = Rs. 6,00,000.

Hence, the total net worth of the firm is Rs. 6,00,000.

Therefore, the correct answer is option 'D' - Rs. 6,00,000.

Amit and Anil are partners sharing profits in the ratio of 5:3 with capital of Rs. 2,50,000 and Rs. 2,00,000. Atul was admitted and would pay Rs. 50,000 as capital and Rs. 16,000 as goodwill for 1/5th profit. Find the balance of capital account after admission of Atul:- a)2,60,000 : 2,06,000 : 50,000

- b)2,20,000 : 1,82,000 : 66,000

- c)2,92,500 : 2,25,500 : 50,000

- d)2,82,500 : 2,19,500 : 66,000

Correct answer is option 'A'. Can you explain this answer?

Amit and Anil are partners sharing profits in the ratio of 5:3 with capital of Rs. 2,50,000 and Rs. 2,00,000. Atul was admitted and would pay Rs. 50,000 as capital and Rs. 16,000 as goodwill for 1/5th profit. Find the balance of capital account after admission of Atul:

a)

2,60,000 : 2,06,000 : 50,000

b)

2,20,000 : 1,82,000 : 66,000

c)

2,92,500 : 2,25,500 : 50,000

d)

2,82,500 : 2,19,500 : 66,000

|

Prasenjit Kapoor answered |

Given:

- Amit and Anil are partners sharing profits in the ratio of 5:3 with capital of Rs. 2,50,000 and Rs. 2,00,000.

- Atul was admitted and would pay Rs. 50,000 as capital and Rs. 16,000 as goodwill for 1/5th profit.

To find: The balance of capital account after admission of Atul.

Solution:

1. Calculation of new profit sharing ratio:

- Amit and Anil's total capital = Rs. 2,50,000 + Rs. 2,00,000 = Rs. 4,50,000

- Atul's capital = Rs. 50,000

- Total capital after admission = Rs. 5,00,000

- Atul has been given 1/5th profit, which means he will get 1/6th share in the total profit (since there are now 3 partners).

- So, Atul's profit sharing ratio = 1/6 or 5:25

- Amit and Anil's profit sharing ratio = 5:3 or 25:15

- New profit sharing ratio = 25:15:5 or 5:3:1

2. Calculation of new capital:

- Amit's share in the total capital = 25/44 * Rs. 5,00,000 = Rs. 2,84,090.91

- Anil's share in the total capital = 15/44 * Rs. 5,00,000 = Rs. 1,65,909.09

- Atul's share in the total capital = Rs. 50,000

- Total capital after admission = Rs. 5,00,000

- So, the balance of capital account after admission of Atul is:

Amit: Rs. 2,84,090.91

Anil: Rs. 1,65,909.09

Atul: Rs. 50,000

Therefore, the correct answer is option 'A' - 2,60,000 : 2,06,000 : 50,000.

- Amit and Anil are partners sharing profits in the ratio of 5:3 with capital of Rs. 2,50,000 and Rs. 2,00,000.

- Atul was admitted and would pay Rs. 50,000 as capital and Rs. 16,000 as goodwill for 1/5th profit.

To find: The balance of capital account after admission of Atul.

Solution:

1. Calculation of new profit sharing ratio:

- Amit and Anil's total capital = Rs. 2,50,000 + Rs. 2,00,000 = Rs. 4,50,000

- Atul's capital = Rs. 50,000

- Total capital after admission = Rs. 5,00,000

- Atul has been given 1/5th profit, which means he will get 1/6th share in the total profit (since there are now 3 partners).

- So, Atul's profit sharing ratio = 1/6 or 5:25

- Amit and Anil's profit sharing ratio = 5:3 or 25:15

- New profit sharing ratio = 25:15:5 or 5:3:1

2. Calculation of new capital:

- Amit's share in the total capital = 25/44 * Rs. 5,00,000 = Rs. 2,84,090.91

- Anil's share in the total capital = 15/44 * Rs. 5,00,000 = Rs. 1,65,909.09

- Atul's share in the total capital = Rs. 50,000

- Total capital after admission = Rs. 5,00,000

- So, the balance of capital account after admission of Atul is:

Amit: Rs. 2,84,090.91

Anil: Rs. 1,65,909.09

Atul: Rs. 50,000

Therefore, the correct answer is option 'A' - 2,60,000 : 2,06,000 : 50,000.

A and B are partners, sharing profits in the ratio of 5:3. They admit C with 1/5 share in profits, which he acquires equally from both 1/10 from A and 1/10 from B. New profit sharing ratio will be:- a)21:11:8

- b)20:10:4

- c)15:10:4

- d)None

Correct answer is option 'A'. Can you explain this answer?

A and B are partners, sharing profits in the ratio of 5:3. They admit C with 1/5 share in profits, which he acquires equally from both 1/10 from A and 1/10 from B. New profit sharing ratio will be:

a)

21:11:8

b)

20:10:4

c)

15:10:4

d)

None

|

Srsps answered |

C is acquiring 1/10th equally from both A and B,

A's new share= 5/8 - 1/10= 21/40

B's new share= 3/8 - 1/10= 11/40

C's share= 8/40

New profit-sharing ratio= 21:11:8

Therefore, D is the correct answer.

B's new share= 3/8 - 1/10= 11/40

C's share= 8/40

New profit-sharing ratio= 21:11:8

Therefore, D is the correct answer.

In the absence of partnership deed profit sharing ratio will be:- a)Equal ratio irrespective of partners capitals.

- b)Profits will not be distributed

- c)Capital Ratio

- d)Senior partner will get more profit

Correct answer is option 'A'. Can you explain this answer?

In the absence of partnership deed profit sharing ratio will be:

a)

Equal ratio irrespective of partners capitals.

b)

Profits will not be distributed

c)

Capital Ratio

d)

Senior partner will get more profit

|

|

Kiran Mehta answered |

When there is no partnership deed or partnership deed is prepared but it is silent on profit sharing ratio, in such a case rules of Partnership Act, 1932 will be applicable. According to which, profits or losses will be shared by the partners equally irrespective of their capitals.

Revaluation A/c is prepared to find out the profit or loss on :- a)sale of fixed assets

- b)revaluation of assets and liabilities

- c)sale of goods

- d)sale of services

Correct answer is option 'B'. Can you explain this answer?

Revaluation A/c is prepared to find out the profit or loss on :

a)

sale of fixed assets

b)

revaluation of assets and liabilities

c)

sale of goods

d)

sale of services

|

|

Om Desai answered |

A Revaluation Account is prepared in order to ascertain net gain or loss on revaluation of assets and liabilities and bringing unrecorded items into books. The Revaluation profit or loss is transferred to the capital account of all partners including retiring or deceased partners in their old profit sharing ratio.

A and B are partners in a firm sharing profits in the ratio of 2 : 1. They admit C as a new partner for 1/5 share. New Ratio of A and B will be 1 : 2. Sacrificing ratio will be:- a)Sacrificing ratio 1 : 1

- b)Sacrificing ratio 2 : 1

- c)A’s Sacrifice 6/15 and B’s Gain 3/15

- d)Sacrificing ratio 3 : 5

Correct answer is option 'C'. Can you explain this answer?

A and B are partners in a firm sharing profits in the ratio of 2 : 1. They admit C as a new partner for 1/5 share. New Ratio of A and B will be 1 : 2. Sacrificing ratio will be:

a)

Sacrificing ratio 1 : 1

b)

Sacrificing ratio 2 : 1

c)

A’s Sacrifice 6/15 and B’s Gain 3/15

d)

Sacrificing ratio 3 : 5

|

Bhargavi Chopra answered |

Calculation of sacrificing ratio of partners:

Old Ratio = 2:1

New Ratio of A and B = 1:2

New Ratio of A, B and C will be : 1 – 1/5 = 4/5

A’s new share = 1/3 × 4/5 = 4/15

B’s new share = 2/3 × 4/5 = 8/15

C’s Share 1/5 OR 3/15

New Ratio 4 : 8: 3

Sacrificing Ratio = A : 2/3 – 4/15= 6/15

B : 1/3 – 8/15 = 3/15 Gain

Old Ratio = 2:1

New Ratio of A and B = 1:2

New Ratio of A, B and C will be : 1 – 1/5 = 4/5

A’s new share = 1/3 × 4/5 = 4/15

B’s new share = 2/3 × 4/5 = 8/15

C’s Share 1/5 OR 3/15

New Ratio 4 : 8: 3

Sacrificing Ratio = A : 2/3 – 4/15= 6/15

B : 1/3 – 8/15 = 3/15 Gain

Three partners shared the profit in a business in the ratio 5 : 7 : 8. They had partnered for 14 months, 8 months and 7 months respectively. What was the ratio of their investments?- a)5 : 7 : 8

- b)20 : 49 : 64

- c)38 : 28 : 21

- d)None of these

Correct answer is option 'B'. Can you explain this answer?

Three partners shared the profit in a business in the ratio 5 : 7 : 8. They had partnered for 14 months, 8 months and 7 months respectively. What was the ratio of their investments?

a)

5 : 7 : 8

b)

20 : 49 : 64

c)

38 : 28 : 21

d)

None of these

|

Amrutha Goyal answered |

Let their investments be Rs. x for 14 months, Rs. y for 8 months and Rs. z for 7 months respectively.

Then, 14x : 8y : 7z = 5 : 7 : 8.

Now,

Why new profit ratio is determine even for old partners?- a)No change in agreement

- b)Change in the agreement among all partners

- c)Ratio keeps on changing in every six month

- d)Due to change in external environment

Correct answer is option 'B'. Can you explain this answer?

Why new profit ratio is determine even for old partners?

a)

No change in agreement

b)

Change in the agreement among all partners

c)

Ratio keeps on changing in every six month

d)

Due to change in external environment

|

Nilesh Chawla answered |

New profit sharing ratio will be calculated for all the partners because of change in profit sharing ratio agreement among the partners.

A and B are partners sharing the profit the ratio of 3:2. They take C as the new partner, who brings in Rs. 25,000 against capital and Rs. 10,000 against goodwill. New profit sharing ratio is 1:1:1. In what ratio will this amount will be shared among the old partners A & B.- a)8,000:2,000

- b)5,000:5,000

- c)Old partners will not get any share in the goodwill brought in by C

- d)6,000:4,000

Correct answer is option 'A'. Can you explain this answer?

A and B are partners sharing the profit the ratio of 3:2. They take C as the new partner, who brings in Rs. 25,000 against capital and Rs. 10,000 against goodwill. New profit sharing ratio is 1:1:1. In what ratio will this amount will be shared among the old partners A & B.

a)

8,000:2,000

b)

5,000:5,000

c)

Old partners will not get any share in the goodwill brought in by C

d)

6,000:4,000

|

Aman Chaudhary answered |

And B?

Let's calculate the new capital brought in by A and B after the addition of C as a partner:

A's new capital = A's old capital + A's share of goodwill

= Rs. 0 + Rs. 10,000

= Rs. 10,000

B's new capital = B's old capital + B's share of goodwill

= Rs. 0 + Rs. 10,000

= Rs. 10,000

Now, let's calculate the new profit sharing ratio among A, B, and C:

Total capital = A's new capital + B's new capital + C's capital

= Rs. 10,000 + Rs. 10,000 + Rs. 25,000

= Rs. 45,000

A's new profit share = (A's new capital / Total capital) * Total profit

= (Rs. 10,000 / Rs. 45,000) * Total profit

= 2/9 * Total profit

B's new profit share = (B's new capital / Total capital) * Total profit

= (Rs. 10,000 / Rs. 45,000) * Total profit

= 2/9 * Total profit

C's profit share = (C's capital / Total capital) * Total profit

= (Rs. 25,000 / Rs. 45,000) * Total profit

= 5/9 * Total profit

Given that the new profit sharing ratio is 1:1:1, we can equate the profit shares of A and B:

2/9 * Total profit = 1/3 * Total profit

Cross-multiplying, we get:

2/9 * Total profit = 1/3 * Total profit

2/9 = 1/3

2 * 3 = 9 * 1

6 = 9

The equation is not true, which means the profit shares of A and B are not equal. Therefore, the given information is inconsistent.

Let's calculate the new capital brought in by A and B after the addition of C as a partner:

A's new capital = A's old capital + A's share of goodwill

= Rs. 0 + Rs. 10,000

= Rs. 10,000

B's new capital = B's old capital + B's share of goodwill

= Rs. 0 + Rs. 10,000

= Rs. 10,000

Now, let's calculate the new profit sharing ratio among A, B, and C:

Total capital = A's new capital + B's new capital + C's capital

= Rs. 10,000 + Rs. 10,000 + Rs. 25,000

= Rs. 45,000

A's new profit share = (A's new capital / Total capital) * Total profit

= (Rs. 10,000 / Rs. 45,000) * Total profit

= 2/9 * Total profit

B's new profit share = (B's new capital / Total capital) * Total profit

= (Rs. 10,000 / Rs. 45,000) * Total profit

= 2/9 * Total profit

C's profit share = (C's capital / Total capital) * Total profit

= (Rs. 25,000 / Rs. 45,000) * Total profit

= 5/9 * Total profit

Given that the new profit sharing ratio is 1:1:1, we can equate the profit shares of A and B:

2/9 * Total profit = 1/3 * Total profit

Cross-multiplying, we get:

2/9 * Total profit = 1/3 * Total profit

2/9 = 1/3

2 * 3 = 9 * 1

6 = 9

The equation is not true, which means the profit shares of A and B are not equal. Therefore, the given information is inconsistent.

Chapter doubts & questions for Reconstitution of a Partnership Firm: Admission of a Partner - 4 Months Preparation for Commerce Class 12 Boards 2025 is part of Commerce exam preparation. The chapters have been prepared according to the Commerce exam syllabus. The Chapter doubts & questions, notes, tests & MCQs are made for Commerce 2025 Exam. Find important definitions, questions, notes, meanings, examples, exercises, MCQs and online tests here.

Chapter doubts & questions of Reconstitution of a Partnership Firm: Admission of a Partner - 4 Months Preparation for Commerce Class 12 Boards in English & Hindi are available as part of Commerce exam.

Download more important topics, notes, lectures and mock test series for Commerce Exam by signing up for free.

4 Months Preparation for Commerce Class 12 Boards

170 videos|912 docs|214 tests

|

Contact Support

Our team is online on weekdays between 10 AM - 7 PM

Typical reply within 3 hours

|

Free Exam Preparation

at your Fingertips!

Access Free Study Material - Test Series, Structured Courses, Free Videos & Study Notes and Prepare for Your Exam With Ease

Join the 10M+ students on EduRev

Join the 10M+ students on EduRev

|

|

Create your account for free

OR

Forgot Password

OR

Signup to see your scores

go up within 7 days!

Access 1000+ FREE Docs, Videos and Tests

Takes less than 10 seconds to signup