B Com Exam > B Com Questions > how financial market achieve equilibrium Rela...

Start Learning for Free

how financial market achieve equilibrium

?Most Upvoted Answer

how financial market achieve equilibrium Related: Equilibrium in Fina...

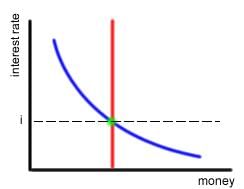

equilibrium conditions- where money supply equals money demand

money supply generally given as a constant (vertical line)

doesn't change w/ interest rate

Ms = Md

Md / $Y = L(i)

Md / $Y - ratio of money demand to nominal income (fraction of total income that ppl hold as money)

LM relation - equilibrium at intersection of money supply and money demand (downward sloping curve dependent on interest rate i from L(i))

interest at level that that cause ppl to hold Md equal to Ms

if Md=Ms then Bd=Bs since (wealth = B+D and wealth stays constant)

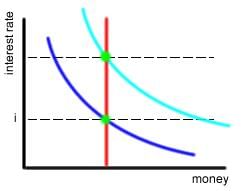

changes in $Y >> shift of Md curve

changes in interest rate >> mov't along curve

money supply (not dependent on interest rate at all)

money demand

equilibrium

higher $Y >> higher interest rate

lower $Y >> lower interest rate

money demand always equals money supply at equilibrium, so interest rate adjusts

need higher interest rate w/ higher income to compel consumers to invest and have the same money demand as before, etc

|

Explore Courses for B Com exam

|

|

how financial market achieve equilibrium Related: Equilibrium in Financial Markets - Financial Markets and Institutions?

Question Description

how financial market achieve equilibrium Related: Equilibrium in Financial Markets - Financial Markets and Institutions? for B Com 2025 is part of B Com preparation. The Question and answers have been prepared according to the B Com exam syllabus. Information about how financial market achieve equilibrium Related: Equilibrium in Financial Markets - Financial Markets and Institutions? covers all topics & solutions for B Com 2025 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for how financial market achieve equilibrium Related: Equilibrium in Financial Markets - Financial Markets and Institutions?.

how financial market achieve equilibrium Related: Equilibrium in Financial Markets - Financial Markets and Institutions? for B Com 2025 is part of B Com preparation. The Question and answers have been prepared according to the B Com exam syllabus. Information about how financial market achieve equilibrium Related: Equilibrium in Financial Markets - Financial Markets and Institutions? covers all topics & solutions for B Com 2025 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for how financial market achieve equilibrium Related: Equilibrium in Financial Markets - Financial Markets and Institutions?.

Solutions for how financial market achieve equilibrium Related: Equilibrium in Financial Markets - Financial Markets and Institutions? in English & in Hindi are available as part of our courses for B Com.

Download more important topics, notes, lectures and mock test series for B Com Exam by signing up for free.

Here you can find the meaning of how financial market achieve equilibrium Related: Equilibrium in Financial Markets - Financial Markets and Institutions? defined & explained in the simplest way possible. Besides giving the explanation of

how financial market achieve equilibrium Related: Equilibrium in Financial Markets - Financial Markets and Institutions?, a detailed solution for how financial market achieve equilibrium Related: Equilibrium in Financial Markets - Financial Markets and Institutions? has been provided alongside types of how financial market achieve equilibrium Related: Equilibrium in Financial Markets - Financial Markets and Institutions? theory, EduRev gives you an

ample number of questions to practice how financial market achieve equilibrium Related: Equilibrium in Financial Markets - Financial Markets and Institutions? tests, examples and also practice B Com tests.

|

Explore Courses for B Com exam

|

|

Signup for Free!

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.