Commerce Exam > Commerce Questions > Journal entry for rent paid in advance?

Start Learning for Free

Journal entry for rent paid in advance?

Verified Answer

Journal entry for rent paid in advance?

Prepaid Rent Payment Journal Entry

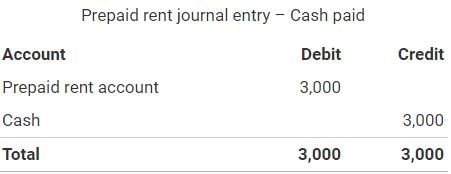

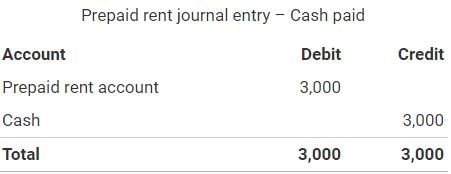

To record the payment of cash which created the pre paid rent, the accounting records will show the following bookkeeping entries on 1 April:

This question is part of UPSC exam. View all Commerce courses

This question is part of UPSC exam. View all Commerce courses

Most Upvoted Answer

Journal entry for rent paid in advance?

Prepaid rent a/c Dr.

To cash a/c cr.

( Being rent paid in advance )

To cash a/c cr.

( Being rent paid in advance )

Community Answer

Journal entry for rent paid in advance?

Rent Paid in Advance

Introduction:

Rent paid in advance refers to the situation where a tenant makes a payment to their landlord before the due date. This payment covers future rental periods and is commonly known as prepaid rent. It is essential to understand how to record such transactions accurately and the implications it has on the financial statements of both the tenant and the landlord.

Recording the Transaction:

When rent is paid in advance, it is important to document the transaction properly to ensure accurate accounting. The following steps should be taken:

1. Identify the Prepaid Rent Account: Create or identify the existing prepaid rent account in the books of the tenant. This account is classified as a current asset since the benefit of the payment will expire within one year.

2. Record the Payment: Debit the prepaid rent account and credit the cash or bank account. This entry reflects the decrease in cash and the increase in the prepaid rent asset.

Impact on Financial Statements:

Rent paid in advance affects the financial statements of both the tenant and the landlord:

1. Tenant's Financial Statements:

- Balance Sheet: Prepaid rent is included as a current asset on the balance sheet, increasing the total assets.

- Income Statement: The prepaid rent is not recognized as an expense in the period it is paid. Instead, it is expensed over the rental period as the benefit is received.

2. Landlord's Financial Statements:

- Balance Sheet: The landlord records the prepaid rent as a liability since the payment is received before providing the services. It increases the total liabilities.

- Income Statement: The payment received is not recognized as revenue until the rental period begins, and the services are provided. At that point, it is recognized as rental income.

Conclusion:

Rent paid in advance is a common practice that affects the financial statements of both the tenant and the landlord. Proper recording of the transaction is crucial to ensure accurate accounting. The prepaid rent is classified as a current asset in the tenant's books and as a liability in the landlord's books. It is important to understand the impact of prepaid rent on the balance sheet and income statement of both parties involved.

Introduction:

Rent paid in advance refers to the situation where a tenant makes a payment to their landlord before the due date. This payment covers future rental periods and is commonly known as prepaid rent. It is essential to understand how to record such transactions accurately and the implications it has on the financial statements of both the tenant and the landlord.

Recording the Transaction:

When rent is paid in advance, it is important to document the transaction properly to ensure accurate accounting. The following steps should be taken:

1. Identify the Prepaid Rent Account: Create or identify the existing prepaid rent account in the books of the tenant. This account is classified as a current asset since the benefit of the payment will expire within one year.

2. Record the Payment: Debit the prepaid rent account and credit the cash or bank account. This entry reflects the decrease in cash and the increase in the prepaid rent asset.

Impact on Financial Statements:

Rent paid in advance affects the financial statements of both the tenant and the landlord:

1. Tenant's Financial Statements:

- Balance Sheet: Prepaid rent is included as a current asset on the balance sheet, increasing the total assets.

- Income Statement: The prepaid rent is not recognized as an expense in the period it is paid. Instead, it is expensed over the rental period as the benefit is received.

2. Landlord's Financial Statements:

- Balance Sheet: The landlord records the prepaid rent as a liability since the payment is received before providing the services. It increases the total liabilities.

- Income Statement: The payment received is not recognized as revenue until the rental period begins, and the services are provided. At that point, it is recognized as rental income.

Conclusion:

Rent paid in advance is a common practice that affects the financial statements of both the tenant and the landlord. Proper recording of the transaction is crucial to ensure accurate accounting. The prepaid rent is classified as a current asset in the tenant's books and as a liability in the landlord's books. It is important to understand the impact of prepaid rent on the balance sheet and income statement of both parties involved.

Attention Commerce Students!

To make sure you are not studying endlessly, EduRev has designed Commerce study material, with Structured Courses, Videos, & Test Series. Plus get personalized analysis, doubt solving and improvement plans to achieve a great score in Commerce.

|

Explore Courses for Commerce exam

|

|

Similar Commerce Doubts

Journal entry for rent paid in advance?

Question Description

Journal entry for rent paid in advance? for Commerce 2024 is part of Commerce preparation. The Question and answers have been prepared according to the Commerce exam syllabus. Information about Journal entry for rent paid in advance? covers all topics & solutions for Commerce 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for Journal entry for rent paid in advance?.

Journal entry for rent paid in advance? for Commerce 2024 is part of Commerce preparation. The Question and answers have been prepared according to the Commerce exam syllabus. Information about Journal entry for rent paid in advance? covers all topics & solutions for Commerce 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for Journal entry for rent paid in advance?.

Solutions for Journal entry for rent paid in advance? in English & in Hindi are available as part of our courses for Commerce.

Download more important topics, notes, lectures and mock test series for Commerce Exam by signing up for free.

Here you can find the meaning of Journal entry for rent paid in advance? defined & explained in the simplest way possible. Besides giving the explanation of

Journal entry for rent paid in advance?, a detailed solution for Journal entry for rent paid in advance? has been provided alongside types of Journal entry for rent paid in advance? theory, EduRev gives you an

ample number of questions to practice Journal entry for rent paid in advance? tests, examples and also practice Commerce tests.

|

Explore Courses for Commerce exam

|

|

Suggested Free Tests

Signup for Free!

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.