Commerce Exam > Commerce Questions > Distinguish between shares and debentures?

Start Learning for Free

Distinguish between shares and debentures?

Most Upvoted Answer

Distinguish between shares and debentures?

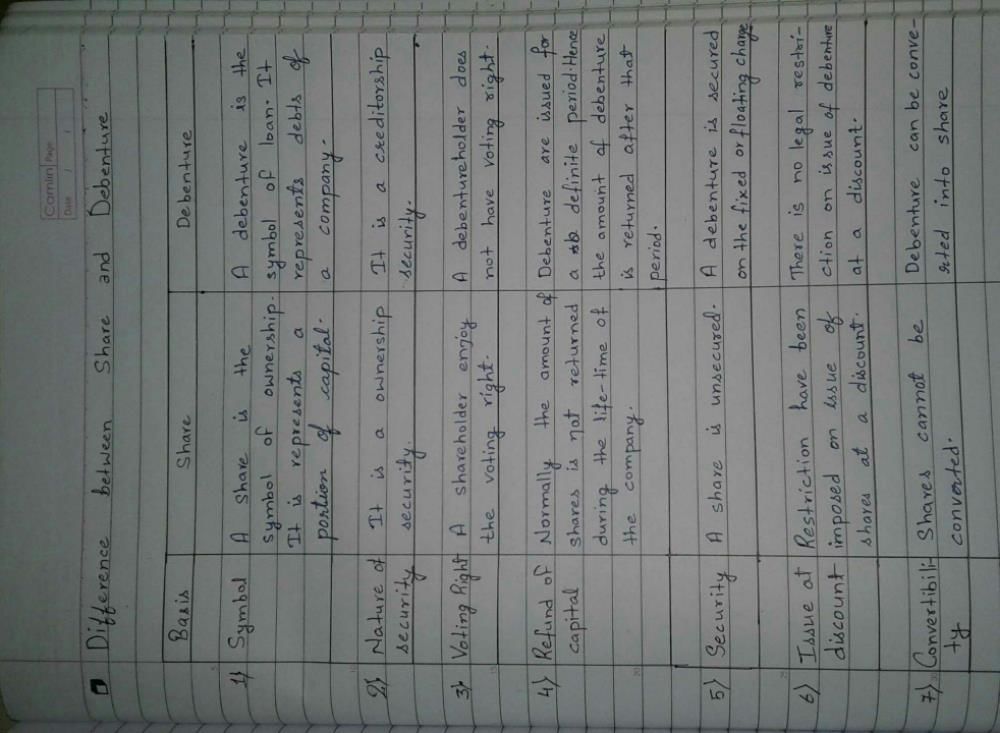

The following are the major differences between Shares and Debentures:

- The holder of shares is known as a shareholder while the holder of debentures is known as debenture holder.

Share is the capital of the company, but Debenture is the debt of the company.

- The shares represent ownership of the shareholders in the company. On the other hand, debentures represent indebtedness of the company.

- The income earned on shares is the dividend, but the income earned on debentures is interest.

- The payment of dividend can be made only out of current profits of the business and not otherwise. Unlike the interest on debentures which has to be paid by the company to debenture holders, no matter company has earned profit or not.

- Dividend is not a business expense and so is not allowed as deduction. On the contrary, interest on debentures is a expense and so allowed as a deduction.

- In the event of winding up, debentures get priority of repayment over shares.

- Shares cannot be converted as opposed to debentures are convertible.

- There is no security charge created for payment of shares. Conversely, security charge is created for the payment of debentures.

- A trust deed is not executed in case of shares whereas trust deed is executed when the debentures are issued to the public.

- Unlike debenture holders, shareholders have voting rights.

- Shares are issued at a discount subject to some legal compliance. Debentures can be issued at a discount without any legal compliance.

Community Answer

Distinguish between shares and debentures?

|

Explore Courses for Commerce exam

|

|

Similar Commerce Doubts

Distinguish between shares and debentures?

Question Description

Distinguish between shares and debentures? for Commerce 2025 is part of Commerce preparation. The Question and answers have been prepared according to the Commerce exam syllabus. Information about Distinguish between shares and debentures? covers all topics & solutions for Commerce 2025 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for Distinguish between shares and debentures?.

Distinguish between shares and debentures? for Commerce 2025 is part of Commerce preparation. The Question and answers have been prepared according to the Commerce exam syllabus. Information about Distinguish between shares and debentures? covers all topics & solutions for Commerce 2025 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for Distinguish between shares and debentures?.

Solutions for Distinguish between shares and debentures? in English & in Hindi are available as part of our courses for Commerce.

Download more important topics, notes, lectures and mock test series for Commerce Exam by signing up for free.

Here you can find the meaning of Distinguish between shares and debentures? defined & explained in the simplest way possible. Besides giving the explanation of

Distinguish between shares and debentures?, a detailed solution for Distinguish between shares and debentures? has been provided alongside types of Distinguish between shares and debentures? theory, EduRev gives you an

ample number of questions to practice Distinguish between shares and debentures? tests, examples and also practice Commerce tests.

|

Explore Courses for Commerce exam

|

|

Signup to solve all Doubts

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.