All Exams >

SSC CGL >

Quantitative Aptitude for SSC CGL >

All Questions

All questions of Banker's Discount for SSC CGL Exam

The banker's gain on a certain sum due 5/2 years hence is 9/25 of the banker's discount. What is the rate percent?- a)

- b)

- c)

- d)

Correct answer is option 'D'. Can you explain this answer?

The banker's gain on a certain sum due 5/2 years hence is 9/25 of the banker's discount. What is the rate percent?

a)

b)

c)

d)

|

|

Kiran Reddy answered |

Let BD = 1

Then, BG = 9/25

T = 5/2 years

TD = BD - BG

=> 1 - 9/25

=> 16/25

BG = (TD * RT)/100

9/25 = 16/25 * R * 5/2 * 1/100

R = 45/2

R = 22 1/2

Then, BG = 9/25

T = 5/2 years

TD = BD - BG

=> 1 - 9/25

=> 16/25

BG = (TD * RT)/100

9/25 = 16/25 * R * 5/2 * 1/100

R = 45/2

R = 22 1/2

A bill is discounted at 10% per annum. If banker's discount is allowed, at what rate percent should the proceeds be invested so that nothing will be lost?- a)

- b)

- c)

- d)11

Correct answer is option 'B'. Can you explain this answer?

A bill is discounted at 10% per annum. If banker's discount is allowed, at what rate percent should the proceeds be invested so that nothing will be lost?

a)

b)

c)

d)

11

|

Iq Funda answered |

Let the amount = Rs. 100

Then BD = Rs.10 (∵ banker's discount, BD is the simple Interest on the face value of the bill for unexpired time and bill is discounted at 10% per annum)

Proceeds = Rs. 100 - Rs. 10 = Rs. 90

Hence we should get Rs. 10 as the interest of Rs. 90 for 1 year so that nothing will be lost

⇒ 10 = (90×1×R)/100

⇒ R = (10×100)/90

= 100/9

= 11 1/9%

Then BD = Rs.10 (∵ banker's discount, BD is the simple Interest on the face value of the bill for unexpired time and bill is discounted at 10% per annum)

Proceeds = Rs. 100 - Rs. 10 = Rs. 90

Hence we should get Rs. 10 as the interest of Rs. 90 for 1 year so that nothing will be lost

⇒ 10 = (90×1×R)/100

⇒ R = (10×100)/90

= 100/9

= 11 1/9%

The banker's gain on a sum due 3 years hence at 12% per annum is Rs. 360. The banker's discount is:- a)Rs. 1360

- b)Rs. 1000

- c)Rs. 360

- d)Rs. 640

Correct answer is option 'A'. Can you explain this answer?

The banker's gain on a sum due 3 years hence at 12% per annum is Rs. 360. The banker's discount is:

a)

Rs. 1360

b)

Rs. 1000

c)

Rs. 360

d)

Rs. 640

|

|

Kiran Reddy answered |

BG = Rs. 360

T = 3 years

R = 12%

TD = (BG×100)/TR

= (360×100)/(3×12)

= Rs. 1000

BG = BD - TD

⇒ BD = BG + TD

= 360 + 1000

= Rs. 1360

T = 3 years

R = 12%

TD = (BG×100)/TR

= (360×100)/(3×12)

= Rs. 1000

BG = BD - TD

⇒ BD = BG + TD

= 360 + 1000

= Rs. 1360

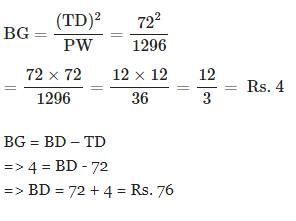

The present worth of a certain sum due sometime hence is Rs. 3400 and the true discount is Rs. 340. The banker's gain is:- a)Rs. 21

- b)Rs. 17

- c)Rs. 18

- d)Rs. 34

Correct answer is option 'D'. Can you explain this answer?

The present worth of a certain sum due sometime hence is Rs. 3400 and the true discount is Rs. 340. The banker's gain is:

a)

Rs. 21

b)

Rs. 17

c)

Rs. 18

d)

Rs. 34

|

|

Kiran Reddy answered |

BG = (TD)2/PW

= (340)2/3400

= (340×340)/3400

= 340/10

= Rs.34

= (340)2/3400

= (340×340)/3400

= 340/10

= Rs.34

The banker's discount on Rs. 1600 at 15% per annum is the same as true discount on Rs. 1680 for the same time and at the same rate. What is the time?- a)3 months

- b)4 months

- c)5 months

- d)6 months

Correct answer is option 'B'. Can you explain this answer?

The banker's discount on Rs. 1600 at 15% per annum is the same as true discount on Rs. 1680 for the same time and at the same rate. What is the time?

a)

3 months

b)

4 months

c)

5 months

d)

6 months

|

|

Kiran Reddy answered |

S.I. on Rs. 1600 = T.D. on Rs. 1680.

Rs. 1600 is the P.W. of Rs. 1680, i.e., Rs. 80 is on Rs. 1600 at 15%.

Time = (100*80)/(1600*15)

= 1/3 year

= 4 months.

Rs. 1600 is the P.W. of Rs. 1680, i.e., Rs. 80 is on Rs. 1600 at 15%.

Time = (100*80)/(1600*15)

= 1/3 year

= 4 months.

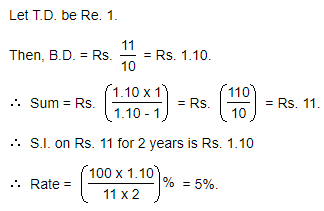

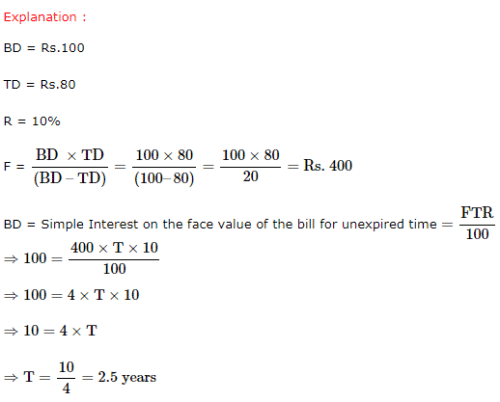

The bankers discount and the true discount of a sum at 10% per annum simple interest for the same time are Rs.100 and Rs.80 respectively. What is the sum and the time?- a)Sum = Rs.400 and Time = 5 years

- b)Sum = Rs.200 and Time = 2.5 years

- c)Sum = Rs.400 and Time = 2.5 years

- d)Sum = Rs.200 and Time = 5 years

Correct answer is option 'C'. Can you explain this answer?

The bankers discount and the true discount of a sum at 10% per annum simple interest for the same time are Rs.100 and Rs.80 respectively. What is the sum and the time?

a)

Sum = Rs.400 and Time = 5 years

b)

Sum = Rs.200 and Time = 2.5 years

c)

Sum = Rs.400 and Time = 2.5 years

d)

Sum = Rs.200 and Time = 5 years

|

Ishani Rane answered |

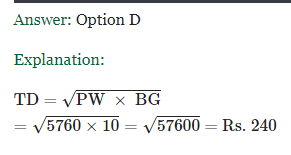

The banker's gain of a certain sum due 3 years hence at 10% per annum is Rs. 36. What is the present worth ?- a)Rs. 400

- b)Rs. 300

- c)Rs. 350

- d)Rs. 500

Correct answer is option 'A'. Can you explain this answer?

The banker's gain of a certain sum due 3 years hence at 10% per annum is Rs. 36. What is the present worth ?

a)

Rs. 400

b)

Rs. 300

c)

Rs. 350

d)

Rs. 500

|

|

Kiran Reddy answered |

T = 3year

R = 10%

TD = (BG × 100)/TR

= (36 × 100)/(3 × 10)

= 12 × 10

= Rs.120

TD = (PW × TR)/100

⇒ 120 = (PW × 3 × 10)/100

⇒ 1200 = PW × 3

PW = 1200/3

= Rs.400

R = 10%

TD = (BG × 100)/TR

= (36 × 100)/(3 × 10)

= 12 × 10

= Rs.120

TD = (PW × TR)/100

⇒ 120 = (PW × 3 × 10)/100

⇒ 1200 = PW × 3

PW = 1200/3

= Rs.400

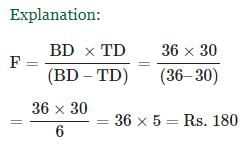

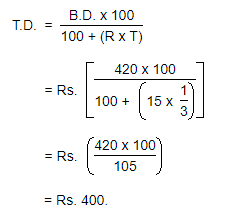

A bill for Rs. 3000 is drawn on 14th July at 5 months. It is discounted on 5th October at 10%. What is the Banker's Discount?- a)Rs. 60

- b)Rs. 82

- c)Rs. 90

- d)Rs. 120

Correct answer is option 'A'. Can you explain this answer?

A bill for Rs. 3000 is drawn on 14th July at 5 months. It is discounted on 5th October at 10%. What is the Banker's Discount?

a)

Rs. 60

b)

Rs. 82

c)

Rs. 90

d)

Rs. 120

|

Manoj Ghosh answered |

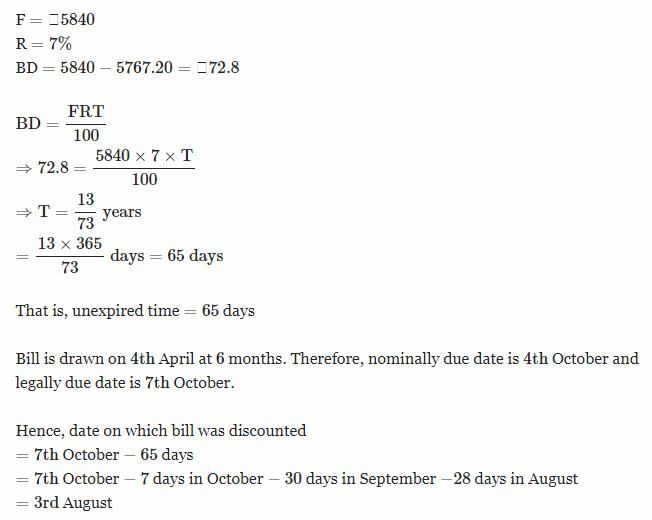

F = Rs. 3000

R = 10%

Date on which the bill is drawn = 14th July at 5 months

Nominally Due Date = 14th December

Legally Due Date = 14th December + 3 days = 17th December

Date on which the bill is discounted = 5th October

Unexpired Time

= [6th to 31st of October] + [30 Days in November] + [1st to 17th of December]

= 26 + 30 + 17

= 73 Days

The true discount on a bill of Rs. 2160 is Rs. 360. What is the banker's discount?- a)Rs. 432

- b)Rs. 422

- c)Rs. 412

- d)Rs. 442

Correct answer is option 'A'. Can you explain this answer?

The true discount on a bill of Rs. 2160 is Rs. 360. What is the banker's discount?

a)

Rs. 432

b)

Rs. 422

c)

Rs. 412

d)

Rs. 442

|

Akanksha Dey answered |

F = Rs. 2160

TD = Rs. 360

PW = F - TD = 2160 - 360 = Rs. 1800

True Discount is the Simple Interest on the present value for unexpired time

⇒ Simple Interest on Rs. 1800 for unexpired time = Rs. 360

Banker's Discount is the Simple Interest on the face value of the bill for unexpired time

= Simple Interest on Rs. 2160 for unexpired time

= (360/1800)×2160

= 1/5×2160

= Rs.432

TD = Rs. 360

PW = F - TD = 2160 - 360 = Rs. 1800

True Discount is the Simple Interest on the present value for unexpired time

⇒ Simple Interest on Rs. 1800 for unexpired time = Rs. 360

Banker's Discount is the Simple Interest on the face value of the bill for unexpired time

= Simple Interest on Rs. 2160 for unexpired time

= (360/1800)×2160

= 1/5×2160

= Rs.432

The true discount on a certain sum due 6 months hence at 15% is Rs. 240. What is the banker's discount on the same sum for the same time at the same rate?- a)Rs. 278

- b)Rs. 228

- c)Rs. 258

- d)None of these

Correct answer is option 'C'. Can you explain this answer?

The true discount on a certain sum due 6 months hence at 15% is Rs. 240. What is the banker's discount on the same sum for the same time at the same rate?

a)

Rs. 278

b)

Rs. 228

c)

Rs. 258

d)

None of these

|

Shreya Tiwari answered |

Given in the question,

True Discount = 240

Rate of interest = 15%

Time = 6 months = 1/2 year

As we know the formula ,

True Discount = Banker's Gain × 100

Time in years x Rate of Interest

⇒ 240 = Banker's Gain × 100/(1/2 × 15)

⇒ 240 = Banker's Gain × (100 x 2)/(1 × 15)

⇒ 24 = Banker's Gain × (10 x 2)/(1 × 15)

⇒ 24 = Banker's Gain × (2 x 2)/(1 × 3 )

⇒ 6 = Banker's Gain × 1/3

⇒ Banker's Gain = Rs. 6 x 3

⇒ Banker's Gain = Rs. 18

Apply the formula, As we know that ,

Banker's Gain = Banker's Discount − True Discount

⇒ 18 = Banker's Discount − 240

⇒ Banker's Discount = Rs. 258

True Discount = 240

Rate of interest = 15%

Time = 6 months = 1/2 year

As we know the formula ,

True Discount = Banker's Gain × 100

Time in years x Rate of Interest

⇒ 240 = Banker's Gain × 100/(1/2 × 15)

⇒ 240 = Banker's Gain × (100 x 2)/(1 × 15)

⇒ 24 = Banker's Gain × (10 x 2)/(1 × 15)

⇒ 24 = Banker's Gain × (2 x 2)/(1 × 3 )

⇒ 6 = Banker's Gain × 1/3

⇒ Banker's Gain = Rs. 6 x 3

⇒ Banker's Gain = Rs. 18

Apply the formula, As we know that ,

Banker's Gain = Banker's Discount − True Discount

⇒ 18 = Banker's Discount − 240

⇒ Banker's Discount = Rs. 258

The banker's gain on a bill due 1 year hence at 10% per annum is Rs. 20. What is the true discount?- a)Rs. 200

- b)Rs. 100

- c)Rs. 150

- d)Rs. 250

Correct answer is option 'A'. Can you explain this answer?

The banker's gain on a bill due 1 year hence at 10% per annum is Rs. 20. What is the true discount?

a)

Rs. 200

b)

Rs. 100

c)

Rs. 150

d)

Rs. 250

|

Gowri Yadav answered |

Calculation of True Discount:

1. Given Data:

- Banker's gain = Rs. 20

- Rate of interest = 10% per annum

- Time = 1 year

2. Formula for Banker's Gain:

Banker's Gain = Face Value - Present Value

Banker's Gain = Face Value - (Face Value * Rate * Time)

3. Calculating Face Value:

Banker's Gain = Rs. 20

Rate of interest = 10% = 0.10

Time = 1 year

Face Value = Banker's Gain / (Rate * Time)

Face Value = 20 / (0.10 * 1)

Face Value = Rs. 200

4. Calculating True Discount:

True Discount = Face Value - Present Value

True Discount = Face Value - (Face Value / (1 + Rate * Time))

True Discount = Rs. 200 - (Rs. 200 / (1 + 0.10 * 1))

True Discount = Rs. 200 - (Rs. 200 / 1.10)

True Discount = Rs. 200 - Rs. 181.82

True Discount = Rs. 18.18

5. Conclusion:

Therefore, the true discount on a bill due 1 year hence at 10% per annum is Rs. 18.18. Hence, the correct answer is not listed in the options provided.

1. Given Data:

- Banker's gain = Rs. 20

- Rate of interest = 10% per annum

- Time = 1 year

2. Formula for Banker's Gain:

Banker's Gain = Face Value - Present Value

Banker's Gain = Face Value - (Face Value * Rate * Time)

3. Calculating Face Value:

Banker's Gain = Rs. 20

Rate of interest = 10% = 0.10

Time = 1 year

Face Value = Banker's Gain / (Rate * Time)

Face Value = 20 / (0.10 * 1)

Face Value = Rs. 200

4. Calculating True Discount:

True Discount = Face Value - Present Value

True Discount = Face Value - (Face Value / (1 + Rate * Time))

True Discount = Rs. 200 - (Rs. 200 / (1 + 0.10 * 1))

True Discount = Rs. 200 - (Rs. 200 / 1.10)

True Discount = Rs. 200 - Rs. 181.82

True Discount = Rs. 18.18

5. Conclusion:

Therefore, the true discount on a bill due 1 year hence at 10% per annum is Rs. 18.18. Hence, the correct answer is not listed in the options provided.

What is the banker's discount if the true discount on a bill of Rs.540 is Rs.90 ?- a)Rs. 108

- b)Rs. 120

- c)Rs. 102

- d)Rs. 106

Correct answer is option 'A'. Can you explain this answer?

What is the banker's discount if the true discount on a bill of Rs.540 is Rs.90 ?

a)

Rs. 108

b)

Rs. 120

c)

Rs. 102

d)

Rs. 106

|

Gowri Chakraborty answered |

P.W. = Rs. (540 - 90) = Rs. 450.

S.I. on Rs. 450 = Rs. 90.

S.I. on Rs. 540 = Rs.( 90 /450)x 540 = Rs. 108.

B.D. = Rs. 108.

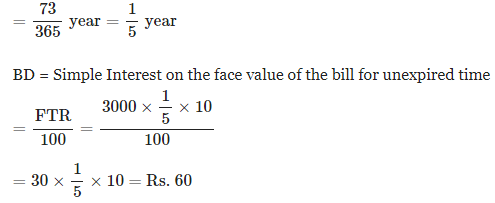

Practice Quiz or MCQ (Multiple Choice Questions) with solution are available for Practice, which would help you prepare for "Banker's Discount" under Logical Reasoning and Data Interpretative. You can practice these practice quizzes as per your speed and improvise the topic. The same topic is covered under various competitive examinations like - CAT, GMAT, Bank PO, SSC and other competitive examinations.Q.The banker's discount on a bill due 4 months hence at 15% is Rs. 420. What is the true discount? - a)Rs. 410

- b)Rs. 400

- c)Rs. 390

- d)Rs. 380

Correct answer is option 'B'. Can you explain this answer?

Practice Quiz or MCQ (Multiple Choice Questions) with solution are available for Practice, which would help you prepare for "Banker's Discount" under Logical Reasoning and Data Interpretative. You can practice these practice quizzes as per your speed and improvise the topic. The same topic is covered under various competitive examinations like - CAT, GMAT, Bank PO, SSC and other competitive examinations.

Q.

The banker's discount on a bill due 4 months hence at 15% is Rs. 420. What is the true discount?

a)

Rs. 410

b)

Rs. 400

c)

Rs. 390

d)

Rs. 380

|

Gowri Chakraborty answered |

The banker's discount on a sum of money for 3 years is Rs. 1116. The true discount on the same sum for 4 years is Rs. 1200. What is the rate percent?- a)8%

- b)12%

- c)10%

- d)6%

Correct answer is option 'D'. Can you explain this answer?

The banker's discount on a sum of money for 3 years is Rs. 1116. The true discount on the same sum for 4 years is Rs. 1200. What is the rate percent?

a)

8%

b)

12%

c)

10%

d)

6%

|

Gitanjali Basak answered |

BD for 3 years = Rs.1116

BD for 4 years = (1116/3)×4

= Rs. 1488

TD for 4 years = Rs.1200

F = (BD×TD)/(BD−TD)

= (1488×1200)/(1488−1200)

= (1488×1200)/288

= (124×1200)/24

= (124×100)/2

= 62×100

= Rs.6200

⇒ Rs. 1488 is the simple interest on Rs. 6200 for 4 years

⇒1488 = (6200×4×R)/100

⇒ R = (1488×100)/(6200×4)

= (372×100)/(6200)

= 372/62

= 6%

BD for 4 years = (1116/3)×4

= Rs. 1488

TD for 4 years = Rs.1200

F = (BD×TD)/(BD−TD)

= (1488×1200)/(1488−1200)

= (1488×1200)/288

= (124×1200)/24

= (124×100)/2

= 62×100

= Rs.6200

⇒ Rs. 1488 is the simple interest on Rs. 6200 for 4 years

⇒1488 = (6200×4×R)/100

⇒ R = (1488×100)/(6200×4)

= (372×100)/(6200)

= 372/62

= 6%

Chapter doubts & questions for Banker's Discount - Quantitative Aptitude for SSC CGL 2025 is part of SSC CGL exam preparation. The chapters have been prepared according to the SSC CGL exam syllabus. The Chapter doubts & questions, notes, tests & MCQs are made for SSC CGL 2025 Exam. Find important definitions, questions, notes, meanings, examples, exercises, MCQs and online tests here.

Chapter doubts & questions of Banker's Discount - Quantitative Aptitude for SSC CGL in English & Hindi are available as part of SSC CGL exam.

Download more important topics, notes, lectures and mock test series for SSC CGL Exam by signing up for free.

Quantitative Aptitude for SSC CGL

315 videos|290 docs|185 tests

|

Contact Support

Our team is online on weekdays between 10 AM - 7 PM

Typical reply within 3 hours

|

Free Exam Preparation

at your Fingertips!

Access Free Study Material - Test Series, Structured Courses, Free Videos & Study Notes and Prepare for Your Exam With Ease

Join the 10M+ students on EduRev

Join the 10M+ students on EduRev

|

|

Create your account for free

OR

Forgot Password

OR

Signup to see your scores

go up within 7 days!

Access 1000+ FREE Docs, Videos and Tests

Takes less than 10 seconds to signup