All Exams >

Commerce >

Accountancy CUET Preparation >

All Questions

All questions of Cash Flow Statements for Commerce Exam

Purchase of marketable securities will result in _________.- a)Decrease in cash and cash equivalents

- b)Increase in Investing activities.

- c)Increase in cash and cash equivalents

- d)No effect on cash and cash equivalents

Correct answer is option 'D'. Can you explain this answer?

Purchase of marketable securities will result in _________.

a)

Decrease in cash and cash equivalents

b)

Increase in Investing activities.

c)

Increase in cash and cash equivalents

d)

No effect on cash and cash equivalents

|

|

Jayant Mishra answered |

Marketable securities are liquid financial instruments that can be quickly converted into cash at a reasonable price. The liquidity of marketable securities comes from the fact that the maturities tend to be less than one year, and that the rates at which they can be bought or sold have little effect on prices.

Refund of income tax is the part of __________- a)Financing Activities

- b)Operating Activities

- c)Both Investing Activities and Financing Activities

- d)Investing Activities

Correct answer is option 'B'. Can you explain this answer?

Refund of income tax is the part of __________

a)

Financing Activities

b)

Operating Activities

c)

Both Investing Activities and Financing Activities

d)

Investing Activities

|

Notes Wala answered |

Refund of income tax is the part of operating activities.

Purchase of shares or debentures are concerned with________- a)Investing Activities

- b)Financing Activities

- c)Operating Activities

- d)Both Operating Activities and Financing Activities

Correct answer is 'A'. Can you explain this answer?

Purchase of shares or debentures are concerned with________

a)

Investing Activities

b)

Financing Activities

c)

Operating Activities

d)

Both Operating Activities and Financing Activities

|

|

Arun Khanna answered |

Investing activities are the second main category of net cash activities listed on the statement of cash flows and consist of buying and selling long-term assets and other investments. In other words, this is the net amount of cash received and paid during an accounting period for long-term assets and investments. You can think of these activities like the money a company uses to invest in itself or the money it makes from its investments.

Items that may be included in the investing activities line item include the following:

1. Purchase of fixed assets (negative cash flow)

2. Sale of fixed assets (positive cash flow)

3. Purchase of investment instruments, such as stocks and bonds (negative cash flow)

4. Sale of investment instruments, such as stocks and bonds (positive cash flow)

5. Lending of money (negative cash flow)

6. Collection of loans (positive cash flow)

7. Proceeds of insurance settlements related to damaged fixed assets (positive cash flow)

Purchase and Sales of Shares by a manufacturing company comes under ______- a)Investing activities

- b)Operating Activities

- c)Not recorded

- d)Financing Activities

Correct answer is option 'A'. Can you explain this answer?

Purchase and Sales of Shares by a manufacturing company comes under ______

a)

Investing activities

b)

Operating Activities

c)

Not recorded

d)

Financing Activities

|

Amrita Kumar answered |

Purchase and Sales of Shares by a manufacturing company comes under Investing activities.

Provision for doubtful debts will appear under:- a)Long – term Provisions

- b)Short – term Provisions

- c)Reserves and Surplus

- d)Other Current Assets

Correct answer is option 'B'. Can you explain this answer?

Provision for doubtful debts will appear under:

a)

Long – term Provisions

b)

Short – term Provisions

c)

Reserves and Surplus

d)

Other Current Assets

|

|

Om Desai answered |

While preparing companies balance sheet trade receivables are shown without deducting the provision for doubtful debts and it is shown in the liabilities side under short term provisions.

Which of the following is not a cash inflow?- a)Goods purchased in cash

- b)Goods sold in cash

- c)Interest received on investment

- d)Sale of asset at loss

Correct answer is option 'A'. Can you explain this answer?

Which of the following is not a cash inflow?

a)

Goods purchased in cash

b)

Goods sold in cash

c)

Interest received on investment

d)

Sale of asset at loss

|

Stuti Kumar answered |

Following are the cash inflows except goods purchased in cash: Goods sold in cash Interest received on investment Sale of asset at loss

Cash and Cash Equivalents do not include_____- a)Cash in hand

- b)Cheques in hand

- c)Cash at bank

- d)Inventories

Correct answer is option 'D'. Can you explain this answer?

Cash and Cash Equivalents do not include_____

a)

Cash in hand

b)

Cheques in hand

c)

Cash at bank

d)

Inventories

|

Manisha Patel answered |

Cash and Cash Equivalents do not include inventories but following items are part of cash and cash equivalents:

•Cheques in hand

•Cash in hand

•Cash at bank

•Cheques in hand

•Cash in hand

•Cash at bank

______ are highly liquid assets that can be converted into cash shortly.- a)Non-current Investments

- b)Inventories

- c)Loose Tools

- d)Cash Equivalents

Correct answer is option 'D'. Can you explain this answer?

______ are highly liquid assets that can be converted into cash shortly.

a)

Non-current Investments

b)

Inventories

c)

Loose Tools

d)

Cash Equivalents

|

Shruti Mehta answered |

Cash Equivalents are highly liquid assets which can be converted into cash in a very short period of time.

Managerial accounting information is generally prepared for …- a)Shareholders

- b)Creditors

- c)Managers

- d)Regulatory agencies

Correct answer is option 'C'. Can you explain this answer?

Managerial accounting information is generally prepared for …

a)

Shareholders

b)

Creditors

c)

Managers

d)

Regulatory agencies

|

Sparsh Sen answered |

Internal users of the organization, such as managers and executives.

Redemption of preference Shares is concerned directly with ______- a)Investing Activities

- b)Not concerned with any activity

- c)Financing Activities

- d)Operating Activities

Correct answer is option 'C'. Can you explain this answer?

Redemption of preference Shares is concerned directly with ______

a)

Investing Activities

b)

Not concerned with any activity

c)

Financing Activities

d)

Operating Activities

|

Moumita Chakraborty answered |

Redemption of preference shares is concerned with financing activities. It will be deducted in financing activities as cash used.

Which of the following transaction is untrue regarding the limitations of cash flow statement- a)To help in short – term financial planning.

- b)To ascertain the liquidity of enterprises

- c)It is not used for judging the profitability of enterprises

- d)To ascertain the net changes in cash and cash equivalents

Correct answer is option 'C'. Can you explain this answer?

Which of the following transaction is untrue regarding the limitations of cash flow statement

a)

To help in short – term financial planning.

b)

To ascertain the liquidity of enterprises

c)

It is not used for judging the profitability of enterprises

d)

To ascertain the net changes in cash and cash equivalents

|

|

Aryan Khanna answered |

Cash Flow statement cannot help in judging the profitability of the enterprise because it just tell about the cash inflows and outflows.

Computer Software is classified under:- a)Fixed tangible Assets

- b)Long term borrowings

- c)Current Liabilities

- d)Fixed Intangible Assets

Correct answer is option 'D'. Can you explain this answer?

Computer Software is classified under:

a)

Fixed tangible Assets

b)

Long term borrowings

c)

Current Liabilities

d)

Fixed Intangible Assets

|

|

Poonam Reddy answered |

Computer software is an intangible asset for a company which is shown under fixed intangible assets.

Decrease in the value of Trade Receivable will be ……..- a)Added in operating activities

- b)Deducted in Investing activities

- c)Added in Investing Activities

- d)Deducted in operating activities

Correct answer is option 'A'. Can you explain this answer?

Decrease in the value of Trade Receivable will be ……..

a)

Added in operating activities

b)

Deducted in Investing activities

c)

Added in Investing Activities

d)

Deducted in operating activities

|

Mansi Chopra answered |

Decrease in the value of Trade Receivables will be added in operating activities while preparing cash flow statement.

In a statement of cash flows (indirect method) a decrease in inventory should be reported as- a)A deduction

- b)An addition

- c)In investing activity

- d)Not reported

Correct answer is option 'B'. Can you explain this answer?

In a statement of cash flows (indirect method) a decrease in inventory should be reported as

a)

A deduction

b)

An addition

c)

In investing activity

d)

Not reported

|

EduRev Humanities answered |

Decrease in current assets (inventory) will be added while calculating cash flow from operating activities.

Short –term highly liquid investments which are readily convertible into known amount of cash and which are subject to an insignificant risk of change in the value are called ------ a)Cash at Bank

- b)Non-current Investment

- c)Cash Equivalents

- d)Non-current Assets

Correct answer is option 'C'. Can you explain this answer?

Short –term highly liquid investments which are readily convertible into known amount of cash and which are subject to an insignificant risk of change in the value are called -----

a)

Cash at Bank

b)

Non-current Investment

c)

Cash Equivalents

d)

Non-current Assets

|

|

Aryan Khanna answered |

Short term investments which can be converted into cash in a very short period of time is treated as cash equivalents.

Directions : In the following questions, a statement of Assertion (A) is followed by a statement of Reason (R). Mark the correct choice as:Assertion (A): Sale of fixed assets is written under the Investing Activities.Reason (R): Sale of fixed assets leads to inflow of cash.- a)Both Assertion (A) and Reason (R) are true, and Reason (R) is the correct explanation of Assertion (A).

- b)Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A).

- c)Assertion (A) is true, but Reason (R) is false .

- d)Assertion (A) is false, but Reason (R) is true.

Correct answer is option 'B'. Can you explain this answer?

Directions : In the following questions, a statement of Assertion (A) is followed by a statement of Reason (R). Mark the correct choice as:

Assertion (A): Sale of fixed assets is written under the Investing Activities.

Reason (R): Sale of fixed assets leads to inflow of cash.

a)

Both Assertion (A) and Reason (R) are true, and Reason (R) is the correct explanation of Assertion (A).

b)

Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A).

c)

Assertion (A) is true, but Reason (R) is false .

d)

Assertion (A) is false, but Reason (R) is true.

|

|

Priyanka Khatri answered |

Investing activities are the acquisition and disposal of long-term assets and other investments not included in cash equivalents.

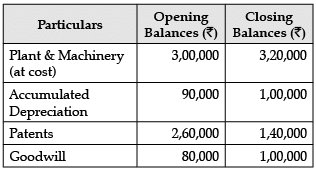

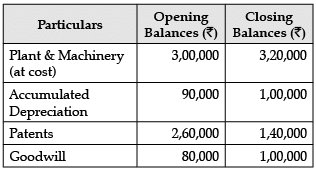

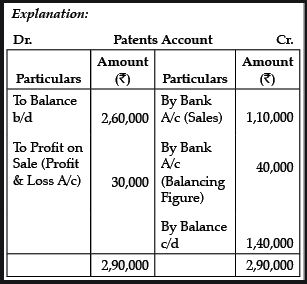

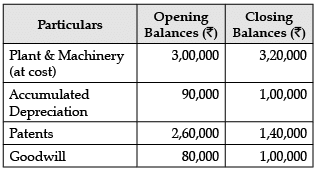

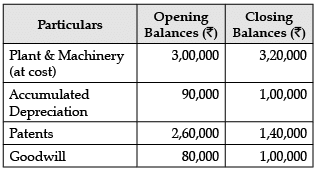

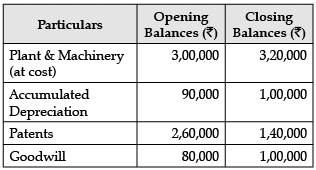

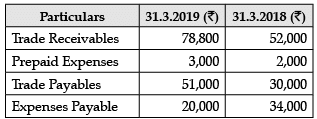

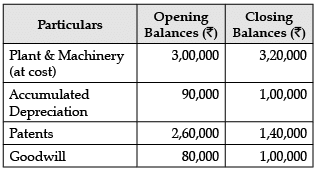

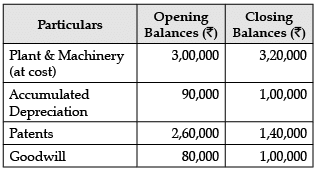

Read the following information and answer the questions that follow:Following are the opening and closing balances of Jayesh Ltd.: Additional information: During the year :(a) Depreciation charged on Plant and Machinery was ₹ 36,000.(b) A machine having a book value of ₹ 20,000 was sold for ₹ 16,000.(c) Patents having a book value of ₹ 80,000 were sold for ₹ 1,10,000.Q. What amount of patents will be added/subtracted to get the cash flow from investment?

Additional information: During the year :(a) Depreciation charged on Plant and Machinery was ₹ 36,000.(b) A machine having a book value of ₹ 20,000 was sold for ₹ 16,000.(c) Patents having a book value of ₹ 80,000 were sold for ₹ 1,10,000.Q. What amount of patents will be added/subtracted to get the cash flow from investment?- a)₹1,50,000 added

- b)₹1,50,000 subtracted

- c)₹1,20,000 added

- d)₹1,20,000 subtracted

Correct answer is option 'A'. Can you explain this answer?

Read the following information and answer the questions that follow:

Following are the opening and closing balances of Jayesh Ltd.:

Additional information:

During the year :

(a) Depreciation charged on Plant and Machinery was ₹ 36,000.

(b) A machine having a book value of ₹ 20,000 was sold for ₹ 16,000.

(c) Patents having a book value of ₹ 80,000 were sold for ₹ 1,10,000.

Q. What amount of patents will be added/subtracted to get the cash flow from investment?

a)

₹1,50,000 added

b)

₹1,50,000 subtracted

c)

₹1,20,000 added

d)

₹1,20,000 subtracted

|

Notes Wala answered |

Directions : In the following questions, a statement of Assertion (A) is followed by a statement of Reason (R). Mark the correct choice as:Assertion (A): Proceeds from Issue of Shares and Debentures are recorded in Financing Activity.Reason (R): Issue of shares and debentures are the cash inflow or outflow made to finance the company.- a)Both Assertion (A) and Reason (R) are true, and Reason (R) is the correct explanation of Assertion (A).

- b)Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A).

- c)Assertion (A) is true, but Reason (R) is false .

- d)Assertion (A) is false, but Reason (R) is true.

Correct answer is option 'A'. Can you explain this answer?

Directions : In the following questions, a statement of Assertion (A) is followed by a statement of Reason (R). Mark the correct choice as:

Assertion (A): Proceeds from Issue of Shares and Debentures are recorded in Financing Activity.

Reason (R): Issue of shares and debentures are the cash inflow or outflow made to finance the company.

a)

Both Assertion (A) and Reason (R) are true, and Reason (R) is the correct explanation of Assertion (A).

b)

Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A).

c)

Assertion (A) is true, but Reason (R) is false .

d)

Assertion (A) is false, but Reason (R) is true.

|

|

Kiran Mehta answered |

- The issue of Equity and preference share capital for cash only. The issue of Debentures, Bonds and long-term note for cash only.

- A company's cash flow from financing activities refers to the cash inflows and outflows resulting from the issuance of debt, the issuance of equity, dividend payments, and the repurchase of existing stock.

Directions : In the following questions, a statement of Assertion (A) is followed by a statement of Reason (R). Mark the correct choice as:Assertion (A): Depreciation is added to the net profit before tax.Reason (R): Depreciation is a non-cash item which is an expense.- a)Both Assertion (A) and Reason (R) are true, and Reason (R) is the correct explanation of Assertion (A).

- b)Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A).

- c)Assertion (A) is true, but Reason (R) is false .

- d)Assertion (A) is false, but Reason (R) is true.

Correct answer is option 'A'. Can you explain this answer?

Directions : In the following questions, a statement of Assertion (A) is followed by a statement of Reason (R). Mark the correct choice as:

Assertion (A): Depreciation is added to the net profit before tax.

Reason (R): Depreciation is a non-cash item which is an expense.

a)

Both Assertion (A) and Reason (R) are true, and Reason (R) is the correct explanation of Assertion (A).

b)

Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A).

c)

Assertion (A) is true, but Reason (R) is false .

d)

Assertion (A) is false, but Reason (R) is true.

|

|

Amita Das answered |

There was cash outflow for depreciation. Companies use investing cash flow to make initial payments for fixed assets that are later depreciated. Depreciation is a type of expense that is used to reduce the carrying value of an asset. Depreciation is entered as a debit-to-expense and a credit to asset value so actual cash flows are not exchanged.

When provision for depreciation account is separately maintained. In this method two accounts namely ___ and _____ account is prepared- a)Investment and provision for recitation account

- b)Fixed assets and Investment account

- c)Fixed assets and Dividend account

- d)Fixed assets and provision for depreciation account

Correct answer is option 'D'. Can you explain this answer?

When provision for depreciation account is separately maintained. In this method two accounts namely ___ and _____ account is prepared

a)

Investment and provision for recitation account

b)

Fixed assets and Investment account

c)

Fixed assets and Dividend account

d)

Fixed assets and provision for depreciation account

|

Shruti Mehta answered |

When provision for depreciation account is maintained separately in such a case at the time of sale of asset two accounts are prepared (i) Asset Account (ii) Provision for Depreciation Account or Accumulated Depreciation Account.

Operating activities is mainly concerned with …..- a)Current assets and current liabilities

- b)Long term assets

- c)Long – term liabilities and stockholders’ equity

- d)Share and debentures

Correct answer is option 'A'. Can you explain this answer?

Operating activities is mainly concerned with …..

a)

Current assets and current liabilities

b)

Long term assets

c)

Long – term liabilities and stockholders’ equity

d)

Share and debentures

|

Manisha Patel answered |

Operating activities is mainly concerned with current assets and current liabilities.

Deferred Tax Liabilities are shown under:- a)Reserves and Surplus

- b)Non – current Liabilities

- c)Shareholders’ Funds

- d)Current Liabilities

Correct answer is option 'B'. Can you explain this answer?

Deferred Tax Liabilities are shown under:

a)

Reserves and Surplus

b)

Non – current Liabilities

c)

Shareholders’ Funds

d)

Current Liabilities

|

Arpita Nambiar answered |

Deferred Tax liabilities are shown under Non-current Liabilities.

Some type of transaction which are considered movement between cash and cash equivalents are given below except …..- a)Cash credit

- b)Sale of cash equivalent securities

- c)Cash withdrawn from bank.

- d)Purchase of cash equivalent securities

Correct answer is option 'A'. Can you explain this answer?

Some type of transaction which are considered movement between cash and cash equivalents are given below except …..

a)

Cash credit

b)

Sale of cash equivalent securities

c)

Cash withdrawn from bank.

d)

Purchase of cash equivalent securities

|

Sravya Banerjee answered |

1. Cash deposited into a bank account.

2. Cash withdrawn from a bank account.

3. Cash paid for a purchase.

4. Cash received from a sale.

5. Cash transferred between different bank accounts.

6. Cash received as interest or dividends on investments.

7. Cash used to repay a loan or debt.

8. Cash received as a loan or debt repayment.

9. Cash used for payroll or employee wages.

10. Cash received from a loan or debt issuance.

2. Cash withdrawn from a bank account.

3. Cash paid for a purchase.

4. Cash received from a sale.

5. Cash transferred between different bank accounts.

6. Cash received as interest or dividends on investments.

7. Cash used to repay a loan or debt.

8. Cash received as a loan or debt repayment.

9. Cash used for payroll or employee wages.

10. Cash received from a loan or debt issuance.

Loose Tools are shown under:- a)Cash and Cash Equivalents

- b)Other Current Assets

- c)Trade Receivables

- d)Inventories

Correct answer is option 'D'. Can you explain this answer?

Loose Tools are shown under:

a)

Cash and Cash Equivalents

b)

Other Current Assets

c)

Trade Receivables

d)

Inventories

|

Amrutha Pillai answered |

Loose tools are shown under current assets and sub heading Inventories. Loose tools are not meant for sale.

Repayment of long term loans _________- a)Investing Activities

- b)Both Investing Activities and Operating Activities

- c)Financing Activities

- d)Operating Activities

Correct answer is option 'C'. Can you explain this answer?

Repayment of long term loans _________

a)

Investing Activities

b)

Both Investing Activities and Operating Activities

c)

Financing Activities

d)

Operating Activities

|

Isha Chopra answered |

Repayment of long-term loans is categorized as a financing activity. Financing activities are transactions or events that involve obtaining or repaying funds to finance the company's operations or investments. These activities primarily involve the company's owners, creditors, and investors.

Financing activities include activities such as issuing and repurchasing equity shares, borrowing and repaying long-term loans, and paying dividends to shareholders. These activities directly affect the company's capital structure and result in changes in its liabilities or equity.

Here is a detailed explanation of why the repayment of long-term loans falls under the category of financing activities:

1. Financing Activities Definition:

- Financing activities involve obtaining funds from external sources and repaying those funds.

2. Nature of Long-Term Loans:

- Long-term loans are typically borrowed from banks or financial institutions for a period exceeding one year.

- These loans are used to finance large-scale investments, such as purchasing fixed assets or funding long-term projects.

3. Repayment of Long-Term Loans:

- When a company repays its long-term loans, it is reducing its long-term debt obligations.

- The repayment may include both principal and interest payments.

- The funds used for repayment may come from cash generated from operations or from raising additional debt or equity.

4. Impact on Capital Structure:

- The repayment of long-term loans reduces the company's liabilities, specifically its long-term debt.

- As a result, the company's leverage decreases, which may improve its financial position and creditworthiness.

- This reduction in liabilities affects the company's capital structure and financial stability.

5. Presentation in Cash Flow Statement:

- The repayment of long-term loans is reported as a cash outflow under the financing activities section of the cash flow statement.

- This section summarizes the cash flows related to the company's financing activities, including borrowings and repayments.

In conclusion, the repayment of long-term loans is classified as a financing activity because it involves the reduction of long-term debt obligations and affects the company's capital structure. This activity is presented as a cash outflow in the financing activities section of the cash flow statement.

Financing activities include activities such as issuing and repurchasing equity shares, borrowing and repaying long-term loans, and paying dividends to shareholders. These activities directly affect the company's capital structure and result in changes in its liabilities or equity.

Here is a detailed explanation of why the repayment of long-term loans falls under the category of financing activities:

1. Financing Activities Definition:

- Financing activities involve obtaining funds from external sources and repaying those funds.

2. Nature of Long-Term Loans:

- Long-term loans are typically borrowed from banks or financial institutions for a period exceeding one year.

- These loans are used to finance large-scale investments, such as purchasing fixed assets or funding long-term projects.

3. Repayment of Long-Term Loans:

- When a company repays its long-term loans, it is reducing its long-term debt obligations.

- The repayment may include both principal and interest payments.

- The funds used for repayment may come from cash generated from operations or from raising additional debt or equity.

4. Impact on Capital Structure:

- The repayment of long-term loans reduces the company's liabilities, specifically its long-term debt.

- As a result, the company's leverage decreases, which may improve its financial position and creditworthiness.

- This reduction in liabilities affects the company's capital structure and financial stability.

5. Presentation in Cash Flow Statement:

- The repayment of long-term loans is reported as a cash outflow under the financing activities section of the cash flow statement.

- This section summarizes the cash flows related to the company's financing activities, including borrowings and repayments.

In conclusion, the repayment of long-term loans is classified as a financing activity because it involves the reduction of long-term debt obligations and affects the company's capital structure. This activity is presented as a cash outflow in the financing activities section of the cash flow statement.

Cash Flow Statement is also known as- a)Statement of Changes in Financial Position on Cash basis

- b)Statement accounting for variation in cash

- c)Both a and b

- d)None of the above.

Correct answer is option 'C'. Can you explain this answer?

Cash Flow Statement is also known as

a)

Statement of Changes in Financial Position on Cash basis

b)

Statement accounting for variation in cash

c)

Both a and b

d)

None of the above.

|

|

Jayant Mishra answered |

In financial accounting, a cash flow statement, also known as statement of cash flows, is a financial statement that shows how changes in balance sheet accounts and income affect cash and cash equivalents, and breaks the analysis down to operating, investing and financing activities.

Which activity is the main revenue generating activities of the enterprises- a)Cash flow from management activities

- b)Non Cash transactions

- c)Cash flow from operating activities

- d)Cash flow from investment activities

Correct answer is option 'C'. Can you explain this answer?

Which activity is the main revenue generating activities of the enterprises

a)

Cash flow from management activities

b)

Non Cash transactions

c)

Cash flow from operating activities

d)

Cash flow from investment activities

|

Anoushka Chopra answered |

Cash flow from operating activities is the main revenue generating activity of enterprises. In this activity, the cash flow is generated from the core operations of the business. It reflects the cash inflows and outflows resulting from the day-to-day operating activities of the enterprise.

Operating activities include the production, sales, and delivery of goods or services, as well as any other activities that are directly related to the main revenue-generating function of the business. These activities are essential for the growth and sustainability of the enterprise.

Below are the reasons why cash flow from operating activities is considered the main revenue generating activity:

1. Revenue Generation: Cash flow from operating activities primarily includes cash received from customers for the goods or services provided. This revenue is the main source of income for the enterprise and directly contributes to its financial performance.

2. Cost Management: Operating activities also involve cash outflows for various expenses, such as the purchase of raw materials, payment of salaries and wages, and other operating expenses. Efficient cost management is crucial for generating positive cash flow from operating activities.

3. Sustainable Operations: Cash flow from operating activities ensures that the business can sustain its day-to-day operations. It covers the costs of running the business and allows for reinvestment in the core activities to drive further growth.

4. Indicator of Profitability: Positive cash flow from operating activities is generally an indicator of the enterprise's profitability. It shows that the business is generating more cash inflows than outflows from its core operations.

5. Cash Flow Stability: Cash flow from operating activities is generally more stable and predictable compared to cash flows from other activities such as financing or investment. This stability allows the enterprise to better manage its cash flow needs and make strategic decisions.

In conclusion, cash flow from operating activities is the main revenue generating activity of enterprises as it reflects the cash inflows and outflows from the core operations of the business. It is crucial for revenue generation, cost management, sustainable operations, profitability, and cash flow stability.

Operating activities include the production, sales, and delivery of goods or services, as well as any other activities that are directly related to the main revenue-generating function of the business. These activities are essential for the growth and sustainability of the enterprise.

Below are the reasons why cash flow from operating activities is considered the main revenue generating activity:

1. Revenue Generation: Cash flow from operating activities primarily includes cash received from customers for the goods or services provided. This revenue is the main source of income for the enterprise and directly contributes to its financial performance.

2. Cost Management: Operating activities also involve cash outflows for various expenses, such as the purchase of raw materials, payment of salaries and wages, and other operating expenses. Efficient cost management is crucial for generating positive cash flow from operating activities.

3. Sustainable Operations: Cash flow from operating activities ensures that the business can sustain its day-to-day operations. It covers the costs of running the business and allows for reinvestment in the core activities to drive further growth.

4. Indicator of Profitability: Positive cash flow from operating activities is generally an indicator of the enterprise's profitability. It shows that the business is generating more cash inflows than outflows from its core operations.

5. Cash Flow Stability: Cash flow from operating activities is generally more stable and predictable compared to cash flows from other activities such as financing or investment. This stability allows the enterprise to better manage its cash flow needs and make strategic decisions.

In conclusion, cash flow from operating activities is the main revenue generating activity of enterprises as it reflects the cash inflows and outflows from the core operations of the business. It is crucial for revenue generation, cost management, sustainable operations, profitability, and cash flow stability.

Income tax paid is concerned with__________- a)Financing Activities

- b)Investing Activities

- c)Both Investing Activities and Financing Activities

- d)Operating Activities

Correct answer is option 'D'. Can you explain this answer?

Income tax paid is concerned with__________

a)

Financing Activities

b)

Investing Activities

c)

Both Investing Activities and Financing Activities

d)

Operating Activities

|

Juhi Iyer answered |

Income tax is concerned with only operating activities. Tax paid is deducted at the end while calculating Cash flow from operating activities.

Sale of machinery is concerned with_________- a)Financing Activities

- b)Investing Activities

- c)Both Operating Activities and Financing Activities

- d)Operating Activities

Correct answer is option 'B'. Can you explain this answer?

Sale of machinery is concerned with_________

a)

Financing Activities

b)

Investing Activities

c)

Both Operating Activities and Financing Activities

d)

Operating Activities

|

Bhavana Chauhan answered |

Sale of machinery is concerned with investing activities. It will be added to investing activities as proceeds from sale of machinery.

Buy Back of equity shares is concerned with_________- a)Investing Activities

- b)Operating Activities

- c)Financing Activities

- d)Both Investing Activities and Operating Activities

Correct answer is option 'C'. Can you explain this answer?

Buy Back of equity shares is concerned with_________

a)

Investing Activities

b)

Operating Activities

c)

Financing Activities

d)

Both Investing Activities and Operating Activities

|

Srishti Roy answered |

Buy back of shares is concerned with financing activities. This is the situation where one company is buying its own shares form the open market.

Read the following information and answer the questions that follow:Following are the opening and closing balances of Jayesh Ltd.: Additional information: During the year :(a) Depreciation charged on Plant and Machinery was ₹ 36,000.(b) A machine having a book value of ₹ 20,000 was sold for ₹ 16,000.(c) Patents having a book value of ₹ 80,000 were sold for ₹ 1,10,000.Q. What amount of Sales proceeds of Plant and Machinery will be added/subtracted?

Additional information: During the year :(a) Depreciation charged on Plant and Machinery was ₹ 36,000.(b) A machine having a book value of ₹ 20,000 was sold for ₹ 16,000.(c) Patents having a book value of ₹ 80,000 were sold for ₹ 1,10,000.Q. What amount of Sales proceeds of Plant and Machinery will be added/subtracted?- a)₹20,000 added

- b)₹20,000 subtracted

- c)₹16,000 added

- d)₹16,000 subtracted

Correct answer is option 'C'. Can you explain this answer?

Read the following information and answer the questions that follow:

Following are the opening and closing balances of Jayesh Ltd.:

Additional information:

During the year :

(a) Depreciation charged on Plant and Machinery was ₹ 36,000.

(b) A machine having a book value of ₹ 20,000 was sold for ₹ 16,000.

(c) Patents having a book value of ₹ 80,000 were sold for ₹ 1,10,000.

Q. What amount of Sales proceeds of Plant and Machinery will be added/subtracted?

a)

₹20,000 added

b)

₹20,000 subtracted

c)

₹16,000 added

d)

₹16,000 subtracted

|

|

Arun Yadav answered |

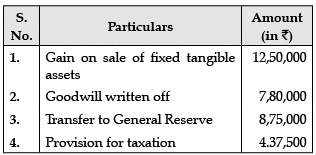

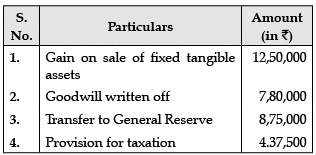

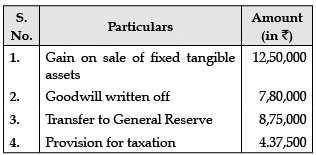

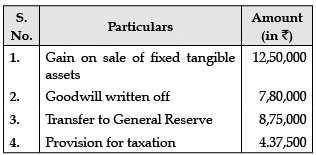

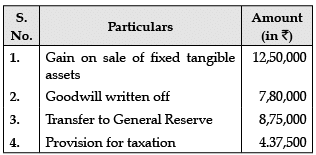

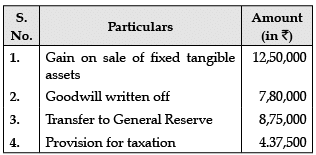

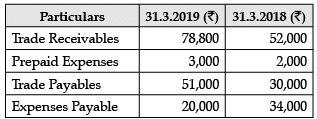

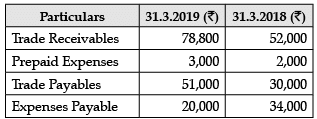

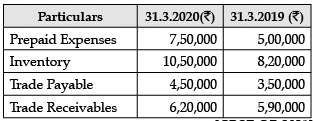

Read the following information and answer the given questions:Krishika an alumni of IIM Ahmedabad initiated her startup Krishika Ltd. in 2018. The profits of Krishika Ltd. in the year 2019-20 after all appropriations was ₹ 31,25,000. This profit was arrived after taking into consideration the following items: Additional information :

Additional information : Q. Cash flow from Operating Activities will be ₹ ___________.

Q. Cash flow from Operating Activities will be ₹ ___________.- a)39,95,000

- b)31,20,000

- c)40,67,500

- d)31,00,000

Correct answer is option 'B'. Can you explain this answer?

Read the following information and answer the given questions:

Krishika an alumni of IIM Ahmedabad initiated her startup Krishika Ltd. in 2018. The profits of Krishika Ltd. in the year 2019-20 after all appropriations was ₹ 31,25,000. This profit was arrived after taking into consideration the following items:

Additional information :

Q. Cash flow from Operating Activities will be ₹ ___________.

a)

39,95,000

b)

31,20,000

c)

40,67,500

d)

31,00,000

|

|

Arun Yadav answered |

Cash flow from Operating Activities = Cash from Operating Activities before tax – Tax paid

= ₹ 35,57,500 − ₹ 4,37,500 = ₹ 31,20,000

Read the following information and answer the given questions:Krishika an alumni of IIM Ahmedabad initiated her startup Krishika Ltd. in 2018. The profits of Krishika Ltd. in the year 2019-20 after all appropriations was ₹ 31,25,000. This profit was arrived after taking into consideration the following items: Additional information :

Additional information : Q. Net Profit before Tax will be ₹ ____________.

Q. Net Profit before Tax will be ₹ ____________.- a)22,50,000

- b)35,62,500

- c)39,67,500

- d)44,37,500

Correct answer is option 'D'. Can you explain this answer?

Read the following information and answer the given questions:

Krishika an alumni of IIM Ahmedabad initiated her startup Krishika Ltd. in 2018. The profits of Krishika Ltd. in the year 2019-20 after all appropriations was ₹ 31,25,000. This profit was arrived after taking into consideration the following items:

Additional information :

Q. Net Profit before Tax will be ₹ ____________.

a)

22,50,000

b)

35,62,500

c)

39,67,500

d)

44,37,500

|

|

Kiran Mehta answered |

Net Profit before Tax = Profit after all Appropriations + Provision for Taxation + Transfer to General Reserve = ₹ 31,25,000 + ₹ 4,37,000 + ₹ 8,75,000

= ₹ 44,37,500

Directions : In the following questions, a statement of Assertion (A) is followed by a statement of Reason (R). Mark the correct choice as:Assertion (A): By-back of equity shares comes under financing activities.Reason (R): Financing activities are the activities which result in change in size, composition of owner's capital and borrowing of the enterprise from other sources.- a)Both Assertion (A) and Reason (R) are true, and Reason (R) is the correct explanation of Assertion (A).

- b)Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A).

- c)Assertion (A) is true, but Reason (R) is false .

- d)Assertion (A) is false, but Reason (R) is true.

Correct answer is option 'A'. Can you explain this answer?

Directions : In the following questions, a statement of Assertion (A) is followed by a statement of Reason (R). Mark the correct choice as:

Assertion (A): By-back of equity shares comes under financing activities.

Reason (R): Financing activities are the activities which result in change in size, composition of owner's capital and borrowing of the enterprise from other sources.

a)

Both Assertion (A) and Reason (R) are true, and Reason (R) is the correct explanation of Assertion (A).

b)

Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A).

c)

Assertion (A) is true, but Reason (R) is false .

d)

Assertion (A) is false, but Reason (R) is true.

|

|

Vikas Kapoor answered |

Financing activities are those which brings changes in composition and size of owner's capital and borrowings of an enterprise. For instance: Cash received from issuing shares or other similar securities. Cash received from issuing loans, debentures, bonds, notes, and other short-term or long-term borrowings.

Read the following information and answer the given questions:Krishika an alumni of IIM Ahmedabad initiated her startup Krishika Ltd. in 2018. The profits of Krishika Ltd. in the year 2019-20 after all appropriations was ₹ 31,25,000. This profit was arrived after taking into consideration the following items: Additional information :

Additional information : Q. Cash from operating activities before tax will be ₹__________.

Q. Cash from operating activities before tax will be ₹__________.- a)35,57,500

- b)40,67,500

- c)37,87,500

- d)35,67,300

Correct answer is option 'A'. Can you explain this answer?

Read the following information and answer the given questions:

Krishika an alumni of IIM Ahmedabad initiated her startup Krishika Ltd. in 2018. The profits of Krishika Ltd. in the year 2019-20 after all appropriations was ₹ 31,25,000. This profit was arrived after taking into consideration the following items:

Additional information :

Q. Cash from operating activities before tax will be ₹__________.

a)

35,57,500

b)

40,67,500

c)

37,87,500

d)

35,67,300

|

|

Arun Yadav answered |

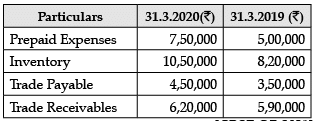

Cash from Operating Activities before Tax = Operating Profit before Working Capital changes − Increase in Current Assets + Increase in Current liabilities = ₹ 39,67,500 − ₹ 2,50,000 − ₹ 2,30,000 − ₹ 30,000 + ₹ 1,00,000 = ₹ 35,57,500

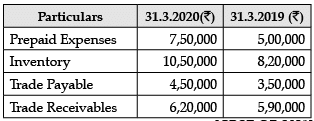

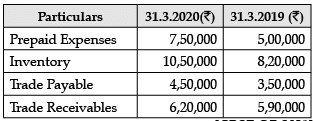

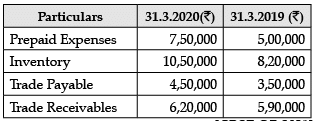

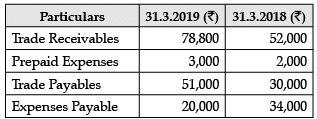

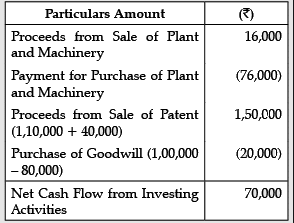

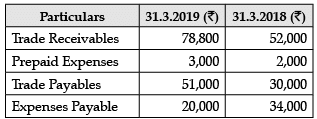

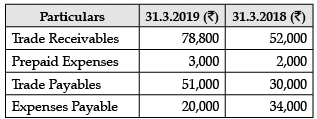

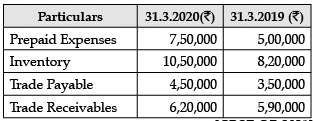

Read the following information and answer the given questions:X Ltd. made a profit of ₹ 5,00,000 after consideration of the following items :₹(i) Goodwill written off 5,000(ii) Depreciation on Fixed Tangible Assets 50,000(iii) Loss on Sale of Fixed Tangible Assets (Machinery) 20,000(iv) Provision for Doubtful Debts 10,000(v) Gain on Sale of Fixed Tangible Assets (Land) 7,500Additional information : Q. What will be the amount of Trade payables added to get the Cash flow from operations?

Q. What will be the amount of Trade payables added to get the Cash flow from operations?- a)₹51,000

- b)₹30,000

- c)₹21,000

- d)₹31,000

Correct answer is option 'C'. Can you explain this answer?

Read the following information and answer the given questions:

X Ltd. made a profit of ₹ 5,00,000 after consideration of the following items :

₹

(i) Goodwill written off 5,000

(ii) Depreciation on Fixed Tangible Assets 50,000

(iii) Loss on Sale of Fixed Tangible Assets (Machinery) 20,000

(iv) Provision for Doubtful Debts 10,000

(v) Gain on Sale of Fixed Tangible Assets (Land) 7,500

Additional information :

Q. What will be the amount of Trade payables added to get the Cash flow from operations?

a)

₹51,000

b)

₹30,000

c)

₹21,000

d)

₹31,000

|

|

Arun Yadav answered |

₹51,000 − ₹30,000 = ₹21,000

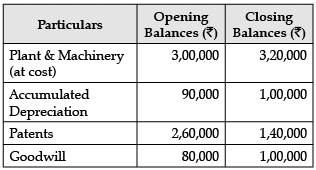

Read the following information and answer the questions that follow:Following are the opening and closing balances of Jayesh Ltd.: Additional information: During the year :(a) Depreciation charged on Plant and Machinery was ₹ 36,000.(b) A machine having a book value of ₹ 20,000 was sold for ₹ 16,000.(c) Patents having a book value of ₹ 80,000 were sold for ₹ 1,10,000.Q. What is the cash flow from investing activities?

Additional information: During the year :(a) Depreciation charged on Plant and Machinery was ₹ 36,000.(b) A machine having a book value of ₹ 20,000 was sold for ₹ 16,000.(c) Patents having a book value of ₹ 80,000 were sold for ₹ 1,10,000.Q. What is the cash flow from investing activities?- a)70,000

- b)72,000

- c)73,000

- d)80,000

Correct answer is option 'A'. Can you explain this answer?

Read the following information and answer the questions that follow:

Following are the opening and closing balances of Jayesh Ltd.:

Additional information:

During the year :

(a) Depreciation charged on Plant and Machinery was ₹ 36,000.

(b) A machine having a book value of ₹ 20,000 was sold for ₹ 16,000.

(c) Patents having a book value of ₹ 80,000 were sold for ₹ 1,10,000.

Q. What is the cash flow from investing activities?

a)

70,000

b)

72,000

c)

73,000

d)

80,000

|

|

Arun Yadav answered |

Payment of dividend is classified as- a)Operational activities

- b)Both Operational activities and Investment activities

- c)Financial activities

- d)Investment activities

Correct answer is option 'C'. Can you explain this answer?

Payment of dividend is classified as

a)

Operational activities

b)

Both Operational activities and Investment activities

c)

Financial activities

d)

Investment activities

|

Stuti Kumar answered |

Payment of dividend is classified as financing activities. It is deducted in financing activities.

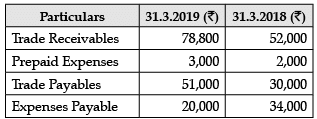

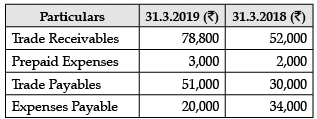

Read the following information and answer the given questions:X Ltd. made a profit of ₹ 5,00,000 after consideration of the following items :₹(i) Goodwill written off 5,000(ii) Depreciation on Fixed Tangible Assets 50,000(iii) Loss on Sale of Fixed Tangible Assets (Machinery) 20,000(iv) Provision for Doubtful Debts 10,000(v) Gain on Sale of Fixed Tangible Assets (Land) 7,500Additional information : Q. What amount of Trade Receivables will be subtracted from the Cash flow Statement to get Cash flow from operations?

Q. What amount of Trade Receivables will be subtracted from the Cash flow Statement to get Cash flow from operations?- a)₹78,800

- b)₹52,000

- c)₹3,000

- d)₹26,800

Correct answer is option 'D'. Can you explain this answer?

Read the following information and answer the given questions:

X Ltd. made a profit of ₹ 5,00,000 after consideration of the following items :

₹

(i) Goodwill written off 5,000

(ii) Depreciation on Fixed Tangible Assets 50,000

(iii) Loss on Sale of Fixed Tangible Assets (Machinery) 20,000

(iv) Provision for Doubtful Debts 10,000

(v) Gain on Sale of Fixed Tangible Assets (Land) 7,500

Additional information :

Q. What amount of Trade Receivables will be subtracted from the Cash flow Statement to get Cash flow from operations?

a)

₹78,800

b)

₹52,000

c)

₹3,000

d)

₹26,800

|

|

Neha Sharma answered |

₹78,800 − ₹52,000 = ₹26,800

The various activities operating, investing and financing classified as per ___related to cash flow statement- a)AS – 6(revised)

- b)AS – 4(revised)

- c)AS – 3(revised)

- d)AS – 5(revised)

Correct answer is option 'C'. Can you explain this answer?

The various activities operating, investing and financing classified as per ___related to cash flow statement

a)

AS – 6(revised)

b)

AS – 4(revised)

c)

AS – 3(revised)

d)

AS – 5(revised)

|

Shruti Mehta answered |

The various activities operating, investing and financing classified as per Accounting Standard – 3 (AS- 3 Revised) related to cash flow statement

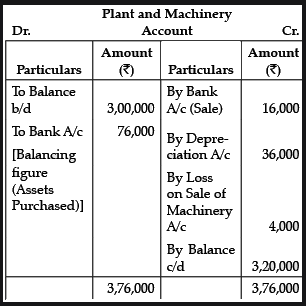

Read the following information and answer the questions that follow:Following are the opening and closing balances of Jayesh Ltd.: Additional information: During the year :(a) Depreciation charged on Plant and Machinery was ₹ 36,000.(b) A machine having a book value of ₹ 20,000 was sold for ₹ 16,000.(c) Patents having a book value of ₹ 80,000 were sold for ₹ 1,10,000.Q. What amount of machinery was purchased?

Additional information: During the year :(a) Depreciation charged on Plant and Machinery was ₹ 36,000.(b) A machine having a book value of ₹ 20,000 was sold for ₹ 16,000.(c) Patents having a book value of ₹ 80,000 were sold for ₹ 1,10,000.Q. What amount of machinery was purchased?- a)₹70,000

- b)₹76,000

- c)₹3,20,000

- d)₹20,000

Correct answer is option 'B'. Can you explain this answer?

Read the following information and answer the questions that follow:

Following are the opening and closing balances of Jayesh Ltd.:

Additional information:

During the year :

(a) Depreciation charged on Plant and Machinery was ₹ 36,000.

(b) A machine having a book value of ₹ 20,000 was sold for ₹ 16,000.

(c) Patents having a book value of ₹ 80,000 were sold for ₹ 1,10,000.

Q. What amount of machinery was purchased?

a)

₹70,000

b)

₹76,000

c)

₹3,20,000

d)

₹20,000

|

|

Amita Das answered |

The amount of machinery purchased was ₹76,000.

Read the following information and answer the given questions:X Ltd. made a profit of ₹5,00,000 after consideration of the following items :₹(i) Goodwill written off 5,000(ii) Depreciation on Fixed Tangible Assets 50,000(iii) Loss on Sale of Fixed Tangible Assets (Machinery) 20,000(iv) Provision for Doubtful Debts 10,000(v) Gain on Sale of Fixed Tangible Assets (Land) 7,500Additional information : Q. How will goodwill written off be adjusted in the cash flow statement?

Q. How will goodwill written off be adjusted in the cash flow statement?- a)Added to the Net Profit Before Tax

- b)Subtracted the Net Profit before Tax

- c)Not recorded in the Cash Flow

- d)None of these

Correct answer is option 'A'. Can you explain this answer?

Read the following information and answer the given questions:

X Ltd. made a profit of ₹5,00,000 after consideration of the following items :

₹

(i) Goodwill written off 5,000

(ii) Depreciation on Fixed Tangible Assets 50,000

(iii) Loss on Sale of Fixed Tangible Assets (Machinery) 20,000

(iv) Provision for Doubtful Debts 10,000

(v) Gain on Sale of Fixed Tangible Assets (Land) 7,500

Additional information :

Q. How will goodwill written off be adjusted in the cash flow statement?

a)

Added to the Net Profit Before Tax

b)

Subtracted the Net Profit before Tax

c)

Not recorded in the Cash Flow

d)

None of these

|

|

Kiran Mehta answered |

It is a non-cash item and should not form a part of cash flow.

Read the following information and answer the given questions:X Ltd. made a profit of ₹ 5,00,000 after consideration of the following items :₹(i) Goodwill written off 5,000(ii) Depreciation on Fixed Tangible Assets 50,000(iii) Loss on Sale of Fixed Tangible Assets (Machinery) 20,000(iv) Provision for Doubtful Debts 10,000(v) Gain on Sale of Fixed Tangible Assets (Land) 7,500Additional information : Q. Which of the following items will adjust to Net Profit before Tax?

Q. Which of the following items will adjust to Net Profit before Tax?- a)Trade Receivables

- b)Prepaid Expenses

- c)Loss on sale of Fixed Asset

- d)Expenses Payable

Correct answer is option 'C'. Can you explain this answer?

Read the following information and answer the given questions:

X Ltd. made a profit of ₹ 5,00,000 after consideration of the following items :

₹

(i) Goodwill written off 5,000

(ii) Depreciation on Fixed Tangible Assets 50,000

(iii) Loss on Sale of Fixed Tangible Assets (Machinery) 20,000

(iv) Provision for Doubtful Debts 10,000

(v) Gain on Sale of Fixed Tangible Assets (Land) 7,500

Additional information :

Q. Which of the following items will adjust to Net Profit before Tax?

a)

Trade Receivables

b)

Prepaid Expenses

c)

Loss on sale of Fixed Asset

d)

Expenses Payable

|

|

Naina Sharma answered |

It is a non-operating item. Non-operating income is the portion of an organization's income that is derived from activities not related to its core business operations. It can include items such as dividend income, profits, or losses from investments, as well as gains or losses incurred by foreign exchange and asset write-downs.

Read the following information and answer the given questions:Krishika an alumni of IIM Ahmedabad initiated her startup Krishika Ltd. in 2018. The profits of Krishika Ltd. in the year 2019-20 after all appropriations was ₹ 31,25,000. This profit was arrived after taking into consideration the following items: Additional information :

Additional information : Q. Operating profit before working capital changes will be ₹ _______ .

Q. Operating profit before working capital changes will be ₹ _______ .- a)52,17,500

- b)64,67,500

- c)39,67,500

- d)39,69,500

Correct answer is option 'C'. Can you explain this answer?

Read the following information and answer the given questions:

Krishika an alumni of IIM Ahmedabad initiated her startup Krishika Ltd. in 2018. The profits of Krishika Ltd. in the year 2019-20 after all appropriations was ₹ 31,25,000. This profit was arrived after taking into consideration the following items:

Additional information :

Q. Operating profit before working capital changes will be ₹ _______ .

a)

52,17,500

b)

64,67,500

c)

39,67,500

d)

39,69,500

|

|

Priyanka Khatri answered |

Operating profit before Working Capital changes = Net Profit before tax − Gain on sale of Fixed tangible assets + Goodwill written off

= ₹ 44,37,500 − ₹ 12,50,000 + ₹ 7,80,000

= ₹ 39,67,500

Chapter doubts & questions for Cash Flow Statements - Accountancy CUET Preparation 2025 is part of Commerce exam preparation. The chapters have been prepared according to the Commerce exam syllabus. The Chapter doubts & questions, notes, tests & MCQs are made for Commerce 2025 Exam. Find important definitions, questions, notes, meanings, examples, exercises, MCQs and online tests here.

Chapter doubts & questions of Cash Flow Statements - Accountancy CUET Preparation in English & Hindi are available as part of Commerce exam.

Download more important topics, notes, lectures and mock test series for Commerce Exam by signing up for free.

Accountancy CUET Preparation

46 videos|7 docs|83 tests

|

Contact Support

Our team is online on weekdays between 10 AM - 7 PM

Typical reply within 3 hours

|

Free Exam Preparation

at your Fingertips!

Access Free Study Material - Test Series, Structured Courses, Free Videos & Study Notes and Prepare for Your Exam With Ease

Join the 10M+ students on EduRev

Join the 10M+ students on EduRev

|

|

Create your account for free

OR

Forgot Password

OR

Signup on EduRev and stay on top of your study goals

10M+ students crushing their study goals daily