Commerce Exam > Commerce Questions > example of balance sheet for financial statem...

Start Learning for Free

example of balance sheet for financial statement

? Related: Format of Balance Sheet

Most Upvoted Answer

example of balance sheet for financial statement Related: Format of B...

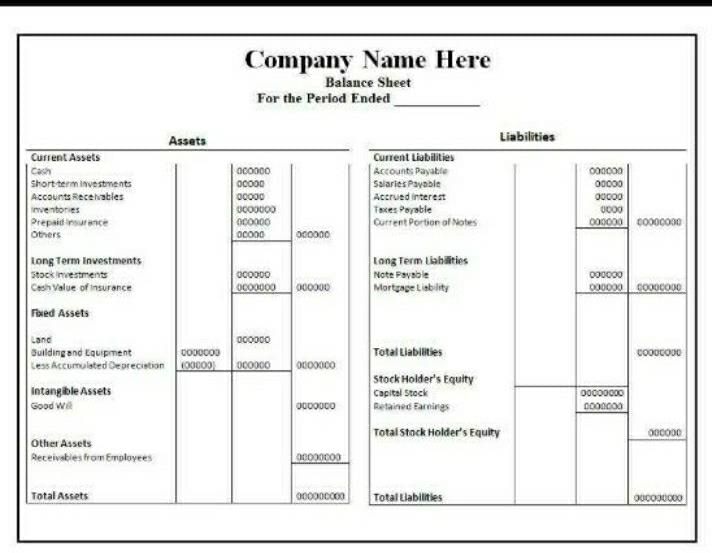

Example of Balance Sheet for Financial Statement:

A balance sheet is a financial statement that provides a snapshot of a company's financial position at a given point in time. It shows the assets, liabilities, and equity of the company and provides information on how the company has financed its operations.

Format of Balance Sheet:

A balance sheet is typically divided into two sections: Assets and Liabilities & Equity. Assets are what the company owns, while liabilities & equity are what the company owes.

1. Assets:

- Current Assets:

- Cash and Cash Equivalents

- Accounts Receivable

- Inventory

- Prepaid Expenses

- Long-term Assets:

- Property, Plant, and Equipment

- Intangible Assets

- Investments

2. Liabilities & Equity:

- Current Liabilities:

- Accounts Payable

- Accrued Expenses

- Short-term Loans

- Income Taxes Payable

- Long-term Liabilities:

- Long-term Debt

- Deferred Taxes

- Equity:

- Common Stock

- Retained Earnings

- Treasury Stock

Explain in Details:

Assets:

- Current Assets: These are assets that the company expects to convert into cash within one year or the operating cycle, whichever is longer. Examples include cash, accounts receivable, inventory, and prepaid expenses.

- Long-term Assets: These are assets that the company expects to hold for more than one year. Examples include property, plant, and equipment, intangible assets, and investments.

Liabilities & Equity:

- Current Liabilities: These are obligations that the company expects to pay within one year or the operating cycle, whichever is longer. Examples include accounts payable, accrued expenses, short-term loans, and income taxes payable.

- Long-term Liabilities: These are obligations that the company expects to pay beyond one year. Examples include long-term debt and deferred taxes.

- Equity: This represents the residual interest in the assets of the company after deducting liabilities. Examples include common stock, retained earnings, and treasury stock.

Balance Sheet Equation:

The balance sheet equation is Assets = Liabilities + Equity. This means that the total assets of the company must equal the total liabilities and equity. The balance sheet provides a snapshot of the financial position of the company at a given point in time. It is an important tool for investors, creditors, and other stakeholders to evaluate the financial health of the company.

A balance sheet is a financial statement that provides a snapshot of a company's financial position at a given point in time. It shows the assets, liabilities, and equity of the company and provides information on how the company has financed its operations.

Format of Balance Sheet:

A balance sheet is typically divided into two sections: Assets and Liabilities & Equity. Assets are what the company owns, while liabilities & equity are what the company owes.

1. Assets:

- Current Assets:

- Cash and Cash Equivalents

- Accounts Receivable

- Inventory

- Prepaid Expenses

- Long-term Assets:

- Property, Plant, and Equipment

- Intangible Assets

- Investments

2. Liabilities & Equity:

- Current Liabilities:

- Accounts Payable

- Accrued Expenses

- Short-term Loans

- Income Taxes Payable

- Long-term Liabilities:

- Long-term Debt

- Deferred Taxes

- Equity:

- Common Stock

- Retained Earnings

- Treasury Stock

Explain in Details:

Assets:

- Current Assets: These are assets that the company expects to convert into cash within one year or the operating cycle, whichever is longer. Examples include cash, accounts receivable, inventory, and prepaid expenses.

- Long-term Assets: These are assets that the company expects to hold for more than one year. Examples include property, plant, and equipment, intangible assets, and investments.

Liabilities & Equity:

- Current Liabilities: These are obligations that the company expects to pay within one year or the operating cycle, whichever is longer. Examples include accounts payable, accrued expenses, short-term loans, and income taxes payable.

- Long-term Liabilities: These are obligations that the company expects to pay beyond one year. Examples include long-term debt and deferred taxes.

- Equity: This represents the residual interest in the assets of the company after deducting liabilities. Examples include common stock, retained earnings, and treasury stock.

Balance Sheet Equation:

The balance sheet equation is Assets = Liabilities + Equity. This means that the total assets of the company must equal the total liabilities and equity. The balance sheet provides a snapshot of the financial position of the company at a given point in time. It is an important tool for investors, creditors, and other stakeholders to evaluate the financial health of the company.

Community Answer

example of balance sheet for financial statement Related: Format of B...

|

Explore Courses for Commerce exam

|

|

Similar Commerce Doubts

example of balance sheet for financial statement Related: Format of Balance Sheet?

Question Description

example of balance sheet for financial statement Related: Format of Balance Sheet? for Commerce 2025 is part of Commerce preparation. The Question and answers have been prepared according to the Commerce exam syllabus. Information about example of balance sheet for financial statement Related: Format of Balance Sheet? covers all topics & solutions for Commerce 2025 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for example of balance sheet for financial statement Related: Format of Balance Sheet?.

example of balance sheet for financial statement Related: Format of Balance Sheet? for Commerce 2025 is part of Commerce preparation. The Question and answers have been prepared according to the Commerce exam syllabus. Information about example of balance sheet for financial statement Related: Format of Balance Sheet? covers all topics & solutions for Commerce 2025 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for example of balance sheet for financial statement Related: Format of Balance Sheet?.

Solutions for example of balance sheet for financial statement Related: Format of Balance Sheet? in English & in Hindi are available as part of our courses for Commerce.

Download more important topics, notes, lectures and mock test series for Commerce Exam by signing up for free.

Here you can find the meaning of example of balance sheet for financial statement Related: Format of Balance Sheet? defined & explained in the simplest way possible. Besides giving the explanation of

example of balance sheet for financial statement Related: Format of Balance Sheet?, a detailed solution for example of balance sheet for financial statement Related: Format of Balance Sheet? has been provided alongside types of example of balance sheet for financial statement Related: Format of Balance Sheet? theory, EduRev gives you an

ample number of questions to practice example of balance sheet for financial statement Related: Format of Balance Sheet? tests, examples and also practice Commerce tests.

|

Explore Courses for Commerce exam

|

|

Signup for Free!

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.