All Exams >

Grade 9 >

Accounting for Grade 9 >

All Questions

All questions of Accounting Procedures for Grade 9 Exam

________ the amount which is incurred in acquiring or improving the value of fixed assets- a)Capital expenditure

- b)Capital receipt

- c)Revenue receipt

- d)Revenue Expenditure

Correct answer is option 'A'. Can you explain this answer?

________ the amount which is incurred in acquiring or improving the value of fixed assets

a)

Capital expenditure

b)

Capital receipt

c)

Revenue receipt

d)

Revenue Expenditure

|

|

Kiran Mehta answered |

An expenditure which results in the acquisition of permanent asset which is intended to be permanently used in the business for the purpose of earning revenue is capital expenditure.

It is the money spent by a business organization on acquiring or maintaining fixed assets such as land, building and equipment.

Amit Ltd. purchased a machine on 01.01.2003 for Rs 1,20,000. Installation expenses were Rs 10,000. Residual value after 5 years Rs 5,000. On 01.07.2003, expenses for repairs were incurred to the extent of Rs 2,000. Depreciation is provided @ 10% p.a. under written down value method. Depreciation for the 4th year = ________.- a)25,000

- b)10530

- c)9,477

- d)13,000

Correct answer is option 'D'. Can you explain this answer?

Amit Ltd. purchased a machine on 01.01.2003 for Rs 1,20,000. Installation expenses were Rs 10,000. Residual value after 5 years Rs 5,000. On 01.07.2003, expenses for repairs were incurred to the extent of Rs 2,000. Depreciation is provided @ 10% p.a. under written down value method. Depreciation for the 4th year = ________.

a)

25,000

b)

10530

c)

9,477

d)

13,000

|

KP Classes answered |

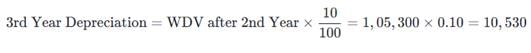

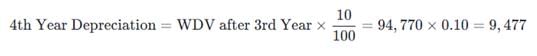

To calculate the depreciation for the 4th year using the Written Down Value (WDV) method, we follow these structured steps:

- Determine the initial cost of the machinery. The purchase price is Rs. 1,20,000, and the installation expenses are Rs. 10,000. Therefore, the total value of the machinery is calculated as follows:

Total Value = Purchase Price + Installation Expenses = 1,20,000 + 10,000 = 1,30,000 - Calculate the depreciation for the first year. The rate of depreciation is 10% on the WDV. Thus, the first-year depreciation is:

- Calculate the WDV at the beginning of the second year:

WDV after 1st Year = Total Value − 1st Year Depreciation = 1,30,000 − 13,000 = 1,17,000 - Calculate the depreciation for the second year:

- Calculate the WDV at the beginning of the third year:

WDV after 2nd Year = WDV after 1st Year − 2nd Year Depreciation = 1,17,000 − 11,700 = 1,05,300 - Calculate the depreciation for the third year:

- Calculate the WDV at the beginning of the fourth year:

WDV after 3rd Year = WDV after 2nd Year − 3rd Year Depreciation = 1,05,300 − 10,530 = 94,770 - Finally, calculate the depreciation for the fourth year:

What is depreciation?- a)Cost of using a fixed asset

- b)The value of asset

- c)Portion of a fixed assets cost consumed during the current accounting

- d)Cost of fixed asset’s repair

Correct answer is option 'A'. Can you explain this answer?

What is depreciation?

a)

Cost of using a fixed asset

b)

The value of asset

c)

Portion of a fixed assets cost consumed during the current accounting

d)

Cost of fixed asset’s repair

|

|

Kavita Joshi answered |

Depreciation: Depreciation is the systematic reduction of the recorded cost of a fixed asset. Examples of fixed assets that can be depreciated are buildings, furniture, leasehold improvements, and office equipment.

To Know the profitability and financial position of a business we prepared at the end__a)Balance sheetb)Profit and loss accountc)Financial statementd)NoneCorrect answer is option 'C'. Can you explain this answer?

|

|

Poonam Reddy answered |

Financial statements is the final stage in preparing final accounts. It is prepared to know profitability of the business and is prepared at the end so it is called as final accounts.

Types of account shown in the balance sheet are- a)Real and Personal

- b)Nominal and real

- c)Nominal and personal

- d)None of these

Correct answer is option 'A'. Can you explain this answer?

Types of account shown in the balance sheet are

a)

Real and Personal

b)

Nominal and real

c)

Nominal and personal

d)

None of these

|

Shruti Mehta answered |

Types of Accounts in Balance Sheet

There are three types of accounts in accounting – Real, Personal, and Nominal accounts. However, in the balance sheet, only two types of accounts are shown, which are as follows:

Real and Personal Accounts

The balance sheet is a statement of assets and liabilities of an organization. It is divided into two main sections – assets and liabilities. The accounts shown in the balance sheet are of two types:

1. Real Accounts: These accounts represent tangible and intangible assets of the organization. They are shown on the asset side of the balance sheet. Examples of real accounts are land, buildings, machinery, patents, trademarks, etc.

2. Personal Accounts: These accounts represent persons, firms, or institutions with whom the organization has transactions. They are shown on the liability side of the balance sheet. Examples of personal accounts are accounts payable, loans payable, salaries payable, etc.

Nominal accounts are not shown in the balance sheet because they are related to the income and expenses of the organization, which are shown in the income statement.

Conclusion

In conclusion, the balance sheet shows only two types of accounts, which are real and personal accounts. Real accounts represent assets, and personal accounts represent liabilities. Nominal accounts are not shown in the balance sheet because they are related to the income and expenses of the organization, which are shown in the income statement.

There are three types of accounts in accounting – Real, Personal, and Nominal accounts. However, in the balance sheet, only two types of accounts are shown, which are as follows:

Real and Personal Accounts

The balance sheet is a statement of assets and liabilities of an organization. It is divided into two main sections – assets and liabilities. The accounts shown in the balance sheet are of two types:

1. Real Accounts: These accounts represent tangible and intangible assets of the organization. They are shown on the asset side of the balance sheet. Examples of real accounts are land, buildings, machinery, patents, trademarks, etc.

2. Personal Accounts: These accounts represent persons, firms, or institutions with whom the organization has transactions. They are shown on the liability side of the balance sheet. Examples of personal accounts are accounts payable, loans payable, salaries payable, etc.

Nominal accounts are not shown in the balance sheet because they are related to the income and expenses of the organization, which are shown in the income statement.

Conclusion

In conclusion, the balance sheet shows only two types of accounts, which are real and personal accounts. Real accounts represent assets, and personal accounts represent liabilities. Nominal accounts are not shown in the balance sheet because they are related to the income and expenses of the organization, which are shown in the income statement.

Which of the following is another of EBIT (earning before interest and taxes)?- a)Operating profit

- b)Gross Profit

- c)Net Profit

- d)None

Correct answer is option 'A'. Can you explain this answer?

Which of the following is another of EBIT (earning before interest and taxes)?

a)

Operating profit

b)

Gross Profit

c)

Net Profit

d)

None

|

|

Rajat Patel answered |

EBIT (earnings before interest and taxes) is a company's net income before income tax expense and interest expenses have been deducted. EBIT is used to analyze the performance of a company's core operations without the costs of the capital structure and tax expenses impacting profit.

The expenditure whose amount is heavy and benefit of the likely to be derived over a number of years called- a)Deferred capital expenditure

- b)Deferred revenue expenditure

- c)Both

- d)None

Correct answer is option 'B'. Can you explain this answer?

The expenditure whose amount is heavy and benefit of the likely to be derived over a number of years called

a)

Deferred capital expenditure

b)

Deferred revenue expenditure

c)

Both

d)

None

|

|

Poonam Reddy answered |

In business, Deferred Revenue Expenditure is an expense which is incurred while accounting period. For example, revenue used for advertisement is deferred revenue expenditure because it will keep showing its benefits over the period of two to three years.

Every fixed asset loses its value due to use or other reasons. This decline in the value of asset is known asa)Amortizationb)Provisionsc)Depreciationd)DevaluationCorrect answer is option 'C'. Can you explain this answer?

|

Rohit Joshi answered |

The fixed assets are long-term assets. They help in the production of goods and services. However, when an asset is in use its value decreases due to the normal wear and tear, efflux of time and obsolescence. This reduction in the value of a fixed asset is known as depreciation.

All direct expenses are ___ to Trading account and all indirect expenses are debited to Profit and Loss account- a)Credited , Debited

- b)Debited, Credited

- c)Credited , Credited

- d)Debited, Debited

Correct answer is option 'D'. Can you explain this answer?

All direct expenses are ___ to Trading account and all indirect expenses are debited to Profit and Loss account

a)

Credited , Debited

b)

Debited, Credited

c)

Credited , Credited

d)

Debited, Debited

|

Aryaman Sinha answered |

Last option is right I.e debited debited

Under which depreciation method the amount of depreciation expenses remains same throughout the useful life of a fixed asset- a) Straight line method

- b) Reducing balance method

- c) Number of units produced method

- d) Machine hours method

Correct answer is option 'A'. Can you explain this answer?

Under which depreciation method the amount of depreciation expenses remains same throughout the useful life of a fixed asset

a)

Straight line method

b)

Reducing balance method

c)

Number of units produced method

d)

Machine hours method

|

|

Ishan Choudhury answered |

Under straight line method of depreciation the amount of depreciation expenses remains same in the entire useful life of fixed asset because, under straight line method the depreciation is charged on the original cost of the asset and not on diminishing value of the asset.

Capital receipts are shown in _____- a)Profit and Loss account

- b)Balance Sheet

- c)Trading account

- d)None of these

Correct answer is option 'B'. Can you explain this answer?

Capital receipts are shown in _____

a)

Profit and Loss account

b)

Balance Sheet

c)

Trading account

d)

None of these

|

|

Vikas Kapoor answered |

► Capital receipts can be found in the balance sheet.

► Revenue receipts can be found in the income statement.

► Capital receipts either reduce the assets of the company or create liability for the company.

Which of the following is not a type of reserve- a)Provision for bad debt

- b)General reserve

- c)Workmen compensation fund

- d)Retained earnings

Correct answer is option 'A'. Can you explain this answer?

Which of the following is not a type of reserve

a)

Provision for bad debt

b)

General reserve

c)

Workmen compensation fund

d)

Retained earnings

|

|

Rajat Patel answered |

The provision for bad debts might refer to the balance sheet account also known as the Allowance for Bad Debts, Allowance for Doubtful Accounts, or Allowance for Uncollectible Accounts. In this case, the account Provision for Bad Debts is a contra asset account (an asset account with a credit balance). It is used along with the account Accounts Receivable in order for the balance sheet to report the net realizable value of the accounts receivable.

Following are the causes of Depreciation except- a)Wear and tear due to use or passage of time.

- b)normal factors

- c)Expiration of legal rights.

- d)Obsolescence.

Correct answer is option 'B'. Can you explain this answer?

Following are the causes of Depreciation except

a)

Wear and tear due to use or passage of time.

b)

normal factors

c)

Expiration of legal rights.

d)

Obsolescence.

|

|

Nandini Iyer answered |

Following are the causes of Depreciation: Natural Wear and Tear- This refers to the reduction in value of a fixed asset due to its usage. ... Depreciation implies allocating the cost of a tangible fixed or long-term asset over its useful life.

Entrance fee of Rs.2,000 received by Ram and Shyam Social club is- a)Capital receipt

- b)Revenue receipt

- c)Capital expenditures

- d)Revenue expenditures

Correct answer is option 'A'. Can you explain this answer?

Entrance fee of Rs.2,000 received by Ram and Shyam Social club is

a)

Capital receipt

b)

Revenue receipt

c)

Capital expenditures

d)

Revenue expenditures

|

|

Priya Patel answered |

Capital receipts are a non-recurring incoming cash flow into your business, which leads to the creation of a liability (a debt to be paid in the future) and a decrease in company assets (resources that lead to capital gain).

On April 01, 2004 the debit balance of the machinery account of A Ltd. was Rs.5,67,000.

The machine was purchased on April 01, 2002. The company charged depreciation at the rate of 10% per annum under diminishing balance method. On October 01, 2004, the company acquired a new machine at a cost of Rs.60,000 and incurred Rs.6,000 for installation of the new machine. The company decided to change the system of providing depreciation from the diminishing balance method to the straight-line method with retrospective effect from April 01, 2002. The rate of depreciation will remain the same.

The company decided to make necessary adjustments in respect of depreciation due to the change in the method in the year 2004-2005.

Depreciation provided in 2002-03 = ______.

- a)Rs. 56,700

- b)Rs. 63,000

- c)Rs. 70,000

- d)Rs. 77,778

Correct answer is option 'C'. Can you explain this answer?

On April 01, 2004 the debit balance of the machinery account of A Ltd. was Rs.5,67,000.

The machine was purchased on April 01, 2002. The company charged depreciation at the rate of 10% per annum under diminishing balance method. On October 01, 2004, the company acquired a new machine at a cost of Rs.60,000 and incurred Rs.6,000 for installation of the new machine. The company decided to change the system of providing depreciation from the diminishing balance method to the straight-line method with retrospective effect from April 01, 2002. The rate of depreciation will remain the same.

The company decided to make necessary adjustments in respect of depreciation due to the change in the method in the year 2004-2005.

The machine was purchased on April 01, 2002. The company charged depreciation at the rate of 10% per annum under diminishing balance method. On October 01, 2004, the company acquired a new machine at a cost of Rs.60,000 and incurred Rs.6,000 for installation of the new machine. The company decided to change the system of providing depreciation from the diminishing balance method to the straight-line method with retrospective effect from April 01, 2002. The rate of depreciation will remain the same.

The company decided to make necessary adjustments in respect of depreciation due to the change in the method in the year 2004-2005.

Depreciation provided in 2002-03 = ______.

a)

Rs. 56,700

b)

Rs. 63,000

c)

Rs. 70,000

d)

Rs. 77,778

|

Freedom Institute answered |

Balance on 1april ,2004is 567000 .

it means that credit balance on 31march ,2004 is also 567000.

let the balance on 1april 2003 be x.

then depreciation will be 10%of x i.e.

10x ÷100= x/10 from this we can understand that x- x/10 =567000 .

here we found thae value of which is 630000.

same process we will follow for the year 2002 to 2003 x-x/10=630000 and value of x is 700000.

so depreciation will be 10% of 7lack that 70000

it means that credit balance on 31march ,2004 is also 567000.

let the balance on 1april 2003 be x.

then depreciation will be 10%of x i.e.

10x ÷100= x/10 from this we can understand that x- x/10 =567000 .

here we found thae value of which is 630000.

same process we will follow for the year 2002 to 2003 x-x/10=630000 and value of x is 700000.

so depreciation will be 10% of 7lack that 70000

_____ prepared to ascertain gross profit and net profit / loss during an accounting period.- a)Financial statement

- b)Cash flow statement

- c)Balance sheet

- d)Income statement

Correct answer is option 'D'. Can you explain this answer?

_____ prepared to ascertain gross profit and net profit / loss during an accounting period.

a)

Financial statement

b)

Cash flow statement

c)

Balance sheet

d)

Income statement

|

EduRev Humanities answered |

The Income Statement is one of a company’s core financial statements that shows their profit and loss over a period of time. The profit or loss is determined by taking all revenues and subtracting all expenses from both operating and non-operating activities.

The income statement is one of three statements used in both corporate finance (including financial modeling) and accounting. The statement displays the company’s revenue, costs, gross profit, selling and administrative expenses, other expenses and income, taxes paid, and net profit, in a coherent and logical manner.

Depreciation charged under diminishing method- a)Increase every year

- b)Decrease every year

- c)Increase in one year and decrease another year

- d)Same every year

Correct answer is option 'B'. Can you explain this answer?

Depreciation charged under diminishing method

a)

Increase every year

b)

Decrease every year

c)

Increase in one year and decrease another year

d)

Same every year

|

|

Priya Patel answered |

According to the Diminishing Balance Method, depreciation is charged at a fixed percentage on the book value of the asset. ... This method is based on the assumption that in the earlier years the cost of repairs to the assets is low and hence more amount of depreciation should be charged.

Which of the following is the normal balance of an accumulated depreciation account

- a)Debit

- b)Credit

- c)Both

- d)None

Correct answer is option 'B'. Can you explain this answer?

Which of the following is the normal balance of an accumulated depreciation account

a)

Debit

b)

Credit

c)

Both

d)

None

|

Swarnim Sharma answered |

I think credit balance will be the answer. Becz accumulated depreciation is created by charging depreciation..whose entry is depreciation A/c...dr To accumulated depreciation A/c... And thus accumulated depreciation shows credit balance and as a result shown in the liability side of the balance sheet . so...'A'will be the correct option...

Original cost = Rs.1,26,000; Salvage value = Nil; Useful life = 6 years. Depreciation for the first year under sum of years digits method will be

- a)Rs.6,000

- b)Rs. 12,000

- c)Rs. 36,000

- d)Rs. 24,000

Correct answer is option 'C'. Can you explain this answer?

Original cost = Rs.1,26,000; Salvage value = Nil; Useful life = 6 years. Depreciation for the first year under sum of years digits method will be

a)

Rs.6,000

b)

Rs. 12,000

c)

Rs. 36,000

d)

Rs. 24,000

|

Freedom Institute answered |

Option C is correct.

Sum of years = 1+2+3+4+5+6 = 21

Original Cost = 1,26,000

Sum of years = 1+2+3+4+5+6 = 21

Original Cost = 1,26,000

Depreciation = 1,26,000*3/21

= 18,000.

= 18,000.

Amount paid for acquiring goodwill is __________.- a)Revenue expenditure

- b)Capital expenditure

- c)Deferred capital expenditure.

- d)Deferred revenue expenditure

Correct answer is option 'B'. Can you explain this answer?

Amount paid for acquiring goodwill is __________.

a)

Revenue expenditure

b)

Capital expenditure

c)

Deferred capital expenditure.

d)

Deferred revenue expenditure

|

|

Alok Mehta answered |

Therefore, CAPEX is both amortized and depreciated, depending on whether it is tangible or intangible. To quote, "Expenses incurred to acquire intangible assets such as goodwill, patents, etc. are also capital expenditure.

Original cost = Rs.1,26,000; Salvage value = Nil; Useful life = 6 years. Depreciation for the first year under sum of years digits method will be- a)Rs.6,000

- b)Rs. 12,000

- c)Rs. 18,000

- d)Rs. 36,000

Correct answer is option 'D'. Can you explain this answer?

Original cost = Rs.1,26,000; Salvage value = Nil; Useful life = 6 years. Depreciation for the first year under sum of years digits method will be

a)

Rs.6,000

b)

Rs. 12,000

c)

Rs. 18,000

d)

Rs. 36,000

|

Deepika Nambiar answered |

Original cost = Rs.1,26,000

Salvage value = Nil

Useful life = 6 years

Depreciation for the first year under sum of years digits method:

Amount of Rs.5,000 spent as lawyers fee to defend a suit claiming that the firm factory site belonged to the plaintiff land is - a)Capital expenditure

- b)Revenue expenditure

- c)Deferred revenue expenditure

- d)None of the above

Correct answer is option 'B'. Can you explain this answer?

Amount of Rs.5,000 spent as lawyers fee to defend a suit claiming that the firm factory site belonged to the plaintiff land is

a)

Capital expenditure

b)

Revenue expenditure

c)

Deferred revenue expenditure

d)

None of the above

|

|

Priya Patel answered |

A revenue expenditure is an amount that is expensed immediately—thereby being matched with revenues of the current accounting period. Routine repairs are revenue expenditures because they are charged directly to an account such as Repairs and Maintenance Expense.

On April 01, 2004 the debit balance of the machinery account of A Ltd. was Rs.5,67,000.

The machine was purchased on April 01, 2002. The company charged depreciation at the rate of 10% per annum under diminishing balance method. On October 01, 2004, the company acquired a new machine at a cost of Rs.60,000 and incurred Rs.6,000 for installation of the new machine. The company decided to change the system of providing depreciation from the diminishing balance method to the straight-line method with retrospective effect from April 01, 2002. The rate of depreciation will remain the same.

The company decided to make necessary adjustments in respect of depreciation due to the change in the method in the year 2004-2005.

Depreciation for the year 2004-05 = _________.

- a)Rs. 3,300

- b)Rs. 7,000

- c)Rs. 10,300

- d)Rs. 60,000

Correct answer is option 'D'. Can you explain this answer?

On April 01, 2004 the debit balance of the machinery account of A Ltd. was Rs.5,67,000.

The machine was purchased on April 01, 2002. The company charged depreciation at the rate of 10% per annum under diminishing balance method. On October 01, 2004, the company acquired a new machine at a cost of Rs.60,000 and incurred Rs.6,000 for installation of the new machine. The company decided to change the system of providing depreciation from the diminishing balance method to the straight-line method with retrospective effect from April 01, 2002. The rate of depreciation will remain the same.

The company decided to make necessary adjustments in respect of depreciation due to the change in the method in the year 2004-2005.

The machine was purchased on April 01, 2002. The company charged depreciation at the rate of 10% per annum under diminishing balance method. On October 01, 2004, the company acquired a new machine at a cost of Rs.60,000 and incurred Rs.6,000 for installation of the new machine. The company decided to change the system of providing depreciation from the diminishing balance method to the straight-line method with retrospective effect from April 01, 2002. The rate of depreciation will remain the same.

The company decided to make necessary adjustments in respect of depreciation due to the change in the method in the year 2004-2005.

Depreciation for the year 2004-05 = _________.

a)

Rs. 3,300

b)

Rs. 7,000

c)

Rs. 10,300

d)

Rs. 60,000

|

Arka Tiwari answered |

Solution:

Calculation of Depreciation under Diminishing Balance method:

Depreciation for FY 2002-03 = 10% of Rs. 6,00,000 = Rs. 60,000

Depreciation for FY 2003-04 = 10% of Rs. 5,40,000 = Rs. 54,000

Depreciation for 6 months of FY 2004-05 = 10% of Rs. 4,86,000 = Rs. 48,600

Adjustment for the change in method:

Calculation of WDV as on 01.04.2004 under Diminishing Balance method:

WDV as on 01.04.2004 = Cost of Machinery - Depreciation charged till 31.03.2004

= Rs. 6,00,000 - (Rs. 60,000 + Rs. 54,000)

= Rs. 4,86,000

Calculation of Depreciation under Straight-line method:

Depreciation for FY 2002-03 = (Rs. 6,00,000 / 3) = Rs. 2,00,000

Depreciation for FY 2003-04 = (Rs. 6,00,000 / 3) = Rs. 2,00,000

Depreciation for 6 months of FY 2004-05 = (Rs. 6,00,000 / 3) = Rs. 2,00,000 / 2 = Rs. 1,00,000

Adjustment for the change in method:

Depreciation for FY 2002-03 = Rs. 2,00,000

Depreciation for FY 2003-04 = Rs. 2,00,000

Depreciation for 6 months of FY 2004-05 = Rs. 1,00,000

Total Depreciation for FY 2004-05 = Depreciation under Diminishing Balance method + Adjustment for Change in Method

= Rs. 48,600 + Rs. 4,00,000

= Rs. 4,48,600

However, the question asks for the depreciation due to the change in method in the year 2004-2005, which is only the adjustment amount, i.e., Rs. 4,00,000.

Hence, the correct answer is option D, Rs. 73,300.

Calculation of Depreciation under Diminishing Balance method:

Depreciation for FY 2002-03 = 10% of Rs. 6,00,000 = Rs. 60,000

Depreciation for FY 2003-04 = 10% of Rs. 5,40,000 = Rs. 54,000

Depreciation for 6 months of FY 2004-05 = 10% of Rs. 4,86,000 = Rs. 48,600

Adjustment for the change in method:

Calculation of WDV as on 01.04.2004 under Diminishing Balance method:

WDV as on 01.04.2004 = Cost of Machinery - Depreciation charged till 31.03.2004

= Rs. 6,00,000 - (Rs. 60,000 + Rs. 54,000)

= Rs. 4,86,000

Calculation of Depreciation under Straight-line method:

Depreciation for FY 2002-03 = (Rs. 6,00,000 / 3) = Rs. 2,00,000

Depreciation for FY 2003-04 = (Rs. 6,00,000 / 3) = Rs. 2,00,000

Depreciation for 6 months of FY 2004-05 = (Rs. 6,00,000 / 3) = Rs. 2,00,000 / 2 = Rs. 1,00,000

Adjustment for the change in method:

Depreciation for FY 2002-03 = Rs. 2,00,000

Depreciation for FY 2003-04 = Rs. 2,00,000

Depreciation for 6 months of FY 2004-05 = Rs. 1,00,000

Total Depreciation for FY 2004-05 = Depreciation under Diminishing Balance method + Adjustment for Change in Method

= Rs. 48,600 + Rs. 4,00,000

= Rs. 4,48,600

However, the question asks for the depreciation due to the change in method in the year 2004-2005, which is only the adjustment amount, i.e., Rs. 4,00,000.

Hence, the correct answer is option D, Rs. 73,300.

Amount spent on unsuccessful patent right is a : - a)Revenue Expenditure (Even though the amount is large)

- b)Deferred Revenue Expenditure (If the amount is large)

- c)Capital Expenditure

- d)None of theses

Correct answer is option 'A'. Can you explain this answer?

Amount spent on unsuccessful patent right is a :

a)

Revenue Expenditure (Even though the amount is large)

b)

Deferred Revenue Expenditure (If the amount is large)

c)

Capital Expenditure

d)

None of theses

|

|

Rajat Patel answered |

Amount spent on unsuccessful patent right is a revenue expenditure as the entire amount spent is a loss with no signs of any recovery in future through any income. Hence, entire amount should be written off all at one go.

Loss caused by theft of cash by cashier after business hours is a : - a)Revenue loss

- b)Deferred revenue loss

- c)Capital loss

- d)None of the above

Correct answer is option 'C'. Can you explain this answer?

Loss caused by theft of cash by cashier after business hours is a :

a)

Revenue loss

b)

Deferred revenue loss

c)

Capital loss

d)

None of the above

|

|

Kavita Joshi answered |

Loss of cash due to theft committed either by the employees or by the outsiders, after business hours, is a capital loss because the loss is outside the trade and not incidental to the business. If the loss had been caused during the business hours it would have been a revenue loss because it is incidental to the business.

Which of the following is not true with regard to fixed assets?- a)They are acquired for using them in the conduct of business operations

- b)They are not meant for resale to earn profit

- c)They can easily be converted into cash

- d)Depreciation at specified rates is to be charged on most of the fixed assets

Correct answer is option 'C'. Can you explain this answer?

Which of the following is not true with regard to fixed assets?

a)

They are acquired for using them in the conduct of business operations

b)

They are not meant for resale to earn profit

c)

They can easily be converted into cash

d)

Depreciation at specified rates is to be charged on most of the fixed assets

|

|

Poonam Reddy answered |

The correct option is C.

Fixed assets are not readily liquid and cannot be easily converted into cash. They are not sold or consumed by a company. Instead, the asset is used to produce goods and services.

The term “fixed” translates to the fact that these assets will not be used up or sold within the accounting year. A fixed asset typically has a physical form and is reported on the balance sheet as property, plant, and equipment

Brokerage on the issue of shares and debentures is a _______expenditure : - a)Revenue

- b)Capital

- c)Deferred Revenue

- d)Partly capital partly revenue

Correct answer is option 'C'. Can you explain this answer?

Brokerage on the issue of shares and debentures is a _______expenditure :

a)

Revenue

b)

Capital

c)

Deferred Revenue

d)

Partly capital partly revenue

|

|

Rajat Patel answered |

Brokerage on the issue of shares and debentures is a Deferred Revenue Expenditure. This expenditure is incurred in one period but its benefit extends to a period of 3 to 5 years. Hence this amount is deferred and written off.

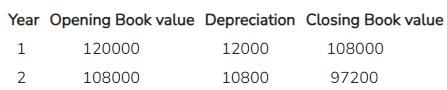

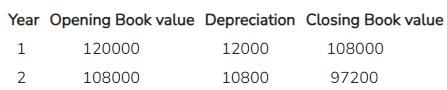

Original cost = Rs 1,26,000. Salvage value = 6,000. Depreciation for 2nd year @ 10% p.a. under WDV method =

- a)11,340

- b)10,800

- c)15,000

- d)14,000

Correct answer is option 'B'. Can you explain this answer?

Original cost = Rs 1,26,000. Salvage value = 6,000. Depreciation for 2nd year @ 10% p.a. under WDV method =

a)

11,340

b)

10,800

c)

15,000

d)

14,000

|

|

Pj Commerce Academy answered |

Depreciation = Opening Book value * rate of depreciation

Following are the Financial statement excepta) Cash Flow statement

b)Income statementc) Balance sheetd)Audit reportCorrect answer is option 'D'. Can you explain this answer?

a) Cash Flow statement

b)Income statement

c) Balance sheet

d)Audit report

Correct answer is option 'D'. Can you explain this answer?

|

Infinity Academy answered |

Financial statements are written records that convey the business activities and the financial performance of a company. Financial statements are often audited by government agencies, accountants, firms, etc. to ensure accuracy and for tax, financing, or investing purposes. Financial statements include:

- Balance sheet

- Income statement

- Cash flow statement.

The term depletion is used for :- a)Natural resources

- b)Fixed asset

- c)Liabilities

- d)Intangible assets

Correct answer is option 'A'. Can you explain this answer?

The term depletion is used for :

a)

Natural resources

b)

Fixed asset

c)

Liabilities

d)

Intangible assets

|

|

Jayant Mishra answered |

Depletion is an accrual accounting technique used to allocate the cost of extracting natural resources such as timber, minerals and oil from the earth.

An increase in the value of fixed asset is referred to as:- a)Reserve depreciation

- b)Appreciation

- c)Purchase of Asset

- d)Market capitalization

Correct answer is option 'C'. Can you explain this answer?

An increase in the value of fixed asset is referred to as:

a)

Reserve depreciation

b)

Appreciation

c)

Purchase of Asset

d)

Market capitalization

|

Arnav Kulkarni answered |

An increase in the value of fixed asset is referred to as Appreciation. Appreciation, in general terms, is an increase in the value of an asset over time. The increase can occur for a number of reasons, including increased demand or weakening supply, or as a result of changes in inflation or interest rates.

Computer of a firm should be classified as- a)Fictitious

- b)Liquid assets

- c)Fixed assets

- d)Current assets

Correct answer is option 'C'. Can you explain this answer?

Computer of a firm should be classified as

a)

Fictitious

b)

Liquid assets

c)

Fixed assets

d)

Current assets

|

|

Vikas Kapoor answered |

Fixed assets can include buildings, computer equipment, software, furniture, land, machinery, and vehicles. For example, if a company sells produce, the delivery trucks it owns and uses are fixed assets.

Share Premium is a :- a)Capital Receipt

- b)Revenue Receipt

- c)Deferred Revenue Receipt

- d)None of these

Correct answer is option 'A'. Can you explain this answer?

Share Premium is a :

a)

Capital Receipt

b)

Revenue Receipt

c)

Deferred Revenue Receipt

d)

None of these

|

|

Jayant Mishra answered |

Share premium is a capital receipt as it is received occasionally when shares are issued and its usage is also restricted. It is shown on the liability side of the balance sheet. It is not in the nature of a regular income and hence its not a revenue receipt

Under which depreciation method the amount of depreciation expenses remain same throughout the useful life of a fixed asset- a)Straight line method

- b)Number of units produced method

- c)Reducing balance method

- d)Machine hour method

Correct answer is option 'A'. Can you explain this answer?

Under which depreciation method the amount of depreciation expenses remain same throughout the useful life of a fixed asset

a)

Straight line method

b)

Number of units produced method

c)

Reducing balance method

d)

Machine hour method

|

Pallavi Krishnan answered |

Straight line method

Original cost = Rs 1,26,000. Salvage value = 6,000. Useful Life = 6 years. Annual depreciation under SLM =- a)21,000

- b)20,000

- c)15,000

- d)14,000

Correct answer is option 'B'. Can you explain this answer?

Original cost = Rs 1,26,000. Salvage value = 6,000. Useful Life = 6 years. Annual depreciation under SLM =

a)

21,000

b)

20,000

c)

15,000

d)

14,000

|

Nipun Tuteja answered |

To calculate the annual depreciation using the Straight-Line Method (SLM), we follow a systematic approach

- Identify the variables involved in the calculation. We have:

- Original Cost (C) = Rs. 126,000

- Salvage Value (S) = Rs. 6,000

- Useful Life (L) = 6 years

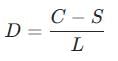

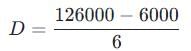

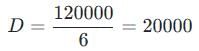

- Apply the formula for annual depreciation (D) under the Straight-Line Method, which is given by:

- Substitute the identified values into the formula:

- Simplify the equation. First, calculate the difference between the original cost and the salvage value:

126000 - 6000 = 120000 - Now, divide this result by the useful life:

Thus, the annual depreciation under the Straight-Line Method is Rs. 20,000

Capital Receipts are represented in : - a)Balance Sheet

- b)Trading account

- c)Profit & Loss A/c

- d)Manufacturing A/c

Correct answer is option 'A'. Can you explain this answer?

Capital Receipts are represented in :

a)

Balance Sheet

b)

Trading account

c)

Profit & Loss A/c

d)

Manufacturing A/c

|

|

Rajat Patel answered |

Capital receipts are represented in Balance Sheet of the liability side. A reasonable portion out of it is transferred to Profit and Loss Account of each year i.e. it is recognized as income.

A company purchased a vehicle for $6000. I will be used for 5 years and its residual value is expected to be $1000. What is the annual amount of deprecation using straight line method of depreciation? - a) $1000

- b) $2000

- c) $3000

- d) $3300

Correct answer is option 'A'. Can you explain this answer?

A company purchased a vehicle for $6000. I will be used for 5 years and its residual value is expected to be $1000. What is the annual amount of deprecation using straight line method of depreciation?

a)

$1000

b)

$2000

c)

$3000

d)

$3300

|

Meera Joshi answered |

The straight-line method of depreciation is a commonly used method to allocate the cost of an asset evenly over its useful life. In this case, the company purchased a vehicle for $6000 and expects to use it for 5 years, with a residual value of $1000 at the end of its useful life. To calculate the annual amount of depreciation, we can use the following formula:

Annual Depreciation = (Cost - Residual Value) / Useful Life

Let's break down the calculation:

Cost of the vehicle = $6000

Residual value = $1000

Useful life = 5 years

Using the formula, we can calculate the annual depreciation:

Annual Depreciation = ($6000 - $1000) / 5

= $5000 / 5

= $1000

Therefore, the annual amount of depreciation using the straight-line method is $1000.

Explanation:

- The straight-line method of depreciation evenly distributes the cost of an asset over its useful life.

- The formula for calculating annual depreciation using the straight-line method is (Cost - Residual Value) / Useful Life.

- In this case, the cost of the vehicle is $6000, the residual value is $1000, and the useful life is 5 years.

- Plugging these values into the formula, we get ($6000 - $1000) / 5 = $1000.

- This means that the company can expect to depreciate $1000 of the vehicle's value each year for 5 years.

- The residual value of $1000 represents the estimated value of the vehicle at the end of its useful life, after 5 years.

- By subtracting the residual value from the cost and dividing by the useful life, we can determine the annual depreciation amount.

- The answer is option 'A', $1000.

Annual Depreciation = (Cost - Residual Value) / Useful Life

Let's break down the calculation:

Cost of the vehicle = $6000

Residual value = $1000

Useful life = 5 years

Using the formula, we can calculate the annual depreciation:

Annual Depreciation = ($6000 - $1000) / 5

= $5000 / 5

= $1000

Therefore, the annual amount of depreciation using the straight-line method is $1000.

Explanation:

- The straight-line method of depreciation evenly distributes the cost of an asset over its useful life.

- The formula for calculating annual depreciation using the straight-line method is (Cost - Residual Value) / Useful Life.

- In this case, the cost of the vehicle is $6000, the residual value is $1000, and the useful life is 5 years.

- Plugging these values into the formula, we get ($6000 - $1000) / 5 = $1000.

- This means that the company can expect to depreciate $1000 of the vehicle's value each year for 5 years.

- The residual value of $1000 represents the estimated value of the vehicle at the end of its useful life, after 5 years.

- By subtracting the residual value from the cost and dividing by the useful life, we can determine the annual depreciation amount.

- The answer is option 'A', $1000.

On April 01, 2004 the debit balance of the machinery account of A Ltd. was Rs.5,67,000.

The machine was purchased on April 01, 2002. The company charged depreciation at the rate of 10% per annum under diminishing balance method. On October 01, 2004, the company acquired a new machine at a cost of Rs.60,000 and incurred Rs.6,000 for installation of the new machine. The company decided to change the system of providing depreciation from the diminishing balance method to the straight-line method with retrospective effect from April 01, 2002. The rate of depreciation will remain the same.

The company decided to make necessary adjustments in respect of depreciation due to the change in the method in the year 2004-2005.

Balance in Machinery A/c on 31.03.2004 = _______.

- a)Rs. 5,67,000

- b)Rs. 6,30,000

- c)Rs. 7,00,000

- d)Rs. 7,77,778

Correct answer is option 'A'. Can you explain this answer?

On April 01, 2004 the debit balance of the machinery account of A Ltd. was Rs.5,67,000.

The machine was purchased on April 01, 2002. The company charged depreciation at the rate of 10% per annum under diminishing balance method. On October 01, 2004, the company acquired a new machine at a cost of Rs.60,000 and incurred Rs.6,000 for installation of the new machine. The company decided to change the system of providing depreciation from the diminishing balance method to the straight-line method with retrospective effect from April 01, 2002. The rate of depreciation will remain the same.

The company decided to make necessary adjustments in respect of depreciation due to the change in the method in the year 2004-2005.

The machine was purchased on April 01, 2002. The company charged depreciation at the rate of 10% per annum under diminishing balance method. On October 01, 2004, the company acquired a new machine at a cost of Rs.60,000 and incurred Rs.6,000 for installation of the new machine. The company decided to change the system of providing depreciation from the diminishing balance method to the straight-line method with retrospective effect from April 01, 2002. The rate of depreciation will remain the same.

The company decided to make necessary adjustments in respect of depreciation due to the change in the method in the year 2004-2005.

Balance in Machinery A/c on 31.03.2004 = _______.

a)

Rs. 5,67,000

b)

Rs. 6,30,000

c)

Rs. 7,00,000

d)

Rs. 7,77,778

|

KP Classes answered |

Given:

- Purchase date of machine: April 01, 2002

- Cost of the machine: Not explicitly provided in the current question, but from previous calculations, it was ₹6,30,000.

- Depreciation method used until March 31, 2004: Diminishing Balance Method (DBM) at 10% per annum.

- Debit balance of the machinery account on April 01, 2004: ₹5,67,000.

Step 1: Calculate depreciation for 2002-03

Since the company initially used the Diminishing Balance Method at 10% per annum:

- Opening balance on April 01, 2002: ₹6,30,000

- Depreciation for 2002-03 = ₹6,30,000 × 10% = ₹63,000

- Closing balance on April 01, 2003:

6,30,000 − 63,000 = ₹5,67,000

Step 2: Calculate depreciation for 2003-04

- Opening balance on April 01, 2003: ₹5,67,000

- Depreciation for 2003-04 = ₹5,67,000 × 10% = ₹56,700

- Closing balance on March 31, 2004:

5,67,000 − 56,700 = ₹5,10,300

The balance in the machinery account on 31.03.2004 is ₹5,67,000.

Which of the following account is affected from the Drawings of cash in sole- proprietorship business?- a) Capital account

- b) Shareholder account

- c) Liability account

- d) Expense account

Correct answer is option 'A'. Can you explain this answer?

Which of the following account is affected from the Drawings of cash in sole- proprietorship business?

a)

Capital account

b)

Shareholder account

c)

Liability account

d)

Expense account

|

Riya Goswami answered |

Capital account bcoz due to drawing cash account will be affected which in turn also affect the capital account

‘A’ purchased a Car on 1.06.2010 for Rs. 5,60,000 and incurred Rs. 25,000 for repairs, etc. He paid Rs. 10,000 as insurance, Rs. 1,500 for petrol. What amount should be debited to Car A/c?- a)Rs. 5,60,000

- b)Rs. 5,96,500

- c)Rs. 5,95,000

- d)Rs. 5,85,000

Correct answer is 'B'. Can you explain this answer?

‘A’ purchased a Car on 1.06.2010 for Rs. 5,60,000 and incurred Rs. 25,000 for repairs, etc. He paid Rs. 10,000 as insurance, Rs. 1,500 for petrol. What amount should be debited to Car A/c?

a)

Rs. 5,60,000

b)

Rs. 5,96,500

c)

Rs. 5,95,000

d)

Rs. 5,85,000

|

|

Priya Patel answered |

All expenses incurred at the time of purchase of a capital asset or to bring the new capital asset in the working condition should be capitalised. The following expenses were incurred at the time of purchase of car:Cost of car Rs. 5,60,000Repairs Rs. 25,000 Insurance Rs. 10,000 Petrol Rs.1,500 Amount debited to Car A/c Rs. 5,96,500

Recovery of Bad debt is a : - a)Revenue Receipt

- b)Capital Receipt

- c)Capital Expenditure

- d)Revenue Expenditure

Correct answer is option 'A'. Can you explain this answer?

Recovery of Bad debt is a :

a)

Revenue Receipt

b)

Capital Receipt

c)

Capital Expenditure

d)

Revenue Expenditure

|

Deepika Desai answered |

Recovery of bad debt is a revenue receipt. Let's break down the answer into headings and HTML bullet points:

Revenue receipt:

- Revenue receipts are the income earned by a business by selling goods or services or any other operational activity.

- Recovery of bad debt is a revenue receipt as it is the income earned by the business through the recovery of the amount that was previously written off as bad debt.

Capital receipt:

- Capital receipts are the income earned by a business through non-operational activities such as the sale of long-term assets, raising of capital, etc.

- Recovery of bad debt cannot be considered as a capital receipt as it is earned through an operational activity.

Capital expenditure:

- Capital expenditure refers to the expenses incurred by a business for acquiring long-term assets such as buildings, land, machinery, etc.

- Recovery of bad debt cannot be considered as capital expenditure as it does not involve the acquisition of any long-term assets.

Revenue expenditure:

- Revenue expenditure refers to the expenses incurred by a business for the day-to-day operations such as salaries, rent, utilities, etc.

- Recovery of bad debt cannot be considered as revenue expenditure as it does not involve any expenses incurred by the business.

In conclusion, recovery of bad debt is a revenue receipt as it is the income earned by a business through an operational activity.

Revenue receipt:

- Revenue receipts are the income earned by a business by selling goods or services or any other operational activity.

- Recovery of bad debt is a revenue receipt as it is the income earned by the business through the recovery of the amount that was previously written off as bad debt.

Capital receipt:

- Capital receipts are the income earned by a business through non-operational activities such as the sale of long-term assets, raising of capital, etc.

- Recovery of bad debt cannot be considered as a capital receipt as it is earned through an operational activity.

Capital expenditure:

- Capital expenditure refers to the expenses incurred by a business for acquiring long-term assets such as buildings, land, machinery, etc.

- Recovery of bad debt cannot be considered as capital expenditure as it does not involve the acquisition of any long-term assets.

Revenue expenditure:

- Revenue expenditure refers to the expenses incurred by a business for the day-to-day operations such as salaries, rent, utilities, etc.

- Recovery of bad debt cannot be considered as revenue expenditure as it does not involve any expenses incurred by the business.

In conclusion, recovery of bad debt is a revenue receipt as it is the income earned by a business through an operational activity.

The item discount received will appear on the- a)Credit side of Balance sheet

- b)Debit side of Balance sheet

- c)Debit side of Profit and loss account

- d)Credit side of Profit and loss account

Correct answer is option 'D'. Can you explain this answer?

The item discount received will appear on the

a)

Credit side of Balance sheet

b)

Debit side of Balance sheet

c)

Debit side of Profit and loss account

d)

Credit side of Profit and loss account

|

|

Naina Sharma answered |

Discount received will appear in profit & loss account statement credit side, discount received by the buyer when seller allow discount. Generally discount allowed by the supplier when transaction happened on credit basis, such as trade discount, early payment discounts and high volume purchase discounts.

Renewal fee for patent is a:- a)Capital expenditure

- b)Revenue expenditure

- c)Deferred revenue expenditure

- d)Development expenditure

Correct answer is 'B'. Can you explain this answer?

Renewal fee for patent is a:

a)

Capital expenditure

b)

Revenue expenditure

c)

Deferred revenue expenditure

d)

Development expenditure

|

|

Priya Patel answered |

Amount spent on renewal fee for patent right is a revenue expenditure.

Any expenditure incurred in order to reduce the operating expenses is ________.- a)Deferred revenue expenditure

- b)Promotional expenditure

- c)Revenue expenditure

- d)Capital expenditure

Correct answer is option 'D'. Can you explain this answer?

Any expenditure incurred in order to reduce the operating expenses is ________.

a)

Deferred revenue expenditure

b)

Promotional expenditure

c)

Revenue expenditure

d)

Capital expenditure

|

|

Jayant Mishra answered |

An operating expense, operating expenditure, operational expense, operational expenditure or opex is an ongoing cost for running a product, business, or system. Its counterpart, a capital expenditure (capex), is the cost of developing or providing non-consumable parts for the product or system. For example, the purchase of a photocopier involves capex, and the annual paper, toner, power and maintenance costs represents opex.For larger systems like businesses, opex may also include the cost of workers and facility expenses such as rent and utilities.

Original cost = Rs 1,26,000. Salvage value = 6,000. Depreciation for 2nd year @ Units of Production Method, if units produced in 2nd year was 5,000 and total estimated production 50,000.- a)10,800

- b)11,340

- c)12,600

- d)12,000

Correct answer is option 'D'. Can you explain this answer?

Original cost = Rs 1,26,000. Salvage value = 6,000. Depreciation for 2nd year @ Units of Production Method, if units produced in 2nd year was 5,000 and total estimated production 50,000.

a)

10,800

b)

11,340

c)

12,600

d)

12,000

|

KP Classes answered |

Given:

- Original cost = ₹1,26,000

- Salvage value = ₹6,000

- Units produced in 2nd year = 5,000 units

- Total estimated production = 50,000 units

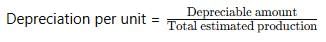

Step 1: Calculate depreciable amount

Depreciable amount = Original cost - Salvage value

Depreciable amount = ₹1,26,000 − ₹6,000 = ₹1,20,000

Step 2: Calculate depreciation per unit

Step 3: Calculate depreciation for 2nd year

Step 3: Calculate depreciation for 2nd year

Depreciation for 2nd year = Depreciation per unit × Units produced in 2nd year

Depreciation for 2nd year = ₹2.40 × 5,000 = ₹12,000

The depreciation for the 2nd year is ₹12,000, so the correct answer is Option D: ₹12,000.

Heavy advertisement expenditure should be treated as :- a)Deferred Revenue Expenditure

- b)Revenue expenditure

- c)Capital Expenditure

- d)None of these.

Correct answer is option 'A'. Can you explain this answer?

Heavy advertisement expenditure should be treated as :

a)

Deferred Revenue Expenditure

b)

Revenue expenditure

c)

Capital Expenditure

d)

None of these.

|

|

Kavita Joshi answered |

Deferred revenue expenditure is that expenditure for which payment has been made or a liability incurred but which is carried forward on the presumption that it will be of benefit over a subsequent period or periods. Heavy advertisement expenditure is the expenditure made in the present which will benefit the organization in the future upcoming years and hence it is a deferred revenue expenditure.

What is the rate of charging depreciation under diminishing method?- a)12% p.a.

- b)15% p.a.

- c)10% p.a.

- d)Not fixed

Correct answer is option 'D'. Can you explain this answer?

What is the rate of charging depreciation under diminishing method?

a)

12% p.a.

b)

15% p.a.

c)

10% p.a.

d)

Not fixed

|

|

Ehnar Singh answered |

Becoz diminishing method charge on balance of assets

Which of the following expenses is not included in the acquisition cost of a plant and equipment?

a)Financing costs incurred subsequent to the period after plant and equipment is put to use.

b)Delivery and handling charges

c)Installation costs

d)Cost of site preparation

Correct answer is option 'A'. Can you explain this answer?

|

Mehul Saini answered |

The cost of equipment, vehicles, and furniture includes the purchase price, sales taxes, transportation fees, insurance paid to cover the item during shipment, assembly, installation, Delivery and handling charges and all other costs associated with making the item ready for use.

A second hand car is purchased for Rs. 10,000 the amount of Rs. 1,000 is spent on its repairs, Rs. 500 is incurred to get the car registered in owner’s name and Rs. 1,200 is paid as dealer’s commission. The amount debited to car account will be

- a)Rs. 10,000

- b)Rs. 10,500

- c)Rs. 11,500

- d)Rs. 12,700

Correct answer is option 'D'. Can you explain this answer?

A second hand car is purchased for Rs. 10,000 the amount of Rs. 1,000 is spent on its repairs, Rs. 500 is incurred to get the car registered in owner’s name and Rs. 1,200 is paid as dealer’s commission. The amount debited to car account will be

a)

Rs. 10,000

b)

Rs. 10,500

c)

Rs. 11,500

d)

Rs. 12,700

|

Nipun Tuteja answered |

Purchase price of the car: Rs. 10,000

Repair costs: Rs. 1,000

Registration fees: Rs. 500

Dealer's commission: Rs. 1,200

To find the total amount debited to the car account, you would add all these costs together:

Total cost = Purchase price + Repair costs + Registration fees + Dealer's commission

Let's calculate the total cost.

The amount debited to the car account will be Rs. 12,700.

Chapter doubts & questions for Accounting Procedures - Accounting for Grade 9 2025 is part of Grade 9 exam preparation. The chapters have been prepared according to the Grade 9 exam syllabus. The Chapter doubts & questions, notes, tests & MCQs are made for Grade 9 2025 Exam. Find important definitions, questions, notes, meanings, examples, exercises, MCQs and online tests here.

Chapter doubts & questions of Accounting Procedures - Accounting for Grade 9 in English & Hindi are available as part of Grade 9 exam.

Download more important topics, notes, lectures and mock test series for Grade 9 Exam by signing up for free.

Accounting for Grade 9

60 videos|76 docs|34 tests

|

Contact Support

Our team is online on weekdays between 10 AM - 7 PM

Typical reply within 3 hours

|

Free Exam Preparation

at your Fingertips!

Access Free Study Material - Test Series, Structured Courses, Free Videos & Study Notes and Prepare for Your Exam With Ease

Join the 10M+ students on EduRev

Join the 10M+ students on EduRev

|

|

Create your account for free

OR

Forgot Password

OR

Signup on EduRev and stay on top of your study goals

10M+ students crushing their study goals daily