All Exams >

Bank Exams >

RBI Assistant Preparation Course >

All Questions

All questions of Investment & Exchange for Bank Exams Exam

Which among the following are the types of mutual funds?- a)Equity funds

- b)Debt funds

- c)Hybrid funds

- d)Both (1) and (2) are true

- e)All (1), (2) and (3) are true

Correct answer is option 'E'. Can you explain this answer?

Which among the following are the types of mutual funds?

a)

Equity funds

b)

Debt funds

c)

Hybrid funds

d)

Both (1) and (2) are true

e)

All (1), (2) and (3) are true

|

|

Kavya Saxena answered |

Equity funds - Equity funds are the type of mutual funds that invests investors money in the stock market. These are categorized as -

- Large-cap mutual funds - In large-cap funds, a large portion of the investment is done in companies with large market capitalization. Large-cap are big, well-established companies in the equity market. These companies are strong, reputable, and trustworthy. Large-cap companies generally are the top 100 companies in a market.

- Large-cap funds have lower growth potential and give investors lower returns on investment as compared to mid and small-cap funds.

- Such companies have capital worth 20,000 crores or more.

- Mid-cap mutual funds - In mid-cap funds, a large portion of the investment is done in companies with medium market capitalization.

- It has better growth potential and gives investors higher returns on investment as compared to large-cap funds.

- Small-cap mutual funds - In small-cap funds, a large portion of the investment is done in companies with small market capitalization i.e. having a market cap of less than INR 500 crore.

- It has exponential growth potential and gives investors high returns on investment.

- Equity-linked saving scheme(ELSS) - These funds provide tax savings to the investors and hence most popular among them. But these funds have a lock-in period of 3 years.

- Investors cannot redeem their money before the maturity date.

- It also provides an opportunity for long term capital appreciation.

Debt Funds- These are relatively safer investments and are suitable for Income Generation.

- The investment in Fixed Income Securities, like Government Securities or Bonds, Commercial Papers and Debentures, Bank Certificates of Deposits, and Money Market instruments like Treasury Bills, Commercial Paper, etc comes under the category of debt funds.

Hybrid funds- These funds invest in both Equities and debt funds, thus offering the best in Growth Potential as well as Income Generation.

- Examples of these types of funds are Pension Plans, Child Plans, and Monthly Income Plans, etc.

Which among the following authority governs the mutual funds business in India?- a)SEBI

- b)RBI

- c)NABARD

- d)AMFI

- e)IRDAI

Correct answer is option 'A'. Can you explain this answer?

Which among the following authority governs the mutual funds business in India?

a)

SEBI

b)

RBI

c)

NABARD

d)

AMFI

e)

IRDAI

|

|

Ritika Choudhury answered |

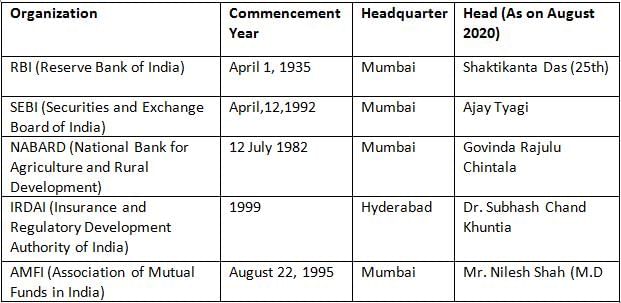

SEBI(Securities and Exchange Board of India)

- The mutual fund industry was set up in India in the year 1963 with the formation of Unit Trust of India(UTI), as the initiative of the Government of India and the Reserve bank of India.

- Mutual funds business is governed by the SEBI(Securities and Exchange Board of India) in India.

About SEBI:

- The Securities and Exchange Board of India was established on April 12, 1992, in accordance with the provisions of the Securities and Exchange Board of India Act, 1992.

- Its headquarters is in Mumbai.

- Shri Ajay Tyagi is the current chairman of SEBI.

About RBI:

- RBI was established on April 1, 1935, under the Reserve Bank of India Act,1934.

- Current Governor of RBI is Shri Shaktikanta Das ( 25th )

- Sir Osborne Smith was the first governor of RBI and C.D Deshmukh was the first Indian governor of RBI.

- It operates the currency and credit system of the country.

- It is called the Bankers Bank of India.

- It formulates, implements, and monitors the monetary policy.

Which of the following are correct regarding the Mutual Funds?

I. Custodian of the Mutual Funds should be registered with RBI

II. Mutual Funds can not invest in debt securities

III. In India, the Mutual Fund Industry started in 1991- a)Only I and II are correct

- b)Only III is correct

- c)Only II is correct

- d)All are correct

- e)None are correct

Correct answer is option 'E'. Can you explain this answer?

Which of the following are correct regarding the Mutual Funds?

I. Custodian of the Mutual Funds should be registered with RBI

II. Mutual Funds can not invest in debt securities

III. In India, the Mutual Fund Industry started in 1991

I. Custodian of the Mutual Funds should be registered with RBI

II. Mutual Funds can not invest in debt securities

III. In India, the Mutual Fund Industry started in 1991

a)

Only I and II are correct

b)

Only III is correct

c)

Only II is correct

d)

All are correct

e)

None are correct

|

|

Ritika Choudhury answered |

- A trust that pools together the savings of many individuals and then invest in capital market instruments are referred to as Mutual Funds.

- Custodian of the Mutual Funds should be registered with SEBI. Mutual Funds can invest in debt securities and other securities depending on the financial requirements of the investors.

- In India, mutual Fund industry started in 1963, with the formation of Unit Trust of India as an initiative of the Government of India and the Reserve Bank of India.

In the equity linked savings scheme what is the minimum lock-in period?- a)2 years

- b)2 years and 6 months

- c)3 years

- d)3 years and 6 months

- e)4 years

Correct answer is option 'C'. Can you explain this answer?

In the equity linked savings scheme what is the minimum lock-in period?

a)

2 years

b)

2 years and 6 months

c)

3 years

d)

3 years and 6 months

e)

4 years

|

|

Ritika Choudhury answered |

- Equity funds are the type of mutual funds that invest investors money in the stock market.

- Large-cap mutual funds - In large-cap funds, a large portion of the investment is done in companies with large market capitalization. Large-cap are big, well-established companies in the equity market. These companies are strong, reputable, and trustworthy. Large-cap companies generally are the top 100 companies in a market.

- Large-cap funds have lower growth potential and give investors lower returns on investment as compared to mid and small-cap funds.

- Such companies have capital worth 20,000 crores or more.

- Mid-cap mutual funds - In mid-cap funds, a large portion of the investment is done in companies with medium market capitalization.

- It has better growth potential and gives investors higher returns on investment as compared to large-cap funds.

- Small-cap mutual funds - In small-cap funds, a large portion of the investment is done in companies with small market capitalization i.e. having a market cap of less than INR 500 crore.

- It has exponential growth potential and gives investors high returns on investment.

- Equity-linked saving scheme(ELSS) - These funds provide tax savings to the investors and hence most popular among them. But these funds have a lock-in period of 3 years.

- Investors cannot redeem their money before the maturity date.

- It also provides an opportunity for long term capital appreciation.

Liquid funds are the funds that invest in securities with a maturity period of upto ______________ days.- a)364 days

- b)90 days

- c)120 days

- d)91 days

- e)30 days

Correct answer is option 'D'. Can you explain this answer?

Liquid funds are the funds that invest in securities with a maturity period of upto ______________ days.

a)

364 days

b)

90 days

c)

120 days

d)

91 days

e)

30 days

|

|

Ritika Choudhury answered |

- Liquid funds are a type of mutual fund that invests in securities with a residual maturity of up to 91 days.

- Investment is not tied up for a long time as liquid funds do not have a lock-in period.

- Return on investment in the liquid funds depends on the market performance.

- Mutual funds are governed by the Securities and Exchange Board of India (SEBI).

- The Securities and Exchange Board of India was established on April 12, 1992, in accordance with the provisions of the Securities and Exchange Board of India Act, 1992.

- Its headquarters is in Mumbai.

- Madhabi Puri Buch is the current chairman of SEBI.(March 2022)

NAV in mutual funds stands for ?- a)Newly Acquired Value

- b)Net Asset value

- c)Net Asset Visibility

- d)Net Amount Valuation

- e)None of the above

Correct answer is option 'B'. Can you explain this answer?

NAV in mutual funds stands for ?

a)

Newly Acquired Value

b)

Net Asset value

c)

Net Asset Visibility

d)

Net Amount Valuation

e)

None of the above

|

|

Aisha Gupta answered |

Net asset value:

- The net asset value (NAV) is the total value of an entity's assets minus the entire value of its liabilities, and it represents the entity's net worth.

- The NAV indicates the per share/unit price of a mutual fund or an exchange-traded fund (ETF) on a certain date or time and is most typically used in the context of a mutual fund or an exchange-traded fund (ETF).

- The NAV is the price at which shares/units of funds registered with the Securities and Exchange Commission (SEC) in the United States are exchanged (invested or redeemed).

The first Mutual funds in India was created in which year?- a)1954

- b)1964

- c)1967

- d)1980

- e)1974

Correct answer is option 'B'. Can you explain this answer?

The first Mutual funds in India was created in which year?

a)

1954

b)

1964

c)

1967

d)

1980

e)

1974

|

|

Rohan Sengupta answered |

The first Mutual funds in India were created in 1964 by the Unit Trust of India. In 1987, the leading public sector banks of the country, such as SBI and Canara bank, set up their mutual funds. It becomes popular after the 1991 liberalization of the Indian economy.

Which among the following is NOT a correct statement?- a)Hedge funds are not mutual funds

- b)Hedge funds can be sold to public

- c)Investors in mutual funds must pay various fees and expenses.

- d)Mutual funds provide economies of scale to investment decisions

- e)All the statements are correct

Correct answer is option 'B'. Can you explain this answer?

Which among the following is NOT a correct statement?

a)

Hedge funds are not mutual funds

b)

Hedge funds can be sold to public

c)

Investors in mutual funds must pay various fees and expenses.

d)

Mutual funds provide economies of scale to investment decisions

e)

All the statements are correct

|

|

Kavya Saxena answered |

Mutual fund:

- A mutual fund is a company that pools money from many investors and invests the money in securities such as stocks, bonds, and short-term debt.

- The combined holdings of the mutual fund are known as its portfolio.

- Mutual funds are regulated investment products offered to the public and available for daily trading. Mutual fund companies rely on economies of scale to generate profits.

- Mutual fund fees generally fall into two big buckets:

- Annual fund operating expenses: Ongoing fees toward the cost of paying managers, accountants, legal fees, marketing, and the like.

- Shareholder fees: Sales commissions and other one-time costs when you buy or sell mutual fund shares.

Hedge Funds:

- Hedge funds are private investments that are only available to accredited investors.

- Hedge funds are known for using higher risk investing strategies with the goal of achieving higher returns for their investors.

- Hedge funds are rarely accessible to the majority of investors; instead, hedge funds are geared toward accredited investors, as they need less SEC regulation than other funds.

- An accredited investor is a person or a business entity who is allowed to deal in securities that may not be registered with financial authorities

- Hedge funds are also notoriously less regulated than mutual funds and other investment vehicles.

Therefore, option 2 is NOT a correct statement.

Which of the following statements holds true about Mutual Funds?- a)The entry of mutual funds into call money market as a lender has helped to stabilize the Interest rates in this highly volatile market

- b)In a depressed market, the Mutual Funds can steady the 'market' due to their absorbing capacity

- c)Mutual Funds help to channelize the saving in productive lines by providing the much-needed long-term finance to the industries for assets formation, modernization and expansion

- d)All of the above

- e)None of the above

Correct answer is option 'D'. Can you explain this answer?

Which of the following statements holds true about Mutual Funds?

a)

The entry of mutual funds into call money market as a lender has helped to stabilize the Interest rates in this highly volatile market

b)

In a depressed market, the Mutual Funds can steady the 'market' due to their absorbing capacity

c)

Mutual Funds help to channelize the saving in productive lines by providing the much-needed long-term finance to the industries for assets formation, modernization and expansion

d)

All of the above

e)

None of the above

|

|

Ritika Choudhury answered |

All the three statements hold true about Mutual Funds. Firstly, The entry of mutual funds into call money market as a lender has helped to stabilize the Interest rates in this highly volatile market. Secondly, In a depressed market, the Mutual Funds can steady the 'market' due to their absorbing capacity. Lastly,Mutual Funds help to channelize the saving in productive lines by providing the much-needed long-term finance to the industries for assets formation, modernization and expansion.

Which of the following statements holds true about Mutual Funds?- a)The entry of mutual funds into call money market as a lender has helped to stabilize the Interest rates in this highly volatile market

- b)In a depressed market, the Mutual Funds can steady the 'market' due to their absorbing capacity

- c)Mutual Funds help to channelize the saving in productive lines by providing the much-needed long-term finance to the industries for assets formation, modernization and expansion

- d)All of the above

- e)None of the above

Correct answer is option 'D'. Can you explain this answer?

Which of the following statements holds true about Mutual Funds?

a)

The entry of mutual funds into call money market as a lender has helped to stabilize the Interest rates in this highly volatile market

b)

In a depressed market, the Mutual Funds can steady the 'market' due to their absorbing capacity

c)

Mutual Funds help to channelize the saving in productive lines by providing the much-needed long-term finance to the industries for assets formation, modernization and expansion

d)

All of the above

e)

None of the above

|

|

Nikita Singh answered |

All the three statements hold true about Mutual Funds. Firstly, The entry of mutual funds into call money market as a lender has helped to stabilize the Interest rates in this highly volatile market. Secondly, In a depressed market, the Mutual Funds can steady the 'market' due to their absorbing capacity. Lastly,Mutual Funds help to channelize the saving in productive lines by providing the much-needed long-term finance to the industries for assets formation, modernization and expansion.

Chapter doubts & questions for Investment & Exchange - RBI Assistant Preparation Course 2025 is part of Bank Exams exam preparation. The chapters have been prepared according to the Bank Exams exam syllabus. The Chapter doubts & questions, notes, tests & MCQs are made for Bank Exams 2025 Exam. Find important definitions, questions, notes, meanings, examples, exercises, MCQs and online tests here.

Chapter doubts & questions of Investment & Exchange - RBI Assistant Preparation Course in English & Hindi are available as part of Bank Exams exam.

Download more important topics, notes, lectures and mock test series for Bank Exams Exam by signing up for free.

RBI Assistant Preparation Course

713 videos|966 docs|289 tests

|

Contact Support

Our team is online on weekdays between 10 AM - 7 PM

Typical reply within 3 hours

|

Free Exam Preparation

at your Fingertips!

Access Free Study Material - Test Series, Structured Courses, Free Videos & Study Notes and Prepare for Your Exam With Ease

Join the 10M+ students on EduRev

Join the 10M+ students on EduRev

|

|

Create your account for free

OR

Forgot Password

OR

Signup to see your scores

go up

within 7 days!

within 7 days!

Takes less than 10 seconds to signup