Commerce Exam > Commerce Questions > For the year ended 31st March 2017, net profi...

Start Learning for Free

For the year ended 31st March 2017, net profit after tax of K X limited was Rs. 6,00,000. The company has Rs. 40,00,000, 12% debentures of Rs. 100 each. Calculate interest coverage ratio assuming 40% tax rate. State its significance also. Will the interest coverage ratio change if during the year 2017-18, the company decides to redeem debentures of Rs. 5,00,000 and expects to maintain the same rate of net profit and assume that the tax rate will not change. ?

Verified Answer

For the year ended 31st March 2017, net profit after tax of K X limite...

This question is part of UPSC exam. View all Commerce courses

This question is part of UPSC exam. View all Commerce courses

Most Upvoted Answer

For the year ended 31st March 2017, net profit after tax of K X limite...

Interest Coverage Ratio

The interest coverage ratio is a financial ratio that measures a company's ability to pay its interest expenses on its outstanding debt. It is calculated by dividing the company's earnings before interest and taxes (EBIT) by its interest expenses.

The formula for interest coverage ratio is as follows:

Interest Coverage Ratio = EBIT / Interest Expenses

Calculation of Interest Coverage Ratio

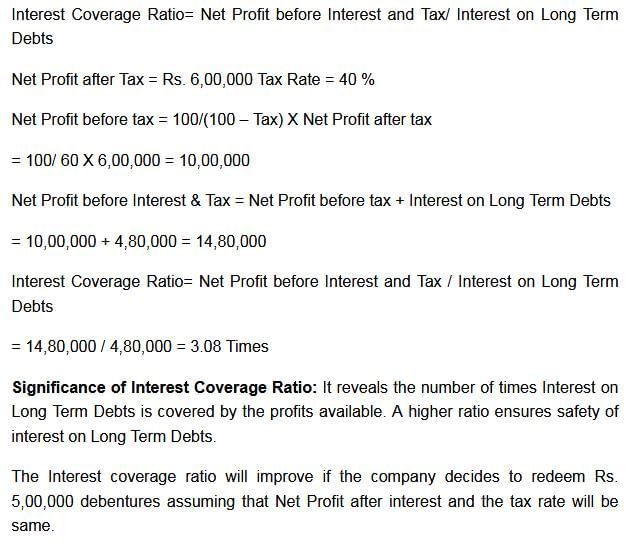

Given that the net profit after tax of K X Limited for the year ended 31st March 2017 is Rs. 6,00,000 and the company has Rs. 40,00,000, 12% debentures of Rs. 100 each, we can calculate the interest coverage ratio as follows:

1. Calculate the interest expenses:

Interest Expenses = Debentures * Interest Rate

= Rs. 40,00,000 * 12% = Rs. 4,80,000

2. Calculate the EBIT:

EBIT = Net Profit After Tax + Interest Expenses * (1 - Tax Rate)

= Rs. 6,00,000 + Rs. 4,80,000 * (1 - 0.40) = Rs. 6,00,000 + Rs. 2,88,000 = Rs. 8,88,000

3. Calculate the interest coverage ratio:

Interest Coverage Ratio = EBIT / Interest Expenses

= Rs. 8,88,000 / Rs. 4,80,000 ≈ 1.85

Significance of Interest Coverage Ratio

The interest coverage ratio is an important measure of a company's financial health and stability. It indicates the company's ability to generate enough earnings to cover its interest expenses. A higher interest coverage ratio is generally considered favorable as it means the company has more income available to pay its interest obligations.

A ratio of 1 or lower indicates that the company's earnings are just enough to cover its interest expenses, and any decrease in earnings could lead to difficulties in meeting interest payments. A ratio below 1 implies that the company is not generating sufficient income to cover its interest expenses, which can signify financial distress and potential default on debt.

Effect of Debenture Redemption on Interest Coverage Ratio

If during the year 2017-18, K X Limited decides to redeem debentures of Rs. 5,00,000 and expects to maintain the same rate of net profit and tax rate, the interest coverage ratio will change.

1. Calculate the new interest expenses:

New Interest Expenses = (Debentures - Debenture Redemption) * Interest Rate

= (Rs. 40,00,000 - Rs. 5,00,000) * 12% = Rs. 4,20,000

2. Calculate the new EBIT:

New EBIT = Net Profit After Tax + New Interest Expenses * (1 - Tax Rate)

= Rs. 6,00,000 + Rs. 4,20,000 * (1 - 0.40) = Rs. 6,00,000 + Rs. 2,52,000 = Rs. 8,52,000

3. Calculate the new interest coverage ratio:

New Interest Coverage Ratio = New EBIT / New Interest Expenses

= Rs. 8,52,000 / Rs. 4,20,000 ≈ 2

The interest coverage ratio is a financial ratio that measures a company's ability to pay its interest expenses on its outstanding debt. It is calculated by dividing the company's earnings before interest and taxes (EBIT) by its interest expenses.

The formula for interest coverage ratio is as follows:

Interest Coverage Ratio = EBIT / Interest Expenses

Calculation of Interest Coverage Ratio

Given that the net profit after tax of K X Limited for the year ended 31st March 2017 is Rs. 6,00,000 and the company has Rs. 40,00,000, 12% debentures of Rs. 100 each, we can calculate the interest coverage ratio as follows:

1. Calculate the interest expenses:

Interest Expenses = Debentures * Interest Rate

= Rs. 40,00,000 * 12% = Rs. 4,80,000

2. Calculate the EBIT:

EBIT = Net Profit After Tax + Interest Expenses * (1 - Tax Rate)

= Rs. 6,00,000 + Rs. 4,80,000 * (1 - 0.40) = Rs. 6,00,000 + Rs. 2,88,000 = Rs. 8,88,000

3. Calculate the interest coverage ratio:

Interest Coverage Ratio = EBIT / Interest Expenses

= Rs. 8,88,000 / Rs. 4,80,000 ≈ 1.85

Significance of Interest Coverage Ratio

The interest coverage ratio is an important measure of a company's financial health and stability. It indicates the company's ability to generate enough earnings to cover its interest expenses. A higher interest coverage ratio is generally considered favorable as it means the company has more income available to pay its interest obligations.

A ratio of 1 or lower indicates that the company's earnings are just enough to cover its interest expenses, and any decrease in earnings could lead to difficulties in meeting interest payments. A ratio below 1 implies that the company is not generating sufficient income to cover its interest expenses, which can signify financial distress and potential default on debt.

Effect of Debenture Redemption on Interest Coverage Ratio

If during the year 2017-18, K X Limited decides to redeem debentures of Rs. 5,00,000 and expects to maintain the same rate of net profit and tax rate, the interest coverage ratio will change.

1. Calculate the new interest expenses:

New Interest Expenses = (Debentures - Debenture Redemption) * Interest Rate

= (Rs. 40,00,000 - Rs. 5,00,000) * 12% = Rs. 4,20,000

2. Calculate the new EBIT:

New EBIT = Net Profit After Tax + New Interest Expenses * (1 - Tax Rate)

= Rs. 6,00,000 + Rs. 4,20,000 * (1 - 0.40) = Rs. 6,00,000 + Rs. 2,52,000 = Rs. 8,52,000

3. Calculate the new interest coverage ratio:

New Interest Coverage Ratio = New EBIT / New Interest Expenses

= Rs. 8,52,000 / Rs. 4,20,000 ≈ 2

|

Explore Courses for Commerce exam

|

|

Similar Commerce Doubts

For the year ended 31st March 2017, net profit after tax of K X limited was Rs. 6,00,000. The company has Rs. 40,00,000, 12% debentures of Rs. 100 each. Calculate interest coverage ratio assuming 40% tax rate. State its significance also. Will the interest coverage ratio change if during the year 2017-18, the company decides to redeem debentures of Rs. 5,00,000 and expects to maintain the same rate of net profit and assume that the tax rate will not change. ?

Question Description

For the year ended 31st March 2017, net profit after tax of K X limited was Rs. 6,00,000. The company has Rs. 40,00,000, 12% debentures of Rs. 100 each. Calculate interest coverage ratio assuming 40% tax rate. State its significance also. Will the interest coverage ratio change if during the year 2017-18, the company decides to redeem debentures of Rs. 5,00,000 and expects to maintain the same rate of net profit and assume that the tax rate will not change. ? for Commerce 2025 is part of Commerce preparation. The Question and answers have been prepared according to the Commerce exam syllabus. Information about For the year ended 31st March 2017, net profit after tax of K X limited was Rs. 6,00,000. The company has Rs. 40,00,000, 12% debentures of Rs. 100 each. Calculate interest coverage ratio assuming 40% tax rate. State its significance also. Will the interest coverage ratio change if during the year 2017-18, the company decides to redeem debentures of Rs. 5,00,000 and expects to maintain the same rate of net profit and assume that the tax rate will not change. ? covers all topics & solutions for Commerce 2025 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for For the year ended 31st March 2017, net profit after tax of K X limited was Rs. 6,00,000. The company has Rs. 40,00,000, 12% debentures of Rs. 100 each. Calculate interest coverage ratio assuming 40% tax rate. State its significance also. Will the interest coverage ratio change if during the year 2017-18, the company decides to redeem debentures of Rs. 5,00,000 and expects to maintain the same rate of net profit and assume that the tax rate will not change. ?.

For the year ended 31st March 2017, net profit after tax of K X limited was Rs. 6,00,000. The company has Rs. 40,00,000, 12% debentures of Rs. 100 each. Calculate interest coverage ratio assuming 40% tax rate. State its significance also. Will the interest coverage ratio change if during the year 2017-18, the company decides to redeem debentures of Rs. 5,00,000 and expects to maintain the same rate of net profit and assume that the tax rate will not change. ? for Commerce 2025 is part of Commerce preparation. The Question and answers have been prepared according to the Commerce exam syllabus. Information about For the year ended 31st March 2017, net profit after tax of K X limited was Rs. 6,00,000. The company has Rs. 40,00,000, 12% debentures of Rs. 100 each. Calculate interest coverage ratio assuming 40% tax rate. State its significance also. Will the interest coverage ratio change if during the year 2017-18, the company decides to redeem debentures of Rs. 5,00,000 and expects to maintain the same rate of net profit and assume that the tax rate will not change. ? covers all topics & solutions for Commerce 2025 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for For the year ended 31st March 2017, net profit after tax of K X limited was Rs. 6,00,000. The company has Rs. 40,00,000, 12% debentures of Rs. 100 each. Calculate interest coverage ratio assuming 40% tax rate. State its significance also. Will the interest coverage ratio change if during the year 2017-18, the company decides to redeem debentures of Rs. 5,00,000 and expects to maintain the same rate of net profit and assume that the tax rate will not change. ?.

Solutions for For the year ended 31st March 2017, net profit after tax of K X limited was Rs. 6,00,000. The company has Rs. 40,00,000, 12% debentures of Rs. 100 each. Calculate interest coverage ratio assuming 40% tax rate. State its significance also. Will the interest coverage ratio change if during the year 2017-18, the company decides to redeem debentures of Rs. 5,00,000 and expects to maintain the same rate of net profit and assume that the tax rate will not change. ? in English & in Hindi are available as part of our courses for Commerce.

Download more important topics, notes, lectures and mock test series for Commerce Exam by signing up for free.

Here you can find the meaning of For the year ended 31st March 2017, net profit after tax of K X limited was Rs. 6,00,000. The company has Rs. 40,00,000, 12% debentures of Rs. 100 each. Calculate interest coverage ratio assuming 40% tax rate. State its significance also. Will the interest coverage ratio change if during the year 2017-18, the company decides to redeem debentures of Rs. 5,00,000 and expects to maintain the same rate of net profit and assume that the tax rate will not change. ? defined & explained in the simplest way possible. Besides giving the explanation of

For the year ended 31st March 2017, net profit after tax of K X limited was Rs. 6,00,000. The company has Rs. 40,00,000, 12% debentures of Rs. 100 each. Calculate interest coverage ratio assuming 40% tax rate. State its significance also. Will the interest coverage ratio change if during the year 2017-18, the company decides to redeem debentures of Rs. 5,00,000 and expects to maintain the same rate of net profit and assume that the tax rate will not change. ?, a detailed solution for For the year ended 31st March 2017, net profit after tax of K X limited was Rs. 6,00,000. The company has Rs. 40,00,000, 12% debentures of Rs. 100 each. Calculate interest coverage ratio assuming 40% tax rate. State its significance also. Will the interest coverage ratio change if during the year 2017-18, the company decides to redeem debentures of Rs. 5,00,000 and expects to maintain the same rate of net profit and assume that the tax rate will not change. ? has been provided alongside types of For the year ended 31st March 2017, net profit after tax of K X limited was Rs. 6,00,000. The company has Rs. 40,00,000, 12% debentures of Rs. 100 each. Calculate interest coverage ratio assuming 40% tax rate. State its significance also. Will the interest coverage ratio change if during the year 2017-18, the company decides to redeem debentures of Rs. 5,00,000 and expects to maintain the same rate of net profit and assume that the tax rate will not change. ? theory, EduRev gives you an

ample number of questions to practice For the year ended 31st March 2017, net profit after tax of K X limited was Rs. 6,00,000. The company has Rs. 40,00,000, 12% debentures of Rs. 100 each. Calculate interest coverage ratio assuming 40% tax rate. State its significance also. Will the interest coverage ratio change if during the year 2017-18, the company decides to redeem debentures of Rs. 5,00,000 and expects to maintain the same rate of net profit and assume that the tax rate will not change. ? tests, examples and also practice Commerce tests.

|

Explore Courses for Commerce exam

|

|

Signup for Free!

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.