All questions of Unit 3: Admission of a New Partner for CA Foundation Exam

A and B are partners sharing the profit the ratio of 3:2. They take C as the new partner, who brings in Rs. 25,000 against capital and Rs. 10,000 against goodwill. New profit sharing ratio is 1:1:1. In what ratio will this amount will be shared among the old partners A & B.- a)8,000:2,000

- b)5,000:5,000

- c)Old partners will not get any share in the goodwill brought in by C

- d)6,000:4,000

Correct answer is option 'A'. Can you explain this answer?

|

Aman Chaudhary answered |

Let's calculate the new capital brought in by A and B after the addition of C as a partner:

A's new capital = A's old capital + A's share of goodwill

= Rs. 0 + Rs. 10,000

= Rs. 10,000

B's new capital = B's old capital + B's share of goodwill

= Rs. 0 + Rs. 10,000

= Rs. 10,000

Now, let's calculate the new profit sharing ratio among A, B, and C:

Total capital = A's new capital + B's new capital + C's capital

= Rs. 10,000 + Rs. 10,000 + Rs. 25,000

= Rs. 45,000

A's new profit share = (A's new capital / Total capital) * Total profit

= (Rs. 10,000 / Rs. 45,000) * Total profit

= 2/9 * Total profit

B's new profit share = (B's new capital / Total capital) * Total profit

= (Rs. 10,000 / Rs. 45,000) * Total profit

= 2/9 * Total profit

C's profit share = (C's capital / Total capital) * Total profit

= (Rs. 25,000 / Rs. 45,000) * Total profit

= 5/9 * Total profit

Given that the new profit sharing ratio is 1:1:1, we can equate the profit shares of A and B:

2/9 * Total profit = 1/3 * Total profit

Cross-multiplying, we get:

2/9 * Total profit = 1/3 * Total profit

2/9 = 1/3

2 * 3 = 9 * 1

6 = 9

The equation is not true, which means the profit shares of A and B are not equal. Therefore, the given information is inconsistent.

A and B are partners sharing the profit in the ratio of 3:2. They take C as the new partner, who is supposed to bring Rs. 25,000 against capital and Rs. 10,000 against goodwill. New profit sharing ratio is 1:1:1. C is able to bring Rs. 30,000 only. How this will be treated in the books of the firm.- a)A and B will share goodwill brought by C as Rs. 4,000: Rs.1,000

- b)Goodwill not brought, will be adjusted to the extent of Rs.5,000 in sacrificing ratio.

- c)Both

- d)None

Correct answer is option 'B'. Can you explain this answer?

|

Lekshmi Mehta answered |

1. Calculation of new capital of partners:

- A's capital = (3/5)*(25000+10000) = Rs. 18,000

- B's capital = (2/5)*(25000+10000) = Rs. 12,000

- C's capital = Rs. 30,000

2. Calculation of new profit sharing ratio:

- A:B:C = 1:1:1

3. Calculation of new share of profit:

- Total profit = Old profit + Goodwill

- Goodwill = C's goodwill contribution - Actual goodwill = Rs. 10,000 - Rs. 5,000 = Rs. 5,000

- New profit = Rs. 5,000

- A's share = Rs. 5,000*(1/3) = Rs. 1,667

- B's share = Rs. 5,000*(1/3) = Rs. 1,667

- C's share = Rs. 5,000*(1/3) = Rs. 1,667

4. Adjustment of goodwill:

- As per the new profit sharing ratio, A and B will have to sacrifice their share of profit in the ratio of 3:2.

- Sacrifice of A = Rs. 1,667*(3/5) = Rs. 1,000

- Sacrifice of B = Rs. 1,667*(2/5) = Rs. 667

- Total sacrifice = Rs. 1,667

- As the actual goodwill is only Rs. 5,000, the remaining Rs. 3,333 (Rs. 5,000 - Rs. 1,667) cannot be adjusted.

- Therefore, the unadjusted goodwill will be written off to the old partners' capital accounts in the sacrificing ratio.

- A's share of unadjusted goodwill = Rs. 3,333*(3/5) = Rs. 2,000

- B's share of unadjusted goodwill = Rs. 3,333*(2/5) = Rs. 1,333

- A's new capital = Rs. 18,000 + Rs. 2,000 - Rs. 1,000 = Rs. 19,000

- B's new capital = Rs. 12,000 + Rs. 1,333 - Rs. 667 = Rs. 12,666

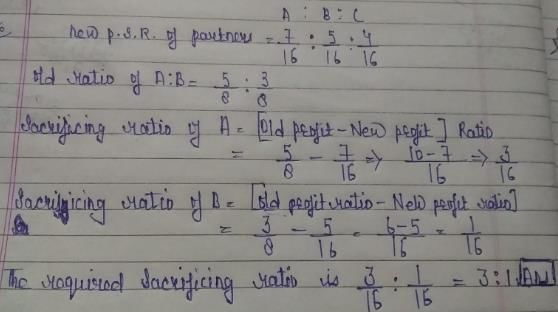

A and B are partners sharing profits in the ratio 5:3, they admitted C giving him 3/10th share of profit. If C acquires 1/5th share from A and 1/10th from B, new profit sharing ratio will be:- a)5:6:3.

- b)2:4:6.

- c)18:24:38.

- d)17:11:12

Correct answer is option 'D'. Can you explain this answer?

|

Sounak Jain answered |

A and B share profits in the ratio of 5:3

C is given 3/10th share of profit

C acquires 1/5th share from A and 1/10th share from B

To find: New profit sharing ratio

Step-by-step solution:

1. Let the total profit be x

2. A's share in the profit = 5/8 * x

3. B's share in the profit = 3/8 * x

4. C's share in the profit = 3/10 * x

5. C acquires 1/5th share from A, which is (1/5 * 5/8) = 1/8 of the total profit. Hence, A's new share in the profit = 5/8 - 1/8 = 4/8 = 1/2

6. C acquires 1/10th share from B, which is (1/10 * 3/8) = 3/80 of the total profit. Hence, B's new share in the profit = 3/8 - 3/80 = 27/80

7. Add up the new shares of A, B, and C to get the total profit: 1/2 + 27/80 + 3/10 = 17/40

8. New profit sharing ratio: A:B:C = (1/2)/(27/80)/(3/10) = 17:11:12

Hence, the correct answer is option D) 17:11:12.

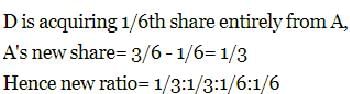

X and Y are sharing profits and losses in the ratio of 3 :2. Z is admitted with 1/5th share in profits of the firm which he gets from X. Now the new profit sharing ratio among X, Y and Z will be _________.

- a)12:8:5

- b)8:12:5

- c)2:2:1

- d)2:2:2

Correct answer is option 'C'. Can you explain this answer?

|

Madhavan Malik answered |

Z is admitted with 1/5th share in profits of the firm which he gets from X.

To Find: New profit sharing ratio.

Solution:

Let the total profit be 'P'.

Profit share of X and Y = 3P/5 and 2P/5 respectively.

Profit share of Z = 1/5 of X's share = (1/5) × (3P/5) = 3P/25.

Total profit share of X, Y, and Z = 3P/5 + 2P/5 + 3P/25 = 27P/25.

New profit sharing ratio:

X's share = (3P/5 + 3P/25) = 18P/25

Y's share = 2P/5

Z's share = 3P/25

The new profit-sharing ratio of X, Y, and Z is 18:10:3.

Therefore, the correct answer is option (c) 2:2:1.

P and Q are partners sharing Profits in the ratio of 2:1. R is admitted to the partnership with effect from 1st April on the term that he will bring Rs. 20,000 as his capital for 1/4th share and pays Rs. 9,000 for goodwill, half of which is to be withdrawn by P and Q. If profit on revaluation is Rs. 6,000 and opening capital of P is Rs. 40,000 and of Q is Rs. 30,000, find the closing balance of each capital.- a)47,000:33.500:20,000.

- b)50,000:35,000:20,000.

- c)40,000:30,000:20,000.

- d)41,000:30,500:29,000.

Correct answer is option 'A'. Can you explain this answer?

|

Srsps answered |

Given:

- P and Q are partners sharing profits in the ratio of 2:1.

- R is admitted to the partnership with effect from 1st April.

- R brings Rs. 20,000 as his capital for 1/4th share.

- R pays Rs. 9,000 for goodwill, half of which is to be withdrawn by P and Q.

- Profit on revaluation is Rs. 6,000.

- Opening capital of P is Rs. 40,000 and of Q is Rs. 30,000.

To find:

Closing balance of each capital.

Step 1: Calculate the share of R in the profits and capital:

- R's share in the profits = 1/4 * total profits

- R's share in the capital = Rs. 20,000

Step 2: Calculate the total profits:

- Let the total profits be x.

- P's share in the profits = 2/3 * x

- Q's share in the profits = 1/3 * x

- R's share in the profits = 1/4 * x

Given that half of the goodwill payment is to be withdrawn by P and Q, we can calculate the goodwill payment as follows:

- Goodwill payment = Rs. 9,000

- Amount withdrawn by P and Q = 1/2 * Rs. 9,000 = Rs. 4,500

Step 3: Calculate the new capital of P and Q after the withdrawal:

- P's new capital = Opening capital + Share of profits - Amount withdrawn

- Q's new capital = Opening capital + Share of profits - Amount withdrawn

Step 4: Calculate the total capital:

- Total capital = P's capital + Q's capital + R's capital

Step 5: Calculate the closing balance of each capital:

- Closing balance of P = P's new capital / Total capital * x

- Closing balance of Q = Q's new capital / Total capital * x

- Closing balance of R = R's capital / Total capital * x

Now let's calculate the values:

Given:

- Opening capital of P = Rs. 40,000

- Opening capital of Q = Rs. 30,000

- Profit on revaluation = Rs. 6,000

- Goodwill payment = Rs. 9,000

- Amount withdrawn by P and Q = Rs. 4,500

- R's capital = Rs. 20,000

Step 1: Calculate the share of R in the profits and capital:

- R's share in the profits = 1/4 * total profits = 1/4 * x

- R's share in the capital = Rs. 20,000

Step 2: Calculate the total profits:

- P's share in the profits = 2/3 * x

- Q's share in the profits = 1/3 * x

- R's share in the profits = 1/4 * x

Given that half of the goodwill payment is to be withdrawn by P and Q, we can calculate the goodwill payment as follows:

- Goodwill payment = Rs. 9,000

- Amount withdrawn by P and Q =

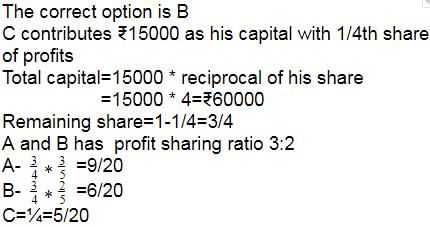

X and Y are partners sharing profits in the ratio 5:3. They admitted Z for 1/5th share of profits, for which he paid Rs. 1,20,000 against capital and Rs. 60,000 against goodwill.Find the capital balances for each partner taking Z’s capital as base capital.- a)3,00,000; 1,20,000 and 1,20,000.

- b)3,00,000; 1,20,000 and 1,80,000.

- c)3,00,000; 1,80,000 and 1,20,000.

- d)3,00,000; 1,80,000 and 1,80,000.

Correct answer is option 'C'. Can you explain this answer?

|

|

Poonam Reddy answered |

A, B, C, D are partners sharing their profits and losses equally. They change their profit sharing ratio to 2:2:1:1. How much will C sacrifice?- a)1/6

- b)1/12

- c)1/24

- d)None

Correct answer is option 'B'. Can you explain this answer?

|

Maheshwar Datta answered |

Initial profit sharing ratio = 1:1:1:1

New profit sharing ratio = 2:2:1:1

To find out how much C will sacrifice, we need to compare the old share of C with the new share of C.

Let the total profit of the firm be x.

Initial share of C = (1/4) x

New share of C = (1/6) x

C sacrifice = Initial share of C - New share of C

= (1/4)x - (1/6)x

= (3x - 2x)/12

= x/12

Therefore, C will sacrifice 1/12th of the total profit.

Hence, option B is the correct answer.

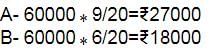

A and B are partners sharing profits and losses in the ratio of 3:2. A’s Capital is Rs. 60,000 and B’s Capital is Rs. 30,000. They admit C for 1/5th share of profits. How much C should bring in towards his capital?- a)Rs. 18,000

- b)Rs. 24,000

- c)Rs. 29,000

- d)Rs. 22,500

Correct answer is option 'D'. Can you explain this answer?

|

Raghav Ghoshal answered |

To calculate the share of profits for A and B, we need to first determine the total profits for the year. Let's say the total profits are $30,000.

A's share of the profits:

3/5 x $30,000 = $18,000

B's share of the profits:

2/5 x $30,000 = $12,000

To calculate the return on investment (ROI) for each partner, we need to divide their share of profits by their initial investment and express it as a percentage.

A's ROI:

($18,000 / $15,000) x 100% = 120%

B's ROI:

($12,000 / $10,000) x 100% = 120%

Both partners have the same ROI of 120%.

X and Y are partners sharing profits in the ratio of 3 : 1. They admit Z as a partner who pays Rs. 4,000 as Goodwill the new profit sharing ratio being 2 : 1 : 1 among X, Y and Z respectively. The amount of goodwill will be credited to :- a)X and Y as Rs. 3,000 and Rs. 1,000 respectively.

- b)X only

- c)Y only.

- d)None of the above.

Correct answer is option 'B'. Can you explain this answer?

|

Shahin Ansari. answered |

X and Y share profits and losses in the ratio of 4:3. They admit Z in the firm with 3/7 share which he gets 2/7 from X and 1/7 form Y. The new profit sharing ratio will be:- a)7:3:3

- b)2:2:3

- c)5:2:3

- d)2:3:3

Correct answer is option 'B'. Can you explain this answer?

|

|

Poonam Reddy answered |

Rahul and Bajaj are partners sharing profit and loss in the ratio of 1:2. Birla is admitted in partnership for - a)1 : 3

- b)2 : 1

- c)3 : 1

- d)1 : 2

Correct answer is option 'D'. Can you explain this answer?

|

Prashanth Datta answered |

Let the capital of Rahul and Bajaj be R and B respectively.

Their profit sharing ratio is 1:2, which can be written as:

Rahul's share : Bajaj's share = 1/3 : 2/3

Let the capital contributed by Birla be x.

When Birla is admitted, the new profit sharing ratio becomes:

Rahul's share : Bajaj's share : Birla's share = 1/3 : 2/3 : x

It is given that the answer is option 'D', which means the new profit sharing ratio is 1:2:2.

Equating the ratios, we get:

1/3 : 2/3 : x = 1 : 2 : 2

On solving the above equation, we get:

x = Birla's capital = 2B

Therefore, Birla's capital is twice that of Bajaj's capital, which means the new profit sharing ratio is 1:2:2, as given in option 'D'.

A and B carry on business and share profits and losses in the ratio of 3:2. Their respective capital are Rs. 1,20,000 and Rs. 54,000. C is admitted for 1/3rd share in profit and brings Rs. 75,000 as his share of capital. Capitals of A and B to be adjusted according to C’s share. Calculate the amount refunded to A. - a)Rs. 30,000

- b)Rs. 32,000

- c)Rs. 15,000

- d)Rs. 28,000

Correct answer is option 'A'. Can you explain this answer?

|

Arnab Nambiar answered |

Let the new capital of A and B be x and y respectively. Then,

A's new capital = x

B's new capital = y

Total new capital = x + y + 75000 (C's capital)

According to the question, the new profit-sharing ratio is 3:2:1, which means:

3x/6 + 2y/6 + 1(75000/6) = 0 (since there is no profit in the beginning)

Simplifying the above equation, we get:

x + y + 12500 = 0

We also know that A's old capital is Rs. 1,20,000 and B's old capital is Rs. 54,000. So, we can write:

A's old capital/A's new capital = B's old capital/B's new capital

120000/x = 54000/y

Solving the above equations simultaneously, we get:

x = Rs. 1,50,000

y = Rs. 67,500

Therefore, A's new capital is Rs. 1,50,000 and B's new capital is Rs. 67,500.

A and B shares profit and losses equally. They admit C as an equal partner and assets were revalued as follow: Goodwill at Rs. 30,000 (book value NIL). Stock at Rs. 20,000 (book value Rs. 12,000); Machinery at Rs. 60,000 (book value Rs. 55,000). C is to bring in Rs. 20,000 as his capital and the necessary cash towards his share of Goodwill. Goodwill account will not remain in the books. Find the profit/loss on revaluation to be shared among A, B and C. - a)21,500:21,5000:0

- b)6,500:6,500:0

- c)14,333:14,333:14,333

- d)4,333:4,333:4,333

Correct answer is option 'B'. Can you explain this answer?

|

|

Stuti Sharma answered |

self generated goodwill not recorded in balance sheet and revaluation account.

so goodwill written off between A and B in 1:1. although C bring 1/3 of 30000,as his share of goodwill.

The opening balance of Partner’s Capital Account is credited with:- a)Interest on Capital

- b)Interest on Drawings

- c)Drawings

- d)Share in Loss

Correct answer is option 'A'. Can you explain this answer?

|

Akshat Choudhary answered |

A and B are partners sharing profits and losses in the ratio 5:3. They admitted C and agreed to give him 3/10th of the profit. What is the new ratio after C’s admission?- a)35:42:17.

- b)35:21:24.

- c)49:22:29.

- d)34:20:12.

Correct answer is option 'B'. Can you explain this answer?

|

Maheshwar Goyal answered |

To find: The new ratio after Cs admission.

Solution:

Let the profit be x.

C's share in the profit = 3/10 x

Remaining profit = x - 3/10 x = 7/10 x

Now, A and B have to share 7/10 x in the ratio 5:3.

A's share = 5/8 * 7/10 x = 7/16 x

B's share = 3/8 * 7/10 x = 21/80 x

C's share = 3/10 x

Therefore, the new ratio of A, B, and C's share in the profit will be:

A:B:C = 7/16 x : 21/80 x : 3/10 x

= 35:21:24 (by cross multiplying)

Hence, the correct option is (b) 35:21:24.

Balance sheet prepared after the new partnership agreement, assets and liabilities are recorded at:- a)Original Value.

- b)Revalued Figure.

- c)At realisable value.

- d)At current cost.

Correct answer is option 'B'. Can you explain this answer?

|

|

Jayant Mishra answered |

X and Y are partners sharing profits equally. Z was admitted for 1/7th share. Calculate New Profit Sharing Ratio. - a)2:3:1

- b)3:3:1

- c)6:5:2

- d)1:1:1

Correct answer is option 'B'. Can you explain this answer?

|

Jatin Mehta answered |

X and Y are partners sharing profits equally.

Z was admitted for 1/7th share.

To find: New Profit Sharing Ratio

Solution:

Let the total profit be P.

X and Y share the profit equally, so their share will be P/2 each.

Z was admitted for 1/7th share, so their share will be P/7.

Therefore, the total share of X, Y, and Z will be:

= P/2 + P/2 + P/7

= (7P+7P+2P)/14

= 16P/14

= 8P/7

Now, we need to find the new profit sharing ratio.

X and Y are sharing equally which means they have a 1:1 ratio.

Z has 1/7th share, so their ratio will be 1:6 (as 1/7 = 1/7 x 6/6 = 6/42 or 1:6)

Therefore, the new profit sharing ratio of X, Y, and Z will be:

= 1:1:6

= 3:3:18 (by multiplying each share by 3)

= 1:1:6 (by dividing each share by 3)

Hence, option B (3:3:1) is the correct answer.

Summary:

X and Y share the profit equally, Z has a 1/7th share. The new profit sharing ratio is 1:1:6 or 3:3:1 after dividing by 3.

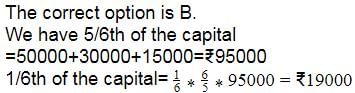

C was admitted in a firm with 1/4th share of the profits of the firm. C contributes Rs. 15,000 as his capital, A and B are other partners with the profit sharing ratio as 3:2. Find the required capital of A and B, if capital should be in profit sharing ratio taking C’s as base capital:- a)Rs. 27,000 and Rs. 16,000 for A and B respectively.

- b)Rs. 27,000 and Rs. 18,000 for A and B respectively.

- c)Rs. 32,000 and Rs. 21,000 for A and B respectively.

- d)Rs. 31,000 and Rs. 26,000 for A and B respectively.

Correct answer is option 'B'. Can you explain this answer?

|

|

Poonam Reddy answered |

A and B are partners sharing profits in the ratio 5:3, they admitted C giving him 3/10th share of profit. If C acquires 1/5th share from A and 1/10th from B, new profit sharing ratio will be: - a)5:6:3

- b)2:4:6

- c)18:24:38

- d)17:11:12

Correct answer is option 'D'. Can you explain this answer?

|

Khushi Shrivastav answered |

A's new share =5/8-1/5=17/40

B's new share = 3/8-1/10=11/40

C's share =3/10*4/4=12/40

New psr is 17:11:12

A and B shares profit and losses equally. They admit C as an equal partner and goodwill was valued as Rs. 30,000 (book value NIL). C is to bring in Rs. 20,000 as his capital and the necessary cash towards his share of Goodwill. Goodwill Account will not remain in the books. What will be the final effect of goodwill in the partner’s capital account?- a)A & B’s account credited with Rs. 5,000 each.

- b)All partners’ account credited with Rs. 10,000 each.

- c)Only C’s account credited with Rs. 10,000 as cash bought in for goodwill.

- d)Final effect will be nil in each partner.

Correct answer is option 'A'. Can you explain this answer?

|

Shivam Chawla answered |

Partnership refers to a business entity formed by two or more persons who mutually agree to share profits and losses. Goodwill, on the other hand, refers to the intangible value of a business that arises due to its reputation, customer base, and other non-physical assets.

Admission of a New Partner

When a new partner is admitted to a partnership, the existing partners may decide to value the goodwill of the business. In this case, the goodwill is usually paid for by the new partner as part of their capital contribution. The amount paid for goodwill is then distributed among the existing partners in the profit sharing ratio.

Effect on Partners' Capital Accounts

The final effect of goodwill on partners' capital accounts depends on how the amount paid for goodwill is distributed among the partners. In this case, A and B share profits and losses equally and admit C as an equal partner. Goodwill is valued at Rs. 30,000, and C is to bring in Rs. 20,000 as capital and the necessary cash towards their share of goodwill. The Goodwill Account will not remain in the books.

The effect on the partners' capital accounts is as follows:

- A's capital account will be credited with Rs. 5,000 (half of the goodwill amount)

- B's capital account will be credited with Rs. 5,000 (half of the goodwill amount)

- C's capital account will be credited with Rs. 20,000 (capital contribution) and debited with Rs. 10,000 (share of goodwill)

Therefore, the final effect of goodwill on the partners' capital accounts is that A and B's accounts are credited with Rs. 5,000 each.

C was admitted in a firm with 1/4th share of the profits of the firm. C contributes Rs. 15,000 as his capital, A and B are other partners with the profit sharing ratio as 3:2. Find the required capital of A and B, if capital should be in profit sharing ratio taking C’s as base capital: - a)Rs. 27,000 and Rs. 16,000 for A and B respectively

- b)Rs. 27,000 and Rs. 18,000 for A and B respectively

- c)Rs. 32.000 and Rs. 21,000 for A and B respectively

- d)Rs. 31,000 and Rs. 26,000 for A and B respectively

Correct answer is option 'B'. Can you explain this answer?

|

Prashanth Datta answered |

Let the required capital of A be x.

Then the required capital of B will be (2/3)x (as their profit sharing ratio is 3:2)

Total profit sharing ratio = 3 + 2 + 1 = 6

Given, C has 1/4th share in profits.

So, (1/4)th share = 1/6 of the total profit sharing ratio

=> 1/4 = (1/6) x 1

=> 1 = 6/4 = 3/2

Now, C's capital = Rs. 15,000

So, total capital = C's capital / (C's share in profit)

= 15000 / (1/4) = Rs. 60,000

Total capital = A's capital + B's capital + C's capital

=> x + (2/3)x + 15000 = 60000

=> (5/3)x = 45000

=> x = 27,000

Therefore, the required capital of A is Rs. 27,000 and the required capital of B is (2/3) x 27,000 = Rs. 18,000.

A and B are partners sharing profits in the ratio of 5:3. They admitted C for 1/5th share of profits for which he paid Rs. 1,20,000 against capital and Rs. 60,000 against goodwill. Find the capital balances for each partner taking C’s Capital as base capital:- a)3,00,000 : 1,20,000 : 1,20,000

- b)3,00,000 : 1,20,000 : 1,80,000

- c)3,00,000 : 1,80,000 : 1,20,000

- d)3,00,000 : 1,80,000 : 1,80,000

Correct answer is option 'C'. Can you explain this answer?

|

Niharika Datta answered |

Initially, A and B shared profits in the ratio of 5:3, which means they had invested capital in the same ratio. Let their initial capital be 5x and 3x respectively.

When C is admitted, he is given 1/5th share of profits. This means the new profit sharing ratio is 5:3:1 (A:B:C). Let C's share of profits be y.

We know that C paid Rs. 1,20,000 against capital and Rs. 60,000 against goodwill. This means his total investment is Rs. 1,80,000.

Let C's capital be z. Then we can set up the following equation:

y/z = 1/5

y = z/5

Total capital after C's admission = 5x + 3x + z

Total capital after C's admission = 8x + z

We can also set up an equation based on the payment made by C:

z = 1,20,000 + 60,000

z = 1,80,000

Substituting z = 1,80,000 in the equation y = z/5, we get:

y = 36,000

Now we can set up an equation based on the new profit sharing ratio:

5x : 3x : 36,000 = 5 : 3 : 1

Multiplying both sides by the common factor of 9:

45x : 27x : 36,000 = 45 : 27 : 9

We can simplify this further by dividing all sides by 9:

5x : 3x : 4,000 = 5 : 3 : 1

This means A's capital is 5x = 5/9 * (5x + 3x + z) = 5/9 * (8x + 1,80,000) = Rs. 1,60,000

B's capital is 3x = 3/9 * (8x + 1,80,000) = Rs. 1,20,000

C's capital is z = Rs. 1,80,000

Therefore, the capital balances for A, B and C after C's admission are Rs. 1,60,000, Rs. 1,20,000 and Rs. 1,80,000 respectively.

A and B share profits in the ratio of 3:2. A’s capital is Rs. 48,000 B’s capital is Rs. 32,000. C is admitted for 1/5th share in profits. What is the amount of capital which C should bring?- a)Rs. 20,000

- b)Rs. 16,000

- c)Rs. 1,00,00

- d)Rs. 64,000

Correct answer is option 'A'. Can you explain this answer?

|

Tanvi Pillai answered |

Total capital = Rs. 30,000 + Rs. 20,000 = Rs. 50,000

Ratio of profit sharing = 3:2

Let the profit be x.

A's share = 3/5 * x

B's share = 2/5 * x

A's capital ratio = 30,000/50,000 = 3/5

B's capital ratio = 20,000/50,000 = 2/5

Therefore, A's share = 3/5 * x = (3/5) * (5/5) * Rs. x = 3x/5

And B's share = 2/5 * x = (2/5) * (5/5) * Rs. x = 2x/5

Total profit earned = A's share + B's share = 3x/5 + 2x/5 = 5x/5 = Rs. x

Therefore, the total profit earned is Rs. x.

And A's share is 3x/5 and B's share is 2x/5.

A, B and C are partners sharing profits and losses in the ratio 6:3:3, they agreed to take D into partnership for 1/8th share of profits. Find the new profit sharing ratio.- a)12:27:36:42

- b)14:7:7:4

- c)1:2:3:4

- d)7:5:3:1

Correct answer is option 'B'. Can you explain this answer?

|

Khushi Shrivastav answered |

Let total profit of the form =1 then deduct the share of D from total share i.e. 1- 1/8=7/8

Now distribute 7/8 between A,B&c i.e.

A's new share = 7/8*6/12=42/96

B's new share = 7/8*3/12=21/96

C's new share =7/8*3/12=21/96

D's share = 1/8*12/12=12/96

new psr = 42:21:21:12 i.e. 14:7:7:4

Which account will be prepared at the time of admission of a new partner for giving effect of revaluation of assets and liabilities without changing the value of assets and liabilities of old Balances Sheet?- a)P & L Adjustment A/c

- b)Revaluation A/c

- c)Memorandum Revaluation A/c

- d)Realisation A/c

Correct answer is option 'C'. Can you explain this answer?

|

Sparsh Chauhan answered |

When a new partner is admitted into a partnership, it is essential to revalue the assets and liabilities to reflect their current market values. However, this process must be executed without altering the old balances in the Balance Sheet. The appropriate account for this situation is the Memorandum Revaluation Account.

Purpose of Memorandum Revaluation A/c

- The Memorandum Revaluation Account is used to record the adjustments in the values of assets and liabilities as per the current market conditions.

- This account does not affect the existing Balance Sheet directly; instead, it serves as a means to document the changes in values for the sake of the new partner's admission.

Key Features of Memorandum Revaluation A/c

- Temporary Account: It is a temporary account used solely for the purpose of revaluation during the admission of a new partner.

- No Impact on Capital Accounts: The revaluation adjustments are reflected in the Memorandum Revaluation Account, ensuring that the original capital accounts of existing partners remain unchanged.

- Distribution of Gains/Losses: Any gains or losses arising from the revaluation are typically shared between the old partners based on their existing profit-sharing ratio.

Conclusion

Using the Memorandum Revaluation Account allows the partnership to maintain the integrity of the Balance Sheet while recognizing the need to adjust asset and liability values. This ensures that both old and new partners have a clear understanding of the financial standing of the partnership at the time of admission.

A and B are partners sharing the profit in the ratio of 3:2. They take C as the new partner, who brings in Rs. 25,000 against capital and Rs. 10,000 against goodwill. New profit sharing ratio is 1:1:1. In what ratio will this amount will be shared among the old partners A & B.- a)8,000:2,000.

- b)5,000:5,000.

- c)Old partners will not get any share in the goodwill bought in by C.

- d)6,000:4,000.

Correct answer is option 'A'. Can you explain this answer?

|

Sanchit Garg answered |

After admission of c the new ratio will 1:1:1

So,we know that goodwill of new partner will be divided to old partner in sacrificing ratio

So first of all calculate sacrificing ratio

A's sacrificing ratio=3/5-1/3=9-5/15=4/15

B's sacrificing ratio=2/5-1/3=6-5/15=1/5

So the sacrificing ratio is 4:1 of A and B respectively.

Goodwill shared between A and B in old profit sharing ratio is

A's= 10000×4/5=8000B's=10000×1/5=2000

P and Q are partners sharing Profits in the ratio of 2:1. R is admitted to the partnership with effect from 1st April on the term that he will bring Rs. 20,000 as his capital for 1/4th share and pays Rs. 9,000 for goodwill, half of which is to be withdrawn by P and Q. If profit on revaluation is Rs. 6,000 and opening capital of P is Rs. 40,000 and of Q is Rs. 30,000, find the closing balance of each capital.- a)Rs.47,000: Rs.33,500: Rs.20,000

- b)Rs.50,000: Rs.35,000: Rs.20,000

- c)Rs.40,000: Rs.30,000: Rs.20,000

- d)Rs.41,000: Rs.30,500: Rs.29,000

Correct answer is option 'A'. Can you explain this answer?

|

Mehul Ghoshal answered |

- P and Q are partners sharing profits in the ratio of 2:1

- R is admitted to the partnership with effect from 1st April, bringing Rs. 20,000 as his capital for 1/4th share and paying Rs. 9,000 for goodwill, half of which is to be withdrawn by P and Q

- Profit on revaluation is Rs. 6,000

- Opening capital of P is Rs. 40,000 and of Q is Rs. 30,000

Step 1: Calculate the total capital after R's admission

R's capital = Rs. 20,000 for 1/4th share

So, total capital = R's capital * 4 = Rs. 80,000

Goodwill paid by R = Rs. 9,000

Goodwill to be withdrawn by P and Q = Rs. 4,500 (half of Rs. 9,000)

Total capital after R's admission = Rs. 80,000 + Rs. 9,000 - Rs. 4,500 = Rs. 84,500

Step 2: Calculate the new profit sharing ratio

P and Q's ratio = 2:1

R is to get 1/4th share, which is equivalent to 2/8th share

So, the new ratio will be 4:2:2 (P:Q:R)

Step 3: Calculate the revalued capital

Total revaluation profit = Rs. 6,000

Profit sharing ratio = 4:2:2

P's share of profit = 4/8 * Rs. 6,000 = Rs. 3,000

Q's share of profit = 2/8 * Rs. 6,000 = Rs. 1,500

R's share of profit = 2/8 * Rs. 6,000 = Rs. 1,500

P's revalued capital = Opening capital + Share of profit = Rs. 40,000 + Rs. 3,000 = Rs. 43,000

Q's revalued capital = Opening capital + Share of profit = Rs. 30,000 + Rs. 1,500 = Rs. 31,500

R's capital = Rs. 20,000 + Rs. 1,500 (share of profit) = Rs. 21,500

Step 4: Calculate the closing balance of each capital

P's closing balance = Revalued capital + Share of goodwill withdrawn = Rs. 43,000 + Rs. 2,250 (half of Rs. 4,500) = Rs. 45,250

Q's closing balance = Revalued capital + Share of goodwill withdrawn = Rs. 31,500 + Rs. 2,250 (half of Rs. 4,500) = Rs. 33,750

R's closing balance = Revalued capital = Rs. 21,500

Therefore, the closing balances of each capital are Rs. 47,000 for P, Rs. 33,500 for Q, and Rs. 20,000 for R, which is option A.

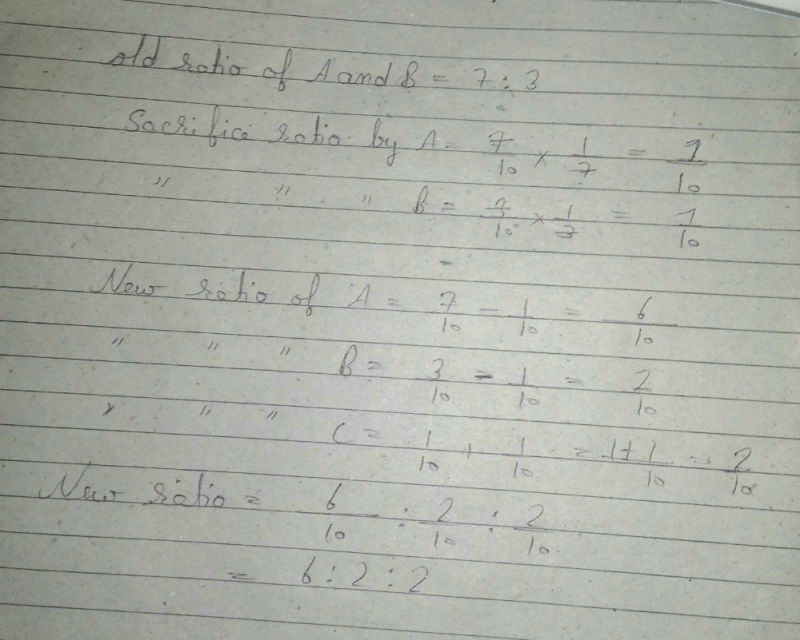

A and B are partners sharing profits in the ratio of 7:3. C is admitted as a new partner. ‘A’ surrenders 1/7 of his share and ‘B’ surrenders 1/3rd of his share in favour of C. The new profit sharing ratio will be:- a)6:2:2

- b)4:1:1

- c)3:2:2

- d)None

Correct answer is option 'A'. Can you explain this answer?

|

Ansh Garg answered |

Which of the following asset is compulsory to revalue at the time of admission of a new partner:- a)Stock.

- b)Fixed Assets.

- c)Investment.

- d)Goodwill.

Correct answer is option 'D'. Can you explain this answer?

|

|

Alok Mehta answered |

Can you explain the answer of this question below:A, B, C are equal partners, they wanted to change the profit sharing ratio into 4:3:2. They raised the goodwill to Rs. 90,000 but want to write it off immediately. The effected accounts will be :

- A:

C’s Capital A/c Dr. 10,000To A’s Capital A/c 10,000

- B:

B’s Capital A/c Dr. A/c 10,000To A’s Capital A/c 10,000

- C:

C’s Capital A/c Dr. 10,000To B’s Capital A/c 10,000

- D:

A’s Capital A/c Dr. 10,000To C’s Capital A/c 10,000

The answer is d.

A, B, C are equal partners, they wanted to change the profit sharing ratio into 4:3:2. They raised the goodwill to Rs. 90,000 but want to write it off immediately. The effected accounts will be :

C’s Capital A/c Dr. 10,000To A’s Capital A/c 10,000

B’s Capital A/c Dr. A/c 10,000To A’s Capital A/c 10,000

C’s Capital A/c Dr. 10,000To B’s Capital A/c 10,000

A’s Capital A/c Dr. 10,000To C’s Capital A/c 10,000

|

Arka Kaur answered |

Initially, all three partners had equal capital, so let's assume each partner had a capital of Rs. x.

After changing the profit sharing ratio to 4:3:2, the new capital contribution of each partner will be:

A = 4x/(4+3+2) = 4x/9

B = 3x/9 = x/3

C = 2x/9

The total capital of the firm will remain unchanged at 9x/9 = x.

Now, the partners have decided to write off the goodwill of Rs. 90,000 immediately. This means that the goodwill account will be closed and its balance will be transferred to the capital accounts of the partners according to their new profit sharing ratio.

The journal entry to write off the goodwill will be:

Goodwill account Dr. 90,000

To A's capital account 40,000

To B's capital account 30,000

To C's capital account 20,000

This entry reduces the value of the goodwill account to zero and increases the capital accounts of the partners according to their new profit sharing ratio.

Therefore, the accounts that will be affected by the change in profit sharing ratio and writing off of goodwill are the capital accounts of A and C, as they will receive a credit balance of Rs. 40,000 and Rs. 20,000 respectively due to the transfer of goodwill.

A and B are partners sharing profits and losses in the proportion of 7 : 5. They agree to admit C, their manager, into partnership who is to get 1 / 6th share in the profit. He acquires this share as 1 / 24th from A and 1 / 8th from B. Calculate new profit-sharing ratio.- a)12 : 7 : 4

- b)13 : 7 : 4

- c)7 : 3 : 2

- d)13 : 3 : 4

Correct answer is option 'B'. Can you explain this answer?

|

Freedom Institute answered |

B's old share = 5 / 12

C is admitted for 1 / 6th share

A's new ratio = 7 / 12 - 1 / 24 = 13 / 24

B's new ratio = 5 / 12 - 1 / 8 = 7 / 24

New Ratio of the firm = 13 : 7 : 4

Adam, Brain and Chris were equal partners of a firm with goodwill Rs. 1,20,000 shown in the balance sheet and they agreed to take Daniel as an equal partner on the term that he should bring Rs. 1,60,000 as his capital and goodwill, his share of goodwill was evaluated at Rs. 60,000 and the goodwill account is to be written off before admission. What will be the treatment for goodwill?- a)Write off the goodwill of Rs. 1,20,000 in old ratio.

- b)Cash bought in by Daniel for goodwill will be distributed among old partners in sacrificing ratio.

- c)Both.

- d)Non

Correct answer is option 'C'. Can you explain this answer?

|

Vandana Kulkarni answered |

Goodwill is an intangible asset that represents the reputation and brand value of a business. It is usually generated when a business operates successfully over a period of time. When a new partner is admitted to a partnership firm, the treatment of goodwill depends on the terms agreed by the partners.

In this case, Daniel is being admitted as an equal partner and he is bringing Rs. 1,60,000 as his capital and goodwill. His share of goodwill is evaluated at Rs. 60,000 and the existing goodwill of Rs. 1,20,000 is to be written off before admission. The treatment of goodwill in this case will be as follows:

1. Write off the goodwill of Rs. 1,20,000 in old ratio:

The existing goodwill of Rs. 1,20,000 will be written off from the balance sheet before admission. This will reduce the value of the firm's assets and also the value of the partners' capital accounts. The old partners (Adam, Brain and Chris) will share the loss of goodwill in their old ratio.

2. Cash bought in by Daniel for goodwill will be distributed among old partners in sacrificing ratio:

Daniel is bringing Rs. 1,60,000 as his capital and goodwill. His share of goodwill is evaluated at Rs. 60,000. Therefore, he is bringing Rs. 1,00,000 as his capital. This amount will be credited to his capital account. The remaining Rs. 60,000 will be distributed among the old partners in their sacrificing ratio. This is because the old partners will be sacrificing their share of the existing goodwill to accommodate the new partner.

3. Both:

The correct answer is option C, which means that both the above treatments will be applied. The existing goodwill of Rs. 1,20,000 will be written off in old ratio and the cash brought in by Daniel for goodwill will be distributed among old partners in sacrificing ratio.

In conclusion, the treatment of goodwill in partnership admission depends on the terms agreed by the partners. In this case, the existing goodwill will be written off and the cash brought in by the new partner will be distributed among the old partners.

A and B shares profit and losses equally. They admit C as an equal partner and assets were revalued as follow: Goodwill at Rs. 30,000 (book value NIL). Stock at Rs. 20,000 (book value Rs. 12,000); Machinery at Rs. 60,000 (book value Rs. 55,000). C is to bring in Rs. 20,000 as his capital and the necessary cash towards his share of Goodwill. Goodwill Account will not remain in the books. Find the profit/loss on revaluation to be shared among A, B and C.- a)21,500:21,500:0.

- b)6,500:6,500:0.

- c)14,333:14,333:14,333.

- d)4,333:4,333:4,333.

Correct answer is option 'B'. Can you explain this answer?

|

Geetika Basak answered |

Given information:

- Goodwill: Book value = NIL, Revalued value = Rs. 30,000

- Stock: Book value = Rs. 12,000, Revalued value = Rs. 20,000

- Machinery: Book value = Rs. 55,000, Revalued value = Rs. 60,000

Let's calculate the increase or decrease in the value of each asset:

1. Goodwill:

- Increase in value = Rs. 30,000 (Revalued value)

- Decrease in value = Rs. 0 (Book value)

- Profit on revaluation = Increase - Decrease = Rs. 30,000 - Rs. 0 = Rs. 30,000

2. Stock:

- Increase in value = Rs. 8,000 (Revalued value - Book value)

- Decrease in value = Rs. 0 (No change in book value)

- Profit on revaluation = Increase - Decrease = Rs. 8,000 - Rs. 0 = Rs. 8,000

3. Machinery:

- Increase in value = Rs. 5,000 (Revalued value - Book value)

- Decrease in value = Rs. 0 (No change in book value)

- Profit on revaluation = Increase - Decrease = Rs. 5,000 - Rs. 0 = Rs. 5,000

Now, let's calculate the total profit on revaluation:

Total profit on revaluation = Profit on revaluation of Goodwill + Profit on revaluation of Stock + Profit on revaluation of Machinery

= Rs. 30,000 + Rs. 8,000 + Rs. 5,000

= Rs. 43,000

Since A, B, and C share the profit and losses equally, the profit/loss on revaluation will be divided equally among them.

Profit/loss on revaluation to be shared among A, B, and C:

A's share = B's share = C's share = Total profit on revaluation / 3

= Rs. 43,000 / 3

= Rs. 14,333

Therefore, the correct answer is option 'C': 14,333:14,333:14,333.

A and B having shares capital of Rs.20,000 each, share profit and losses equally. They admit C as an equal partner and goodwill was valued as Rs. 30,000 (book value NIL). C is to bring in Rs. 20,000 as his capital and the necessary cash towards his share of Goodwill. Goodwill Account will not remain in the books. If profit on revaluation is Rs. 13,000, find the closing balance of the capital account- a)Rs.31,500: Rs.31,500: Rs.20,000

- b)Rs.31,500: Rs.31,500: Rs.30,000

- c)Rs.26,500: Rs.26,500: Rs.30,000

- d)Rs.20,000: Rs.20,000: Rs.20,000

Correct answer is option 'A'. Can you explain this answer?

|

Ankita Mukherjee answered |

Given information:

- A and B have share capital of Rs. 20,000 each.

- A and B share profit and losses equally.

- C is admitted as an equal partner.

- Goodwill is valued at Rs. 30,000 (book value is NIL).

- C brings in Rs. 20,000 as his capital and the necessary cash towards his share of Goodwill.

- Goodwill account will not remain in the books.

- Profit on revaluation is Rs. 13,000.

Step 1: Calculation of New Profit Sharing Ratio:

Since C is admitted as an equal partner, the new profit sharing ratio will be 1:1:1.

Step 2: Allocation of Goodwill:

As per the new profit sharing ratio, the share of Goodwill for each partner will be Rs. 10,000 (30,000/3).

Step 3: Adjusting the Capital Accounts:

- A and B's capital accounts will be adjusted by deducting their share of Goodwill and adding their share of the profit on revaluation.

- C's capital account will be adjusted by adding his capital contribution and his share of the profit on revaluation.

Step 4: Calculation of Closing Capital Account Balance:

The closing balance of each partner's capital account can be calculated as follows:

A's Capital Account:

Opening balance = Rs. 20,000

Less: Share of Goodwill = Rs. 10,000

Add: Share of profit on revaluation = Rs. (13,000/3) = Rs. 4,333.33

Closing balance = Rs. 20,000 - Rs. 10,000 + Rs. 4,333.33 = Rs. 14,333.33

B's Capital Account:

Opening balance = Rs. 20,000

Less: Share of Goodwill = Rs. 10,000

Add: Share of profit on revaluation = Rs. (13,000/3) = Rs. 4,333.33

Closing balance = Rs. 20,000 - Rs. 10,000 + Rs. 4,333.33 = Rs. 14,333.33

C's Capital Account:

Opening balance = Rs. 20,000

Add: Capital contribution = Rs. 20,000

Add: Share of profit on revaluation = Rs. (13,000/3) = Rs. 4,333.33

Closing balance = Rs. 20,000 + Rs. 20,000 + Rs. 4,333.33 = Rs. 44,333.33

Therefore, the closing balance of the capital accounts will be:

A: Rs. 14,333.33

B: Rs. 14,333.33

C: Rs. 44,333.33

Summary:

The closing balance of the capital account is Rs. 14,333.33 for A and B, and Rs. 44,333.33 for C. Hence, the correct option is A) Rs. 31,500: Rs. 31,500: Rs. 20,000.

X and Y are partners sharing profits in the ratio 5:3. They admitted Z for 1/5th share of profits, for which he paid Rs. 1,20,000 against capital and Rs. 60,000 against goodwill. Find the capital balances for each partner taking Z’s capital as base capital. - a)3,00,000; 1,20,000 and 1,20,000

- b)3,00,000; 1,20,000 and 1,80,000

- c)3,00,000; 1,80,000 and 1,20,000

- d)3,00,000; 1,80,000 and 1,80,000

Correct answer is option 'C'. Can you explain this answer?

|

Aarya Sharma answered |

Let the total profit be represented by P.

X's share of profit = 5/8P

Y's share of profit = 3/8P

Z's share of profit = 1/5P

Z paid Rs. 1,20,000 against capital, which represents 1/5th of the total capital needed for his share of profit. Therefore, the total capital required for his share of profit is:

1/5P = 1,20,000

P = 6,00,000

Z paid Rs. 60,000 against goodwill, which means that the total goodwill of the partnership is:

Goodwill = 60,000 * 5/1 = Rs. 3,00,000 (since Z is taking 1/5th share of profits)

Now we can calculate the capital balances for each partner:

X's capital = (5/8P) - (1/5P) = (25/40P) - (8/40P) = (17/40P)

X's capital = (17/40 * 6,00,000) = Rs. 2,55,000

Y's capital = (3/8P) - (1/5P) = (15/40P) - (8/40P) = (7/40P)

Y's capital = (7/40 * 6,00,000) = Rs. 1,05,000

Z's capital = (1/5P) = (1/5 * 6,00,000) = Rs. 1,20,000

Therefore, the capital balances for X, Y, and Z are Rs. 2,55,000, Rs. 1,05,000, and Rs. 1,20,000 respectively.

Can you explain the answer of this question below:A, B, C are partners sharing profits in the ratio of 4:3:2. D is admitted for 2/9th share of profits and brings Rs. 30,000 as capital and 10,000 for his share of goodwill. The new profit sharing ratio between partners will be 3:2:2:2. Goodwill amount will be credited in the capital accounts of :

- A:

A only

- B:

A, B and C (equally)

- C:

A, and B (equally)

- D:

A, and C (equally)

The answer is c.

A, B, C are partners sharing profits in the ratio of 4:3:2. D is admitted for 2/9th share of profits and brings Rs. 30,000 as capital and 10,000 for his share of goodwill. The new profit sharing ratio between partners will be 3:2:2:2. Goodwill amount will be credited in the capital accounts of :

A only

A, B and C (equally)

A, and B (equally)

A, and C (equally)

|

Abc answered |

A and B are partners sharing profits and losses in the ratio of 3:2 (A’s Capital is Rs. 30,000 and B’s Capital is Rs. 15,000). They admitted C agreed to give 1/5th share of profits to him. How much C should bring in towards his capital?- a)Rs. 9,000

- b)Rs. 12,000

- c)Rs. 14,500

- d)Rs. 11,250

Correct answer is option 'D'. Can you explain this answer?

|

Raghav Ghoshal answered |

To find the new ratio, we need to convert all the shares into a common denominator. In this case, the common denominator is 5.

The new profit sharing ratio becomes A:B:C = (3/5):(2/5):(1/5).

This means that A will receive 3/5 of the profits, B will receive 2/5 of the profits, and C will receive 1/5 of the profits.

To calculate the actual amounts, we need to know the total profit. Let's say the total profit is $100.

A will receive (3/5) * $100 = $60.

B will receive (2/5) * $100 = $40.

C will receive (1/5) * $100 = $20.

So, A will receive $60, B will receive $40, and C will receive $20.

A and B share profits equally. They admit C with 1/7th share. The new profit sharing ratio of A and B is - a)4/7, 1/7

- b)3/7, 3/7

- c)2/7, 2/7

- d)None

Correct answer is option 'B'. Can you explain this answer?

|

Maheshwar Goyal answered |

Given, A and B share profits equally. Let their share be x.

So, A's share = B's share = x

Total profit = A's share + B's share = 2x

Now, C is admitted with 1/7th share. So, C's share = (1/7) of total profit

= (1/7) x 2x

= 2x/7

Total profit after C is admitted = A's share + B's share + C's share

= x + x + 2x/7

= (14x + 14x + 2x)/7

= 30x/7

New profit sharing ratio of A and B = A's share : B's share

= (x + 2x/7) : (x + 2x/7)

= (7x/7 + 2x/7) : (7x/7 + 2x/7)

= 9x/7 : 9x/7

= 9: 9

= 1:1

Therefore, the new profit sharing ratio of A and B is 1:1 after admitting C with 1/7th share. Hence, the correct option is B.

Profit or loss on revaluation is shared among the partners in ……… ratio.- a)Old Profit Sharing.

- b)New Profit Sharing.

- c)Capital.

- d)Equal

Correct answer is option 'A'. Can you explain this answer?

|

Srsps answered |

The correct answer is Old Profit Sharing.

Explanation:

When a partnership firm revalues its assets and liabilities, it may result in a profit or loss on revaluation. This profit or loss on revaluation is shared among the partners in the Old Profit Sharing ratio. Let's break down the explanation into bullet points:

- Revaluation of assets and liabilities is done to bring their values closer to their current market values.

- The revaluation process may lead to an increase or decrease in the value of assets and liabilities.

- If the revaluation results in a profit (i.e., the value of assets increases or the value of liabilities decreases), this profit is shared among the partners.

- The sharing of profit on revaluation is done based on the Old Profit Sharing ratio.

- The Old Profit Sharing ratio is the ratio in which the partners were sharing the profits before the revaluation.

- On the other hand, if the revaluation results in a loss (i.e., the value of assets decreases or the value of liabilities increases), this loss is also shared among the partners in the Old Profit Sharing ratio.

- The Old Profit Sharing ratio is important because it reflects the partnership agreement and the understanding between the partners regarding the sharing of profits and losses.

In conclusion, the profit or loss on revaluation is shared among the partners in the Old Profit Sharing ratio.

Chapter doubts & questions for Unit 3: Admission of a New Partner - Accounting for CA Foundation 2025 is part of CA Foundation exam preparation. The chapters have been prepared according to the CA Foundation exam syllabus. The Chapter doubts & questions, notes, tests & MCQs are made for CA Foundation 2025 Exam. Find important definitions, questions, notes, meanings, examples, exercises, MCQs and online tests here.

Accounting for CA Foundation

68 videos|265 docs|83 tests

|