CA Foundation Exam > CA Foundation Questions > A machine cost₹520000 with an estimated life...

Start Learning for Free

A machine cost₹520000 with an estimated life of 25 years . A sinking fund is created to replac it by a new model at 25% higher cost after 25 years with a scrap value realisation of₹25000 what amount should be setaside every year if sinking fund investments accumulate at 3.5% compound interest p.a.

? Related: Time Value of Money (Part - 3)

Verified Answer

A machine cost₹520000 with an estimated life of 25 years . A sinking ...

This question is part of UPSC exam. View all CA Foundation courses

This question is part of UPSC exam. View all CA Foundation courses

Most Upvoted Answer

A machine cost₹520000 with an estimated life of 25 years . A sinking ...

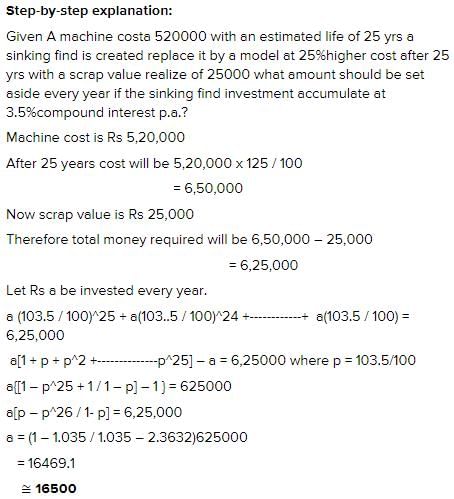

MACHINE COST = 520000

AFTER 25 YEARS = 520000 + 25% = 650000

SCRAP VALUE = 25000

MONEY REQUIRED = 650000 - 25000

= 625000

FUTURE VALUE = 625000

FUTURE VALUE FORMULA = ANUITY× ( 1.035) RAISE TO 25 -1

÷

0.035

625000 = ANNUITY( 1.035) RAISE TO 25 - 1

÷

0.035

ANNUITY = 625000

÷

38.949

ANNUITY = 16046.27..take nearest value 16050

AFTER 25 YEARS = 520000 + 25% = 650000

SCRAP VALUE = 25000

MONEY REQUIRED = 650000 - 25000

= 625000

FUTURE VALUE = 625000

FUTURE VALUE FORMULA = ANUITY× ( 1.035) RAISE TO 25 -1

÷

0.035

625000 = ANNUITY( 1.035) RAISE TO 25 - 1

÷

0.035

ANNUITY = 625000

÷

38.949

ANNUITY = 16046.27..take nearest value 16050

Community Answer

A machine cost₹520000 with an estimated life of 25 years . A sinking ...

Calculation for Sinking Fund:

To determine the amount that should be set aside every year for the sinking fund, we need to consider the cost of the new machine after 25 years, the scrap value realization, and the interest rate at which the sinking fund investments accumulate.

1. Cost of the new machine after 25 years:

The cost of the new machine will be 25% higher than the original cost of ₹520000. Therefore, the cost of the new machine after 25 years will be:

Cost of new machine = ₹520000 + 25% of ₹520000

= ₹520000 + (25/100) * ₹520000

= ₹520000 + ₹130000

= ₹650000

2. Scrap value realization:

The scrap value realization is the amount that can be obtained by selling the old machine after 25 years. In this case, the scrap value realization is ₹25000.

3. Sinking fund investments accumulate at 3.5% compound interest p.a.:

The sinking fund investments accumulate at a compound interest rate of 3.5% per annum. This means that the amount set aside every year will accumulate and earn interest at a rate of 3.5% per annum.

Calculation of annual sinking fund amount:

The sinking fund amount can be calculated using the sinking fund formula:

Sinking fund amount = (Cost of new machine - Scrap value realization) / (1 + interest rate)^n - 1 / interest rate

Where:

- Cost of new machine = ₹650000

- Scrap value realization = ₹25000

- Interest rate = 3.5% = 0.035

- n = 25 years

Sinking fund amount = (₹650000 - ₹25000) / (1 + 0.035)^25 - 1 / 0.035

Using this formula, the sinking fund amount can be calculated.

Explanation of the Time Value of Money:

The concept of time value of money is based on the principle that the value of money changes over time due to factors such as inflation, interest rates, and the opportunity cost of investing money elsewhere. In this case, the sinking fund is created to account for the future cost of replacing the machine.

By setting aside a certain amount of money every year and investing it in a sinking fund, the accumulated funds will grow over time due to compound interest. This ensures that sufficient funds are available to replace the machine at the end of its estimated life.

The sinking fund amount is calculated based on the future cost of the new machine, taking into account the scrap value realization and the interest rate at which the funds accumulate. By considering these factors, the sinking fund amount can be determined to ensure that enough funds are available to replace the machine at the end of its estimated life.

The sinking fund concept helps to manage the financial aspect of replacing assets or equipment in the future. It allows for systematic savings and investment to ensure that the required funds are available when needed. By considering the time value of money, the sinking fund takes into account the changes in the value of money over time and ensures that sufficient funds are set aside to meet future expenses.

To determine the amount that should be set aside every year for the sinking fund, we need to consider the cost of the new machine after 25 years, the scrap value realization, and the interest rate at which the sinking fund investments accumulate.

1. Cost of the new machine after 25 years:

The cost of the new machine will be 25% higher than the original cost of ₹520000. Therefore, the cost of the new machine after 25 years will be:

Cost of new machine = ₹520000 + 25% of ₹520000

= ₹520000 + (25/100) * ₹520000

= ₹520000 + ₹130000

= ₹650000

2. Scrap value realization:

The scrap value realization is the amount that can be obtained by selling the old machine after 25 years. In this case, the scrap value realization is ₹25000.

3. Sinking fund investments accumulate at 3.5% compound interest p.a.:

The sinking fund investments accumulate at a compound interest rate of 3.5% per annum. This means that the amount set aside every year will accumulate and earn interest at a rate of 3.5% per annum.

Calculation of annual sinking fund amount:

The sinking fund amount can be calculated using the sinking fund formula:

Sinking fund amount = (Cost of new machine - Scrap value realization) / (1 + interest rate)^n - 1 / interest rate

Where:

- Cost of new machine = ₹650000

- Scrap value realization = ₹25000

- Interest rate = 3.5% = 0.035

- n = 25 years

Sinking fund amount = (₹650000 - ₹25000) / (1 + 0.035)^25 - 1 / 0.035

Using this formula, the sinking fund amount can be calculated.

Explanation of the Time Value of Money:

The concept of time value of money is based on the principle that the value of money changes over time due to factors such as inflation, interest rates, and the opportunity cost of investing money elsewhere. In this case, the sinking fund is created to account for the future cost of replacing the machine.

By setting aside a certain amount of money every year and investing it in a sinking fund, the accumulated funds will grow over time due to compound interest. This ensures that sufficient funds are available to replace the machine at the end of its estimated life.

The sinking fund amount is calculated based on the future cost of the new machine, taking into account the scrap value realization and the interest rate at which the funds accumulate. By considering these factors, the sinking fund amount can be determined to ensure that enough funds are available to replace the machine at the end of its estimated life.

The sinking fund concept helps to manage the financial aspect of replacing assets or equipment in the future. It allows for systematic savings and investment to ensure that the required funds are available when needed. By considering the time value of money, the sinking fund takes into account the changes in the value of money over time and ensures that sufficient funds are set aside to meet future expenses.

Attention CA Foundation Students!

To make sure you are not studying endlessly, EduRev has designed CA Foundation study material, with Structured Courses, Videos, & Test Series. Plus get personalized analysis, doubt solving and improvement plans to achieve a great score in CA Foundation.

|

Explore Courses for CA Foundation exam

|

|

Similar CA Foundation Doubts

A machine cost₹520000 with an estimated life of 25 years . A sinking fund is created to replac it by a new model at 25% higher cost after 25 years with a scrap value realisation of₹25000 what amount should be setaside every year if sinking fund investments accumulate at 3.5% compound interest p.a. Related: Time Value of Money (Part - 3)?

Question Description

A machine cost₹520000 with an estimated life of 25 years . A sinking fund is created to replac it by a new model at 25% higher cost after 25 years with a scrap value realisation of₹25000 what amount should be setaside every year if sinking fund investments accumulate at 3.5% compound interest p.a. Related: Time Value of Money (Part - 3)? for CA Foundation 2024 is part of CA Foundation preparation. The Question and answers have been prepared according to the CA Foundation exam syllabus. Information about A machine cost₹520000 with an estimated life of 25 years . A sinking fund is created to replac it by a new model at 25% higher cost after 25 years with a scrap value realisation of₹25000 what amount should be setaside every year if sinking fund investments accumulate at 3.5% compound interest p.a. Related: Time Value of Money (Part - 3)? covers all topics & solutions for CA Foundation 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for A machine cost₹520000 with an estimated life of 25 years . A sinking fund is created to replac it by a new model at 25% higher cost after 25 years with a scrap value realisation of₹25000 what amount should be setaside every year if sinking fund investments accumulate at 3.5% compound interest p.a. Related: Time Value of Money (Part - 3)?.

A machine cost₹520000 with an estimated life of 25 years . A sinking fund is created to replac it by a new model at 25% higher cost after 25 years with a scrap value realisation of₹25000 what amount should be setaside every year if sinking fund investments accumulate at 3.5% compound interest p.a. Related: Time Value of Money (Part - 3)? for CA Foundation 2024 is part of CA Foundation preparation. The Question and answers have been prepared according to the CA Foundation exam syllabus. Information about A machine cost₹520000 with an estimated life of 25 years . A sinking fund is created to replac it by a new model at 25% higher cost after 25 years with a scrap value realisation of₹25000 what amount should be setaside every year if sinking fund investments accumulate at 3.5% compound interest p.a. Related: Time Value of Money (Part - 3)? covers all topics & solutions for CA Foundation 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for A machine cost₹520000 with an estimated life of 25 years . A sinking fund is created to replac it by a new model at 25% higher cost after 25 years with a scrap value realisation of₹25000 what amount should be setaside every year if sinking fund investments accumulate at 3.5% compound interest p.a. Related: Time Value of Money (Part - 3)?.

Solutions for A machine cost₹520000 with an estimated life of 25 years . A sinking fund is created to replac it by a new model at 25% higher cost after 25 years with a scrap value realisation of₹25000 what amount should be setaside every year if sinking fund investments accumulate at 3.5% compound interest p.a. Related: Time Value of Money (Part - 3)? in English & in Hindi are available as part of our courses for CA Foundation.

Download more important topics, notes, lectures and mock test series for CA Foundation Exam by signing up for free.

Here you can find the meaning of A machine cost₹520000 with an estimated life of 25 years . A sinking fund is created to replac it by a new model at 25% higher cost after 25 years with a scrap value realisation of₹25000 what amount should be setaside every year if sinking fund investments accumulate at 3.5% compound interest p.a. Related: Time Value of Money (Part - 3)? defined & explained in the simplest way possible. Besides giving the explanation of

A machine cost₹520000 with an estimated life of 25 years . A sinking fund is created to replac it by a new model at 25% higher cost after 25 years with a scrap value realisation of₹25000 what amount should be setaside every year if sinking fund investments accumulate at 3.5% compound interest p.a. Related: Time Value of Money (Part - 3)?, a detailed solution for A machine cost₹520000 with an estimated life of 25 years . A sinking fund is created to replac it by a new model at 25% higher cost after 25 years with a scrap value realisation of₹25000 what amount should be setaside every year if sinking fund investments accumulate at 3.5% compound interest p.a. Related: Time Value of Money (Part - 3)? has been provided alongside types of A machine cost₹520000 with an estimated life of 25 years . A sinking fund is created to replac it by a new model at 25% higher cost after 25 years with a scrap value realisation of₹25000 what amount should be setaside every year if sinking fund investments accumulate at 3.5% compound interest p.a. Related: Time Value of Money (Part - 3)? theory, EduRev gives you an

ample number of questions to practice A machine cost₹520000 with an estimated life of 25 years . A sinking fund is created to replac it by a new model at 25% higher cost after 25 years with a scrap value realisation of₹25000 what amount should be setaside every year if sinking fund investments accumulate at 3.5% compound interest p.a. Related: Time Value of Money (Part - 3)? tests, examples and also practice CA Foundation tests.

|

Explore Courses for CA Foundation exam

|

|

Suggested Free Tests

Signup for Free!

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.