All Exams >

Commerce >

Entrepreneurship Class 12 >

All Questions

All questions of Resource Mobilization for Commerce Exam

Nishtha, a professionally qualified entrepreneur decided to start ‘kids furniture’ a website of designer furniture. It was relatively an untried area involving high risk. She lacked the necessary funds and experience to give shape to her idea. She knew that if she failed to get investment from the public her idea would die down before it is tried. So, she made a detailed business plan and presented her idea to ‘FiFa Finance Ltd.’ a company run by a group of professional investors. They were impressed by her business plan and decided to fund her start-up in exchange for an equity stake in the business. The source of finance used by Nishtha is:- a)Angel investor

- b)Venture capitalist

- c)Both (a) and (b)

- d)Neither (a) nor (b)

Correct answer is option 'B'. Can you explain this answer?

Nishtha, a professionally qualified entrepreneur decided to start ‘kids furniture’ a website of designer furniture. It was relatively an untried area involving high risk. She lacked the necessary funds and experience to give shape to her idea. She knew that if she failed to get investment from the public her idea would die down before it is tried. So, she made a detailed business plan and presented her idea to ‘FiFa Finance Ltd.’ a company run by a group of professional investors. They were impressed by her business plan and decided to fund her start-up in exchange for an equity stake in the business. The source of finance used by Nishtha is:

a)

Angel investor

b)

Venture capitalist

c)

Both (a) and (b)

d)

Neither (a) nor (b)

|

Pranjal Pillai answered |

Her own business. She had always been passionate about fashion and decided to open a boutique that specialized in sustainable and ethically produced clothing. Nishtha believed that fashion could be both stylish and environmentally friendly, and she wanted to show the world that it was possible to look good while also doing good for the planet.

Nishtha spent months researching and sourcing materials for her boutique. She made sure that all the fabrics she used were made from organic or recycled materials. She also worked with local artisans and manufacturers who shared her commitment to sustainability.

Once she had gathered all the necessary materials, Nishtha began designing her collection. She created stylish and trendy pieces that were also timeless and versatile. She wanted her customers to be able to wear her clothes for years to come, rather than just for one season.

Next, Nishtha focused on the branding and marketing of her boutique. She wanted to create a brand that not only stood for sustainable fashion, but also inspired and educated people about the importance of choosing ethical clothing. She created a website and social media accounts where she shared the stories behind her designs and the journey of each garment from production to sale.

Finally, Nishtha opened her boutique in a trendy neighborhood known for its support of local businesses. She hosted a grand opening event where she invited fashion influencers and local celebrities to showcase her collection. The event was a success, and Nishtha's boutique quickly gained a following of loyal customers who shared her passion for sustainable fashion.

As her business grew, Nishtha continued to innovate and expand her collection. She introduced new lines of accessories made from recycled materials and collaborated with other sustainable fashion brands to create limited edition collections. She also started hosting workshops and events to educate her customers about sustainable fashion and how they could make more conscious choices in their own lives.

Nishtha's boutique became a symbol of style and sustainability in the fashion industry. She proved that it was possible to create beautiful and eco-friendly clothing without compromising on quality or design. Her success inspired other entrepreneurs to follow in her footsteps and start their own sustainable fashion businesses.

Nishtha's journey as an entrepreneur was not always easy, but she remained committed to her vision and never lost sight of her values. Through her boutique, she was able to make a positive impact on the fashion industry and contribute to a more sustainable future.

Nishtha spent months researching and sourcing materials for her boutique. She made sure that all the fabrics she used were made from organic or recycled materials. She also worked with local artisans and manufacturers who shared her commitment to sustainability.

Once she had gathered all the necessary materials, Nishtha began designing her collection. She created stylish and trendy pieces that were also timeless and versatile. She wanted her customers to be able to wear her clothes for years to come, rather than just for one season.

Next, Nishtha focused on the branding and marketing of her boutique. She wanted to create a brand that not only stood for sustainable fashion, but also inspired and educated people about the importance of choosing ethical clothing. She created a website and social media accounts where she shared the stories behind her designs and the journey of each garment from production to sale.

Finally, Nishtha opened her boutique in a trendy neighborhood known for its support of local businesses. She hosted a grand opening event where she invited fashion influencers and local celebrities to showcase her collection. The event was a success, and Nishtha's boutique quickly gained a following of loyal customers who shared her passion for sustainable fashion.

As her business grew, Nishtha continued to innovate and expand her collection. She introduced new lines of accessories made from recycled materials and collaborated with other sustainable fashion brands to create limited edition collections. She also started hosting workshops and events to educate her customers about sustainable fashion and how they could make more conscious choices in their own lives.

Nishtha's boutique became a symbol of style and sustainability in the fashion industry. She proved that it was possible to create beautiful and eco-friendly clothing without compromising on quality or design. Her success inspired other entrepreneurs to follow in her footsteps and start their own sustainable fashion businesses.

Nishtha's journey as an entrepreneur was not always easy, but she remained committed to her vision and never lost sight of her values. Through her boutique, she was able to make a positive impact on the fashion industry and contribute to a more sustainable future.

Raghav is a very creative person and has always been working on innovating products and services that can make living healthy and hygienic. He developed a design of an air conditioner with an inbuilt air purifier as well. Since he did not get any financial support from any bank, he approached Nirvana Vent (VC), a venture capitalist firm. Though VC liked the idea but it refused to help Raghav at the seeding stage and asked him to come again if needed during second round financing.

Why was seed capital not given by VC when it was ready to fund the second round financing?- a)They did not like the idea.

- b)They did not have enough funds for the innovation.

- c)They doubt on the potential for rapid growth.

- d)They do not give preference to new businesses.

Correct answer is option 'C'. Can you explain this answer?

Raghav is a very creative person and has always been working on innovating products and services that can make living healthy and hygienic. He developed a design of an air conditioner with an inbuilt air purifier as well. Since he did not get any financial support from any bank, he approached Nirvana Vent (VC), a venture capitalist firm. Though VC liked the idea but it refused to help Raghav at the seeding stage and asked him to come again if needed during second round financing.

Why was seed capital not given by VC when it was ready to fund the second round financing?

Why was seed capital not given by VC when it was ready to fund the second round financing?

a)

They did not like the idea.

b)

They did not have enough funds for the innovation.

c)

They doubt on the potential for rapid growth.

d)

They do not give preference to new businesses.

|

|

Arun Yadav answered |

Venture capitalists are typically very selective in deciding what to invest in and as a rule of thumb:

- They may invest in one in four hundred opportunities presented to it,

- Looks for the extremely rare, yet sought after qualities, such as :

(a) innovative technology,

(b) potential for rapid growth,

(c) a well-developed business model

(d) an impressive management team. - Looks for an "exit" in the time frame of typically 3-7 years.

- Is inclined towards ventures with exceptionally high growth potential.

The VC do not fund for seed capital as its result and return both are not sure

Pradeep and Paras were not being able to agree on the method they would like to choose for issuing their shares. Pradeep said that they should issue their shares to the existing employees as this will lead to higher efficiency. On the other hand, Paras wanted to issue shares to the smaller number of sophisticated investors as this will not let the management slip from their hands. The method suggested by Paras is :- a)Private placement

- b)Right issue

- c)e-IPOs

- d)Offer for sale

Correct answer is option 'A'. Can you explain this answer?

Pradeep and Paras were not being able to agree on the method they would like to choose for issuing their shares. Pradeep said that they should issue their shares to the existing employees as this will lead to higher efficiency. On the other hand, Paras wanted to issue shares to the smaller number of sophisticated investors as this will not let the management slip from their hands. The method suggested by Paras is :

a)

Private placement

b)

Right issue

c)

e-IPOs

d)

Offer for sale

|

|

Neha Sharma answered |

A private placement is a sale of stock shares or bonds to pre-selected investors and institutions rather than on the open market. It is an alternative to an initial public offering (IPO) for a company seeking to raise capital for expansion.

Examples of the types of securities that may be sold through a private placement are common stock, preferred stock, and promissory notes.

Examples of the types of securities that may be sold through a private placement are common stock, preferred stock, and promissory notes.

Which one of the following groups of states accounts for about 90% of the annual coal production in India?- a) Madhya Pradesh, Tamil Nadu and West Bengal

- b) Orissa, Madhya Pradesh and Tamil Nadu

- c) Jharkhand, Orissa and Madhya Pradesh

- d) Jharkhand, Orissa and West Bengal

Correct answer is option 'D'. Can you explain this answer?

Which one of the following groups of states accounts for about 90% of the annual coal production in India?

a)

Madhya Pradesh, Tamil Nadu and West Bengal

b)

Orissa, Madhya Pradesh and Tamil Nadu

c)

Jharkhand, Orissa and Madhya Pradesh

d)

Jharkhand, Orissa and West Bengal

|

|

Kavita Mehta answered |

Jharkhand, Orissa and West Bengal States accounts for about 90% of the annual coal production in India.

State Whether the Following Statements are True or False.

Q. Seed capital finance refers to the capital required by an entrepreneur for conducting research at precommercialization stage.- a)True

- b)False

Correct answer is option 'A'. Can you explain this answer?

State Whether the Following Statements are True or False.

Q. Seed capital finance refers to the capital required by an entrepreneur for conducting research at precommercialization stage.

Q. Seed capital finance refers to the capital required by an entrepreneur for conducting research at precommercialization stage.

a)

True

b)

False

|

|

Aryan Khanna answered |

- The term seed capital refers to the type of financing used in the formation of a startup.

- Funding is provided by private investors usually in exchange for an equity stake in the company or for a share in the profits of a product.

The organisation, management, membership and functioning of stock exchanges in India are governed by the provisions of:- a)The Securities Contracts (Regulation) Act, 1956.

- b)The Securities Council (Regulation) Act, 1956.

- c)The Securities Contracts (Regulation) Act, 1965.

- d)The Securities Council (Regulation) Act, 1965.

Correct answer is option 'A'. Can you explain this answer?

The organisation, management, membership and functioning of stock exchanges in India are governed by the provisions of:

a)

The Securities Contracts (Regulation) Act, 1956.

b)

The Securities Council (Regulation) Act, 1956.

c)

The Securities Contracts (Regulation) Act, 1965.

d)

The Securities Council (Regulation) Act, 1965.

|

Nilanjan Malik answered |

The correct answer is option 'A', which states that the organization, management, membership, and functioning of stock exchanges in India are governed by the provisions of The Securities Contracts (Regulation) Act, 1956.

Explanation:

The Securities Contracts (Regulation) Act, 1956 (SCRA) is the main legislation that governs the functioning and regulation of stock exchanges in India. It was enacted to regulate the securities market and protect the interests of investors. The SCRA provides a legal framework for the establishment, recognition, and regulation of stock exchanges in India.

1. Organization of Stock Exchanges:

- The SCRA lays down the rules and regulations regarding the organization and establishment of stock exchanges in India.

- It specifies the requirements for the recognition of a stock exchange by the Securities and Exchange Board of India (SEBI), the regulatory authority for the securities market in India.

2. Management of Stock Exchanges:

- The SCRA defines the powers and functions of the governing bodies of stock exchanges, such as the board of directors and the governing council.

- It sets out the rules for the appointment and removal of key management personnel, such as the chairman, managing director, and chief executive officer.

3. Membership of Stock Exchanges:

- The SCRA establishes the eligibility criteria for membership of a stock exchange.

- It specifies the qualifications, standards, and conditions that an individual or a corporate entity must meet to become a member of a stock exchange.

4. Functioning of Stock Exchanges:

- The SCRA outlines the rules and regulations governing the trading, clearing, and settlement of securities on stock exchanges.

- It sets out the obligations and responsibilities of stock exchange members, including brokers and traders.

- The SCRA also provides provisions for the prevention of fraudulent and unfair trade practices, market manipulation, and insider trading.

In addition to the SCRA, the functioning of stock exchanges in India is also regulated by SEBI, which has the power to issue regulations, guidelines, and directions for the orderly conduct of trading and to protect the interests of investors.

In conclusion, the provisions of The Securities Contracts (Regulation) Act, 1956 govern the organization, management, membership, and functioning of stock exchanges in India. The SCRA provides a legal framework for the establishment and regulation of stock exchanges, ensuring transparency, fairness, and investor protection in the securities market.

Explanation:

The Securities Contracts (Regulation) Act, 1956 (SCRA) is the main legislation that governs the functioning and regulation of stock exchanges in India. It was enacted to regulate the securities market and protect the interests of investors. The SCRA provides a legal framework for the establishment, recognition, and regulation of stock exchanges in India.

1. Organization of Stock Exchanges:

- The SCRA lays down the rules and regulations regarding the organization and establishment of stock exchanges in India.

- It specifies the requirements for the recognition of a stock exchange by the Securities and Exchange Board of India (SEBI), the regulatory authority for the securities market in India.

2. Management of Stock Exchanges:

- The SCRA defines the powers and functions of the governing bodies of stock exchanges, such as the board of directors and the governing council.

- It sets out the rules for the appointment and removal of key management personnel, such as the chairman, managing director, and chief executive officer.

3. Membership of Stock Exchanges:

- The SCRA establishes the eligibility criteria for membership of a stock exchange.

- It specifies the qualifications, standards, and conditions that an individual or a corporate entity must meet to become a member of a stock exchange.

4. Functioning of Stock Exchanges:

- The SCRA outlines the rules and regulations governing the trading, clearing, and settlement of securities on stock exchanges.

- It sets out the obligations and responsibilities of stock exchange members, including brokers and traders.

- The SCRA also provides provisions for the prevention of fraudulent and unfair trade practices, market manipulation, and insider trading.

In addition to the SCRA, the functioning of stock exchanges in India is also regulated by SEBI, which has the power to issue regulations, guidelines, and directions for the orderly conduct of trading and to protect the interests of investors.

In conclusion, the provisions of The Securities Contracts (Regulation) Act, 1956 govern the organization, management, membership, and functioning of stock exchanges in India. The SCRA provides a legal framework for the establishment and regulation of stock exchanges, ensuring transparency, fairness, and investor protection in the securities market.

Suhani used to sell vegetables in a cart with her sister. They were able to earn profit of ` 300 per day. Even though the amount was sufficient for their living, but they wanted to earn more. In order to expand the business and arrange funds, Suhani contacted an angel investor in her locality. Suhnai contacted Angel Investor because as per the view of Suhani, Angel investors provide funds to small businesses. State whether her view point is true or false. - a)True

- b)False

Correct answer is option 'A'. Can you explain this answer?

Suhani used to sell vegetables in a cart with her sister. They were able to earn profit of ` 300 per day. Even though the amount was sufficient for their living, but they wanted to earn more. In order to expand the business and arrange funds, Suhani contacted an angel investor in her locality. Suhnai contacted Angel Investor because as per the view of Suhani, Angel investors provide funds to small businesses. State whether her view point is true or false.

a)

True

b)

False

|

|

Arun Yadav answered |

An angel investor (also known as a private investor, seed investor or angel funder) is a high-net-worth individual who provides financial backing for small startups or entrepreneurs, typically in exchange for ownership equity in the company. Often, angel investors are found among an entrepreneur's family and friends.

For example, let's say that John Doe has an idea for a way to power widgets with small, flexible solar panels rather than electricity. He needs to build a prototype and form a business in order to capitalize on the idea and begin selling the product. John finds Ralph Jones, an angel investor.

For example, let's say that John Doe has an idea for a way to power widgets with small, flexible solar panels rather than electricity. He needs to build a prototype and form a business in order to capitalize on the idea and begin selling the product. John finds Ralph Jones, an angel investor.

State Whether the Following Statements are True or False.

Q. Volume is nothing but quantity of shares.- a)True

- b)False

Correct answer is option 'A'. Can you explain this answer?

State Whether the Following Statements are True or False.

Q. Volume is nothing but quantity of shares.

Q. Volume is nothing but quantity of shares.

a)

True

b)

False

|

|

Amita Das answered |

- Volume is the number of shares of a security traded during a given period of time.

- Volume is an important indicator in technical analysis because it is used to measure the relative significance of a market move

- Calculating volume is simply the total amount of shares traded for the day, which includes both buy and sell orders.

State Whether the Following Statements are True or False.

Q. Startup finance is the capital required by an entrepreneur for conducting research at pre commercialization stage.- a)True

- b)False

Correct answer is option 'B'. Can you explain this answer?

State Whether the Following Statements are True or False.

Q. Startup finance is the capital required by an entrepreneur for conducting research at pre commercialization stage.

Q. Startup finance is the capital required by an entrepreneur for conducting research at pre commercialization stage.

a)

True

b)

False

|

|

Priyanka Khatri answered |

Financing for the start-up phase involves bridge financing from the time the pre-launch phase is funded until operations commence, sufficient working capital for the smooth operation of the business, funding of any losses during the start-up phase and contingency funds in case of an unexpected interruption in the start-up process. Funding for the pre-launch stage and the start-up phase may occur at the same time.

ABC Ltd., decided to raise funds by issuing shares. the finance department felt that the company should offer the shares to existing shareholders on a pro-rata basis. Out of the following, identify the method of raising the funds being suggested by the finance department:- a)Public Issue

- b)Right Issue

- c)Private Placement

- d)Offer to Employees

Correct answer is option 'B'. Can you explain this answer?

ABC Ltd., decided to raise funds by issuing shares. the finance department felt that the company should offer the shares to existing shareholders on a pro-rata basis. Out of the following, identify the method of raising the funds being suggested by the finance department:

a)

Public Issue

b)

Right Issue

c)

Private Placement

d)

Offer to Employees

|

|

Naina Sharma answered |

Right Issue means to offer shares to the existing shareholders of the company in proportion to their existing share holding in the company for the purpose of raising fresh capital for the company. With these rights the shareholders of the company can purchase new shares at a discounted rate to the market price.

State Whether the Following Statements are True or False.

Q. In March, 1996 the SEBI was constituted as the regulator of capital markets in India under a resolution of the Government of India.- a)True

- b)False

Correct answer is option 'B'. Can you explain this answer?

State Whether the Following Statements are True or False.

Q. In March, 1996 the SEBI was constituted as the regulator of capital markets in India under a resolution of the Government of India.

Q. In March, 1996 the SEBI was constituted as the regulator of capital markets in India under a resolution of the Government of India.

a)

True

b)

False

|

Nidhi Nambiar answered |

False

The statement that in March 1996, the Securities and Exchange Board of India (SEBI) was constituted as the regulator of capital markets in India under a resolution of the Government of India is false.

Explanation:

- The SEBI was actually constituted on April 12, 1988, under the SEBI Act of 1992. It was established as an independent regulatory body to regulate and develop the securities market in India.

- The SEBI Act was passed by the Parliament of India in 1992, and it received the President's assent on January 30, 1992. The act provided statutory powers to the SEBI to regulate the securities market in India and protect the interests of investors.

- The establishment of SEBI was a significant step towards the development and regulation of the capital market in India. It aimed to promote transparency, fairness, and efficiency in the securities market and provide a safe and secure investment environment for investors.

- Prior to the establishment of SEBI, the capital market in India was regulated by the Controller of Capital Issues (CCI) and the Capital Issues (Control) Act, 1947. However, these regulatory mechanisms were considered inadequate, and there was a need for an independent regulatory body to oversee the capital market.

- SEBI has been given various powers and functions under the SEBI Act, including the regulation of stock exchanges, registration and regulation of intermediaries, prohibition of fraudulent and unfair trade practices, promotion of investors' education and training, and regulation of substantial acquisition of shares and takeover of companies.

- Over the years, SEBI has played a crucial role in the development and regulation of the capital market in India. It has introduced various reforms and measures to enhance transparency, improve governance standards, and protect the interests of investors.

- In conclusion, the SEBI was constituted in 1988, not in March 1996, as stated in the given statement. It was established under the SEBI Act of 1992 to regulate and develop the securities market in India.

The statement that in March 1996, the Securities and Exchange Board of India (SEBI) was constituted as the regulator of capital markets in India under a resolution of the Government of India is false.

Explanation:

- The SEBI was actually constituted on April 12, 1988, under the SEBI Act of 1992. It was established as an independent regulatory body to regulate and develop the securities market in India.

- The SEBI Act was passed by the Parliament of India in 1992, and it received the President's assent on January 30, 1992. The act provided statutory powers to the SEBI to regulate the securities market in India and protect the interests of investors.

- The establishment of SEBI was a significant step towards the development and regulation of the capital market in India. It aimed to promote transparency, fairness, and efficiency in the securities market and provide a safe and secure investment environment for investors.

- Prior to the establishment of SEBI, the capital market in India was regulated by the Controller of Capital Issues (CCI) and the Capital Issues (Control) Act, 1947. However, these regulatory mechanisms were considered inadequate, and there was a need for an independent regulatory body to oversee the capital market.

- SEBI has been given various powers and functions under the SEBI Act, including the regulation of stock exchanges, registration and regulation of intermediaries, prohibition of fraudulent and unfair trade practices, promotion of investors' education and training, and regulation of substantial acquisition of shares and takeover of companies.

- Over the years, SEBI has played a crucial role in the development and regulation of the capital market in India. It has introduced various reforms and measures to enhance transparency, improve governance standards, and protect the interests of investors.

- In conclusion, the SEBI was constituted in 1988, not in March 1996, as stated in the given statement. It was established under the SEBI Act of 1992 to regulate and develop the securities market in India.

State Whether the Following Statements are True or False.

Q. Angel investor’s objective is to create great companies by providing value creation.- a)True

- b)False

Correct answer is option 'A'. Can you explain this answer?

State Whether the Following Statements are True or False.

Q. Angel investor’s objective is to create great companies by providing value creation.

Q. Angel investor’s objective is to create great companies by providing value creation.

a)

True

b)

False

|

|

Amita Das answered |

- Angel investors are wealthy individuals who provide capital to help entrepreneurs and small businesses succeed.

- These individuals want to invest in up-and-coming new companies not only to earn money, but also to provide a resource that would have been helpful to them in the early stages of their own businesses.

Which of the following terms related to stock and stock market trading means buying price?- a)Bid

- b)Offer

- c)Open

- d)High

Correct answer is option 'A'. Can you explain this answer?

Which of the following terms related to stock and stock market trading means buying price?

a)

Bid

b)

Offer

c)

Open

d)

High

|

|

Ishan Choudhury answered |

- The term "bid" refers to the highest price a buyer will pay to buy a specified number of shares of a stock at any given time.

- The term ask refers to the lowest price at which a seller will sell the stock.

- The bid price will almost always be lower than the ask or “offer,” price.

The Securities and Exchange Board of India was established on:- a)22 April, 1982

- b)12 April, 1992

- c)12 March, 1982

- d)22 March, 1992

Correct answer is option 'B'. Can you explain this answer?

The Securities and Exchange Board of India was established on:

a)

22 April, 1982

b)

12 April, 1992

c)

12 March, 1982

d)

22 March, 1992

|

|

Amit Kumar answered |

The Securities and Exchange Board of India is the regulatory body for securities and commodity market in India under the jurisdiction of Ministry of Finance, Government of India. It was established on 12 April 1992 and given Statutory Powers on 30 January 1992 through the SEBI Act, 1992.

The order get executed at your mentioned price:- a)Limit order

- b)Market order

- c)Transaction

- d)Squaring off

Correct answer is option 'A'. Can you explain this answer?

The order get executed at your mentioned price:

a)

Limit order

b)

Market order

c)

Transaction

d)

Squaring off

|

|

Kiran Mehta answered |

A limit order is an order to buy or sell a stock with a restriction on the maximum price to be paid or the minimum price to be received (the “limit price”). If the order is filled, it will only be at the specified limit price or better.

For example, if a trader is looking to buy XYZ's stock but has a limit of $14.50, they will only buy the stock at a price of $14.50 or lower. Limit orders can also be left open with an expiration date.

For example, if a trader is looking to buy XYZ's stock but has a limit of $14.50, they will only buy the stock at a price of $14.50 or lower. Limit orders can also be left open with an expiration date.

State Whether the Following Statements are True or False.

Q. Capital Markets play a very vital role of a financial intermediary.- a)True

- b)False

Correct answer is option 'A'. Can you explain this answer?

State Whether the Following Statements are True or False.

Q. Capital Markets play a very vital role of a financial intermediary.

Q. Capital Markets play a very vital role of a financial intermediary.

a)

True

b)

False

|

|

Ishan Choudhury answered |

- Financial intermediaries move funds from parties with excess capital to parties needing funds.

- The process creates efficient markets and lowers the cost of conducting business.

- For example, a financial advisor connects with clients through purchasing insurance, stocks, bonds, real estate, and other assets.

State Whether the Following Statements are True or False.

Q. Venture capital has been used as a tool for economic development in a variety of developing regions.- a)True

- b)False

Correct answer is option 'A'. Can you explain this answer?

State Whether the Following Statements are True or False.

Q. Venture capital has been used as a tool for economic development in a variety of developing regions.

Q. Venture capital has been used as a tool for economic development in a variety of developing regions.

a)

True

b)

False

|

|

Priyanka Khatri answered |

- Venture capital (VC) is a form of private equity and a type of financing that investors provide to startup companies and small businesses that are believed to have long-term growth potential.

- Venture capital generally comes from well-off investors, investment banks, and any other financial institutions.

During an interview, the HR of MultiCorp. Ltd. asked one of the candidates if the set-up finance is the capital required by an entrepreneur to conduct research at pre-commercialization stage. He responded by agreeing to the statement. Mention whether the candidate’s response was true or false. - a)True

- b)False

Correct answer is option 'B'. Can you explain this answer?

During an interview, the HR of MultiCorp. Ltd. asked one of the candidates if the set-up finance is the capital required by an entrepreneur to conduct research at pre-commercialization stage. He responded by agreeing to the statement. Mention whether the candidate’s response was true or false.

a)

True

b)

False

|

|

Naina Sharma answered |

The Pre-commercialization Phase involves the transition from design and development, and validation, to the execution of the launch. However, the Pre-commercialization Phase is critical for large, complex programs with many elements that have to be timed perfectly at launch.

State Whether the Following Statements are True or False.

Q. Angel investors expect a low return on investment.- a)True

- b)False

Correct answer is option 'B'. Can you explain this answer?

State Whether the Following Statements are True or False.

Q. Angel investors expect a low return on investment.

Q. Angel investors expect a low return on investment.

a)

True

b)

False

|

|

Kiran Mehta answered |

Basically, the Angel investors are investing larger sizes, later stages and higher valuations. That all indicates that there is less risk in these investments, because the Angel groups are moving downstream a little bit. There's less risk, accordingly, you could expect lower returns.

State Whether the Following Statements are True or False.

Q. Venture capital is a subset of public equity.- a)True

- b)False

Correct answer is option 'B'. Can you explain this answer?

State Whether the Following Statements are True or False.

Q. Venture capital is a subset of public equity.

Q. Venture capital is a subset of public equity.

a)

True

b)

False

|

|

Vikas Kapoor answered |

Technically, venture capital (VC) is a form of private equity. The main difference is that while private equity investors prefer stable companies, VC investors usually come in during the startup phase. Venture capital is usually given to small companies with incredible growth potential.

Susan and Joseph are partners in a firm of car manufacturing. They are planning to merge their firm SJ Ltd. with a retain car seller in order to expand their business and maximize the profits. For this merger, SJ Ltd. need a short-term loan. They have chosen Trade credit to finance them for this merger to take place. State whether trade credit being a short-term funding way is true or false. - a)True

- b)False

Correct answer is option 'A'. Can you explain this answer?

Susan and Joseph are partners in a firm of car manufacturing. They are planning to merge their firm SJ Ltd. with a retain car seller in order to expand their business and maximize the profits. For this merger, SJ Ltd. need a short-term loan. They have chosen Trade credit to finance them for this merger to take place. State whether trade credit being a short-term funding way is true or false.

a)

True

b)

False

|

|

Ishan Choudhury answered |

Trade credit means many things but the simplest definition is an arrangement to buy goods and/or services on account without making immediate cash or cheque payments. Trade credit is a helpful tool for growing businesses, when favourable terms are agreed with a business's supplier.

For example, a customer is granted credit with terms of 4/10, net 30. This means that the customer has 30 days from the invoice date within which to pay the seller.

Trade credit extended to a customer by a firm appears as accounts receivable. Browse hundreds of guides and resources.

For example, a customer is granted credit with terms of 4/10, net 30. This means that the customer has 30 days from the invoice date within which to pay the seller.

Trade credit extended to a customer by a firm appears as accounts receivable. Browse hundreds of guides and resources.

State Whether the Following Statements are True or False.

Q. Secondary capital market deals with buying and selling of new securities.- a)True

- b)False

Correct answer is option 'B'. Can you explain this answer?

State Whether the Following Statements are True or False.

Q. Secondary capital market deals with buying and selling of new securities.

Q. Secondary capital market deals with buying and selling of new securities.

a)

True

b)

False

|

|

Arun Yadav answered |

The secondary market is where investors buy and sell securities they already own. It is what most people typically think of as the "stock market," though stocks are also sold on the primary market when they are first issued.

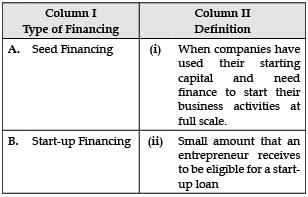

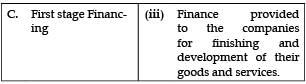

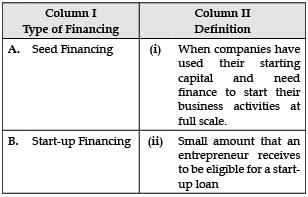

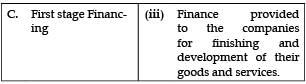

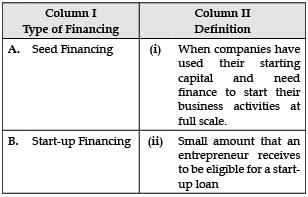

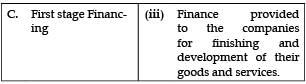

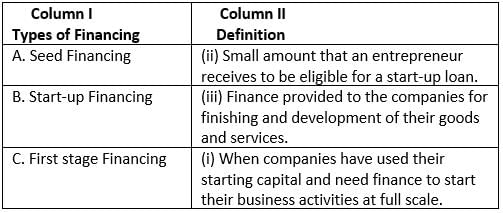

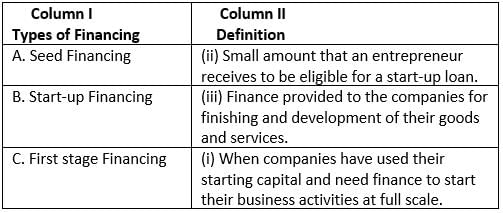

Given below are the type of financing in Column 1 and their definition in Column 2. Match these accordingly.

- a)A. (ii), B. (iii), C. (i)

- b)A. (iii), B. (ii), C. (i)

- c)A. (ii), B. (i), C. (iii)

- d)A. (iii), B. (i), C. (ii)

Correct answer is option 'A'. Can you explain this answer?

Given below are the type of financing in Column 1 and their definition in Column 2. Match these accordingly.

a)

A. (ii), B. (iii), C. (i)

b)

A. (iii), B. (ii), C. (i)

c)

A. (ii), B. (i), C. (iii)

d)

A. (iii), B. (i), C. (ii)

|

|

Kiran Mehta answered |

Correct Match:

Chapter doubts & questions for Resource Mobilization - Entrepreneurship Class 12 2025 is part of Commerce exam preparation. The chapters have been prepared according to the Commerce exam syllabus. The Chapter doubts & questions, notes, tests & MCQs are made for Commerce 2025 Exam. Find important definitions, questions, notes, meanings, examples, exercises, MCQs and online tests here.

Chapter doubts & questions of Resource Mobilization - Entrepreneurship Class 12 in English & Hindi are available as part of Commerce exam.

Download more important topics, notes, lectures and mock test series for Commerce Exam by signing up for free.

Entrepreneurship Class 12

19 videos|70 docs|12 tests

|

Contact Support

Our team is online on weekdays between 10 AM - 7 PM

Typical reply within 3 hours

|

Free Exam Preparation

at your Fingertips!

Access Free Study Material - Test Series, Structured Courses, Free Videos & Study Notes and Prepare for Your Exam With Ease

Join the 10M+ students on EduRev

Join the 10M+ students on EduRev

|

|

Create your account for free

OR

Forgot Password

OR

Signup to see your scores

go up within 7 days!

Access 1000+ FREE Docs, Videos and Tests

Takes less than 10 seconds to signup