B Com Exam > B Com Questions > Needed a Document for Difference between pool...

Start Learning for Free

Needed a Document for Difference between pooling of interest and purchase methiod?

Most Upvoted Answer

Needed a Document for Difference between pooling of interest and purch...

Community Answer

Needed a Document for Difference between pooling of interest and purch...

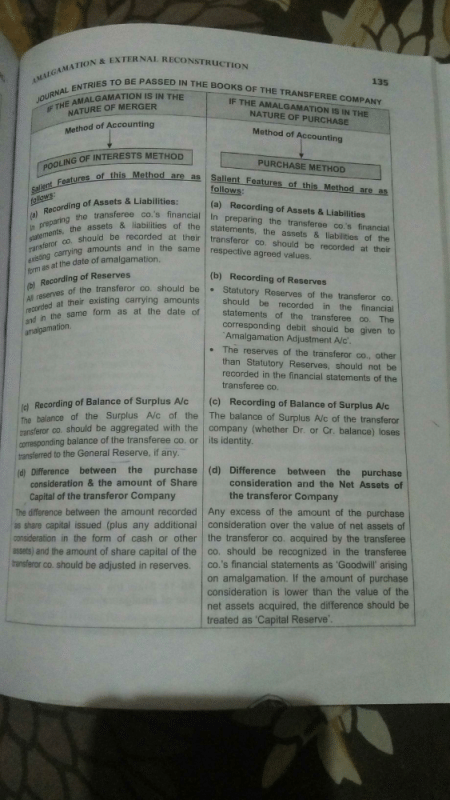

Difference between Pooling of Interest and Purchase Method

Introduction

Amalgamation refers to the process of combining two or more companies into one entity. In the field of corporate accounting, there are two methods used to account for amalgamation: pooling of interest method and purchase method. These methods differ in terms of their treatment of assets, liabilities, and shareholders' equity.

Pooling of Interest Method

The pooling of interest method is used when two or more companies merge to form a new entity, and the transaction is considered a pooling of interests rather than an acquisition. Under this method, the financial statements of the merging companies are combined as if they have been operating as a single entity from the beginning. The key features of the pooling of interest method include:

1. No adjustment to the book values: The assets, liabilities, and shareholders' equity of the merging companies are combined at their book values.

2. No goodwill calculation: Since the transaction is treated as a pooling of interests, no goodwill is recognized.

3. Continuity of historical financial statements: The financial statements of the merging companies are combined without any restatement or adjustment to historical figures.

Purchase Method

The purchase method is used when one company acquires another company, and the transaction is considered an acquisition. Under this method, the acquiring company recognizes the fair value of the assets and liabilities acquired and records any excess as goodwill. The key features of the purchase method include:

1. Recognition of fair value: The assets, liabilities, and shareholders' equity of the acquired company are recorded at their fair values at the date of acquisition.

2. Calculation of goodwill: Any excess of the purchase price over the fair value of net assets acquired is recorded as goodwill. Goodwill represents the premium paid for the acquired company's future earnings potential.

3. Restatement of historical financial statements: The financial statements of the acquired company are restated to reflect the fair value of its assets and liabilities at the date of acquisition.

Comparison

Pooling of Interest Method

- Combines the financial statements of merging companies at their book values

- No adjustment to historical figures

- No recognition of goodwill

Purchase Method

- Recognizes fair value of assets and liabilities acquired

- Calculates and recognizes goodwill

- Restates historical financial statements to reflect fair value

Conclusion

In summary, the pooling of interest method is used when two or more companies merge to form a new entity, while the purchase method is used when one company acquires another. The pooling of interest method combines the financial statements at book values, while the purchase method recognizes fair values and calculates goodwill. It is important for companies to choose the appropriate method based on the nature of the amalgamation transaction to ensure accurate and transparent financial reporting.

Introduction

Amalgamation refers to the process of combining two or more companies into one entity. In the field of corporate accounting, there are two methods used to account for amalgamation: pooling of interest method and purchase method. These methods differ in terms of their treatment of assets, liabilities, and shareholders' equity.

Pooling of Interest Method

The pooling of interest method is used when two or more companies merge to form a new entity, and the transaction is considered a pooling of interests rather than an acquisition. Under this method, the financial statements of the merging companies are combined as if they have been operating as a single entity from the beginning. The key features of the pooling of interest method include:

1. No adjustment to the book values: The assets, liabilities, and shareholders' equity of the merging companies are combined at their book values.

2. No goodwill calculation: Since the transaction is treated as a pooling of interests, no goodwill is recognized.

3. Continuity of historical financial statements: The financial statements of the merging companies are combined without any restatement or adjustment to historical figures.

Purchase Method

The purchase method is used when one company acquires another company, and the transaction is considered an acquisition. Under this method, the acquiring company recognizes the fair value of the assets and liabilities acquired and records any excess as goodwill. The key features of the purchase method include:

1. Recognition of fair value: The assets, liabilities, and shareholders' equity of the acquired company are recorded at their fair values at the date of acquisition.

2. Calculation of goodwill: Any excess of the purchase price over the fair value of net assets acquired is recorded as goodwill. Goodwill represents the premium paid for the acquired company's future earnings potential.

3. Restatement of historical financial statements: The financial statements of the acquired company are restated to reflect the fair value of its assets and liabilities at the date of acquisition.

Comparison

Pooling of Interest Method

- Combines the financial statements of merging companies at their book values

- No adjustment to historical figures

- No recognition of goodwill

Purchase Method

- Recognizes fair value of assets and liabilities acquired

- Calculates and recognizes goodwill

- Restates historical financial statements to reflect fair value

Conclusion

In summary, the pooling of interest method is used when two or more companies merge to form a new entity, while the purchase method is used when one company acquires another. The pooling of interest method combines the financial statements at book values, while the purchase method recognizes fair values and calculates goodwill. It is important for companies to choose the appropriate method based on the nature of the amalgamation transaction to ensure accurate and transparent financial reporting.

|

Explore Courses for B Com exam

|

|

Similar B Com Doubts

Question Description

Needed a Document for Difference between pooling of interest and purchase methiod? Related: Introduction to Amalgamation - Amalgamation of Companies, Advanced Corporate Accounting? for B Com 2025 is part of B Com preparation. The Question and answers have been prepared according to the B Com exam syllabus. Information about Needed a Document for Difference between pooling of interest and purchase methiod? Related: Introduction to Amalgamation - Amalgamation of Companies, Advanced Corporate Accounting? covers all topics & solutions for B Com 2025 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for Needed a Document for Difference between pooling of interest and purchase methiod? Related: Introduction to Amalgamation - Amalgamation of Companies, Advanced Corporate Accounting?.

Needed a Document for Difference between pooling of interest and purchase methiod? Related: Introduction to Amalgamation - Amalgamation of Companies, Advanced Corporate Accounting? for B Com 2025 is part of B Com preparation. The Question and answers have been prepared according to the B Com exam syllabus. Information about Needed a Document for Difference between pooling of interest and purchase methiod? Related: Introduction to Amalgamation - Amalgamation of Companies, Advanced Corporate Accounting? covers all topics & solutions for B Com 2025 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for Needed a Document for Difference between pooling of interest and purchase methiod? Related: Introduction to Amalgamation - Amalgamation of Companies, Advanced Corporate Accounting?.

Solutions for Needed a Document for Difference between pooling of interest and purchase methiod? Related: Introduction to Amalgamation - Amalgamation of Companies, Advanced Corporate Accounting? in English & in Hindi are available as part of our courses for B Com.

Download more important topics, notes, lectures and mock test series for B Com Exam by signing up for free.

Here you can find the meaning of Needed a Document for Difference between pooling of interest and purchase methiod? Related: Introduction to Amalgamation - Amalgamation of Companies, Advanced Corporate Accounting? defined & explained in the simplest way possible. Besides giving the explanation of

Needed a Document for Difference between pooling of interest and purchase methiod? Related: Introduction to Amalgamation - Amalgamation of Companies, Advanced Corporate Accounting?, a detailed solution for Needed a Document for Difference between pooling of interest and purchase methiod? Related: Introduction to Amalgamation - Amalgamation of Companies, Advanced Corporate Accounting? has been provided alongside types of Needed a Document for Difference between pooling of interest and purchase methiod? Related: Introduction to Amalgamation - Amalgamation of Companies, Advanced Corporate Accounting? theory, EduRev gives you an

ample number of questions to practice Needed a Document for Difference between pooling of interest and purchase methiod? Related: Introduction to Amalgamation - Amalgamation of Companies, Advanced Corporate Accounting? tests, examples and also practice B Com tests.

|

Explore Courses for B Com exam

|

|

Signup to solve all Doubts

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.