All Exams >

CA Foundation >

Accounting for CA Foundation >

All Questions

All questions of Inventories for CA Foundation Exam

The total cost of gods available for sale with a company during the current years is Rs. 12,00,000 and the total sales during the period are Rs. 13,00,000. If the gross profit margin of the company is 331 /3% on cost, the closing inventory during the current year is- a)Rs. 4,00,000

- b)Rs. 3,00,000

- c)Rs. 2,25,000

- d)Rs. 2,60,000

Correct answer is option 'C'. Can you explain this answer?

The total cost of gods available for sale with a company during the current years is Rs. 12,00,000 and the total sales during the period are Rs. 13,00,000. If the gross profit margin of the company is 331 /3% on cost, the closing inventory during the current year is

a)

Rs. 4,00,000

b)

Rs. 3,00,000

c)

Rs. 2,25,000

d)

Rs. 2,60,000

|

|

Jayant Mishra answered |

Purchase Rs. 12,00,000, Sales Rs. 13,00,000, Gross profit 33 1/3% of Cost

Because we do not know the cost of goods sold, we have to derive that figure (cost of goods sold) to arrive at the figure of Gross Profit.

Alternatively we can calculate gross profit by finding out the Gross Profit % on sales from the Gross Profit % on cost.

33 1/3% of Cost => 25% of Sales (Or) 1/3 of Cost => 1/4 of sales

Opening Stock + Net Purchases - (Net Sales - Gross Profit) - Abnormal Loss = Closing Stock

Opening Stock + Net Purchases = 12,00,000, Net Sales = 13,00,000, Gross Profit = Net Sales * 25%

Opening Stock + Net Purchases - (Net Sales - Gross Profit) - Abnormal Loss = Closing Stock

==>12,00,000 - [13,00,000 - (13,00,000 * 25%)] = Closing stock

==>12,00,000 - [13,00,000 - 3,25,000] = Closing stock

==>12,00,000 - 9,75,000 = Closing stock

==>Closing stock = 2,25,000

What is the amount of purchase when opening stock = Rs. 3,500 closing stock = Rs. 1,500, Cost of goods sold = Rs. 22,000.

- a)Rs. 20,000

- b)Rs. 24,000

- c)Rs. 27,000

- d)Rs. 17,000

Correct answer is option 'A'. Can you explain this answer?

What is the amount of purchase when opening stock = Rs. 3,500 closing stock = Rs. 1,500, Cost of goods sold = Rs. 22,000.

a)

Rs. 20,000

b)

Rs. 24,000

c)

Rs. 27,000

d)

Rs. 17,000

|

Freedom Institute answered |

- Formula of COGS:

- COGS = Opening inventory + Purchases - Closing inventory

- 22,000 = 3,500 + Purchases - 1,500

- 22,000 = 2,000 + Purchases

- Purchases = 22,000 - 2,000

- Purchases = 20,000

Goods purchased Rs. 1,00,000. Sales Rs. 90,000. Margin 20% on cost. Closing Inventory =?- a)Rs.20,000

- b)Rs.10,000

- c)Rs.25,000

- d)Rs.28,000

Correct answer is option 'C'. Can you explain this answer?

Goods purchased Rs. 1,00,000. Sales Rs. 90,000. Margin 20% on cost. Closing Inventory =?

a)

Rs.20,000

b)

Rs.10,000

c)

Rs.25,000

d)

Rs.28,000

|

Freedom Institute answered |

The correct answer is c) Rs. 25,000.

Step 1: Calculate the cost price (C.P.):

Cost Price (C.P.) = Sales / (1 + Margin Percentage) = 90,000 / 1.20 = 75,000

Step 2: Calculate the closing inventory:

Closing Inventory = Goods Purchased - COGS = 1,00,000 - 75,000 = 25,000

Step 1: Calculate the cost price (C.P.):

Cost Price (C.P.) = Sales / (1 + Margin Percentage) = 90,000 / 1.20 = 75,000

Step 2: Calculate the closing inventory:

Closing Inventory = Goods Purchased - COGS = 1,00,000 - 75,000 = 25,000

If average stock is Rs. 20,000. Closing stock is Rs. 4,000 more than value of opening stock. Closing stock will be : - a)Rs. 16,000

- b)Rs. 18,000

- c)Rs. 20,000

- d)Rs. 22,000

Correct answer is 'D'. Can you explain this answer?

If average stock is Rs. 20,000. Closing stock is Rs. 4,000 more than value of opening stock. Closing stock will be :

a)

Rs. 16,000

b)

Rs. 18,000

c)

Rs. 20,000

d)

Rs. 22,000

|

Moumita Bajaj answered |

let os be x , then cs will be 4000+x

average stock =x+x+4000/2=20000

os = 18000

cs = 22000

Opening stock Rs. 10,000

Purchases Rs. 1,10,000

Closing Stock Rs. 20,000

Find out total sales if profit margin is 30% on cost of sales : - a)Rs. 1,20,000

- b)Rs. 1,30,000

- c)Rs. 1,10,000

- d)Rs. 1,25,000

Correct answer is option 'B'. Can you explain this answer?

Opening stock Rs. 10,000

Purchases Rs. 1,10,000

Closing Stock Rs. 20,000

Find out total sales if profit margin is 30% on cost of sales :

Purchases Rs. 1,10,000

Closing Stock Rs. 20,000

Find out total sales if profit margin is 30% on cost of sales :

a)

Rs. 1,20,000

b)

Rs. 1,30,000

c)

Rs. 1,10,000

d)

Rs. 1,25,000

|

|

Poonam Reddy answered |

COGS=OPENING STOCK +PURCHASE- CLOSING STOCK

=10000+110000-20000=100000 sales =cost +profit =100000+30000 =130000

Find out value of Closing Stock :

Opening Stock Rs. 70,000

Purchase Rs. 4,16,000

Sales Rs. 5,22,000

Gross profit earned 25% of cost - a)Rs. 68,400

- b)Rs. 36,000

- c)Rs. 94,500

- d)None

Correct answer is option 'A'. Can you explain this answer?

Find out value of Closing Stock :

Opening Stock Rs. 70,000

Purchase Rs. 4,16,000

Sales Rs. 5,22,000

Gross profit earned 25% of cost

Opening Stock Rs. 70,000

Purchase Rs. 4,16,000

Sales Rs. 5,22,000

Gross profit earned 25% of cost

a)

Rs. 68,400

b)

Rs. 36,000

c)

Rs. 94,500

d)

None

|

|

Poonam Reddy answered |

Accounting Equation to find out the cost of goods sold is :

Cost of Goods sold = Opening stock + Purchases - Closing Stock

Gross Profit earned is 25% on cost.

Let us assume cost is Rs.100

GP will @25% on cost i.e. Rs.25

Hence sales becomes cost of goods sold + Profit i.e. Rs.100 + Rs.25= Rs.125

Therefore Gross Profit on sales will be = Gross Profit / Sales * 100

Profit on sales = Rs.25 / Rs.125 * 100 i.e 20% on Sales

In the given problem Sales is Rs. 522000

Hence Gross Profit will be 20% of Rs.522000 i.e. Rs.104400

Cost of Goods Sold = Rs.522000 - Rs.104400

Cost of goods sold = Rs.417600

Therefore

Rs.417600 = Rs.70000 + Rs.416000 - Closing stock

Closing stock = Rs.486000 - Rs.417600

Closing Stock = Rs.68400

Purchases = Rs. 1,10,000, Return outward Rs. 10,000. Goods given away as charity = Rs. 1,500. Goods distributed as sample = Rs. 1,000. What is the amount of net purchases ?- a)Rs. 97,500

- b)Rs. 1,00,000

- c)Rs. 11,7500

- d)Rs. 1,10,000

Correct answer is option 'A'. Can you explain this answer?

Purchases = Rs. 1,10,000, Return outward Rs. 10,000. Goods given away as charity = Rs. 1,500. Goods distributed as sample = Rs. 1,000. What is the amount of net purchases ?

a)

Rs. 97,500

b)

Rs. 1,00,000

c)

Rs. 11,7500

d)

Rs. 1,10,000

|

Lekshmi Mehta answered |

Given:

Purchases = Rs. 1,10,000

Return outward = Rs. 10,000

Goods given away as charity = Rs. 1,500

Goods distributed as sample = Rs. 1,000

To find: Net purchases

Explanation:

Net purchases is the value of goods purchased by a business after deducting purchase returns, goods given away as charity and goods distributed as samples.

Net purchases = Purchases - Return outward - Goods given away as charity - Goods distributed as sample

Substituting the given values, we get:

Net purchases = 1,10,000 - 10,000 - 1,500 - 1,000

Net purchases = Rs. 97,500

Therefore, the amount of net purchases is Rs. 97,500 (Option A).

Purchases = Rs. 1,10,000

Return outward = Rs. 10,000

Goods given away as charity = Rs. 1,500

Goods distributed as sample = Rs. 1,000

To find: Net purchases

Explanation:

Net purchases is the value of goods purchased by a business after deducting purchase returns, goods given away as charity and goods distributed as samples.

Net purchases = Purchases - Return outward - Goods given away as charity - Goods distributed as sample

Substituting the given values, we get:

Net purchases = 1,10,000 - 10,000 - 1,500 - 1,000

Net purchases = Rs. 97,500

Therefore, the amount of net purchases is Rs. 97,500 (Option A).

Opening Stock Rs. 40,000

Closing Stock Rs. 50,000

Purchases Rs. 5,50,000

Return outward Rs. 5,000

Return inward Rs. 20,000

Carriage inward Rs. 5,000

If gross profit is 20% of sales, the gross sales will be: - a)Rs. 6,95,000

- b)Rs. 6,75,000

- c)Rs. 5,40,000

- d)Rs.6,68,750

Correct answer is 'A'. Can you explain this answer?

Opening Stock Rs. 40,000

Closing Stock Rs. 50,000

Purchases Rs. 5,50,000

Return outward Rs. 5,000

Return inward Rs. 20,000

Carriage inward Rs. 5,000

If gross profit is 20% of sales, the gross sales will be:

Closing Stock Rs. 50,000

Purchases Rs. 5,50,000

Return outward Rs. 5,000

Return inward Rs. 20,000

Carriage inward Rs. 5,000

If gross profit is 20% of sales, the gross sales will be:

a)

Rs. 6,95,000

b)

Rs. 6,75,000

c)

Rs. 5,40,000

d)

Rs.6,68,750

|

|

Arjun Singhania answered |

Cost of goods sold(net)= Opening stock + Net purchases + direct exp. - closing stock

Substitute all values in the above formula,

Cost of goods sold(net) = 30000 + 545000 + 5000 - 40000

= INR 540000

Now question says profit is 20% of net sales which means profit is 1/5th of net sales. To be more clear , 1= profit and 5 = net sales in the above fraction...

So what is cost?

Cost = net sales - profit

= 5 - 1

= 4

Which we can say, that profit is 1/4th on cost of net sales...

So profit will be = 540000(cost of net sales) * 1/4th

= INR 135000

So now the Net sales will be = cost of net sales + profit

= 540000 +135000

Net sales = INR 675000

now gross sales will be = Net sales + returns

= 675000 + 20000

Gross sales = INR 695000

Calculate the value of purchase through following details :

Opening Stock Rs. 20,000

Sales Rs. 1,50,000

Gross profit Margin Rs. 20% of sales

Closing Stock Rs. 30,000 - a)Rs. 1,30,000

- b)Rs. 1,40,000

- c)Rs. 1,50,000

- d)Rs. 1,60,000

Correct answer is option 'A'. Can you explain this answer?

Calculate the value of purchase through following details :

Opening Stock Rs. 20,000

Sales Rs. 1,50,000

Gross profit Margin Rs. 20% of sales

Closing Stock Rs. 30,000

Opening Stock Rs. 20,000

Sales Rs. 1,50,000

Gross profit Margin Rs. 20% of sales

Closing Stock Rs. 30,000

a)

Rs. 1,30,000

b)

Rs. 1,40,000

c)

Rs. 1,50,000

d)

Rs. 1,60,000

|

Raghav Ghoshal answered |

Calculation of Purchases

To calculate the value of purchases, we need to use the following formula:

Purchases = Opening Stock + Net Purchases - Closing Stock

Where,

Net Purchases = Cost of Goods Sold (COGS) = Sales - Gross Profit Margin

Given,

Opening Stock = Rs. 20,000

Sales = Rs. 1,50,000

Gross profit Margin = 20% of Sales

Closing Stock = Rs. 30,000

Calculation of Gross Profit Margin

Gross Profit Margin = 20% of Sales

= 20/100 * 1,50,000

= Rs. 30,000

Calculation of COGS

COGS = Sales - Gross Profit Margin

= 1,50,000 - 30,000

= Rs. 1,20,000

Calculation of Purchases

Purchases = Opening Stock + Net Purchases - Closing Stock

= 20,000 + 1,20,000 - 30,000

= Rs. 1,10,000

Therefore, the value of purchases is Rs. 1,10,000, which is option 'A'.

To calculate the value of purchases, we need to use the following formula:

Purchases = Opening Stock + Net Purchases - Closing Stock

Where,

Net Purchases = Cost of Goods Sold (COGS) = Sales - Gross Profit Margin

Given,

Opening Stock = Rs. 20,000

Sales = Rs. 1,50,000

Gross profit Margin = 20% of Sales

Closing Stock = Rs. 30,000

Calculation of Gross Profit Margin

Gross Profit Margin = 20% of Sales

= 20/100 * 1,50,000

= Rs. 30,000

Calculation of COGS

COGS = Sales - Gross Profit Margin

= 1,50,000 - 30,000

= Rs. 1,20,000

Calculation of Purchases

Purchases = Opening Stock + Net Purchases - Closing Stock

= 20,000 + 1,20,000 - 30,000

= Rs. 1,10,000

Therefore, the value of purchases is Rs. 1,10,000, which is option 'A'.

If average stock is Rs. 20,000. Closing stock is Rs. 4,000 more than value of opening stock. Closing stock will be : - a)Rs. 16,000

- b)Rs. 18,000

- c)Rs. 20,000

- d)Rs. 22,000

Correct answer is option 'D'. Can you explain this answer?

If average stock is Rs. 20,000. Closing stock is Rs. 4,000 more than value of opening stock. Closing stock will be :

a)

Rs. 16,000

b)

Rs. 18,000

c)

Rs. 20,000

d)

Rs. 22,000

|

Anu Kaur answered |

let os be x , then cs will be 4000+x

average stock =x+x+4000/2=20000

os = 18000

cs = 22000

Opening Stock = Rs. 6,000

Closing Stock = Rs. 8,000

Cost of Goods Sold = Rs. 87,000

Calculate the value of Purchases ? - a)Rs. 1,01,000

- b)Rs. 89,000

- c)Rs. 73,000

- d)Rs. 85,000

Correct answer is option 'B'. Can you explain this answer?

Opening Stock = Rs. 6,000

Closing Stock = Rs. 8,000

Cost of Goods Sold = Rs. 87,000

Calculate the value of Purchases ?

Closing Stock = Rs. 8,000

Cost of Goods Sold = Rs. 87,000

Calculate the value of Purchases ?

a)

Rs. 1,01,000

b)

Rs. 89,000

c)

Rs. 73,000

d)

Rs. 85,000

|

Anu Sen answered |

Calculation of Purchases

Opening Stock = Rs. 6,000

Closing Stock = Rs. 8,000

Cost of Goods Sold = Rs. 87,000

To calculate the value of purchases, we can use the following formula:

Purchases = Cost of Goods Sold + Closing Stock - Opening Stock

Substituting the given values, we get:

Purchases = Rs. 87,000 + Rs. 8,000 - Rs. 6,000

Purchases = Rs. 89,000

Therefore, the value of purchases is Rs. 89,000.

Explanation

The concept of purchases is important in accounting, as it helps to determine the cost of goods sold during a particular period. In this question, we are given the opening stock, closing stock, and cost of goods sold, and we are required to calculate the value of purchases.

The formula for calculating purchases is based on the principle of accounting known as the cost of goods sold. This principle states that the cost of goods sold during a particular period should include the cost of the goods that were sold, as well as the cost of goods that were not sold but were used in the production process.

To apply this formula, we first need to understand the meaning of opening stock, closing stock, and cost of goods sold. Opening stock refers to the value of inventory that a company has at the beginning of a particular period. Closing stock refers to the value of inventory that a company has at the end of a particular period. Cost of goods sold refers to the cost of the goods that were sold during a particular period.

Using the formula for purchases, we can calculate the value of purchases by adding the cost of goods sold and the value of closing stock, and subtracting the value of opening stock. This gives us the total cost of goods that a company has purchased during a particular period.

In this question, we are given the values of opening stock, closing stock, and cost of goods sold, and we can simply substitute these values into the formula to calculate the value of purchases. The answer is Rs. 89,000.

Opening Stock = Rs. 6,000

Closing Stock = Rs. 8,000

Cost of Goods Sold = Rs. 87,000

To calculate the value of purchases, we can use the following formula:

Purchases = Cost of Goods Sold + Closing Stock - Opening Stock

Substituting the given values, we get:

Purchases = Rs. 87,000 + Rs. 8,000 - Rs. 6,000

Purchases = Rs. 89,000

Therefore, the value of purchases is Rs. 89,000.

Explanation

The concept of purchases is important in accounting, as it helps to determine the cost of goods sold during a particular period. In this question, we are given the opening stock, closing stock, and cost of goods sold, and we are required to calculate the value of purchases.

The formula for calculating purchases is based on the principle of accounting known as the cost of goods sold. This principle states that the cost of goods sold during a particular period should include the cost of the goods that were sold, as well as the cost of goods that were not sold but were used in the production process.

To apply this formula, we first need to understand the meaning of opening stock, closing stock, and cost of goods sold. Opening stock refers to the value of inventory that a company has at the beginning of a particular period. Closing stock refers to the value of inventory that a company has at the end of a particular period. Cost of goods sold refers to the cost of the goods that were sold during a particular period.

Using the formula for purchases, we can calculate the value of purchases by adding the cost of goods sold and the value of closing stock, and subtracting the value of opening stock. This gives us the total cost of goods that a company has purchased during a particular period.

In this question, we are given the values of opening stock, closing stock, and cost of goods sold, and we can simply substitute these values into the formula to calculate the value of purchases. The answer is Rs. 89,000.

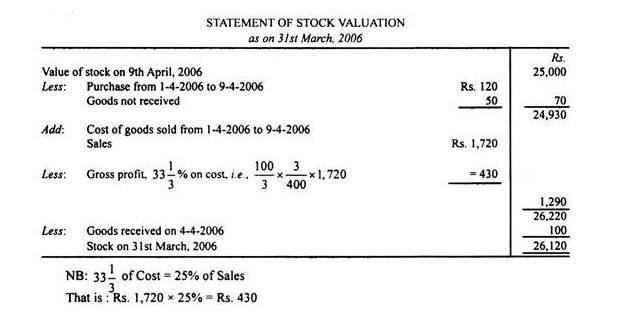

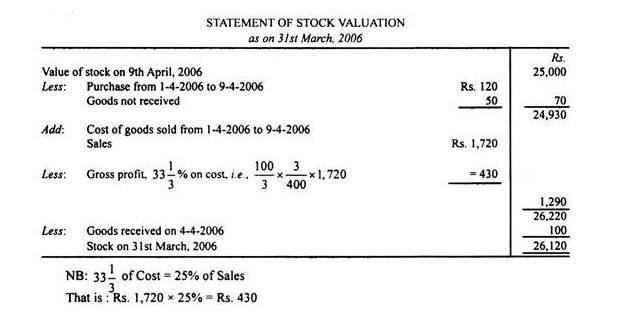

X who was closing his books on 31.03.2006 failed to take the actual stock which he did on 9th April, when it was ascertained by him to be worth Rs 25,000.It was found that sales are entered in the Sales Day Book on the same day of despatch and the returns inward in the returns book as and when the goods are received back. Purchases are entered in the Purchase Day Book once the invoices are received. Observations -i. Sales between 31st March and 9th April as per Sales Book are Rs 1,720. Rate of gross profit is 33 1/3 % on cost.ii. Purchases during the same period as per Purchases Book are Rs 120.iii. Out of above purchases, goods amounting to Rs 50 were not received until after the stock was taken.iv. Goods invoiced during the month of March, but goods received only on 4th April, amounted to Rs 100.You want to find the value of physical stock on 31st March. You start with the value of stock on 9th April. Q.How would you adjust the observation # 3?- a)70 (Less)

- b)50 (Less)

- c)120

- d)50 (Add)

Correct answer is option 'D'. Can you explain this answer?

X who was closing his books on 31.03.2006 failed to take the actual stock which he did on 9th April, when it was ascertained by him to be worth Rs 25,000.

It was found that sales are entered in the Sales Day Book on the same day of despatch and the returns inward in the returns book as and when the goods are received back. Purchases are entered in the Purchase Day Book once the invoices are received. Observations -

i. Sales between 31st March and 9th April as per Sales Book are Rs 1,720. Rate of gross profit is 33 1/3 % on cost.

ii. Purchases during the same period as per Purchases Book are Rs 120.

iii. Out of above purchases, goods amounting to Rs 50 were not received until after the stock was taken.

iv. Goods invoiced during the month of March, but goods received only on 4th April, amounted to Rs 100.

You want to find the value of physical stock on 31st March. You start with the value of stock on 9th April.

Q.How would you adjust the observation # 3?

a)

70 (Less)

b)

50 (Less)

c)

120

d)

50 (Add)

|

Mrinalini Iyer answered |

Ans.

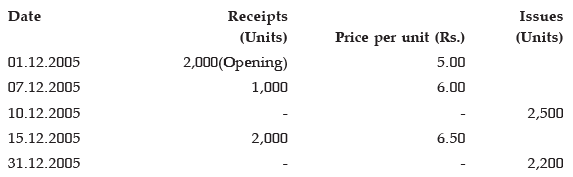

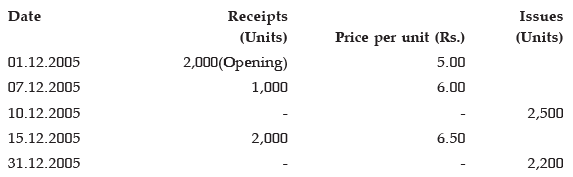

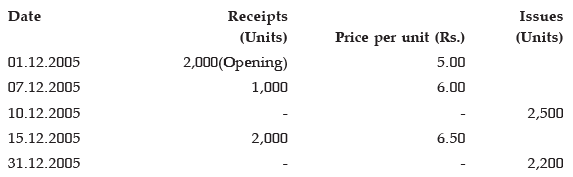

The following are the details supplied by Agni Ltd. in respect of its raw materials for the Month of December, 2005 :

On 31.12.2005, a shortage of 100 units was foundQ.Using the data given in problem, the value of issues in the month of December 2005 using LIFO principle.

On 31.12.2005, a shortage of 100 units was foundQ.Using the data given in problem, the value of issues in the month of December 2005 using LIFO principle. - a)Rs 35,000

- b)Rs 28,000

- c)Rs 20,000

- d)Rs 65,000

Correct answer is option 'B'. Can you explain this answer?

The following are the details supplied by Agni Ltd. in respect of its raw materials for the Month of December, 2005 :

On 31.12.2005, a shortage of 100 units was found

Q.Using the data given in problem, the value of issues in the month of December 2005 using LIFO principle.

a)

Rs 35,000

b)

Rs 28,000

c)

Rs 20,000

d)

Rs 65,000

|

Varun Kapoor answered |

Ok the answer is Rs28000 yea I got it

If cost of goods sold is Rs. 80,700, opening stock Rs.5,800 and closing stock Rs. 6,000, then the amount of purchase will be :-- a)Rs. 80,500

- b)Rs. 74,900

- c)Rs. 74,700

- d)Rs. 80,900

Correct answer is option 'D'. Can you explain this answer?

If cost of goods sold is Rs. 80,700, opening stock Rs.5,800 and closing stock Rs. 6,000, then the amount of purchase will be :-

a)

Rs. 80,500

b)

Rs. 74,900

c)

Rs. 74,700

d)

Rs. 80,900

|

|

Khushi Singhania answered |

Cogs=opening stock +purchase-closing stock

80700=5800+p-6000

p=80700+6000-5800

p=80900

80700=5800+p-6000

p=80700+6000-5800

p=80900

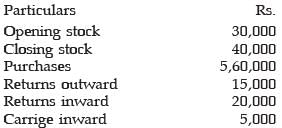

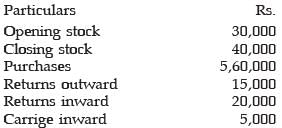

Consider the following data pertaining to R Ltd. for the month of June 2004: Q.If the gross profit is 20% of net sales, the gross sales for the month of June 2004 is

Q.If the gross profit is 20% of net sales, the gross sales for the month of June 2004 is- a)Rs.6,95,000

- b)Rs.6,75,000

- c)Rs.5,40,000

- d)Rs.6,68,750.

Correct answer is option 'A'. Can you explain this answer?

Consider the following data pertaining to R Ltd. for the month of June 2004:

Q.If the gross profit is 20% of net sales, the gross sales for the month of June 2004 is

a)

Rs.6,95,000

b)

Rs.6,75,000

c)

Rs.5,40,000

d)

Rs.6,68,750.

|

|

Vyshnavi Kodela answered |

Gross sales = o.s+purchases + return outwards -return inwards - carriage inwards- c.s. so 30000+560000+15000-20000-5000-40000=540000

AS – 2 Prescribes the use of which method of stock valuation?- a)FIFO

- b)LIFO

- c)Weighted Average Cost

- d)Both (a) and (c) above

Correct answer is option 'D'. Can you explain this answer?

AS – 2 Prescribes the use of which method of stock valuation?

a)

FIFO

b)

LIFO

c)

Weighted Average Cost

d)

Both (a) and (c) above

|

Raghavendra Choudhury answered |

AS can have several meanings depending on the context:

1. As a conjunction, it can be used to introduce a comparison between two things or ideas. Example: "I like chocolate as much as I like ice cream."

2. As an adverb, it can be used to describe the manner in which something is done. Example: "He ran as fast as he could."

3. As an abbreviation, it can stand for several different things:

- Alaska (state abbreviation)

- American Samoa (territory abbreviation)

- Antisocial (psychology abbreviation)

- Assistant (job title abbreviation)

1. As a conjunction, it can be used to introduce a comparison between two things or ideas. Example: "I like chocolate as much as I like ice cream."

2. As an adverb, it can be used to describe the manner in which something is done. Example: "He ran as fast as he could."

3. As an abbreviation, it can stand for several different things:

- Alaska (state abbreviation)

- American Samoa (territory abbreviation)

- Antisocial (psychology abbreviation)

- Assistant (job title abbreviation)

Physical verification of stock was done on 23rd june. the value of stock was rs 4,80,000. following transactions took place between 23rd june and 30th june –1 . Out of goods sent on consignment, goods costing Rs 24,000 were unsold.2 . Purchases of Rs 40,000 were made, out of which goods worth Rs 16,000 were delivered on 5th July.3 . Sales were Rs 1,36,000, which include goods worth Rs 32,000 sent on approval. Half of these goods were returned before 30th June, but no intimation is available regarding the remaining goods. Goods are sold at cost plus 25%. However, goods costing Rs24,000 had been sold for Rs12,000.You want to determine the value of stock on 30th June. You start with physical stock on 23rd June. Q.What will you do regarding adjustment # 1?- a)24,000 (Add)

- b)24,000 (less)

- c)48,000 (Add)

- d)48,000 (Less)

Correct answer is option 'A'. Can you explain this answer?

Physical verification of stock was done on 23rd june. the value of stock was rs 4,80,000. following transactions took place between 23rd june and 30th june –

1 . Out of goods sent on consignment, goods costing Rs 24,000 were unsold.

2 . Purchases of Rs 40,000 were made, out of which goods worth Rs 16,000 were delivered on 5th July.

3 . Sales were Rs 1,36,000, which include goods worth Rs 32,000 sent on approval. Half of these goods were returned before 30th June, but no intimation is available regarding the remaining goods. Goods are sold at cost plus 25%. However, goods costing Rs24,000 had been sold for Rs12,000.

You want to determine the value of stock on 30th June. You start with physical stock on 23rd June.

Q.What will you do regarding adjustment # 1?

a)

24,000 (Add)

b)

24,000 (less)

c)

48,000 (Add)

d)

48,000 (Less)

|

Anu Kaur answered |

Ans.

Method to Solve :

A company is following weighted average cost method for valuing its inventory. The details of its purchase and issue of raw-materials during the week are as follows:1.12.2005 opening stock 50 units value Rs.2,200. 2.12.2005 purchased 100 units @Rs.47.4.12.2005 issued 50 units.5.12.2005 purchased 200 units @Rs.48.The value of inventory at the end of the week and the unit weighted average costs is- a)Rs.14200 – 47.33

- b)Rs.14300 – 47.67

- c)Rs.14000 – 46.66

- d)Rs.14400 – 48.00

Correct answer is option 'A'. Can you explain this answer?

A company is following weighted average cost method for valuing its inventory. The details of its purchase and issue of raw-materials during the week are as follows:

1.12.2005 opening stock 50 units value Rs.

2,200. 2.12.2005 purchased 100 units @Rs.47.

4.12.2005 issued 50 units.

5.12.2005 purchased 200 units @Rs.48.

The value of inventory at the end of the week and the unit weighted average costs is

a)

Rs.14200 – 47.33

b)

Rs.14300 – 47.67

c)

Rs.14000 – 46.66

d)

Rs.14400 – 48.00

|

Pragati Shah answered |

Calculation of Weighted Average Cost

Opening Stock:

- Quantity: 50 units

- Value: Rs.2,200

- Unit cost: 2,200/50 = Rs.44

Purchase on 2.12.2005:

- Quantity: 100 units

- Value: Rs.4,740

- Unit cost: 4,740/100 = Rs.47.4

Issue on 4.12.2005:

- Quantity: 50 units

- Value: 50 x 44 (unit cost of opening stock) = Rs.2,200

Purchase on 5.12.2005:

- Quantity: 200 units

- Value: Rs.9,600

- Unit cost: 9,600/200 = Rs.48

Total Quantity and Value:

- Quantity: 50 (opening stock) + 100 (purchase on 2.12.2005) + 200 (purchase on 5.12.2005) - 50 (issue on 4.12.2005) = 300 units

- Value: 2,200 (opening stock) + 4,740 (purchase on 2.12.2005) + 9,600 (purchase on 5.12.2005) - 2,200 (issue on 4.12.2005) = Rs.14,340

Weighted Average Cost:

- Total cost: Rs.14,340

- Total quantity: 300 units

- Weighted average cost: 14,340/300 = Rs.47.33

Answer:

The value of inventory at the end of the week and the unit weighted average costs is Rs.14,200 and Rs.47.33 respectively.

Opening Stock:

- Quantity: 50 units

- Value: Rs.2,200

- Unit cost: 2,200/50 = Rs.44

Purchase on 2.12.2005:

- Quantity: 100 units

- Value: Rs.4,740

- Unit cost: 4,740/100 = Rs.47.4

Issue on 4.12.2005:

- Quantity: 50 units

- Value: 50 x 44 (unit cost of opening stock) = Rs.2,200

Purchase on 5.12.2005:

- Quantity: 200 units

- Value: Rs.9,600

- Unit cost: 9,600/200 = Rs.48

Total Quantity and Value:

- Quantity: 50 (opening stock) + 100 (purchase on 2.12.2005) + 200 (purchase on 5.12.2005) - 50 (issue on 4.12.2005) = 300 units

- Value: 2,200 (opening stock) + 4,740 (purchase on 2.12.2005) + 9,600 (purchase on 5.12.2005) - 2,200 (issue on 4.12.2005) = Rs.14,340

Weighted Average Cost:

- Total cost: Rs.14,340

- Total quantity: 300 units

- Weighted average cost: 14,340/300 = Rs.47.33

Answer:

The value of inventory at the end of the week and the unit weighted average costs is Rs.14,200 and Rs.47.33 respectively.

Buffer stock is the level of stock- a)Half of the actual stock

- b)At which the ordering process should start

- c)Minimum stock level below which actual stock should not fall

- d)Maximum stock in inventory

Correct answer is option 'C'. Can you explain this answer?

Buffer stock is the level of stock

a)

Half of the actual stock

b)

At which the ordering process should start

c)

Minimum stock level below which actual stock should not fall

d)

Maximum stock in inventory

|

Freedom Institute answered |

Here's the detailed explanation of Buffer Stock:

It is essentially another term in inventory management used to describe a level of extra stock that is kept to account for uncertainties in supply and demand or the risk of stockout.

Hence, the correct answer is Option C

You can cover concepts of business economics for CA foundation through the course:

Opening Stock Rs. 40,000

Closing Stock Rs. 50,000

Purchases Rs. 5,50,000

Return outward Rs. 5,000

Return inward Rs. 20,000

Carriage inward Rs. 5,000

If gross profit is 20% of sales, the gross sales will be: - a)Rs. 6,95,000

- b)Rs. 6,75,000

- c)Rs. 5,40,000

- d)Rs.6,68,750

Correct answer is option 'A'. Can you explain this answer?

Opening Stock Rs. 40,000

Closing Stock Rs. 50,000

Purchases Rs. 5,50,000

Return outward Rs. 5,000

Return inward Rs. 20,000

Carriage inward Rs. 5,000

If gross profit is 20% of sales, the gross sales will be:

Closing Stock Rs. 50,000

Purchases Rs. 5,50,000

Return outward Rs. 5,000

Return inward Rs. 20,000

Carriage inward Rs. 5,000

If gross profit is 20% of sales, the gross sales will be:

a)

Rs. 6,95,000

b)

Rs. 6,75,000

c)

Rs. 5,40,000

d)

Rs.6,68,750

|

Srsps answered |

Cost of goods sold(net)= Opening stock + Net purchases + direct exp. - closing stock

Substitute all values in the above formula,

Cost of goods sold(net) = 30000 + 545000 + 5000 - 40000

= INR 540000

Now question says profit is 20% of net sales which means profit is 1/5th of net sales. To be more clear , 1= profit and 5 = net sales in the above fraction...

So what is cost?

Cost = net sales - profit

= 5 - 1

= 4

Which we can say, that profit is 1/4th on cost of net sales...

So profit will be = 540000(cost of net sales) * 1/4th

= INR 135000

So now the Net sales will be = cost of net sales + profit

= 540000 +135000

Net sales = INR 675000

now gross sales will be = Net sales + returns

= 675000 + 20000

Gross sales = INR 695000

The books of T Ltd. revealed the following information:

Opening inventory Rs.6,00,000

Purchases during the year 2010-2011 Rs.34,00,000

Sales during the year 2010-2011 Rs.48,00,000

On March 31, 2011, the value of inventory as per physical Inventory-taking was Rs. 3,25,000. The company’s gross profit on sales has remained constant at 25%. The management of the company suspects that some inventory might have been pilfered by a new employee. What is the estimated cost of missing inventory?- a)Rs.75,000

- b)Rs. 25,000

- c)Rs. 1,00,000

- d)Rs. 1,50,000

Correct answer is option 'A'. Can you explain this answer?

The books of T Ltd. revealed the following information:

Opening inventory Rs.6,00,000

Purchases during the year 2010-2011 Rs.34,00,000

Sales during the year 2010-2011 Rs.48,00,000

On March 31, 2011, the value of inventory as per physical Inventory-taking was Rs. 3,25,000. The company’s gross profit on sales has remained constant at 25%. The management of the company suspects that some inventory might have been pilfered by a new employee. What is the estimated cost of missing inventory?

Opening inventory Rs.6,00,000

Purchases during the year 2010-2011 Rs.34,00,000

Sales during the year 2010-2011 Rs.48,00,000

On March 31, 2011, the value of inventory as per physical Inventory-taking was Rs. 3,25,000. The company’s gross profit on sales has remained constant at 25%. The management of the company suspects that some inventory might have been pilfered by a new employee. What is the estimated cost of missing inventory?

a)

Rs.75,000

b)

Rs. 25,000

c)

Rs. 1,00,000

d)

Rs. 1,50,000

|

Freedom Institute answered |

- To find the estimated cost of the missing inventory, we use the gross profit method.

- The gross profit on sales is 25%, which means the cost of goods sold (COGS) is 75% of sales.

- The total sales amount to Rs. 48,00,000, so the COGS is Rs. 36,00,000 (75% of Rs. 48,00,000).

- The cost of goods available for sale is the sum of opening inventory and purchases, which is Rs. 40,00,000 (Rs. 6,00,000 + Rs. 34,00,000).

- Therefore, the expected closing inventory should be Rs. 4,00,000 (Rs. 40,00,000 - Rs. 36,00,000).

- The actual physical inventory counted is Rs. 3,25,000.

- The difference between the expected and actual inventory is Rs. 75,000, which is the estimated cost of the missing inventory, confirming that option a is correct.

Can you explain the answer of this question below:A businessman purchased goods for Rs. 25,00,000 and sold 70% of such goods during the accounting year ended 31stMarch, 2005. The market value of remaining goods was Rs. 5,00,000. He valued the Closing stock at Rs. 5,00,000 and not at Rs. 7,50,000 due to :

- A:

Money measurement

- B:

Conservatism

- C:

Cost

- D:

Periodicity

The answer is b.

A businessman purchased goods for Rs. 25,00,000 and sold 70% of such goods during the accounting year ended 31stMarch, 2005. The market value of remaining goods was Rs. 5,00,000. He valued the Closing stock at Rs. 5,00,000 and not at Rs. 7,50,000 due to :

Money measurement

Conservatism

Cost

Periodicity

|

Arka Kaur answered |

Explanation:

The concept of conservatism in accounting requires that the assets and revenues should be not overstated and liabilities and expenses should not be understated. In this case, the businessman purchased goods for Rs. 25,00,000 and sold 70% of such goods during the accounting year ended 31st March, 2005. The market value of remaining goods was Rs. 5,00,000.

The businessman valued the Closing stock at Rs. 5,00,000 and not at Rs. 7,50,000. This is because of the concept of conservatism. The reasons are:

• Certainty - The market value of Rs. 5,00,000 is certain, whereas the market value of Rs. 7,50,000 is not certain.

• Objectivity - The market value of Rs. 5,00,000 is more objective, whereas the market value of Rs. 7,50,000 is more subjective.

• Prudence - The concept of conservatism requires prudence in valuing the closing stock. In this case, valuing the closing stock at Rs. 5,00,000 is more prudent and conservative than valuing it at Rs. 7,50,000.

Therefore, the correct answer is option B, i.e. conservatism.

The concept of conservatism in accounting requires that the assets and revenues should be not overstated and liabilities and expenses should not be understated. In this case, the businessman purchased goods for Rs. 25,00,000 and sold 70% of such goods during the accounting year ended 31st March, 2005. The market value of remaining goods was Rs. 5,00,000.

The businessman valued the Closing stock at Rs. 5,00,000 and not at Rs. 7,50,000. This is because of the concept of conservatism. The reasons are:

• Certainty - The market value of Rs. 5,00,000 is certain, whereas the market value of Rs. 7,50,000 is not certain.

• Objectivity - The market value of Rs. 5,00,000 is more objective, whereas the market value of Rs. 7,50,000 is more subjective.

• Prudence - The concept of conservatism requires prudence in valuing the closing stock. In this case, valuing the closing stock at Rs. 5,00,000 is more prudent and conservative than valuing it at Rs. 7,50,000.

Therefore, the correct answer is option B, i.e. conservatism.

Average Inventory = Rs. 12,000. Closing stock is Rs. 3,000 more than opening stock. The value of closing Inventory = _________.- a)Rs. 12,000

- b)Rs. 24,000

- c)Rs. 10,500

- d)Rs. 13,500

Correct answer is option 'D'. Can you explain this answer?

Average Inventory = Rs. 12,000. Closing stock is Rs. 3,000 more than opening stock. The value of closing Inventory = _________.

a)

Rs. 12,000

b)

Rs. 24,000

c)

Rs. 10,500

d)

Rs. 13,500

|

Sameer Basu answered |

Given:

Average Inventory = Rs. 12,000

Closing stock is Rs. 3,000 more than opening stock

To find: The value of closing Inventory

Solution:

Let the opening stock be x.

Then, the closing stock will be x+3,000.

Average inventory = (Opening stock + Closing stock) / 2

12,000 = (x + (x+3,000)) / 2

24,000 = 2x + 3,000

2x = 21,000

x = 10,500

Therefore,

Opening stock = Rs. 10,500

Closing stock = Rs. 10,500 + Rs. 3,000 = Rs. 13,500

The value of closing inventory = Rs. 13,500

Hence, option D is the correct answer.

Average Inventory = Rs. 12,000

Closing stock is Rs. 3,000 more than opening stock

To find: The value of closing Inventory

Solution:

Let the opening stock be x.

Then, the closing stock will be x+3,000.

Average inventory = (Opening stock + Closing stock) / 2

12,000 = (x + (x+3,000)) / 2

24,000 = 2x + 3,000

2x = 21,000

x = 10,500

Therefore,

Opening stock = Rs. 10,500

Closing stock = Rs. 10,500 + Rs. 3,000 = Rs. 13,500

The value of closing inventory = Rs. 13,500

Hence, option D is the correct answer.

Under Inflationary conditions, LIFO will lead to : - a)No change in sale

- b)Higher Sale

- c)Lower profit

- d)Higher profit

Correct answer is option 'C'. Can you explain this answer?

Under Inflationary conditions, LIFO will lead to :

a)

No change in sale

b)

Higher Sale

c)

Lower profit

d)

Higher profit

|

|

Jayant Mishra answered |

Under LIFO (last-in, first out), the latest/higher costs will flow quickly to the cost of goods sold, and the older/lower costs will remain in inventory. If a company can increase its selling prices by the amount of the cost increases, the gross profit (sales minus the cost of goods sold), net income, taxable income, income taxes, and inventory will remain nearly the same.

Physical verification of stock was done on 23rd june. the value of stock was rs 4,80,000. following transactions took place between 23rd june and 30th june –1 . Out of goods sent on consignment, goods costing Rs 24,000 were unsold.2 . Purchases of Rs 40,000 were made, out of which goods worth Rs 16,000 were delivered on 5th July.3 . Sales were Rs 1,36,000, which include goods worth Rs 32,000 sent on approval. Half of these goods were returned before 30th June, but no intimation is available regarding the remaining goods. Goods are sold at cost plus 25%. However, goods costing Rs24,000 had been sold for Rs12,000.You want to determine the value of stock on 30th June. You start with physical stock on 23rd June. Q.Value of stock on 30th June = ________.- a)4,80,000

- b)5,44,000

- c)4,36,000

- d)4,46,400

Correct answer is option 'D'. Can you explain this answer?

Physical verification of stock was done on 23rd june. the value of stock was rs 4,80,000. following transactions took place between 23rd june and 30th june –

1 . Out of goods sent on consignment, goods costing Rs 24,000 were unsold.

2 . Purchases of Rs 40,000 were made, out of which goods worth Rs 16,000 were delivered on 5th July.

3 . Sales were Rs 1,36,000, which include goods worth Rs 32,000 sent on approval. Half of these goods were returned before 30th June, but no intimation is available regarding the remaining goods. Goods are sold at cost plus 25%. However, goods costing Rs24,000 had been sold for Rs12,000.

You want to determine the value of stock on 30th June. You start with physical stock on 23rd June.

Q.Value of stock on 30th June = ________.

a)

4,80,000

b)

5,44,000

c)

4,36,000

d)

4,46,400

|

Arnab Nambiar answered |

Calculation of value of stock on 30th June:

1. Adjust physical stock on 23rd June: Rs 4,80,000

2. Add purchases made: Rs 40,000

3. Subtract goods delivered on 5th July: Rs 16,000

4. Adjust for goods sent on consignment: Rs 24,000 (unsold)

5. Adjust for goods sent on approval: Rs 16,000 (returned) + Rs 16,000 (remaining)

6. Adjust for goods sold at cost plus 25%: Rs 1,36,000 + 25% = Rs 1,70,000

- Rs 24,000 (sold at loss)

= Rs 1,46,000

- Rs 32,000 (sent on approval and returned)

= Rs 1,14,000

Calculation:

1. Physical stock on 23rd June = Rs 4,80,000

2. Add purchases made = Rs 40,000

3. Subtract goods delivered on 5th July = Rs 16,000

Value of stock as on 30th June before other adjustments = Rs 5,04,000

4. Adjust for goods sent on consignment = Rs 24,000 (unsold)

Value of stock as on 30th June after adjustment for consignment goods = Rs 4,80,000

5. Adjust for goods sent on approval = Rs 16,000 (returned) + Rs 16,000 (remaining)

Value of stock as on 30th June after adjustment for approval goods = Rs 4,48,000

6. Adjust for goods sold at cost plus 25% = Rs 1,14,000

- Rs 24,000 (sold at loss)

= Rs 90,000

Value of stock as on 30th June after adjustment for sales = Rs 4,46,400

Therefore, the value of stock on 30th June is Rs 4,46,400.

1. Adjust physical stock on 23rd June: Rs 4,80,000

2. Add purchases made: Rs 40,000

3. Subtract goods delivered on 5th July: Rs 16,000

4. Adjust for goods sent on consignment: Rs 24,000 (unsold)

5. Adjust for goods sent on approval: Rs 16,000 (returned) + Rs 16,000 (remaining)

6. Adjust for goods sold at cost plus 25%: Rs 1,36,000 + 25% = Rs 1,70,000

- Rs 24,000 (sold at loss)

= Rs 1,46,000

- Rs 32,000 (sent on approval and returned)

= Rs 1,14,000

Calculation:

1. Physical stock on 23rd June = Rs 4,80,000

2. Add purchases made = Rs 40,000

3. Subtract goods delivered on 5th July = Rs 16,000

Value of stock as on 30th June before other adjustments = Rs 5,04,000

4. Adjust for goods sent on consignment = Rs 24,000 (unsold)

Value of stock as on 30th June after adjustment for consignment goods = Rs 4,80,000

5. Adjust for goods sent on approval = Rs 16,000 (returned) + Rs 16,000 (remaining)

Value of stock as on 30th June after adjustment for approval goods = Rs 4,48,000

6. Adjust for goods sold at cost plus 25% = Rs 1,14,000

- Rs 24,000 (sold at loss)

= Rs 90,000

Value of stock as on 30th June after adjustment for sales = Rs 4,46,400

Therefore, the value of stock on 30th June is Rs 4,46,400.

Under inflationary conditions, which of the methods will not show lowest value of cost of goods sold?- a)FIFO

- b)LIFO

- c)Weighted Average

- d)All of the above

Correct answer is option 'B,C'. Can you explain this answer?

Under inflationary conditions, which of the methods will not show lowest value of cost of goods sold?

a)

FIFO

b)

LIFO

c)

Weighted Average

d)

All of the above

|

Arka Kaur answered |

Explanation:

Inflation refers to the general increase in the price level of goods and services in an economy over a period of time. Under inflationary conditions, the cost of goods sold (COGS) will increase, as the cost of raw materials, labor, and other expenses also increase.

There are different methods of inventory valuation, such as FIFO (first-in, first-out), LIFO (last-in, first-out), and weighted average. Each method has its own advantages and disadvantages, and the choice of method can affect the calculation of COGS and the profitability of the business.

FIFO Method:

The FIFO method assumes that the first items purchased are the first items sold. Therefore, the COGS is calculated based on the cost of the oldest inventory, and the ending inventory is based on the cost of the most recent purchases. Inflationary conditions will lead to higher COGS and lower ending inventory value under FIFO.

LIFO Method:

The LIFO method assumes that the last items purchased are the first items sold. Therefore, the COGS is calculated based on the cost of the most recent purchases, and the ending inventory is based on the cost of the oldest inventory. Inflationary conditions will lead to lower COGS and higher ending inventory value under LIFO.

Weighted Average Method:

The weighted average method calculates the average cost of all the units in inventory, based on the total cost of goods available for sale and the total units available for sale. Inflationary conditions will lead to a higher average cost and higher COGS under weighted average.

Conclusion:

Under inflationary conditions, LIFO and weighted average methods will not show the lowest value of COGS, as they will result in lower COGS and higher ending inventory value or higher average cost and higher COGS, respectively. On the other hand, FIFO will result in higher COGS and lower ending inventory value under inflation. Therefore, the choice of inventory valuation method can have a significant impact on the financial statements of a business, especially under inflationary conditions.

Inflation refers to the general increase in the price level of goods and services in an economy over a period of time. Under inflationary conditions, the cost of goods sold (COGS) will increase, as the cost of raw materials, labor, and other expenses also increase.

There are different methods of inventory valuation, such as FIFO (first-in, first-out), LIFO (last-in, first-out), and weighted average. Each method has its own advantages and disadvantages, and the choice of method can affect the calculation of COGS and the profitability of the business.

FIFO Method:

The FIFO method assumes that the first items purchased are the first items sold. Therefore, the COGS is calculated based on the cost of the oldest inventory, and the ending inventory is based on the cost of the most recent purchases. Inflationary conditions will lead to higher COGS and lower ending inventory value under FIFO.

LIFO Method:

The LIFO method assumes that the last items purchased are the first items sold. Therefore, the COGS is calculated based on the cost of the most recent purchases, and the ending inventory is based on the cost of the oldest inventory. Inflationary conditions will lead to lower COGS and higher ending inventory value under LIFO.

Weighted Average Method:

The weighted average method calculates the average cost of all the units in inventory, based on the total cost of goods available for sale and the total units available for sale. Inflationary conditions will lead to a higher average cost and higher COGS under weighted average.

Conclusion:

Under inflationary conditions, LIFO and weighted average methods will not show the lowest value of COGS, as they will result in lower COGS and higher ending inventory value or higher average cost and higher COGS, respectively. On the other hand, FIFO will result in higher COGS and lower ending inventory value under inflation. Therefore, the choice of inventory valuation method can have a significant impact on the financial statements of a business, especially under inflationary conditions.

X who was closing his books on 31.03.2006 failed to take the actual stock which he did on 9th April, when it was ascertained by him to be worth Rs 25,000.It was found that sales are entered in the Sales Day Book on the same day of despatch and the returns inward in the returns book as and when the goods are received back. Purchases are entered in the Purchase Day Book once the invoices are received. Observations -i. Sales between 31st March and 9th April as per Sales Book are Rs 1,720. Rate of gross profit is 33 1/3 % on cost.ii. Purchases during the same period as per Purchases Book are Rs 120.iii. Out of above purchases, goods amounting to Rs 50 were not received until after the stock was taken.iv. Goods invoiced during the month of March, but goods received only on 4th April, amounted to Rs 100.You want to find the value of physical stock on 31st March. You start with the value of stock on 9th April. Q.How would you adjust the observation # 4?- a)100 (Add)

- b)150 (Less)

- c)100 (Less)

- d)150 (Add)

Correct answer is option 'C'. Can you explain this answer?

X who was closing his books on 31.03.2006 failed to take the actual stock which he did on 9th April, when it was ascertained by him to be worth Rs 25,000.

It was found that sales are entered in the Sales Day Book on the same day of despatch and the returns inward in the returns book as and when the goods are received back. Purchases are entered in the Purchase Day Book once the invoices are received. Observations -

i. Sales between 31st March and 9th April as per Sales Book are Rs 1,720. Rate of gross profit is 33 1/3 % on cost.

ii. Purchases during the same period as per Purchases Book are Rs 120.

iii. Out of above purchases, goods amounting to Rs 50 were not received until after the stock was taken.

iv. Goods invoiced during the month of March, but goods received only on 4th April, amounted to Rs 100.

You want to find the value of physical stock on 31st March. You start with the value of stock on 9th April.

Q.How would you adjust the observation # 4?

a)

100 (Add)

b)

150 (Less)

c)

100 (Less)

d)

150 (Add)

|

|

Murshina Mujeeb answered |

Because it is asked to find the physical stock on 31 march not the actual stock ,so in the given case the goods physically arrive on 4 th april ie it is not the physical stock on 31 march so it is substracted from stock on april 9 th

Goods purchased Rs 1,00,000. Sales Rs 90,000. Margin 20% on cost. Closing Stock = ?- a)(10,000)

- b)10,000

- c)25,000

- d)28,000

Correct answer is option 'C'. Can you explain this answer?

Goods purchased Rs 1,00,000. Sales Rs 90,000. Margin 20% on cost. Closing Stock = ?

a)

(10,000)

b)

10,000

c)

25,000

d)

28,000

|

Disha Joshi answered |

Calculation of Closing Stock:

Step 1: Calculation of Cost of Goods Sold

Cost of Goods Sold = Sales / (1 - Margin % on Cost)

Cost of Goods Sold = 90,000 / (1 - 20%) = 1,12,500

Step 2: Calculation of Cost of Goods Available for Sale

Cost of Goods Available for Sale = Cost of Goods Sold + Closing Stock

Cost of Goods Available for Sale = 1,12,500 + Closing Stock

Step 3: Calculation of Closing Stock

Closing Stock = Cost of Goods Available for Sale - Cost of Goods Purchased

Closing Stock = (1,12,500 + Closing Stock) - 1,00,000

Closing Stock = 12,500 + Closing Stock

Closing Stock - Closing Stock = 12,500

Closing Stock = 12,500 / 1

Closing Stock = 12,500

Hence, the closing stock is Rs 25,000 (Option C).

Step 1: Calculation of Cost of Goods Sold

Cost of Goods Sold = Sales / (1 - Margin % on Cost)

Cost of Goods Sold = 90,000 / (1 - 20%) = 1,12,500

Step 2: Calculation of Cost of Goods Available for Sale

Cost of Goods Available for Sale = Cost of Goods Sold + Closing Stock

Cost of Goods Available for Sale = 1,12,500 + Closing Stock

Step 3: Calculation of Closing Stock

Closing Stock = Cost of Goods Available for Sale - Cost of Goods Purchased

Closing Stock = (1,12,500 + Closing Stock) - 1,00,000

Closing Stock = 12,500 + Closing Stock

Closing Stock - Closing Stock = 12,500

Closing Stock = 12,500 / 1

Closing Stock = 12,500

Hence, the closing stock is Rs 25,000 (Option C).

Re-ordering level is calculated as - a)Maximum consumption rate x Maximum re-order period

- b)Minimum consumption rate x Minimum re-order period

- c)Maximum consumption rate x Minimum re-order period

- d)Minimum consumption rate x Maximum re-order period

Correct answer is option 'A'. Can you explain this answer?

Re-ordering level is calculated as

a)

Maximum consumption rate x Maximum re-order period

b)

Minimum consumption rate x Minimum re-order period

c)

Maximum consumption rate x Minimum re-order period

d)

Minimum consumption rate x Maximum re-order period

|

Freedom Institute answered |

Re-order level is calculated as Maximum consumption x Maximum re-order period. To calculate the reorder level, multiply the average daily usage rate by the lead time in days for an inventory item.

Bharat Indian Oil is a bulk distributor of petrol. A periodic inventory of petrol on hand is taken when the books are closed at the end of each month. The following summary of information is available for the month :Sales Rs.9,45,000General administration cost Rs.25,000Opening Stock: 1,00,000 litres @ Rs.3 per litre Rs.3,00,000Purchases (including freight inward):June 1 2,00,000 litres @ Rs.2.85 per litreJune 30 1,00,000 litres @ Rs.3.03 per litreJune 30 Closing stock 1,30,000 litres Q.Using the information given in problem, compute the amount of cost of goods sold for June using LIFO principle.- a)Rs 7,80,000

- b)Rs 6,75,000

- c)Rs 8,15,000

- d)Rs 7,95,000

Correct answer is option 'A'. Can you explain this answer?

Bharat Indian Oil is a bulk distributor of petrol. A periodic inventory of petrol on hand is taken when the books are closed at the end of each month. The following summary of information is available for the month :

Sales Rs.9,45,000

General administration cost Rs.25,000

Opening Stock: 1,00,000 litres @ Rs.3 per litre Rs.3,00,000

Purchases (including freight inward):

June 1 2,00,000 litres @ Rs.2.85 per litre

June 30 1,00,000 litres @ Rs.3.03 per litre

June 30 Closing stock 1,30,000 litres

Q.Using the information given in problem, compute the amount of cost of goods sold for June using LIFO principle.

a)

Rs 7,80,000

b)

Rs 6,75,000

c)

Rs 8,15,000

d)

Rs 7,95,000

|

Meera Basak answered |

Correct Answer :- a

Explanation : Calculation of quantity of goods sold = Opening stock + purchases - Closing stock

= 1,00,000 + 3,00,000 - 1,30,000

= 2,70,000

Amount of goods sold (under LIFO)

= 2,00,000 x 2.85 = 5,70,000

70,000 x 3 = 2,10,000

now,

5,70,000 + 2,10,000 = 7,80,000

(Under LIFO method the last purchased/produced inventory is sold first)

The amount of purchase ifCost of goods sold is Rs.80,700Opening stock Rs.5,800Closing stock Rs.6,000- a)Rs.80,500

- b)Rs.74,900

- c)Rs.74,700

- d)Rs.80,900.

Correct answer is option 'D'. Can you explain this answer?

The amount of purchase if

Cost of goods sold is Rs.80,700

Opening stock Rs.5,800

Closing stock Rs.6,000

a)

Rs.80,500

b)

Rs.74,900

c)

Rs.74,700

d)

Rs.80,900.

|

Puja Singh answered |

To calculate the amount of purchase, we need to use the formula:

Purchase = Cost of Goods Sold + Closing Stock - Opening Stock

Given information:

Cost of Goods Sold = Rs.80,700

Opening Stock = Rs.5,800

Closing Stock = Rs.6,000

Let's calculate the amount of purchase using the above formula:

Purchase = Rs.80,700 + Rs.6,000 - Rs.5,800

Purchase = Rs.80,700 + Rs.200

Purchase = Rs.80,900

Therefore, the correct answer is option 'D' - Rs.80,900.

Purchase = Cost of Goods Sold + Closing Stock - Opening Stock

Given information:

Cost of Goods Sold = Rs.80,700

Opening Stock = Rs.5,800

Closing Stock = Rs.6,000

Let's calculate the amount of purchase using the above formula:

Purchase = Rs.80,700 + Rs.6,000 - Rs.5,800

Purchase = Rs.80,700 + Rs.200

Purchase = Rs.80,900

Therefore, the correct answer is option 'D' - Rs.80,900.

Inventories are assets : - a)Held for sales in the ordinary course of business

- b)In the production process for such sale

- c)In the form of materials or supplies to be consumed in the production process or in the rendering of service

- d)All of the above

Correct answer is option 'D'. Can you explain this answer?

Inventories are assets :

a)

Held for sales in the ordinary course of business

b)

In the production process for such sale

c)

In the form of materials or supplies to be consumed in the production process or in the rendering of service

d)

All of the above

|

|

Rajat Patel answered |

International Accounting Standard 2 (IAS 2) defines inventories as the “assets:

(a) held for sale in the ordinary course of business;

(b) in the process of production for such sale; or

(c) in the form of materials or supplies to be consumed in the production process or in the rendering of services.

Inventories are those assets of an entity which are sold in the normal course of business. These are the finished goods which are ready for being sold. Assets which are held for sale but are not traded in the normal course of business cannot be classified as inventories.

Apart from the finished goods that are ready for sale the goods in the process of production are also classified as inventories. The goods which have undergone some production process but are not in the intended selling condition are termed as work in progress or work in process. Work in progress is also part of the inventories.

The raw materials used for the production of goods are also classified as inventories. All the raw materials that are available in the store waiting for being used in the production of goods are included in inventories.

Under inflationary conditions, which of the methods will not show lowest value of closing stock?- a)FIFO

- b)LIFO

- c)Weighted Average

- d) All of the above

Correct answer is option 'A,C'. Can you explain this answer?

Under inflationary conditions, which of the methods will not show lowest value of closing stock?

a)

FIFO

b)

LIFO

c)

Weighted Average

d)

All of the above

|

|

Dashvanth Kumar answered |

Right answer is lifo because under inflationary conditions the recently purchased goods will be of higher price and hence we require the closing stock at lowest value therefore if we follow lifo then the goods which are purchased recently at Higher prices will be sold and those goods which are purchase at the beginning at lower prices will be in our closing stock

If the profit is 25% of the cost price then it is- a)25% of the sales price

- b)33% of the sales price

- c)20% of the sales price

- d)15% of the sales price.

Correct answer is option 'C'. Can you explain this answer?

If the profit is 25% of the cost price then it is

a)

25% of the sales price

b)

33% of the sales price

c)

20% of the sales price

d)

15% of the sales price.

|

|

Ayush Agarwal answered |

Here,, in the given question,,

profit is on cost,, 25% or 1/4

to make it in sales

we know the formula,, sp=cp+prof.

so.., 1/5 I. e. 20%ans

profit is on cost,, 25% or 1/4

to make it in sales

we know the formula,, sp=cp+prof.

so.., 1/5 I. e. 20%ans

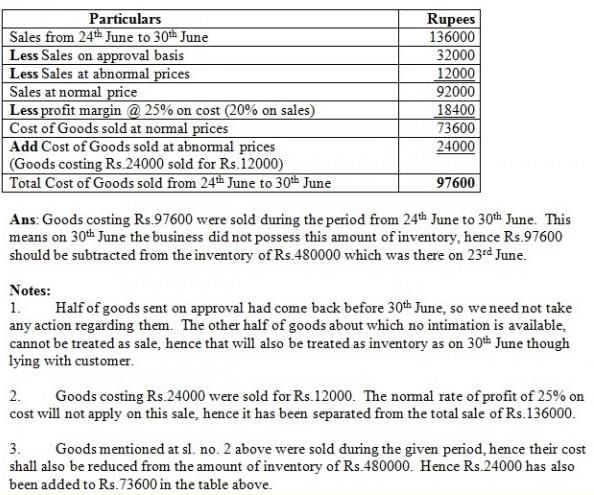

Physical verification of stock was done on 23rd june. the value of stock was rs 4,80,000. following transactions took place between 23rd june and 30th june –1 . Out of goods sent on consignment, goods costing Rs 24,000 were unsold.2 . Purchases of Rs 40,000 were made, out of which goods worth Rs 16,000 were delivered on 5th July.3 . Sales were Rs 1,36,000, which include goods worth Rs 32,000 sent on approval. Half of these goods were returned before 30th June, but no intimation is available regarding the remaining goods. Goods are sold at cost plus 25%. However, goods costing Rs24,000 had been sold for Rs12,000.You want to determine the value of stock on 30th June. You start with physical stock on 23rd June. Q.Cost of Normal Sales = _______.- a)73,600

- b)80,000

- c)1,08,800

- d)99,200

Correct answer is option 'A'. Can you explain this answer?

Physical verification of stock was done on 23rd june. the value of stock was rs 4,80,000. following transactions took place between 23rd june and 30th june –

1 . Out of goods sent on consignment, goods costing Rs 24,000 were unsold.

2 . Purchases of Rs 40,000 were made, out of which goods worth Rs 16,000 were delivered on 5th July.

3 . Sales were Rs 1,36,000, which include goods worth Rs 32,000 sent on approval. Half of these goods were returned before 30th June, but no intimation is available regarding the remaining goods. Goods are sold at cost plus 25%. However, goods costing Rs24,000 had been sold for Rs12,000.

You want to determine the value of stock on 30th June. You start with physical stock on 23rd June.

Q.Cost of Normal Sales = _______.

a)

73,600

b)

80,000

c)

1,08,800

d)

99,200

|

Dhruba Choudhary answered |

Cost of Normal Sales Calculation

The cost of normal sales can be calculated using the following formula:

Cost of Goods Sold = Opening Stock + Purchases - Closing Stock

Here, we are given the value of physical stock on 23rd June, which is Rs 4,80,000. We need to calculate the value of closing stock on 30th June, taking into account the following transactions:

1. Out of goods sent on consignment, goods costing Rs 24,000 were unsold.

2. Purchases of Rs 40,000 were made, out of which goods worth Rs 16,000 were delivered on 5th July.

3. Sales were Rs 1,36,000, which include goods worth Rs 32,000 sent on approval. Half of these goods were returned before 30th June, but no intimation is available regarding the remaining goods. Goods are sold at cost plus 25%. However, goods costing Rs 24,000 had been sold for Rs 12,000.

Let's calculate the cost of normal sales using the above formula:

Opening Stock = Rs 4,80,000

Purchases = Rs 40,000 - Rs 16,000 (goods delivered on 5th July) = Rs 24,000

Closing Stock = Opening Stock + Purchases - Cost of Goods Sold

Cost of Goods Sold = Rs 4,80,000 + Rs 24,000 - Cost of Normal Sales

Sales = Rs 1,36,000 - Rs 32,000 (goods sent on approval) = Rs 1,04,000

Cost of Normal Sales = (Cost of Goods Sold - Rs 24,000) / 1.25

We need to subtract the cost of goods sent on consignment but not sold (Rs 24,000) from the cost of goods sold, as these goods are still with us and have not been sold. We also need to divide the cost of normal sales by 1.25 to account for the fact that goods are sold at cost plus 25%.

Let's substitute the values in the above formula:

Cost of Normal Sales = (Rs 4,80,000 + Rs 24,000 - Cost of Goods Sold - Rs 24,000) / 1.25

Cost of Normal Sales = (Rs 4,80,000 + Rs 24,000 - Rs 1,04,000 - Rs 24,000) / 1.25

Cost of Normal Sales = Rs 73,600

Therefore, the cost of normal sales is Rs 73,600.

The cost of normal sales can be calculated using the following formula:

Cost of Goods Sold = Opening Stock + Purchases - Closing Stock

Here, we are given the value of physical stock on 23rd June, which is Rs 4,80,000. We need to calculate the value of closing stock on 30th June, taking into account the following transactions:

1. Out of goods sent on consignment, goods costing Rs 24,000 were unsold.

2. Purchases of Rs 40,000 were made, out of which goods worth Rs 16,000 were delivered on 5th July.

3. Sales were Rs 1,36,000, which include goods worth Rs 32,000 sent on approval. Half of these goods were returned before 30th June, but no intimation is available regarding the remaining goods. Goods are sold at cost plus 25%. However, goods costing Rs 24,000 had been sold for Rs 12,000.

Let's calculate the cost of normal sales using the above formula:

Opening Stock = Rs 4,80,000

Purchases = Rs 40,000 - Rs 16,000 (goods delivered on 5th July) = Rs 24,000

Closing Stock = Opening Stock + Purchases - Cost of Goods Sold

Cost of Goods Sold = Rs 4,80,000 + Rs 24,000 - Cost of Normal Sales

Sales = Rs 1,36,000 - Rs 32,000 (goods sent on approval) = Rs 1,04,000

Cost of Normal Sales = (Cost of Goods Sold - Rs 24,000) / 1.25

We need to subtract the cost of goods sent on consignment but not sold (Rs 24,000) from the cost of goods sold, as these goods are still with us and have not been sold. We also need to divide the cost of normal sales by 1.25 to account for the fact that goods are sold at cost plus 25%.

Let's substitute the values in the above formula:

Cost of Normal Sales = (Rs 4,80,000 + Rs 24,000 - Cost of Goods Sold - Rs 24,000) / 1.25

Cost of Normal Sales = (Rs 4,80,000 + Rs 24,000 - Rs 1,04,000 - Rs 24,000) / 1.25

Cost of Normal Sales = Rs 73,600

Therefore, the cost of normal sales is Rs 73,600.

Bharat Indian Oil is a bulk distributor of petrol. A periodic inventory of petrol on hand is taken when the books are closed at the end of each month. The following summary of information is available for the month :Sales Rs.9,45,000General administration cost Rs.25,000Opening Stock: 1,00,000 litres @ Rs.3 per litre Rs.3,00,000Purchases (including freight inward):June 1 2,00,000 litres @ Rs.2.85 per litreJune 30 1,00,000 litres @ Rs.3.03 per litreJune 30 Closing stock 1,30,000 litres Q.Using the information given in problem, compute the amount of cost of goods sold for June using weighted average method.- a)Rs 8,15,000

- b)Rs 7,52,000

- c)Rs 7,83,000

- d)Rs 6,79,000

Correct answer is option 'C'. Can you explain this answer?

Bharat Indian Oil is a bulk distributor of petrol. A periodic inventory of petrol on hand is taken when the books are closed at the end of each month. The following summary of information is available for the month :

Sales Rs.9,45,000

General administration cost Rs.25,000

Opening Stock: 1,00,000 litres @ Rs.3 per litre Rs.3,00,000

Purchases (including freight inward):

June 1 2,00,000 litres @ Rs.2.85 per litre

June 30 1,00,000 litres @ Rs.3.03 per litre

June 30 Closing stock 1,30,000 litres

Q.Using the information given in problem, compute the amount of cost of goods sold for June using weighted average method.

a)

Rs 8,15,000

b)

Rs 7,52,000

c)

Rs 7,83,000

d)

Rs 6,79,000

|

Subhankar Sen answered |

Which of these is not an objective of inventory valuation ?- a)To determine true profit and Loss

- b)To show true financial position of the business

- c)To properly value closing stock

- d)To evade tax liability

Correct answer is option 'D'. Can you explain this answer?

Which of these is not an objective of inventory valuation ?

a)

To determine true profit and Loss

b)

To show true financial position of the business

c)

To properly value closing stock

d)

To evade tax liability

|

|

Jayant Mishra answered |

OBJECTIVES OF INVENTORY VALUATION:

The Balance sheet of a concern must show true and fair view of the financial position of the concern. For these purpose assets including inventory should be properly valued to exhibit a true and fair view. True profits cannot be calculated unless assets are properly valued. The measurement of inventory has a significant effect on income determination and financial position of a business enterprise.

Can you explain the answer of this question below:Physical Inventory system is also known as :

- A:

Perpetual Inventory System

- B:

Periodic Inventory System

- C:

Inventory Record System

- D:

None

The answer is b.

Physical Inventory system is also known as :

Perpetual Inventory System

Periodic Inventory System

Inventory Record System

None

|

Tanvi Pillai answered |

Periodic Inventory system

Periodic Inventory System is a method of inventory management where the inventory balance and cost of goods sold are determined at specific intervals of time, rather than continuously. The physical count of inventory is performed periodically, usually at the end of each accounting period.

Features of Periodic Inventory System:

1. Physical Count: Under the periodic inventory system, physical inventory counts are done periodically to determine the ending inventory balance.

2. Cost of Goods Sold: The cost of goods sold is calculated by subtracting the ending inventory balance from the cost of goods available for sale.

3. No Real-Time Inventory Information: Since inventory is only counted periodically, there is no real-time information available on inventory levels.

4. Lower Cost: Periodic inventory systems are generally less expensive to implement and maintain than perpetual inventory systems.

5. Suitable for Small Businesses: Small businesses with low inventory levels may find periodic inventory systems more suitable.

Advantages of Periodic Inventory System:

1. Lower Cost: The periodic inventory system is less expensive to implement and maintain than perpetual inventory systems.

2. Simplicity: The periodic inventory system is simple to use and is suitable for small businesses with low inventory levels.

3. Flexibility: The periodic inventory system is flexible and allows businesses to adjust the frequency of physical inventory counts to their needs.

Disadvantages of Periodic Inventory System:

1. No Real-Time Information: The periodic inventory system does not provide real-time information on inventory levels, which can lead to stockouts and overstocking.

2. Inaccurate Information: The periodic inventory system relies on physical inventory counts, which can be inaccurate due to human error or theft.

3. Time-Consuming: Physical inventory counts are time-consuming and can disrupt business operations.

Conclusion:

The periodic inventory system is a simple and flexible method of inventory management that is suitable for small businesses with low inventory levels. However, it does not provide real-time information on inventory levels and can be inaccurate due to physical inventory counts.

Periodic Inventory System is a method of inventory management where the inventory balance and cost of goods sold are determined at specific intervals of time, rather than continuously. The physical count of inventory is performed periodically, usually at the end of each accounting period.

Features of Periodic Inventory System:

1. Physical Count: Under the periodic inventory system, physical inventory counts are done periodically to determine the ending inventory balance.

2. Cost of Goods Sold: The cost of goods sold is calculated by subtracting the ending inventory balance from the cost of goods available for sale.

3. No Real-Time Inventory Information: Since inventory is only counted periodically, there is no real-time information available on inventory levels.

4. Lower Cost: Periodic inventory systems are generally less expensive to implement and maintain than perpetual inventory systems.

5. Suitable for Small Businesses: Small businesses with low inventory levels may find periodic inventory systems more suitable.

Advantages of Periodic Inventory System:

1. Lower Cost: The periodic inventory system is less expensive to implement and maintain than perpetual inventory systems.

2. Simplicity: The periodic inventory system is simple to use and is suitable for small businesses with low inventory levels.

3. Flexibility: The periodic inventory system is flexible and allows businesses to adjust the frequency of physical inventory counts to their needs.

Disadvantages of Periodic Inventory System:

1. No Real-Time Information: The periodic inventory system does not provide real-time information on inventory levels, which can lead to stockouts and overstocking.

2. Inaccurate Information: The periodic inventory system relies on physical inventory counts, which can be inaccurate due to human error or theft.

3. Time-Consuming: Physical inventory counts are time-consuming and can disrupt business operations.

Conclusion:

The periodic inventory system is a simple and flexible method of inventory management that is suitable for small businesses with low inventory levels. However, it does not provide real-time information on inventory levels and can be inaccurate due to physical inventory counts.

Under inflationary conditions, which of the methods will not show highest value of closing stock?- a)FIFO

- b)LIFO

- c)Weighted Average

- d)None of the above

Correct answer is option 'B,C'. Can you explain this answer?

Under inflationary conditions, which of the methods will not show highest value of closing stock?

a)

FIFO

b)

LIFO

c)

Weighted Average

d)

None of the above

|

|

Nandini Iyer answered |

Before chosing any of the stock valuation methods you have to see that there is inflation , deflation or balace situation in the marekt for materials, labors etc.if there is inflation,FIFO method will give you the highest stock value and then Average method.if there is deflation,

LIFO method will give you the highest stock value and the average menthod.if there is balance situation which is uncommon.then all the method will give same stock.

Bharat Indian oil is a bulk distributor of petrol . A periodic inventory of petrol on hand is taken when the book are closed at the end of each month. The following summary of information is available for the month:

Sales between 2nd and 29th June Rs.9,45,000

General administration cost Rs.25,000

Opening Stock :1,00,000 litres @ Rs.3 per litre Rs.3,00,000

Purchases (including freight inward):

June 1 2,00,000 litres @ Rs 2.85 per litre

June 30 1,00,000 litres @ 3.03 per litre

June 30 Closing stock 1,30,000 litres.

The profit or loss for June using LIFO method of inventory Method is- a)Rs 1,95,500

- b)Rs 165,000

- c)Rs 1,40,000

- d)Rs 1,95,000

Correct answer is option 'C'. Can you explain this answer?

Bharat Indian oil is a bulk distributor of petrol . A periodic inventory of petrol on hand is taken when the book are closed at the end of each month. The following summary of information is available for the month:

Sales between 2nd and 29th June Rs.9,45,000

General administration cost Rs.25,000

Opening Stock :1,00,000 litres @ Rs.3 per litre Rs.3,00,000

Purchases (including freight inward):

June 1 2,00,000 litres @ Rs 2.85 per litre

June 30 1,00,000 litres @ 3.03 per litre

June 30 Closing stock 1,30,000 litres.

The profit or loss for June using LIFO method of inventory Method is

Sales between 2nd and 29th June Rs.9,45,000

General administration cost Rs.25,000

Opening Stock :1,00,000 litres @ Rs.3 per litre Rs.3,00,000

Purchases (including freight inward):

June 1 2,00,000 litres @ Rs 2.85 per litre

June 30 1,00,000 litres @ 3.03 per litre

June 30 Closing stock 1,30,000 litres.

The profit or loss for June using LIFO method of inventory Method is

a)

Rs 1,95,500

b)

Rs 165,000

c)

Rs 1,40,000

d)

Rs 1,95,000

|

Arka Kaur answered |

Net Profit = Sales - Cost of goods sold - General admin cost

= 9,45,000 - 7,80,000(WN 1) - 25,000

= 1,40,000

Calculation of quantity of goods sold = Opening stock + purchases - Closing stock

= 1,00,000 + 3,00,000 - 1,30,000

= 2,70,000