CA Foundation Exam > CA Foundation Questions > How to calculate goodwill from annuity method...

Start Learning for Free

How to calculate goodwill from annuity method?

Most Upvoted Answer

How to calculate goodwill from annuity method?

Calculating Goodwill using Annuity Method

Goodwill is an intangible asset that arises when one company acquires another company for a price greater than the fair value of the net assets acquired. The annuity method is one of the methods used to calculate goodwill, and it is based on the future earnings or cash flows of the acquired company. Here are the steps to calculate goodwill using the annuity method:

Step 1: Calculate the average annual earnings

- Determine the earnings of the acquired company for the past few years.

- Calculate the average annual earnings by adding the earnings of the past few years and dividing the sum by the number of years.

Step 2: Determine the expected future earnings

- Estimate the expected future earnings of the acquired company for the next few years based on the current market conditions and the company’s performance.

- Calculate the average of the expected future earnings by adding the estimated earnings and dividing the sum by the number of years.

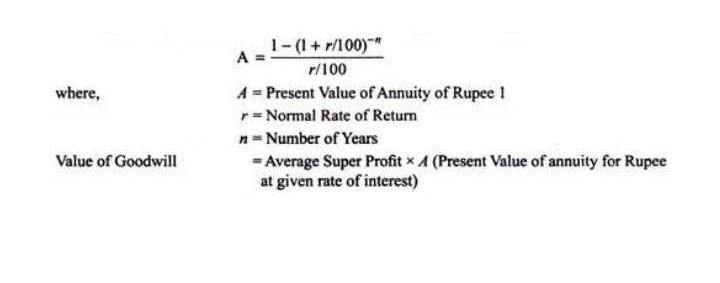

Step 3: Determine the annuity factor

- Calculate the annuity factor based on the number of years and the discount rate.

- The discount rate is the rate of return required by the acquirer to compensate for the risk of investing in the acquired company.

- The annuity factor is calculated using the following formula: AF = (1 - (1 + r)-n) / r, where AF is the annuity factor, r is the discount rate, and n is the number of years.

Step 4: Calculate the value of the annuity

- Multiply the average expected future earnings by the annuity factor to get the value of the annuity.

Step 5: Calculate the value of net assets acquired

- Determine the fair value of the net assets acquired, which includes tangible assets, intangible assets, liabilities, and equity.

- Calculate the difference between the fair value of the net assets acquired and the purchase price to get the value of goodwill.

Step 6: Calculate the value of goodwill

- Subtract the value of the annuity from the value of net assets acquired to get the value of goodwill.

Conclusion

The annuity method is one of the methods used to calculate goodwill, and it is based on the future earnings or cash flows of the acquired company. To calculate goodwill using the annuity method, you need to determine the average annual earnings, expected future earnings, annuity factor, value of the annuity, value of net assets acquired, and the value of goodwill.

Goodwill is an intangible asset that arises when one company acquires another company for a price greater than the fair value of the net assets acquired. The annuity method is one of the methods used to calculate goodwill, and it is based on the future earnings or cash flows of the acquired company. Here are the steps to calculate goodwill using the annuity method:

Step 1: Calculate the average annual earnings

- Determine the earnings of the acquired company for the past few years.

- Calculate the average annual earnings by adding the earnings of the past few years and dividing the sum by the number of years.

Step 2: Determine the expected future earnings

- Estimate the expected future earnings of the acquired company for the next few years based on the current market conditions and the company’s performance.

- Calculate the average of the expected future earnings by adding the estimated earnings and dividing the sum by the number of years.

Step 3: Determine the annuity factor

- Calculate the annuity factor based on the number of years and the discount rate.

- The discount rate is the rate of return required by the acquirer to compensate for the risk of investing in the acquired company.

- The annuity factor is calculated using the following formula: AF = (1 - (1 + r)-n) / r, where AF is the annuity factor, r is the discount rate, and n is the number of years.

Step 4: Calculate the value of the annuity

- Multiply the average expected future earnings by the annuity factor to get the value of the annuity.

Step 5: Calculate the value of net assets acquired

- Determine the fair value of the net assets acquired, which includes tangible assets, intangible assets, liabilities, and equity.

- Calculate the difference between the fair value of the net assets acquired and the purchase price to get the value of goodwill.

Step 6: Calculate the value of goodwill

- Subtract the value of the annuity from the value of net assets acquired to get the value of goodwill.

Conclusion

The annuity method is one of the methods used to calculate goodwill, and it is based on the future earnings or cash flows of the acquired company. To calculate goodwill using the annuity method, you need to determine the average annual earnings, expected future earnings, annuity factor, value of the annuity, value of net assets acquired, and the value of goodwill.

Community Answer

How to calculate goodwill from annuity method?

|

Explore Courses for CA Foundation exam

|

|

Similar CA Foundation Doubts

How to calculate goodwill from annuity method?

Question Description

How to calculate goodwill from annuity method? for CA Foundation 2025 is part of CA Foundation preparation. The Question and answers have been prepared according to the CA Foundation exam syllabus. Information about How to calculate goodwill from annuity method? covers all topics & solutions for CA Foundation 2025 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for How to calculate goodwill from annuity method?.

How to calculate goodwill from annuity method? for CA Foundation 2025 is part of CA Foundation preparation. The Question and answers have been prepared according to the CA Foundation exam syllabus. Information about How to calculate goodwill from annuity method? covers all topics & solutions for CA Foundation 2025 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for How to calculate goodwill from annuity method?.

Solutions for How to calculate goodwill from annuity method? in English & in Hindi are available as part of our courses for CA Foundation.

Download more important topics, notes, lectures and mock test series for CA Foundation Exam by signing up for free.

Here you can find the meaning of How to calculate goodwill from annuity method? defined & explained in the simplest way possible. Besides giving the explanation of

How to calculate goodwill from annuity method?, a detailed solution for How to calculate goodwill from annuity method? has been provided alongside types of How to calculate goodwill from annuity method? theory, EduRev gives you an

ample number of questions to practice How to calculate goodwill from annuity method? tests, examples and also practice CA Foundation tests.

|

Explore Courses for CA Foundation exam

|

|

Signup to solve all Doubts

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.