All Exams >

CA Foundation >

Accounting for CA Foundation >

All Questions

All questions of Unit 3: Trial Balance for CA Foundation Exam

The Trial Balance of M/S RAM & Co. shows closing Stock of Rs. 30,000. It will be recorded in : - a)Trading account

- b)Profit and Loss account

- c)Balance sheet

- d)Both (a) and (c)

Correct answer is option 'C'. Can you explain this answer?

The Trial Balance of M/S RAM & Co. shows closing Stock of Rs. 30,000. It will be recorded in :

a)

Trading account

b)

Profit and Loss account

c)

Balance sheet

d)

Both (a) and (c)

|

Harshad Nair answered |

Please provide the necessary data to prepare the trial balance.

Opening and Closing Balance of Debtors A/c were Rs. 30,000 and 40,000 respectively cash collected from the debtors during the year was Rs. 2,40,000. Discount allowed to debtors for timely payment amounted to Rs. 15,000 and bad debts written off were Rs. 10,00. Goods sold on credit were:- a)Rs. 2,55,000

- b)Rs. 2,45,000

- c)Rs. 2,95,000

- d)Rs. 2,75,000

Correct answer is option 'D'. Can you explain this answer?

Opening and Closing Balance of Debtors A/c were Rs. 30,000 and 40,000 respectively cash collected from the debtors during the year was Rs. 2,40,000. Discount allowed to debtors for timely payment amounted to Rs. 15,000 and bad debts written off were Rs. 10,00. Goods sold on credit were:

a)

Rs. 2,55,000

b)

Rs. 2,45,000

c)

Rs. 2,95,000

d)

Rs. 2,75,000

|

Rithika Mukherjee answered |

Calculation of Closing Balance of Debtors A/c:

Cash collected from debtors during the year = Rs. 2,40,000

Discount allowed to debtors = Rs. 15,000

Bad debts written off = Rs. 10,000

Total amount received from debtors = Rs. 2,40,000 + Rs. 15,000 - Rs. 10,000 = Rs. 2,45,000

Closing balance of Debtors A/c = Opening balance + Goods sold on credit - Total amount received from debtors

Closing balance of Debtors A/c = Rs. 30,000 + Goods sold on credit - Rs. 2,45,000

Closing balance of Debtors A/c = Goods sold on credit - Rs. 2,15,000

Since the closing balance of Debtors A/c is Rs. 40,000,

Goods sold on credit = Rs. 40,000 + Rs. 2,15,000 = Rs. 2,55,000

Therefore, the correct option is D) Rs. 2,75,000

Cash collected from debtors during the year = Rs. 2,40,000

Discount allowed to debtors = Rs. 15,000

Bad debts written off = Rs. 10,000

Total amount received from debtors = Rs. 2,40,000 + Rs. 15,000 - Rs. 10,000 = Rs. 2,45,000

Closing balance of Debtors A/c = Opening balance + Goods sold on credit - Total amount received from debtors

Closing balance of Debtors A/c = Rs. 30,000 + Goods sold on credit - Rs. 2,45,000

Closing balance of Debtors A/c = Goods sold on credit - Rs. 2,15,000

Since the closing balance of Debtors A/c is Rs. 40,000,

Goods sold on credit = Rs. 40,000 + Rs. 2,15,000 = Rs. 2,55,000

Therefore, the correct option is D) Rs. 2,75,000

Which of the following in Trial Balance is contradictory to each other? __________.- a)Inventory and Drawings

- b)Sales and Purchase Return

- c)Carriage Inward and Outward

- d)Trade Receivable and Liability

Correct answer is option 'D'. Can you explain this answer?

Which of the following in Trial Balance is contradictory to each other? __________.

a)

Inventory and Drawings

b)

Sales and Purchase Return

c)

Carriage Inward and Outward

d)

Trade Receivable and Liability

|

Freedom Institute answered |

The correct option is D

A trial balance is the accounting equation of our business laid out in detail. It has our assets, expenses and drawings on the left (the debit side) and our liabilities, revenue and owner's equity on the right (the credit side).

Since inventory is an asset and drawings are expenses, both are debit items.

Sales are a form of income so go on the credit side of the trial balance.Purchases returns will reduce the expense so go on the credit side.

Carriage inwards in trial balance and Carriage outwards in trial balance are both treated as just another expense, so they are debit items

Trade receivables are revenues so are recorded on debit side and liability is recorded as a credit item.

Trial Balance is a :- a)Statement

- b)Account

- c)Summary

- d)Ledger

Correct answer is option 'A'. Can you explain this answer?

Trial Balance is a :

a)

Statement

b)

Account

c)

Summary

d)

Ledger

|

K Srivastava answered |

It is a statement because it has no Dr or cr side

Closing stock in the trial balance implies that.- a)It is already adjusted in the opening stock.

- b)It is adjusted in sales a/c

- c)It is adjusted in the purchase a/c

- d)None of these.

Correct answer is option 'C'. Can you explain this answer?

Closing stock in the trial balance implies that.

a)

It is already adjusted in the opening stock.

b)

It is adjusted in sales a/c

c)

It is adjusted in the purchase a/c

d)

None of these.

|

|

Nandini Iyer answered |

Closing stock is the leftover balance out of goods which were purchased during an accounting period. Total purchases are already included in the trial balance, Hence closing stock should not be included in the trial balance again. If it is included, the effect will be doubled.

Balances of the accounts are transferred to : - a)Trial Balance

- b)Trading Account

- c)Profit & Loss Account

- d)Balance sheet

Correct answer is option 'A'. Can you explain this answer?

Balances of the accounts are transferred to :

a)

Trial Balance

b)

Trading Account

c)

Profit & Loss Account

d)

Balance sheet

|

|

Arun Khanna answered |

A trial balance is a listing of the ledger accounts and their debit or credit balances to determine that debits equal credits in the recording process. Note that totals for the Debit and Credit entries come from the ending balance of the T-accounts or ledger cards.

Trial Balance under balance method is known as :- a)Gross Trial Balance

- b)Net Trial Balance

- c)Simple Trial balance

- d)Trial Balance Appropriation

Correct answer is option 'B'. Can you explain this answer?

Trial Balance under balance method is known as :

a)

Gross Trial Balance

b)

Net Trial Balance

c)

Simple Trial balance

d)

Trial Balance Appropriation

|

|

Arun Khanna answered |

Under the Balance Method of trial preparation, every ledger account is balanced and the balances thus determined are only carried forward to the trial balance. Since the balances of the ledger accounts are placed in the trial, it is known as Net Trial Balance. Under the Total Method of trial preparation, the totals of each side of ledger account are placed on trial balance. This is known as gross trial balance.

A Trial balance will not balance if - a)correct journal entry is posted twice.

- b)The purchase on credit basis is debited to purchases and credited to cash.

- c)Rs. 500 cash payment to creditors is debited to creditors for Rs. 50 and credited to cash as Rs.500.

- d)None of the above.

Correct answer is option 'C'. Can you explain this answer?

A Trial balance will not balance if

a)

correct journal entry is posted twice.

b)

The purchase on credit basis is debited to purchases and credited to cash.

c)

Rs. 500 cash payment to creditors is debited to creditors for Rs. 50 and credited to cash as Rs.500.

d)

None of the above.

|

Jay Chakraborty answered |

Explanation:

A trial balance is a statement that lists all the ledger accounts and their balances to check whether the total debits equal the total credits. If the trial balance does not balance, it indicates that there is an error in the accounting records.

The correct journal entry posted twice will not affect the trial balance because it will be recorded as equal debits and credits. Similarly, if a purchase on credit is debited to purchases and credited to cash, it will not affect the trial balance because the total debits and credits will remain the same.

However, if a cash payment to creditors is debited to creditors for Rs. 50 and credited to cash as Rs. 500, it will cause an imbalance in the trial balance. This is because the total debits and credits will not match, and the difference will be equal to the amount of the error, which in this case is Rs. 450.

Therefore, option C is the correct answer.

In summary, the reasons why a trial balance will not balance are:

- Posting the correct journal entry twice (will not affect the trial balance)

- Debiting a purchase on credit to purchases and crediting it to cash (will not affect the trial balance)

- Debiting a cash payment to creditors for a lesser amount and crediting it to cash for a higher amount (will cause an imbalance in the trial balance)

A trial balance is a statement that lists all the ledger accounts and their balances to check whether the total debits equal the total credits. If the trial balance does not balance, it indicates that there is an error in the accounting records.

The correct journal entry posted twice will not affect the trial balance because it will be recorded as equal debits and credits. Similarly, if a purchase on credit is debited to purchases and credited to cash, it will not affect the trial balance because the total debits and credits will remain the same.

However, if a cash payment to creditors is debited to creditors for Rs. 50 and credited to cash as Rs. 500, it will cause an imbalance in the trial balance. This is because the total debits and credits will not match, and the difference will be equal to the amount of the error, which in this case is Rs. 450.

Therefore, option C is the correct answer.

In summary, the reasons why a trial balance will not balance are:

- Posting the correct journal entry twice (will not affect the trial balance)

- Debiting a purchase on credit to purchases and crediting it to cash (will not affect the trial balance)

- Debiting a cash payment to creditors for a lesser amount and crediting it to cash for a higher amount (will cause an imbalance in the trial balance)

Agreement of Trial Balance is not a _______ proof of accuracy. - a)Submissive

- b)Inclusive

- c)Exhaustive

- d)Conclusive

Correct answer is option 'D'. Can you explain this answer?

Agreement of Trial Balance is not a _______ proof of accuracy.

a)

Submissive

b)

Inclusive

c)

Exhaustive

d)

Conclusive

|

|

Anubhuti Jain answered |

It's conclusive because it shows all balances of assets and liabilities at end of year which give glimpse of financial position of business

The preparation of trial balance is for : - a)Locating errors of commission

- b)Locating errors of principle

- c)Locating clerical errors

- d)All of the above

Correct answer is option 'C'. Can you explain this answer?

The preparation of trial balance is for :

a)

Locating errors of commission

b)

Locating errors of principle

c)

Locating clerical errors

d)

All of the above

|

Arya Reddy answered |

The preparation of trial balance is essential in the accounting process as it helps in identifying and locating clerical errors. The trial balance is a statement that lists all the balances of the ledger accounts in the form of debit and credit. It serves as a tool to ensure the accuracy of the accounting records and provides a summary of the financial transactions recorded in the ledger.

Locating Clerical Errors:

One of the primary purposes of preparing a trial balance is to identify and locate clerical errors. Clerical errors can occur during the recording, posting, or totaling of transactions in the accounting system. These errors may include mistakes in recording the wrong amount, posting entries to the wrong accounts, or incorrectly totaling the debits and credits. By comparing the totals of the debit and credit columns in the trial balance, any discrepancies or imbalances can be easily identified, indicating the presence of clerical errors.

Identifying Errors of Commission and Principle:

While the trial balance is primarily used to locate clerical errors, it can also indirectly help in identifying errors of commission and principle. Errors of commission refer to mistakes made intentionally or unintentionally while recording transactions. These errors may involve incorrect classification, double counting, or omission of transactions. Errors of principle, on the other hand, occur when fundamental accounting principles are violated, such as recording revenue as an expense or vice versa.

Although the trial balance may not directly highlight errors of commission or principle, it can indirectly point towards their existence. If the trial balance does not balance, it suggests that there is an error somewhere in the accounting records. Further investigation and scrutiny will be required to identify the nature of the error, whether it is a clerical error, an error of commission, or an error of principle. Therefore, while the trial balance does not directly locate errors of commission or principle, it plays a crucial role in indicating their presence, leading to further investigation and correction.

In conclusion, the preparation of a trial balance is primarily for locating clerical errors. However, it indirectly helps in identifying errors of commission and principle by highlighting imbalances or discrepancies in the debit and credit totals. Therefore, the correct answer to the question is option 'C'.

Locating Clerical Errors:

One of the primary purposes of preparing a trial balance is to identify and locate clerical errors. Clerical errors can occur during the recording, posting, or totaling of transactions in the accounting system. These errors may include mistakes in recording the wrong amount, posting entries to the wrong accounts, or incorrectly totaling the debits and credits. By comparing the totals of the debit and credit columns in the trial balance, any discrepancies or imbalances can be easily identified, indicating the presence of clerical errors.

Identifying Errors of Commission and Principle:

While the trial balance is primarily used to locate clerical errors, it can also indirectly help in identifying errors of commission and principle. Errors of commission refer to mistakes made intentionally or unintentionally while recording transactions. These errors may involve incorrect classification, double counting, or omission of transactions. Errors of principle, on the other hand, occur when fundamental accounting principles are violated, such as recording revenue as an expense or vice versa.

Although the trial balance may not directly highlight errors of commission or principle, it can indirectly point towards their existence. If the trial balance does not balance, it suggests that there is an error somewhere in the accounting records. Further investigation and scrutiny will be required to identify the nature of the error, whether it is a clerical error, an error of commission, or an error of principle. Therefore, while the trial balance does not directly locate errors of commission or principle, it plays a crucial role in indicating their presence, leading to further investigation and correction.

In conclusion, the preparation of a trial balance is primarily for locating clerical errors. However, it indirectly helps in identifying errors of commission and principle by highlighting imbalances or discrepancies in the debit and credit totals. Therefore, the correct answer to the question is option 'C'.

Trial Balance is prepared on :- a)End of the year

- b)A particular date

- c)For the period ending

- d)Both “a” and “b”

Correct answer is option 'B'. Can you explain this answer?

Trial Balance is prepared on :

a)

End of the year

b)

A particular date

c)

For the period ending

d)

Both “a” and “b”

|

|

Arun Khanna answered |

Trial Balance is a list of closing balances of ledger accounts on a certain date and is the first step towards the preparation of financial statements. It is usually prepared at the end of an accounting period to assist in the drafting of financial statements.

Rs. 1500 received from sub-tenant for rent and entered correctly in the cash book is posted to the debit of the rent account. In the trial balance- a)The debit total will be greater by Rs. 3000 that the credit total.

- b)The debit total will be greater by Rs. 1500 that the credit total.

- c)Subject to other entries being correct the total will agree.

- d)None of the above.

Correct answer is option 'A'. Can you explain this answer?

Rs. 1500 received from sub-tenant for rent and entered correctly in the cash book is posted to the debit of the rent account. In the trial balance

a)

The debit total will be greater by Rs. 3000 that the credit total.

b)

The debit total will be greater by Rs. 1500 that the credit total.

c)

Subject to other entries being correct the total will agree.

d)

None of the above.

|

Srsps answered |

The correct option is A.

The correct journal entry should be

Cash Account Dr. 1500

To Rent Account 1500

The entry in the cash book was correct, but the rent account was debited, which is incorrect because it should have been credited. Since the amount which has to be credited is not credited but instead is debited. So first the error is to be rectified, that is it will be credited to nullify the effect and then it will be credited again which should have been the correct entry. This means that the amount credited is doubled which will be 3000.

Bhandari’s trial balance was showing difference of Rs. 5,000 (debit side exceeds). While checking of total sales register, he found that the total is overcast by Rs. 2,000. After correction in sales register what would be the difference in his trial balance. - a)Debit side exceeds by Rs. 7,000

- b)Debit side exceeds by Rs. 5,000

- c)Debit side exceeds by Rs. 3,000

- d)Credit side exceeds by Rs. 3,000

Correct answer is option 'A'. Can you explain this answer?

Bhandari’s trial balance was showing difference of Rs. 5,000 (debit side exceeds). While checking of total sales register, he found that the total is overcast by Rs. 2,000. After correction in sales register what would be the difference in his trial balance.

a)

Debit side exceeds by Rs. 7,000

b)

Debit side exceeds by Rs. 5,000

c)

Debit side exceeds by Rs. 3,000

d)

Credit side exceeds by Rs. 3,000

|

|

Arjun Singhania answered |

With a difference of Rs. 5,000 shown in trial balance debit side was exceeding. With a reduction in the sales A/c by Rs. 2,000 Credit balance reduces by Rs. 2,000 which causes increase in debit by Rs. 2,000 i.e. the difference in Trial Balance now will be Rs. 7,000; debit side exceeding credit side.

A list which contains balances of accounts to know whether the debit and credit balances are matched.- a)Balance sheet

- b)Day Book

- c)Journal

- d)Trial balance

Correct answer is option 'D'. Can you explain this answer?

A list which contains balances of accounts to know whether the debit and credit balances are matched.

a)

Balance sheet

b)

Day Book

c)

Journal

d)

Trial balance

|

Abhiram Choudhary answered |

The correct answer is option 'D' - Trial balance.

Explanation:

A Trial balance is a list of all the balances of accounts in a company's general ledger. It is prepared at the end of an accounting period to ensure that the debit and credit balances are matched and the books are in balance. Here is a detailed explanation:

1. Balance Sheet:

The balance sheet is a financial statement that provides a snapshot of a company's financial position at a specific point in time. It shows the assets, liabilities, and equity of the company. While it provides information about the balances of various accounts, it doesn't directly indicate whether the debit and credit balances are matched.

2. Day Book:

The day book, also known as the journal or book of original entry, is where all the financial transactions of a business are recorded in chronological order. It serves as a record of all the debits and credits, but it does not provide a consolidated view of the balances of different accounts.

3. Journal:

The journal is a book of original entry where all the financial transactions are recorded in chronological order. It includes a detailed description of each transaction, the accounts involved, and the corresponding debit and credit amounts. However, it does not directly show whether the debit and credit balances are matched.

4. Trial Balance:

A trial balance is a statement that lists all the accounts and their respective debit or credit balances. It is prepared by taking the balances from the general ledger accounts. The total of the debit balances should equal the total of the credit balances if the books are in balance. If they don't match, it indicates that there are errors in the recording of transactions, such as omissions, duplications, or incorrect postings.

In conclusion, while all the options listed (balance sheet, day book, journal) provide information about account balances, the trial balance specifically allows us to check whether the debit and credit balances are matched. It provides a summarized view of the accounts and helps in identifying errors before preparing the financial statements.

Explanation:

A Trial balance is a list of all the balances of accounts in a company's general ledger. It is prepared at the end of an accounting period to ensure that the debit and credit balances are matched and the books are in balance. Here is a detailed explanation:

1. Balance Sheet:

The balance sheet is a financial statement that provides a snapshot of a company's financial position at a specific point in time. It shows the assets, liabilities, and equity of the company. While it provides information about the balances of various accounts, it doesn't directly indicate whether the debit and credit balances are matched.

2. Day Book:

The day book, also known as the journal or book of original entry, is where all the financial transactions of a business are recorded in chronological order. It serves as a record of all the debits and credits, but it does not provide a consolidated view of the balances of different accounts.

3. Journal:

The journal is a book of original entry where all the financial transactions are recorded in chronological order. It includes a detailed description of each transaction, the accounts involved, and the corresponding debit and credit amounts. However, it does not directly show whether the debit and credit balances are matched.

4. Trial Balance:

A trial balance is a statement that lists all the accounts and their respective debit or credit balances. It is prepared by taking the balances from the general ledger accounts. The total of the debit balances should equal the total of the credit balances if the books are in balance. If they don't match, it indicates that there are errors in the recording of transactions, such as omissions, duplications, or incorrect postings.

In conclusion, while all the options listed (balance sheet, day book, journal) provide information about account balances, the trial balance specifically allows us to check whether the debit and credit balances are matched. It provides a summarized view of the accounts and helps in identifying errors before preparing the financial statements.

Difference of totals of both debit and credit side of trial balance is transferred to : - a)Trading account

- b)Suspense account

- c)Difference account

- d)Miscellaneous account

Correct answer is option 'B'. Can you explain this answer?

Difference of totals of both debit and credit side of trial balance is transferred to :

a)

Trading account

b)

Suspense account

c)

Difference account

d)

Miscellaneous account

|

Mansi Mukherjee answered |

Suspense Account in Trial Balance

Explanation:

When there is a difference in the totals of the debit and credit side of the trial balance, it implies that there has been an error in the accounting process. In such a situation, the difference is transferred to a suspense account. The suspense account is a temporary account created to hold the difference until the error is traced and rectified.

Reasons for Difference in Trial Balance:

There can be several reasons for the difference in the trial balance, including:

- Errors in recording transactions

- Omissions in recording transactions

- Wrong totaling of accounts

- Errors in balancing accounts

Role of Suspense Account:

The Suspense account plays a crucial role in the accounting process as it helps in identifying errors and rectifying them. The suspense account acts as a holding account, where the difference in the trial balance is transferred until the error is discovered and rectified.

Rectification of Errors:

Once the error is identified, it is rectified, and the necessary adjustments are made. The correction entry is then passed to transfer the balance from the suspense account to the correct account.

Conclusion:

In conclusion, the suspense account is used to hold the difference in the trial balance until the error is discovered and rectified. It is a temporary account that helps in identifying errors and ensures that the final accounts are accurate.

Explanation:

When there is a difference in the totals of the debit and credit side of the trial balance, it implies that there has been an error in the accounting process. In such a situation, the difference is transferred to a suspense account. The suspense account is a temporary account created to hold the difference until the error is traced and rectified.

Reasons for Difference in Trial Balance:

There can be several reasons for the difference in the trial balance, including:

- Errors in recording transactions

- Omissions in recording transactions

- Wrong totaling of accounts

- Errors in balancing accounts

Role of Suspense Account:

The Suspense account plays a crucial role in the accounting process as it helps in identifying errors and rectifying them. The suspense account acts as a holding account, where the difference in the trial balance is transferred until the error is discovered and rectified.

Rectification of Errors:

Once the error is identified, it is rectified, and the necessary adjustments are made. The correction entry is then passed to transfer the balance from the suspense account to the correct account.

Conclusion:

In conclusion, the suspense account is used to hold the difference in the trial balance until the error is discovered and rectified. It is a temporary account that helps in identifying errors and ensures that the final accounts are accurate.

A Trial Balance contains the balances of : - a)Only Personal and Real accounts

- b)Only Real and Nominal accounts

- c)Only Nominal and Personal accounts

- d)All accounts

Correct answer is option 'D'. Can you explain this answer?

A Trial Balance contains the balances of :

a)

Only Personal and Real accounts

b)

Only Real and Nominal accounts

c)

Only Nominal and Personal accounts

d)

All accounts

|

Swara Saha answered |

Explanation:

A trial balance is a statement that lists all the balances of all the accounts in the ledger to check if the total of debits is equal to the total of credits.

All accounts include three types of accounts: Personal, Real, and Nominal. Therefore, a trial balance contains the balances of all accounts.

Types of accounts:

Importance of trial balance:

A trial balance is prepared to ensure the accuracy of the ledger accounts. It helps in identifying errors and omissions in the recording of transactions. If the total of debits and credits does not match, then it indicates that there is some error in the accounting records.

Conclusion:

In conclusion, a trial balance contains the balances of all accounts, including personal, real, and nominal accounts. It is an important tool in the accounting process that helps in detecting errors and ensuring the accuracy of accounting records.

A trial balance is a statement that lists all the balances of all the accounts in the ledger to check if the total of debits is equal to the total of credits.

All accounts include three types of accounts: Personal, Real, and Nominal. Therefore, a trial balance contains the balances of all accounts.

Types of accounts:

- Personal accounts: These accounts are related to individuals, firms, or organizations with whom a business has transactions. For example, accounts of debtors and creditors.

- Real accounts: These accounts are related to assets and liabilities of a business. For example, accounts of land, building, machinery, etc.

- Nominal accounts: These accounts are related to expenses, losses, incomes, and gains of a business. For example, accounts of salaries, rent, interest, commission, etc.

Importance of trial balance:

A trial balance is prepared to ensure the accuracy of the ledger accounts. It helps in identifying errors and omissions in the recording of transactions. If the total of debits and credits does not match, then it indicates that there is some error in the accounting records.

Conclusion:

In conclusion, a trial balance contains the balances of all accounts, including personal, real, and nominal accounts. It is an important tool in the accounting process that helps in detecting errors and ensuring the accuracy of accounting records.

Which of the following will not affect the agreement of Trial Balance ?- a)An amount of purchase of Rs. 10,000 recorded in Cr. A/c as Rs. 1,000

- b)Customer account debited with the amount of cash received

- c)An Entry of debit of Rs. 1,000 was credit with twice the amount.

- d)An Entry posted twice in the ledger.

Correct answer is option 'D'. Can you explain this answer?

Which of the following will not affect the agreement of Trial Balance ?

a)

An amount of purchase of Rs. 10,000 recorded in Cr. A/c as Rs. 1,000

b)

Customer account debited with the amount of cash received

c)

An Entry of debit of Rs. 1,000 was credit with twice the amount.

d)

An Entry posted twice in the ledger.

|

Janhavi Banerjee answered |

Explanation:

Trial balance is a statement of debit and credit balances of all ledger accounts. It is prepared to ensure that the total of debit balances is equal to the total of credit balances. If the trial balance does not agree, it indicates that there is an error in the accounting records. The following options explain which entry will not affect the agreement of the trial balance.

Option A: An amount of purchase of Rs. 10,000 recorded in Cr. A/c as Rs. 1,000

This entry will affect the agreement of the trial balance because it is an error of omission. The purchase account should have been debited with Rs. 10,000, but instead, it has been credited with Rs. 1,000. This will result in a difference between the debit and credit balances.

Option B: Customer account debited with the amount of cash received

This entry will not affect the agreement of the trial balance because it is a correct entry. When a customer pays cash, the cash account is debited, and the customer account is credited. This will result in an equal debit and credit balance.

Option C: An Entry of debit of Rs. 1,000 was credit with twice the amount.

This entry will affect the agreement of the trial balance because it is an error of commission. The debit account should have been credited with Rs. 1,000, but instead, it has been credited with Rs. 2,000. This will result in a difference between the debit and credit balances.

Option D: An Entry posted twice in the ledger.

This entry will not affect the agreement of the trial balance because it is a compensating error. If an entry is posted twice in the ledger, the debit and credit balances will be doubled. As a result, the total debit and credit balances will remain the same, and the trial balance will still agree.

Conclusion:

The correct answer is option D because a compensating error will not affect the agreement of the trial balance.

Trial balance is a statement of debit and credit balances of all ledger accounts. It is prepared to ensure that the total of debit balances is equal to the total of credit balances. If the trial balance does not agree, it indicates that there is an error in the accounting records. The following options explain which entry will not affect the agreement of the trial balance.

Option A: An amount of purchase of Rs. 10,000 recorded in Cr. A/c as Rs. 1,000

This entry will affect the agreement of the trial balance because it is an error of omission. The purchase account should have been debited with Rs. 10,000, but instead, it has been credited with Rs. 1,000. This will result in a difference between the debit and credit balances.

Option B: Customer account debited with the amount of cash received

This entry will not affect the agreement of the trial balance because it is a correct entry. When a customer pays cash, the cash account is debited, and the customer account is credited. This will result in an equal debit and credit balance.

Option C: An Entry of debit of Rs. 1,000 was credit with twice the amount.

This entry will affect the agreement of the trial balance because it is an error of commission. The debit account should have been credited with Rs. 1,000, but instead, it has been credited with Rs. 2,000. This will result in a difference between the debit and credit balances.

Option D: An Entry posted twice in the ledger.

This entry will not affect the agreement of the trial balance because it is a compensating error. If an entry is posted twice in the ledger, the debit and credit balances will be doubled. As a result, the total debit and credit balances will remain the same, and the trial balance will still agree.

Conclusion:

The correct answer is option D because a compensating error will not affect the agreement of the trial balance.

Methods of preparation of Trial Balance are : - a)Balance Method

- b)Total Method

- c)Total and Balance Method

- d)All of these

Correct answer is option 'D'. Can you explain this answer?

Methods of preparation of Trial Balance are :

a)

Balance Method

b)

Total Method

c)

Total and Balance Method

d)

All of these

|

Shail Chakraborty answered |

Methods of Preparation of Trial Balance

Trial Balance is a statement that shows the list of all balances of ledger accounts at the end of an accounting period. It is an important tool used in the process of preparing financial statements. There are different methods of preparation of trial balance:

1. Balance Method:

In this method, the balances of all ledger accounts are listed in a column. The debit balances are listed in one column and the credit balances are listed in another column. The total of both columns should be equal if the books of accounts are correctly maintained. This method is simple and easy to understand.

2. Total Method:

In this method, the total of debit and credit sides of each ledger account is listed in separate columns. The total of debit column and the total of credit column should be equal. This method is also easy to understand.

3. Total and Balance Method:

In this method, the balances of all ledger accounts are listed in a column like the balance method. Additionally, the total of debit and credit columns of each ledger account is also listed in separate columns like the total method. This method combines both the balance and total methods. It is a comprehensive method and ensures the accuracy of trial balance.

4. All of these:

All the above methods are valid and widely used for preparing a trial balance. The choice of method depends on the preference of the accountant or the organization. The main objective of all methods is to ensure the accuracy of the trial balance.

Conclusion:

Trial balance is a crucial step in the accounting process. It helps in identifying errors and omissions in the books of accounts. The preparation of trial balance is done using different methods like balance method, total method, total and balance method, and all of these. The choice of method depends on the preference of the accountant or the organization.

Trial Balance is a statement that shows the list of all balances of ledger accounts at the end of an accounting period. It is an important tool used in the process of preparing financial statements. There are different methods of preparation of trial balance:

1. Balance Method:

In this method, the balances of all ledger accounts are listed in a column. The debit balances are listed in one column and the credit balances are listed in another column. The total of both columns should be equal if the books of accounts are correctly maintained. This method is simple and easy to understand.

2. Total Method:

In this method, the total of debit and credit sides of each ledger account is listed in separate columns. The total of debit column and the total of credit column should be equal. This method is also easy to understand.

3. Total and Balance Method:

In this method, the balances of all ledger accounts are listed in a column like the balance method. Additionally, the total of debit and credit columns of each ledger account is also listed in separate columns like the total method. This method combines both the balance and total methods. It is a comprehensive method and ensures the accuracy of trial balance.

4. All of these:

All the above methods are valid and widely used for preparing a trial balance. The choice of method depends on the preference of the accountant or the organization. The main objective of all methods is to ensure the accuracy of the trial balance.

Conclusion:

Trial balance is a crucial step in the accounting process. It helps in identifying errors and omissions in the books of accounts. The preparation of trial balance is done using different methods like balance method, total method, total and balance method, and all of these. The choice of method depends on the preference of the accountant or the organization.

Trial Balance creates _______accuracy. - a)Principle

- b)Arithmetical

- c)Clerical

- d)None

Correct answer is option 'B'. Can you explain this answer?

Trial Balance creates _______accuracy.

a)

Principle

b)

Arithmetical

c)

Clerical

d)

None

|

Sparsh Sen answered |

Arithmetical Accuracy in Trial Balance

Trial Balance is a statement that lists all the ledger account balances in debit and credit sides to verify their accuracy. It is a significant step in the accounting process as it ensures that the total of all debit balances is equal to the total of all credit balances. The following are the reasons why Trial Balance creates arithmetical accuracy:

Matching Principle

The matching principle is a fundamental principle of accounting which states that expenses must be recognized in the same period as the revenue they help to generate. In other words, it is the process of matching the expenses incurred to produce the revenue. Trial Balance ensures the matching principle by checking the debit and credit balances of all the accounts to make sure that both the sides are equal.

Double Entry System

The double-entry system is another fundamental principle of accounting that states that every transaction must have equal and opposite effects on at least two accounts. In other words, it is a system in which every transaction is recorded in two accounts, one debit, and one credit. Trial Balance ensures the double-entry system by listing all the ledger account balances in debit and credit sides, which should be equal in total.

Clerical Errors

Clerical errors are mistakes made by the accountant or bookkeeper while recording the transactions in the accounting system. These errors can be transposition errors, calculation errors, or omission errors. Trial Balance ensures the arithmetical accuracy by identifying and correcting the clerical errors in the accounting system. If the total of the debit and credit sides of the Trial Balance does not match, it indicates that there is an error in the accounting system that needs to be corrected.

Conclusion

In conclusion, Trial Balance creates arithmetical accuracy by ensuring the matching principle, double-entry system, and identifying and correcting the clerical errors in the accounting system. It is an essential step in the accounting process that helps to verify the accuracy of the financial statements.

Trial Balance is a statement that lists all the ledger account balances in debit and credit sides to verify their accuracy. It is a significant step in the accounting process as it ensures that the total of all debit balances is equal to the total of all credit balances. The following are the reasons why Trial Balance creates arithmetical accuracy:

Matching Principle

The matching principle is a fundamental principle of accounting which states that expenses must be recognized in the same period as the revenue they help to generate. In other words, it is the process of matching the expenses incurred to produce the revenue. Trial Balance ensures the matching principle by checking the debit and credit balances of all the accounts to make sure that both the sides are equal.

Double Entry System

The double-entry system is another fundamental principle of accounting that states that every transaction must have equal and opposite effects on at least two accounts. In other words, it is a system in which every transaction is recorded in two accounts, one debit, and one credit. Trial Balance ensures the double-entry system by listing all the ledger account balances in debit and credit sides, which should be equal in total.

Clerical Errors

Clerical errors are mistakes made by the accountant or bookkeeper while recording the transactions in the accounting system. These errors can be transposition errors, calculation errors, or omission errors. Trial Balance ensures the arithmetical accuracy by identifying and correcting the clerical errors in the accounting system. If the total of the debit and credit sides of the Trial Balance does not match, it indicates that there is an error in the accounting system that needs to be corrected.

Conclusion

In conclusion, Trial Balance creates arithmetical accuracy by ensuring the matching principle, double-entry system, and identifying and correcting the clerical errors in the accounting system. It is an essential step in the accounting process that helps to verify the accuracy of the financial statements.

In trial balance, which accounts with normal balance are recorded at the credit side?- a)Bank account

- b)Equipment account

- c)Accrued expenses account

- d)Cash account

Correct answer is option 'C'. Can you explain this answer?

In trial balance, which accounts with normal balance are recorded at the credit side?

a)

Bank account

b)

Equipment account

c)

Accrued expenses account

d)

Cash account

|

Nilesh Chawla answered |

The trial balance is a statement that contains a list of all the general ledger accounts and their respective debit or credit balances. It is used to ensure that the total of all debits equals the total of all credits, which is a fundamental principle of double-entry bookkeeping.

Accounts with a normal credit balance are typically recorded on the credit side of the trial balance. These accounts include liabilities, equity, and revenue accounts. The accounts with a normal debit balance, such as assets and expenses, are recorded on the debit side.

Now, let's analyze the options given in the question to determine which ones have a normal balance that is recorded on the credit side of the trial balance.

a) Bank account:

The bank account is an asset account. Assets normally have a debit balance and are recorded on the debit side of the trial balance. Therefore, option 'a' is incorrect.

b) Equipment account:

The equipment account is also an asset account. As mentioned earlier, asset accounts have a normal debit balance and are recorded on the debit side of the trial balance. Hence, option 'b' is incorrect.

c) Accrued expenses account:

Accrued expenses are liabilities that arise from expenses that have been incurred but not yet paid. Liabilities have a normal credit balance, and therefore, the accrued expenses account is recorded on the credit side of the trial balance. This means that option 'c' is correct.

d) Cash account:

The cash account is another asset account. As with other asset accounts, it also has a normal debit balance and is recorded on the debit side of the trial balance. Consequently, option 'd' is incorrect.

In conclusion, the correct option is 'c' because the accrued expenses account is the only account with a normal credit balance that is recorded on the credit side of the trial balance.

Accounts with a normal credit balance are typically recorded on the credit side of the trial balance. These accounts include liabilities, equity, and revenue accounts. The accounts with a normal debit balance, such as assets and expenses, are recorded on the debit side.

Now, let's analyze the options given in the question to determine which ones have a normal balance that is recorded on the credit side of the trial balance.

a) Bank account:

The bank account is an asset account. Assets normally have a debit balance and are recorded on the debit side of the trial balance. Therefore, option 'a' is incorrect.

b) Equipment account:

The equipment account is also an asset account. As mentioned earlier, asset accounts have a normal debit balance and are recorded on the debit side of the trial balance. Hence, option 'b' is incorrect.

c) Accrued expenses account:

Accrued expenses are liabilities that arise from expenses that have been incurred but not yet paid. Liabilities have a normal credit balance, and therefore, the accrued expenses account is recorded on the credit side of the trial balance. This means that option 'c' is correct.

d) Cash account:

The cash account is another asset account. As with other asset accounts, it also has a normal debit balance and is recorded on the debit side of the trial balance. Consequently, option 'd' is incorrect.

In conclusion, the correct option is 'c' because the accrued expenses account is the only account with a normal credit balance that is recorded on the credit side of the trial balance.

A Trial Balance contains the balances of : - a)Only Personal and Real accounts

- b)Only Real and Nominal accounts

- c)Only Nominal and Personal accounts

- d)All accounts

Correct answer is option 'D'. Can you explain this answer?

A Trial Balance contains the balances of :

a)

Only Personal and Real accounts

b)

Only Real and Nominal accounts

c)

Only Nominal and Personal accounts

d)

All accounts

|

Nipun Tuteja answered |

A Trial Balance is a statement prepared to check the arithmetical accuracy of ledger accounts. It includes the balances of all types of accounts — Personal, Real, and Nominal — from the ledger. This means a Trial Balance contains the balances of all accounts, not just one or two types. Therefore, the correct answer is "All accounts".

Which of the following is not a process in the preparation of a Trial Balance ?- a)Recording

- b)Summarizing

- c)Classifying

- d)Interpretation

Correct answer is option 'D'. Can you explain this answer?

Which of the following is not a process in the preparation of a Trial Balance ?

a)

Recording

b)

Summarizing

c)

Classifying

d)

Interpretation

|

Krithika Kulkarni answered |

Not a process in the preparation of a Trial Balance

In accounting, a trial balance is a list of all the general ledger accounts of a company and their balances. It is used to ensure the accuracy of the recorded financial transactions and to prepare financial statements. The preparation of a trial balance involves several processes, which are as follows:

Recording

The first process in the preparation of a trial balance is recording. This involves the systematic and chronological recording of all financial transactions of a company in its books of accounts. The transactions are recorded in the journal, which is also known as the book of original entry. The journal serves as a chronological record of all financial transactions.

Summarizing

The second process in the preparation of a trial balance is summarizing. This involves the transfer of all the transactions recorded in the journal to the ledger. The ledger is a book of accounts that contains all the individual accounts of a company. The ledger serves as a summary of all the financial transactions of a company.

Classifying

The third process in the preparation of a trial balance is classifying. This involves grouping the accounts in the ledger into categories. The categories are usually based on the nature of the account, such as assets, liabilities, equity, income, and expenses. The purpose of classifying the accounts is to facilitate the preparation of financial statements and to ensure that all accounts are included in the trial balance.

Interpretation

The fourth process in the preparation of a trial balance is interpretation. This involves analyzing the trial balance to ensure that all the accounts are balanced. A balanced trial balance means that the total debits and the total credits are equal. If the trial balance is not balanced, it means that there is an error in the recording or summarizing of the financial transactions.

Therefore, the correct answer is option D, interpretation, as it is not a process in the preparation of a trial balance. The purpose of the trial balance is to ensure the accuracy of the recorded financial transactions, and interpretation is not a part of this process.

In accounting, a trial balance is a list of all the general ledger accounts of a company and their balances. It is used to ensure the accuracy of the recorded financial transactions and to prepare financial statements. The preparation of a trial balance involves several processes, which are as follows:

Recording

The first process in the preparation of a trial balance is recording. This involves the systematic and chronological recording of all financial transactions of a company in its books of accounts. The transactions are recorded in the journal, which is also known as the book of original entry. The journal serves as a chronological record of all financial transactions.

Summarizing

The second process in the preparation of a trial balance is summarizing. This involves the transfer of all the transactions recorded in the journal to the ledger. The ledger is a book of accounts that contains all the individual accounts of a company. The ledger serves as a summary of all the financial transactions of a company.

Classifying

The third process in the preparation of a trial balance is classifying. This involves grouping the accounts in the ledger into categories. The categories are usually based on the nature of the account, such as assets, liabilities, equity, income, and expenses. The purpose of classifying the accounts is to facilitate the preparation of financial statements and to ensure that all accounts are included in the trial balance.

Interpretation

The fourth process in the preparation of a trial balance is interpretation. This involves analyzing the trial balance to ensure that all the accounts are balanced. A balanced trial balance means that the total debits and the total credits are equal. If the trial balance is not balanced, it means that there is an error in the recording or summarizing of the financial transactions.

Therefore, the correct answer is option D, interpretation, as it is not a process in the preparation of a trial balance. The purpose of the trial balance is to ensure the accuracy of the recorded financial transactions, and interpretation is not a part of this process.

Salaries paid Rs. 4,500 is shown in credit side of trial balance. In the total of trial balance the debit side will be short by _____- a)Short by Rs. 4,500

- b)Excess by Rs. 4,500

- c)Short by Rs. 9,000

- d)Excess by Rs. 9,000

Correct answer is option 'C'. Can you explain this answer?

Salaries paid Rs. 4,500 is shown in credit side of trial balance. In the total of trial balance the debit side will be short by _____

a)

Short by Rs. 4,500

b)

Excess by Rs. 4,500

c)

Short by Rs. 9,000

d)

Excess by Rs. 9,000

|

Sharmila Sharma answered |

Explanation:

In accounting, every transaction has two aspects: debit and credit. A debit is an entry on the left-hand side of an account, and a credit is an entry on the right-hand side of an account.

Given that salaries paid Rs. 4,500 is shown in the credit side of the trial balance. This means that the entry for salaries paid has been credited to the account. Therefore, the corresponding entry for this transaction should be on the debit side of the account.

Since this entry has not been made on the debit side, the debit side of the trial balance will be short by Rs. 4,500.

Therefore, the correct answer is option 'C' - Short by Rs. 9,000 (Rs. 4,500 on the credit side and Rs. 4,500 short on the debit side).

In accounting, every transaction has two aspects: debit and credit. A debit is an entry on the left-hand side of an account, and a credit is an entry on the right-hand side of an account.

Given that salaries paid Rs. 4,500 is shown in the credit side of the trial balance. This means that the entry for salaries paid has been credited to the account. Therefore, the corresponding entry for this transaction should be on the debit side of the account.

Since this entry has not been made on the debit side, the debit side of the trial balance will be short by Rs. 4,500.

Therefore, the correct answer is option 'C' - Short by Rs. 9,000 (Rs. 4,500 on the credit side and Rs. 4,500 short on the debit side).

After preparing the trial balance the accountant finds that the total of debit side is short by Rs. 1,500. This difference will be- a)Credited to suspense account

- b)Debited to suspense account

- c)Adjusted to any of the debit balance account

- d)Adjusted to any of the debit balance in account

Correct answer is option 'B'. Can you explain this answer?

After preparing the trial balance the accountant finds that the total of debit side is short by Rs. 1,500. This difference will be

a)

Credited to suspense account

b)

Debited to suspense account

c)

Adjusted to any of the debit balance account

d)

Adjusted to any of the debit balance in account

|

Sarthak Verma answered |

Explanation:

When the total of the debit side in the trial balance is short, it means that some of the debit entries have been omitted or undercast. In such a case, the difference is entered in the suspense account.

The suspense account is a temporary account used to record the difference between the debit and credit sides of the trial balance. It is used to hold the difference until it can be identified and corrected.

In this case, since the total of the debit side is short, the difference of Rs. 1,500 will be debited to the suspense account. This means that the suspense account will be credited with Rs. 1,500 to balance the entry.

Once the error is identified, the suspense account will be adjusted accordingly. The error may be corrected by adjusting any of the debit balance accounts or by posting a new entry. Once the error is corrected, the suspense account will be closed and the balance will be transferred to the correct account.

Conclusion:

In conclusion, when the total of the debit side in the trial balance is short, the difference is entered in the suspense account. The suspense account is used to hold the difference until it can be identified and corrected. Once the error is identified, the suspense account will be adjusted accordingly. In this case, since the total of the debit side is short, the difference of Rs. 1,500 will be debited to the suspense account.

When the total of the debit side in the trial balance is short, it means that some of the debit entries have been omitted or undercast. In such a case, the difference is entered in the suspense account.

The suspense account is a temporary account used to record the difference between the debit and credit sides of the trial balance. It is used to hold the difference until it can be identified and corrected.

In this case, since the total of the debit side is short, the difference of Rs. 1,500 will be debited to the suspense account. This means that the suspense account will be credited with Rs. 1,500 to balance the entry.

Once the error is identified, the suspense account will be adjusted accordingly. The error may be corrected by adjusting any of the debit balance accounts or by posting a new entry. Once the error is corrected, the suspense account will be closed and the balance will be transferred to the correct account.

Conclusion:

In conclusion, when the total of the debit side in the trial balance is short, the difference is entered in the suspense account. The suspense account is used to hold the difference until it can be identified and corrected. Once the error is identified, the suspense account will be adjusted accordingly. In this case, since the total of the debit side is short, the difference of Rs. 1,500 will be debited to the suspense account.

__________ is prepare to ascertain the arithmetical accuracy of posting and balancing - a)Cash Book

- b)Journal

- c)Trial Balance

- d)Bank Reconciliation Statement

Correct answer is option 'C'. Can you explain this answer?

__________ is prepare to ascertain the arithmetical accuracy of posting and balancing

a)

Cash Book

b)

Journal

c)

Trial Balance

d)

Bank Reconciliation Statement

|

Abhiram Choudhary answered |

The correct answer is option 'C' - Trial Balance.

The Trial Balance is prepared to ascertain the arithmetical accuracy of posting and balancing in an accounting system. It is a statement that lists all the accounts and their balances at a particular point in time. The purpose of the trial balance is to ensure that the total debits equal the total credits, which indicates that the accounting entries have been recorded correctly.

Here is a detailed explanation of why the Trial Balance is used to ascertain the arithmetical accuracy of posting and balancing:

1. Purpose of the Trial Balance:

- The primary purpose of the trial balance is to check the mathematical accuracy of the ledger accounts.

- It ensures that the total debits and total credits recorded in the ledger are equal.

- If the trial balance does not balance, it indicates that there are errors in the posting or balancing of accounts.

2. Process of Preparing a Trial Balance:

- The trial balance is prepared by listing all the ledger accounts and their respective balances.

- The balances are classified into debit and credit columns.

- The total of the debit column is compared to the total of the credit column.

- If the totals match, the trial balance is said to be in balance. If they don't match, there is an error somewhere in the accounts.

3. Identifying Errors through the Trial Balance:

- If the trial balance does not balance, it suggests that there are errors in the ledger accounts.

- Some common errors that can be identified through the trial balance include:

- Errors in recording transactions in the ledger.

- Errors in posting entries from the journal to the ledger.

- Errors in totaling or balancing accounts.

- Errors in calculating account balances.

- Errors in transferring balances from one account to another.

4. Correcting Errors:

- Once errors are identified through the trial balance, they need to be corrected.

- The trial balance helps in locating the accounts where errors have occurred.

- By reviewing the ledger accounts and the corresponding journal entries, the errors can be rectified.

In conclusion, the Trial Balance is prepared to ascertain the arithmetical accuracy of posting and balancing in an accounting system. It serves as a tool for identifying errors in the ledger accounts and ensuring that the total debits equal the total credits.

The Trial Balance is prepared to ascertain the arithmetical accuracy of posting and balancing in an accounting system. It is a statement that lists all the accounts and their balances at a particular point in time. The purpose of the trial balance is to ensure that the total debits equal the total credits, which indicates that the accounting entries have been recorded correctly.

Here is a detailed explanation of why the Trial Balance is used to ascertain the arithmetical accuracy of posting and balancing:

1. Purpose of the Trial Balance:

- The primary purpose of the trial balance is to check the mathematical accuracy of the ledger accounts.

- It ensures that the total debits and total credits recorded in the ledger are equal.

- If the trial balance does not balance, it indicates that there are errors in the posting or balancing of accounts.

2. Process of Preparing a Trial Balance:

- The trial balance is prepared by listing all the ledger accounts and their respective balances.

- The balances are classified into debit and credit columns.

- The total of the debit column is compared to the total of the credit column.

- If the totals match, the trial balance is said to be in balance. If they don't match, there is an error somewhere in the accounts.

3. Identifying Errors through the Trial Balance:

- If the trial balance does not balance, it suggests that there are errors in the ledger accounts.

- Some common errors that can be identified through the trial balance include:

- Errors in recording transactions in the ledger.

- Errors in posting entries from the journal to the ledger.

- Errors in totaling or balancing accounts.

- Errors in calculating account balances.

- Errors in transferring balances from one account to another.

4. Correcting Errors:

- Once errors are identified through the trial balance, they need to be corrected.

- The trial balance helps in locating the accounts where errors have occurred.

- By reviewing the ledger accounts and the corresponding journal entries, the errors can be rectified.

In conclusion, the Trial Balance is prepared to ascertain the arithmetical accuracy of posting and balancing in an accounting system. It serves as a tool for identifying errors in the ledger accounts and ensuring that the total debits equal the total credits.

Difference of totals of both debit and credit side of trial balance is transferred to : - a)Trading account

- b)Suspense account

- c)Difference account

- d)Miscellaneous account

Correct answer is option 'B'. Can you explain this answer?

Difference of totals of both debit and credit side of trial balance is transferred to :

a)

Trading account

b)

Suspense account

c)

Difference account

d)

Miscellaneous account

|

|

Priyanka Garg answered |

As it is known from its name 'suspense' means if any diff is in the trial balance it will be transferred to suspense account for compensate the error

The preparation of trial balance is for : - a)Locating errors of commission

- b)Locating errors of principle

- c)Locating clerical errors

- d)All of the above

Correct answer is option 'C'. Can you explain this answer?

The preparation of trial balance is for :

a)

Locating errors of commission

b)

Locating errors of principle

c)

Locating clerical errors

d)

All of the above

|

|

Priyanka Garg answered |

It is prepared for locating clerical errors.It checks all the debit and credit entries of ledger It not check any error of principle and commission

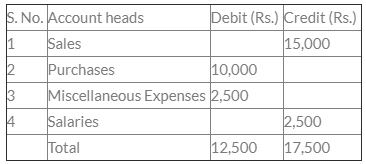

.The difference in trial balance is due to:

.The difference in trial balance is due to:- a)Wrong placing of sales account

- b)Wrong placing of salaries account

- c)Wrong placing of miscellaneous expenses account

- d)Wrong placing of all accounts

Correct answer is option 'B'. Can you explain this answer?

The difference in trial balance is due to:

a)

Wrong placing of sales account

b)

Wrong placing of salaries account

c)

Wrong placing of miscellaneous expenses account

d)

Wrong placing of all accounts

|

Liladhar Advirkar Advirk answered |

It's very simple .

When you , as a business give salaries to your staff and workers your net profits go down as salaries is an expense which will reduce your money.

Thus , applying the golden rule

"Debit all expenses and loses"

entry is :

Salary A/c Dr. 2,500

To Cash A/c. 2,500

This salary A/c will have a Debit balance instead of Credit balance in Trial balance.

Total leading to 15,000.

Methods of preparation of Trial Balance are : - a)Balance Method

- b)Total Method

- c)Total and Balance Method

- d)All of these

Correct answer is option 'D'. Can you explain this answer?

Methods of preparation of Trial Balance are :

a)

Balance Method

b)

Total Method

c)

Total and Balance Method

d)

All of these

|

Pranav Saha answered |

**Methods of preparation of Trial Balance**

The Trial Balance is a statement that lists all the general ledger accounts and their respective balances at a specific point in time. It is prepared to ensure the accuracy of the double-entry bookkeeping system. There are three methods of preparing a Trial Balance:

**a) Balance Method:**

In the Balance Method, the trial balance is prepared by listing all the ledger accounts and their respective balances. The accounts are usually listed in the order of their appearance in the ledger, starting with the assets, followed by liabilities, equity, income, and expenses. The balance method simply lists the account names and their balances, without any subtotals or totals.

**b) Total Method:**

In the Total Method, the trial balance is prepared by listing all the ledger accounts and their respective balances, similar to the balance method. However, in the total method, the accounts are grouped and subtotaled based on their nature (e.g., assets, liabilities, equity, income, and expenses). This method provides a clearer picture of the financial position and performance of the business.

**c) Total and Balance Method:**

The Total and Balance Method is a combination of the balance method and the total method. In this method, the accounts are listed and balanced individually (balance method) and then grouped and subtotaled based on their nature (total method). This method provides both the detailed information of individual accounts and the summarized information of different account groups.

**d) All of these:**

The correct answer is option 'D' - All of these. This means that all three methods (balance method, total method, and total and balance method) can be used to prepare the trial balance. The choice of method depends on the preference of the accountant or the requirements of the business.

Using different methods of preparing the trial balance allows accountants to present financial information in different ways, catering to the needs of different users. It also helps in identifying any errors or discrepancies in the accounts before the financial statements are prepared.

In conclusion, the trial balance can be prepared using the balance method, total method, or total and balance method. Each method has its own advantages and provides different levels of detail in presenting the financial information.

The Trial Balance is a statement that lists all the general ledger accounts and their respective balances at a specific point in time. It is prepared to ensure the accuracy of the double-entry bookkeeping system. There are three methods of preparing a Trial Balance:

**a) Balance Method:**

In the Balance Method, the trial balance is prepared by listing all the ledger accounts and their respective balances. The accounts are usually listed in the order of their appearance in the ledger, starting with the assets, followed by liabilities, equity, income, and expenses. The balance method simply lists the account names and their balances, without any subtotals or totals.

**b) Total Method:**

In the Total Method, the trial balance is prepared by listing all the ledger accounts and their respective balances, similar to the balance method. However, in the total method, the accounts are grouped and subtotaled based on their nature (e.g., assets, liabilities, equity, income, and expenses). This method provides a clearer picture of the financial position and performance of the business.

**c) Total and Balance Method:**

The Total and Balance Method is a combination of the balance method and the total method. In this method, the accounts are listed and balanced individually (balance method) and then grouped and subtotaled based on their nature (total method). This method provides both the detailed information of individual accounts and the summarized information of different account groups.

**d) All of these:**

The correct answer is option 'D' - All of these. This means that all three methods (balance method, total method, and total and balance method) can be used to prepare the trial balance. The choice of method depends on the preference of the accountant or the requirements of the business.

Using different methods of preparing the trial balance allows accountants to present financial information in different ways, catering to the needs of different users. It also helps in identifying any errors or discrepancies in the accounts before the financial statements are prepared.

In conclusion, the trial balance can be prepared using the balance method, total method, or total and balance method. Each method has its own advantages and provides different levels of detail in presenting the financial information.

After the preparation of ledgers, the next step is the preparation of - a)Trading accounts

- b)Trial balance

- c)Profit and loss account

- d)None of the above

Correct answer is option 'B'. Can you explain this answer?

After the preparation of ledgers, the next step is the preparation of

a)

Trading accounts

b)

Trial balance

c)

Profit and loss account

d)

None of the above

|

Tanvi Roy answered |

Explanation:

The correct answer is option 'b', which is the preparation of the trial balance. Let's understand why.

1. Overview:

After the preparation of ledgers, the next step in the accounting process is to prepare the trial balance. A trial balance is a statement that lists all the general ledger accounts along with their respective debit or credit balances.

2. Purpose of Trial Balance:

The trial balance serves as a tool to check the accuracy of the accounting records. It ensures that the total debits equal the total credits in the ledger accounts. The primary purpose of preparing a trial balance is to identify any errors or discrepancies in the recording or posting of transactions.

3. Process of Preparing Trial Balance:

The process of preparing a trial balance involves the following steps:

a. Collecting Ledger Balances:

All the ledger accounts are reviewed, and the closing balances of each account are collected. These balances are then recorded in the trial balance.

b. Classification of Balances:

The balances from the ledger accounts are classified into debit and credit balances. Assets, expenses, and losses have debit balances, while liabilities, equity, income, and gains have credit balances.

c. Listing Accounts:

The trial balance is prepared by listing all the accounts in a particular order. Typically, the accounts are arranged in the same sequence as they appear in the ledger.

d. Recording Balances:

The debit balances are recorded in the debit column of the trial balance, and the credit balances are recorded in the credit column. The amounts are usually written in the respective columns on the same line as the account name.

e. Calculation of Totals:

The total of the debit column is calculated, and the total of the credit column is also calculated. These totals should be equal if the books are in balance.

4. Verification of Accuracy:

Once the trial balance is prepared, the totals of the debit and credit columns are compared. If they are equal, it indicates that the ledger accounts have been accurately recorded and posted. However, if the totals do not match, there may be errors in the books of accounts that need to be identified and rectified.

5. Conclusion:

In conclusion, the preparation of the trial balance is the next step after the preparation of ledgers. It plays a crucial role in ensuring the accuracy of the accounting records and acts as a basis for preparing financial statements such as the profit and loss account and the balance sheet.

The correct answer is option 'b', which is the preparation of the trial balance. Let's understand why.

1. Overview:

After the preparation of ledgers, the next step in the accounting process is to prepare the trial balance. A trial balance is a statement that lists all the general ledger accounts along with their respective debit or credit balances.

2. Purpose of Trial Balance:

The trial balance serves as a tool to check the accuracy of the accounting records. It ensures that the total debits equal the total credits in the ledger accounts. The primary purpose of preparing a trial balance is to identify any errors or discrepancies in the recording or posting of transactions.

3. Process of Preparing Trial Balance:

The process of preparing a trial balance involves the following steps:

a. Collecting Ledger Balances:

All the ledger accounts are reviewed, and the closing balances of each account are collected. These balances are then recorded in the trial balance.

b. Classification of Balances:

The balances from the ledger accounts are classified into debit and credit balances. Assets, expenses, and losses have debit balances, while liabilities, equity, income, and gains have credit balances.

c. Listing Accounts:

The trial balance is prepared by listing all the accounts in a particular order. Typically, the accounts are arranged in the same sequence as they appear in the ledger.

d. Recording Balances:

The debit balances are recorded in the debit column of the trial balance, and the credit balances are recorded in the credit column. The amounts are usually written in the respective columns on the same line as the account name.

e. Calculation of Totals:

The total of the debit column is calculated, and the total of the credit column is also calculated. These totals should be equal if the books are in balance.

4. Verification of Accuracy:

Once the trial balance is prepared, the totals of the debit and credit columns are compared. If they are equal, it indicates that the ledger accounts have been accurately recorded and posted. However, if the totals do not match, there may be errors in the books of accounts that need to be identified and rectified.

5. Conclusion:

In conclusion, the preparation of the trial balance is the next step after the preparation of ledgers. It plays a crucial role in ensuring the accuracy of the accounting records and acts as a basis for preparing financial statements such as the profit and loss account and the balance sheet.

Chapter doubts & questions for Unit 3: Trial Balance - Accounting for CA Foundation 2025 is part of CA Foundation exam preparation. The chapters have been prepared according to the CA Foundation exam syllabus. The Chapter doubts & questions, notes, tests & MCQs are made for CA Foundation 2025 Exam. Find important definitions, questions, notes, meanings, examples, exercises, MCQs and online tests here.

Chapter doubts & questions of Unit 3: Trial Balance - Accounting for CA Foundation in English & Hindi are available as part of CA Foundation exam.

Download more important topics, notes, lectures and mock test series for CA Foundation Exam by signing up for free.

Accounting for CA Foundation

68 videos|265 docs|83 tests

|

Contact Support