All Exams >

CA Foundation >

Accounting for CA Foundation >

All Questions

All questions of Unit 4: Subsidiary Books for CA Foundation Exam

Total of the sales book for March indicates:- a)Total sales for the month

- b)Total credit sales for the month

- c)Total cash sales for the month

- d)Total sales less sales return

Correct answer is option 'B'. Can you explain this answer?

Total of the sales book for March indicates:

a)

Total sales for the month

b)

Total credit sales for the month

c)

Total cash sales for the month

d)

Total sales less sales return

|

|

Nikita Singh answered |

A Sales book is a record of all credit sales made by a business.

It is one of the secondary book of accounts, and unlike cash sales, which are recorded in cash book, sales book is only prepared to record credit sales.

The amount entered in the sales book is on behalf of invoices supplied to purchasers.

A Sales book is also called Sales Journal or Sales Day Book.

It is one of the secondary book of accounts, and unlike cash sales, which are recorded in cash book, sales book is only prepared to record credit sales.

The amount entered in the sales book is on behalf of invoices supplied to purchasers.

A Sales book is also called Sales Journal or Sales Day Book.

Credit purchase of stationery worth Rs. 5,000 by a stationery dealer. - a)Purchase book

- b)Sales book

- c)Cash book

- d)Journal proper (General journal)

Correct answer is option 'A'. Can you explain this answer?

Credit purchase of stationery worth Rs. 5,000 by a stationery dealer.

a)

Purchase book

b)

Sales book

c)

Cash book

d)

Journal proper (General journal)

|

|

Nikita Singh answered |

Purchase book is an accounting ledger in which all credit purchase of trading goods are recorded. Two most important requirement for recording entry in purchase book are:

1. Purchase must be on credit

2. Purchase must be of trading goods.

Therefore, in the given question credit purchase of stationery will be recorded in purchase book. as the purchaser deals in stationery.

1. Purchase must be on credit

2. Purchase must be of trading goods.

Therefore, in the given question credit purchase of stationery will be recorded in purchase book. as the purchaser deals in stationery.

Which of the following are subsidiary book:

a) sales bookb) Cash bookc) Purchase bookd)All of the AboveCorrect answer is option 'D'. Can you explain this answer?

|

Rishika Kumar answered |

Subsidiary Books are those books of original entry in which transactions of similar nature are recorded at one place and in chronological order. In a big concern, recording of all transactions in one Journal and posting them into various ledger accounts will be very difficult and involve a lot of clerical work.

A___________ is sent to a customer when he returns goods :- a)Debit Note

- b)Credit Note

- c)Proforma Invoice

- d)None of the above

Correct answer is option 'B'. Can you explain this answer?

A___________ is sent to a customer when he returns goods :

a)

Debit Note

b)

Credit Note

c)

Proforma Invoice

d)

None of the above

|

Freedom Institute answered |

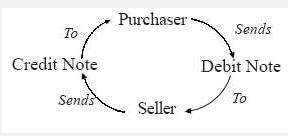

A document sent to customer when he returns the goods is called Credit note. A credit note or credit memo is a commercial document issued by a seller to a buyer.

Goods sold for cash Rs. 10,000 plus 10% sales tax. Sales A/c will be credited by:

- a)Rs. 10,000

- b)Rs. 11,000

- c)Rs. 9,000

- d)None

Correct answer is option 'B'. Can you explain this answer?

Goods sold for cash Rs. 10,000 plus 10% sales tax. Sales A/c will be credited by:

a)

Rs. 10,000

b)

Rs. 11,000

c)

Rs. 9,000

d)

None

|

Arka Tiwari answered |

Calculation of Sales Tax

- The goods are sold for Rs. 10,000.

- The sales tax is 10% of the selling price, i.e. 10/100 * 10,000 = Rs. 1,000.

- Therefore, the total amount paid by the customer is Rs. 10,000 + Rs. 1,000 = Rs. 11,000.

Journal Entry

- The Sales A/c is credited because the company has made a sale.

- The amount to be credited is the selling price, i.e. Rs. 10,000.

- The sales tax collected is not revenue for the company, but a liability that has to be paid to the government.

- Therefore, the Sales Tax A/c is credited with the amount of Rs. 1,000.

The journal entry for the sale will be:

Debit - Cash A/c - Rs. 11,000

Credit - Sales A/c - Rs. 10,000

Credit - Sales Tax A/c - Rs. 1,000 (Liability)

Conclusion

Hence, the correct option is 'B', Rs. 10,000, as the Sales A/c will be credited with the selling price of the goods.

- The goods are sold for Rs. 10,000.

- The sales tax is 10% of the selling price, i.e. 10/100 * 10,000 = Rs. 1,000.

- Therefore, the total amount paid by the customer is Rs. 10,000 + Rs. 1,000 = Rs. 11,000.

Journal Entry

- The Sales A/c is credited because the company has made a sale.

- The amount to be credited is the selling price, i.e. Rs. 10,000.

- The sales tax collected is not revenue for the company, but a liability that has to be paid to the government.

- Therefore, the Sales Tax A/c is credited with the amount of Rs. 1,000.

The journal entry for the sale will be:

Debit - Cash A/c - Rs. 11,000

Credit - Sales A/c - Rs. 10,000

Credit - Sales Tax A/c - Rs. 1,000 (Liability)

Conclusion

Hence, the correct option is 'B', Rs. 10,000, as the Sales A/c will be credited with the selling price of the goods.

Purchases of Fixed assets on credit basis is recorded in :

- a)Purchase Book

- b)Cash Book

- c)Journal Proper

- d)none

Correct answer is option 'C'. Can you explain this answer?

Purchases of Fixed assets on credit basis is recorded in :

a)

Purchase Book

b)

Cash Book

c)

Journal Proper

d)

none

|

Srsps answered |

Purchase of fixed assets on credit is originally recorded in Journal Proper. On the assumption that the asset was purchased on credit, the initial entry is a credit to accounts payable and a debit to the applicable fixed asset account for the cost of the asset.

Unpaid salary for Rs. 340 is to be provided for in the accounts.- a)Bills Receivable Book

- b)Purchases Book

- c)Journal Proper (General Journal)

- d)Purchases Return

Correct answer is option 'C'. Can you explain this answer?

Unpaid salary for Rs. 340 is to be provided for in the accounts.

a)

Bills Receivable Book

b)

Purchases Book

c)

Journal Proper (General Journal)

d)

Purchases Return

|

Amrutha Goyal answered |

Unpaid Salary Entry in Journal Proper

When there is a transaction that does not have a specific book to record it in, it is recorded in the Journal Proper. Unpaid salary is one such transaction that is recorded in the Journal Proper.

Steps to record Unpaid Salary in Journal Proper:

1. Identify the accounts involved in the transaction:

- Salary Account (Expense Account)

- Salary Payable Account (Liability Account)

2. Determine the amount of the transaction:

- Unpaid Salary of Rs. 340

3. Record the transaction in the Journal Proper:

Date | Particulars | Debit | Credit

- | Salary Account | 340 |

- | Salary Payable Account | | 340

Explanation:

- The Salary Account is debited for Rs. 340 as it is an expense incurred by the company.

- The Salary Payable Account is credited for Rs. 340 as it is a liability owed by the company to its employees.

Thus, the unpaid salary of Rs. 340 is recorded in the Journal Proper through this entry.

When there is a transaction that does not have a specific book to record it in, it is recorded in the Journal Proper. Unpaid salary is one such transaction that is recorded in the Journal Proper.

Steps to record Unpaid Salary in Journal Proper:

1. Identify the accounts involved in the transaction:

- Salary Account (Expense Account)

- Salary Payable Account (Liability Account)

2. Determine the amount of the transaction:

- Unpaid Salary of Rs. 340

3. Record the transaction in the Journal Proper:

Date | Particulars | Debit | Credit

- | Salary Account | 340 |

- | Salary Payable Account | | 340

Explanation:

- The Salary Account is debited for Rs. 340 as it is an expense incurred by the company.

- The Salary Payable Account is credited for Rs. 340 as it is a liability owed by the company to its employees.

Thus, the unpaid salary of Rs. 340 is recorded in the Journal Proper through this entry.

The Sales Book - a)Is a part of journal,

- b)Is a part of the ledger,

- c)Is a part of the balance sheet.

- d)None of the above

Correct answer is option 'A'. Can you explain this answer?

The Sales Book

a)

Is a part of journal,

b)

Is a part of the ledger,

c)

Is a part of the balance sheet.

d)

None of the above

|

Jyoti Nair answered |

A Sales book is a record of all credit sales made by a business. It is one of the secondary book of accounts and unlike cash sales which are recorded in cash book, sales book is only to record credit sales. The amount entered in the sales book is on behalf of invoices supplied to purchasers. A Sales book is also called Sales Journal or Sales Day Book.

A second hand motor car was purchased on credit from B Brothers for Rs. 10,000.- a)Journal Proper (General Journal)

- b)Sales Book

- c)Cash book

- d)Purchase Book

Correct answer is option 'A'. Can you explain this answer?

A second hand motor car was purchased on credit from B Brothers for Rs. 10,000.

a)

Journal Proper (General Journal)

b)

Sales Book

c)

Cash book

d)

Purchase Book

|

|

Poonam Reddy answered |

A journal proper is the book of original entry in which only those entries are recorded that cannot be recorded in the special journal. It is also termed as a General Journal. When the journal is divided into various subsidiary books, it remains only a residuary book in which only those transactions are recorded that cannot be recorded in any other subsidiary book. In such a case, the journal is called as Journal proper. Purchase of asset on credit can neither be recorded in the cash book or the purchase book because cash book only records cash transactions and purchase book only records the credit purchase of goods. Thus purchase and sale or return of purchased or sale asset on credit is recorded in journal proper. In our question a second hand motor car is purchased on credit which is fixed asset hence, it will be recorded in Journal proper.

A note sent by buyer on return of goods is : - a)Debit Note

- b)Credit Note

- c)Return Note

- d)None

Correct answer is option 'A'. Can you explain this answer?

A note sent by buyer on return of goods is :

a)

Debit Note

b)

Credit Note

c)

Return Note

d)

None

|

|

Rajat Patel answered |

Buyer of goods is customer from the point of view of business. In his books our account balance would show a credit balance. When he returns the goods to us, he debits our account and to show this fact he sends a debit note to us indicating the above fact.

Rectifying the error of a credit purchase of goods worth Rs. 10,000 recorded as credit sale to Mr. D, discovered two months later. - a)Journal Proper (General journal)

- b)Sales Book

- c)Cash Book

- d)Purchase book

Correct answer is option 'A'. Can you explain this answer?

Rectifying the error of a credit purchase of goods worth Rs. 10,000 recorded as credit sale to Mr. D, discovered two months later.

a)

Journal Proper (General journal)

b)

Sales Book

c)

Cash Book

d)

Purchase book

|

Freedom Institute answered |

The rectifying entry will be made in Journal proper to rectify the error of posting in wrong account.

The Balance of Sales day book is Rs. 25,000. Rs. 5,000 were recovered from debtors. Then balance of Day Book will be transferred by which amount ?

- a)Rs. 30,000

- b)Rs. 5,000

- c)Rs. 20,000

- d)Rs. 10,000

Correct answer is option 'A'. Can you explain this answer?

The Balance of Sales day book is Rs. 25,000. Rs. 5,000 were recovered from debtors. Then balance of Day Book will be transferred by which amount ?

a)

Rs. 30,000

b)

Rs. 5,000

c)

Rs. 20,000

d)

Rs. 10,000

|

Sahil Malik answered |

Balance of Sales Day Book

The Balance of Sales day book is the total amount of sales that are recorded and yet to be collected from debtors.

Given Information

The Balance of Sales day book is Rs. 25,000. Rs. 5,000 were recovered from debtors.

Calculation

To calculate the new balance of the Sales day book, we need to subtract the amount recovered from the previous balance.

New Balance = Previous Balance - Amount Recovered

New Balance = Rs. 25,000 - Rs. 5,000

New Balance = Rs. 20,000

Therefore, the balance of the Sales day book will be transferred by Rs. 20,000.

Conclusion

The correct option is A, which states that the balance of the Sales day book will be transferred by Rs. 25,000. However, the correct answer should be Rs. 20,000, which is calculated by subtracting the amount recovered from the previous balance. It is essential to carefully read and understand the question before choosing the answer.

The Balance of Sales day book is the total amount of sales that are recorded and yet to be collected from debtors.

Given Information

The Balance of Sales day book is Rs. 25,000. Rs. 5,000 were recovered from debtors.

Calculation

To calculate the new balance of the Sales day book, we need to subtract the amount recovered from the previous balance.

New Balance = Previous Balance - Amount Recovered

New Balance = Rs. 25,000 - Rs. 5,000

New Balance = Rs. 20,000

Therefore, the balance of the Sales day book will be transferred by Rs. 20,000.

Conclusion

The correct option is A, which states that the balance of the Sales day book will be transferred by Rs. 25,000. However, the correct answer should be Rs. 20,000, which is calculated by subtracting the amount recovered from the previous balance. It is essential to carefully read and understand the question before choosing the answer.

Goods were sold on credit basis to A Brothers for Rs. 1,000.- a)Cash Book

- b)Journal Proper (General Journal)

- c)Sales book

- d)Bills Receivable book

Correct answer is option 'C'. Can you explain this answer?

Goods were sold on credit basis to A Brothers for Rs. 1,000.

a)

Cash Book

b)

Journal Proper (General Journal)

c)

Sales book

d)

Bills Receivable book

|

Sonal Patel answered |

C. Sales Book

The correct option is C) Sales Book.

The sales book is a special book of original entry used to record credit sales made by a business. It is also known as the Sales Day Book or Sales Journal. In this book, all credit sales transactions are recorded in chronological order as and when they occur.

Explanation:

When goods are sold on a credit basis, it means that the buyer does not make an immediate payment but instead promises to pay at a later date. In this case, the goods were sold on a credit basis to A Brothers for Rs. 1,000.

The sales book is the appropriate book to record this transaction because it specifically deals with credit sales. The purpose of the sales book is to provide a record of all credit sales made by the business, allowing for easy tracking and monitoring of these transactions.

The sales book typically includes the following information for each credit sale:

- Date of the transaction

- Invoice or sales number

- Name of the customer

- Description of the goods sold

- Quantity of goods sold

- Selling price per unit

- Total amount of the sale

By recording the credit sale in the sales book, the business can keep track of its accounts receivable and also have a clear record of all credit sales made during a given period. This information is then used for various purposes, such as issuing invoices to customers, calculating sales commissions, and preparing financial statements.

In summary, the sales book is used to record credit sales transactions, and since the goods were sold on a credit basis to A Brothers, the correct option is C) Sales Book.

The correct option is C) Sales Book.

The sales book is a special book of original entry used to record credit sales made by a business. It is also known as the Sales Day Book or Sales Journal. In this book, all credit sales transactions are recorded in chronological order as and when they occur.

Explanation:

When goods are sold on a credit basis, it means that the buyer does not make an immediate payment but instead promises to pay at a later date. In this case, the goods were sold on a credit basis to A Brothers for Rs. 1,000.

The sales book is the appropriate book to record this transaction because it specifically deals with credit sales. The purpose of the sales book is to provide a record of all credit sales made by the business, allowing for easy tracking and monitoring of these transactions.

The sales book typically includes the following information for each credit sale:

- Date of the transaction

- Invoice or sales number

- Name of the customer

- Description of the goods sold

- Quantity of goods sold

- Selling price per unit

- Total amount of the sale

By recording the credit sale in the sales book, the business can keep track of its accounts receivable and also have a clear record of all credit sales made during a given period. This information is then used for various purposes, such as issuing invoices to customers, calculating sales commissions, and preparing financial statements.

In summary, the sales book is used to record credit sales transactions, and since the goods were sold on a credit basis to A Brothers, the correct option is C) Sales Book.

Debit note issued are used to prepare _______- a)Sales Return Book

- b)Purchase Return Book

- c)Journal Proper

- d)Purchase Book

Correct answer is option 'B'. Can you explain this answer?

Debit note issued are used to prepare _______

a)

Sales Return Book

b)

Purchase Return Book

c)

Journal Proper

d)

Purchase Book

|

|

Rajat Patel answered |

Purchases returns book is a book in which the goods returned to suppliers are recorded. It is also called returns outward book or purchases returns day book. Goods may be returned because they are of the wrong kind or not up to sample or because they are damaged etc.

PURCHASE Book is used to record- a)All purchase of goods

- b)All credit purchases

- c)All credit purchases of goods

- d)All credit purchases of assets

Correct answer is option 'C'. Can you explain this answer?

PURCHASE Book is used to record

a)

All purchase of goods

b)

All credit purchases

c)

All credit purchases of goods

d)

All credit purchases of assets

|

Ruchi Mishra answered |

A purchase book records only all credit purchases of goods and trade. Cash purchases are recorded via the cash book while the credit purchase of an asset is recorded via a journal entry.

The source document or voucher used for recording entries in sales Book is : - a)Invoice received

- b)Invoice sent out

- c)Credit notes sent out

- d)Debit notes received

Correct answer is option 'B'. Can you explain this answer?

The source document or voucher used for recording entries in sales Book is :

a)

Invoice received

b)

Invoice sent out

c)

Credit notes sent out

d)

Debit notes received

|

Madhavan Malik answered |

Sales Book records only credit sale of goods to the customers. When goods are sold, invoices are sent out to them and that only becomes the source document or voucher for recording transaction in sale book.

Purchase goods from E worth Rs. 5,000 on credit basis.

- a)Bills Receivable book

- b)Purchases book

- c)Journal Proper (General journal)

- d)Purchases Return

Correct answer is option 'B'. Can you explain this answer?

Purchase goods from E worth Rs. 5,000 on credit basis.

a)

Bills Receivable book

b)

Purchases book

c)

Journal Proper (General journal)

d)

Purchases Return

|

Prasenjit Kapoor answered |

Purchases Book

When a business purchases goods on credit, it is recorded in the purchases book. This book is used to record all credit purchases made by the business.

In this scenario, the business has purchased goods worth Rs. 5,000 on credit basis. This transaction will be recorded in the purchases book.

The purchases book is a subsidiary book, which means it is a book of original entry. This means that transactions are first recorded in the purchases book before being posted to the general ledger.

The purchases book is usually divided into columns for the date of the transaction, the name of the supplier, the invoice number, the amount, and the GST paid.

When the invoice is received from the supplier, it should be checked for accuracy and then entered into the purchases book. The transaction is then posted to the relevant accounts in the general ledger.

Other options:

- Bills Receivable book: This book is used to record all bills receivable, which are promissory notes or other forms of written promises to pay. This is not relevant to this scenario as the business has not received any bills receivable.

- Journal Proper (General journal): The general journal is used to record transactions that do not fit into any other subsidiary book. This is not relevant to this scenario as the purchase of goods on credit would be recorded in the purchases book.

- Purchases Return: This is used to record returns of goods that the business has purchased. This is not relevant to this scenario as the business has not returned any goods.

When a business purchases goods on credit, it is recorded in the purchases book. This book is used to record all credit purchases made by the business.

In this scenario, the business has purchased goods worth Rs. 5,000 on credit basis. This transaction will be recorded in the purchases book.

The purchases book is a subsidiary book, which means it is a book of original entry. This means that transactions are first recorded in the purchases book before being posted to the general ledger.

The purchases book is usually divided into columns for the date of the transaction, the name of the supplier, the invoice number, the amount, and the GST paid.

When the invoice is received from the supplier, it should be checked for accuracy and then entered into the purchases book. The transaction is then posted to the relevant accounts in the general ledger.

Other options:

- Bills Receivable book: This book is used to record all bills receivable, which are promissory notes or other forms of written promises to pay. This is not relevant to this scenario as the business has not received any bills receivable.

- Journal Proper (General journal): The general journal is used to record transactions that do not fit into any other subsidiary book. This is not relevant to this scenario as the purchase of goods on credit would be recorded in the purchases book.

- Purchases Return: This is used to record returns of goods that the business has purchased. This is not relevant to this scenario as the business has not returned any goods.

Goods Outward Journal is meant for recording all returns of goods- a)Sold on credit

- b)Purchased on credit

- c)Purchased on cash

- d)None of the above

Correct answer is option 'B'. Can you explain this answer?

Goods Outward Journal is meant for recording all returns of goods

a)

Sold on credit

b)

Purchased on credit

c)

Purchased on cash

d)

None of the above

|

|

Alok Mehta answered |

Purchases returns journal is a book in which goods returned to the supplier are recorded. This book is also known as returns outwards and purchases returns day book.

Goods once purchased on credit may subsequently be returned to the seller for certain reasons. For the buyer such return of goods to the supplier (seller) is know as purchases returns. The usual reasons for returning goods are:

1. Purchaser finds that the goods are unsatisfactory for some reasons, e.g. wrong color, wrong size, not according to the sample, not up to specification, not properly finished; damaged in transit, etc.

2. The purchaser is entitled by contract to return goods.

An allowance of Rs. 50 was offered for an early payment of cash of Rs. 1,050. - a)Sales Book

- b)Cash Book

- c)Journal Proper (General Journal)

- d)Purchase Book

Correct answer is option 'B'. Can you explain this answer?

An allowance of Rs. 50 was offered for an early payment of cash of Rs. 1,050.

a)

Sales Book

b)

Cash Book

c)

Journal Proper (General Journal)

d)

Purchase Book

|

Srsps answered |

The shop owner gives discount due early payment and it is a cash transaction so it is recorded in cash book.

In which book of original entry, will you record the following transactions?Q.A second hand motor car was purchased on credit from B Brothers for Rs. 10,000.- a)Journal Proper (General Journal)

- b)Sales Book

- c)Cash Book

- d)Purchase Book

Correct answer is option 'A'. Can you explain this answer?

In which book of original entry, will you record the following transactions?

Q.A second hand motor car was purchased on credit from B Brothers for Rs. 10,000.

a)

Journal Proper (General Journal)

b)

Sales Book

c)

Cash Book

d)

Purchase Book

|

Maheshwar Goyal answered |

Answer:

Recording Purchase of Second Hand Motor Car on Credit in Journal Proper

Journal Proper is a book of original entry used to record all transactions that do not have a specific book for recording. The purchase of a second-hand motor car on credit from B Brothers will be recorded in Journal Proper as follows:

Date | Particulars | L.F. | Debit Amount | Credit Amount

---- | ---------- | --- | ------------ | -------------

[Date of transaction] | B Brothers A/C | | 10,000 |

| Purchases A/C | | | 10,000

Explanation:

The entry is recorded in Journal Proper because there is no specific book for recording the purchase of second-hand motor cars on credit. The entry is recorded in the following manner:

- Date: The date on which the transaction took place is recorded in the first column.

- Particulars: The name of the account to be debited and credited is written in the second column. In this case, B Brothers A/C is debited, and Purchases A/C is credited.

- L.F.: L.F. stands for Ledger Folio, which is the page number of the ledger where the account is maintained. The L.F. column is left blank in Journal Proper.

- Debit Amount: The amount debited to B Brothers A/C is recorded in the Debit Amount column.

- Credit Amount: The amount credited to Purchases A/C is recorded in the Credit Amount column.

Therefore, the purchase of a second-hand motor car on credit from B Brothers will be recorded in Journal Proper.

Recording Purchase of Second Hand Motor Car on Credit in Journal Proper

Journal Proper is a book of original entry used to record all transactions that do not have a specific book for recording. The purchase of a second-hand motor car on credit from B Brothers will be recorded in Journal Proper as follows:

Date | Particulars | L.F. | Debit Amount | Credit Amount

---- | ---------- | --- | ------------ | -------------

[Date of transaction] | B Brothers A/C | | 10,000 |

| Purchases A/C | | | 10,000

Explanation:

The entry is recorded in Journal Proper because there is no specific book for recording the purchase of second-hand motor cars on credit. The entry is recorded in the following manner:

- Date: The date on which the transaction took place is recorded in the first column.

- Particulars: The name of the account to be debited and credited is written in the second column. In this case, B Brothers A/C is debited, and Purchases A/C is credited.

- L.F.: L.F. stands for Ledger Folio, which is the page number of the ledger where the account is maintained. The L.F. column is left blank in Journal Proper.

- Debit Amount: The amount debited to B Brothers A/C is recorded in the Debit Amount column.

- Credit Amount: The amount credited to Purchases A/C is recorded in the Credit Amount column.

Therefore, the purchase of a second-hand motor car on credit from B Brothers will be recorded in Journal Proper.

A note sent by buyer on return of goods is : - a)Debit Note

- b)Credit Note

- c)Return Note

- d)None

Correct answer is option 'A'. Can you explain this answer?

A note sent by buyer on return of goods is :

a)

Debit Note

b)

Credit Note

c)

Return Note

d)

None

|

|

Arjun Singhania answered |

When a buyer returns goods to the seller, he sends a debit note as an intimation to the seller of the amount and quantity being returned and requesting the return of money. 2. A debit note is sent to inform about the debit made in the account of the seller along with the reasons mentioned in it.

In which book of original entry, will you record the following transactions?Q.Credit purchase of stationery worth Rs. 5,000 by a stationery dealer.- a)Purchase Book

- b)Sales Book

- c)Cash Book

- d)Journal Proper (General Journal)

Correct answer is option 'A'. Can you explain this answer?

In which book of original entry, will you record the following transactions?

Q.Credit purchase of stationery worth Rs. 5,000 by a stationery dealer.

a)

Purchase Book

b)

Sales Book

c)

Cash Book

d)

Journal Proper (General Journal)

|

Dhruba Choudhary answered |

Answer:

Book of Original Entry for Credit Purchase of Stationery worth Rs. 5,000 by a Stationery Dealer is Purchase Book.

Explanation:

Purchase Book is a book of original entry in which all credit purchases of goods and services are recorded. Credit purchases are the purchases made on credit from suppliers or vendors. In this case, stationery worth Rs. 5,000 is purchased on credit from a stationery dealer, so it will be recorded in the Purchase Book.

The following are the reasons why the transaction will be recorded in the Purchase Book:

1. The transaction is a credit purchase, so it will be recorded in the Purchase Book.

2. The transaction involves the purchase of goods, i.e., stationery, so it will be recorded in the Purchase Book.

3. The transaction involves a supplier or vendor, i.e., stationery dealer, so it will be recorded in the Purchase Book.

Therefore, the correct answer is option 'A,' i.e., Purchase Book.

HTML Version:

Book of Original Entry for Credit Purchase of Stationery worth Rs. 5,000 by a Stationery Dealer is Purchase Book.

Explanation:

Purchase Book is a book of original entry in which all credit purchases of goods and services are recorded. Credit purchases are the purchases made on credit from suppliers or vendors. In this case, stationery worth Rs. 5,000 is purchased on credit from a stationery dealer, so it will be recorded in the Purchase Book.

The following are the reasons why the transaction will be recorded in the Purchase Book:

1. The transaction is a credit purchase, so it will be recorded in the Purchase Book.

2. The transaction involves the purchase of goods, i.e., stationery, so it will be recorded in the Purchase Book.

3. The transaction involves a supplier or vendor, i.e., stationery dealer, so it will be recorded in the Purchase Book.

Therefore, the correct answer is option 'A,' i.e., Purchase Book.

HTML Version:

Book of Original Entry for Credit Purchase of Stationery worth Rs. 5,000 by a Stationery Dealer

- Option A: Purchase Book

- Option B: Sales Book

- Option C: Cash Book

- Option D: Journal Proper (General Journal)

Explanation:

Purchase Book is a book of original entry in which all credit purchases of goods and services are recorded. Credit purchases are the purchases made on credit from suppliers or vendors. In this case, stationery worth Rs. 5,000 is purchased on credit from a stationery dealer, so it will be recorded in the Purchase Book.

The following are the reasons why the transaction will be recorded in the Purchase Book:

- The transaction is a credit purchase, so it will be recorded in the Purchase Book.

- The transaction involves the purchase of goods, i.e., stationery, so it will be recorded in the Purchase Book.

- The transaction involves a supplier or vendor, i.e., stationery dealer, so it will be recorded in the Purchase Book.

Therefore, the correct answer is option 'A,' i.e., Purchase Book.

The total of the Sales Book is posted to- a)the credit of the Sales Account,

- b)credit of the Purchases Account,

- c)credit of the Capital Account

Correct answer is option 'A'. Can you explain this answer?

The total of the Sales Book is posted to

a)

the credit of the Sales Account,

b)

credit of the Purchases Account,

c)

credit of the Capital Account

|

|

Nikita Singh answered |

The Sales book is a subsidiary book which records only credit sales. Sales A/c is a ledger account which includes cash as well as credit sales. Thus, we need to post the total of sales book to the credit of Sales A/c.

The correct option is A.

The correct option is A.

The Sales Book- a)is a part of journal,

- b)is a part of the ledger,

- c)is a part of the balance sheet.

Correct answer is option 'A'. Can you explain this answer?

The Sales Book

a)

is a part of journal,

b)

is a part of the ledger,

c)

is a part of the balance sheet.

|

|

Jayant Mishra answered |

A sales journal is a specialized accounting journal and it is also a prime entry book used in an accounting system to keep track of the sales of items that customers(debtors) have purchased on account by charging a receivable on the debit side of an accounts receivable account and crediting revenue on the credit side. It differs from the cash receipts journal in that the latter will serve to book sales when cash is received.The sales journal is used to record all of the company sales on credit. Most often these sales are made up of inventory sales or other merchandise sales. Notice that only credit sales of inventory and merchandise items are recorded in the sales journal. Cash sales of inventory are recorded in the cash receipts journal. Both cash and credit sales of non-inventory or merchandise are recorded in the general journal.

The debit note issued are used to prepare- a)Sales return book

- b)Purchase Return Book

- c)Sales book

- d)Purchases book

Correct answer is option 'B'. Can you explain this answer?

The debit note issued are used to prepare

a)

Sales return book

b)

Purchase Return Book

c)

Sales book

d)

Purchases book

|

Freedom Institute answered |

Purchase returns book is maintained to record the transactions of goods returned to the supplier which were purchased on credit.

Whenever, such purchases are to be returned a debit note is issued by a seller as an advise of the amount of returns by the buyer with the complete details of the purchases to be returned.

Whenever, such purchases are to be returned a debit note is issued by a seller as an advise of the amount of returns by the buyer with the complete details of the purchases to be returned.

Purchase goods from E worth Rs. 5,000 on credit basis. - a)Bills Receivable book

- b)Purchases book

- c)Journal Proper (General journal)

- d)Purchases Return

Correct answer is option 'B'. Can you explain this answer?

Purchase goods from E worth Rs. 5,000 on credit basis.

a)

Bills Receivable book

b)

Purchases book

c)

Journal Proper (General journal)

d)

Purchases Return

|

Srsps answered |

Purchase book also known as purchase journal is an accounting ledger in which all credit purchases of trading goods are recorded.

In Purchases Book the record is in respect of- a)Cash purchase of goods,

- b)Credit purchase of goods dealt in,

- c)All purchases of goods.

- d)None of the above

Correct answer is option 'B'. Can you explain this answer?

In Purchases Book the record is in respect of

a)

Cash purchase of goods,

b)

Credit purchase of goods dealt in,

c)

All purchases of goods.

d)

None of the above

|

Srsps answered |

Purchase book records credit purchases of goods only. Whenever, goods are purchased, purchase account is debited. In all cases of purchases, goods come into business, so purchases account has to be debited. Monthly total of purchases book is posted to the debit of purchases account in the ledger.

In which book of original entry, will you record the following transactions?Q.An allowance of Rs. 50 was offered for an early payment of cash of Rs. 1,050.- a)Sales Book

- b)Cash Book

- c)Journal Proper (General Journal)

- d)Purchase Book

Correct answer is option 'B'. Can you explain this answer?

In which book of original entry, will you record the following transactions?

Q.An allowance of Rs. 50 was offered for an early payment of cash of Rs. 1,050.

a)

Sales Book

b)

Cash Book

c)

Journal Proper (General Journal)

d)

Purchase Book

|

Raghav Ghoshal answered |

The correct answer is option 'B' which is the Cash Book. The reason for this is as follows:

Recording of Cash Transactions:

Cash transactions are recorded in the Cash Book which is a book of original entry. It is a subsidiary book that records all cash receipts and cash payments. It is maintained on a daily basis and is used to keep track of the cash balance.

Allowance for Early Payment:

An allowance for early payment is a discount offered to a customer for paying early. In this case, an allowance of Rs. 50 was offered for an early payment of cash of Rs. 1,050. This means that the customer paid Rs. 1,000 instead of the full amount of Rs. 1,050.

Recording of Allowance for Early Payment:

The entry for the allowance for early payment will be recorded in the Cash Book. The entry will be as follows:

Date | Particulars | L.F. | Amount

-----|------------|-----|-------

DD/MM/YY | Cash A/c Dr. | | 1,000

| Discount Allowed A/c Dr. | | 50

| Sales A/c Cr. | | 1,050

In this entry, the cash account is debited with Rs. 1,000, the discount allowed account is debited with Rs. 50, and the sales account is credited with Rs. 1,050.

Conclusion:

Hence, the correct book of original entry to record the transaction of allowance for early payment is the Cash Book.

Recording of Cash Transactions:

Cash transactions are recorded in the Cash Book which is a book of original entry. It is a subsidiary book that records all cash receipts and cash payments. It is maintained on a daily basis and is used to keep track of the cash balance.

Allowance for Early Payment:

An allowance for early payment is a discount offered to a customer for paying early. In this case, an allowance of Rs. 50 was offered for an early payment of cash of Rs. 1,050. This means that the customer paid Rs. 1,000 instead of the full amount of Rs. 1,050.

Recording of Allowance for Early Payment:

The entry for the allowance for early payment will be recorded in the Cash Book. The entry will be as follows:

Date | Particulars | L.F. | Amount

-----|------------|-----|-------

DD/MM/YY | Cash A/c Dr. | | 1,000

| Discount Allowed A/c Dr. | | 50

| Sales A/c Cr. | | 1,050

In this entry, the cash account is debited with Rs. 1,000, the discount allowed account is debited with Rs. 50, and the sales account is credited with Rs. 1,050.

Conclusion:

Hence, the correct book of original entry to record the transaction of allowance for early payment is the Cash Book.

Choose the most appropriate answer from the given options :Q.In Purchases Book the record is in respect of- a)cash purchase of goods,

- b)credit purchase of goods dealt in,

- c)all purchases of goods.

Correct answer is option 'B'. Can you explain this answer?

Choose the most appropriate answer from the given options :

Q.In Purchases Book the record is in respect of

a)

cash purchase of goods,

b)

credit purchase of goods dealt in,

c)

all purchases of goods.

|

Monica D answered |

Because in purchases book only credit transactions relating to purchases will be recorded. Theres no scope for cash purchase transactions in purchases book. cash purchases are directly taken in cash book.

The weekly or monthly total of the purchase Book is- a)posted to the debit of the Purchases Account,

- b)posted to the debit of the Sales Account,

- c)posted to the credit of the Purchases Account.

Correct answer is option 'A'. Can you explain this answer?

The weekly or monthly total of the purchase Book is

a)

posted to the debit of the Purchases Account,

b)

posted to the debit of the Sales Account,

c)

posted to the credit of the Purchases Account.

|

|

Nikita Singh answered |

Explanation:

The correct answer is A: posted to the debit of the Purchases Account. Here's why:

- The purchase book is used to record all purchases made by a business.

- The purpose of the purchase book is to keep track of all purchases and to have a record of the total amount spent on purchases over a certain period, which could be weekly or monthly.

- The total amount of purchases recorded in the purchase book needs to be posted to the appropriate account in the general ledger, which is the Purchases Account.

- The Purchases Account is a nominal account and is classified as an expense account. It is used to record the cost of goods purchased for resale or for use in the production of goods.

- Since purchases are considered an expense, the total amount of purchases recorded in the purchase book should be posted to the debit side of the Purchases Account.

- Posting the total amount of purchases to the debit side of the Purchases Account increases the balance of the account, reflecting the total amount spent on purchases during the specified period.

In conclusion, the weekly or monthly total of the purchase book is posted to the debit of the Purchases Account.

The correct answer is A: posted to the debit of the Purchases Account. Here's why:

- The purchase book is used to record all purchases made by a business.

- The purpose of the purchase book is to keep track of all purchases and to have a record of the total amount spent on purchases over a certain period, which could be weekly or monthly.

- The total amount of purchases recorded in the purchase book needs to be posted to the appropriate account in the general ledger, which is the Purchases Account.

- The Purchases Account is a nominal account and is classified as an expense account. It is used to record the cost of goods purchased for resale or for use in the production of goods.

- Since purchases are considered an expense, the total amount of purchases recorded in the purchase book should be posted to the debit side of the Purchases Account.

- Posting the total amount of purchases to the debit side of the Purchases Account increases the balance of the account, reflecting the total amount spent on purchases during the specified period.

In conclusion, the weekly or monthly total of the purchase book is posted to the debit of the Purchases Account.

Accounting for partial recovery from Mr. C of an amount of Rs. 2,000 earlier written off as bad debt. - a)Journal Proper (General journal)

- b)Sales book

- c)Purchase book

- d)Cash Book

Correct answer is option 'D'. Can you explain this answer?

Accounting for partial recovery from Mr. C of an amount of Rs. 2,000 earlier written off as bad debt.

a)

Journal Proper (General journal)

b)

Sales book

c)

Purchase book

d)

Cash Book

|

Niharika Datta answered |

Journal Entry for Partial Recovery of Bad Debt:

The journal entry for the partial recovery of bad debt from Mr. C would be as follows:

Date | Particulars | Debit | Credit

|Bad debts recovered account | Rs. 2,000 |

|Cash Account | | Rs. 2,000 |

Sales Book:

There is no entry required in the Sales book for the partial recovery of bad debt.

Purchase Book:

There is no entry required in the Purchase book for the partial recovery of bad debt.

Cash Book:

The entry for the partial recovery of bad debt from Mr. C in the Cash Book would be as follows:

Date | Particulars | V. No. | Debit | Credit | Balance

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| |Bad debts recovered account | | Rs. 2,000 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| |Total | | | Rs. 2,000 |

In the Cash Book, we would debit the Bad Debts Recovered account and credit the Cash account with the amount of Rs. 2,000. This entry would be recorded on the same day when the cash is received from Mr. C.

The journal entry for the partial recovery of bad debt from Mr. C would be as follows:

Date | Particulars | Debit | Credit

|Bad debts recovered account | Rs. 2,000 |

|Cash Account | | Rs. 2,000 |

Sales Book:

There is no entry required in the Sales book for the partial recovery of bad debt.

Purchase Book:

There is no entry required in the Purchase book for the partial recovery of bad debt.

Cash Book:

The entry for the partial recovery of bad debt from Mr. C in the Cash Book would be as follows:

Date | Particulars | V. No. | Debit | Credit | Balance

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| |Bad debts recovered account | | Rs. 2,000 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| |Total | | | Rs. 2,000 |

In the Cash Book, we would debit the Bad Debts Recovered account and credit the Cash account with the amount of Rs. 2,000. This entry would be recorded on the same day when the cash is received from Mr. C.

The Sale Returns Book records- a)The return of goods purchased

- b)Return of anything purchased,

- c)Return of goods sold.

- d)None of the above

Correct answer is option 'C'. Can you explain this answer?

The Sale Returns Book records

a)

The return of goods purchased

b)

Return of anything purchased,

c)

Return of goods sold.

d)

None of the above

|

Meera Basak answered |

The Sale Returns Book

The Sale Returns Book is a type of subsidiary book used in accounting. It is used to record the return of goods sold to customers. The book is also known as the Return Inward Book or the Sales Return Book.

Purpose of the Sale Returns Book

The purpose of the Sale Returns Book is to record the returns of goods sold to customers. It is important to keep track of these returns because they affect the revenue and cost of goods sold. The book provides a record of the returns so that they can be properly accounted for in the financial statements.

What is recorded in the Sale Returns Book?

The Sale Returns Book records the return of goods sold. This means that it only records the returns of goods that were previously sold to customers. It does not record the return of anything else, such as office supplies or equipment.

Why is option C the correct answer?

Option C is the correct answer because the Sale Returns Book records the return of goods sold. It does not record the return of goods purchased or anything else purchased. The book is used to keep track of the returns of goods sold to customers and is an important tool in accounting for these returns.

The Sale Returns Book is a type of subsidiary book used in accounting. It is used to record the return of goods sold to customers. The book is also known as the Return Inward Book or the Sales Return Book.

Purpose of the Sale Returns Book

The purpose of the Sale Returns Book is to record the returns of goods sold to customers. It is important to keep track of these returns because they affect the revenue and cost of goods sold. The book provides a record of the returns so that they can be properly accounted for in the financial statements.

What is recorded in the Sale Returns Book?

The Sale Returns Book records the return of goods sold. This means that it only records the returns of goods that were previously sold to customers. It does not record the return of anything else, such as office supplies or equipment.

Why is option C the correct answer?

Option C is the correct answer because the Sale Returns Book records the return of goods sold. It does not record the return of goods purchased or anything else purchased. The book is used to keep track of the returns of goods sold to customers and is an important tool in accounting for these returns.

Rectifying the error of a credit purchase of goods worth Rs. 10,000 recorded as credit sale to Mr. D, discovered two months later. - a)Journal Proper (General journal)

- b)Sales Book

- c)Cash Book

- d)Purchase book

Correct answer is option 'A'. Can you explain this answer?

Rectifying the error of a credit purchase of goods worth Rs. 10,000 recorded as credit sale to Mr. D, discovered two months later.

a)

Journal Proper (General journal)

b)

Sales Book

c)

Cash Book

d)

Purchase book

|

Akshat Choudhary answered |

Rectification of Credit Purchase Recorded as Credit Sale

Journal proper (General journal) is used to rectify errors in accounting records. The rectification of credit purchase of goods worth Rs. 10,000 recorded as credit sale to Mr. D is done as follows:

a) Journal Proper:

Date | Particulars | L.F. | Debit | Credit

--- | --- | --- | --- | ---

[Date of rectification] | Mr. D A/c | Dr. | 10,000 |

| To Purchase A/c | | | 10,000 |

Explanation: In this entry, we debit Mr. D's account with Rs. 10,000 to reduce the amount due from him for the credit sale of goods. At the same time, we credit Purchase account with Rs. 10,000 to rectify the error of recording the credit purchase as a credit sale.

b) Sales Book:

The sales book is not relevant in this case as the transaction was a credit purchase recorded as a credit sale.

c) Cash Book:

The cash book is not relevant in this case as the transaction was a credit purchase recorded as a credit sale.

d) Purchase Book:

The purchase book is relevant in this case as the transaction was a credit purchase. However, since the error has been rectified through the journal entry mentioned above, there is no need to make any entry in the purchase book.

Conclusion:

The rectification of the error of a credit purchase of goods worth Rs. 10,000 recorded as a credit sale to Mr. D is done through a journal entry in the journal proper. The entry debits Mr. D's account and credits the Purchase account. The sales book and cash book are not relevant in this case, and there is no need to make any entry in the purchase book.

Journal proper (General journal) is used to rectify errors in accounting records. The rectification of credit purchase of goods worth Rs. 10,000 recorded as credit sale to Mr. D is done as follows:

a) Journal Proper:

Date | Particulars | L.F. | Debit | Credit

--- | --- | --- | --- | ---

[Date of rectification] | Mr. D A/c | Dr. | 10,000 |

| To Purchase A/c | | | 10,000 |

Explanation: In this entry, we debit Mr. D's account with Rs. 10,000 to reduce the amount due from him for the credit sale of goods. At the same time, we credit Purchase account with Rs. 10,000 to rectify the error of recording the credit purchase as a credit sale.

b) Sales Book:

The sales book is not relevant in this case as the transaction was a credit purchase recorded as a credit sale.

c) Cash Book:

The cash book is not relevant in this case as the transaction was a credit purchase recorded as a credit sale.

d) Purchase Book:

The purchase book is relevant in this case as the transaction was a credit purchase. However, since the error has been rectified through the journal entry mentioned above, there is no need to make any entry in the purchase book.

Conclusion:

The rectification of the error of a credit purchase of goods worth Rs. 10,000 recorded as a credit sale to Mr. D is done through a journal entry in the journal proper. The entry debits Mr. D's account and credits the Purchase account. The sales book and cash book are not relevant in this case, and there is no need to make any entry in the purchase book.

A second hand motor car was purchased on credit from B Brothers for Rs. 10,000.- a)Journal Proper (General Journal)

- b)Sales Book

- c)Cash book

- d)Purchase Book

Correct answer is option 'A'. Can you explain this answer?

A second hand motor car was purchased on credit from B Brothers for Rs. 10,000.

a)

Journal Proper (General Journal)

b)

Sales Book

c)

Cash book

d)

Purchase Book

|

Maheshwar Sharma answered |

Answer:

Journal Proper (General Journal)

The purchase of a second hand motor car from B Brothers on credit for Rs. 10,000 should be recorded in the Journal Proper as follows:

Date Particulars L.F. Debit Credit

Rs. Rs.

[Date of Purchase] B Brothers A/c Dr. 10,000

To Purchase A/c 10,000

Sales Book

The Sales Book is not relevant in this transaction, as it is a purchase of a motor car and not a sale.

Cash Book

The Cash Book is not relevant in this transaction, as it is a purchase on credit and not a cash transaction.

Purchase Book

The Purchase Book is not relevant in this transaction, as it is a purchase of a second hand motor car and not a purchase of goods for resale.

Therefore, the correct answer is option 'A' - Journal Proper (General Journal).

Journal Proper (General Journal)

The purchase of a second hand motor car from B Brothers on credit for Rs. 10,000 should be recorded in the Journal Proper as follows:

Date Particulars L.F. Debit Credit

Rs. Rs.

[Date of Purchase] B Brothers A/c Dr. 10,000

To Purchase A/c 10,000

Sales Book

The Sales Book is not relevant in this transaction, as it is a purchase of a motor car and not a sale.

Cash Book

The Cash Book is not relevant in this transaction, as it is a purchase on credit and not a cash transaction.

Purchase Book

The Purchase Book is not relevant in this transaction, as it is a purchase of a second hand motor car and not a purchase of goods for resale.

Therefore, the correct answer is option 'A' - Journal Proper (General Journal).

The weekly or monthly total of the purchase Book is - a)Posted to the debit of the Purchases Account,

- b)Posted to the debit of the Sales Account,

- c)Posted to the credit of the Purchases Account.

- d)None of the above

Correct answer is option 'A'. Can you explain this answer?

The weekly or monthly total of the purchase Book is

a)

Posted to the debit of the Purchases Account,

b)

Posted to the debit of the Sales Account,

c)

Posted to the credit of the Purchases Account.

d)

None of the above

|

|

Priya Patel answered |

Purchases book or purchases day book is a book of original entry maintained to record credit purchases. You must note that cash purchases will not be entered in purchases day book because entries in respect of cash purchases must have been entered in the cash book. At the end of each month, the purchases book is totaled. The total shows the total amount of goods purchased on credit. Purchases book is written up daily from the invoices received. The invoices are consecutively numbered. The invoice of each number is noted in the purchases book.

RULING:

It is not ruled like the ordinary journal. The first column in this book is for date. In the second column, the name of the supplier or the seller, quantity of each article bought, description of the article, rate etc., are recorded. Sometimes a separate column to record the details of the transactions is added in the purchases day book. The third column is for invoice number. The fourth column is for ledger folio. The last column gives the total amount to the supplier.

POSTING:

The total of the purchases book is posted to the debit of purchases account. Names of the suppliers appear in the purchases book. These parties have supplied the goods. They are, therefore, credited with the amount appearing against their respective names. The double entry will thus be completed.

Which of the following types of information are found in subsidiary ledgers, but not in the general ledger?- a)Total cost of goods sold for the period.

- b)The quantity of a particular product sold during the period.

- c)The amount owed to a particular creditor.

- d)The portion of total current assets that consist of cash.

Correct answer is option 'B'. Can you explain this answer?

Which of the following types of information are found in subsidiary ledgers, but not in the general ledger?

a)

Total cost of goods sold for the period.

b)

The quantity of a particular product sold during the period.

c)

The amount owed to a particular creditor.

d)

The portion of total current assets that consist of cash.

|

|

Arun Khanna answered |

A subledger is a ledger containing all of a detailed sub-set of transactions. The total of the transactions in the subledger roll up into the general ledger. For example, a subledger may contain all accounts receivable, or accounts payable, or fixed asset transactions.

In which book of original entry, will you record the following transactions?Q.Which of the following types of information are found in subsidiary ledgers, but not in the general ledger?- a)Total cost of goods sold for the period.

- b)The quantity of a particular product sold during the period.

- c)The amount owed to a particular creditor.

- d)The portion of total current assets that consist of cash.

Correct answer is option 'B'. Can you explain this answer?

In which book of original entry, will you record the following transactions?

Q.Which of the following types of information are found in subsidiary ledgers, but not in the general ledger?

a)

Total cost of goods sold for the period.

b)

The quantity of a particular product sold during the period.

c)

The amount owed to a particular creditor.

d)

The portion of total current assets that consist of cash.

|

Sanjay Chaudhary answered |

A subledger is a ledger containing all of a detailed subset of transaction.The total of the transaction in the subledger roll up into the general ledger.For example, a subledger may contain all accounts receivable, or accounts payable,or fixed asset transaction.

A bills receivable of Rs. 1,000, which was received from a debtor in full settlement for a claim of Rs. 1,100 is dishonoured.- a)Purchases Return Book

- b)Bills Receivable Book

- c)Purchases Book

- d)Journal Proper (General journal)

Correct answer is option 'D'. Can you explain this answer?

A bills receivable of Rs. 1,000, which was received from a debtor in full settlement for a claim of Rs. 1,100 is dishonoured.

a)

Purchases Return Book

b)

Bills Receivable Book

c)

Purchases Book

d)

Journal Proper (General journal)

|

Tanvi Pillai answered |

Answer:

Journal Proper (General Journal)

Explanation:

When a bills receivable of Rs. 1,000 is received from a debtor in full settlement for a claim of Rs. 1,100, it is recorded in the Bills Receivable Book. However, if the bill is dishonoured, it needs to be recorded in the Journal Proper or General Journal. This is because the dishonour of a bill affects two accounts, the Bills Receivable account and the Debtor's account.

The entry in the Journal Proper will be as follows:

Debtor's A/c Dr. 1,000

To Bills Receivable A/c 1,000

(Being the dishonour of a bill of Rs. 1,000 received from the debtor in full settlement for a claim of Rs. 1,100)

In this entry, the Debtor's account is debited with Rs. 1,000, which represents the amount received from the debtor, and the Bills Receivable account is credited with Rs. 1,000, which represents the amount of the bill that was dishonoured.

Recording the dishonour of the bill in the Journal Proper ensures that the accounts are accurately updated and reflects the financial position of the business.

Journal Proper (General Journal)

Explanation:

When a bills receivable of Rs. 1,000 is received from a debtor in full settlement for a claim of Rs. 1,100, it is recorded in the Bills Receivable Book. However, if the bill is dishonoured, it needs to be recorded in the Journal Proper or General Journal. This is because the dishonour of a bill affects two accounts, the Bills Receivable account and the Debtor's account.

The entry in the Journal Proper will be as follows:

Debtor's A/c Dr. 1,000

To Bills Receivable A/c 1,000

(Being the dishonour of a bill of Rs. 1,000 received from the debtor in full settlement for a claim of Rs. 1,100)

In this entry, the Debtor's account is debited with Rs. 1,000, which represents the amount received from the debtor, and the Bills Receivable account is credited with Rs. 1,000, which represents the amount of the bill that was dishonoured.

Recording the dishonour of the bill in the Journal Proper ensures that the accounts are accurately updated and reflects the financial position of the business.

In which book of original entry, will you record the following transactions?Q.Purchased goods from E worth Rs. 5,000 on credit basis.- a)Bills Receivable Book

- b)Purchases Book

- c)Journal Proper (General Journal)

- d)Purchases Return

Correct answer is option 'B'. Can you explain this answer?

In which book of original entry, will you record the following transactions?

Q.Purchased goods from E worth Rs. 5,000 on credit basis.

a)

Bills Receivable Book

b)

Purchases Book

c)

Journal Proper (General Journal)

d)

Purchases Return

|

Prasenjit Kapoor answered |

Explanation:

What is the Purchases Book?

The Purchases Book is a book of original entry used to record all credit purchases of goods by a business. It is also known as a Purchase Journal. The Purchase Book is used to record purchases of goods only, not assets, expenses, or services. The Purchases Book is a part of the double-entry accounting system, where each transaction is recorded twice, once as a debit and once as a credit.

Why is the Purchases Book used for this transaction?

The transaction given in the question is the purchase of goods on credit basis. The Purchases Book is used to record all credit purchases of goods by a business. Hence, the correct answer is option 'B', which is the Purchases Book.

What are the other options?

a) Bills Receivable Book - This book is used to record bills receivable that are received by the business. Bills receivable are written promises by a customer to pay a certain amount of money on a specific date.

c) Journal Proper (General Journal) - This book is used to record all transactions that cannot be recorded in any other book of original entry. These transactions are usually rare and complex.

d) Purchases Return - This book is used to record all goods that are returned to the supplier by the business. This book is used to record credit notes issued by the supplier for the returned goods.

Conclusion:

The correct book of original entry to record the given transaction is the Purchases Book, as it is a credit purchase of goods. The other options given in the question are not applicable to this transaction.

What is the Purchases Book?

The Purchases Book is a book of original entry used to record all credit purchases of goods by a business. It is also known as a Purchase Journal. The Purchase Book is used to record purchases of goods only, not assets, expenses, or services. The Purchases Book is a part of the double-entry accounting system, where each transaction is recorded twice, once as a debit and once as a credit.

Why is the Purchases Book used for this transaction?

The transaction given in the question is the purchase of goods on credit basis. The Purchases Book is used to record all credit purchases of goods by a business. Hence, the correct answer is option 'B', which is the Purchases Book.

What are the other options?

a) Bills Receivable Book - This book is used to record bills receivable that are received by the business. Bills receivable are written promises by a customer to pay a certain amount of money on a specific date.

c) Journal Proper (General Journal) - This book is used to record all transactions that cannot be recorded in any other book of original entry. These transactions are usually rare and complex.

d) Purchases Return - This book is used to record all goods that are returned to the supplier by the business. This book is used to record credit notes issued by the supplier for the returned goods.

Conclusion:

The correct book of original entry to record the given transaction is the Purchases Book, as it is a credit purchase of goods. The other options given in the question are not applicable to this transaction.

The total of the purchases day book is posted periodically to the debit of : - a)Purchases account.

- b)Cash book

- c)Journal proper

- d)None of these.

Correct answer is option 'A'. Can you explain this answer?

The total of the purchases day book is posted periodically to the debit of :

a)

Purchases account.

b)

Cash book

c)

Journal proper

d)

None of these.

|

Freedom Institute answered |

Purchase Day book (Purchase Register)is the book of original entry in which all the transactions relating to only credit purchase are recorded. Cash purchases do not find place in purchase day book as they are recorded in Cash book.The every month total of purchase is to be posted on the debit side of the purchase account.

Goods Outward Journal is meant for recording all returns of goods- a)Sold on credit

- b)Purchased on credit

- c)Purchased on cash

- d)None of the above

Correct answer is option 'B'. Can you explain this answer?

Goods Outward Journal is meant for recording all returns of goods

a)

Sold on credit

b)

Purchased on credit

c)

Purchased on cash

d)

None of the above

|

Maheshwar Sharma answered |

A purchase returns journal (also known as returns outwards journal/purchase debits daybook) is a prime entry book or a daybook which is used to record purchase returns. In other words, it is the journal which is used to record the goods which are returned to the suppliers.

Which of the following is not a subsidiary book?

- a)Sales Book

- b)Purchases Book

- c)Pass Book

- d)Bills Receivable Book.

Correct answer is option 'C'. Can you explain this answer?

Which of the following is not a subsidiary book?

a)

Sales Book

b)

Purchases Book

c)

Pass Book

d)

Bills Receivable Book.

|

|

Arun Khanna answered |

Subsidiary Books are the sub divisions of a Journal. These books are meant for recording the transactions of a similar nature in a separate book. When there are many transactions, the Journal is sub-divided into subsidiary books to record such voluminous transactions and events in one single book. These books are also termed as 'Special Purpose Books or Special Journals or Book of Original/Primary/Prime entry'.

A Pass Book is a copy of the ledger account maintained by a bank to record the transactions of its clients. Each customer is issued a separate passbook by the bank. It is the copy of the ledger account provided periodically to a customer in order to inform him/her about the transactions and balances in the account.

In which book of original entry, will you record the following transactions?Q.Unpaid salary for Rs. 340 is to be provided for in the accounts.- a)Bills Receivable Book

- b)Purchases Book

- c)Journal Proper (General Journal)

- d)Purchases Return

Correct answer is option 'C'. Can you explain this answer?

In which book of original entry, will you record the following transactions?

Q.Unpaid salary for Rs. 340 is to be provided for in the accounts.

a)

Bills Receivable Book

b)

Purchases Book

c)

Journal Proper (General Journal)

d)

Purchases Return

|

Ishan Goyal answered |

Explanation:

The correct answer is option 'C', which is Journal Proper (General Journal).

Journal Proper:

The Journal Proper, also known as the General Journal, is a book of original entry where transactions that do not fit into any other specific book are recorded. It is used to record non-routine or special transactions.

Unpaid Salary:

In this case, the transaction is related to providing for unpaid salary amounting to Rs. 340. This transaction does not fit into any specific book like Bills Receivable Book, Purchases Book, or Purchases Return.

Reason for using Journal Proper:

The reason for recording this transaction in the Journal Proper is that it does not involve any external parties like bills receivable or purchases. It is an internal transaction related to the provision of unpaid salary.

Recording the Transaction:

To record this transaction in the Journal Proper, we would follow the general format of a journal entry, which includes the date, account titles, and amounts.

The entry in the Journal Proper would be as follows:

Date | Account Title | Debit | Credit

-------------------------------------

| Unpaid Salary | | 340

Conclusion:

In conclusion, the transaction of providing for unpaid salary would be recorded in the Journal Proper (General Journal) as it is a non-routine internal transaction that does not fit into any other specific book of original entry.

The correct answer is option 'C', which is Journal Proper (General Journal).

Journal Proper:

The Journal Proper, also known as the General Journal, is a book of original entry where transactions that do not fit into any other specific book are recorded. It is used to record non-routine or special transactions.

Unpaid Salary:

In this case, the transaction is related to providing for unpaid salary amounting to Rs. 340. This transaction does not fit into any specific book like Bills Receivable Book, Purchases Book, or Purchases Return.

Reason for using Journal Proper:

The reason for recording this transaction in the Journal Proper is that it does not involve any external parties like bills receivable or purchases. It is an internal transaction related to the provision of unpaid salary.

Recording the Transaction:

To record this transaction in the Journal Proper, we would follow the general format of a journal entry, which includes the date, account titles, and amounts.

The entry in the Journal Proper would be as follows:

Date | Account Title | Debit | Credit

-------------------------------------

| Unpaid Salary | | 340

Conclusion:

In conclusion, the transaction of providing for unpaid salary would be recorded in the Journal Proper (General Journal) as it is a non-routine internal transaction that does not fit into any other specific book of original entry.

In which book of original entry, will you record the following transactions?Q.Goods Outward Journal is meant for recording all returns of goods- a)Sold on credit

- b)Purchased on credit

- c)Purchased on cash

- d)None of the above

Correct answer is option 'B'. Can you explain this answer?

In which book of original entry, will you record the following transactions?

Q.Goods Outward Journal is meant for recording all returns of goods

a)

Sold on credit

b)

Purchased on credit

c)

Purchased on cash

d)

None of the above

|

Simran Pillai answered |

Goods Outward Journal for Recording Returns of Goods Purchased on Credit

Explanation:

Goods Outward Journal:

- The Goods Outward Journal is a book of original entry where all returns of goods sold on credit are recorded.

- It is used to keep track of goods that have been returned by customers for various reasons.

Transactions Recorded in Goods Outward Journal:

- Goods returned that were sold on credit are recorded in the Goods Outward Journal.

- This includes instances where customers return goods due to defects, incorrect orders, or dissatisfaction with the product.

Purchases on Credit:

- When goods are purchased on credit, they are not immediately paid for in cash.

- Instead, the buyer agrees to pay for the goods at a later date, usually with an agreed-upon interest rate.

Recording Returns of Goods Purchased on Credit:

- When goods purchased on credit are returned to the seller, the transaction is recorded in the Goods Outward Journal.

- This helps maintain accurate records of inventory levels and accounts payable.

Conclusion:

- In the case of goods purchased on credit, the returns of these goods are recorded in the Goods Outward Journal.

- This journal helps businesses keep track of returns and maintain accurate financial records.

Explanation:

Goods Outward Journal:

- The Goods Outward Journal is a book of original entry where all returns of goods sold on credit are recorded.

- It is used to keep track of goods that have been returned by customers for various reasons.

Transactions Recorded in Goods Outward Journal:

- Goods returned that were sold on credit are recorded in the Goods Outward Journal.

- This includes instances where customers return goods due to defects, incorrect orders, or dissatisfaction with the product.

Purchases on Credit:

- When goods are purchased on credit, they are not immediately paid for in cash.

- Instead, the buyer agrees to pay for the goods at a later date, usually with an agreed-upon interest rate.

Recording Returns of Goods Purchased on Credit:

- When goods purchased on credit are returned to the seller, the transaction is recorded in the Goods Outward Journal.

- This helps maintain accurate records of inventory levels and accounts payable.

Conclusion:

- In the case of goods purchased on credit, the returns of these goods are recorded in the Goods Outward Journal.

- This journal helps businesses keep track of returns and maintain accurate financial records.

The total of the Purchase Day Book is posted periodically to the : - a)Debit of purchases A/c

- b)Credit of purchase A/c

- c)Cash Book

- d)None of these

Correct answer is option 'A'. Can you explain this answer?

The total of the Purchase Day Book is posted periodically to the :

a)

Debit of purchases A/c

b)

Credit of purchase A/c

c)

Cash Book

d)

None of these

|

Mansi Pathak answered |

Correct answer is option A because you have purchase i.e debit of purchase A/c

The total of the Purchase Day Book is posted periodically to the : - a)Debit of purchases A/c

- b)Credit of purchase A/c

- c)Cash Book

- d)None of these

Correct answer is option 'A'. Can you explain this answer?

The total of the Purchase Day Book is posted periodically to the :

a)

Debit of purchases A/c

b)

Credit of purchase A/c

c)

Cash Book

d)

None of these

|

Aditi Joshi answered |

Posting of Purchase Day Book Total to Purchases Account

Explanation: