Test: Poverty, Planning, Finance And Economic / Social Development - 1 - UPSC MCQ

30 Questions MCQ Test - Test: Poverty, Planning, Finance And Economic / Social Development - 1

The money multiplier in an economy increases with which one of the following?

[2019]

Which one of the following is not the most likely measure the Government/RBI takes to stop the slide of Indian rupee?

[2019]

Considering the following statements:

1. Purchasing Power Parity (PPP) exchange rates are calculated by the prices of the same basket of goods and services in different countries.

2. In terms of PPP dollars, India is the sixth largest economy in the world.

Which of the statements given above is/ are correct?

[2019]

1. Purchasing Power Parity (PPP) exchange rates are calculated by the prices of the same basket of goods and services in different countries.

2. In terms of PPP dollars, India is the sixth largest economy in the world.

Which of the statements given above is/ are correct?

Which of the following statements is/are correct regarding the Maternity Benefit (Amendment) Act, 2017?

1. Pregnant women are entitled for three months predelivery and three months post-delivery paid leave

2. Enterprises with creches must allow the mother minimum six creche visits daily

3. Women with two children get reduced en titlements.

Select the correct answer using the code given below

[2019]

With reference to India’s Five Year Plans, which of the following statements is/are correct?

1. From the Second Five-Year Plan, there was a determined thrust towards substitution of basic and capital good industries.

2. The Fourth Five-Year Plan adopted the objective of correcting the earlier trend of increased concentration of wealth and economic power.

3. In the Fifth Five-Year Plan, for the first time, the financial sector was included as an integral part of the Plan.

Select the correct answer using the code given below

[2019]

In a given year in India, official poverty lines are higher in some states than in other because

[2019]

Atal innovation mission is set up under the

[2019]

Increase in absolute and per capita real GNP do not connote a higher level of economic development, if

[2018]

If a commodity is provided free to the public by the Government, then:

[2018]

Consider the following statements:

1. The Reserve Bank of India manages and services Government of India Securities but not any State Government Securities.

2. Treasury bills are issued by the Government of India and there are no treasury bills issued by the State Governments.

3. Treasury bills offer are issued at a discount from the par value.

Which of the statements given above is/are correct?

[2018]

What is the purpose of Vidyanjali Yojana'?

1. To enable the famous foreign educational institutions to open their campuses in India.

2. To increase the quality of education provided in government schools by taking help from the private sector and the community.

3. To encourage voluntary monetary contributions from private individuals and organizations so as to improve the infrastructure facilities for primary and secondary schools.

Select the correct answer using the code given below:

[2017]

Which of the following are the objectives of 'National Nutrition Mission'?

1. To create awareness relating to malnutrition among pregnant women and lactating mothers.

2. To reduce the incidence of anemia among young children, adolescent girls and women.

3. To promote the consumption of millets, coarse cereals and unpolished rice.

4. To promote the consumption of poultry eggs.

Select the correct answer using the code given below:

[2017]

With reference to 'National Investment and Infrastructure Fund', which of the following statements is/are correct?

1. It is an organ of NITI Aayog.

2. It has a corpus of ₹ 4, 00,000 crore at present.

Select the correct answer using the code given below:

[2017]

What is the aim of the programme 'Unnat Bharat Abhiyan'?

[2017]

Consider the following statements:

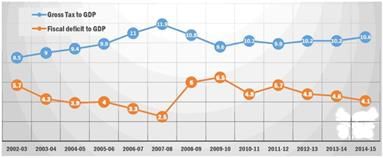

1. Tax revenue as a per cent of GDP of India has steadily increased in the last decade.

2. Fiscal deficit as a per cent of GDP of India has steadily increased in the last decade.

Which of the statements given above is/are correct?

[2017]

With reference to the 'Prohibition of Benami Property Transactions Act, 1988 (PBPT Act)', consider the following statements:

1. A property transaction is not treated as a benami transaction if the owner of the property is not aware of the transaction.

2. Properties held benami are liable for confiscation by the Government.

3. The Act provides for three author ities for investigations but does not provide for any appellate mechanism.

Which of the statements given above is/are correct?

[2017]

What is/are the most likely advantages of implementing 'Goods and Services Tax (GST)'?

1. It will replace multiple taxes collected by multiple authorities and will thus create a single market in India.

2. It will drastically reduce the 'Current Account Deficit' of India and will enable it to increase its foreign exchange reserves.

3. It will enormously increase the growth and size of economy of India and will enable it to overtake China in the near future.

Select the correct answer using the code given below:

[2017]

Who among the following can join the National Pension System (NPS)?

[2017]

What is the purpose of setting up of Small Finance Banks (SFBs) in India?

1. To supply credit to small business units

2. To supply credit to small and marginal farmers

3. To encourage young entrepreneurs to set up business particularly in rural areas.

Select the correct answer using the code given below:

[2017]

Which of the following statements is/are correct regarding the Monetary Policy Committee (MPC)?

1. It decides the RBI's benchmark interest rates.

2. It is a 12-member body including the Governor of RBI and is reconstituted every year.

3. It functions under the chairmanship of the Union Finance Minister.

Select the correct answer using the code given below:

[2017]

Which of the following is a most likely consequence of implementing the 'Unified Payments Interface (UPI)'?

[2017]

Consider the following statements:

1. National Payments Corporation of India (NPCI) helps in promoting the financial inclusion in the country.

2. NPCI has launched RuPay, a card payment scheme.

Which of the statements given above is/are correct?

[2017]

‘Mission Indradhanush’ launched by the Government of India pertains to

[2016]

Regarding DigiLocker, sometimes seen in the news, which of the following statements is/are correct?

1. It is a digital locker system offered by the Government under Digital India Programme.

2. It allows you to access your e-documents irrespective of your physical location.

Select the correct answer using the code given below.

[2016]

‘SWAYAM’, an initiative of the Government of India, aims at

[2016]

What is/are the purpose/purposes of ‘District Mineral Foundations’ in India?

1. Promoting mineral exploration activities in mineralrich districts

2. Protecting the interests of the persons affected by mining operations

3. Authorizing State Governments to issue licences for mineral exploration

Select the correct answer using the code given below.

[2016]

Which one of the following is a purpose of ‘UDAY’, a scheme of the Government?

[2016]

Pradhan Mantri MUDRA Yojana is aimed at

[2016]

With reference to ‘Stand up India scheme’, which of the following statement is/are correct?

1. Its purpose is to promote entrepreneurship among SC/ST and women entrepreneurs.

2. It provides for refinance through SIDBI.

Select the correct answer using the code given below.

[2016]

Regarding ‘Atal Pension Yojana’, which of the following statements is/are correct?

1. It is a minimum guaranteed pension scheme mainly targeted at unorganized sector workers.

2. Only one member of a family can join the scheme.

3. Same amount of pension is guaranteed for the spouse for life after subscriber’s death.

Select the correct answer using the code given below.

[2016]