All Exams >

CA Foundation >

Accounting for CA Foundation >

All Questions

All questions of Unit 1: Meaning and Scope of Accounting for CA Foundation Exam

The LCM of two co-prime numbers is

- a)their sum

- b)their difference

- c)their product

- d)none of these

Correct answer is option 'C'. Can you explain this answer?

The LCM of two co-prime numbers is

a)

their sum

b)

their difference

c)

their product

d)

none of these

|

EduRev Class 6 answered |

The LCM of two coprime numbers is the product of the numbers.

Can you explain the answer of this question below:On January 1, Sohan paid rent Rs. 5,000. This can be classified as

- A:

An event

- B:

A transaction.

- C:

A transaction as well as an event.

- D:

Neither a transaction nor an event.

The answer is b.

On January 1, Sohan paid rent Rs. 5,000. This can be classified as

An event

A transaction.

A transaction as well as an event.

Neither a transaction nor an event.

|

Anand Dasgupta answered |

Explanation:

A transaction is an exchange of goods, services, or money between two or more parties. In this case, Sohan paid rent of Rs. 5,000 which involves an exchange of money between Sohan and his landlord. Hence, it is a transaction.

An event, on the other hand, is a happening or occurrence that may or may not involve an exchange of goods, services, or money. In this case, if Sohan had received the rent payment from his landlord, it would have been an event. However, since he paid the rent, it is not just an event.

Therefore, the correct answer is option 'B' - A transaction.

A transaction is an exchange of goods, services, or money between two or more parties. In this case, Sohan paid rent of Rs. 5,000 which involves an exchange of money between Sohan and his landlord. Hence, it is a transaction.

An event, on the other hand, is a happening or occurrence that may or may not involve an exchange of goods, services, or money. In this case, if Sohan had received the rent payment from his landlord, it would have been an event. However, since he paid the rent, it is not just an event.

Therefore, the correct answer is option 'B' - A transaction.

Net Profit or Loss will be derived at _______ stage of accounting- a)Classifying

- b)Interpretation

- c)Recording

- d)Summarising

Correct answer is 'D'. Can you explain this answer?

Net Profit or Loss will be derived at _______ stage of accounting

a)

Classifying

b)

Interpretation

c)

Recording

d)

Summarising

|

|

Alok Mehta answered |

The answer is D.Summarising stage is concerned with the preparation and presentation of the classified data in a manner useful to the internal as well as external users of financial statements. This process leads to the preparation of the following financial statements. Therefore, Net Profit or Loss is derived at the summarising stage.

On 31st December, 2005, Ashok Ltd. purchased a machine from Mohan Ltd. for Rs. 1,75,000. This is : (year end : 31st December)

- a)A transaction

- b)An event

- c)Both transaction as well as event

- d)None of these

Correct answer is option 'C'. Can you explain this answer?

On 31st December, 2005, Ashok Ltd. purchased a machine from Mohan Ltd. for Rs. 1,75,000. This is : (year end : 31st December)

a)

A transaction

b)

An event

c)

Both transaction as well as event

d)

None of these

|

|

Alok Mehta answered |

The purchase of a machine by Ashok Ltd. from Mohan Ltd. for Rs. 1,75,000 on 31st December, 2005, is both a transaction as well as an event.

A transaction is an exchange of goods or services for something of value. In this case, Ashok Ltd. exchanged Rs. 1,75,000 for a machine from Mohan Ltd., which qualifies as a transaction.

An event, on the other hand, is a happening or occurrence that has significance or consequences. The purchase of a machine by Ashok Ltd. from Mohan Ltd. on 31st December, 2005, can be considered an event as it is a significant happening that has financial implications for both companies.

Therefore, the purchase of the machine is both a transaction and an event.

Accounting has universal application for recording _______ and events and presenting suitable information for decision making- a)Entries

- b)Transactions

- c)Data

- d)Figures.

Correct answer is option 'B'. Can you explain this answer?

Accounting has universal application for recording _______ and events and presenting suitable information for decision making

a)

Entries

b)

Transactions

c)

Data

d)

Figures.

|

|

Kavita Joshi answered |

Accounting has universal application for recording transactions and events and presenting suitable information to aid decision-making regarding any type of economic activity ranging from a family function to functions of the national government. But hereinafter we shall concentrate only on business activities and their accounting because the objective of this study material is to provide a basic understanding on accounting for business activities. Nevertheless, it will give adequate knowledge to think coherently of accounting as a field of study for universal application.

On March 31, 2011 after sale of goods worth Rs. 2,000, he is left with the closing inventory of Rs. 10,000. This is- a)An event

- b)A transaction.

- c)A transaction as well as an event.

- d)Neither a transaction nor an event

Correct answer is 'A'. Can you explain this answer?

On March 31, 2011 after sale of goods worth Rs. 2,000, he is left with the closing inventory of Rs. 10,000. This is

a)

An event

b)

A transaction.

c)

A transaction as well as an event.

d)

Neither a transaction nor an event

|

Neha Yadav answered |

Correct answer is option A

Which of the following is correct? Owner’s Equity is : - a)(Current Asset + Fixed Asset) + (Current Liabilities + Long term Liabilities)

- b)(Current Asset + Fixed Asset) – (Current Liabilities + Long term Liabilities)

- c)(Current Asset – Fixed Asset) – (Current Liabilities + Long term Liabilities)

- d)None of the above.

Correct answer is option 'B'. Can you explain this answer?

Which of the following is correct? Owner’s Equity is :

a)

(Current Asset + Fixed Asset) + (Current Liabilities + Long term Liabilities)

b)

(Current Asset + Fixed Asset) – (Current Liabilities + Long term Liabilities)

c)

(Current Asset – Fixed Asset) – (Current Liabilities + Long term Liabilities)

d)

None of the above.

|

Deepika Desai answered |

Owner.

Rs. 5,000 paid as rent of office premises in an/a _________- a)Event

- b)Transaction

- c)Both

- d)None

Correct answer is option 'B'. Can you explain this answer?

Rs. 5,000 paid as rent of office premises in an/a _________

a)

Event

b)

Transaction

c)

Both

d)

None

|

Palak Choudhary answered |

Explanation:

This question is related to the accounting concept of "transactions".

Transactions are defined as any financial event that affects a business's financial position and can be measured reliably.

In this case, the payment of rent for office premises is a financial event that affects the business's financial position and can be measured reliably. Therefore, it is considered a transaction.

Events, on the other hand, are occurrences that may or may not have a financial impact on the business. For example, attending a business conference may be considered an event, but it does not have a direct financial impact on the business.

Therefore, the correct answer is option B - Transaction.

This question is related to the accounting concept of "transactions".

Transactions are defined as any financial event that affects a business's financial position and can be measured reliably.

In this case, the payment of rent for office premises is a financial event that affects the business's financial position and can be measured reliably. Therefore, it is considered a transaction.

Events, on the other hand, are occurrences that may or may not have a financial impact on the business. For example, attending a business conference may be considered an event, but it does not have a direct financial impact on the business.

Therefore, the correct answer is option B - Transaction.

Users of accounting information include

- a)Trade payables/ Suppliers

- b)Lenders.

- c)Customers.

- d)all of the above.

Correct answer is option 'D'. Can you explain this answer?

Users of accounting information include

a)

Trade payables/ Suppliers

b)

Lenders.

c)

Customers.

d)

all of the above.

|

|

Jayant Mishra answered |

The correct answer is 4 - all of the above.

Users of accounting information include various stakeholders who have an interest in a company's financial performance and position. These stakeholders can use accounting information to make decisions regarding their engagement with the company. The users of accounting information can include trade payables/suppliers, lenders, customers, investors, regulatory authorities, employees, management, and others. All of the options given in the question - trade payables/suppliers, lenders, and customers - are users of accounting information, but there are also many others.

Financial position of the business is ascertained on the basis of - a)Records prepared under book-keeping process.

- b)Trial balance.

- c)Accounting reports.

- d)None of the above.

Correct answer is option 'C'. Can you explain this answer?

Financial position of the business is ascertained on the basis of

a)

Records prepared under book-keeping process.

b)

Trial balance.

c)

Accounting reports.

d)

None of the above.

|

|

Arjun Singhania answered |

Accounting reports are compilations of financial information that are derived from the accounting records of a business. These can be brief, custom-made reports that are intended for specific purposes, such as a detailed analysis of sales by region, or the profitability of a specific product line. More commonly, accounting reports are considered to be equivalent to the financial statements. These statements include the following reports:

1. Income statement. States the revenues earned during a period, less expenses, to arrive at a profit or loss. This is the most commonly used accounting report, since it is used to judge the performance of a business.

2. Balance sheet. Shows the ending asset, liability, and equity balances as of the balance sheet date. It is used to judge the liquidity and financial reserves of a business.

3. Statement of cash flows. Shows the sources and uses of cash related to operations, financing, and investments. Can be the most accurate source of information regarding the cash-generating ability of an entity.

A number of disclosures may accompany the financial statements, in the form of footnotes. This is more likely to be the case when the financial statements have been audited.

Double Accounting System owes its origin to : a)Luca De Pacioli b)Adam Smithc)Kohlerd)Karl MarxCorrect answer is option 'A'. Can you explain this answer?

b)Adam Smith

c)Kohler

d)Karl Marx

Correct answer is option 'A'. Can you explain this answer?

|

|

Poonam Reddy answered |

Luca Pacioli, in venice (1494) is considered as the first book on double entry book-keeping. A portion of this book contains knowledge of business and book-keeping.

The main objectives of Book- Keeping are :- a)Complete Recording of Transactions

- b)Ascertainment of Financial Effect on the Business

- c)Analysis and interpretation of data

- d)(a) and (b) both

Correct answer is option 'D'. Can you explain this answer?

The main objectives of Book- Keeping are :

a)

Complete Recording of Transactions

b)

Ascertainment of Financial Effect on the Business

c)

Analysis and interpretation of data

d)

(a) and (b) both

|

|

Arjun Singhania answered |

- Objective of Book-keeping

- - To have a permanent record of each transaction of the business.

- - To show the financial effect on the entity of each transaction recorded.

- - To ascertain the combined effect of all the transactions (during an accounting period) on the financial position on a particular date.

- - To disclose the factors responsible for earning profit or suffering loss in a given period.

- - The amount recoverable by the business from others (sundry debtors) and payable to others (sundry creditors)

- - Determination of tax-liability of the business.

- - Prevention of errors and frauds.

- - Protection of assets.

- - Measure of exercising a system of control.

Which of these is not available in the Financial Statements of Company?- a)Total Sales

- b)Total Profit & Loss

- c)Capital

- d)Cost of Production

Correct answer is option 'D'. Can you explain this answer?

Which of these is not available in the Financial Statements of Company?

a)

Total Sales

b)

Total Profit & Loss

c)

Capital

d)

Cost of Production

|

Neha Sindal answered |

Simply cost of production isnt taken in consideration due to this is a expense related to manufacturing costs nd this doesn't includes in the trading or p/l ac or balance sheet that is there is a all new account for the firms who r involving in manufacturing business called manufacturing account

so this is not includes in financial statements

so this is not includes in financial statements

Net Profit or Loss will be derived at _______ stage of accounting- a)Classifying

- b)Interpretation

- c)Recording

- d)Summarising

Correct answer is option 'D'. Can you explain this answer?

Net Profit or Loss will be derived at _______ stage of accounting

a)

Classifying

b)

Interpretation

c)

Recording

d)

Summarising

|

Sonal Patel answered |

Summarising stage is concerned with the preparation and presentation of the classified data in a manner useful to the internal as well as external users of financial statements. This process leads to the preparation of the following financial statements. Therefore, Net Profit or Loss is derived at the summarising stage.

Book-keeping is mainly concerned with - a)Recording of financial data.

- b)Designing the systems in recording, classifying and summarizing the recorded data.

- c)Interpreting the data for internal and external users.

- d)None of the above.

Correct answer is option 'A'. Can you explain this answer?

Book-keeping is mainly concerned with

a)

Recording of financial data.

b)

Designing the systems in recording, classifying and summarizing the recorded data.

c)

Interpreting the data for internal and external users.

d)

None of the above.

|

|

Kavita Joshi answered |

According to North Cott ,“Book-keeping is an art of recording in books of accounts the monetary aspect of commercial or financial transactions”. It is mainly concerned with record keeping or maintenance of books of accounts.

Interpreting Financial Statements means:- a)Methodical classification of the data given in the financial statements.

- b)Preparation and presentation of the classified data in a manner useful to the users of financial statements.

- c)Systematic analysis of the recorded data so as to put information in usable from.

- d)Explaining the meaning and significance of the relationship of analysis of accounting data.

Correct answer is 'D'. Can you explain this answer?

Interpreting Financial Statements means:

a)

Methodical classification of the data given in the financial statements.

b)

Preparation and presentation of the classified data in a manner useful to the users of financial statements.

c)

Systematic analysis of the recorded data so as to put information in usable from.

d)

Explaining the meaning and significance of the relationship of analysis of accounting data.

|

|

Alok Mehta answered |

Interpretation of financial statements are an attempt to determine the significance and meaning of the financial statement data so that a forecast may be made of the prospects for future earnings, ability to pay interest, debt maturities, both current as well as long term, and profitability of sound dividend policy.

Interpretation of financial statements involves many processes like arrangement, analysis, establishing relationship between available facts and drawing conclusions on that basis.

Book-keeping is mainly concerned with- a)Recording of financial data.

- b)Designing the systems in recording, classifying and summarising the recorded data.

- c)Interpreting the data for internal and external users.

- d)None of the above.

Correct answer is option 'A'. Can you explain this answer?

Book-keeping is mainly concerned with

a)

Recording of financial data.

b)

Designing the systems in recording, classifying and summarising the recorded data.

c)

Interpreting the data for internal and external users.

d)

None of the above.

|

|

Kavita Joshi answered |

Book-keeping. According to North Cott ,“Book-keeping is an art of recording in books of accounts the monetary aspect of commercial or financial transactions”. It is mainly concerned with record keeping or maintenance of books of accounts.

Financial statements do not consider- a)Assets expressed in monetary terms.

- b)Liabilities expressed in monetary terms.

- c)Only assets expressed in non-monetary terms.

- d)Assets and liabilities expressed in non-monetary terms

Correct answer is option 'D'. Can you explain this answer?

Financial statements do not consider

a)

Assets expressed in monetary terms.

b)

Liabilities expressed in monetary terms.

c)

Only assets expressed in non-monetary terms.

d)

Assets and liabilities expressed in non-monetary terms

|

Pallabi Khanna answered |

Nonmonetary items are those assets and liabilities appearing on the balance sheet that are not cash, or cannot be readily converted into cash. ... Nonmonetary liabilities include those obligations that are not payable in cash, or items that will adjust an expense.

Financial Statements are a part of : - a)Accounting

- b)Book- Keeping

- c)Both

- d)None

Correct answer is option 'A'. Can you explain this answer?

Financial Statements are a part of :

a)

Accounting

b)

Book- Keeping

c)

Both

d)

None

|

Freedom Institute answered |

Financial statement is a formal record of the financial activities and position of a business, person or other entity. Financial statement are major part of accounting as accounting is incomplete without financial statements.

Management Accounting:

- a)Is a clerical work

- b)Is accounting for future

- c)Is a recording technique of the management related transactions

- d)Is an analysis of the past business activities

Correct answer is option 'C'. Can you explain this answer?

Management Accounting:

a)

Is a clerical work

b)

Is accounting for future

c)

Is a recording technique of the management related transactions

d)

Is an analysis of the past business activities

|

|

Jayant Mishra answered |

Hence, the correct option is c) is a recording technique of management related transaction. Other options, such as b) is accounting for the future is not correct as management accounting is being used today to analyze the cost in a business.

Which of the following is not a subfield of accounting?- a)Management accounting.

- b)Cost accounting.

- c)Financial Accounting.

- d)Book-keeping

Correct answer is option 'D'. Can you explain this answer?

Which of the following is not a subfield of accounting?

a)

Management accounting.

b)

Cost accounting.

c)

Financial Accounting.

d)

Book-keeping

|

|

Arjun Singhania answered |

Book Keeping is the Recording Branch of Accountancy. Accountancy includes Book Keeping and classifying,interpreting and summarizing of the business transactions.

Net Profit or Loss will be derived at _______ stage of accounting- a)Classifying

- b)Interpretation

- c)Recording

- d)Summarising

Correct answer is option 'D'. Can you explain this answer?

Net Profit or Loss will be derived at _______ stage of accounting

a)

Classifying

b)

Interpretation

c)

Recording

d)

Summarising

|

|

Jayant Mishra answered |

Summarising stage is concerned with the preparation and presentation of the classified data in a manner useful to the internal as well as external users of financial statements. This process leads to the preparation of the following financial statements. Therefore, Net Profit or Loss is derived at the summarising stage.

The direct advantage of accounting do not include: - a)Preparation of financial statements

- b)Competitive advantage

- c)Ascertainment of profit or loss

- d)Information to interested groups

Correct answer is 'B'. Can you explain this answer?

The direct advantage of accounting do not include:

a)

Preparation of financial statements

b)

Competitive advantage

c)

Ascertainment of profit or loss

d)

Information to interested groups

|

|

Arun Khanna answered |

Accounting is defined as the art of recording, classifying, summarizing, analyzing, interpretation and communicating the results of transactions and events which are of financial character. Hence, it includes preparation of final accounts, ascertainment of profit or loss and its communication to users, but it does not includes any kind of competitive advantage.

Financial position of the business is ascertained on the basis of- a)Records prepared under book-keeping process.

- b)Trial balance.

- c)Accounting reports.

- d)None of the above.

Correct answer is 'C'. Can you explain this answer?

Financial position of the business is ascertained on the basis of

a)

Records prepared under book-keeping process.

b)

Trial balance.

c)

Accounting reports.

d)

None of the above.

|

Freedom Institute answered |

Financial position of the business is ascertained on the basis of:

1. Records prepared under bookkeeping process:

- Bookkeeping refers to the process of recording financial transactions and maintaining accurate and detailed records of a business's financial activities.

- The records prepared under bookkeeping process serve as the foundation for determining the financial position of the business.

- These records include journals, ledgers, and other financial documents that provide a comprehensive view of the company's financial transactions.

2. Trial balance:

- A trial balance is a statement that lists all the accounts in the general ledger along with their respective debit or credit balances.

- It is used to ensure that the total debits equal the total credits, which helps in detecting any errors or discrepancies in the accounting records.

- The trial balance provides a snapshot of the financial position of the business at a particular point in time.

3. Accounting reports:

- Accounting reports, such as balance sheets, income statements, and cash flow statements, are prepared based on the financial data recorded in the bookkeeping process.

- These reports provide detailed information about the company's assets, liabilities, equity, revenues, and expenses.

- By analyzing these reports, stakeholders can evaluate the financial performance and position of the business.

- The accounting reports help in making informed decisions, analyzing profitability, and assessing the overall financial health of the company.

4. None of the above:

- This option is incorrect as the financial position of the business is indeed ascertained based on the records prepared under the bookkeeping process, trial balance, and accounting reports.

In conclusion, the financial position of a business is determined by examining the records prepared under the bookkeeping process, verifying the trial balance, and analyzing the accounting reports. These sources provide the necessary information to assess the company's assets, liabilities, equity, and overall financial performance.

1. Records prepared under bookkeeping process:

- Bookkeeping refers to the process of recording financial transactions and maintaining accurate and detailed records of a business's financial activities.

- The records prepared under bookkeeping process serve as the foundation for determining the financial position of the business.

- These records include journals, ledgers, and other financial documents that provide a comprehensive view of the company's financial transactions.

2. Trial balance:

- A trial balance is a statement that lists all the accounts in the general ledger along with their respective debit or credit balances.

- It is used to ensure that the total debits equal the total credits, which helps in detecting any errors or discrepancies in the accounting records.

- The trial balance provides a snapshot of the financial position of the business at a particular point in time.

3. Accounting reports:

- Accounting reports, such as balance sheets, income statements, and cash flow statements, are prepared based on the financial data recorded in the bookkeeping process.

- These reports provide detailed information about the company's assets, liabilities, equity, revenues, and expenses.

- By analyzing these reports, stakeholders can evaluate the financial performance and position of the business.

- The accounting reports help in making informed decisions, analyzing profitability, and assessing the overall financial health of the company.

4. None of the above:

- This option is incorrect as the financial position of the business is indeed ascertained based on the records prepared under the bookkeeping process, trial balance, and accounting reports.

In conclusion, the financial position of a business is determined by examining the records prepared under the bookkeeping process, verifying the trial balance, and analyzing the accounting reports. These sources provide the necessary information to assess the company's assets, liabilities, equity, and overall financial performance.

Which of the following is correct? Owner’s Equity is : - a)(Current Asset + Fixed Asset) + (Current Liabilities + Long term Liabilities)

- b)(Current Asset + Fixed Asset) – (Current Liabilities + Long term Liabilities)

- c)(Current Asset – Fixed Asset) – (Current Liabilities + Long term Liabilities)

- d)None of the above.

Correct answer is option 'B'. Can you explain this answer?

Which of the following is correct? Owner’s Equity is :

a)

(Current Asset + Fixed Asset) + (Current Liabilities + Long term Liabilities)

b)

(Current Asset + Fixed Asset) – (Current Liabilities + Long term Liabilities)

c)

(Current Asset – Fixed Asset) – (Current Liabilities + Long term Liabilities)

d)

None of the above.

|

Deepika Nambiar answered |

It seems like you have not provided any options for us to evaluate. Could you please provide the options you want us to choose from?

On January 1, Sohan paid rent of Rs. 5,000. This can be classified as- a)An event.

- b)A transaction.

- c)A transaction as well as an event.

- d)Neither a transaction nor an event.

Correct answer is 'B'. Can you explain this answer?

On January 1, Sohan paid rent of Rs. 5,000. This can be classified as

a)

An event.

b)

A transaction.

c)

A transaction as well as an event.

d)

Neither a transaction nor an event.

|

|

Rajat Patel answered |

A rent can be a office rent then it will be a transaction according to book-keeping OR if a rent is house rent then it is not consider as a transaction.

If owner’s capital is Rs. 50,000 liability is Rs. 30,000 and fixed assets is Rs. 70,000, then what is the value of current assets?- a)Rs. 10,000

- b)Rs. 40,000

- c)Rs. 80,000

- d)Rs. 1,00,000

Correct answer is 'A'. Can you explain this answer?

If owner’s capital is Rs. 50,000 liability is Rs. 30,000 and fixed assets is Rs. 70,000, then what is the value of current assets?

a)

Rs. 10,000

b)

Rs. 40,000

c)

Rs. 80,000

d)

Rs. 1,00,000

|

Malavika Basak answered |

According to the accounting equation:

Owner's capital= Assets- Liabilities

50,000= (70,000+ current assets)- 30,000

Current Assets= Rs. 10,000

Owner's capital= Assets- Liabilities

50,000= (70,000+ current assets)- 30,000

Current Assets= Rs. 10,000

Interpreting Financial Statements means:- a)Methodical classification of the data given in the financial statements.

- b)Preparation and presentation of the classified data in a manner useful to the users of financial statements.

- c)Systematic analysis of the recorded data so as to put information in usable from.

- d)Explaining the meaning and significance of the relationship of analysis of accounting data.

Correct answer is option 'D'. Can you explain this answer?

Interpreting Financial Statements means:

a)

Methodical classification of the data given in the financial statements.

b)

Preparation and presentation of the classified data in a manner useful to the users of financial statements.

c)

Systematic analysis of the recorded data so as to put information in usable from.

d)

Explaining the meaning and significance of the relationship of analysis of accounting data.

|

|

Alok Mehta answered |

Financial statement analysis (or financial analysis) is the process of reviewing and analyzing a company's financial statements to make better economic decisions. These statements include the income statement, balance sheet, statement of cash flows, and a statement of changes in equity.

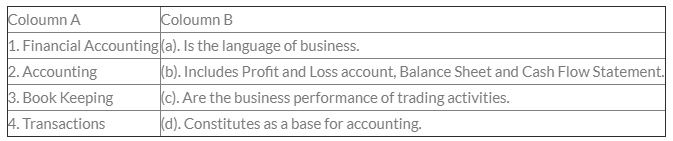

Match the following items from column A with column B.

- a)1-a, 2-b, 3-c, 4-d

- b) 1-b, 2-a, 3-d, 4-c

- c)1-a, 2-c, 3-b, 4-d

- d)1-d, 2-c, 3-a, 4-b

Correct answer is option 'B'. Can you explain this answer?

Match the following items from column A with column B.

a)

1-a, 2-b, 3-c, 4-d

b)

1-b, 2-a, 3-d, 4-c

c)

1-a, 2-c, 3-b, 4-d

d)

1-d, 2-c, 3-a, 4-b

|

|

Bhavadharini answered |

First , start from column B. First option is language of business. Accounting is the language of business. Hence 2-a. Even by solving only one, we can conclude that option B is right answer

Which of the following is not an event?

- a)Sale of goods for Rs.5,000

- b)Closing stock of worth Rs.4,000

- c)Purchase of goods for Rs.8,000

- d)Rent paid Rs.2,000

Correct answer is option 'B'. Can you explain this answer?

Which of the following is not an event?

a)

Sale of goods for Rs.5,000

b)

Closing stock of worth Rs.4,000

c)

Purchase of goods for Rs.8,000

d)

Rent paid Rs.2,000

|

Nilanjan Saha answered |

Event in Accounting

An event in accounting refers to any transaction or occurrence that affects a company's financial position and can be measured reliably. Let's understand the given options and identify the event.

a) Sale of goods for Rs.5,000 - It is a transaction but not an event as it has not affected the company's financial position.

b) Closing stock of worth Rs.4,000 - This is an event as it affects the company's financial position. The closing stock is an asset and its value is added to the company's balance sheet.

c) Purchase of goods for Rs.8,000 - This is a transaction but not an event as it has not affected the company's financial position.

d) Rent paid Rs.2,000 - This is a transaction but not an event as it has not affected the company's financial position.

Conclusion

From the above analysis, it is clear that the closing stock of worth Rs.4,000 is an event. The closing stock is an important component of the company's balance sheet and it affects the company's profitability. Therefore, the correct answer is option 'B'.

An event in accounting refers to any transaction or occurrence that affects a company's financial position and can be measured reliably. Let's understand the given options and identify the event.

a) Sale of goods for Rs.5,000 - It is a transaction but not an event as it has not affected the company's financial position.

b) Closing stock of worth Rs.4,000 - This is an event as it affects the company's financial position. The closing stock is an asset and its value is added to the company's balance sheet.

c) Purchase of goods for Rs.8,000 - This is a transaction but not an event as it has not affected the company's financial position.

d) Rent paid Rs.2,000 - This is a transaction but not an event as it has not affected the company's financial position.

Conclusion

From the above analysis, it is clear that the closing stock of worth Rs.4,000 is an event. The closing stock is an important component of the company's balance sheet and it affects the company's profitability. Therefore, the correct answer is option 'B'.

All of the following are functions of Accounting except- a)Decision making.

- b)Measurement.

- c)Forecasting.

- d)Ledger posting.

Correct answer is option 'D'. Can you explain this answer?

All of the following are functions of Accounting except

a)

Decision making.

b)

Measurement.

c)

Forecasting.

d)

Ledger posting.

|

|

Arjun Singhania answered |

It is clear that the functions of Accounting are

- identification,

- recording,

- classification and

- summarization of transactions

- ascertainment of results

- exhibition of financial position of an organization

- communication of necessary information derived from interpretation

- analysis to the interested parties including the management.

- Carter in his Advanced Accounts has also divided the functions of Accounting into two parts –

(a) permanent recording of financial transactions of a business,

(b) exhibiting the financial impact of each transaction or collective transactions over financial position of interested parties.

Yorston, Smyth and Brown have divided functions of Accounting in two groups;

(1) Historical or stewardship functions and

(2) Managerial functions. These are listed below;

Five Managerial Functions of Accounting

The management is to take various decisions for smooth running of the business. These decisions are taken by evaluation of past activities.

Accounting provides reports of past financial activities which are made suitable for decision-making through analysis.

These activities of Accounting are regarded as managerial functions.

Five Managerial Functions of Accounting are;

Control of financial policy and formation of planning.

Preparation of budget.

Cost control.

Evaluation of employees’ performance.

Prevention of errors and frauds.

On January 1, Sohan paid rent Rs. 5,000. This can be classified as - a)An event

- b)A transaction.

- c)A transaction as well as an event.

- d)Neither a transaction nor an event.

Correct answer is option 'B'. Can you explain this answer?

On January 1, Sohan paid rent Rs. 5,000. This can be classified as

a)

An event

b)

A transaction.

c)

A transaction as well as an event.

d)

Neither a transaction nor an event.

|

Srsps answered |

The correct answer is (b) A transaction.

A transaction is an economic event that involves the transfer of money or goods between two parties. In this case, Sohan paid rent of Rs. 5,000. This can be classified as a transaction because:

A transaction is an economic event that involves the transfer of money or goods between two parties. In this case, Sohan paid rent of Rs. 5,000. This can be classified as a transaction because:

1. Two parties are involved: Sohan (the payer) and the landlord (the receiver).

2. Transfer of value: Sohan is transferring Rs. 5,000 to the landlord in exchange for the use of the rented property.

3. Recordable: This transaction can be recorded in the financial books (e.g., rent expense account for Sohan and rent income account for the landlord).

An event, on the other hand, is a happening or occurrence that may or may not have financial consequences. In this case, the payment of rent is a transaction and not just an event because it involves a transfer of value between parties and can be recorded in financial books.

2. Transfer of value: Sohan is transferring Rs. 5,000 to the landlord in exchange for the use of the rented property.

3. Recordable: This transaction can be recorded in the financial books (e.g., rent expense account for Sohan and rent income account for the landlord).

An event, on the other hand, is a happening or occurrence that may or may not have financial consequences. In this case, the payment of rent is a transaction and not just an event because it involves a transfer of value between parties and can be recorded in financial books.

Financial statements users include: - a)Shareholders

- b)Government

- c)Vendors

- d)All of the above

Correct answer is option 'D'. Can you explain this answer?

Financial statements users include:

a)

Shareholders

b)

Government

c)

Vendors

d)

All of the above

|

Freedom Institute answered |

The correct answer is (d) All of the above. Financial statements are essential tools that provide valuable information to various users. These users can be classified into internal and external users. Here, let's explain each of them in detail:

Shareholders

- Shareholders are the owners of a company and have a direct interest in its financial performance.

- Financial statements provide information about a company's profitability, financial stability, and potential for growth, which are crucial factors for shareholders when making investment decisions.

- Shareholders use financial statements to assess the company's management effectiveness and the return on their investment.

Government

- Governments use financial statements to ensure companies comply with tax laws and regulations.

- Financial statements provide the necessary information for tax authorities to determine the amount of taxes owed by a company.

- Governments also use financial statements to assess the economic health of a country, as they provide insights into various industries and sectors.

Vendors

- Vendors, or suppliers, provide goods and services to a company, and they need to ensure that the company can pay for these goods and services.

- Financial statements help vendors assess a company's creditworthiness and financial stability.

- By analyzing financial statements, vendors can determine whether to extend credit to a company, negotiate payment terms, or require upfront payment for goods and services.

In conclusion, financial statements are essential tools for various users, including shareholders, government, and vendors. These users rely on financial statements to make informed decisions and ensure the financial stability and growth of companies, industries, and the overall economy.

Shareholders

- Shareholders are the owners of a company and have a direct interest in its financial performance.

- Financial statements provide information about a company's profitability, financial stability, and potential for growth, which are crucial factors for shareholders when making investment decisions.

- Shareholders use financial statements to assess the company's management effectiveness and the return on their investment.

Government

- Governments use financial statements to ensure companies comply with tax laws and regulations.

- Financial statements provide the necessary information for tax authorities to determine the amount of taxes owed by a company.

- Governments also use financial statements to assess the economic health of a country, as they provide insights into various industries and sectors.

Vendors

- Vendors, or suppliers, provide goods and services to a company, and they need to ensure that the company can pay for these goods and services.

- Financial statements help vendors assess a company's creditworthiness and financial stability.

- By analyzing financial statements, vendors can determine whether to extend credit to a company, negotiate payment terms, or require upfront payment for goods and services.

In conclusion, financial statements are essential tools for various users, including shareholders, government, and vendors. These users rely on financial statements to make informed decisions and ensure the financial stability and growth of companies, industries, and the overall economy.

Purposes of an accounting system include all the following except- a)Interpret and record the effects of business transaction.

- b)Classify the effects of transactions to facilitate the preparation of reports.

- c)Summarize and communicate information to decision makers.

- d)Dictate the specify types of business enterprise transactions that the enterprises may engage in.

Correct answer is option 'D'. Can you explain this answer?

Purposes of an accounting system include all the following except

a)

Interpret and record the effects of business transaction.

b)

Classify the effects of transactions to facilitate the preparation of reports.

c)

Summarize and communicate information to decision makers.

d)

Dictate the specify types of business enterprise transactions that the enterprises may engage in.

|

|

Nikita Singh answered |

The purpose of accounting is to accumulate and report on financial information about the performance, financial position, and cash flows of a business. This information is then used to reach decisions about how to manage the business, or invest in it, or lend money to it. This information is accumulated in accounting records with accounting transactions, which are recorded either through such standardized business transactions as customer invoicing or supplier invoices, or through more specialized transactions, known as journal entries.

accounting involves recording, classifying, summarizing, and interpreting financial information.So it does not define which type of business transactions that the enterprise must engage in.

______ was the root of financial accounting system:- a)Social accounting

- b)Stewardship accounting

- c)Management accounting

- d)Responsibility accounting

Correct answer is 'B'. Can you explain this answer?

______ was the root of financial accounting system:

a)

Social accounting

b)

Stewardship accounting

c)

Management accounting

d)

Responsibility accounting

|

|

Alok Mehta answered |

In its oldest form, accounting aided the stewards to discharge their stewardship function. The wealthy men employed steward to manage their property; the steward in return rendered an account periodically of their stewardship. Thus 'Stewardship Accounting' was the root of financial accounting system.

On March 31, 2006 after sale of goods worth Rs. 2,000, he is left with the closing stock of Rs. 10,000. This is- a)An event.

- b)A transaction.

- c)A transaction as well as an event.

- d)Neither a transaction nor an event.

Correct answer is 'A'. Can you explain this answer?

On March 31, 2006 after sale of goods worth Rs. 2,000, he is left with the closing stock of Rs. 10,000. This is

a)

An event.

b)

A transaction.

c)

A transaction as well as an event.

d)

Neither a transaction nor an event.

|

|

Poonam Reddy answered |

Unsold items i.e Closing stock is captured in the financial statements as 'Current Assets'.

An event can be internal or external. This is an internal event.

There is no exchange of goods or services or money. Hence, it cannot be termed as a 'transaction'.

If owner’s capital is Rs. 50,000 liability is Rs. 30,000 and fixed assets is Rs. 70,000, then what is the value of current assets?- a)Rs. 10,000

- b)Rs. 40,000

- c)Rs. 80,000

- d)Rs. 1,00,000

Correct answer is option 'A'. Can you explain this answer?

If owner’s capital is Rs. 50,000 liability is Rs. 30,000 and fixed assets is Rs. 70,000, then what is the value of current assets?

a)

Rs. 10,000

b)

Rs. 40,000

c)

Rs. 80,000

d)

Rs. 1,00,000

|

|

Jayant Mishra answered |

According to the accounting equation:

Owner's capital= Assets- Liabilities

50,000= (70,000+ current assets)- 30,000

Current Assets= Rs. 10,000

Purposes of an accounting system include all the following except- a)Interpret and record the effects of business transaction.

- b)Classify the effects of transaction to facilitate the preparation of reports.

- c)Summarize and communicate information to decision makers.

- d)Dictate the specific types of business enterprise transactions that the enterprises may engage in.

Correct answer is option 'D'. Can you explain this answer?

Purposes of an accounting system include all the following except

a)

Interpret and record the effects of business transaction.

b)

Classify the effects of transaction to facilitate the preparation of reports.

c)

Summarize and communicate information to decision makers.

d)

Dictate the specific types of business enterprise transactions that the enterprises may engage in.

|

|

Alok Mehta answered |

The purpose of accounting is to accumulate and report on financial information about the performance, financial position, and cash flows of a business. This information is then used to reach decisions about how to manage the business, or invest in it, or lend money to it. This information is accumulated in accounting records with accounting transactions, which are recorded either through such standardized business transactions as customer invoicing or supplier invoices, or through more specialized transactions, known as journal entries.

Once this financial information has been stored in the accounting records, it is usually compiled into financial statements, which include the following documents:

Income statement

Balance sheet

Statement of cash flows

Statement of retained earnings

Disclosures that accompany the financial statements

Financial statements are assembled under certain sets of rules, known as accounting frameworks, of which the best known are Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS). The results shown in financial statements can vary somewhat, depending on the framework used. The framework that a business uses depends upon which one the recipient of the financial statements wants. Thus, a European investor might want to see financial statements based on IFRS, while an American investor might want to see statements that comply with GAAP.

The accountant may generate additional reports for special purposes, such as determining the profit on sale of a product, or the revenues generated from a particular sales region. These are usually considered to be managerial reports, rather than the financial reports issued to outsiders.

Thus, the purpose of accounting centers on the collection and subsequent reporting of financial information.

Financial accounting information is characterized by all of the following except- a)It is historical in nature.

- b)It is factual, so it does not require judgement to prepare.

- c)It results from inexact and appropriate measures.

- d)It is enhanced by management’s explanation.

Correct answer is option 'B'. Can you explain this answer?

Financial accounting information is characterized by all of the following except

a)

It is historical in nature.

b)

It is factual, so it does not require judgement to prepare.

c)

It results from inexact and appropriate measures.

d)

It is enhanced by management’s explanation.

|

|

Kavita Joshi answered |

It is historical in nature. It is used mainly by creditors, investors, and potential creditors and investors.

________ of American Institute of Certified Public Accountants enumerated the functions of Accounting:- a)Accounting Principles Board

- b)Accounting Standards Board

- c)Accounting Concepts Board

- d)None of these

Correct answer is option 'A'. Can you explain this answer?

________ of American Institute of Certified Public Accountants enumerated the functions of Accounting:

a)

Accounting Principles Board

b)

Accounting Standards Board

c)

Accounting Concepts Board

d)

None of these

|

|

Arjun Singhania answered |

The Accounting Principles Board (APB) was the former authoritative body of the American Institute of Certified Public Accountants (AICPA) formed in 1959. It was replaced in 1973 by the Financial Accounting Standards Board (FASB). The purpose of the APB was to issue guidelines and rules on accounting principles. Some of the opinions released by the APB still stand as part of the Generally Accepted Accounting Principles (GAAP), but most have been either amended or entirely superseded by FASB statements.

The direct advantage of accounting do not include: - a)Preparation of financial statements

- b)Competitive advantage

- c)Ascertainment of profit or loss

- d)Information to interested groups

Correct answer is option 'B'. Can you explain this answer?

The direct advantage of accounting do not include:

a)

Preparation of financial statements

b)

Competitive advantage

c)

Ascertainment of profit or loss

d)

Information to interested groups

|

|

Arun Khanna answered |

Accounting is defined as the art of recording, classifying, summarizing, analyzing, interpretation and communicating the results of transactions and events which are of financial character. Hence, it includes preparation of final accounts, ascertainment of profit or loss and its communication to users, but it does not includes any kind of competitive advantage.

Which of the following is an example of the Golden Rule of Accounting for Nominal Accounts?

- a)Debit what comes in, Credit what goes out

- b)Debit all expenses and losses, Credit all incomes and gains

- c)Debit the receiver, Credit the giver

- d)Debit what goes out, Credit what comes in

Correct answer is option 'B'. Can you explain this answer?

Which of the following is an example of the Golden Rule of Accounting for Nominal Accounts?

a)

Debit what comes in, Credit what goes out

b)

Debit all expenses and losses, Credit all incomes and gains

c)

Debit the receiver, Credit the giver

d)

Debit what goes out, Credit what comes in

|

Bhavana Chauhan answered |

Understanding the Golden Rule of Accounting for Nominal Accounts

The Golden Rule of Accounting provides a framework for recording financial transactions. It consists of three main rules, one for each type of account: real accounts, personal accounts, and nominal accounts.

Nominal Accounts Explained

Nominal accounts are used to record expenses, losses, incomes, and gains. They are temporary accounts that are closed at the end of each accounting period. The primary aim of these accounts is to track a business's performance over time.

Golden Rule for Nominal Accounts

The Golden Rule for Nominal Accounts states:

- Debit all expenses and losses

- Credit all incomes and gains

This means that when a business incurs an expense or loss, the nominal account is debited to reflect the decrease in equity. Conversely, when income or gains are realized, the account is credited to show an increase in equity.

Why Option B is Correct

Option B: "Debit all expenses and losses, Credit all incomes and gains" is the correct answer because it accurately reflects the treatment of nominal accounts under the Golden Rule. Here’s why:

- Expenses and Losses: When a business spends money or incurs a loss, it reduces its net profit; hence these transactions are debited.

- Incomes and Gains: When a business earns revenue or realizes a gain, it increases its net profit; therefore, these transactions are credited.

Conclusion

Understanding the Golden Rule for nominal accounts is crucial for accurate financial reporting. By following this rule, businesses can effectively track their performance, ensuring that all financial statements reflect the true financial position of the entity.

The Golden Rule of Accounting provides a framework for recording financial transactions. It consists of three main rules, one for each type of account: real accounts, personal accounts, and nominal accounts.

Nominal Accounts Explained

Nominal accounts are used to record expenses, losses, incomes, and gains. They are temporary accounts that are closed at the end of each accounting period. The primary aim of these accounts is to track a business's performance over time.

Golden Rule for Nominal Accounts

The Golden Rule for Nominal Accounts states:

- Debit all expenses and losses

- Credit all incomes and gains

This means that when a business incurs an expense or loss, the nominal account is debited to reflect the decrease in equity. Conversely, when income or gains are realized, the account is credited to show an increase in equity.

Why Option B is Correct

Option B: "Debit all expenses and losses, Credit all incomes and gains" is the correct answer because it accurately reflects the treatment of nominal accounts under the Golden Rule. Here’s why:

- Expenses and Losses: When a business spends money or incurs a loss, it reduces its net profit; hence these transactions are debited.

- Incomes and Gains: When a business earns revenue or realizes a gain, it increases its net profit; therefore, these transactions are credited.

Conclusion

Understanding the Golden Rule for nominal accounts is crucial for accurate financial reporting. By following this rule, businesses can effectively track their performance, ensuring that all financial statements reflect the true financial position of the entity.

Financial statements do not consider- a)Assets expressed in monetary terms.

- b)Liabilities expressed in monetary terms.

- c)Assets expressed in non-monetary terms.

- d)Assets and liabilities expressed in non-monetary terms

Correct answer is option 'D'. Can you explain this answer?

Financial statements do not consider

a)

Assets expressed in monetary terms.

b)

Liabilities expressed in monetary terms.

c)

Assets expressed in non-monetary terms.

d)

Assets and liabilities expressed in non-monetary terms

|

|

Rajat Patel answered |

Non-monetary asset. An asset (such as equipment, inventory, land, or plant) that does not have a fixed exchange cash value, but whose value depends on economic conditions.

Gross Book Value of a fixed assets is its- a)Market Value

- b)Realisable Value

- c)cost less depreciation

- d)Historical Cost

Correct answer is option 'D'. Can you explain this answer?

Gross Book Value of a fixed assets is its

a)

Market Value

b)

Realisable Value

c)

cost less depreciation

d)

Historical Cost

|

Nipun Tuteja answered |

- Gross Book Value refers to the original cost of acquiring a fixed asset.

- It is recorded at the Historical Cost, which is the purchase price or construction cost.

- This value does not account for depreciation or any market fluctuations.

- Depreciation is later subtracted from the gross book value to find the net book value.

Therefore, the correct answer is D: Historical Cost.

The objective of wealth maximization takes into account - a) Amount of returns expected

- b) Timing of anticipated returns

- c) Risk associated with uncertainty of returns

- d) All of the above

Correct answer is option 'D'. Can you explain this answer?

The objective of wealth maximization takes into account

a)

Amount of returns expected

b)

Timing of anticipated returns

c)

Risk associated with uncertainty of returns

d)

All of the above

|

Ruchi Mishra answered |

Wealth maximization is a modern approach to financial management. Maximization of profit used to be the main aim of a business and financial management till the concept of wealth maximization came into being. It is a superior goal compared to profit maximization as it takes broader arena into consideration.

All of the following are functions of Accounting except- a)Decision making

- b)Measurement

- c)Forecasting

- d)Ledger posting

Correct answer is option 'D'. Can you explain this answer?

All of the following are functions of Accounting except

a)

Decision making

b)

Measurement

c)

Forecasting

d)

Ledger posting

|

Simran Mishra answered |

Understanding Accounting Functions

Accounting is a crucial discipline that encompasses various functions aimed at maintaining financial integrity and facilitating informed decision-making. Among the functions listed, the role of ledger posting stands out as an activity rather than a core function.

Functions of Accounting

- Decision Making:

Accounting provides vital financial information that aids stakeholders in making informed decisions. By analyzing financial data, businesses can strategize their operations effectively.

- Measurement:

One of the primary functions of accounting is to measure financial performance and position. This involves quantifying economic events and transactions to assess the business's health.

- Forecasting:

Accounting plays a significant role in forecasting future financial performance. By analyzing historical data, businesses can project future revenues, expenses, and cash flows, guiding strategic planning.

Why Ledger Posting is Not a Function

- Definition:

Ledger posting refers to the process of transferring journal entries to the general ledger. This is a procedural step in the accounting cycle.

- Nature of Activity:

While ledger posting is essential for maintaining accurate financial records, it does not directly contribute to the analytical or strategic aspects of accounting. Instead, it serves as a foundational activity that supports the functions of decision making, measurement, and forecasting.

- Conclusion:

Thus, while all options listed are important in accounting, ledger posting is merely a process that facilitates the accounting function rather than a function itself.

In summary, the correct answer is option 'D' because ledger posting is an activity rather than a core function of accounting.

Accounting is a crucial discipline that encompasses various functions aimed at maintaining financial integrity and facilitating informed decision-making. Among the functions listed, the role of ledger posting stands out as an activity rather than a core function.

Functions of Accounting

- Decision Making:

Accounting provides vital financial information that aids stakeholders in making informed decisions. By analyzing financial data, businesses can strategize their operations effectively.

- Measurement:

One of the primary functions of accounting is to measure financial performance and position. This involves quantifying economic events and transactions to assess the business's health.

- Forecasting:

Accounting plays a significant role in forecasting future financial performance. By analyzing historical data, businesses can project future revenues, expenses, and cash flows, guiding strategic planning.

Why Ledger Posting is Not a Function

- Definition:

Ledger posting refers to the process of transferring journal entries to the general ledger. This is a procedural step in the accounting cycle.

- Nature of Activity:

While ledger posting is essential for maintaining accurate financial records, it does not directly contribute to the analytical or strategic aspects of accounting. Instead, it serves as a foundational activity that supports the functions of decision making, measurement, and forecasting.

- Conclusion:

Thus, while all options listed are important in accounting, ledger posting is merely a process that facilitates the accounting function rather than a function itself.

In summary, the correct answer is option 'D' because ledger posting is an activity rather than a core function of accounting.

Financial statements users include: - a)Shareholders

- b)Government

- c)Vendors

- d)All of the above

Correct answer is option 'D'. Can you explain this answer?

Financial statements users include:

a)

Shareholders

b)

Government

c)

Vendors

d)

All of the above

|

|

Arjun Singhania answered |

Users of financial statements may be internal or external. Internal users may include Board of Directors, Partners, Managers, officers etc and External users may include investors, shareholders, government, vendors, suppliers, etc. Hence, all are users in the given question.

Chapter doubts & questions for Unit 1: Meaning and Scope of Accounting - Accounting for CA Foundation 2025 is part of CA Foundation exam preparation. The chapters have been prepared according to the CA Foundation exam syllabus. The Chapter doubts & questions, notes, tests & MCQs are made for CA Foundation 2025 Exam. Find important definitions, questions, notes, meanings, examples, exercises, MCQs and online tests here.

Chapter doubts & questions of Unit 1: Meaning and Scope of Accounting - Accounting for CA Foundation in English & Hindi are available as part of CA Foundation exam.

Download more important topics, notes, lectures and mock test series for CA Foundation Exam by signing up for free.

Accounting for CA Foundation

68 videos|265 docs|83 tests

|

Contact Support

Our team is online on weekdays between 10 AM - 7 PM

Typical reply within 3 hours

|

Free Exam Preparation

at your Fingertips!

Access Free Study Material - Test Series, Structured Courses, Free Videos & Study Notes and Prepare for Your Exam With Ease

Join the 10M+ students on EduRev

Join the 10M+ students on EduRev

|

|

Create your account for free

OR

Forgot Password

OR

Signup to see your scores

go up within 7 days!

Access 1000+ FREE Docs, Videos and Tests

Takes less than 10 seconds to signup