All Exams >

Commerce >

Economics Class 12 >

All Questions

All questions of CBSE Practice Questions for Commerce Exam

Directions: In the following questions, a statement of assertion (A) is followed by a statement of reason (R). Mark the correct choice as:Assertion (A): Commercial banks contribute to the quantum of money supply in the economy through credit creation.Rcason(R): As they do have note-issuing authority.- a)Both assertion (A) and reason (R) are true and reason (R) is the correct explanation of assertion (A).

- b)Both assertion (A) and reason (R) are true but reason (R) is not the correct explanation of assertion (A).

- c)Assertion (A) is true but reason (R) is false.

- d)Assertion (A) is false but reason (R) is true.

Correct answer is option 'C'. Can you explain this answer?

Directions: In the following questions, a statement of assertion (A) is followed by a statement of reason (R). Mark the correct choice as:

Assertion (A): Commercial banks contribute to the quantum of money supply in the economy through credit creation.

Rcason(R): As they do have note-issuing authority.

a)

Both assertion (A) and reason (R) are true and reason (R) is the correct explanation of assertion (A).

b)

Both assertion (A) and reason (R) are true but reason (R) is not the correct explanation of assertion (A).

c)

Assertion (A) is true but reason (R) is false.

d)

Assertion (A) is false but reason (R) is true.

|

|

Aryan Khanna answered |

Commercial banks contribute to quantum of money supply in the economy through credit creation.

Commercial banks do not have the note-issuing authority, but they do contribute to the money supply in the economy.

Directions: In the following questions, a statement of assertion (A) is followed by a statement of reason (R). Mark the correct choice as:Assertion (A): In case of currency appreciation, less rupees are to be paid to buy one US dollar.Reason (R): Currency appreciation leads to increase in value of domestic currency in reference to foreign currency. So, less is needed to pay for the same amount.- a)Both assertion (A) and reason (R) are true and reason (R) is the correct explanation of assertion (A).

- b)Both assertion (A) and reason (R) are true but reason (R) is not the correct explanation of assertion (A).

- c)Assertion (A) is true but reason (R) is false.

- d)Assertion (A) is false but reason (R) is true.

Correct answer is option 'A'. Can you explain this answer?

Directions: In the following questions, a statement of assertion (A) is followed by a statement of reason (R). Mark the correct choice as:

Assertion (A): In case of currency appreciation, less rupees are to be paid to buy one US dollar.

Reason (R): Currency appreciation leads to increase in value of domestic currency in reference to foreign currency. So, less is needed to pay for the same amount.

a)

Both assertion (A) and reason (R) are true and reason (R) is the correct explanation of assertion (A).

b)

Both assertion (A) and reason (R) are true but reason (R) is not the correct explanation of assertion (A).

c)

Assertion (A) is true but reason (R) is false.

d)

Assertion (A) is false but reason (R) is true.

|

|

Amita Das answered |

Export of goods and services from India to the US would mean inflow of foreign exchange to India.

छोटानागपुर पठार कितने राज्यों में फैला है?- a)4

- b)3

- c)6

- d)5

Correct answer is option 'D'. Can you explain this answer?

छोटानागपुर पठार कितने राज्यों में फैला है?

a)

4

b)

3

c)

6

d)

5

|

|

Sanjay Rana answered |

यह 5 राज्यों में फैला है: बिहार, झारखंड, छत्तीसगढ़ पश्चिम बंगाल, ओडिशा

निम्नलिखित में से कौन सा जोड़ा सही ढंग से मेल नहीं खाता है?बांध / झील - नदी- a)गोविंद सागर - सतलज

- b)कोलेरु झील - कृष्ण

- c)उकाई जलाशय - लेकिन

- d)वुलर झील - झेलम

Correct answer is option 'B'. Can you explain this answer?

निम्नलिखित में से कौन सा जोड़ा सही ढंग से मेल नहीं खाता है?

बांध / झील - नदी

a)

गोविंद सागर - सतलज

b)

कोलेरु झील - कृष्ण

c)

उकाई जलाशय - लेकिन

d)

वुलर झील - झेलम

|

|

Kavita Mehta answered |

कोल्लेरू झील भारत की सबसे बड़ी ताजे पानी की झीलों में से एक है जो आंध्र प्रदेश राज्य में स्थित है। यह कृष्णा और गोदावरी डेल्टा के बीच स्थित है।

Read the following case study paragraph carefully and answer the question based on the same.The central bank of India i.e. Reserve Bank of India is the apex institution that controls the entire financial market. It’s one of the major functions is to maintain the reserve of foreign exchange. Also, it intervenes in the foreign exchange market to stabilize the excessive fluctuation in the foreign exchange rate.In other words, it is the central bank’s job to control a country’s economy through monetary policy; if the economy is moving slowly or going backward, there are steps that the central bank can take to boost the economy. These steps, whether they are asset purchases or printing more money, all involve injecting more cash into the economy. The simple supply and demand economic projection occurs and currency will devalue.When the opposite occurs, and the economy is growing, the central bank will use various methods to keep that growth steady and in-line with other economic factors such as wages and prices. Whatever the central bank does or doesn’t do, will affect the currency of that country. Sometimes, it is within the central bank’s interest to purposefully affect the value of a currency. For example, if the economy is heavily reliant on exports and their currency value becomes too high, importers of that country’s commodities will seek cheaper supply; hence directly affecting the economy.Q. Which of the following steps should be taken by the central bank if there is an excessive rise in the foreign exchange rate?- a)Supply foreign exchange from its stock

- b)Demand more of other foreign exchange

- c)Not intervene in the market as the exchange rate is determined by the market forces

- d)Help the central government to stabilize the foreign exchange rate.

Correct answer is option 'A'. Can you explain this answer?

Read the following case study paragraph carefully and answer the question based on the same.

The central bank of India i.e. Reserve Bank of India is the apex institution that controls the entire financial market. It’s one of the major functions is to maintain the reserve of foreign exchange. Also, it intervenes in the foreign exchange market to stabilize the excessive fluctuation in the foreign exchange rate.

In other words, it is the central bank’s job to control a country’s economy through monetary policy; if the economy is moving slowly or going backward, there are steps that the central bank can take to boost the economy. These steps, whether they are asset purchases or printing more money, all involve injecting more cash into the economy. The simple supply and demand economic projection occurs and currency will devalue.

When the opposite occurs, and the economy is growing, the central bank will use various methods to keep that growth steady and in-line with other economic factors such as wages and prices. Whatever the central bank does or doesn’t do, will affect the currency of that country. Sometimes, it is within the central bank’s interest to purposefully affect the value of a currency. For example, if the economy is heavily reliant on exports and their currency value becomes too high, importers of that country’s commodities will seek cheaper supply; hence directly affecting the economy.

Q. Which of the following steps should be taken by the central bank if there is an excessive rise in the foreign exchange rate?

a)

Supply foreign exchange from its stock

b)

Demand more of other foreign exchange

c)

Not intervene in the market as the exchange rate is determined by the market forces

d)

Help the central government to stabilize the foreign exchange rate.

|

|

Arun Yadav answered |

As regards control on rise in the price of the foreign exchange, Central Bank will increase the Bank role. It will attract foreign Direct Investment, that will increase the flow of foreign exchange and it will automatically control the price of foreign exchange. Simultaneously, it will increase the job potentials due to induction of MNCs and common man will be benefitted.

Direction: Read the below case and answer the questions that follow:The Centre on Saturday increased the budgetary allocation for the environment ministry from last fiscal by nearly five percent for 2020-21 with no change in the amount allotted to pollution abatement and climate change action plan.Union Finance Minister, Nirmala Sitharaman, allocated ₹ 3,100 crore for the ministry out of which ₹ 460 crore were allotted to control pollution, which is the same as the money it received in the last budget.Control of pollution has been conceptualized to provide financial assistance to Pollution Control Boards/Committees and funding to National Clean Air Programme (NCAP).Similarly, budget for pollution abatement, which was cut by 50 percent last year from 2018-19, remained unchanged at ₹ 10 crore.The minister also announced that states, which are formulating and implementing plans for ensuring cleaner air in cities above one million population should be encouraged.Real GDP and Welfare are ___________ related with each other.- a)Directly

- b)Indirectly

- c)Inversely

- d)None of the above

Correct answer is option 'A'. Can you explain this answer?

Direction: Read the below case and answer the questions that follow:

The Centre on Saturday increased the budgetary allocation for the environment ministry from last fiscal by nearly five percent for 2020-21 with no change in the amount allotted to pollution abatement and climate change action plan.

Union Finance Minister, Nirmala Sitharaman, allocated ₹ 3,100 crore for the ministry out of which ₹ 460 crore were allotted to control pollution, which is the same as the money it received in the last budget.

Control of pollution has been conceptualized to provide financial assistance to Pollution Control Boards/Committees and funding to National Clean Air Programme (NCAP).

Similarly, budget for pollution abatement, which was cut by 50 percent last year from 2018-19, remained unchanged at ₹ 10 crore.

The minister also announced that states, which are formulating and implementing plans for ensuring cleaner air in cities above one million population should be encouraged.

Real GDP and Welfare are ___________ related with each other.

a)

Directly

b)

Indirectly

c)

Inversely

d)

None of the above

|

Tarun Chakraborty answered |

Understanding the Relationship Between Real GDP and Welfare

Real GDP (Gross Domestic Product) is a measure of the economic performance of a country, adjusted for inflation, representing the total value of goods and services produced over a specific time period. Welfare, on the other hand, refers to the overall well-being and quality of life of individuals within a society. The relationship between Real GDP and welfare can be understood as follows:

Direct Relationship

- Economic Growth: When Real GDP increases, it typically indicates economic growth, which can lead to higher employment rates and increased income levels for individuals. This upliftment often translates to better living standards.

- Increased Resources: A growing economy generates more resources that can be allocated towards social services, education, healthcare, and infrastructure, thereby enhancing the welfare of the population.

- Investment in Welfare Programs: Higher GDP allows governments to invest more in welfare programs aimed at poverty alleviation, education improvement, and public health, directly impacting the quality of life.

Limitations of GDP as a Welfare Metric

- Quality of Growth Matters: While there is a direct correlation, it is essential to note that not all growth leads to increased welfare. For example, growth driven by environmental degradation or inequality can harm overall well-being.

- Non-Economic Factors: Welfare also encompasses social, emotional, and environmental factors that GDP does not capture, such as happiness, community, and ecological health.

Conclusion

The relationship between Real GDP and welfare is primarily direct, as economic growth generally leads to improvements in living standards and overall quality of life. However, for sustainable welfare improvement, it is crucial to focus on the quality and distribution of that growth.

Real GDP (Gross Domestic Product) is a measure of the economic performance of a country, adjusted for inflation, representing the total value of goods and services produced over a specific time period. Welfare, on the other hand, refers to the overall well-being and quality of life of individuals within a society. The relationship between Real GDP and welfare can be understood as follows:

Direct Relationship

- Economic Growth: When Real GDP increases, it typically indicates economic growth, which can lead to higher employment rates and increased income levels for individuals. This upliftment often translates to better living standards.

- Increased Resources: A growing economy generates more resources that can be allocated towards social services, education, healthcare, and infrastructure, thereby enhancing the welfare of the population.

- Investment in Welfare Programs: Higher GDP allows governments to invest more in welfare programs aimed at poverty alleviation, education improvement, and public health, directly impacting the quality of life.

Limitations of GDP as a Welfare Metric

- Quality of Growth Matters: While there is a direct correlation, it is essential to note that not all growth leads to increased welfare. For example, growth driven by environmental degradation or inequality can harm overall well-being.

- Non-Economic Factors: Welfare also encompasses social, emotional, and environmental factors that GDP does not capture, such as happiness, community, and ecological health.

Conclusion

The relationship between Real GDP and welfare is primarily direct, as economic growth generally leads to improvements in living standards and overall quality of life. However, for sustainable welfare improvement, it is crucial to focus on the quality and distribution of that growth.

Read the news report given below and answer the question that follow:In a 40 minute long speech Prime Minister Narendra Modi announced the demonetization of existing notes of ₹500 and ₹1,000 during a televised address on Tuesday evening.Modi announced that the notes of ₹500 and ₹1,000 “will not be legal tender from midnight tonight” and these will be “just worthless pieces of paper. The PM also urged people to ‘join this mahayojna against the ills of corruption.Here is a guide for you explaining everything about the move.What is demonetization of currency?Demonetization for us means that the Reserve Bank of India has withdrawn the old `500 and ₹1,000 notes as an official mode of payment. According to Investopedia, demonetization is the act of stripping a currency unit of its status as legal tender.What was the reason?The reasoning given by Modi was: (A) To tackle black money in the economy. (B) To lower the cash circulation in the country which “is directly related to corruption in our country, “ according to PM Modi. (C) To eliminate fake currency and dodgy funds which have been used by terror groups to fund terrorism in India. (D) The move is estimated to scoop out more than ₹5 lakh crore black money from the economy, according to Baba Ramdev, a staunch Modi supporter.Q. Why is demonetisation termed as the mahayojna by the Prime Minister?- a)It is to curb the ills of corruption.

- b)It is to tackle the black money.

- c)It is to digitalise the economy.

- d)All of the above.

Correct answer is option 'A'. Can you explain this answer?

Read the news report given below and answer the question that follow:

In a 40 minute long speech Prime Minister Narendra Modi announced the demonetization of existing notes of ₹500 and ₹1,000 during a televised address on Tuesday evening.

Modi announced that the notes of ₹500 and ₹1,000 “will not be legal tender from midnight tonight” and these will be “just worthless pieces of paper. The PM also urged people to ‘join this mahayojna against the ills of corruption.

Here is a guide for you explaining everything about the move.

What is demonetization of currency?

Demonetization for us means that the Reserve Bank of India has withdrawn the old `500 and ₹1,000 notes as an official mode of payment. According to Investopedia, demonetization is the act of stripping a currency unit of its status as legal tender.

What was the reason?

The reasoning given by Modi was: (A) To tackle black money in the economy. (B) To lower the cash circulation in the country which “is directly related to corruption in our country, “ according to PM Modi. (C) To eliminate fake currency and dodgy funds which have been used by terror groups to fund terrorism in India. (D) The move is estimated to scoop out more than ₹5 lakh crore black money from the economy, according to Baba Ramdev, a staunch Modi supporter.

Q. Why is demonetisation termed as the mahayojna by the Prime Minister?

a)

It is to curb the ills of corruption.

b)

It is to tackle the black money.

c)

It is to digitalise the economy.

d)

All of the above.

|

Rakesh Bhatki answered |

D)

Read the below case and answer the question that follow:In a 40-minute long speech Prime Minister Narendra Modi announced the demonetisation of existing notes of ₹ 500 and ₹ 1,000 during a televised address on Tuesday evening.Modi announced that the notes of ₹ 500 and ₹ 1,000 will not be legal tender from midnight tonight and these will be “just worthless pieces of paper''. The PM also urged people to ‘join this mahayojna against the ills of corruption.Q. ______________ is issued by the government of India.- a)Coins

- b)₹500 note

- c)₹1000 note

- d)All of these

Correct answer is option 'A'. Can you explain this answer?

Read the below case and answer the question that follow:

In a 40-minute long speech Prime Minister Narendra Modi announced the demonetisation of existing notes of ₹ 500 and ₹ 1,000 during a televised address on Tuesday evening.

Modi announced that the notes of ₹ 500 and ₹ 1,000 will not be legal tender from midnight tonight and these will be “just worthless pieces of paper''. The PM also urged people to ‘join this mahayojna against the ills of corruption.

Q. ______________ is issued by the government of India.

a)

Coins

b)

₹500 note

c)

₹1000 note

d)

All of these

|

|

Arun Yadav answered |

It is the sole responsibility of the Government of India to mint coins of all denominations.

Directions: In the following questions, a statement of assertion (A) is followed by a statement of reason (R). Mark the correct choice as:Assertion (A): Equity in agriculture called for land reforms which primarily refer to change of ownership from tillers to Zamindars.Reason (R): The Zamindari system introduced by the British Raj led to the destruction of the agricultural sector in India so the land reforms had to be introduced.- a)Both assertion (A) and reason (R) are true and reason (R) is the correct explanation of assertion (A).

- b)Both assertion (A) and reason (R) are true but reason (R) is not the correct explanation of assertion (A).

- c)Assertion (A) is true but reason (R) is false.

- d)Assertion (A) is false but reason (R) is true.

Correct answer is option 'D'. Can you explain this answer?

Directions: In the following questions, a statement of assertion (A) is followed by a statement of reason (R). Mark the correct choice as:

Assertion (A): Equity in agriculture called for land reforms which primarily refer to change of ownership from tillers to Zamindars.

Reason (R): The Zamindari system introduced by the British Raj led to the destruction of the agricultural sector in India so the land reforms had to be introduced.

a)

Both assertion (A) and reason (R) are true and reason (R) is the correct explanation of assertion (A).

b)

Both assertion (A) and reason (R) are true but reason (R) is not the correct explanation of assertion (A).

c)

Assertion (A) is true but reason (R) is false.

d)

Assertion (A) is false but reason (R) is true.

|

|

Om Desai answered |

In post-independent India, equity in agriculture called for land reforms which primarily refer to change in the ownership of landholdings from Zamindars to tillers.

Read the following hypothetical text and answer the question that follow:The performance of the Indian economy during the period of first seven five-year plans (1950-1990) was satisfactory if not very impressive. On the eve of independence, India was an industrially backward country, but during this period of first seven plans our industries became far more diversified, with the stress being laid on the public investments in the industrial sector. The policy of import substitution led to protection of the domestic industries against the foreign producersbut we failed to promote a strong export surplus. Although public sector expanded to a large extent but it could not bring desired level of improvement in the secondary sector. Excessive government regulations prevented the natural trajectory of growth of entrepreneurship as there was no competition, no innovation and no modernization on the front of the industrial sector. Many Public Sector Undertakings (PSUs) incurred huge losses due to operational inefficiencies, red-tapism, poor technology and other similar reasons. These PSUs continued to function because it was difficult to close a government undertaking even it is a drain on country’s limited resources. On the Agricultural front, due to the measures taken under the Green Revolution, India more or less became self-sufficient in the production of food grains. So, the needs for reform of economic policy was widely felt in the context of changing global economic scenario to achieve desired growth in the country.Q. Which of the following was not a reason for the public sector to play a major role in the initial phase of Indian Economic Planning?- a)Private entrepreneurs lacked sufficient capital for investment.

- b)Government aimed at social welfare.

- c)The market was big enough to encourage private industrialists for investment.

- d)The government wanted to protect the indigenous producers from the foreign competition.

Correct answer is option 'C'. Can you explain this answer?

Read the following hypothetical text and answer the question that follow:

The performance of the Indian economy during the period of first seven five-year plans (1950-1990) was satisfactory if not very impressive. On the eve of independence, India was an industrially backward country, but during this period of first seven plans our industries became far more diversified, with the stress being laid on the public investments in the industrial sector. The policy of import substitution led to protection of the domestic industries against the foreign producers

but we failed to promote a strong export surplus. Although public sector expanded to a large extent but it could not bring desired level of improvement in the secondary sector. Excessive government regulations prevented the natural trajectory of growth of entrepreneurship as there was no competition, no innovation and no modernization on the front of the industrial sector. Many Public Sector Undertakings (PSUs) incurred huge losses due to operational inefficiencies, red-tapism, poor technology and other similar reasons. These PSUs continued to function because it was difficult to close a government undertaking even it is a drain on country’s limited resources. On the Agricultural front, due to the measures taken under the Green Revolution, India more or less became self-sufficient in the production of food grains. So, the needs for reform of economic policy was widely felt in the context of changing global economic scenario to achieve desired growth in the country.

Q. Which of the following was not a reason for the public sector to play a major role in the initial phase of Indian Economic Planning?

a)

Private entrepreneurs lacked sufficient capital for investment.

b)

Government aimed at social welfare.

c)

The market was big enough to encourage private industrialists for investment.

d)

The government wanted to protect the indigenous producers from the foreign competition.

|

|

Kiran Mehta answered |

The market was big enough to encourage private industrialists for investment.

Directions: In the following questions, a statement of assertion (A) is followed by a statement of reason (R). Mark the correct choice as:Assertion (A): Because of India's rapidly growing population the country's traditional agricultural practices yielded insufficient food production.Reason (R): Agricultural technological advancements offered opportunities to increase productivity.- a)Both assertion (A) and reason (R) are true and reason (R) is the correct explanation of assertion (A).

- b)Both assertion (A) and reason (R) are true but reason (R) is not the correct explanation of assertion (A).

- c)Assertion (A) is true but reason (R) is false.

- d)Assertion (A) is false but reason (R) is true.

Correct answer is option 'B'. Can you explain this answer?

Directions: In the following questions, a statement of assertion (A) is followed by a statement of reason (R). Mark the correct choice as:

Assertion (A): Because of India's rapidly growing population the country's traditional agricultural practices yielded insufficient food production.

Reason (R): Agricultural technological advancements offered opportunities to increase productivity.

a)

Both assertion (A) and reason (R) are true and reason (R) is the correct explanation of assertion (A).

b)

Both assertion (A) and reason (R) are true but reason (R) is not the correct explanation of assertion (A).

c)

Assertion (A) is true but reason (R) is false.

d)

Assertion (A) is false but reason (R) is true.

|

|

Priyanka Khatri answered |

In the context of India's rapidly growing population, the country's traditional agricultural practices yielded insufficient food production. By the 1960s, this low productivity led India to experience food grain shortages that were more severe than those of other developing countries. Agricultural technological advancements offered opportunities to increase productivity.

Directions: In the following questions, a statement of assertion (A) is followed by a statement of reason (R). Mark the correct choice as:Assertion (A): Finished goods were exported from India during the Colonial Era.Reason (R): India was a hub for raw materials for the British Industries.- a)Both assertion (A) and reason (R) are true and reason (R) is the correct explanation of assertion (A).

- b)Both assertion (A) and reason (R) are true but reason (R) is not the correct explanation of assertion (A).

- c)Assertion (A) is true but reason (R) is false.

- d)Assertion (A) is false but reason (R) is true.

Correct answer is option 'D'. Can you explain this answer?

Directions: In the following questions, a statement of assertion (A) is followed by a statement of reason (R). Mark the correct choice as:

Assertion (A): Finished goods were exported from India during the Colonial Era.

Reason (R): India was a hub for raw materials for the British Industries.

a)

Both assertion (A) and reason (R) are true and reason (R) is the correct explanation of assertion (A).

b)

Both assertion (A) and reason (R) are true but reason (R) is not the correct explanation of assertion (A).

c)

Assertion (A) is true but reason (R) is false.

d)

Assertion (A) is false but reason (R) is true.

|

|

Amita Das answered |

From the time of Independence, India has been one of the important trading countries, exporting primary items like cotton, raw silk, sugar, wool, jute, and indigo, etc. and importer of finished consumer goods like woollen clothes, cotton, silk, and capital goods like light machinery manufactured in Britain.

Directions: In the following questions, a statement of assertion (A) is followed by a statement of reason (R). Mark the correct choice as:Assertion (A): Size of multiplier is given by the inverse of LRRReason(R): There is direct relationship between LRR and value of money multiplier- a)Both assertion (A) and reason (R) are true and reason (R) is the correct explanation of assertion (A).

- b)Both assertion (A) and reason (R) are true but reason (R) is not the correct explanation of assertion (A).

- c)Assertion (A) is true but reason (R) is false.

- d)Assertion (A) is false but reason (R) is true.

Correct answer is option 'C'. Can you explain this answer?

Directions: In the following questions, a statement of assertion (A) is followed by a statement of reason (R). Mark the correct choice as:

Assertion (A): Size of multiplier is given by the inverse of LRR

Reason(R): There is direct relationship between LRR and value of money multiplier

a)

Both assertion (A) and reason (R) are true and reason (R) is the correct explanation of assertion (A).

b)

Both assertion (A) and reason (R) are true but reason (R) is not the correct explanation of assertion (A).

c)

Assertion (A) is true but reason (R) is false.

d)

Assertion (A) is false but reason (R) is true.

|

|

Arun Yadav answered |

The deposit multiplier is sometimes expressed as the deposit multiplier ratio, which is the inverse of the required reserve ratio. For example, if the required reserve ratio is 20%, the deposit multiplier ratio is 80%.

Directions: In the following questions, a statement of assertion (A) is followed by a statement of reason (R). Mark the correct choice as:Assertion: Central bank uses many tools such as Bank rate, repo rate, reverse repo rate etc. to control money supply in the economy.Reason: Commercial bank is the apex Bank of India.- a)Both assertion (A) and reason (R) are true and reason (R) is the correct explanation of assertion (A).

- b)Both assertion (A) and reason (R) are true but reason (R) is not the correct explanation of assertion (A).

- c)Assertion (A) is true but reason (R) is false.

- d)Assertion (A) is false but reason (R) is true.

Correct answer is option 'C'. Can you explain this answer?

Directions: In the following questions, a statement of assertion (A) is followed by a statement of reason (R). Mark the correct choice as:

Assertion: Central bank uses many tools such as Bank rate, repo rate, reverse repo rate etc. to control money supply in the economy.

Reason: Commercial bank is the apex Bank of India.

a)

Both assertion (A) and reason (R) are true and reason (R) is the correct explanation of assertion (A).

b)

Both assertion (A) and reason (R) are true but reason (R) is not the correct explanation of assertion (A).

c)

Assertion (A) is true but reason (R) is false.

d)

Assertion (A) is false but reason (R) is true.

|

|

Ishan Choudhury answered |

Reverse Repo rate is the short term borrowing rate at which RBI borrows money from banks. The central bank uses this tool to change the money supply in the economy. An increase in the reverse repo rate means that the banks will get a higher rate of interest from RBI.

Direction: Read the report given below and answer the questions that follow:China and India are the two emerging economies of the world. As of 2019, China and India are 2nd and 5th largest country of the world, respectively in nominal basis. On PPP basis, China is at 1st and India is at 3rd place. Both countries together share 19.46% and 27.18% of total global wealth in nominal and PPP terms, respectively. Among Asian countries, China and India together contribute more than half of Asia’s GDP.In 1987, GDP (Nominal) of both countries was almost equal. But in 2019, China’s GDP is 4.78 times greater than India. On PPP basis, GDP of China is 2.38x of India. China crossed $1 trillion mark in 1998 while India crossed 9 year later in 2007 at exchange rate basis.Both countries have been neck-to-neck in GDP per capita terms. As per both methods, India was richer than China in 1990. Now in 2019, China is almost 4.61 times richer than India in nominal method and 2.30 times richer in PPP method. Per capita rank of China and India is 72th and 145th, resp, in nominal. Per capita rank of China and India is 75th and 126th, resp, in PPP.China attains maximum GDP growth rate of 19.30% in year 1970 and minimum -27.27% in 1961. India reached an all time high of 9.63% in 1988 and a record low of -5.24% in 1979. During period 1961 to 2018, China grew by more than 10% in 22 years while India never. GDP growth rate was negative in five and four years for China and India, respectively.According to CIA Factbook sector wise GDP composition of India in 2017 are as follows : Agriculture (15.4%), Industry (23%) and Services (61.5%). Sector wise GDP composition of China in 2017 are : Agriculture (8.3%), Industry (39.5%) and Services (52.2%).- Comparing China and India by Economy – The Statistic Times – 28th August, 2019China is ______________ economy.- a)Agricultural

- b)Industrial

- c)Both (A) and (B)

- d)Neither (A) nor (B)

Correct answer is option 'B'. Can you explain this answer?

Direction: Read the report given below and answer the questions that follow:

China and India are the two emerging economies of the world. As of 2019, China and India are 2nd and 5th largest country of the world, respectively in nominal basis. On PPP basis, China is at 1st and India is at 3rd place. Both countries together share 19.46% and 27.18% of total global wealth in nominal and PPP terms, respectively. Among Asian countries, China and India together contribute more than half of Asia’s GDP.

In 1987, GDP (Nominal) of both countries was almost equal. But in 2019, China’s GDP is 4.78 times greater than India. On PPP basis, GDP of China is 2.38x of India. China crossed $1 trillion mark in 1998 while India crossed 9 year later in 2007 at exchange rate basis.

Both countries have been neck-to-neck in GDP per capita terms. As per both methods, India was richer than China in 1990. Now in 2019, China is almost 4.61 times richer than India in nominal method and 2.30 times richer in PPP method. Per capita rank of China and India is 72th and 145th, resp, in nominal. Per capita rank of China and India is 75th and 126th, resp, in PPP.

China attains maximum GDP growth rate of 19.30% in year 1970 and minimum -27.27% in 1961. India reached an all time high of 9.63% in 1988 and a record low of -5.24% in 1979. During period 1961 to 2018, China grew by more than 10% in 22 years while India never. GDP growth rate was negative in five and four years for China and India, respectively.

According to CIA Factbook sector wise GDP composition of India in 2017 are as follows : Agriculture (15.4%), Industry (23%) and Services (61.5%). Sector wise GDP composition of China in 2017 are : Agriculture (8.3%), Industry (39.5%) and Services (52.2%).

- Comparing China and India by Economy – The Statistic Times – 28th August, 2019

China is ______________ economy.

a)

Agricultural

b)

Industrial

c)

Both (A) and (B)

d)

Neither (A) nor (B)

|

|

Ishan Choudhury answered |

Industry was 39.5% of China's gross domestic product (GDP).

Directions: In the following questions, a statement of assertion (A) is followed by a statement of reason (R). Mark the correct choice as:Assertion (A): Supply of money is a stock variableReason (R): Supply of money is measured over a period of time, usually a fiscal year- a)Both assertion (A) and reason (R) are true and reason (R) is the correct explanation of assertion (A).

- b)Both assertion (A) and reason (R) are true but reason (R) is not the correct explanation of assertion (A).

- c)Assertion (A) is true but reason (R) is false.

- d)Assertion (A) is false but reason (R) is true.

Correct answer is option 'C'. Can you explain this answer?

Directions: In the following questions, a statement of assertion (A) is followed by a statement of reason (R). Mark the correct choice as:

Assertion (A): Supply of money is a stock variable

Reason (R): Supply of money is measured over a period of time, usually a fiscal year

a)

Both assertion (A) and reason (R) are true and reason (R) is the correct explanation of assertion (A).

b)

Both assertion (A) and reason (R) are true but reason (R) is not the correct explanation of assertion (A).

c)

Assertion (A) is true but reason (R) is false.

d)

Assertion (A) is false but reason (R) is true.

|

|

Ishan Choudhury answered |

Money supply refers to the total sum of money available to the public in the economy at a point of time. Because money supply is measured at a particular point of time,it is a stock variable.

Direction: Read the below case and answer the questions that follow:The country’s real gross domestic product (GDP) is likely to expand by 11 percent in the next financial year due to a faster economic recovery and on a low base, says a report. The report by domestic rating agency Brickwork Ratings said economic activities are slowly reaching Pre-COVID levels following the relaxation of the lockdown, except in sectors that remain affected by social distancing norms.“With progress in developing an effective vaccine for COVID-19 and signals of faster-than-expected recovery in the domestic economy, and also supported by a low base, we expect the real GDP to grow at 11 percent in F/Y 22, from the estimated contraction of 7 percent to 7.5 percent in F/Y 21,” the agency said.According to the first advance estimates of national income released by the National Statistical Office (NSO), the country’s GDP is estimated to contract by a record 7.7 percent during the current financial year.What will be the growth rate of GDP according to the NSO? - a)– 7.7%

- b)+7.7%

- c)+11%

- d)– 7.5%

Correct answer is option 'A'. Can you explain this answer?

Direction: Read the below case and answer the questions that follow:

The country’s real gross domestic product (GDP) is likely to expand by 11 percent in the next financial year due to a faster economic recovery and on a low base, says a report. The report by domestic rating agency Brickwork Ratings said economic activities are slowly reaching Pre-COVID levels following the relaxation of the lockdown, except in sectors that remain affected by social distancing norms.

“With progress in developing an effective vaccine for COVID-19 and signals of faster-than-expected recovery in the domestic economy, and also supported by a low base, we expect the real GDP to grow at 11 percent in F/Y 22, from the estimated contraction of 7 percent to 7.5 percent in F/Y 21,” the agency said.

According to the first advance estimates of national income released by the National Statistical Office (NSO), the country’s GDP is estimated to contract by a record 7.7 percent during the current financial year.

What will be the growth rate of GDP according to the NSO?

a)

– 7.7%

b)

+7.7%

c)

+11%

d)

– 7.5%

|

Navya Sengupta answered |

Explanation:

Growth Rate of GDP According to NSO:

- The National Statistical Office (NSO) has estimated that the country's GDP will contract by a record 7.7% during the current financial year.

This indicates that the GDP is expected to shrink by 7.7% as per the first advance estimates released by the NSO. The negative growth rate suggests a contraction in the economy's overall output and performance during the specified period.

Growth Rate of GDP According to NSO:

- The National Statistical Office (NSO) has estimated that the country's GDP will contract by a record 7.7% during the current financial year.

This indicates that the GDP is expected to shrink by 7.7% as per the first advance estimates released by the NSO. The negative growth rate suggests a contraction in the economy's overall output and performance during the specified period.

Read the following hypothetical case study carefully and answer the question on the basis of the same.Since ages, farmers in India have taken recourse to debt. In the earlier times the same was from informal sources. Since independence with the efforts of the government, the formal sector has actively come into picture. Farmers borrow not only to meet their investment needs but also to satisfy their personal needs. Uncertainty of income caused by factors like crop failure caused by irregular rainfall, reduction in ground water table, locust/other pest attack, etc. These reasons push them into the clutches of the private money lenders, who charge exorbitant rates of interest which add to their miseries.Various governments in India, at different times for different reasons, introduced debt relief/waiver schemes. These schemes are used by governments as a quick means to extricate farmers from their indebtedness, helping to restore their capacity to invest and produce, in short to lessen the miseries of the farmers across India. The costs and benefits of such debt relief schemes are, however, a widely debated topic among economists. Some economists argue that such schemes are extremely beneficial to the poor and marginalised farmers while others argue that these schemes add to the fiscal burden of the government, others believe that these schemes may develop the expectation of repeated bailouts among farmers which may spoil the credit culture among farmers.Q. The rural banking structure in India consists of a set of multi-agency institutions _____________ is expected to dispense credit at cheaper rates for agricultural purposes to farmers.- a)Regional Rural Banks

- b)Small Industries Development Bank of India

- c)Both (A) and (B)

- d)None of the above

Correct answer is option 'A'. Can you explain this answer?

Read the following hypothetical case study carefully and answer the question on the basis of the same.

Since ages, farmers in India have taken recourse to debt. In the earlier times the same was from informal sources. Since independence with the efforts of the government, the formal sector has actively come into picture. Farmers borrow not only to meet their investment needs but also to satisfy their personal needs. Uncertainty of income caused by factors like crop failure caused by irregular rainfall, reduction in ground water table, locust/other pest attack, etc. These reasons push them into the clutches of the private money lenders, who charge exorbitant rates of interest which add to their miseries.

Various governments in India, at different times for different reasons, introduced debt relief/waiver schemes. These schemes are used by governments as a quick means to extricate farmers from their indebtedness, helping to restore their capacity to invest and produce, in short to lessen the miseries of the farmers across India. The costs and benefits of such debt relief schemes are, however, a widely debated topic among economists. Some economists argue that such schemes are extremely beneficial to the poor and marginalised farmers while others argue that these schemes add to the fiscal burden of the government, others believe that these schemes may develop the expectation of repeated bailouts among farmers which may spoil the credit culture among farmers.

Q. The rural banking structure in India consists of a set of multi-agency institutions _____________ is expected to dispense credit at cheaper rates for agricultural purposes to farmers.

a)

Regional Rural Banks

b)

Small Industries Development Bank of India

c)

Both (A) and (B)

d)

None of the above

|

|

Amita Das answered |

The institutional structure of rural banking today consists of a set of multi agency institutions, which are

(i) Commercial banks

(ii) Regional Rural Banks (HHBs)

(iii) C o-operatives and Land development banks

Recently, Self-Help Groups (henceforth SHGs) have also emerged.

Read the report given below and answer the question that follow:NEW DELHI: Finance Minister Nirmala Sitharaman on Monday announced plans to sell a stake in LIC as part of her disinvestment plans for F/Y 22. In her Budget speech, the FM said her government will complete divestment of BPCL, CONCOR and SCI in F/Y 22. She said that her government will privatise two public sector banks (PSBs) and one general insurance company as well. “LIC IPO may see the light of day soon,” said Jiger Saiya, Partner and Leader - Tax & Regulatory Services at BDO India.Earlier, in an interview with ET, LIC Chairman M R Kumar had said the IPO is very much likely. “The point is that it is going to be big and we want to get the valuations right,” he had said, adding that the listing of an insurance company requires determining the embedded value of the business.LIC has started the process and would soon announce the software, which will assist it determine the right valuation. “We have floated an RFP for the actuarial firm that will undertake the exercise. This calculation will take some time. Once this process is done, we will be ready,” Kumar said on January 11.Last week, a Reuters report quoting sources suggested that the government was looking to sell 10-15 per cent in the country’s biggest insurer to improve public finances.To facilitate the sale of the LIC stake, the government will need Parliament approval to amend the LIC Act.As part of its divestment drive, four CPSEs – HAL, SAIL, Bharat Dynamics and IRCTC –have come out with offers for sale (OFSs) this financial year. They garnered ₹12,907 crore to the exchequer. In addition, IPOs of IRFC and Mazagon Dock Shipbuilders together fetched ₹1,984 crore.Also, this year, the government sold shares worth about ₹1,837 crore in private companies, in which it holds stakes through SUUTI.Four state-owned companies, NTPC, RITES, NMDC and KIOCL, completed share buybacks, adding ₹2,769 crore to the exchequer.The government is also looking to sell its entire 26.12 per cent stake in Tata Communications (TCL), erstwhile VSNL, through an OFS and strategic sale this financial year. The process of privatisation of Air India, BPCL, Pawan Hans, BEML, Shipping Corp, Neelachal Ispat Nigam Limited and Ferro Scrap Nigam Limited (FSNL) is currently underway.Q. According to Reuters, why is the government looking to sell the country's insurer?- a)To reduce revenue deficit

- b)To reduce fiscal deficit

- c)To improve public finances

- d)To get money other than taxes.

Correct answer is option 'C'. Can you explain this answer?

Read the report given below and answer the question that follow:

NEW DELHI: Finance Minister Nirmala Sitharaman on Monday announced plans to sell a stake in LIC as part of her disinvestment plans for F/Y 22. In her Budget speech, the FM said her government will complete divestment of BPCL, CONCOR and SCI in F/Y 22. She said that her government will privatise two public sector banks (PSBs) and one general insurance company as well. “LIC IPO may see the light of day soon,” said Jiger Saiya, Partner and Leader - Tax & Regulatory Services at BDO India.

Earlier, in an interview with ET, LIC Chairman M R Kumar had said the IPO is very much likely. “The point is that it is going to be big and we want to get the valuations right,” he had said, adding that the listing of an insurance company requires determining the embedded value of the business.

LIC has started the process and would soon announce the software, which will assist it determine the right valuation. “We have floated an RFP for the actuarial firm that will undertake the exercise. This calculation will take some time. Once this process is done, we will be ready,” Kumar said on January 11.

Last week, a Reuters report quoting sources suggested that the government was looking to sell 10-15 per cent in the country’s biggest insurer to improve public finances.

To facilitate the sale of the LIC stake, the government will need Parliament approval to amend the LIC Act.

As part of its divestment drive, four CPSEs – HAL, SAIL, Bharat Dynamics and IRCTC –have come out with offers for sale (OFSs) this financial year. They garnered ₹12,907 crore to the exchequer. In addition, IPOs of IRFC and Mazagon Dock Shipbuilders together fetched ₹1,984 crore.

Also, this year, the government sold shares worth about ₹1,837 crore in private companies, in which it holds stakes through SUUTI.

Four state-owned companies, NTPC, RITES, NMDC and KIOCL, completed share buybacks, adding ₹2,769 crore to the exchequer.

The government is also looking to sell its entire 26.12 per cent stake in Tata Communications (TCL), erstwhile VSNL, through an OFS and strategic sale this financial year. The process of privatisation of Air India, BPCL, Pawan Hans, BEML, Shipping Corp, Neelachal Ispat Nigam Limited and Ferro Scrap Nigam Limited (FSNL) is currently underway.

Q. According to Reuters, why is the government looking to sell the country's insurer?

a)

To reduce revenue deficit

b)

To reduce fiscal deficit

c)

To improve public finances

d)

To get money other than taxes.

|

|

Neha Sharma answered |

A Reuters report citing sources suggested the government was looking to sell 10-15 percent of the country's largest insurer to improve public finances.

निम्नलिखित में से कौन सा मार्ग मुंबई को नासिक से जोड़ता है?- a)थाल घाट

- b)पाल घाट

- c)शेंकोत्तह गैप

- d)दर्रा दर्रा

Correct answer is option 'A'. Can you explain this answer?

निम्नलिखित में से कौन सा मार्ग मुंबई को नासिक से जोड़ता है?

a)

थाल घाट

b)

पाल घाट

c)

शेंकोत्तह गैप

d)

दर्रा दर्रा

|

|

Rahul Mehta answered |

थाल घाट भी Thul घाट या कसारा घाट के रूप में बुलाया जोड़ता है नासिक से मुंबई । यह मुंबई में अग्रणी चार प्रमुख मार्गों, रेल और सड़क मार्गों में से एक है।

Directions: In the following questions, a statement of assertion (A) is followed by a statement of reason (R). Mark the correct choice as:Assertion (A): Green revolution though improved the production of crops but did not increase the income of the farmers.Reason (R): The farmers sold more crops at a lesser price.- a)Both assertion (A) and reason (R) are true and reason (R) is the correct explanation of assertion (A).

- b)Both assertion (A) and reason (R) are true but reason (R) is not the correct explanation of assertion (A).

- c)Assertion (A) is true but reason (R) is false.

- d)Assertion (A) is false but reason (R) is true.

Correct answer is option 'D'. Can you explain this answer?

Directions: In the following questions, a statement of assertion (A) is followed by a statement of reason (R). Mark the correct choice as:

Assertion (A): Green revolution though improved the production of crops but did not increase the income of the farmers.

Reason (R): The farmers sold more crops at a lesser price.

a)

Both assertion (A) and reason (R) are true and reason (R) is the correct explanation of assertion (A).

b)

Both assertion (A) and reason (R) are true but reason (R) is not the correct explanation of assertion (A).

c)

Assertion (A) is true but reason (R) is false.

d)

Assertion (A) is false but reason (R) is true.

|

Gowri Chavan answered |

Explanation:

Assertion (A) is false:

The assertion that the Green Revolution did not increase the income of farmers is false. The Green Revolution, which introduced high-yielding variety seeds, modern agricultural techniques, and increased the use of fertilizers and pesticides, did lead to a significant increase in crop production. This increase in production did result in higher incomes for many farmers who were able to sell more crops.

Reason (R) is true:

The reason given for the assertion is true. Due to the increased production brought about by the Green Revolution, farmers often had to sell their crops at lower prices to compete in the market. The surplus of crops led to a decrease in prices, which affected the income of some farmers who were not able to benefit from the increased production.

Therefore, while the assertion is false because the Green Revolution did increase the income of many farmers through higher production, the reason is true as some farmers did face challenges with selling their increased crops at lower prices.

Assertion (A) is false:

The assertion that the Green Revolution did not increase the income of farmers is false. The Green Revolution, which introduced high-yielding variety seeds, modern agricultural techniques, and increased the use of fertilizers and pesticides, did lead to a significant increase in crop production. This increase in production did result in higher incomes for many farmers who were able to sell more crops.

Reason (R) is true:

The reason given for the assertion is true. Due to the increased production brought about by the Green Revolution, farmers often had to sell their crops at lower prices to compete in the market. The surplus of crops led to a decrease in prices, which affected the income of some farmers who were not able to benefit from the increased production.

Therefore, while the assertion is false because the Green Revolution did increase the income of many farmers through higher production, the reason is true as some farmers did face challenges with selling their increased crops at lower prices.

Read the following hypothetical text and answer the question that follow:The performance of the Indian economy during the period of first seven five-year plans (1950-1990) was satisfactory if not very impressive. On the eve of independence, India was an industrially backward country, but during this period of first seven plans our industries became far more diversified, with the stress being laid on the public investments in the industrial sector. The policy of import substitution led to protection of the domestic industries against the foreign producersbut we failed to promote a strong export surplus. Although public sector expanded to a large extent but it could not bring desired level of improvement in the secondary sector. Excessive government regulations prevented the natural trajectory of growth of entrepreneurship as there was no competition, no innovation and no modernization on the front of the industrial sector. Many Public Sector Undertakings (PSUs) incurred huge losses due to operational inefficiencies, red-tapism, poor technology and other similar reasons. These PSUs continued to function because it was difficult to close a government undertaking even it is a drain on country’s limited resources. On the Agricultural front, due to the measures taken under the Green Revolution, India more or less became self-sufficient in the production of food grains. So, the needs for reform of economic policy was widely felt in the context of changing global economic scenario to achieve desired growth in the country.Q. Mechanization of Indian agriculture was one of the causes of ___________ in India.- a)Green Revolution

- b)White Revolution

- c)Yellow Revolution

- d)None of the above

Correct answer is option 'A'. Can you explain this answer?

Read the following hypothetical text and answer the question that follow:

The performance of the Indian economy during the period of first seven five-year plans (1950-1990) was satisfactory if not very impressive. On the eve of independence, India was an industrially backward country, but during this period of first seven plans our industries became far more diversified, with the stress being laid on the public investments in the industrial sector. The policy of import substitution led to protection of the domestic industries against the foreign producers

but we failed to promote a strong export surplus. Although public sector expanded to a large extent but it could not bring desired level of improvement in the secondary sector. Excessive government regulations prevented the natural trajectory of growth of entrepreneurship as there was no competition, no innovation and no modernization on the front of the industrial sector. Many Public Sector Undertakings (PSUs) incurred huge losses due to operational inefficiencies, red-tapism, poor technology and other similar reasons. These PSUs continued to function because it was difficult to close a government undertaking even it is a drain on country’s limited resources. On the Agricultural front, due to the measures taken under the Green Revolution, India more or less became self-sufficient in the production of food grains. So, the needs for reform of economic policy was widely felt in the context of changing global economic scenario to achieve desired growth in the country.

Q. Mechanization of Indian agriculture was one of the causes of ___________ in India.

a)

Green Revolution

b)

White Revolution

c)

Yellow Revolution

d)

None of the above

|

|

Amita Das answered |

This necessitated the “Green Revolution”, which was largely due to the advent of technology, improved water supply and better agricultural practices. In addition, the increase in agricultural mechanisation and the use of crop protection systems have also contributed to the emergence of “Green Revolution” in India.

Directions: In the following questions, a statement of assertion (A) is followed by a statement of reason (R). Mark the correct choice as:Assertion (A): Currency held with the government and banks is not included in the Money Supply.Reason (R): Currency can be legally used to make payment of debts or other obligations.- a)Both assertion (A) and reason (R) are true and reason (R) is the correct explanation of assertion (A).

- b)Both assertion (A) and reason (R) are true but reason (R) is not the correct explanation of assertion (A).

- c)Assertion (A) is true but reason (R) is false.

- d)Assertion (A) is false but reason (R) is true.

Correct answer is option 'B'. Can you explain this answer?

Directions: In the following questions, a statement of assertion (A) is followed by a statement of reason (R). Mark the correct choice as:

Assertion (A): Currency held with the government and banks is not included in the Money Supply.

Reason (R): Currency can be legally used to make payment of debts or other obligations.

a)

Both assertion (A) and reason (R) are true and reason (R) is the correct explanation of assertion (A).

b)

Both assertion (A) and reason (R) are true but reason (R) is not the correct explanation of assertion (A).

c)

Assertion (A) is true but reason (R) is false.

d)

Assertion (A) is false but reason (R) is true.

|

|

Arun Yadav answered |

Money supply includes the currency that is in circulation with the public at a particular point of time, hence it does not include the money held by government or commercial banks as it is not in circulation with the public at a given point in time.

Direction: Read the below case and answer the questions that follow:The Centre on Saturday increased the budgetary allocation for the environment ministry from last fiscal by nearly five percent for 2020-21 with no change in the amount allotted to pollution abatement and climate change action plan.Union Finance Minister, Nirmala Sitharaman, allocated ₹ 3,100 crore for the ministry out of which ₹ 460 crore were allotted to control pollution, which is the same as the money it received in the last budget.Control of pollution has been conceptualized to provide financial assistance to Pollution Control Boards/Committees and funding to National Clean Air Programme (NCAP).Similarly, budget for pollution abatement, which was cut by 50 percent last year from 2018-19, remained unchanged at ₹ 10 crore.The minister also announced that states, which are formulating and implementing plans for ensuring cleaner air in cities above one million population should be encouraged.Why is the policy implemented?- a)To ensure clear air

- b)To ensure clear water

- c)To ensure clean roads

- d)All of the above

Correct answer is option 'A'. Can you explain this answer?

Direction: Read the below case and answer the questions that follow:

The Centre on Saturday increased the budgetary allocation for the environment ministry from last fiscal by nearly five percent for 2020-21 with no change in the amount allotted to pollution abatement and climate change action plan.

Union Finance Minister, Nirmala Sitharaman, allocated ₹ 3,100 crore for the ministry out of which ₹ 460 crore were allotted to control pollution, which is the same as the money it received in the last budget.

Control of pollution has been conceptualized to provide financial assistance to Pollution Control Boards/Committees and funding to National Clean Air Programme (NCAP).

Similarly, budget for pollution abatement, which was cut by 50 percent last year from 2018-19, remained unchanged at ₹ 10 crore.

The minister also announced that states, which are formulating and implementing plans for ensuring cleaner air in cities above one million population should be encouraged.

Why is the policy implemented?

a)

To ensure clear air

b)

To ensure clear water

c)

To ensure clean roads

d)

All of the above

|

Meera Rane answered |

Rationale Behind the Policy Implementation

The policy implemented by the Centre focuses primarily on ensuring cleaner air, reflecting a commitment to environmental health and public welfare.

Key Objectives of the Policy

- Air Quality Improvement: The allocation of funds specifically for pollution control indicates a targeted approach to improving air quality. With cities housing over a million inhabitants facing severe air pollution, this policy aims to tackle the issue by funding initiatives that promote cleaner air.

- Support for State Initiatives: By encouraging states to formulate and implement plans for cleaner air, the government acknowledges the importance of local action in addressing pollution. This decentralized approach empowers states to tailor solutions to their specific challenges.

- Allocation of Resources: The unchanged budget for pollution control and its clear designation for the National Clean Air Programme (NCAP) highlight a sustained commitment to strategies that effectively address air pollution.

Broader Environmental Impact

While the focus is on air quality, the implications of cleaner air extend beyond just one element of the environment. Cleaner air contributes to better health outcomes, reduced healthcare costs, and overall improved quality of life for citizens.

Conclusion

In summary, the policy's primary aim is to ensure clear air, addressing a critical environmental concern that affects the health and well-being of the population. While water and road cleanliness are also important, this specific allocation and focus on air quality delineate the central objective of the implemented policy.

The policy implemented by the Centre focuses primarily on ensuring cleaner air, reflecting a commitment to environmental health and public welfare.

Key Objectives of the Policy

- Air Quality Improvement: The allocation of funds specifically for pollution control indicates a targeted approach to improving air quality. With cities housing over a million inhabitants facing severe air pollution, this policy aims to tackle the issue by funding initiatives that promote cleaner air.

- Support for State Initiatives: By encouraging states to formulate and implement plans for cleaner air, the government acknowledges the importance of local action in addressing pollution. This decentralized approach empowers states to tailor solutions to their specific challenges.

- Allocation of Resources: The unchanged budget for pollution control and its clear designation for the National Clean Air Programme (NCAP) highlight a sustained commitment to strategies that effectively address air pollution.

Broader Environmental Impact

While the focus is on air quality, the implications of cleaner air extend beyond just one element of the environment. Cleaner air contributes to better health outcomes, reduced healthcare costs, and overall improved quality of life for citizens.

Conclusion

In summary, the policy's primary aim is to ensure clear air, addressing a critical environmental concern that affects the health and well-being of the population. While water and road cleanliness are also important, this specific allocation and focus on air quality delineate the central objective of the implemented policy.

Directions: In the following questions, a statement of assertion (A) is followed by a statement of reason (R). Mark the correct choice as:Assertion (A): Soil Erosion is the major environmental problem faced by India.Reason (R): India is an agricultural economy- a)Both assertion (A) and reason (R) are true and reason (R) is the correct explanation of assertion (A).

- b)Both assertion (A) and reason (R) are true but reason (R) is not the correct explanation of assertion (A).

- c)Assertion (A) is true but reason (R) is false.

- d)Assertion (A) is false but reason (R) is true.

Correct answer is option 'C'. Can you explain this answer?

Directions: In the following questions, a statement of assertion (A) is followed by a statement of reason (R). Mark the correct choice as:

Assertion (A): Soil Erosion is the major environmental problem faced by India.

Reason (R): India is an agricultural economy

a)

Both assertion (A) and reason (R) are true and reason (R) is the correct explanation of assertion (A).

b)

Both assertion (A) and reason (R) are true but reason (R) is not the correct explanation of assertion (A).

c)

Assertion (A) is true but reason (R) is false.

d)

Assertion (A) is false but reason (R) is true.

|

Isha Chopra answered |

Assertion (A): Soil Erosion is the major environmental problem faced by India.

Reason (R): India is an agricultural economy.

Explanation:

Soil erosion is indeed a major environmental problem faced by India, and this is due to various reasons. Let's analyze the given assertion and reason in detail:

Assertion (A): Soil Erosion is the major environmental problem faced by India.

Soil erosion refers to the process of the removal of topsoil by natural forces such as wind, water, and human activities. It is a significant concern for agricultural countries like India as it affects the fertility and productivity of the land, leading to reduced agricultural output and food security issues. Soil erosion can also result in the loss of vital nutrients, increased sedimentation in rivers, and degradation of water quality. Therefore, the assertion that soil erosion is a major environmental problem faced by India is true.

Reason (R): India is an agricultural economy.

India is primarily an agricultural economy, with a significant portion of its population engaged in agriculture and allied activities. The agricultural sector contributes significantly to India's GDP, employment, and food production. However, intensive agricultural practices, improper land management, deforestation, and overgrazing have led to increased soil erosion in the country. The excessive use of chemical fertilizers and pesticides, as well as the absence of proper soil conservation measures, further exacerbate the problem. Therefore, the reason given that India is an agricultural economy is true.

Conclusion:

Both the assertion and reason are true. However, the reason provided does not directly explain why soil erosion is a major environmental problem in India. While being an agricultural economy contributes to soil erosion, it is not the sole reason. Other factors such as improper land management, deforestation, and intensive agricultural practices also play significant roles. Hence, option 'C' is the correct answer as assertion (A) is true, but reason (R) is false.

Reason (R): India is an agricultural economy.

Explanation:

Soil erosion is indeed a major environmental problem faced by India, and this is due to various reasons. Let's analyze the given assertion and reason in detail:

Assertion (A): Soil Erosion is the major environmental problem faced by India.

Soil erosion refers to the process of the removal of topsoil by natural forces such as wind, water, and human activities. It is a significant concern for agricultural countries like India as it affects the fertility and productivity of the land, leading to reduced agricultural output and food security issues. Soil erosion can also result in the loss of vital nutrients, increased sedimentation in rivers, and degradation of water quality. Therefore, the assertion that soil erosion is a major environmental problem faced by India is true.

Reason (R): India is an agricultural economy.

India is primarily an agricultural economy, with a significant portion of its population engaged in agriculture and allied activities. The agricultural sector contributes significantly to India's GDP, employment, and food production. However, intensive agricultural practices, improper land management, deforestation, and overgrazing have led to increased soil erosion in the country. The excessive use of chemical fertilizers and pesticides, as well as the absence of proper soil conservation measures, further exacerbate the problem. Therefore, the reason given that India is an agricultural economy is true.

Conclusion:

Both the assertion and reason are true. However, the reason provided does not directly explain why soil erosion is a major environmental problem in India. While being an agricultural economy contributes to soil erosion, it is not the sole reason. Other factors such as improper land management, deforestation, and intensive agricultural practices also play significant roles. Hence, option 'C' is the correct answer as assertion (A) is true, but reason (R) is false.

Directions: In the following questions, a statement of assertion (A) is followed by a statement of reason (R). Mark the correct choice as:Assertion (A): During colonial period, India’s export trade was export surplus.Reason (R): During the colonial period, India’s exports were more than its imports.- a)Both assertion (A) and reason (R) are true and reason (R) is the correct explanation of assertion (A).

- b)Both assertion (A) and reason (R) are true but reason (R) is not the correct explanation of assertion (A).

- c)Assertion (A) is true but reason (R) is false.

- d)Assertion (A) is false but reason (R) is true.

Correct answer is option 'B'. Can you explain this answer?

Directions: In the following questions, a statement of assertion (A) is followed by a statement of reason (R). Mark the correct choice as:

Assertion (A): During colonial period, India’s export trade was export surplus.

Reason (R): During the colonial period, India’s exports were more than its imports.

a)

Both assertion (A) and reason (R) are true and reason (R) is the correct explanation of assertion (A).

b)

Both assertion (A) and reason (R) are true but reason (R) is not the correct explanation of assertion (A).

c)

Assertion (A) is true but reason (R) is false.

d)

Assertion (A) is false but reason (R) is true.

|

Surbhi Mishra answered |

Assertion and Reasoning in Commerce: India's Export Trade During Colonial Period

Assertion: During colonial period, India’s export trade was export surplus.

Reason: During the colonial period, India’s exports were more than its imports.

The correct choice is option B, which means that both the assertion and reasoning are true, but the reasoning is not the correct explanation of the assertion. Let's break down this question and understand why this is the correct answer.

Export Surplus:

Export surplus refers to a situation when a country's total export earnings exceed its total import expenditure. In other words, a country is exporting more goods and services than it is importing. This situation is also known as a favorable balance of trade.

Colonial Period:

The colonial period in India refers to the time when India was under British rule, from the mid-18th century to 1947. During this time, the British East India Company and later the British government controlled India's economy and trade.

India's Export Trade during Colonial Period:

During the colonial period, India's export trade was mainly based on raw materials such as cotton, jute, tea, and indigo. These raw materials were exported to Britain and other European countries, where they were processed and manufactured into finished goods. India's exports exceeded its imports during this period, which means that India had an export surplus.

Reason for India's Export Surplus:

The reason for India's export surplus during the colonial period was mainly due to the exploitative economic policies of the British government. India was forced to export its raw materials to Britain at low prices and was required to import finished goods at high prices. This resulted in an unfavorable balance of trade for India, which led to the drain of wealth from India to Britain.

Conclusion:

In conclusion, during the colonial period, India's export trade was export surplus due to the exploitative economic policies of the British government. While the assertion and reasoning in this question are both true, the reasoning is not the correct explanation of the assertion.

Assertion: During colonial period, India’s export trade was export surplus.

Reason: During the colonial period, India’s exports were more than its imports.

The correct choice is option B, which means that both the assertion and reasoning are true, but the reasoning is not the correct explanation of the assertion. Let's break down this question and understand why this is the correct answer.

Export Surplus:

Export surplus refers to a situation when a country's total export earnings exceed its total import expenditure. In other words, a country is exporting more goods and services than it is importing. This situation is also known as a favorable balance of trade.

Colonial Period:

The colonial period in India refers to the time when India was under British rule, from the mid-18th century to 1947. During this time, the British East India Company and later the British government controlled India's economy and trade.

India's Export Trade during Colonial Period:

During the colonial period, India's export trade was mainly based on raw materials such as cotton, jute, tea, and indigo. These raw materials were exported to Britain and other European countries, where they were processed and manufactured into finished goods. India's exports exceeded its imports during this period, which means that India had an export surplus.

Reason for India's Export Surplus:

The reason for India's export surplus during the colonial period was mainly due to the exploitative economic policies of the British government. India was forced to export its raw materials to Britain at low prices and was required to import finished goods at high prices. This resulted in an unfavorable balance of trade for India, which led to the drain of wealth from India to Britain.

Conclusion:

In conclusion, during the colonial period, India's export trade was export surplus due to the exploitative economic policies of the British government. While the assertion and reasoning in this question are both true, the reasoning is not the correct explanation of the assertion.

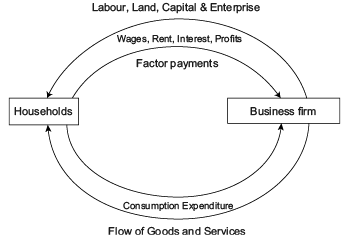

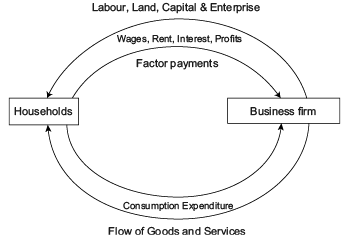

Direction: Read the below case and answer the questions that follow:Circular Income Flow in a Two Sector Economy: In the figure given we can see that upper loop shows the resources such as land, capital and entrepreneurial ability flow from households to firms in the direction shown by the arrow direction. The money flows from firms to the households as factor payments in the form of wages, rent, interest and profits, shown by the arrow direction.The lower part of the figure shows the flow of money from households to firms in the form of consumption expenditure done by the households to purchase the goods and services produced by the firms, making the flow of goods and services from firms to households.Thus, we see that money flows from business firms to households as factor payments and then it flows from households to firms. Thus, there is, in fact, a circular flow of money or income. This is how the economy functions.Which of the following is not an assumption of a two sector model of Circular Flow of Income?