All Exams >

Commerce >

Crash Course of Accountancy - Class 12 >

All Questions

All questions of Admission of a partner for Commerce Exam

A and B are partners sharing profits in the ratio 5:3, they admitted C giving him 3/10th share of profit. If C acquires 1/5th share from A and 1/10th from B, new profit sharing ratio will be:- a)5:6:3.

- b)2:4:6.

- c)18:24:38.

- d)17:11:12

Correct answer is option 'D'. Can you explain this answer?

A and B are partners sharing profits in the ratio 5:3, they admitted C giving him 3/10th share of profit. If C acquires 1/5th share from A and 1/10th from B, new profit sharing ratio will be:

a)

5:6:3.

b)

2:4:6.

c)

18:24:38.

d)

17:11:12

|

Sounak Jain answered |

Given:

A and B share profits in the ratio of 5:3

C is given 3/10th share of profit

C acquires 1/5th share from A and 1/10th share from B

To find: New profit sharing ratio

Step-by-step solution:

1. Let the total profit be x

2. A's share in the profit = 5/8 * x

3. B's share in the profit = 3/8 * x

4. C's share in the profit = 3/10 * x

5. C acquires 1/5th share from A, which is (1/5 * 5/8) = 1/8 of the total profit. Hence, A's new share in the profit = 5/8 - 1/8 = 4/8 = 1/2

6. C acquires 1/10th share from B, which is (1/10 * 3/8) = 3/80 of the total profit. Hence, B's new share in the profit = 3/8 - 3/80 = 27/80

7. Add up the new shares of A, B, and C to get the total profit: 1/2 + 27/80 + 3/10 = 17/40

8. New profit sharing ratio: A:B:C = (1/2)/(27/80)/(3/10) = 17:11:12

Hence, the correct answer is option D) 17:11:12.

A and B share profits in the ratio of 5:3

C is given 3/10th share of profit

C acquires 1/5th share from A and 1/10th share from B

To find: New profit sharing ratio

Step-by-step solution:

1. Let the total profit be x

2. A's share in the profit = 5/8 * x

3. B's share in the profit = 3/8 * x

4. C's share in the profit = 3/10 * x

5. C acquires 1/5th share from A, which is (1/5 * 5/8) = 1/8 of the total profit. Hence, A's new share in the profit = 5/8 - 1/8 = 4/8 = 1/2

6. C acquires 1/10th share from B, which is (1/10 * 3/8) = 3/80 of the total profit. Hence, B's new share in the profit = 3/8 - 3/80 = 27/80

7. Add up the new shares of A, B, and C to get the total profit: 1/2 + 27/80 + 3/10 = 17/40

8. New profit sharing ratio: A:B:C = (1/2)/(27/80)/(3/10) = 17:11:12

Hence, the correct answer is option D) 17:11:12.

The amount of goodwill brought in by the new partner is shared by the ____ partners in their ____ ratio- a)All old partners in old ratio

- b)Sacrificing partners, sacrificing

- c)Gaining partner, gaining

- d)All partners (including new) in new ratio

Correct answer is option 'B'. Can you explain this answer?

The amount of goodwill brought in by the new partner is shared by the ____ partners in their ____ ratio

a)

All old partners in old ratio

b)

Sacrificing partners, sacrificing

c)

Gaining partner, gaining

d)

All partners (including new) in new ratio

|

Tejas Desai answered |

The amount of premium for goodwill brought in by the new partner will be shared by the only sacrificing partners in their sacrificing ratio.

P and Q are partners sharing Profits in the ratio of 2:1. R is admitted to the partnership with effect from 1st April on the term that he will bring Rs. 20,000 as his capital for 1/4th share and pays Rs. 9,000 for goodwill, half of which is to be withdrawn by P and Q. If profit on revaluation is Rs. 6,000 and opening capital of P is Rs. 40,000 and of Q is Rs. 30,000, find the closing balance of each capital.- a)47,000:33.500:20,000.

- b)50,000:35,000:20,000.

- c)40,000:30,000:20,000.

- d)41,000:30,500:29,000.

Correct answer is option 'A'. Can you explain this answer?

P and Q are partners sharing Profits in the ratio of 2:1. R is admitted to the partnership with effect from 1st April on the term that he will bring Rs. 20,000 as his capital for 1/4th share and pays Rs. 9,000 for goodwill, half of which is to be withdrawn by P and Q. If profit on revaluation is Rs. 6,000 and opening capital of P is Rs. 40,000 and of Q is Rs. 30,000, find the closing balance of each capital.

a)

47,000:33.500:20,000.

b)

50,000:35,000:20,000.

c)

40,000:30,000:20,000.

d)

41,000:30,500:29,000.

|

Monica D answered |

CAPITALS OF

P=40000 (op. bal)+ 4000 (reval)+ 6000 (goodwill)- [3000](withdrawn) = 47000

Q= 30000+ 2000+ 3000 -1500 =33500

R=20000

Sacrifice ratio is used only for- a)Distribution of Reserve

- b)Revaluation profit

- c)Revaluation of loss

- d)Premium for goodwill

Correct answer is option 'D'. Can you explain this answer?

Sacrifice ratio is used only for

a)

Distribution of Reserve

b)

Revaluation profit

c)

Revaluation of loss

d)

Premium for goodwill

|

|

Ishan Choudhury answered |

At the time of admission of a new partner, the main use of sacrificing ratio is to adjust the premium for goodwill brought by a new partner.

X and Y are partners sharing profits in the ratio 5:3. They admitted Z for 1/5th share of profits, for which he paid Rs. 1,20,000 against capital and Rs. 60,000 against goodwill.Find the capital balances for each partner taking Z’s capital as base capital.- a)3,00,000; 1,20,000 and 1,20,000.

- b)3,00,000; 1,20,000 and 1,80,000.

- c)3,00,000; 1,80,000 and 1,20,000.

- d)3,00,000; 1,80,000 and 1,80,000.

Correct answer is option 'C'. Can you explain this answer?

X and Y are partners sharing profits in the ratio 5:3. They admitted Z for 1/5th share of profits, for which he paid Rs. 1,20,000 against capital and Rs. 60,000 against goodwill.Find the capital balances for each partner taking Z’s capital as base capital.

a)

3,00,000; 1,20,000 and 1,20,000.

b)

3,00,000; 1,20,000 and 1,80,000.

c)

3,00,000; 1,80,000 and 1,20,000.

d)

3,00,000; 1,80,000 and 1,80,000.

|

|

Poonam Reddy answered |

Correct Answer :- c

Explanation : New Profit sharing ratio = 1 - 1/5 = 4/5

A= 5/8 * 4/5 = 20/40 ; B= 3/8 * 4/5 = 12/40 ; C= 1/5 * 8/8 = 8/40

i.e. 5 ; 3 ; 2.

Capitals = 120000 * 5 = 600000

A - 600000 * 5/10 = 300000

B - 600000 * 3/10 = 180000

C - 600000 * 2/10 = 120000

X and Y are partners sharing profits in the ratio of 3 : 1. They admit Z as a partner who pays Rs. 4,000 as Goodwill the new profit sharing ratio being 2 : 1 : 1 among X, Y and Z respectively. The amount of goodwill will be credited to :- a)X and Y as Rs. 3,000 and Rs. 1,000 respectively.

- b)X only

- c)Y only.

- d)None of the above.

Correct answer is option 'B'. Can you explain this answer?

X and Y are partners sharing profits in the ratio of 3 : 1. They admit Z as a partner who pays Rs. 4,000 as Goodwill the new profit sharing ratio being 2 : 1 : 1 among X, Y and Z respectively. The amount of goodwill will be credited to :

a)

X and Y as Rs. 3,000 and Rs. 1,000 respectively.

b)

X only

c)

Y only.

d)

None of the above.

|

Shahin Ansari. answered |

S/R of X and Y.....X=3/4-2/4=1/4.....Y=1/4-1/4=0/4....so X is credit because X is sacrificing partner...

New profit sharing ratio means- a)All partner(excluding old) share future profit and losses

- b)Two partner(including new) share future profit and losses

- c)All partner(including new) share future profit and losses

- d)Partners will share future profits equally

Correct answer is option 'C'. Can you explain this answer?

New profit sharing ratio means

a)

All partner(excluding old) share future profit and losses

b)

Two partner(including new) share future profit and losses

c)

All partner(including new) share future profit and losses

d)

Partners will share future profits equally

|

Gowri Nambiar answered |

New profit sharing ratio refers to that ratio in which all the partners (old partners + new partner) will share future profits. It is not compulsory to share future profits equally. If there is no partnership deed or partnership deed is silent on the distribution of future profits, only in that case they will share future profits equally.

Is admission of a new partner is a reconstitution of partnership firm:- a)No

- b)It is called merger

- c)Yes

- d)It is dissolution of firm

Correct answer is option 'C'. Can you explain this answer?

Is admission of a new partner is a reconstitution of partnership firm:

a)

No

b)

It is called merger

c)

Yes

d)

It is dissolution of firm

|

|

Priya Patel answered |

The partnership is an agreement between two or more persons for sharing the profits of a business carried on by all or any one of them acting for all. Any change in the existing agreement is known as reconstitution of the partnership firm. Thus, the existing agreement ends and a new agreement is formed with the changed relationship among the members of the partnership firm and its composition.

Reconstitution of a partnership firm takes place whenever there is a change in the profit sharing ratio among the partners, admission of a new partner, retirement of a partner and death or insolvency of a partner.

Ways in which incoming partner may acquire his share except :- a)From one or more partners (not from all partners)

- b)From the old partners in their old profit sharing ratio

- c)From the old partners in some agreed ratio

- d)From the old partners in their new profit sharing ratio

Correct answer is 'D'. Can you explain this answer?

Ways in which incoming partner may acquire his share except :

a)

From one or more partners (not from all partners)

b)

From the old partners in their old profit sharing ratio

c)

From the old partners in some agreed ratio

d)

From the old partners in their new profit sharing ratio

|

|

Vikas Kapoor answered |

A new partner can acquired his share from one partner or two partners or from all partners in an agreed ratio. He may acquire his share in old ratio of the partners or in an agreed ratio for sacrifice but not in the new ratio of all the partners because new ratio will be fixed after adjusting his share.

X and Y are partners sharing profits in the ratio of 3:2. Z is admitted for 1/5 share. All partners have decided to share future profits equally. The profit of new partnership firm was Rs.30,000. This profit will be shared by all the partners in _______- a)Old Ratio

- b)Gaining Ratio

- c)New Ratio

- d)Sacrificing Ratio

Correct answer is option 'C'. Can you explain this answer?

X and Y are partners sharing profits in the ratio of 3:2. Z is admitted for 1/5 share. All partners have decided to share future profits equally. The profit of new partnership firm was Rs.30,000. This profit will be shared by all the partners in _______

a)

Old Ratio

b)

Gaining Ratio

c)

New Ratio

d)

Sacrificing Ratio

|

Sarthak Verma answered |

Distribution of profit is to be done in new profit sharing ratio:

X = 30,000 × 1/3 = 10,000

Y = 30,000 × 1/3 = 10,000

Z = 30,000 × 1/3 = 10,000

X = 30,000 × 1/3 = 10,000

Y = 30,000 × 1/3 = 10,000

Z = 30,000 × 1/3 = 10,000

This a MCQ (Multiple Choice Question) based practice test of Chapter 3 - Admission of a Partner of Accountancy of Class XII (12) for the quick revision/preparation of School Board examinationsQ Why a new partner is admitted in the firm?- a)To Increase the Number of partners

- b)To Increase the Capital of the firm.

- c)To Increase the Profit sharing Ratio

- d)To increase the goodwill of the firm

Correct answer is option 'B'. Can you explain this answer?

This a MCQ (Multiple Choice Question) based practice test of Chapter 3 - Admission of a Partner of Accountancy of Class XII (12) for the quick revision/preparation of School Board examinations

Q Why a new partner is admitted in the firm?

a)

To Increase the Number of partners

b)

To Increase the Capital of the firm.

c)

To Increase the Profit sharing Ratio

d)

To increase the goodwill of the firm

|

Moumita Chakraborty answered |

The main purpose of admission of a new partner is to increase the capital of the firm. When old partners feel that the capital they have employed in the business is not enough for the future growth of the business. They may admit a new partner to maintain or to build up the financial strength of the business.

Section ____ of the Indian Partnership Act provides that a new partner shall not be inducted into a firm without the consent of all existing partners- a)32

- b)30

- c)33

- d)31

Correct answer is option 'D'. Can you explain this answer?

Section ____ of the Indian Partnership Act provides that a new partner shall not be inducted into a firm without the consent of all existing partners

a)

32

b)

30

c)

33

d)

31

|

|

Arjun Singhania answered |

Section 31 in The Indian Partnership Act, 1932

31. Introduction of a partner.—

(1) Subject to contract between the partners and to the provisions of section 30, no person shall be introduced as a partner into a firm without the consent of all the existing partners.

(2) Subject to the provisions of section 30, a person who is introduced as a partner into a firm does not thereby become liable for any act of the firm done before he became a partner.

A and B are partners sharing profits and losses in the ratio 5:3. They admitted C and agreed to give him 3/10th of the profit. What is the new ratio after C’s admission?- a)35:42:17.

- b)35:21:24.

- c)49:22:29.

- d)34:20:12.

Correct answer is option 'B'. Can you explain this answer?

A and B are partners sharing profits and losses in the ratio 5:3. They admitted C and agreed to give him 3/10th of the profit. What is the new ratio after C’s admission?

a)

35:42:17.

b)

35:21:24.

c)

49:22:29.

d)

34:20:12.

|

Maheshwar Goyal answered |

Given: A and B are partners sharing profits and losses in the ratio 5:3. They admitted C and agreed to give him 3/10th of the profit.

To find: The new ratio after Cs admission.

Solution:

Let the profit be x.

C's share in the profit = 3/10 x

Remaining profit = x - 3/10 x = 7/10 x

Now, A and B have to share 7/10 x in the ratio 5:3.

A's share = 5/8 * 7/10 x = 7/16 x

B's share = 3/8 * 7/10 x = 21/80 x

C's share = 3/10 x

Therefore, the new ratio of A, B, and C's share in the profit will be:

A:B:C = 7/16 x : 21/80 x : 3/10 x

= 35:21:24 (by cross multiplying)

Hence, the correct option is (b) 35:21:24.

To find: The new ratio after Cs admission.

Solution:

Let the profit be x.

C's share in the profit = 3/10 x

Remaining profit = x - 3/10 x = 7/10 x

Now, A and B have to share 7/10 x in the ratio 5:3.

A's share = 5/8 * 7/10 x = 7/16 x

B's share = 3/8 * 7/10 x = 21/80 x

C's share = 3/10 x

Therefore, the new ratio of A, B, and C's share in the profit will be:

A:B:C = 7/16 x : 21/80 x : 3/10 x

= 35:21:24 (by cross multiplying)

Hence, the correct option is (b) 35:21:24.

Balance sheet prepared after the new partnership agreement, assets and liabilities are recorded at:- a)Original Value.

- b)Revalued Figure.

- c)At realisable value.

- d)At current cost.

Correct answer is option 'B'. Can you explain this answer?

Balance sheet prepared after the new partnership agreement, assets and liabilities are recorded at:

a)

Original Value.

b)

Revalued Figure.

c)

At realisable value.

d)

At current cost.

|

|

Jayant Mishra answered |

A partnership is a form of business commonly chosen when two or more people decide to form a business together. A partnership is not incorporated and does not have the reporting requirements of a corporation. A partnership must follow generally accepted accounting principles when reporting its financial transactions and creating financial statements. Partnerships use balance sheets and income statements as a way of measuring business profitability, but there are differences you must be aware of when preparing partnership financial statements of revalued figure.

A and B are partners in a firm sharing profits in the ratio of 2 : 1. They admit C as a new partner for 1/5 share. New Ratio will be 3 : 1 : 1. Sacrificing ratio will be:- a)2 : 1

- b)1 : 7

- c)3 : 5

- d)1 : 2

Correct answer is option 'D'. Can you explain this answer?

A and B are partners in a firm sharing profits in the ratio of 2 : 1. They admit C as a new partner for 1/5 share. New Ratio will be 3 : 1 : 1. Sacrificing ratio will be:

a)

2 : 1

b)

1 : 7

c)

3 : 5

d)

1 : 2

|

Krithika Kulkarni answered |

Calculation of sacrificing ratio of partners:

Old Ratio = 2:1

New Ratio = 3:1:1

Sacrificing Ratio = A : 2/3 – 3/5 = 1/15

B : 1/3 – 1/5 = 2/15

Old Ratio = 2:1

New Ratio = 3:1:1

Sacrificing Ratio = A : 2/3 – 3/5 = 1/15

B : 1/3 – 1/5 = 2/15

REPORT ERROR

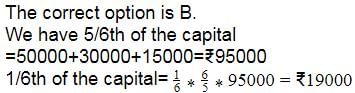

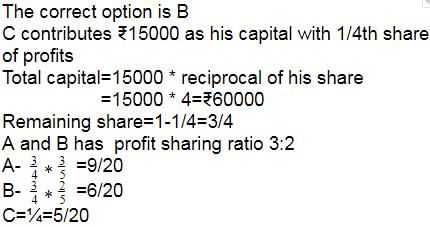

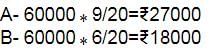

C was admitted in a firm with 1/4th share of the profits of the firm. C contributes Rs. 15,000 as his capital, A and B are other partners with the profit sharing ratio as 3:2. Find the required capital of A and B, if capital should be in profit sharing ratio taking C’s as base capital:- a)Rs. 27,000 and Rs. 16,000 for A and B respectively.

- b)Rs. 27,000 and Rs. 18,000 for A and B respectively.

- c)Rs. 32,000 and Rs. 21,000 for A and B respectively.

- d)Rs. 31,000 and Rs. 26,000 for A and B respectively.

Correct answer is option 'B'. Can you explain this answer?

C was admitted in a firm with 1/4th share of the profits of the firm. C contributes Rs. 15,000 as his capital, A and B are other partners with the profit sharing ratio as 3:2. Find the required capital of A and B, if capital should be in profit sharing ratio taking C’s as base capital:

a)

Rs. 27,000 and Rs. 16,000 for A and B respectively.

b)

Rs. 27,000 and Rs. 18,000 for A and B respectively.

c)

Rs. 32,000 and Rs. 21,000 for A and B respectively.

d)

Rs. 31,000 and Rs. 26,000 for A and B respectively.

|

|

Poonam Reddy answered |

A and B shares profit and losses equally. They admit C as an equal partner and goodwill was valued as Rs. 30,000 (book value NIL). C is to bring in Rs. 20,000 as his capital and the necessary cash towards his share of Goodwill. Goodwill Account will not remain in the books. What will be the final effect of goodwill in the partner’s capital account?- a)A & B’s account credited with Rs. 5,000 each.

- b)All partners’ account credited with Rs. 10,000 each.

- c)Only C’s account credited with Rs. 10,000 as cash bought in for goodwill.

- d)Final effect will be nil in each partner.

Correct answer is option 'A'. Can you explain this answer?

A and B shares profit and losses equally. They admit C as an equal partner and goodwill was valued as Rs. 30,000 (book value NIL). C is to bring in Rs. 20,000 as his capital and the necessary cash towards his share of Goodwill. Goodwill Account will not remain in the books. What will be the final effect of goodwill in the partner’s capital account?

a)

A & B’s account credited with Rs. 5,000 each.

b)

All partners’ account credited with Rs. 10,000 each.

c)

Only C’s account credited with Rs. 10,000 as cash bought in for goodwill.

d)

Final effect will be nil in each partner.

|

Shivam Chawla answered |

Partnership and Goodwill

Partnership refers to a business entity formed by two or more persons who mutually agree to share profits and losses. Goodwill, on the other hand, refers to the intangible value of a business that arises due to its reputation, customer base, and other non-physical assets.

Admission of a New Partner

When a new partner is admitted to a partnership, the existing partners may decide to value the goodwill of the business. In this case, the goodwill is usually paid for by the new partner as part of their capital contribution. The amount paid for goodwill is then distributed among the existing partners in the profit sharing ratio.

Effect on Partners' Capital Accounts

The final effect of goodwill on partners' capital accounts depends on how the amount paid for goodwill is distributed among the partners. In this case, A and B share profits and losses equally and admit C as an equal partner. Goodwill is valued at Rs. 30,000, and C is to bring in Rs. 20,000 as capital and the necessary cash towards their share of goodwill. The Goodwill Account will not remain in the books.

The effect on the partners' capital accounts is as follows:

- A's capital account will be credited with Rs. 5,000 (half of the goodwill amount)

- B's capital account will be credited with Rs. 5,000 (half of the goodwill amount)

- C's capital account will be credited with Rs. 20,000 (capital contribution) and debited with Rs. 10,000 (share of goodwill)

Therefore, the final effect of goodwill on the partners' capital accounts is that A and B's accounts are credited with Rs. 5,000 each.

Partnership refers to a business entity formed by two or more persons who mutually agree to share profits and losses. Goodwill, on the other hand, refers to the intangible value of a business that arises due to its reputation, customer base, and other non-physical assets.

Admission of a New Partner

When a new partner is admitted to a partnership, the existing partners may decide to value the goodwill of the business. In this case, the goodwill is usually paid for by the new partner as part of their capital contribution. The amount paid for goodwill is then distributed among the existing partners in the profit sharing ratio.

Effect on Partners' Capital Accounts

The final effect of goodwill on partners' capital accounts depends on how the amount paid for goodwill is distributed among the partners. In this case, A and B share profits and losses equally and admit C as an equal partner. Goodwill is valued at Rs. 30,000, and C is to bring in Rs. 20,000 as capital and the necessary cash towards their share of goodwill. The Goodwill Account will not remain in the books.

The effect on the partners' capital accounts is as follows:

- A's capital account will be credited with Rs. 5,000 (half of the goodwill amount)

- B's capital account will be credited with Rs. 5,000 (half of the goodwill amount)

- C's capital account will be credited with Rs. 20,000 (capital contribution) and debited with Rs. 10,000 (share of goodwill)

Therefore, the final effect of goodwill on the partners' capital accounts is that A and B's accounts are credited with Rs. 5,000 each.

Which of the following is not an example of Reconstitution of partnership firm?- a)Admission of a new partner

- b)Retirement/Death of a partner

- c)Change in Existing profit sharing ratio

- d)Purchase of Assets for the business

Correct answer is option 'D'. Can you explain this answer?

Which of the following is not an example of Reconstitution of partnership firm?

a)

Admission of a new partner

b)

Retirement/Death of a partner

c)

Change in Existing profit sharing ratio

d)

Purchase of Assets for the business

|

Srishti Kaur answered |

Reconstitution on a partnership means change in the number of partners through Admission, Retirement or Death of the partners or change in the ratio of partners. Puchase of Assets will not change the constitution of the partnership.

Any change in the existing agreement amounts to ______- a)Remodulation of the partnership firm

- b)Reconstitution of the partnership firm

- c)Resolution of the partnership firm

- d)Revaluation of the partnership firm

Correct answer is option 'B'. Can you explain this answer?

Any change in the existing agreement amounts to ______

a)

Remodulation of the partnership firm

b)

Reconstitution of the partnership firm

c)

Resolution of the partnership firm

d)

Revaluation of the partnership firm

|

|

Rohini Desai answered |

Correct option is B. Reconstitution of the partnership firm

A and B are partners sharing the profit in the ratio of 3:2. They take C as the new partner, who brings in Rs. 25,000 against capital and Rs. 10,000 against goodwill. New profit sharing ratio is 1:1:1. In what ratio will this amount will be shared among the old partners A & B.- a)8,000:2,000.

- b)5,000:5,000.

- c)Old partners will not get any share in the goodwill bought in by C.

- d)6,000:4,000.

Correct answer is option 'A'. Can you explain this answer?

A and B are partners sharing the profit in the ratio of 3:2. They take C as the new partner, who brings in Rs. 25,000 against capital and Rs. 10,000 against goodwill. New profit sharing ratio is 1:1:1. In what ratio will this amount will be shared among the old partners A & B.

a)

8,000:2,000.

b)

5,000:5,000.

c)

Old partners will not get any share in the goodwill bought in by C.

d)

6,000:4,000.

|

Sanchit Garg answered |

We are given old ratio of A and B 3:2

After admission of c the new ratio will 1:1:1

So,we know that goodwill of new partner will be divided to old partner in sacrificing ratio

So first of all calculate sacrificing ratio

A's sacrificing ratio=3/5-1/3=9-5/15=4/15

B's sacrificing ratio=2/5-1/3=6-5/15=1/5

So the sacrificing ratio is 4:1 of A and B respectively.

Goodwill shared between A and B in old profit sharing ratio is

A's= 10000×4/5=8000B's=10000×1/5=2000

After admission of c the new ratio will 1:1:1

So,we know that goodwill of new partner will be divided to old partner in sacrificing ratio

So first of all calculate sacrificing ratio

A's sacrificing ratio=3/5-1/3=9-5/15=4/15

B's sacrificing ratio=2/5-1/3=6-5/15=1/5

So the sacrificing ratio is 4:1 of A and B respectively.

Goodwill shared between A and B in old profit sharing ratio is

A's= 10000×4/5=8000B's=10000×1/5=2000

What adjustments are mainly done at the time of admission of a new partner?

(i) Adjustment in Profit sharing ratio

(ii) Goodwill

(iii) Accumulated profits, Reserves and losses- a)Only (i) and (ii)

- b)Only (i)

- c)All (i), (ii) and (iii)

- d)Only (ii)

Correct answer is option 'C'. Can you explain this answer?

What adjustments are mainly done at the time of admission of a new partner?

(i) Adjustment in Profit sharing ratio

(ii) Goodwill

(iii) Accumulated profits, Reserves and losses

(i) Adjustment in Profit sharing ratio

(ii) Goodwill

(iii) Accumulated profits, Reserves and losses

a)

Only (i) and (ii)

b)

Only (i)

c)

All (i), (ii) and (iii)

d)

Only (ii)

|

Pooja Pillai answered |

Adjustments to be done at the time of admission of a partner are:

1.Change in profit sharing ratio

2.Adjustment for premium for goodwill

3.Adjustment of old goodwill (given in balance sheet)

4.Revaluation account (revaluation of assets and re-assessment of liabilities)

5.Accumulated profits and reserves

6.Adjustment of capital

1.Change in profit sharing ratio

2.Adjustment for premium for goodwill

3.Adjustment of old goodwill (given in balance sheet)

4.Revaluation account (revaluation of assets and re-assessment of liabilities)

5.Accumulated profits and reserves

6.Adjustment of capital

Which of the following asset is compulsory to revalue at the time of admission of a new partner:- a)Stock.

- b)Fixed Assets.

- c)Investment.

- d)Goodwill.

Correct answer is option 'D'. Can you explain this answer?

Which of the following asset is compulsory to revalue at the time of admission of a new partner:

a)

Stock.

b)

Fixed Assets.

c)

Investment.

d)

Goodwill.

|

|

Alok Mehta answered |

At the time of admission of a partner, the assets and liabilities may or may not be revalued depending upon whether there is any increase or decrease in their balances. However, it is necessary to value goodwill of the firm at the time of admission of a partner. We all know that the incoming partner is required to compensate the old partners for their sacrifice by way of his share of goodwill. So, it is goodwill that has to be valued.

Adam, Brain and Chris were equal partners of a firm with goodwill Rs. 1,20,000 shown in the balance sheet and they agreed to take Daniel as an equal partner on the term that he should bring Rs. 1,60,000 as his capital and goodwill, his share of goodwill was evaluated at Rs. 60,000 and the goodwill account is to be written off before admission. What will be the treatment for goodwill?- a)Write off the goodwill of Rs. 1,20,000 in old ratio.

- b)Cash bought in by Daniel for goodwill will be distributed among old partners in sacrificing ratio.

- c)Both.

- d)Non

Correct answer is option 'C'. Can you explain this answer?

Adam, Brain and Chris were equal partners of a firm with goodwill Rs. 1,20,000 shown in the balance sheet and they agreed to take Daniel as an equal partner on the term that he should bring Rs. 1,60,000 as his capital and goodwill, his share of goodwill was evaluated at Rs. 60,000 and the goodwill account is to be written off before admission. What will be the treatment for goodwill?

a)

Write off the goodwill of Rs. 1,20,000 in old ratio.

b)

Cash bought in by Daniel for goodwill will be distributed among old partners in sacrificing ratio.

c)

Both.

d)

Non

|

Vandana Kulkarni answered |

Treatment of Goodwill in Partnership Admission

Goodwill is an intangible asset that represents the reputation and brand value of a business. It is usually generated when a business operates successfully over a period of time. When a new partner is admitted to a partnership firm, the treatment of goodwill depends on the terms agreed by the partners.

In this case, Daniel is being admitted as an equal partner and he is bringing Rs. 1,60,000 as his capital and goodwill. His share of goodwill is evaluated at Rs. 60,000 and the existing goodwill of Rs. 1,20,000 is to be written off before admission. The treatment of goodwill in this case will be as follows:

1. Write off the goodwill of Rs. 1,20,000 in old ratio:

The existing goodwill of Rs. 1,20,000 will be written off from the balance sheet before admission. This will reduce the value of the firm's assets and also the value of the partners' capital accounts. The old partners (Adam, Brain and Chris) will share the loss of goodwill in their old ratio.

2. Cash bought in by Daniel for goodwill will be distributed among old partners in sacrificing ratio:

Daniel is bringing Rs. 1,60,000 as his capital and goodwill. His share of goodwill is evaluated at Rs. 60,000. Therefore, he is bringing Rs. 1,00,000 as his capital. This amount will be credited to his capital account. The remaining Rs. 60,000 will be distributed among the old partners in their sacrificing ratio. This is because the old partners will be sacrificing their share of the existing goodwill to accommodate the new partner.

3. Both:

The correct answer is option C, which means that both the above treatments will be applied. The existing goodwill of Rs. 1,20,000 will be written off in old ratio and the cash brought in by Daniel for goodwill will be distributed among old partners in sacrificing ratio.

In conclusion, the treatment of goodwill in partnership admission depends on the terms agreed by the partners. In this case, the existing goodwill will be written off and the cash brought in by the new partner will be distributed among the old partners.

Goodwill is an intangible asset that represents the reputation and brand value of a business. It is usually generated when a business operates successfully over a period of time. When a new partner is admitted to a partnership firm, the treatment of goodwill depends on the terms agreed by the partners.

In this case, Daniel is being admitted as an equal partner and he is bringing Rs. 1,60,000 as his capital and goodwill. His share of goodwill is evaluated at Rs. 60,000 and the existing goodwill of Rs. 1,20,000 is to be written off before admission. The treatment of goodwill in this case will be as follows:

1. Write off the goodwill of Rs. 1,20,000 in old ratio:

The existing goodwill of Rs. 1,20,000 will be written off from the balance sheet before admission. This will reduce the value of the firm's assets and also the value of the partners' capital accounts. The old partners (Adam, Brain and Chris) will share the loss of goodwill in their old ratio.

2. Cash bought in by Daniel for goodwill will be distributed among old partners in sacrificing ratio:

Daniel is bringing Rs. 1,60,000 as his capital and goodwill. His share of goodwill is evaluated at Rs. 60,000. Therefore, he is bringing Rs. 1,00,000 as his capital. This amount will be credited to his capital account. The remaining Rs. 60,000 will be distributed among the old partners in their sacrificing ratio. This is because the old partners will be sacrificing their share of the existing goodwill to accommodate the new partner.

3. Both:

The correct answer is option C, which means that both the above treatments will be applied. The existing goodwill of Rs. 1,20,000 will be written off in old ratio and the cash brought in by Daniel for goodwill will be distributed among old partners in sacrificing ratio.

In conclusion, the treatment of goodwill in partnership admission depends on the terms agreed by the partners. In this case, the existing goodwill will be written off and the cash brought in by the new partner will be distributed among the old partners.

A and B shares profit and losses equally. They admit C as an equal partner and assets were revalued as follow: Goodwill at Rs. 30,000 (book value NIL). Stock at Rs. 20,000 (book value Rs. 12,000); Machinery at Rs. 60,000 (book value Rs. 55,000). C is to bring in Rs. 20,000 as his capital and the necessary cash towards his share of Goodwill. Goodwill Account will not remain in the books. Find the profit/loss on revaluation to be shared among A, B and C.- a)21,500:21,500:0.

- b)6,500:6,500:0.

- c)14,333:14,333:14,333.

- d)4,333:4,333:4,333.

Correct answer is option 'B'. Can you explain this answer?

A and B shares profit and losses equally. They admit C as an equal partner and assets were revalued as follow: Goodwill at Rs. 30,000 (book value NIL). Stock at Rs. 20,000 (book value Rs. 12,000); Machinery at Rs. 60,000 (book value Rs. 55,000). C is to bring in Rs. 20,000 as his capital and the necessary cash towards his share of Goodwill. Goodwill Account will not remain in the books. Find the profit/loss on revaluation to be shared among A, B and C.

a)

21,500:21,500:0.

b)

6,500:6,500:0.

c)

14,333:14,333:14,333.

d)

4,333:4,333:4,333.

|

Geetika Basak answered |

To find the profit/loss on revaluation to be shared among A, B, and C, we need to calculate the increase or decrease in the value of assets and liabilities after revaluation.

Given information:

- Goodwill: Book value = NIL, Revalued value = Rs. 30,000

- Stock: Book value = Rs. 12,000, Revalued value = Rs. 20,000

- Machinery: Book value = Rs. 55,000, Revalued value = Rs. 60,000

Let's calculate the increase or decrease in the value of each asset:

1. Goodwill:

- Increase in value = Rs. 30,000 (Revalued value)

- Decrease in value = Rs. 0 (Book value)

- Profit on revaluation = Increase - Decrease = Rs. 30,000 - Rs. 0 = Rs. 30,000

2. Stock:

- Increase in value = Rs. 8,000 (Revalued value - Book value)

- Decrease in value = Rs. 0 (No change in book value)

- Profit on revaluation = Increase - Decrease = Rs. 8,000 - Rs. 0 = Rs. 8,000

3. Machinery:

- Increase in value = Rs. 5,000 (Revalued value - Book value)

- Decrease in value = Rs. 0 (No change in book value)

- Profit on revaluation = Increase - Decrease = Rs. 5,000 - Rs. 0 = Rs. 5,000

Now, let's calculate the total profit on revaluation:

Total profit on revaluation = Profit on revaluation of Goodwill + Profit on revaluation of Stock + Profit on revaluation of Machinery

= Rs. 30,000 + Rs. 8,000 + Rs. 5,000

= Rs. 43,000

Since A, B, and C share the profit and losses equally, the profit/loss on revaluation will be divided equally among them.

Profit/loss on revaluation to be shared among A, B, and C:

A's share = B's share = C's share = Total profit on revaluation / 3

= Rs. 43,000 / 3

= Rs. 14,333

Therefore, the correct answer is option 'C': 14,333:14,333:14,333.

Given information:

- Goodwill: Book value = NIL, Revalued value = Rs. 30,000

- Stock: Book value = Rs. 12,000, Revalued value = Rs. 20,000

- Machinery: Book value = Rs. 55,000, Revalued value = Rs. 60,000

Let's calculate the increase or decrease in the value of each asset:

1. Goodwill:

- Increase in value = Rs. 30,000 (Revalued value)

- Decrease in value = Rs. 0 (Book value)

- Profit on revaluation = Increase - Decrease = Rs. 30,000 - Rs. 0 = Rs. 30,000

2. Stock:

- Increase in value = Rs. 8,000 (Revalued value - Book value)

- Decrease in value = Rs. 0 (No change in book value)

- Profit on revaluation = Increase - Decrease = Rs. 8,000 - Rs. 0 = Rs. 8,000

3. Machinery:

- Increase in value = Rs. 5,000 (Revalued value - Book value)

- Decrease in value = Rs. 0 (No change in book value)

- Profit on revaluation = Increase - Decrease = Rs. 5,000 - Rs. 0 = Rs. 5,000

Now, let's calculate the total profit on revaluation:

Total profit on revaluation = Profit on revaluation of Goodwill + Profit on revaluation of Stock + Profit on revaluation of Machinery

= Rs. 30,000 + Rs. 8,000 + Rs. 5,000

= Rs. 43,000

Since A, B, and C share the profit and losses equally, the profit/loss on revaluation will be divided equally among them.

Profit/loss on revaluation to be shared among A, B, and C:

A's share = B's share = C's share = Total profit on revaluation / 3

= Rs. 43,000 / 3

= Rs. 14,333

Therefore, the correct answer is option 'C': 14,333:14,333:14,333.

According to section 31(1) of _____ new partner can be admitted only with consent of all existing partners- a)Companies Act 1956

- b)Cooperatives

- c)Joint Hindu Family

- d)Partnership Act, 1932

Correct answer is option 'D'. Can you explain this answer?

According to section 31(1) of _____ new partner can be admitted only with consent of all existing partners

a)

Companies Act 1956

b)

Cooperatives

c)

Joint Hindu Family

d)

Partnership Act, 1932

|

Sravya Datta answered |

Partnership Act, 1932

In the Partnership Act, 1932, specifically in section 31(1), it is stated that a new partner can only be admitted with the consent of all existing partners. This rule ensures that all partners have a say in the decision-making process of admitting a new member into the partnership.

Importance of Consent

- The consent of all existing partners is crucial as it helps in maintaining the harmony and trust among the partners.

- It ensures that all partners are on the same page regarding the addition of a new member and are willing to share profits, losses, and responsibilities with the new partner.

Decision-making Process

- Before admitting a new partner, all existing partners need to discuss and agree on the terms of the partnership.

- Unanimous consent is required to avoid any conflicts or misunderstandings in the future.

Legal Implications

- Admitting a new partner without the consent of all existing partners can lead to legal issues and disputes within the partnership.

- The Partnership Act, 1932, provides guidelines on how partnerships should be formed and managed to prevent any potential legal complications.

In conclusion, the provision in the Partnership Act, 1932, requiring the consent of all existing partners for admitting a new partner is essential for maintaining the integrity and stability of the partnership. It ensures that all partners are involved in the decision-making process and are in agreement before any new member is welcomed into the partnership.

In the Partnership Act, 1932, specifically in section 31(1), it is stated that a new partner can only be admitted with the consent of all existing partners. This rule ensures that all partners have a say in the decision-making process of admitting a new member into the partnership.

Importance of Consent

- The consent of all existing partners is crucial as it helps in maintaining the harmony and trust among the partners.

- It ensures that all partners are on the same page regarding the addition of a new member and are willing to share profits, losses, and responsibilities with the new partner.

Decision-making Process

- Before admitting a new partner, all existing partners need to discuss and agree on the terms of the partnership.

- Unanimous consent is required to avoid any conflicts or misunderstandings in the future.

Legal Implications

- Admitting a new partner without the consent of all existing partners can lead to legal issues and disputes within the partnership.

- The Partnership Act, 1932, provides guidelines on how partnerships should be formed and managed to prevent any potential legal complications.

In conclusion, the provision in the Partnership Act, 1932, requiring the consent of all existing partners for admitting a new partner is essential for maintaining the integrity and stability of the partnership. It ensures that all partners are involved in the decision-making process and are in agreement before any new member is welcomed into the partnership.

Profit or loss on revaluation is shared among the partners in ……… ratio.- a)Old Profit Sharing.

- b)New Profit Sharing.

- c)Capital.

- d)Equal

Correct answer is option 'A'. Can you explain this answer?

Profit or loss on revaluation is shared among the partners in ……… ratio.

a)

Old Profit Sharing.

b)

New Profit Sharing.

c)

Capital.

d)

Equal

|

Rajeev Chaudhary answered |

Old Profit Sharing:

In the traditional method of profit sharing among partners, the profit or loss on revaluation is shared among the partners in their old profit sharing ratio. This means that the partners will divide the revaluation profit or loss based on their existing profit-sharing percentages.

Explanation:

When a partnership undergoes a revaluation of assets and liabilities, any resulting profit or loss needs to be allocated among the partners. The old profit sharing ratio is used for this purpose, as it reflects the agreed-upon distribution of profits before the revaluation took place.

Example:

For example, if Partner A has a 40% profit share, Partner B has a 30% profit share, and Partner C has a 30% profit share, any revaluation profit or loss will be distributed among them in this same ratio.

Importance:

Using the old profit sharing ratio ensures that partners receive their fair share of the revaluation profit or loss based on their contribution to the partnership's previous profits. This method maintains transparency and fairness in the distribution of revaluation gains or losses.

Conclusion:

In conclusion, when it comes to sharing the profit or loss on revaluation among partners, the old profit sharing ratio is the standard method used in partnerships. This approach ensures that partners receive their appropriate share of revaluation gains or losses based on their agreed-upon profit sharing percentages.

In the traditional method of profit sharing among partners, the profit or loss on revaluation is shared among the partners in their old profit sharing ratio. This means that the partners will divide the revaluation profit or loss based on their existing profit-sharing percentages.

Explanation:

When a partnership undergoes a revaluation of assets and liabilities, any resulting profit or loss needs to be allocated among the partners. The old profit sharing ratio is used for this purpose, as it reflects the agreed-upon distribution of profits before the revaluation took place.

Example:

For example, if Partner A has a 40% profit share, Partner B has a 30% profit share, and Partner C has a 30% profit share, any revaluation profit or loss will be distributed among them in this same ratio.

Importance:

Using the old profit sharing ratio ensures that partners receive their fair share of the revaluation profit or loss based on their contribution to the partnership's previous profits. This method maintains transparency and fairness in the distribution of revaluation gains or losses.

Conclusion:

In conclusion, when it comes to sharing the profit or loss on revaluation among partners, the old profit sharing ratio is the standard method used in partnerships. This approach ensures that partners receive their appropriate share of revaluation gains or losses based on their agreed-upon profit sharing percentages.

A and B are partners sharing the profit in the ratio of 3:2. They take C as the new partner, who is supposed to bring Rs. 25,000 against capital and Rs. 10,000 against goodwill. New profit sharing ratio is 1:1:1. C bought cash for his share of Capital and agreed to compensate to A and B outside the firm. How this will be treated in the books of the firm.- a)Cash bought in by C will only be credited to his capital account.

- b)Goodwill will be raised to full value in old ratio.

- c)Goodwill will be raised to full value in new ratio.

- d)Cash bought by C will be credited to his account and debited with his share of goodwill, which will be debited to A and B’s account in sacrificing ratio.

Correct answer is option 'A'. Can you explain this answer?

A and B are partners sharing the profit in the ratio of 3:2. They take C as the new partner, who is supposed to bring Rs. 25,000 against capital and Rs. 10,000 against goodwill. New profit sharing ratio is 1:1:1. C bought cash for his share of Capital and agreed to compensate to A and B outside the firm. How this will be treated in the books of the firm.

a)

Cash bought in by C will only be credited to his capital account.

b)

Goodwill will be raised to full value in old ratio.

c)

Goodwill will be raised to full value in new ratio.

d)

Cash bought by C will be credited to his account and debited with his share of goodwill, which will be debited to A and B’s account in sacrificing ratio.

|

Sameer Sharma answered |

Treatment of C's capital and goodwill contribution in the books of the firm

Capital Contribution

- C brought Rs. 25,000 against capital.

- The cash brought in by C will only be credited to his capital account.

- Therefore, the entry will be:

- C's Capital A/c Dr. 25,000

- To Cash A/c 25,000

Goodwill Contribution

- C brought Rs. 10,000 against goodwill.

- As per the new profit sharing ratio of 1:1:1, the sacrificing ratio of A and B will be 3:2.

- Therefore, the amount of goodwill to be sacrificed by A and B will be in the ratio of 3:2.

- The total amount of goodwill will be raised to its full value in the old ratio of 3:2.

- However, C's goodwill contribution will not be credited to the goodwill account of the firm.

- Instead, C will compensate A and B outside the firm for their sacrifice.

- Therefore, the entry to record C's goodwill contribution will be:

- C's Capital A/c Dr. 10,000

- To A's Capital A/c 7,500 (3/5 of 10,000)

- To B's Capital A/c 5,000 (2/5 of 10,000)

Conclusion

- C's capital contribution will be credited to his capital account only.

- C's goodwill contribution will not be credited to the goodwill account of the firm.

- A and B's sacrifice of goodwill will be debited to their respective capital accounts in the sacrificing ratio of 3:2.

Capital Contribution

- C brought Rs. 25,000 against capital.

- The cash brought in by C will only be credited to his capital account.

- Therefore, the entry will be:

- C's Capital A/c Dr. 25,000

- To Cash A/c 25,000

Goodwill Contribution

- C brought Rs. 10,000 against goodwill.

- As per the new profit sharing ratio of 1:1:1, the sacrificing ratio of A and B will be 3:2.

- Therefore, the amount of goodwill to be sacrificed by A and B will be in the ratio of 3:2.

- The total amount of goodwill will be raised to its full value in the old ratio of 3:2.

- However, C's goodwill contribution will not be credited to the goodwill account of the firm.

- Instead, C will compensate A and B outside the firm for their sacrifice.

- Therefore, the entry to record C's goodwill contribution will be:

- C's Capital A/c Dr. 10,000

- To A's Capital A/c 7,500 (3/5 of 10,000)

- To B's Capital A/c 5,000 (2/5 of 10,000)

Conclusion

- C's capital contribution will be credited to his capital account only.

- C's goodwill contribution will not be credited to the goodwill account of the firm.

- A and B's sacrifice of goodwill will be debited to their respective capital accounts in the sacrificing ratio of 3:2.

P and Q are partners sharing Profits in the ratio of 2:1. R is admitted to the partnership with effect from 1st April on the term that he will bring Rs. 20,000 as his capital for 1/4th share and pays Rs. 9,000 for goodwill, half of which is to be withdrawn by P and Q. How much cash can P & Q withdraw from the firm (if any).- a)3,000:1,500.

- b)6,000:3,000.

- c)NIL.

- d)None of the above.

Correct answer is option 'A'. Can you explain this answer?

P and Q are partners sharing Profits in the ratio of 2:1. R is admitted to the partnership with effect from 1st April on the term that he will bring Rs. 20,000 as his capital for 1/4th share and pays Rs. 9,000 for goodwill, half of which is to be withdrawn by P and Q. How much cash can P & Q withdraw from the firm (if any).

a)

3,000:1,500.

b)

6,000:3,000.

c)

NIL.

d)

None of the above.

|

Shahin Ansari. answered |

P and Q withdrew half of goodwill.. 9000/2= 4500. in sacrificing ratio 3000 and 1500 by P and Q respectively.

Amit and Anil are partners of a partnership firm sharing profits in the ratio of 5:3 respectively. Atul was admitted on the following terms: Atul would pay Rs. 50,000 as capital and Rs. 16,000 as Goodwill, for 1/5th share of profit. Machinery would be appreciated by 10% (book value Rs. 80,000) and building would be depreciated by 20% (Rs. 2,00,000). Unrecorded debtors of Rs. 1,250 would be bought into books now and a creditors amounting to Rs. 2,750 died and need not to pay anything to its estate. Find the distribution of profit/loss on revaluation between Amit, Anil and Atul.- a)Loss – 17,500:10,500:0.

- b)Loss – 14,000:8,400:5,600.

- c)Profits – 17,500:10,500:0.

- d)Profits – 14,000:8,400:5,600.

Correct answer is option 'A'. Can you explain this answer?

Amit and Anil are partners of a partnership firm sharing profits in the ratio of 5:3 respectively. Atul was admitted on the following terms: Atul would pay Rs. 50,000 as capital and Rs. 16,000 as Goodwill, for 1/5th share of profit. Machinery would be appreciated by 10% (book value Rs. 80,000) and building would be depreciated by 20% (Rs. 2,00,000). Unrecorded debtors of Rs. 1,250 would be bought into books now and a creditors amounting to Rs. 2,750 died and need not to pay anything to its estate. Find the distribution of profit/loss on revaluation between Amit, Anil and Atul.

a)

Loss – 17,500:10,500:0.

b)

Loss – 14,000:8,400:5,600.

c)

Profits – 17,500:10,500:0.

d)

Profits – 14,000:8,400:5,600.

|

Sameer Sharma answered |

Given data:

- Amit and Anil share profits in the ratio of 5:3

- Atul brings in capital of Rs. 50,000 and pays Rs. 16,000 as goodwill for 1/5th share of profit

- Machinery is appreciated by 10% (book value Rs. 80,000)

- Building is depreciated by 20% (Rs. 2,00,000)

- Unrecorded debtors of Rs. 1,250 are bought into books now

- Creditors amounting to Rs. 2,750 died and need not to pay anything to its estate

Revaluation of Assets and Liabilities:

- Machinery: 10% appreciation, so new book value = Rs. 80,000 + 10% of 80,000 = Rs. 88,000

- Building: 20% depreciation, so new book value = Rs. 2,00,000 - 20% of 2,00,000 = Rs. 1,60,000

- Debtors of Rs. 1,250 are added to the books

- Creditors of Rs. 2,750 are eliminated from the books

Calculation of New Profit Sharing Ratio:

- Amit and Anil's old ratio = 5:3, total 8 parts

- Atul's share = 1/5th, which is 2 parts

- Total new ratio = 8 + 2 = 10 parts

- Amit's share = 5/10 = 1/2

- Anil's share = 3/10

- Atul's share = 2/10 = 1/5

Calculation of Revaluation Profit/Loss:

- Machinery: Appreciation of Rs. 8,000 (88,000 - 80,000)

- Building: Depreciation of Rs. 40,000 (2,00,000 - 1,60,000)

- Total revaluation loss = Rs. 32,000 (8,000 + 40,000 - 1,250 + 2,750)

- Loss to be distributed in old ratio of 5:3 = Rs. 17,500:10,500

- Atul joined after revaluation, so he does not share in this loss

Distribution of Profit/Loss on Revaluation:

- Amit's share of loss = 5/8 x 17,500 = Rs. 10,937.50

- Anil's share of loss = 3/8 x 17,500 = Rs. 6,562.50

- Atul does not share in this loss, as he joined after the revaluation

Therefore, the correct answer is option A, i.e. Loss 17,500:10,500:0.

- Amit and Anil share profits in the ratio of 5:3

- Atul brings in capital of Rs. 50,000 and pays Rs. 16,000 as goodwill for 1/5th share of profit

- Machinery is appreciated by 10% (book value Rs. 80,000)

- Building is depreciated by 20% (Rs. 2,00,000)

- Unrecorded debtors of Rs. 1,250 are bought into books now

- Creditors amounting to Rs. 2,750 died and need not to pay anything to its estate

Revaluation of Assets and Liabilities:

- Machinery: 10% appreciation, so new book value = Rs. 80,000 + 10% of 80,000 = Rs. 88,000

- Building: 20% depreciation, so new book value = Rs. 2,00,000 - 20% of 2,00,000 = Rs. 1,60,000

- Debtors of Rs. 1,250 are added to the books

- Creditors of Rs. 2,750 are eliminated from the books

Calculation of New Profit Sharing Ratio:

- Amit and Anil's old ratio = 5:3, total 8 parts

- Atul's share = 1/5th, which is 2 parts

- Total new ratio = 8 + 2 = 10 parts

- Amit's share = 5/10 = 1/2

- Anil's share = 3/10

- Atul's share = 2/10 = 1/5

Calculation of Revaluation Profit/Loss:

- Machinery: Appreciation of Rs. 8,000 (88,000 - 80,000)

- Building: Depreciation of Rs. 40,000 (2,00,000 - 1,60,000)

- Total revaluation loss = Rs. 32,000 (8,000 + 40,000 - 1,250 + 2,750)

- Loss to be distributed in old ratio of 5:3 = Rs. 17,500:10,500

- Atul joined after revaluation, so he does not share in this loss

Distribution of Profit/Loss on Revaluation:

- Amit's share of loss = 5/8 x 17,500 = Rs. 10,937.50

- Anil's share of loss = 3/8 x 17,500 = Rs. 6,562.50

- Atul does not share in this loss, as he joined after the revaluation

Therefore, the correct answer is option A, i.e. Loss 17,500:10,500:0.

A and B are partners sharing the profit in the ratio of 3:2. They take C as the new partner, who is supposed to bring Rs. 25,000 against capital and Rs. 10,000 against goodwill. New profit sharing ratio is 1:1:1. C is able to bring Rs. 30,000 only. How this will be treated in the books of the firm.- a)A and B will share goodwill bought by C as 4,000:1,000.

- b)Goodwill will be raised to Rs. 15,000 in old profit sharing ratio.

- c)Both.

- d)None.

Correct answer is option 'C'. Can you explain this answer?

A and B are partners sharing the profit in the ratio of 3:2. They take C as the new partner, who is supposed to bring Rs. 25,000 against capital and Rs. 10,000 against goodwill. New profit sharing ratio is 1:1:1. C is able to bring Rs. 30,000 only. How this will be treated in the books of the firm.

a)

A and B will share goodwill bought by C as 4,000:1,000.

b)

Goodwill will be raised to Rs. 15,000 in old profit sharing ratio.

c)

Both.

d)

None.

|

Anu Sen answered |

The correct answer is C.

At the time of admission of a new partner, When capital goodwill is brought by the new partner it is divided among the partners in their gaining and sacrificing ratio. Calculation of sacrificing ratio:

Sacrificing Ratio = Old Ratio - New Ratio

A's sacrificing ratio = (3/5) - (1/3) = 4/15

B's sacrificing ratio = (2/5) - (1/3) = 1/15

Therefore, sacrificing ratio of A and B is 4 : 1 or 4000:1000

Since no already existing goodwill is given we assume it to be zero and when the goodwill is zero then the Goodwill is raised at the remaining premium which is not brought in by the partner at its full value.

Which is ₹5000

So value of goodwill is 5000*3=₹15000 which is to be raised in old ratio.

Incoming partner may acquire his share from the old partners

(i) In their old profit sharing ratio

(ii) In a particular ratio

(iii) In particular fraction from some of the partners

In which of the above mentioned alternatives- a)Only I and iii

- b)Only i

- c)All the three

- d)Only i and ii

Correct answer is option 'C'. Can you explain this answer?

Incoming partner may acquire his share from the old partners

(i) In their old profit sharing ratio

(ii) In a particular ratio

(iii) In particular fraction from some of the partners

In which of the above mentioned alternatives

(i) In their old profit sharing ratio

(ii) In a particular ratio

(iii) In particular fraction from some of the partners

In which of the above mentioned alternatives

a)

Only I and iii

b)

Only i

c)

All the three

d)

Only i and ii

|

Jyoti Mukherjee answered |

A newly admitted partner may acquire his share of profit from one partner or two partners or from all partners in an agreed ratio. He may acquire his share in old ratio of the partners or in an agreed ratio for sacrifice but not in the new ratio of all the partners because new ratio will be fixed after adjusting his share.

When a new partner is admitted he acquires his share of profits , this will ____ the old partner’s shares in profits:- a)Reduce

- b)Increase

- c)Remain same

- d)No change

Correct answer is option 'A'. Can you explain this answer?

When a new partner is admitted he acquires his share of profits , this will ____ the old partner’s shares in profits:

a)

Reduce

b)

Increase

c)

Remain same

d)

No change

|

Gaurav Banerjee answered |

Reduce the share of profits for the old partner.

Chapter doubts & questions for Admission of a partner - Crash Course of Accountancy - Class 12 2025 is part of Commerce exam preparation. The chapters have been prepared according to the Commerce exam syllabus. The Chapter doubts & questions, notes, tests & MCQs are made for Commerce 2025 Exam. Find important definitions, questions, notes, meanings, examples, exercises, MCQs and online tests here.

Chapter doubts & questions of Admission of a partner - Crash Course of Accountancy - Class 12 in English & Hindi are available as part of Commerce exam.

Download more important topics, notes, lectures and mock test series for Commerce Exam by signing up for free.

Crash Course of Accountancy - Class 12

79 docs|43 tests

|