Commerce Exam > Commerce Questions > Face value of debenture Rs.100 ,issued 1000 ,...

Start Learning for Free

Face value of debenture Rs.100 ,issued 1000 , 10% Debentures as follows: CASE1- Issued @ Rs. 100 ; Redeemed @ Rs. 105 CASE2- issued @ Rs. 105 ; Redeemed @Rs.100?

Most Upvoted Answer

Face value of debenture Rs.100 ,issued 1000 , 10% Debentures as follow...

**Face Value of Debenture and its Issuance**

Debentures are long-term debt instruments issued by companies to raise funds from the public. They are usually issued at a specific face value, which represents the principal amount that the company promises to repay to the debenture holders upon maturity. In this case, the face value of the debenture is Rs. 100.

Debentures can be issued at par, at a premium, or at a discount to their face value. The issuance price depends on various factors such as market conditions, interest rates, and creditworthiness of the company. Let's analyze the two cases mentioned:

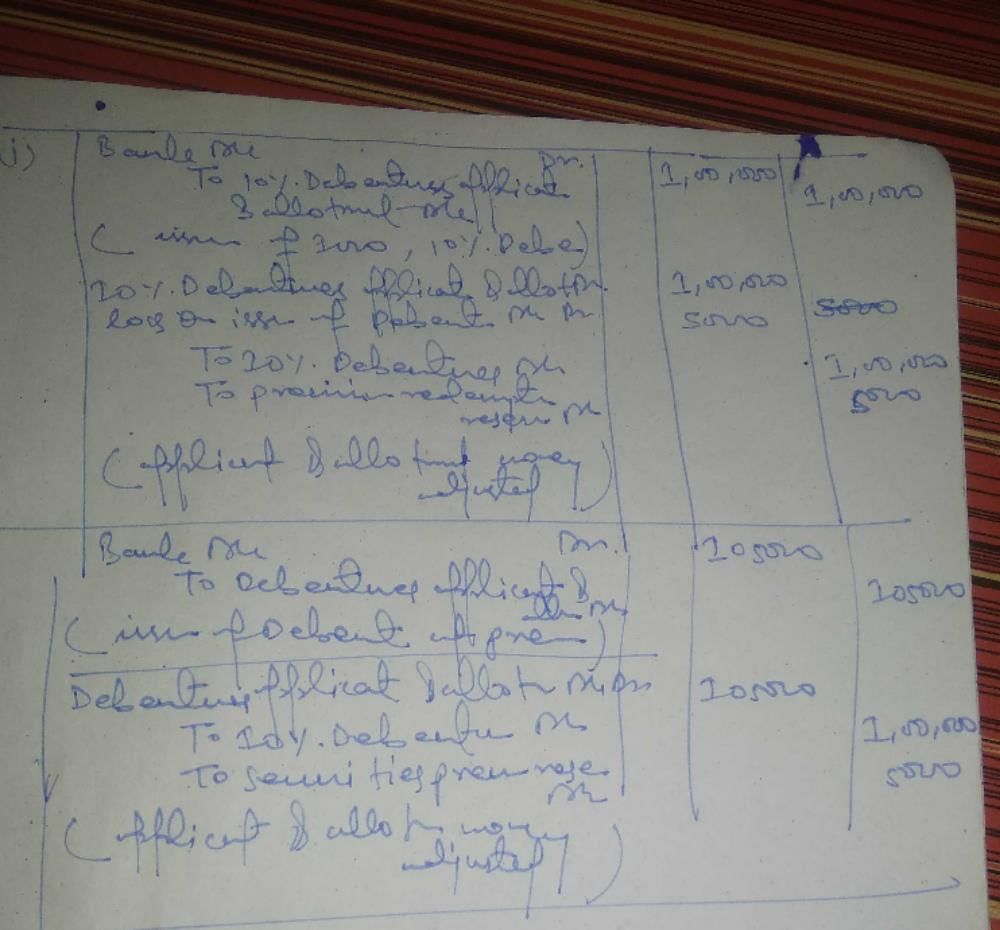

**CASE 1: Issued @ Rs. 100; Redeemed @ Rs. 105**

When debentures are issued at par, i.e., at their face value, the company receives the full amount of the debenture from the investors. In this case, the company issued 1000 debentures at Rs. 100 each, resulting in a total inflow of Rs. 1,00,000.

The debentures are redeemed at a premium of Rs. 105, which means that the company will pay Rs. 105 per debenture to the debenture holders upon maturity. Therefore, the total outflow for redemption would be Rs. 1,05,000.

**CASE 2: Issued @ Rs. 105; Redeemed @ Rs. 100**

When debentures are issued at a premium, i.e., at a price higher than their face value, the company receives a higher amount from the investors. In this case, the company issued 1000 debentures at Rs. 105 each, resulting in a total inflow of Rs. 1,05,000.

The debentures are redeemed at par, i.e., at their face value of Rs. 100. Therefore, the total outflow for redemption would be Rs. 1,00,000.

**Effect on the Company's Financials**

The issuance and redemption of debentures at different prices have implications on the company's financials. Let's analyze the impact of each case:

**CASE 1: Issued @ Rs. 100; Redeemed @ Rs. 105**

- Inflow from issuance: Rs. 1,00,000

- Outflow for redemption: Rs. 1,05,000

- Net effect: Decrease in cash by Rs. 5,000

**CASE 2: Issued @ Rs. 105; Redeemed @ Rs. 100**

- Inflow from issuance: Rs. 1,05,000

- Outflow for redemption: Rs. 1,00,000

- Net effect: Increase in cash by Rs. 5,000

**Conclusion**

The face value of a debenture represents the principal amount that the company promises to repay to the debenture holders upon maturity. The issuance and redemption prices of debentures can be at par, at a premium, or at a discount to their face value. The choice of issuance and redemption price depends on various factors and has implications on the company's financials. In the given cases, one debenture was issued at par and redeemed at a premium, while the other was issued at a premium and redeemed at par. The net effect on the company's cash

Debentures are long-term debt instruments issued by companies to raise funds from the public. They are usually issued at a specific face value, which represents the principal amount that the company promises to repay to the debenture holders upon maturity. In this case, the face value of the debenture is Rs. 100.

Debentures can be issued at par, at a premium, or at a discount to their face value. The issuance price depends on various factors such as market conditions, interest rates, and creditworthiness of the company. Let's analyze the two cases mentioned:

**CASE 1: Issued @ Rs. 100; Redeemed @ Rs. 105**

When debentures are issued at par, i.e., at their face value, the company receives the full amount of the debenture from the investors. In this case, the company issued 1000 debentures at Rs. 100 each, resulting in a total inflow of Rs. 1,00,000.

The debentures are redeemed at a premium of Rs. 105, which means that the company will pay Rs. 105 per debenture to the debenture holders upon maturity. Therefore, the total outflow for redemption would be Rs. 1,05,000.

**CASE 2: Issued @ Rs. 105; Redeemed @ Rs. 100**

When debentures are issued at a premium, i.e., at a price higher than their face value, the company receives a higher amount from the investors. In this case, the company issued 1000 debentures at Rs. 105 each, resulting in a total inflow of Rs. 1,05,000.

The debentures are redeemed at par, i.e., at their face value of Rs. 100. Therefore, the total outflow for redemption would be Rs. 1,00,000.

**Effect on the Company's Financials**

The issuance and redemption of debentures at different prices have implications on the company's financials. Let's analyze the impact of each case:

**CASE 1: Issued @ Rs. 100; Redeemed @ Rs. 105**

- Inflow from issuance: Rs. 1,00,000

- Outflow for redemption: Rs. 1,05,000

- Net effect: Decrease in cash by Rs. 5,000

**CASE 2: Issued @ Rs. 105; Redeemed @ Rs. 100**

- Inflow from issuance: Rs. 1,05,000

- Outflow for redemption: Rs. 1,00,000

- Net effect: Increase in cash by Rs. 5,000

**Conclusion**

The face value of a debenture represents the principal amount that the company promises to repay to the debenture holders upon maturity. The issuance and redemption prices of debentures can be at par, at a premium, or at a discount to their face value. The choice of issuance and redemption price depends on various factors and has implications on the company's financials. In the given cases, one debenture was issued at par and redeemed at a premium, while the other was issued at a premium and redeemed at par. The net effect on the company's cash

Community Answer

Face value of debenture Rs.100 ,issued 1000 , 10% Debentures as follow...

|

Explore Courses for Commerce exam

|

|

Question Description

Face value of debenture Rs.100 ,issued 1000 , 10% Debentures as follows: CASE1- Issued @ Rs. 100 ; Redeemed @ Rs. 105 CASE2- issued @ Rs. 105 ; Redeemed @Rs.100? for Commerce 2025 is part of Commerce preparation. The Question and answers have been prepared according to the Commerce exam syllabus. Information about Face value of debenture Rs.100 ,issued 1000 , 10% Debentures as follows: CASE1- Issued @ Rs. 100 ; Redeemed @ Rs. 105 CASE2- issued @ Rs. 105 ; Redeemed @Rs.100? covers all topics & solutions for Commerce 2025 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for Face value of debenture Rs.100 ,issued 1000 , 10% Debentures as follows: CASE1- Issued @ Rs. 100 ; Redeemed @ Rs. 105 CASE2- issued @ Rs. 105 ; Redeemed @Rs.100?.

Face value of debenture Rs.100 ,issued 1000 , 10% Debentures as follows: CASE1- Issued @ Rs. 100 ; Redeemed @ Rs. 105 CASE2- issued @ Rs. 105 ; Redeemed @Rs.100? for Commerce 2025 is part of Commerce preparation. The Question and answers have been prepared according to the Commerce exam syllabus. Information about Face value of debenture Rs.100 ,issued 1000 , 10% Debentures as follows: CASE1- Issued @ Rs. 100 ; Redeemed @ Rs. 105 CASE2- issued @ Rs. 105 ; Redeemed @Rs.100? covers all topics & solutions for Commerce 2025 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for Face value of debenture Rs.100 ,issued 1000 , 10% Debentures as follows: CASE1- Issued @ Rs. 100 ; Redeemed @ Rs. 105 CASE2- issued @ Rs. 105 ; Redeemed @Rs.100?.

Solutions for Face value of debenture Rs.100 ,issued 1000 , 10% Debentures as follows: CASE1- Issued @ Rs. 100 ; Redeemed @ Rs. 105 CASE2- issued @ Rs. 105 ; Redeemed @Rs.100? in English & in Hindi are available as part of our courses for Commerce.

Download more important topics, notes, lectures and mock test series for Commerce Exam by signing up for free.

Here you can find the meaning of Face value of debenture Rs.100 ,issued 1000 , 10% Debentures as follows: CASE1- Issued @ Rs. 100 ; Redeemed @ Rs. 105 CASE2- issued @ Rs. 105 ; Redeemed @Rs.100? defined & explained in the simplest way possible. Besides giving the explanation of

Face value of debenture Rs.100 ,issued 1000 , 10% Debentures as follows: CASE1- Issued @ Rs. 100 ; Redeemed @ Rs. 105 CASE2- issued @ Rs. 105 ; Redeemed @Rs.100?, a detailed solution for Face value of debenture Rs.100 ,issued 1000 , 10% Debentures as follows: CASE1- Issued @ Rs. 100 ; Redeemed @ Rs. 105 CASE2- issued @ Rs. 105 ; Redeemed @Rs.100? has been provided alongside types of Face value of debenture Rs.100 ,issued 1000 , 10% Debentures as follows: CASE1- Issued @ Rs. 100 ; Redeemed @ Rs. 105 CASE2- issued @ Rs. 105 ; Redeemed @Rs.100? theory, EduRev gives you an

ample number of questions to practice Face value of debenture Rs.100 ,issued 1000 , 10% Debentures as follows: CASE1- Issued @ Rs. 100 ; Redeemed @ Rs. 105 CASE2- issued @ Rs. 105 ; Redeemed @Rs.100? tests, examples and also practice Commerce tests.

|

Explore Courses for Commerce exam

|

|

Signup for Free!

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.