All Exams >

Bank Exams >

IBPS PO Prelims & Mains Preparation >

All Questions

All questions of Insurance Industry for Bank Exams Exam

Which among the following is a life insurance policy in which the amount is payable only at the death of the policy holder?- a)Whole Life Policy

- b)Endowment Policy

- c)Unit Linked Insurance Plan

- d)Personal Accident Insurance

- e)Both (a) and (c)

Correct answer is option 'A'. Can you explain this answer?

Which among the following is a life insurance policy in which the amount is payable only at the death of the policy holder?

a)

Whole Life Policy

b)

Endowment Policy

c)

Unit Linked Insurance Plan

d)

Personal Accident Insurance

e)

Both (a) and (c)

|

|

Nikita Singh answered |

- Whole Life Policy is issued for the entire lifetime of the insured and the claim is payable only after the death of the insured, to the nominee of the policy.

- The endowment policy is limited for a certain period and the sum is payable to the insured at the expiry of such period.

- Unit Linked Insurance Plan is issued for the purpose of both investment and insurance.

- Personal Accident Insurance is issued in order to cover for any loss due to an accident.

The first ever life insurance company in India, Oriental Life Insurance Company, was set up in Calcutta in the year _________.- a)1818

- b)1820

- c)1819

- d)1821

- e)None of the above

Correct answer is option 'A'. Can you explain this answer?

The first ever life insurance company in India, Oriental Life Insurance Company, was set up in Calcutta in the year _________.

a)

1818

b)

1820

c)

1819

d)

1821

e)

None of the above

|

|

Nikita Singh answered |

- The life insurance business commenced in India with the establishment of Oriental Life Insurance Company in Calcutta in 1818.

- The general insurance business came to India in the year 1850 in Calcutta as the Triton Insurance Company Limited.

Which is the following does not belong to the main products of life insurance?- a)Term

- b)Endowment

- c)Whole life

- d)Personal accident insurance

- e)Money Back Policy

Correct answer is option 'D'. Can you explain this answer?

Which is the following does not belong to the main products of life insurance?

a)

Term

b)

Endowment

c)

Whole life

d)

Personal accident insurance

e)

Money Back Policy

|

Geetika Kulkarni answered |

The main products of life insurance are:

- Term insurance

- Endowment insurance

- Whole life insurance

- Money back policy

Explanation:

Life insurance is a contract between the policyholder and the insurance company, in which the policyholder pays regular premiums in exchange for a sum of money to be paid to the beneficiaries upon the insured's death. Life insurance policies can offer various benefits and coverage options to suit the needs of individuals.

1. Term insurance:

Term insurance is a type of life insurance that provides coverage for a specific term or period of time. If the insured person dies during the term of the policy, a death benefit is paid out to the beneficiaries. However, if the insured person survives the term, no benefit is paid out. Term insurance is usually more affordable compared to other types of life insurance.

2. Endowment insurance:

Endowment insurance is a type of life insurance that provides both a death benefit and a savings component. The policyholder pays regular premiums, and if the insured person dies during the term of the policy, the death benefit is paid out to the beneficiaries. However, if the insured person survives the term, a maturity benefit is paid out to the policyholder.

3. Whole life insurance:

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured person. It offers a death benefit to the beneficiaries upon the insured's death, as well as a cash value component that grows over time. The policyholder pays regular premiums, and the policy accumulates cash value that can be accessed during the insured's lifetime.

4. Money back policy:

Money back policy is a type of life insurance that provides periodic payouts to the policyholder during the term of the policy. The policyholder receives a percentage of the sum assured at regular intervals, typically every few years. If the insured person dies during the term, the full sum assured is paid out to the beneficiaries.

5. Personal accident insurance:

Personal accident insurance is not a main product of life insurance. It is a separate type of insurance that provides coverage in the event of accidental death or disability. Personal accident insurance policies typically offer financial compensation to the insured or their beneficiaries in case of accidental death, bodily injury, or permanent disability caused by an accident.

Therefore, option D, which is personal accident insurance, does not belong to the main products of life insurance.

- Term insurance

- Endowment insurance

- Whole life insurance

- Money back policy

Explanation:

Life insurance is a contract between the policyholder and the insurance company, in which the policyholder pays regular premiums in exchange for a sum of money to be paid to the beneficiaries upon the insured's death. Life insurance policies can offer various benefits and coverage options to suit the needs of individuals.

1. Term insurance:

Term insurance is a type of life insurance that provides coverage for a specific term or period of time. If the insured person dies during the term of the policy, a death benefit is paid out to the beneficiaries. However, if the insured person survives the term, no benefit is paid out. Term insurance is usually more affordable compared to other types of life insurance.

2. Endowment insurance:

Endowment insurance is a type of life insurance that provides both a death benefit and a savings component. The policyholder pays regular premiums, and if the insured person dies during the term of the policy, the death benefit is paid out to the beneficiaries. However, if the insured person survives the term, a maturity benefit is paid out to the policyholder.

3. Whole life insurance:

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured person. It offers a death benefit to the beneficiaries upon the insured's death, as well as a cash value component that grows over time. The policyholder pays regular premiums, and the policy accumulates cash value that can be accessed during the insured's lifetime.

4. Money back policy:

Money back policy is a type of life insurance that provides periodic payouts to the policyholder during the term of the policy. The policyholder receives a percentage of the sum assured at regular intervals, typically every few years. If the insured person dies during the term, the full sum assured is paid out to the beneficiaries.

5. Personal accident insurance:

Personal accident insurance is not a main product of life insurance. It is a separate type of insurance that provides coverage in the event of accidental death or disability. Personal accident insurance policies typically offer financial compensation to the insured or their beneficiaries in case of accidental death, bodily injury, or permanent disability caused by an accident.

Therefore, option D, which is personal accident insurance, does not belong to the main products of life insurance.

How many life insurance companies collaborated to form the Life Insurance corporation?- a)246

- b)245

- c)250

- d)244

- e)247

Correct answer is option 'B'. Can you explain this answer?

How many life insurance companies collaborated to form the Life Insurance corporation?

a)

246

b)

245

c)

250

d)

244

e)

247

|

|

Rohan Sengupta answered |

- An Ordinance was issued on 19th January 1956 nationalizing the Life Insurance sector and Life Insurance Corporation (LIC) came into existence in the same year.

- The LIC absorbed 154 Indian, 16 non-Indian insurers as also 75 provident societies—245 Indian and foreign insurers in all.

- The LIC had a monopoly till the late 90s when the Insurance sector was reopened to the private sector.

- Yogakshemam Vahamyaham is the tagline of the Life Insurance Corporation.

- The headquarters of LIC is in Mumbai.

- LIC has 2048 fully computerized branch offices.

- LIC has 113 divisional offices.

- There are 1381 satellite offices and corporate offices of LIC.

Which of the following types of insurance usually requires higher premium?- a)Whole life Insurance

- b)Broad Form Insurance

- c)Health Insurance

- d)Term Insurance

- e)Life Insurance

Correct answer is option 'B'. Can you explain this answer?

Which of the following types of insurance usually requires higher premium?

a)

Whole life Insurance

b)

Broad Form Insurance

c)

Health Insurance

d)

Term Insurance

e)

Life Insurance

|

Avi Shah answered |

Understanding Insurance Premiums

When it comes to insurance, the premium is the amount you pay for coverage. Different types of insurance have varying premium costs based on their coverage extent and risk factors.

Types of Insurance and Premiums

- Whole Life Insurance: This provides lifelong coverage and includes a cash value component, leading to higher premiums compared to term insurance.

- Broad Form Insurance: This type of insurance offers extensive coverage, often encompassing various risks. Because it covers multiple scenarios and provides greater protection, it typically requires the highest premiums among the options listed.

- Health Insurance: Premiums can vary widely based on coverage levels, age, and health status, but they generally fall below broad form insurance due to their specific nature.

- Term Insurance: This offers coverage for a specific period and is usually the least expensive option, as it does not accumulate cash value.

- Life Insurance: This is a more general term that can include both whole and term life insurance, with varying premiums based on the type.

Conclusion

Broad Form Insurance generally requires higher premiums due to its comprehensive coverage and the associated risks involved. This makes it more expensive than the other options listed, which either offer limited coverage or have specific duration terms. Understanding these distinctions helps individuals make informed decisions about their insurance needs.

When it comes to insurance, the premium is the amount you pay for coverage. Different types of insurance have varying premium costs based on their coverage extent and risk factors.

Types of Insurance and Premiums

- Whole Life Insurance: This provides lifelong coverage and includes a cash value component, leading to higher premiums compared to term insurance.

- Broad Form Insurance: This type of insurance offers extensive coverage, often encompassing various risks. Because it covers multiple scenarios and provides greater protection, it typically requires the highest premiums among the options listed.

- Health Insurance: Premiums can vary widely based on coverage levels, age, and health status, but they generally fall below broad form insurance due to their specific nature.

- Term Insurance: This offers coverage for a specific period and is usually the least expensive option, as it does not accumulate cash value.

- Life Insurance: This is a more general term that can include both whole and term life insurance, with varying premiums based on the type.

Conclusion

Broad Form Insurance generally requires higher premiums due to its comprehensive coverage and the associated risks involved. This makes it more expensive than the other options listed, which either offer limited coverage or have specific duration terms. Understanding these distinctions helps individuals make informed decisions about their insurance needs.

Under which of the following committee's recommendations in 1999, the Insurance Regulatory and Development Authority (IRDA) was constituted as an autonomous body to regulate and develop the insurance industry?- a)B. Shivraman Committee

- b)Malhotra Committee

- c)Ajit Kumar Committee

- d)Bhurelal Committee

- e)Abhijit Sen Committee

Correct answer is option 'B'. Can you explain this answer?

Under which of the following committee's recommendations in 1999, the Insurance Regulatory and Development Authority (IRDA) was constituted as an autonomous body to regulate and develop the insurance industry?

a)

B. Shivraman Committee

b)

Malhotra Committee

c)

Ajit Kumar Committee

d)

Bhurelal Committee

e)

Abhijit Sen Committee

|

|

Nikita Singh answered |

EARLY INSURERS

- In 1972 with the passing of the General Insurance Business (Nationalisation) Act, general insurance business was nationalized with effect from 1st January 1973. 107 insurers were amalgamated and grouped into four companies, namely National Insurance Company Ltd., the New India Assurance Company Ltd., the Oriental Insurance Company Ltd, and the United India Insurance Company Ltd. The General Insurance Corporation of India was incorporated as a company in 1971 and it commenced business on January 1sst 1973. This millennium has seen insurance come a full circle in a journey extending to nearly 200 years.

- The process of re-opening of the sector had begun in the early 1990s and the last decade and more has seen it been opened up substantially.

MALHOTRA COMMITTEE

- In 1993, the Government set up a committee under the chairmanship of RN Malhotra, former Governor of RBI, to propose recommendations for reforms in the insurance sector. The objective was to complement the reforms initiated in the financial sector.

- The committee submitted its report in 1994 wherein, among other things, it recommended that the private sector be permitted to enter the insurance industry. They stated that foreign companies be allowed to enter by floating Indian companies, preferably a joint venture with Indian partners.

The Union Cabinet has approved changes to the Insurance Act that will allow for ______ foreign direct investment in the industry.(March 2021)- a)68%

- b)74%

- c)85%

- d)90%

- e)60%

Correct answer is option 'B'. Can you explain this answer?

The Union Cabinet has approved changes to the Insurance Act that will allow for ______ foreign direct investment in the industry.(March 2021)

a)

68%

b)

74%

c)

85%

d)

90%

e)

60%

|

|

Rohan Sengupta answered |

- The Union Cabinet has approved changes to the Insurance Act that will allow for 74% foreign direct investment in the industry.

- The allowable FDI cap in life and general insurance is currently set at 49 percent, with Indian ownership and management control.

- According to reports, the Cabinet approved amendments to the Insurance Act of 1938 during its meeting.

- The government raised the foreign direct investment ceiling in the insurance sector from 26% to 49% in 2015.

Which among the following is correct regarding the Unit Linked Insurance Plans?- a)Unit Linked Insurance Plan gives an option to the insured for insurance as well as investment

- b)The first ULIP was issued by the Unit Trust of India

- c)Some of the premium is invested in providing insurance cover and the rest is invested in equity or debt fund

- d)Both 1 and 2

- e)All 1, 2 and 3

Correct answer is option 'E'. Can you explain this answer?

Which among the following is correct regarding the Unit Linked Insurance Plans?

a)

Unit Linked Insurance Plan gives an option to the insured for insurance as well as investment

b)

The first ULIP was issued by the Unit Trust of India

c)

Some of the premium is invested in providing insurance cover and the rest is invested in equity or debt fund

d)

Both 1 and 2

e)

All 1, 2 and 3

|

|

Ishan Choudhury answered |

Unit Linked Insurance Plan is meant to give the insured an opportunity for insurance and investment.

The first such plan was launched by Unit Trust of India.

The premium collected is divided into mortality charge or providing insurance cover whereas the rest is invested in the equity or debt markets.

The first such plan was launched by Unit Trust of India.

The premium collected is divided into mortality charge or providing insurance cover whereas the rest is invested in the equity or debt markets.

When was Triton Insurance Company Ltd established?- a)1846

- b)1850

- c)1854

- d)1857

- e)1860

Correct answer is option 'B'. Can you explain this answer?

When was Triton Insurance Company Ltd established?

a)

1846

b)

1850

c)

1854

d)

1857

e)

1860

|

|

Nikita Singh answered |

- Triton Insurance CO LTD is a Non-govt company, incorporated on 04 Jul 1918.

- It's a public unlisted company and is classified as a company limited by shares'.

- The company's authorized capital stands at Rs 23.0 lakhs and has 0.0% paid-up capital which is Rs 0.0 lakhs.

- Triton Insurance CO LTD is majorly in the Insurance business for the last 103 years and currently, company operations are strike off.

- The company is registered in Kolkata (West Bengal) Registrar Office. Triton Insurance CO LTD registered address is 4, CLIVE ROW, KOLKATA W.B WB 700001 IN.

What percent of the ownership was allowed for foreign companies when applications for registrations were invited in August 2000 by IRDA?- a)10%

- b)20%

- c)26%

- d)32%

- e)36%

Correct answer is option 'C'. Can you explain this answer?

What percent of the ownership was allowed for foreign companies when applications for registrations were invited in August 2000 by IRDA?

a)

10%

b)

20%

c)

26%

d)

32%

e)

36%

|

|

Rohan Sengupta answered |

- Pursuing the suggestions mentioned in the report by the Malhotra Committee in the year 1999, gave birth to an autonomous body i.e.“Insurance Regulatory and Development Authority (IRDA)”.

- For the regulation and development of the insurance industry, Insurance Regulatory and Development Authority was integrated as a constitutional body in April 2000.

- The promotion of competition, developing customer satisfaction at the lower premium rate, and assuring financial security was one key objective of IRDA.

- The applications for registrations were invited in August 2000 by IRDA. Up to 26% of the ownership was allowed for foreign companies.

- The power to frame regulations under Section 114A of the Insurance Act, 1938 was given to the authority.

- The registration to carry insurance business by securitizing the interest of the policyholders was also allocated to the authority by 2000.

What type of insurance will apply if a family member has broken his/her leg in an accident while on vacation in Singapore?- a)Motor Insurance

- b)Travel Insurance

- c)Life Insurance

- d)Home Insurance

- e)Health Insurance

Correct answer is option 'B'. Can you explain this answer?

What type of insurance will apply if a family member has broken his/her leg in an accident while on vacation in Singapore?

a)

Motor Insurance

b)

Travel Insurance

c)

Life Insurance

d)

Home Insurance

e)

Health Insurance

|

|

Nikita Singh answered |

General insurance covers home, your travel, vehicle, and health (non-life assets) from fire, floods, accidents, man-made disasters, and theft. Different types of general insurance include motor insurance, health insurance, travel insurance, and home insurance. A general insurance policy pays for the losses that are incurred by the insured during the period of the policy.

Which among the following defines the model in which the banks sell the insurance products of their partner insurance company?- a)Bancassurance

- b)Banking Assurance

- c)Bank Assurance

- d)Insurance Banking

- e)None of the above

Correct answer is option 'A'. Can you explain this answer?

Which among the following defines the model in which the banks sell the insurance products of their partner insurance company?

a)

Bancassurance

b)

Banking Assurance

c)

Bank Assurance

d)

Insurance Banking

e)

None of the above

|

|

Rohan Sengupta answered |

- Bancassurance means selling insurance products through banks. Banks and insurance companies come up in a partnership wherein the bank sells the tied insurance company's insurance products to its clients.

- Bancassurance arrangement benefits both the firms. On the one hand, the bank earns fee amount (non-interest income) from the insurance company apart from the interest income whereas, on the other hand, the insurance firm increases its market reach and customers. The bank acts as an intermediary, helping the insurance firm reach its target customer in order to increase its market share.

- Bancassurance has emerged as a very important route for the distribution of insurance products and services. This partnership of Banking and the Insurance sector, if implemented in a well-planned and structured manner, can be beneficial for all the participants i.e., banks, insurers, and the customers.

- Types of Bancassurance products:

- Life insurance facilities:

- Term insurance plans (with accidental and death claims).

- Endowment plans

- ULIPs( Unit Linked Insurance Plans)

- Non-life Insurance facilities:

- Health insurance

- Marine insurance( for cargo shipments)

- Property insurance( against natural calamities)

- Key Men insurance (Top executives of companies, partnership firms, etc.)

The life insurance business in India was nationalized in the year ________.- a)1958

- b)1956

- c)1957

- d)1972

- e)1978

Correct answer is option 'B'. Can you explain this answer?

The life insurance business in India was nationalized in the year ________.

a)

1958

b)

1956

c)

1957

d)

1972

e)

1978

|

|

Rohan Sengupta answered |

- The life insurance sector in India was nationalized in the year 1956 with a view to spread life insurance to more areas of the country.

- The Life Insurance Corporation of India Act was passed in the year 1956 on 19th June and LIC was established also on 1st September 1956.

The IRDAI was incorporated as a statutory body on?- a)30 April 2001

- b)01 July 2002

- c)31 December 1999

- d)19 April 2000

- e)None of these

Correct answer is option 'D'. Can you explain this answer?

The IRDAI was incorporated as a statutory body on?

a)

30 April 2001

b)

01 July 2002

c)

31 December 1999

d)

19 April 2000

e)

None of these

|

|

Aisha Gupta answered |

The IRDAI(Insurance Regulatory and Development Authority of India) was incorporated as a statutory body on 19th April 2000.

- It is an independent, legislative body responsible for overseeing and promoting the Indian insurance and reinsurance industries.

- It was established by the Insurance Regulatory and Development Authority Act, 1999, a legislative act passed by the Indian Government.

- The headquarters of the organization are in Hyderabad, Telangana where it relocated in 2001 from Delhi.

- Subhash Chandra Khuntia is the chairman of IRDAI.

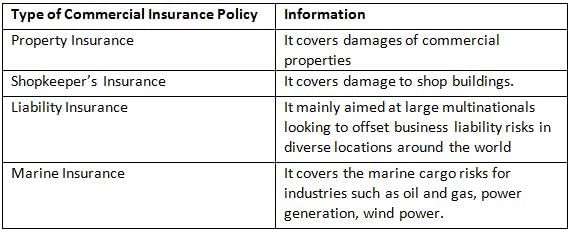

Which of the following is type of Commercial Insurance Policy?- a)Property Insurance

- b)Shopkeeper’s Insurance

- c)Liability Insurance

- d)Marine Insurance

- e)All of the above

Correct answer is option 'E'. Can you explain this answer?

Which of the following is type of Commercial Insurance Policy?

a)

Property Insurance

b)

Shopkeeper’s Insurance

c)

Liability Insurance

d)

Marine Insurance

e)

All of the above

|

|

Kabir Verma answered |

Major insurers offering commercial insurance in India include:

- New India Assurance

- HDFC Ergo

- Bajaj Allianz General Insurance Co. Ltd

- Bharti AXA General Insurance Company Limited

Which was the first statutory measure (Act) to regulate life business in India?- a)Indian Life Assurance Companies Act, 1911

- b)Indian Life Assurance Companies Act, 1912

- c)Indian Life Assurance Companies Act, 1950

- d)Indian Life Assurance Companies Act, 1938

- e)Indian Life Assurance Companies Act, 1928

Correct answer is option 'B'. Can you explain this answer?

Which was the first statutory measure (Act) to regulate life business in India?

a)

Indian Life Assurance Companies Act, 1911

b)

Indian Life Assurance Companies Act, 1912

c)

Indian Life Assurance Companies Act, 1950

d)

Indian Life Assurance Companies Act, 1938

e)

Indian Life Assurance Companies Act, 1928

|

|

Ritika Choudhury answered |

- The Indian Life Assurance Companies Act, 1912 was the first statutory measure to regulate life business.

- In 1928, the Indian Insurance Companies Act was enacted to enable the Government to collect statistical information about both life and non-life business transacted in India by Indian and foreign insurers including provident insurance societies.

- In 1938, with a view to protecting the interest of the Insurance public, the earlier legislation was consolidated and amended by the Insurance Act, 1938 with comprehensive provisions for effective control over the activities of insurers.

- The Insurance Amendment Act of 1950 abolished Principal Agencies. However, there were a large number of insurance companies and the level of competition was high. So the government of India decided to nationalize the life insurance business in India.

What is a type of life insurance policy that provides coverage for a certain period of time, or a specified “term” of years?- a)Catastrophe Reinsurance

- b)Excess of Loss Reinsurance

- c)Facultative Reinsurance

- d)Term Insurance

- e)None of these

Correct answer is option 'D'. Can you explain this answer?

What is a type of life insurance policy that provides coverage for a certain period of time, or a specified “term” of years?

a)

Catastrophe Reinsurance

b)

Excess of Loss Reinsurance

c)

Facultative Reinsurance

d)

Term Insurance

e)

None of these

|

|

Kabir Verma answered |

- Term insurance a type of life insurance policy that provides coverage for a certain period of time, or a specified “term” of years.

- Term insurance is a type of life insurance policy that provides coverage for a specified period or a specified "term" of years. If the insured dies during the time period specified in the policy and the policy is active, or in force, a death benefit will be paid in future.

- After the time interval due to the catastrophe and natural disaster, a fixed amount is paid by the insurance company to the insured, which is called the catastrophe reinsurance.

- It is a form of reinsurance which condemns the seeding company for the accumulation of losses in excess of the stipulated amount arising from a single catastrophe event or series of events.

- Facultative reinsurance is coverage purchased by a primary insurer to cover a single risk or a block of risks held in the primary insurer's book of business. Facultative reinsurance is one of the two types of reinsurance, with the other type being treaty reinsurance.

- Excess of loss reinsurance is a kind of reinsurance in which the reinsurer indemnifies the ceding company for losses that exceed a specified limit. Excess of loss reinsurance is a form of non-proportional reinsurance for the help of insured person.

Which of the following insurance type is under life insurance?- a)Motor insurance

- b)Home insurance

- c)Health insurance

- d)Fire insurance

- e)Term insurance

Correct answer is option 'E'. Can you explain this answer?

Which of the following insurance type is under life insurance?

a)

Motor insurance

b)

Home insurance

c)

Health insurance

d)

Fire insurance

e)

Term insurance

|

|

Ritika Choudhury answered |

- Term insurance is the insurance which is under life insurance.

- Types of insurance as follows:

- Types of Life Insurance

- Term Insurance

- Money-back policy

- Unit-Linked Insurance Plan

- Pension Plans

- Types of General Insurance

- Motor Insurance

- Home Insurance

- Health Insurance

- Fire Insurance

Which amongst the following denotes a type of insurance? - Life insurance

- Health insurance

- Liability insurance

- a)Only (1)

- b)Only (1) and (2)

- c)Only (2) and (3)

- d)All the three

- e)None of the three

Correct answer is option 'D'. Can you explain this answer?

Which amongst the following denotes a type of insurance?

- Life insurance

- Health insurance

- Liability insurance

a)

Only (1)

b)

Only (1) and (2)

c)

Only (2) and (3)

d)

All the three

e)

None of the three

|

|

Nikita Singh answered |

Life insurance is the insurance that pays out a sum of money either on the death of the insured person or after a set period. Health insurance is the insurance taken out to cover the cost of medical care. Liability insurance is a part of the general insurance system of risk financing to protect the purchaser (the "insured") from the risks of liabilities imposed by lawsuits and similar claims.

The insurance in which the number of employees and their dependents are insured under a single policy is known as _______.- a)Group insurance

- b)Co-insurance

- c)Dual insurance

- d)Re-insurance

- e)None of these

Correct answer is option 'A'. Can you explain this answer?

The insurance in which the number of employees and their dependents are insured under a single policy is known as _______.

a)

Group insurance

b)

Co-insurance

c)

Dual insurance

d)

Re-insurance

e)

None of these

|

|

Ritika Choudhury answered |

- Group Insurance Cover: Group Insurance cover is bought by an employer for his employees in which employees and their dependents are covers under a single policy The premium in group insurance is lower than an individual health insurance policy.

- Group insurance plans are usually standardized in nature and offer the same benefits to all employees.

- Co-insurance: Co-insurance is the term used when the insurance is placed simultaneously with more than one insurer, it is called co-insurance. This happens in the case of large businesses, this insurance business is divided with a lead insurer ( insurance company ) who negotiates the terms of the policy and then pass on the respective share of the premium to the other insurers.

- Double insurance: It means the policyholder has double insurance on the same risk and the same interest then it is said to be as double insurance.

- Re-Insurance: It is the type of insurance in which insurer transfers its large portion of the risk to the other insurers so that it can bear the risk in a proportion way.

Note - General Insurance Corporation (GIC-Re) is the only re-insurer in India, its headquarters is in Mumbai.

Chapter doubts & questions for Insurance Industry - IBPS PO Prelims & Mains Preparation 2025 is part of Bank Exams exam preparation. The chapters have been prepared according to the Bank Exams exam syllabus. The Chapter doubts & questions, notes, tests & MCQs are made for Bank Exams 2025 Exam. Find important definitions, questions, notes, meanings, examples, exercises, MCQs and online tests here.

Chapter doubts & questions of Insurance Industry - IBPS PO Prelims & Mains Preparation in English & Hindi are available as part of Bank Exams exam.

Download more important topics, notes, lectures and mock test series for Bank Exams Exam by signing up for free.

IBPS PO Prelims & Mains Preparation

675 videos|1082 docs|322 tests

|

Contact Support

Our team is online on weekdays between 10 AM - 7 PM

Typical reply within 3 hours

|

Free Exam Preparation

at your Fingertips!

Access Free Study Material - Test Series, Structured Courses, Free Videos & Study Notes and Prepare for Your Exam With Ease

Join the 10M+ students on EduRev

Join the 10M+ students on EduRev

|

|

Create your account for free

OR

Forgot Password

OR

Signup to see your scores

go up

within 7 days!

within 7 days!

Takes less than 10 seconds to signup