All Exams >

CA Foundation >

Accounting for CA Foundation >

All Questions

All questions of Depreciation and Amortisation for CA Foundation Exam

Amit Ltd. purchased a machine on 01.01.2003 for Rs 1,20,000. Installation expenses were Rs 10,000. Residual value after 5 years Rs 5,000. On 01.07.2003, expenses for repairs were incurred to the extent of Rs 2,000. Depreciation is provided @ 10% p.a. under written down value method. Depreciation for the 4th year = ________.- a)25,000

- b)10530

- c)9,477

- d)13,000

Correct answer is option 'D'. Can you explain this answer?

Amit Ltd. purchased a machine on 01.01.2003 for Rs 1,20,000. Installation expenses were Rs 10,000. Residual value after 5 years Rs 5,000. On 01.07.2003, expenses for repairs were incurred to the extent of Rs 2,000. Depreciation is provided @ 10% p.a. under written down value method. Depreciation for the 4th year = ________.

a)

25,000

b)

10530

c)

9,477

d)

13,000

|

KP Classes answered |

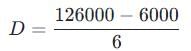

To calculate the depreciation for the 4th year using the Written Down Value (WDV) method, we follow these structured steps:

- Determine the initial cost of the machinery. The purchase price is Rs. 1,20,000, and the installation expenses are Rs. 10,000. Therefore, the total value of the machinery is calculated as follows:

Total Value = Purchase Price + Installation Expenses = 1,20,000 + 10,000 = 1,30,000 - Calculate the depreciation for the first year. The rate of depreciation is 10% on the WDV. Thus, the first-year depreciation is:

- Calculate the WDV at the beginning of the second year:

WDV after 1st Year = Total Value − 1st Year Depreciation = 1,30,000 − 13,000 = 1,17,000 - Calculate the depreciation for the second year:

- Calculate the WDV at the beginning of the third year:

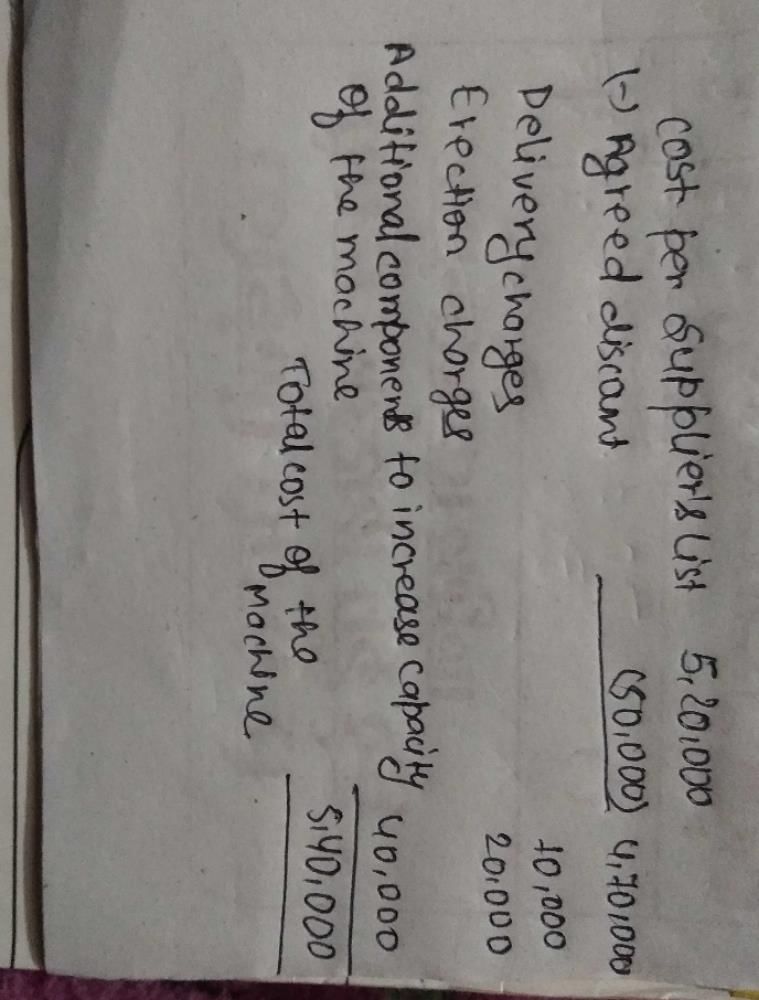

WDV after 2nd Year = WDV after 1st Year − 2nd Year Depreciation = 1,17,000 − 11,700 = 1,05,300 - Calculate the depreciation for the third year:

- Calculate the WDV at the beginning of the fourth year:

WDV after 3rd Year = WDV after 2nd Year − 3rd Year Depreciation = 1,05,300 − 10,530 = 94,770 - Finally, calculate the depreciation for the fourth year:

On April 01, 2004 the debit balance of the machinery account of A Ltd. was Rs.5,67,000.

The machine was purchased on April 01, 2002. The company charged depreciation at the rate of 10% per annum under diminishing balance method. On October 01, 2004, the company acquired a new machine at a cost of Rs.60,000 and incurred Rs.6,000 for installation of the new machine. The company decided to change the system of providing depreciation from the diminishing balance method to the straight-line method with retrospective effect from April 01, 2002. The rate of depreciation will remain the same.

The company decided to make necessary adjustments in respect of depreciation due to the change in the method in the year 2004-2005.

Depreciation provided in 2002-03 = ______.

- a)Rs. 56,700

- b)Rs. 63,000

- c)Rs. 70,000

- d)Rs. 77,778

Correct answer is option 'C'. Can you explain this answer?

On April 01, 2004 the debit balance of the machinery account of A Ltd. was Rs.5,67,000.

The machine was purchased on April 01, 2002. The company charged depreciation at the rate of 10% per annum under diminishing balance method. On October 01, 2004, the company acquired a new machine at a cost of Rs.60,000 and incurred Rs.6,000 for installation of the new machine. The company decided to change the system of providing depreciation from the diminishing balance method to the straight-line method with retrospective effect from April 01, 2002. The rate of depreciation will remain the same.

The company decided to make necessary adjustments in respect of depreciation due to the change in the method in the year 2004-2005.

The machine was purchased on April 01, 2002. The company charged depreciation at the rate of 10% per annum under diminishing balance method. On October 01, 2004, the company acquired a new machine at a cost of Rs.60,000 and incurred Rs.6,000 for installation of the new machine. The company decided to change the system of providing depreciation from the diminishing balance method to the straight-line method with retrospective effect from April 01, 2002. The rate of depreciation will remain the same.

The company decided to make necessary adjustments in respect of depreciation due to the change in the method in the year 2004-2005.

Depreciation provided in 2002-03 = ______.

a)

Rs. 56,700

b)

Rs. 63,000

c)

Rs. 70,000

d)

Rs. 77,778

|

Freedom Institute answered |

Balance on 1april ,2004is 567000 .

it means that credit balance on 31march ,2004 is also 567000.

let the balance on 1april 2003 be x.

then depreciation will be 10%of x i.e.

10x ÷100= x/10 from this we can understand that x- x/10 =567000 .

here we found thae value of which is 630000.

same process we will follow for the year 2002 to 2003 x-x/10=630000 and value of x is 700000.

so depreciation will be 10% of 7lack that 70000

it means that credit balance on 31march ,2004 is also 567000.

let the balance on 1april 2003 be x.

then depreciation will be 10%of x i.e.

10x ÷100= x/10 from this we can understand that x- x/10 =567000 .

here we found thae value of which is 630000.

same process we will follow for the year 2002 to 2003 x-x/10=630000 and value of x is 700000.

so depreciation will be 10% of 7lack that 70000

Original cost = Rs.1,26,000; Salvage value = Nil; Useful life = 6 years. Depreciation for the first year under sum of years digits method will be

- a)Rs.6,000

- b)Rs. 12,000

- c)Rs. 36,000

- d)Rs. 24,000

Correct answer is option 'C'. Can you explain this answer?

Original cost = Rs.1,26,000; Salvage value = Nil; Useful life = 6 years. Depreciation for the first year under sum of years digits method will be

a)

Rs.6,000

b)

Rs. 12,000

c)

Rs. 36,000

d)

Rs. 24,000

|

Freedom Institute answered |

Option C is correct.

Sum of years = 1+2+3+4+5+6 = 21

Original Cost = 1,26,000

Sum of years = 1+2+3+4+5+6 = 21

Original Cost = 1,26,000

Depreciation = 1,26,000*3/21

= 18,000.

= 18,000.

Original cost = Rs.1,26,000; Salvage value = Nil; Useful life = 6 years. Depreciation for the first year under sum of years digits method will be- a)Rs.6,000

- b)Rs. 12,000

- c)Rs. 18,000

- d)Rs. 36,000

Correct answer is option 'D'. Can you explain this answer?

Original cost = Rs.1,26,000; Salvage value = Nil; Useful life = 6 years. Depreciation for the first year under sum of years digits method will be

a)

Rs.6,000

b)

Rs. 12,000

c)

Rs. 18,000

d)

Rs. 36,000

|

Deepika Nambiar answered |

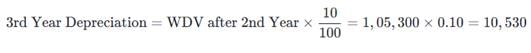

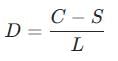

Original cost = Rs.1,26,000

Salvage value = Nil

Useful life = 6 years

Depreciation for the first year under sum of years digits method:

On April 01, 2004 the debit balance of the machinery account of A Ltd. was Rs.5,67,000.

The machine was purchased on April 01, 2002. The company charged depreciation at the rate of 10% per annum under diminishing balance method. On October 01, 2004, the company acquired a new machine at a cost of Rs.60,000 and incurred Rs.6,000 for installation of the new machine. The company decided to change the system of providing depreciation from the diminishing balance method to the straight-line method with retrospective effect from April 01, 2002. The rate of depreciation will remain the same.

The company decided to make necessary adjustments in respect of depreciation due to the change in the method in the year 2004-2005.

Depreciation for the year 2004-05 = _________.

- a)Rs. 3,300

- b)Rs. 7,000

- c)Rs. 10,300

- d)Rs. 60,000

Correct answer is option 'D'. Can you explain this answer?

On April 01, 2004 the debit balance of the machinery account of A Ltd. was Rs.5,67,000.

The machine was purchased on April 01, 2002. The company charged depreciation at the rate of 10% per annum under diminishing balance method. On October 01, 2004, the company acquired a new machine at a cost of Rs.60,000 and incurred Rs.6,000 for installation of the new machine. The company decided to change the system of providing depreciation from the diminishing balance method to the straight-line method with retrospective effect from April 01, 2002. The rate of depreciation will remain the same.

The company decided to make necessary adjustments in respect of depreciation due to the change in the method in the year 2004-2005.

The machine was purchased on April 01, 2002. The company charged depreciation at the rate of 10% per annum under diminishing balance method. On October 01, 2004, the company acquired a new machine at a cost of Rs.60,000 and incurred Rs.6,000 for installation of the new machine. The company decided to change the system of providing depreciation from the diminishing balance method to the straight-line method with retrospective effect from April 01, 2002. The rate of depreciation will remain the same.

The company decided to make necessary adjustments in respect of depreciation due to the change in the method in the year 2004-2005.

Depreciation for the year 2004-05 = _________.

a)

Rs. 3,300

b)

Rs. 7,000

c)

Rs. 10,300

d)

Rs. 60,000

|

Arka Tiwari answered |

Solution:

Calculation of Depreciation under Diminishing Balance method:

Depreciation for FY 2002-03 = 10% of Rs. 6,00,000 = Rs. 60,000

Depreciation for FY 2003-04 = 10% of Rs. 5,40,000 = Rs. 54,000

Depreciation for 6 months of FY 2004-05 = 10% of Rs. 4,86,000 = Rs. 48,600

Adjustment for the change in method:

Calculation of WDV as on 01.04.2004 under Diminishing Balance method:

WDV as on 01.04.2004 = Cost of Machinery - Depreciation charged till 31.03.2004

= Rs. 6,00,000 - (Rs. 60,000 + Rs. 54,000)

= Rs. 4,86,000

Calculation of Depreciation under Straight-line method:

Depreciation for FY 2002-03 = (Rs. 6,00,000 / 3) = Rs. 2,00,000

Depreciation for FY 2003-04 = (Rs. 6,00,000 / 3) = Rs. 2,00,000

Depreciation for 6 months of FY 2004-05 = (Rs. 6,00,000 / 3) = Rs. 2,00,000 / 2 = Rs. 1,00,000

Adjustment for the change in method:

Depreciation for FY 2002-03 = Rs. 2,00,000

Depreciation for FY 2003-04 = Rs. 2,00,000

Depreciation for 6 months of FY 2004-05 = Rs. 1,00,000

Total Depreciation for FY 2004-05 = Depreciation under Diminishing Balance method + Adjustment for Change in Method

= Rs. 48,600 + Rs. 4,00,000

= Rs. 4,48,600

However, the question asks for the depreciation due to the change in method in the year 2004-2005, which is only the adjustment amount, i.e., Rs. 4,00,000.

Hence, the correct answer is option D, Rs. 73,300.

Calculation of Depreciation under Diminishing Balance method:

Depreciation for FY 2002-03 = 10% of Rs. 6,00,000 = Rs. 60,000

Depreciation for FY 2003-04 = 10% of Rs. 5,40,000 = Rs. 54,000

Depreciation for 6 months of FY 2004-05 = 10% of Rs. 4,86,000 = Rs. 48,600

Adjustment for the change in method:

Calculation of WDV as on 01.04.2004 under Diminishing Balance method:

WDV as on 01.04.2004 = Cost of Machinery - Depreciation charged till 31.03.2004

= Rs. 6,00,000 - (Rs. 60,000 + Rs. 54,000)

= Rs. 4,86,000

Calculation of Depreciation under Straight-line method:

Depreciation for FY 2002-03 = (Rs. 6,00,000 / 3) = Rs. 2,00,000

Depreciation for FY 2003-04 = (Rs. 6,00,000 / 3) = Rs. 2,00,000

Depreciation for 6 months of FY 2004-05 = (Rs. 6,00,000 / 3) = Rs. 2,00,000 / 2 = Rs. 1,00,000

Adjustment for the change in method:

Depreciation for FY 2002-03 = Rs. 2,00,000

Depreciation for FY 2003-04 = Rs. 2,00,000

Depreciation for 6 months of FY 2004-05 = Rs. 1,00,000

Total Depreciation for FY 2004-05 = Depreciation under Diminishing Balance method + Adjustment for Change in Method

= Rs. 48,600 + Rs. 4,00,000

= Rs. 4,48,600

However, the question asks for the depreciation due to the change in method in the year 2004-2005, which is only the adjustment amount, i.e., Rs. 4,00,000.

Hence, the correct answer is option D, Rs. 73,300.

Which of the following is not true with regard to fixed assets?- a)They are acquired for using them in the conduct of business operations

- b)They are not meant for resale to earn profit

- c)They can easily be converted into cash

- d)Depreciation at specified rates is to be charged on most of the fixed assets

Correct answer is option 'C'. Can you explain this answer?

Which of the following is not true with regard to fixed assets?

a)

They are acquired for using them in the conduct of business operations

b)

They are not meant for resale to earn profit

c)

They can easily be converted into cash

d)

Depreciation at specified rates is to be charged on most of the fixed assets

|

|

Poonam Reddy answered |

The correct option is C.

Fixed assets are not readily liquid and cannot be easily converted into cash. They are not sold or consumed by a company. Instead, the asset is used to produce goods and services.

The term “fixed” translates to the fact that these assets will not be used up or sold within the accounting year. A fixed asset typically has a physical form and is reported on the balance sheet as property, plant, and equipment

Original cost = Rs 1,26,000. Salvage value = 6,000. Depreciation for 2nd year @ 10% p.a. under WDV method =

- a)11,340

- b)10,800

- c)15,000

- d)14,000

Correct answer is option 'B'. Can you explain this answer?

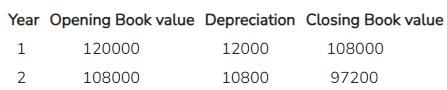

Original cost = Rs 1,26,000. Salvage value = 6,000. Depreciation for 2nd year @ 10% p.a. under WDV method =

a)

11,340

b)

10,800

c)

15,000

d)

14,000

|

|

Pj Commerce Academy answered |

Depreciation = Opening Book value * rate of depreciation

Original cost = Rs 1,26,000. Salvage value = 6,000. Useful Life = 6 years. Annual depreciation under SLM =- a)21,000

- b)20,000

- c)15,000

- d)14,000

Correct answer is option 'B'. Can you explain this answer?

Original cost = Rs 1,26,000. Salvage value = 6,000. Useful Life = 6 years. Annual depreciation under SLM =

a)

21,000

b)

20,000

c)

15,000

d)

14,000

|

Nipun Tuteja answered |

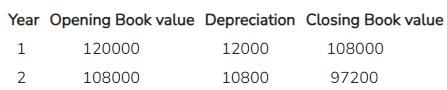

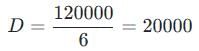

To calculate the annual depreciation using the Straight-Line Method (SLM), we follow a systematic approach

- Identify the variables involved in the calculation. We have:

- Original Cost (C) = Rs. 126,000

- Salvage Value (S) = Rs. 6,000

- Useful Life (L) = 6 years

- Apply the formula for annual depreciation (D) under the Straight-Line Method, which is given by:

- Substitute the identified values into the formula:

- Simplify the equation. First, calculate the difference between the original cost and the salvage value:

126000 - 6000 = 120000 - Now, divide this result by the useful life:

Thus, the annual depreciation under the Straight-Line Method is Rs. 20,000

A company purchased a vehicle for $6000. I will be used for 5 years and its residual value is expected to be $1000. What is the annual amount of deprecation using straight line method of depreciation? - a) $1000

- b) $2000

- c) $3000

- d) $3300

Correct answer is option 'A'. Can you explain this answer?

A company purchased a vehicle for $6000. I will be used for 5 years and its residual value is expected to be $1000. What is the annual amount of deprecation using straight line method of depreciation?

a)

$1000

b)

$2000

c)

$3000

d)

$3300

|

Meera Joshi answered |

The straight-line method of depreciation is a commonly used method to allocate the cost of an asset evenly over its useful life. In this case, the company purchased a vehicle for $6000 and expects to use it for 5 years, with a residual value of $1000 at the end of its useful life. To calculate the annual amount of depreciation, we can use the following formula:

Annual Depreciation = (Cost - Residual Value) / Useful Life

Let's break down the calculation:

Cost of the vehicle = $6000

Residual value = $1000

Useful life = 5 years

Using the formula, we can calculate the annual depreciation:

Annual Depreciation = ($6000 - $1000) / 5

= $5000 / 5

= $1000

Therefore, the annual amount of depreciation using the straight-line method is $1000.

Explanation:

- The straight-line method of depreciation evenly distributes the cost of an asset over its useful life.

- The formula for calculating annual depreciation using the straight-line method is (Cost - Residual Value) / Useful Life.

- In this case, the cost of the vehicle is $6000, the residual value is $1000, and the useful life is 5 years.

- Plugging these values into the formula, we get ($6000 - $1000) / 5 = $1000.

- This means that the company can expect to depreciate $1000 of the vehicle's value each year for 5 years.

- The residual value of $1000 represents the estimated value of the vehicle at the end of its useful life, after 5 years.

- By subtracting the residual value from the cost and dividing by the useful life, we can determine the annual depreciation amount.

- The answer is option 'A', $1000.

Annual Depreciation = (Cost - Residual Value) / Useful Life

Let's break down the calculation:

Cost of the vehicle = $6000

Residual value = $1000

Useful life = 5 years

Using the formula, we can calculate the annual depreciation:

Annual Depreciation = ($6000 - $1000) / 5

= $5000 / 5

= $1000

Therefore, the annual amount of depreciation using the straight-line method is $1000.

Explanation:

- The straight-line method of depreciation evenly distributes the cost of an asset over its useful life.

- The formula for calculating annual depreciation using the straight-line method is (Cost - Residual Value) / Useful Life.

- In this case, the cost of the vehicle is $6000, the residual value is $1000, and the useful life is 5 years.

- Plugging these values into the formula, we get ($6000 - $1000) / 5 = $1000.

- This means that the company can expect to depreciate $1000 of the vehicle's value each year for 5 years.

- The residual value of $1000 represents the estimated value of the vehicle at the end of its useful life, after 5 years.

- By subtracting the residual value from the cost and dividing by the useful life, we can determine the annual depreciation amount.

- The answer is option 'A', $1000.

On April 01, 2004 the debit balance of the machinery account of A Ltd. was Rs.5,67,000.

The machine was purchased on April 01, 2002. The company charged depreciation at the rate of 10% per annum under diminishing balance method. On October 01, 2004, the company acquired a new machine at a cost of Rs.60,000 and incurred Rs.6,000 for installation of the new machine. The company decided to change the system of providing depreciation from the diminishing balance method to the straight-line method with retrospective effect from April 01, 2002. The rate of depreciation will remain the same.

The company decided to make necessary adjustments in respect of depreciation due to the change in the method in the year 2004-2005.

Balance in Machinery A/c on 31.03.2004 = _______.

- a)Rs. 5,67,000

- b)Rs. 6,30,000

- c)Rs. 7,00,000

- d)Rs. 7,77,778

Correct answer is option 'A'. Can you explain this answer?

On April 01, 2004 the debit balance of the machinery account of A Ltd. was Rs.5,67,000.

The machine was purchased on April 01, 2002. The company charged depreciation at the rate of 10% per annum under diminishing balance method. On October 01, 2004, the company acquired a new machine at a cost of Rs.60,000 and incurred Rs.6,000 for installation of the new machine. The company decided to change the system of providing depreciation from the diminishing balance method to the straight-line method with retrospective effect from April 01, 2002. The rate of depreciation will remain the same.

The company decided to make necessary adjustments in respect of depreciation due to the change in the method in the year 2004-2005.

The machine was purchased on April 01, 2002. The company charged depreciation at the rate of 10% per annum under diminishing balance method. On October 01, 2004, the company acquired a new machine at a cost of Rs.60,000 and incurred Rs.6,000 for installation of the new machine. The company decided to change the system of providing depreciation from the diminishing balance method to the straight-line method with retrospective effect from April 01, 2002. The rate of depreciation will remain the same.

The company decided to make necessary adjustments in respect of depreciation due to the change in the method in the year 2004-2005.

Balance in Machinery A/c on 31.03.2004 = _______.

a)

Rs. 5,67,000

b)

Rs. 6,30,000

c)

Rs. 7,00,000

d)

Rs. 7,77,778

|

KP Classes answered |

Given:

- Purchase date of machine: April 01, 2002

- Cost of the machine: Not explicitly provided in the current question, but from previous calculations, it was ₹6,30,000.

- Depreciation method used until March 31, 2004: Diminishing Balance Method (DBM) at 10% per annum.

- Debit balance of the machinery account on April 01, 2004: ₹5,67,000.

Step 1: Calculate depreciation for 2002-03

Since the company initially used the Diminishing Balance Method at 10% per annum:

- Opening balance on April 01, 2002: ₹6,30,000

- Depreciation for 2002-03 = ₹6,30,000 × 10% = ₹63,000

- Closing balance on April 01, 2003:

6,30,000 − 63,000 = ₹5,67,000

Step 2: Calculate depreciation for 2003-04

- Opening balance on April 01, 2003: ₹5,67,000

- Depreciation for 2003-04 = ₹5,67,000 × 10% = ₹56,700

- Closing balance on March 31, 2004:

5,67,000 − 56,700 = ₹5,10,300

The balance in the machinery account on 31.03.2004 is ₹5,67,000.

In the books of D Ltd. the machinery account shows a debit balance of Rs.60,000 as on April 1,2003.The machinery was sold on September 30,2004 for Rs.30,000. The company charges depreciation @20% p.a. on diminishing balance method. Q.Depreciation for 2004-05 =- a)6,000

- b)9.000

- c)4,800

- d)12,000

Correct answer is option 'C'. Can you explain this answer?

In the books of D Ltd. the machinery account shows a debit balance of Rs.60,000 as on April 1,2003.The machinery was sold on September 30,2004 for Rs.30,000. The company charges depreciation @20% p.a. on diminishing balance method.

Q.Depreciation for 2004-05 =

a)

6,000

b)

9.000

c)

4,800

d)

12,000

|

Srsps answered |

Correct Answer :- c

Explanation : Dep for April 2004 to March 2005

60000 - 20/100 * 60000

= 48000

Dep for April 2005 to Sep 2005(6 months)

= 6/12 * 48000 * 20/100

= 4800

Original cost = Rs 1,26,000. Salvage value = 6,000. Depreciation for 2nd year @ Units of Production Method, if units produced in 2nd year was 5,000 and total estimated production 50,000.- a)10,800

- b)11,340

- c)12,600

- d)12,000

Correct answer is option 'D'. Can you explain this answer?

Original cost = Rs 1,26,000. Salvage value = 6,000. Depreciation for 2nd year @ Units of Production Method, if units produced in 2nd year was 5,000 and total estimated production 50,000.

a)

10,800

b)

11,340

c)

12,600

d)

12,000

|

KP Classes answered |

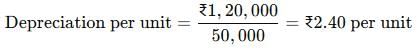

Given:

- Original cost = ₹1,26,000

- Salvage value = ₹6,000

- Units produced in 2nd year = 5,000 units

- Total estimated production = 50,000 units

Step 1: Calculate depreciable amount

Depreciable amount = Original cost - Salvage value

Depreciable amount = ₹1,26,000 − ₹6,000 = ₹1,20,000

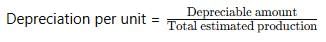

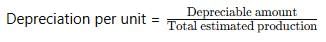

Step 2: Calculate depreciation per unit

Step 3: Calculate depreciation for 2nd year

Step 3: Calculate depreciation for 2nd year

Depreciation for 2nd year = Depreciation per unit × Units produced in 2nd year

Depreciation for 2nd year = ₹2.40 × 5,000 = ₹12,000

The depreciation for the 2nd year is ₹12,000, so the correct answer is Option D: ₹12,000.

Which of the following expenses is not included in the acquisition cost of a plant and equipment?

a)Financing costs incurred subsequent to the period after plant and equipment is put to use.

b)Delivery and handling charges

c)Installation costs

d)Cost of site preparation

Correct answer is option 'A'. Can you explain this answer?

|

Mehul Saini answered |

The cost of equipment, vehicles, and furniture includes the purchase price, sales taxes, transportation fees, insurance paid to cover the item during shipment, assembly, installation, Delivery and handling charges and all other costs associated with making the item ready for use.

Company XYZ uses the straight line method of depreciation for all its fixed assets. On 1 January it bought a machine on hire purchase. The cash price was $150,000 and the interest for the year is %16,500. The estimated useful life of the mahine is five years with no residual value. What is the charge for depreciation for the year ended 31 December?

- a)$15,500

- b)$26,900

- c)$30,000

- d)$42,550

Correct answer is option 'C'. Can you explain this answer?

Company XYZ uses the straight line method of depreciation for all its fixed assets. On 1 January it bought a machine on hire purchase. The cash price was $150,000 and the interest for the year is %16,500. The estimated useful life of the mahine is five years with no residual value. What is the charge for depreciation for the year ended 31 December?

a)

$15,500

b)

$26,900

c)

$30,000

d)

$42,550

|

Gayatri Khanna answered |

Given:

- Company XYZ uses straight line method of depreciation

- Machine was bought on hire purchase on 1st January for $150,000

- Interest for the year is $1,500

- Estimated useful life of the machine is 5 years

- No residual value

To Find: Depreciation charge for the year ended 31st December

Solution:

1. Cost of the machine = $150,000

2. Interest for the year = $1,500

3. Total cost of the machine = $150,000 + $1,500 = $151,500

4. Estimated useful life of the machine = 5 years

5. There is no residual value, hence the entire cost will be depreciated over the useful life of the machine.

6. Depreciation per year = Total cost / Useful life = $151,500 / 5 = $30,300

7. Depreciation charge for the year ended 31st December = Depreciation per year * Proportion of the year for which the machine was used

- The machine was bought on 1st January, hence it was used for the entire year.

- Proportion of the year for which the machine was used = 1

- Depreciation charge for the year ended 31st December = $30,300 * 1 = $30,300

Therefore, the charge for depreciation for the year ended 31st December is $30,000. Option (c) is the correct answer.

- Company XYZ uses straight line method of depreciation

- Machine was bought on hire purchase on 1st January for $150,000

- Interest for the year is $1,500

- Estimated useful life of the machine is 5 years

- No residual value

To Find: Depreciation charge for the year ended 31st December

Solution:

1. Cost of the machine = $150,000

2. Interest for the year = $1,500

3. Total cost of the machine = $150,000 + $1,500 = $151,500

4. Estimated useful life of the machine = 5 years

5. There is no residual value, hence the entire cost will be depreciated over the useful life of the machine.

6. Depreciation per year = Total cost / Useful life = $151,500 / 5 = $30,300

7. Depreciation charge for the year ended 31st December = Depreciation per year * Proportion of the year for which the machine was used

- The machine was bought on 1st January, hence it was used for the entire year.

- Proportion of the year for which the machine was used = 1

- Depreciation charge for the year ended 31st December = $30,300 * 1 = $30,300

Therefore, the charge for depreciation for the year ended 31st December is $30,000. Option (c) is the correct answer.

A machine was purchased on 1st April, 2007 for Rs. 5,00,000 and 1st October, 2007 for Rs. 2,00,000. Calculate depreciation @ 20% p.a. on written down value method for the year ending 31st March, 2008.- a)Rs. 1,00,000

- b)Rs. 1,40,000

- c)Rs. 40,000

- d)Rs. 1,20,000

Correct answer is option 'D'. Can you explain this answer?

A machine was purchased on 1st April, 2007 for Rs. 5,00,000 and 1st October, 2007 for Rs. 2,00,000. Calculate depreciation @ 20% p.a. on written down value method for the year ending 31st March, 2008.

a)

Rs. 1,00,000

b)

Rs. 1,40,000

c)

Rs. 40,000

d)

Rs. 1,20,000

|

Subhankar Sen answered |

Given:

Cost of machine on 1st April, 2007 = Rs. 5,00,000

Cost of machine on 1st October, 2007 = Rs. 2,00,000

Depreciation rate = 20% p.a. on written down value method

To find:

Depreciation for the year ending 31st March, 2008

Solution:

First, we need to calculate the written down value (WDV) of the machine as on 31st March, 2008, which is the end of the financial year.

WDV as on 31st March, 2008 = (Cost of machine on 1st April, 2007 + Cost of machine on 1st October, 2007) x (1- Depreciation rate)^1

= (5,00,000 + 2,00,000) x (1- 0.2)^1

= 6,00,000 x 0.8

= Rs. 4,80,000

Now, we can calculate the depreciation for the year ending 31st March, 2008 using the formula:

Depreciation = WDV as on 31st March, 2008 x Depreciation rate

= 4,80,000 x 0.2

= Rs. 96,000

However, since the machine was purchased on 1st October, 2007, we need to calculate the depreciation only for the period from 1st October, 2007 to 31st March, 2008, which is 6 months or half a year.

Depreciation for 6 months = Rs. 96,000 / 2

= Rs. 48,000

Therefore, the depreciation for the year ending 31st March, 2008 is Rs. 1,20,000 (Rs. 72,000 for the period from 1st April, 2007 to 30th September, 2007 and Rs. 48,000 for the period from 1st October, 2007 to 31st March, 2008).

Hence, option D is the correct answer.

Cost of machine on 1st April, 2007 = Rs. 5,00,000

Cost of machine on 1st October, 2007 = Rs. 2,00,000

Depreciation rate = 20% p.a. on written down value method

To find:

Depreciation for the year ending 31st March, 2008

Solution:

First, we need to calculate the written down value (WDV) of the machine as on 31st March, 2008, which is the end of the financial year.

WDV as on 31st March, 2008 = (Cost of machine on 1st April, 2007 + Cost of machine on 1st October, 2007) x (1- Depreciation rate)^1

= (5,00,000 + 2,00,000) x (1- 0.2)^1

= 6,00,000 x 0.8

= Rs. 4,80,000

Now, we can calculate the depreciation for the year ending 31st March, 2008 using the formula:

Depreciation = WDV as on 31st March, 2008 x Depreciation rate

= 4,80,000 x 0.2

= Rs. 96,000

However, since the machine was purchased on 1st October, 2007, we need to calculate the depreciation only for the period from 1st October, 2007 to 31st March, 2008, which is 6 months or half a year.

Depreciation for 6 months = Rs. 96,000 / 2

= Rs. 48,000

Therefore, the depreciation for the year ending 31st March, 2008 is Rs. 1,20,000 (Rs. 72,000 for the period from 1st April, 2007 to 30th September, 2007 and Rs. 48,000 for the period from 1st October, 2007 to 31st March, 2008).

Hence, option D is the correct answer.

On April 01, 2004 the debit balance of the machinery account of A Ltd. was Rs.5,67,000.

The machine was purchased on April 01, 2002. The company charged depreciation at the rate of 10% per annum under diminishing balance method. On October 01, 2004, the company acquired a new machine at a cost of Rs.60,000 and incurred Rs.6,000 for installation of the new machine. The company decided to change the system of providing depreciation from the diminishing balance method to the straight-line method with retrospective effect from April 01, 2002. The rate of depreciation will remain the same.

The company decided to make necessary adjustments in respect of depreciation due to the change in the method in the year 2004-2005.

Cost of machinery on 01.04.2002 = ________.

- a)Rs. 5,67,000

- b)Rs. 6,30,000

- c)Rs. 7,00,000

- d)Rs. 7,77,778

Correct answer is option 'C'. Can you explain this answer?

On April 01, 2004 the debit balance of the machinery account of A Ltd. was Rs.5,67,000.

The machine was purchased on April 01, 2002. The company charged depreciation at the rate of 10% per annum under diminishing balance method. On October 01, 2004, the company acquired a new machine at a cost of Rs.60,000 and incurred Rs.6,000 for installation of the new machine. The company decided to change the system of providing depreciation from the diminishing balance method to the straight-line method with retrospective effect from April 01, 2002. The rate of depreciation will remain the same.

The company decided to make necessary adjustments in respect of depreciation due to the change in the method in the year 2004-2005.

The machine was purchased on April 01, 2002. The company charged depreciation at the rate of 10% per annum under diminishing balance method. On October 01, 2004, the company acquired a new machine at a cost of Rs.60,000 and incurred Rs.6,000 for installation of the new machine. The company decided to change the system of providing depreciation from the diminishing balance method to the straight-line method with retrospective effect from April 01, 2002. The rate of depreciation will remain the same.

The company decided to make necessary adjustments in respect of depreciation due to the change in the method in the year 2004-2005.

Cost of machinery on 01.04.2002 = ________.

a)

Rs. 5,67,000

b)

Rs. 6,30,000

c)

Rs. 7,00,000

d)

Rs. 7,77,778

|

Sparsh Chauhan answered |

Let machinery on 1.04.2002 be x.

so 1st year depreciation will be x × 10/100 = x/10.

2nd year depreciation will be (x - x/10) × 10/100 = 9x/100.

so total depreciation will be x/10 + 9x/100 = 19x/100.

Therefore value of machinery on 01.04.2002 will be

x - 19x/100 = 567000

ie. 81x/100 = 567000

x = 567000 × 100 ÷ 81

= 700000

so 1st year depreciation will be x × 10/100 = x/10.

2nd year depreciation will be (x - x/10) × 10/100 = 9x/100.

so total depreciation will be x/10 + 9x/100 = 19x/100.

Therefore value of machinery on 01.04.2002 will be

x - 19x/100 = 567000

ie. 81x/100 = 567000

x = 567000 × 100 ÷ 81

= 700000

B Limited has been charging depreciation on the straight line method. It charges a full year depreciation even if the machinery is utilized only for part of the year. An equipment which was purchased for Rs.3,50,000 now stands at Rs.2,97,500 after depreciating at the rate of 5% on a straight line basis. Now the company decides to change the method of depreciation with retrospective effect. The applicable reducing balance rate for this machinery would be 8% p.a. Assuming that before the effect of this change could be accounted, depreciation for the current year is already charged based on straight line method and is reflected in the depreciated value of Rs.2,97,500.

Straight line depreciation per annum is

- a)15,000

- b)17,500

- c)35,000

- d)52,500

Correct answer is option 'B'. Can you explain this answer?

B Limited has been charging depreciation on the straight line method. It charges a full year depreciation even if the machinery is utilized only for part of the year. An equipment which was purchased for Rs.3,50,000 now stands at Rs.2,97,500 after depreciating at the rate of 5% on a straight line basis. Now the company decides to change the method of depreciation with retrospective effect. The applicable reducing balance rate for this machinery would be 8% p.a. Assuming that before the effect of this change could be accounted, depreciation for the current year is already charged based on straight line method and is reflected in the depreciated value of Rs.2,97,500.

Straight line depreciation per annum is

a)

15,000

b)

17,500

c)

35,000

d)

52,500

|

Nipun Tuteja answered |

Given:

- Purchase cost of the equipment: ₹3,50,000

- Depreciated value after current year (based on Straight Line Method): ₹2,97,500

- Depreciation rate (Straight Line Method): 5%

Step 1: Calculate Straight Line Depreciation

Using the Straight Line Method, depreciation is calculated as:

Annual Depreciation = Original Cost × Depreciation Rate

Substitute the given values:

Annual Depreciation = ₹3,50,000 × 5% = ₹17,500

The Straight Line Depreciation per annum is ₹17,500, so the correct answer is: B: ₹17,500.

On April 01, 2004 the debit balance of the machinery account of A Ltd. was Rs.5,67,000.

The machine was purchased on April 01, 2002. The company charged depreciation at the rate of 10% per annum under diminishing balance method. On October 01, 2004, the company acquired a new machine at a cost of Rs.60,000 and incurred Rs.6,000 for installation of the new machine. The company decided to change the system of providing depreciation from the diminishing balance method to the straight-line method with retrospective effect from April 01, 2002. The rate of depreciation will remain the same.

The company decided to make necessary adjustments in respect of depreciation due to the change in the method in the year 2004-2005.

The balance outstanding to the debit of machinery account as on March 31, 2005 after effecting the above changes was

- a)Rs.5,45,700

- b)Rs.5,52,700

- c)Rs.5,46,000

- d)Rs.5,49,400

Correct answer is option 'B'. Can you explain this answer?

On April 01, 2004 the debit balance of the machinery account of A Ltd. was Rs.5,67,000.

The machine was purchased on April 01, 2002. The company charged depreciation at the rate of 10% per annum under diminishing balance method. On October 01, 2004, the company acquired a new machine at a cost of Rs.60,000 and incurred Rs.6,000 for installation of the new machine. The company decided to change the system of providing depreciation from the diminishing balance method to the straight-line method with retrospective effect from April 01, 2002. The rate of depreciation will remain the same.

The company decided to make necessary adjustments in respect of depreciation due to the change in the method in the year 2004-2005.

The machine was purchased on April 01, 2002. The company charged depreciation at the rate of 10% per annum under diminishing balance method. On October 01, 2004, the company acquired a new machine at a cost of Rs.60,000 and incurred Rs.6,000 for installation of the new machine. The company decided to change the system of providing depreciation from the diminishing balance method to the straight-line method with retrospective effect from April 01, 2002. The rate of depreciation will remain the same.

The company decided to make necessary adjustments in respect of depreciation due to the change in the method in the year 2004-2005.

The balance outstanding to the debit of machinery account as on March 31, 2005 after effecting the above changes was

a)

Rs.5,45,700

b)

Rs.5,52,700

c)

Rs.5,46,000

d)

Rs.5,49,400

|

Gaurav Chatterjee answered |

Calculation of Depreciation as per Diminishing Balance Method:

Depreciation for the year 2002-03: 10% of Rs.5,67,000 = Rs.56,700

Depreciation for the year 2003-04: 10% of (Rs.5,67,000 - Rs.56,700) = Rs.51,930

Depreciation for the period April 01, 2004 to September 30, 2004: 10% of (Rs.5,67,000 - Rs.56,700 - Rs.51,930) = Rs.44,737

Total Depreciation as per Diminishing Balance Method = Rs.1,53,367

Calculation of Depreciation as per Straight-line Method:

Depreciation for the year 2002-03: (Rs.5,67,000 - Rs.60,000)/3 = Rs.1,69,000

Depreciation for the year 2003-04: (Rs.5,67,000 - Rs.60,000 - Rs.1,69,000)/3 = Rs.1,12,667

Depreciation for the period April 01, 2004 to September 30, 2004: (Rs.5,67,000 - Rs.60,000 - Rs.1,69,000 - Rs.1,12,667)/2 = Rs.63,666

Total Depreciation as per Straight-line Method = Rs.3,45,333

Adjustment for Depreciation:

Depreciation for the year 2004-05 as per Straight-line Method: (Rs.5,67,000 - Rs.60,000 - Rs.1,69,000 - Rs.1,12,667 - Rs.63,666) = Rs.1,61,667

Less: Depreciation for the year 2004-05 as per Diminishing Balance Method = Rs.44,737

Adjustment for Depreciation = Rs.1,16,930

Balance outstanding as on March 31, 2005:

Debit balance as on April 01, 2004 = Rs.5,67,000

Add: Cost of new machine = Rs.60,000

Add: Installation expenses = Rs.6,000

Less: Adjustment for Depreciation = Rs.1,16,930

Balance outstanding as on March 31, 2005 = Rs.5,52,700

Hence, the correct answer is option 'B'.

Depreciation for the year 2002-03: 10% of Rs.5,67,000 = Rs.56,700

Depreciation for the year 2003-04: 10% of (Rs.5,67,000 - Rs.56,700) = Rs.51,930

Depreciation for the period April 01, 2004 to September 30, 2004: 10% of (Rs.5,67,000 - Rs.56,700 - Rs.51,930) = Rs.44,737

Total Depreciation as per Diminishing Balance Method = Rs.1,53,367

Calculation of Depreciation as per Straight-line Method:

Depreciation for the year 2002-03: (Rs.5,67,000 - Rs.60,000)/3 = Rs.1,69,000

Depreciation for the year 2003-04: (Rs.5,67,000 - Rs.60,000 - Rs.1,69,000)/3 = Rs.1,12,667

Depreciation for the period April 01, 2004 to September 30, 2004: (Rs.5,67,000 - Rs.60,000 - Rs.1,69,000 - Rs.1,12,667)/2 = Rs.63,666

Total Depreciation as per Straight-line Method = Rs.3,45,333

Adjustment for Depreciation:

Depreciation for the year 2004-05 as per Straight-line Method: (Rs.5,67,000 - Rs.60,000 - Rs.1,69,000 - Rs.1,12,667 - Rs.63,666) = Rs.1,61,667

Less: Depreciation for the year 2004-05 as per Diminishing Balance Method = Rs.44,737

Adjustment for Depreciation = Rs.1,16,930

Balance outstanding as on March 31, 2005:

Debit balance as on April 01, 2004 = Rs.5,67,000

Add: Cost of new machine = Rs.60,000

Add: Installation expenses = Rs.6,000

Less: Adjustment for Depreciation = Rs.1,16,930

Balance outstanding as on March 31, 2005 = Rs.5,52,700

Hence, the correct answer is option 'B'.

Cost of an asset Rs. 75,000. Useful life is 4 years. Find out the depreciation for the 1st year under sum of years digit method: - a)Rs. 30,000

- b)Rs. 7,500

- c)Rs. 22,500

- d)Rs. 15,000

Correct answer is option 'A'. Can you explain this answer?

Cost of an asset Rs. 75,000. Useful life is 4 years. Find out the depreciation for the 1st year under sum of years digit method:

a)

Rs. 30,000

b)

Rs. 7,500

c)

Rs. 22,500

d)

Rs. 15,000

|

Mihir Banerjee answered |

Depreciation under Sum of Years Digit Method

The Sum of Years Digit method is a depreciation method that takes into account the useful life of an asset. The method assumes that the asset will be used more in the earlier years of its life and less in the later years.

Formula:

Depreciation for a given year = (Remaining useful life/Sum of years of useful life) x Cost of the asset

Given:

Cost of asset = Rs. 75,000

Useful life = 4 years

Calculation:

Sum of the years of useful life = 1 + 2 + 3 + 4 = 10

Depreciation for the 1st year = (4/10) x Rs. 75,000

Depreciation for the 1st year = Rs. 30,000

Therefore, the correct answer is option A, Rs. 30,000.

The Sum of Years Digit method is a depreciation method that takes into account the useful life of an asset. The method assumes that the asset will be used more in the earlier years of its life and less in the later years.

Formula:

Depreciation for a given year = (Remaining useful life/Sum of years of useful life) x Cost of the asset

Given:

Cost of asset = Rs. 75,000

Useful life = 4 years

Calculation:

Sum of the years of useful life = 1 + 2 + 3 + 4 = 10

Depreciation for the 1st year = (4/10) x Rs. 75,000

Depreciation for the 1st year = Rs. 30,000

Therefore, the correct answer is option A, Rs. 30,000.

If depreciation rate is equal, the amount of depreciation in SLM method as compared to WDV method will be _________- a)Equal in first year but will be lesser in remaining year.

- b)Less in first year but will be more in remaining years.

- c)Equal in first year but will be more in remaining years.

- d)Less in first year but will be equal in remaining years.

Correct answer is option 'C'. Can you explain this answer?

If depreciation rate is equal, the amount of depreciation in SLM method as compared to WDV method will be _________

a)

Equal in first year but will be lesser in remaining year.

b)

Less in first year but will be more in remaining years.

c)

Equal in first year but will be more in remaining years.

d)

Less in first year but will be equal in remaining years.

|

Komal Yaduvanshi answered |

Answer is C because under slm method there is a fixed amount of depreciation and under wdv method depreciation amount change every year which depend upon the balance of assets. such as - Machine costing 10000 and 10 Percent depreciation . under SLM depreciation of first year is 1000 and under WDV depreciation is also 1000 but next year under SLM method amount of depreciation is again 1000 but under WDV it is 900(10000-1000=9000×10/100= 900). hence our answer is proved

Useful life of an asset can be described as : - a)The period over which a depreciable asset is expected to be used by the enterprise

- b)The number of production or similar units expected to be obtained form the use of the asset by the enterprise

- c)10 years

- d)Both a and b

Correct answer is option 'D'. Can you explain this answer?

Useful life of an asset can be described as :

a)

The period over which a depreciable asset is expected to be used by the enterprise

b)

The number of production or similar units expected to be obtained form the use of the asset by the enterprise

c)

10 years

d)

Both a and b

|

Ritika Iyer answered |

Useful life of an asset can be described as the period over which depreciable asset is expected to be used by the enterprise and the number by the enterprise similar units expected to be obtained from the use of the asset by the enterprise. It is basically how long the asset is contributing to the enterprise.

Consider the following information:I. Rate of depreciation under the written down method = 20%.

II. Original cost of the asset = Rs.1,00,000.

III. Residual value of the asset at the end of useful life = Rs.40,960. Q.Depreciation for 3rd year = - a)20,000

- b)16,000

- c)12,800

- d)10,240

Correct answer is option 'C'. Can you explain this answer?

Consider the following information:

I. Rate of depreciation under the written down method = 20%.

II. Original cost of the asset = Rs.1,00,000.

III. Residual value of the asset at the end of useful life = Rs.40,960.

II. Original cost of the asset = Rs.1,00,000.

III. Residual value of the asset at the end of useful life = Rs.40,960.

Q.Depreciation for 3rd year =

a)

20,000

b)

16,000

c)

12,800

d)

10,240

|

Sai Kulkarni answered |

To calculate the depreciation for the 3rd year, we will use the written down method formula:

Depreciation = (Book Value at the beginning of the year) x (Rate of depreciation)

Let's calculate the book value at the beginning of the 3rd year:

Book Value at the beginning of the 3rd year = Original cost - Depreciation for 2 years

Depreciation for 2 years = (Original cost) x (Rate of depreciation)

Depreciation for 2 years = Rs.1,00,000 x 20% = Rs.20,000

Book Value at the beginning of the 3rd year = Rs.1,00,000 - Rs.20,000 = Rs.80,000

Now, let's calculate the depreciation for the 3rd year:

Depreciation for 3rd year = (Book Value at the beginning of the 3rd year) x (Rate of depreciation)

Depreciation for 3rd year = Rs.80,000 x 20% = Rs.16,000

Therefore, the depreciation for the 3rd year is Rs.16,000.

Answer: B) Rs.16,000

Which of the following is of a capital nature?- a)Purchase of a truck

- b)Cost of repair

- c)Wages paid for installation of machinery

- d)Road tax paid

Correct answer is option 'A,C'. Can you explain this answer?

Which of the following is of a capital nature?

a)

Purchase of a truck

b)

Cost of repair

c)

Wages paid for installation of machinery

d)

Road tax paid

|

Freedom Institute answered |

Capital Nature Expenses:

Purchase of a truck:

- Purchasing a truck is considered a capital expense because it is a long-term investment in the business.

- The truck is an asset that will be used for a significant period of time to generate revenue for the business.

Wages paid for installation of machinery:

- The wages paid for the installation of machinery are considered a capital expense.

- The installation of machinery is a one-time investment that will benefit the business in the long run.

Non-Capital Nature Expenses:

Cost of repair:

- The cost of repair is not a capital expense.

- Repairs are considered regular maintenance expenses that are necessary to keep the assets in working condition.

Road tax paid:

- Road tax is not a capital expense.

- It is a recurring expense that is required to be paid annually for the use of vehicles on public roads.

In summary, the expenses that are of a capital nature are the purchase of a truck and the wages paid for the installation of machinery. These expenses are considered long-term investments in the business and are expected to generate benefits over an extended period of time. On the other hand, the cost of repair and road tax paid are considered regular expenses that are necessary for the day-to-day operations of the business.

Purchase of a truck:

- Purchasing a truck is considered a capital expense because it is a long-term investment in the business.

- The truck is an asset that will be used for a significant period of time to generate revenue for the business.

Wages paid for installation of machinery:

- The wages paid for the installation of machinery are considered a capital expense.

- The installation of machinery is a one-time investment that will benefit the business in the long run.

Non-Capital Nature Expenses:

Cost of repair:

- The cost of repair is not a capital expense.

- Repairs are considered regular maintenance expenses that are necessary to keep the assets in working condition.

Road tax paid:

- Road tax is not a capital expense.

- It is a recurring expense that is required to be paid annually for the use of vehicles on public roads.

In summary, the expenses that are of a capital nature are the purchase of a truck and the wages paid for the installation of machinery. These expenses are considered long-term investments in the business and are expected to generate benefits over an extended period of time. On the other hand, the cost of repair and road tax paid are considered regular expenses that are necessary for the day-to-day operations of the business.

On April 01, 2004 the debit balance of the machinery account of A Ltd. was Rs.5,67,000.

The machine was purchased on April 01, 2002. The company charged depreciation at the rate of 10% per annum under diminishing balance method. On October 01, 2004, the company acquired a new machine at a cost of Rs.60,000 and incurred Rs.6,000 for installation of the new machine. The company decided to change the system of providing depreciation from the diminishing balance method to the straight-line method with retrospective effect from April 01, 2002. The rate of depreciation will remain the same.

The company decided to make necessary adjustments in respect of depreciation due to the change in the method in the year 2004-2005.

Depreciation provided in 2003-04 = ______.

- a)Rs. 51,030

- b)Rs. 56,700

- c)Rs. 63,000

- d)Rs. 70,000

Correct answer is option 'C'. Can you explain this answer?

On April 01, 2004 the debit balance of the machinery account of A Ltd. was Rs.5,67,000.

The machine was purchased on April 01, 2002. The company charged depreciation at the rate of 10% per annum under diminishing balance method. On October 01, 2004, the company acquired a new machine at a cost of Rs.60,000 and incurred Rs.6,000 for installation of the new machine. The company decided to change the system of providing depreciation from the diminishing balance method to the straight-line method with retrospective effect from April 01, 2002. The rate of depreciation will remain the same.

The company decided to make necessary adjustments in respect of depreciation due to the change in the method in the year 2004-2005.

The machine was purchased on April 01, 2002. The company charged depreciation at the rate of 10% per annum under diminishing balance method. On October 01, 2004, the company acquired a new machine at a cost of Rs.60,000 and incurred Rs.6,000 for installation of the new machine. The company decided to change the system of providing depreciation from the diminishing balance method to the straight-line method with retrospective effect from April 01, 2002. The rate of depreciation will remain the same.

The company decided to make necessary adjustments in respect of depreciation due to the change in the method in the year 2004-2005.

Depreciation provided in 2003-04 = ______.

a)

Rs. 51,030

b)

Rs. 56,700

c)

Rs. 63,000

d)

Rs. 70,000

|

Anu Sen answered |

Calculation of Depreciation:

The machine was purchased on April 01, 2002. So, the year ended on March 31, 2003, is the first year of depreciation.

Depreciation for the year 2002-03 = 10% of Rs. 5,67,000 = Rs. 56,700

Depreciation for the year 2003-04 = 10% of (Rs. 5,67,000 - Rs. 56,700) = Rs. 51,030

Adjustment for Change in Depreciation Method:

The company changed the method of depreciation from diminishing balance to straight-line with retrospective effect from April 01, 2002. So, the depreciation for the years 2002-03 and 2003-04 needs to be adjusted.

Depreciation for the year 2002-03 under straight-line method = 10% of Rs. 5,67,000 = Rs. 56,700

Depreciation for the year 2003-04 under straight-line method = 10% of Rs. 5,67,000 = Rs. 56,700

So, the adjustment for the year 2002-03 = Rs. (56,700 - 56,700) = Rs. 0

And the adjustment for the year 2003-04 = Rs. (51,030 - 56,700) = Rs. (-5,670) (negative because the amount of depreciation under diminishing balance method is higher than that under straight-line method)

Final Depreciation for the year 2003-04:

Depreciation for the year 2003-04 under straight-line method = Rs. 56,700 - Rs. 5,670 = Rs. 51,030

Hence, the correct answer is option (c) Rs. 63,000.

The machine was purchased on April 01, 2002. So, the year ended on March 31, 2003, is the first year of depreciation.

Depreciation for the year 2002-03 = 10% of Rs. 5,67,000 = Rs. 56,700

Depreciation for the year 2003-04 = 10% of (Rs. 5,67,000 - Rs. 56,700) = Rs. 51,030

Adjustment for Change in Depreciation Method:

The company changed the method of depreciation from diminishing balance to straight-line with retrospective effect from April 01, 2002. So, the depreciation for the years 2002-03 and 2003-04 needs to be adjusted.

Depreciation for the year 2002-03 under straight-line method = 10% of Rs. 5,67,000 = Rs. 56,700

Depreciation for the year 2003-04 under straight-line method = 10% of Rs. 5,67,000 = Rs. 56,700

So, the adjustment for the year 2002-03 = Rs. (56,700 - 56,700) = Rs. 0

And the adjustment for the year 2003-04 = Rs. (51,030 - 56,700) = Rs. (-5,670) (negative because the amount of depreciation under diminishing balance method is higher than that under straight-line method)

Final Depreciation for the year 2003-04:

Depreciation for the year 2003-04 under straight-line method = Rs. 56,700 - Rs. 5,670 = Rs. 51,030

Hence, the correct answer is option (c) Rs. 63,000.

Which method of depreciation is effective if repairs and maintenance cost of an asset increases as it grows old:- a)Straight Line Method

- b)Sinking Fund

- c)Annuity

- d)Reducing Balance.

Correct answer is option 'D'. Can you explain this answer?

Which method of depreciation is effective if repairs and maintenance cost of an asset increases as it grows old:

a)

Straight Line Method

b)

Sinking Fund

c)

Annuity

d)

Reducing Balance.

|

Siddharth Sen answered |

Depreciation Method for Increasing Repair and Maintenance Cost

Introduction:

Depreciation is a process of allocating the cost of an asset over its useful life. There are several methods of depreciation, but the choice of method depends on various factors. One of the factors is the repair and maintenance cost of the asset.

Depreciation Method:

Among the various methods of depreciation, the reducing balance method is effective if the repairs and maintenance cost of an asset increases as it grows old. This method is also known as the diminishing balance method or the accelerated depreciation method.

Working:

In the reducing balance method, the depreciation is charged at a fixed percentage of the book value of the asset. As the book value decreases every year, the amount of depreciation also decreases. This method results in higher depreciation in the early years and lower depreciation in the later years.

Advantages:

The reducing balance method is beneficial for those assets that require more repair and maintenance as they grow old because it allows for higher depreciation in the early years. This higher depreciation helps to offset the higher repair and maintenance costs.

Limitations:

The reducing balance method has a limitation that it may not be appropriate for all types of assets. For example, it may not be suitable for assets that have a long useful life and are expected to have a constant repair and maintenance cost throughout their life.

Conclusion:

In conclusion, the reducing balance method is an effective method of depreciation for assets that have an increasing repair and maintenance cost as they grow old. However, the choice of method should be based on various factors, including the nature of the asset and the expected repair and maintenance cost.

Introduction:

Depreciation is a process of allocating the cost of an asset over its useful life. There are several methods of depreciation, but the choice of method depends on various factors. One of the factors is the repair and maintenance cost of the asset.

Depreciation Method:

Among the various methods of depreciation, the reducing balance method is effective if the repairs and maintenance cost of an asset increases as it grows old. This method is also known as the diminishing balance method or the accelerated depreciation method.

Working:

In the reducing balance method, the depreciation is charged at a fixed percentage of the book value of the asset. As the book value decreases every year, the amount of depreciation also decreases. This method results in higher depreciation in the early years and lower depreciation in the later years.

Advantages:

The reducing balance method is beneficial for those assets that require more repair and maintenance as they grow old because it allows for higher depreciation in the early years. This higher depreciation helps to offset the higher repair and maintenance costs.

Limitations:

The reducing balance method has a limitation that it may not be appropriate for all types of assets. For example, it may not be suitable for assets that have a long useful life and are expected to have a constant repair and maintenance cost throughout their life.

Conclusion:

In conclusion, the reducing balance method is an effective method of depreciation for assets that have an increasing repair and maintenance cost as they grow old. However, the choice of method should be based on various factors, including the nature of the asset and the expected repair and maintenance cost.

On April 01, 2004 the debit balance of the machinery account of A Ltd. was Rs.5,67,000.

The machine was purchased on April 01, 2002. The company charged depreciation at the rate of 10% per annum under diminishing balance method. On October 01, 2004, the company acquired a new machine at a cost of Rs.60,000 and incurred Rs.6,000 for installation of the new machine. The company decided to change the system of providing depreciation from the diminishing balance method to the straight-line method with retrospective effect from April 01, 2002. The rate of depreciation will remain the same.

The company decided to make necessary adjustments in respect of depreciation due to the change in the method in the year 2004-2005.

Depreciation under new method for 2002-03 and 2003-04 = _______.

- a)Rs. 1,33,400

- b)Rs. 1,40,000

- c)Rs. 1,26,000

- d)Rs. 1,55,556

Correct answer is option 'C'. Can you explain this answer?

On April 01, 2004 the debit balance of the machinery account of A Ltd. was Rs.5,67,000.

The machine was purchased on April 01, 2002. The company charged depreciation at the rate of 10% per annum under diminishing balance method. On October 01, 2004, the company acquired a new machine at a cost of Rs.60,000 and incurred Rs.6,000 for installation of the new machine. The company decided to change the system of providing depreciation from the diminishing balance method to the straight-line method with retrospective effect from April 01, 2002. The rate of depreciation will remain the same.

The company decided to make necessary adjustments in respect of depreciation due to the change in the method in the year 2004-2005.

The machine was purchased on April 01, 2002. The company charged depreciation at the rate of 10% per annum under diminishing balance method. On October 01, 2004, the company acquired a new machine at a cost of Rs.60,000 and incurred Rs.6,000 for installation of the new machine. The company decided to change the system of providing depreciation from the diminishing balance method to the straight-line method with retrospective effect from April 01, 2002. The rate of depreciation will remain the same.

The company decided to make necessary adjustments in respect of depreciation due to the change in the method in the year 2004-2005.

Depreciation under new method for 2002-03 and 2003-04 = _______.

a)

Rs. 1,33,400

b)

Rs. 1,40,000

c)

Rs. 1,26,000

d)

Rs. 1,55,556

|

Gopal Sen answered |

Calculation of Depreciation under Diminishing Balance Method:

Debit balance of machinery account as on April 01, 2004 = Rs.5,67,000

Purchase date of machinery = April 01, 2002

Depreciation rate = 10%

Depreciation for the year 2002-03:

Depreciation for the year = Rs.5,67,000 x 10% = Rs.56,700

Depreciation for the year 2003-04:

Depreciation for the year = (Rs.5,67,000 - Rs.56,700) x 10% = Rs.51,330

Depreciation under Straight-Line Method:

New machine cost = Rs.60,000

Installation cost = Rs.6,000

Total cost of the new machine = Rs.66,000

Depreciation rate = 10% per annum

Depreciation per year = Rs.66,000 x 10% = Rs.6,600

Adjustment for the year 2004-05:

Depreciation under Diminishing Balance Method for the year 2004-05 = (Rs.5,67,000 - Rs.1,08,030) x 10% = Rs.4,58,597 x 10% = Rs.45,860

Depreciation under Straight-Line Method for the year 2004-05 = Rs.6,600

Difference in Depreciation = Rs.45,860 - Rs.6,600 = Rs.39,260

Adjustment for the year 2002-03:

Depreciation under Diminishing Balance Method for the year 2002-03 = Rs.56,700

Depreciation under Straight-Line Method for the year 2002-03 = Rs.6,600

Difference in Depreciation = Rs.56,700 - Rs.6,600 = Rs.50,100

Adjustment for the year 2003-04:

Depreciation under Diminishing Balance Method for the year 2003-04 = Rs.51,330

Depreciation under Straight-Line Method for the year 2003-04 = Rs.6,600

Difference in Depreciation = Rs.51,330 - Rs.6,600 = Rs.44,730

Depreciation under new method for 2002-03 and 2003-04 = Rs.50,100 + Rs.44,730 = Rs.94,830

Depreciation under new method for 2004-05 = Rs.6,600

Total Depreciation under new method = Rs.94,830 + Rs.6,600 = Rs.1,01,430

Therefore, the correct answer is option (c) Rs.1,40,000.

Debit balance of machinery account as on April 01, 2004 = Rs.5,67,000

Purchase date of machinery = April 01, 2002

Depreciation rate = 10%

Depreciation for the year 2002-03:

Depreciation for the year = Rs.5,67,000 x 10% = Rs.56,700

Depreciation for the year 2003-04:

Depreciation for the year = (Rs.5,67,000 - Rs.56,700) x 10% = Rs.51,330

Depreciation under Straight-Line Method:

New machine cost = Rs.60,000

Installation cost = Rs.6,000

Total cost of the new machine = Rs.66,000

Depreciation rate = 10% per annum

Depreciation per year = Rs.66,000 x 10% = Rs.6,600

Adjustment for the year 2004-05:

Depreciation under Diminishing Balance Method for the year 2004-05 = (Rs.5,67,000 - Rs.1,08,030) x 10% = Rs.4,58,597 x 10% = Rs.45,860

Depreciation under Straight-Line Method for the year 2004-05 = Rs.6,600

Difference in Depreciation = Rs.45,860 - Rs.6,600 = Rs.39,260

Adjustment for the year 2002-03:

Depreciation under Diminishing Balance Method for the year 2002-03 = Rs.56,700

Depreciation under Straight-Line Method for the year 2002-03 = Rs.6,600

Difference in Depreciation = Rs.56,700 - Rs.6,600 = Rs.50,100

Adjustment for the year 2003-04:

Depreciation under Diminishing Balance Method for the year 2003-04 = Rs.51,330

Depreciation under Straight-Line Method for the year 2003-04 = Rs.6,600

Difference in Depreciation = Rs.51,330 - Rs.6,600 = Rs.44,730

Depreciation under new method for 2002-03 and 2003-04 = Rs.50,100 + Rs.44,730 = Rs.94,830

Depreciation under new method for 2004-05 = Rs.6,600

Total Depreciation under new method = Rs.94,830 + Rs.6,600 = Rs.1,01,430

Therefore, the correct answer is option (c) Rs.1,40,000.

B Limited has been charging depreciation on the straight line method. It charges a full year depreciation even if the machinery is utilized only for part of the year. An equipment which was purchased for Rs.3,50,000 now stands at Rs.2,97,500 after depreciating at the rate of 5% on a straight line basis. Now the company decides to change the method of depreciation with retrospective effect. The applicable reducing balance rate for this machinery would be 8% p.a. Assuming that before the effect of this change could be accounted, depreciation for the current year is already charged based on straight line method and is reflected in the depreciated value of Rs.2,97,500.Q. If 8% depreciation was charged by the reducing balance method, WDV at the end of 1st year is- a)Rs 2,72,541

- b)Rs 2,96,240

- c)Rs 3,22,000

- d)Rs 3,60,000

Correct answer is option 'C'. Can you explain this answer?

B Limited has been charging depreciation on the straight line method. It charges a full year depreciation even if the machinery is utilized only for part of the year. An equipment which was purchased for Rs.3,50,000 now stands at Rs.2,97,500 after depreciating at the rate of 5% on a straight line basis. Now the company decides to change the method of depreciation with retrospective effect. The applicable reducing balance rate for this machinery would be 8% p.a. Assuming that before the effect of this change could be accounted, depreciation for the current year is already charged based on straight line method and is reflected in the depreciated value of Rs.2,97,500.

Q. If 8% depreciation was charged by the reducing balance method, WDV at the end of 1st year is

a)

Rs 2,72,541

b)

Rs 2,96,240

c)

Rs 3,22,000

d)

Rs 3,60,000

|

Mehul Saini answered |

Solution:

Given:

Purchase price of machinery = Rs.3,50,000

Depreciation rate (straight line method) = 5%

WDV after depreciation = Rs.2,97,500

New depreciation rate (reducing balance method) = 8%

Calculation:

1. Calculation of depreciation charged under straight line method

Depreciation charged per year = (Purchase price - Scrap value) / Useful life

Scrap value = 0 (not given)

Useful life = 100 / Depreciation rate = 100 / 5% = 20 years

Depreciation charged per year = (3,50,000 - 0) / 20 = 17,500

2. Calculation of WDV under straight line method after one year

WDV after one year = Purchase price - Depreciation charged for one year

WDV after one year = 3,50,000 - 17,500 = 3,32,500

3. Calculation of WDV under reducing balance method after one year

Depreciation rate (reducing balance method) = 8%

Depreciation charged for one year = WDV at the beginning of the year x Depreciation rate

Depreciation charged for one year = 3,32,500 x 8% = 26,600

WDV after one year = Purchase price - Total depreciation charged for one year

WDV after one year = 3,50,000 - 26,600 = 3,23,400

Therefore, the WDV at the end of 1st year if 8% depreciation was charged by the reducing balance method would be Rs.3,22,000 (nearest to Rs.3,23,400). Hence, option C is the correct answer.

Given:

Purchase price of machinery = Rs.3,50,000

Depreciation rate (straight line method) = 5%

WDV after depreciation = Rs.2,97,500

New depreciation rate (reducing balance method) = 8%

Calculation:

1. Calculation of depreciation charged under straight line method

Depreciation charged per year = (Purchase price - Scrap value) / Useful life

Scrap value = 0 (not given)

Useful life = 100 / Depreciation rate = 100 / 5% = 20 years

Depreciation charged per year = (3,50,000 - 0) / 20 = 17,500

2. Calculation of WDV under straight line method after one year

WDV after one year = Purchase price - Depreciation charged for one year

WDV after one year = 3,50,000 - 17,500 = 3,32,500

3. Calculation of WDV under reducing balance method after one year

Depreciation rate (reducing balance method) = 8%

Depreciation charged for one year = WDV at the beginning of the year x Depreciation rate

Depreciation charged for one year = 3,32,500 x 8% = 26,600

WDV after one year = Purchase price - Total depreciation charged for one year

WDV after one year = 3,50,000 - 26,600 = 3,23,400

Therefore, the WDV at the end of 1st year if 8% depreciation was charged by the reducing balance method would be Rs.3,22,000 (nearest to Rs.3,23,400). Hence, option C is the correct answer.

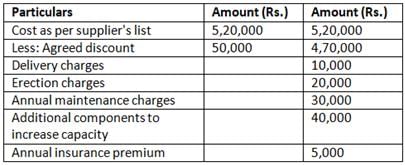

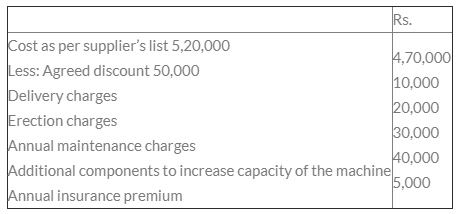

In the year 2004- 2005, C Ltd. purchased a new machine and made the following payments in relation to it:

If depreciation is provided @ 10% p.a. WDV, depreciation for 3rd year is

If depreciation is provided @ 10% p.a. WDV, depreciation for 3rd year is

- a)Rs. 43,740

- b)Rs. 44,145

- c)Rs. 38,070

- d)Rs. 44,550

Correct answer is option 'A'. Can you explain this answer?

In the year 2004- 2005, C Ltd. purchased a new machine and made the following payments in relation to it:

If depreciation is provided @ 10% p.a. WDV, depreciation for 3rd year is

a)

Rs. 43,740

b)

Rs. 44,145

c)

Rs. 38,070

d)

Rs. 44,550

|

|

Abirami Abirami answered |

520000-50000+10000+20000+40000=540000

Ist year dep=540000*10%=54000

IInd year dep=540000-54000*10%=48600

IIIrd year dep=540000-54000-48600*10%=43740

SO CORRECT ANSWER IS OPTION (A)

Ist year dep=540000*10%=54000

IInd year dep=540000-54000*10%=48600

IIIrd year dep=540000-54000-48600*10%=43740

SO CORRECT ANSWER IS OPTION (A)

The number of production or similar units expected to be obtained from the use of an asset by an enterprise is called as- a)Unit life

- b)Useful life

- c)Production life

- d)Expected life

Correct answer is option 'B'. Can you explain this answer?

The number of production or similar units expected to be obtained from the use of an asset by an enterprise is called as

a)

Unit life

b)

Useful life

c)

Production life

d)

Expected life

|

Tanvi Pillai answered |

Useful life of an assets may be determine as number of years or number of units that machine/assets is going to produce. Therefore, unit life is the number of production units expected from the use of asset.

The portion of the acquisition cost of the asset, yet to be allocated is known as

- a)Written down value

- b)Accumulated value

- c)Realisable value

- d)Salvage value

Correct answer is option 'A'. Can you explain this answer?

The portion of the acquisition cost of the asset, yet to be allocated is known as

a)

Written down value

b)

Accumulated value

c)

Realisable value

d)

Salvage value

|

Palak Choudhary answered |

Written-down value is the value of an asset after accounting for depreciation or amortization. It is calculated by subtracting accumulated depreciation or amortization from the asset's original value, and it reflects the asset's present worth from an accounting perspective. It is that value of asset on which depreciation has not yet been charged and can be seen in balance sheet as net book value of asset.

A machine which was bought for $180,000 on 30 April 2008. The residual value was $5,000 and depreciation rate was 25%. Depreciation is to be charged under the reducing balance method on month to month basis. Compute the depreciation at 31st December 2008- a)$30,000

- b)$19,000

- c)$18,000

- d)$15,000

Correct answer is option 'A'. Can you explain this answer?

A machine which was bought for $180,000 on 30 April 2008. The residual value was $5,000 and depreciation rate was 25%. Depreciation is to be charged under the reducing balance method on month to month basis. Compute the depreciation at 31st December 2008

a)

$30,000

b)

$19,000

c)

$18,000

d)

$15,000

|

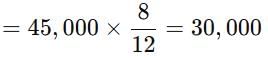

KP Classes answered |

Given:

- Purchase price of the machine: $180,000

- Residual value: $5,000

- Depreciation rate: 25% per annum

- Method: Reducing balance method

- Purchase date: 30 April 2008

- Depreciation period: From 30 April 2008 to 31 December 2008 (8 months)

Step 1: Calculate annual depreciation

Depreciation for a year using the reducing balance method = Cost of asset × Depreciation rate

Annual depreciation = $180,000 × 25% = $45,000

Step 2: Calculate depreciation for 8 months

Since depreciation is calculated month-to-month, we only need to calculate depreciation for 8 months (from 30 April 2008 to 31 December 2008).

Depreciation for 8 months = 8/12 of annual depreciation

Depreciation for 8 months = 8/12 of annual depreciation

Step 3: Reducing balance at 31 December 2008

The depreciation expense for the period from 30 April 2008 to 31 December 2008 is $30,000.

Thus, the depreciation at 31 December 2008 is $30,000.

Original Cost = Rs 1,00,000. Life = 5 years. Expected salvage value = Rs. 2,000.

Q. Depreciation for 3rd year as per straight line method is

- a)Rs. 12,800

- b)Rs. 19,600

- c)Rs. 20,000

- d)Rs. 20,400

Correct answer is option 'B'. Can you explain this answer?

Original Cost = Rs 1,00,000. Life = 5 years. Expected salvage value = Rs. 2,000.

Q. Depreciation for 3rd year as per straight line method is

a)

Rs. 12,800

b)

Rs. 19,600

c)

Rs. 20,000

d)

Rs. 20,400

|

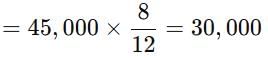

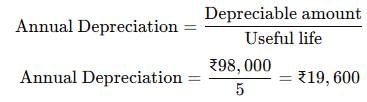

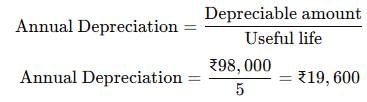

Srsps answered |

Given:

- Original cost = ₹1,00,000

- Salvage value = ₹2,000

- Useful life = 5 years

Step 1: Calculate the depreciable amount

Depreciable amount = Original cost - Salvage value

Depreciable amount = ₹1,00,000 − ₹2,000 = ₹98,000

Step 2: Calculate the annual depreciation

Step 3: Depreciation for the 3rd year

Since depreciation is equal every year under the Straight Line Method, the depreciation for the 3rd year will also be ₹19,600.

The depreciation for the 3rd year is ₹19,600, so the correct answer is Option B: ₹19,600.

Consider the following information:I. Rate of depreciation under the written down method = 20%.

II. Original cost of the asset = Rs.1,00,000.