B Com Exam > B Com Questions > difference between direct tax And indirect ta...

Start Learning for Free

difference between direct tax And indirect tax

?Most Upvoted Answer

difference between direct tax And indirect tax Related: Basic Concept...

Community Answer

difference between direct tax And indirect tax Related: Basic Concept...

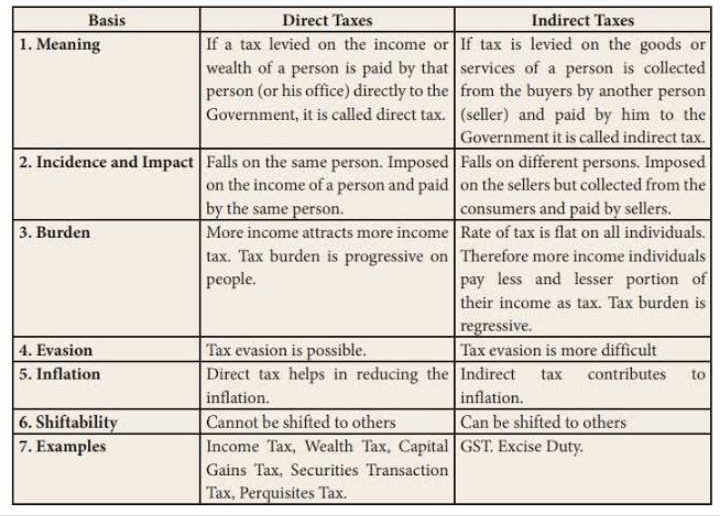

Difference Between Direct Tax and Indirect Tax

Direct taxes and indirect taxes are the two primary types of taxes levied by governments. Understanding their differences is crucial for grasping basic concepts of income tax and its laws.

Direct Tax:

- Direct taxes are taxes paid directly by individuals or organizations to the government.

- Examples include income tax, corporate tax, and wealth tax.

- The burden of direct taxes cannot be transferred; the taxpayer bears the full responsibility.

- Direct taxes are usually progressive, meaning the tax rate increases as the taxable amount increases.

Indirect Tax:

- Indirect taxes are levied on goods and services and are paid indirectly by consumers.

- Examples include Goods and Services Tax (GST), sales tax, and excise duty.

- The burden of indirect taxes can be passed on to consumers; businesses typically include these taxes in the price of goods/services.

- Indirect taxes are generally regressive, affecting lower-income individuals disproportionately compared to their income levels.

Basic Concepts of Income Tax:

- Income tax is a direct tax imposed on the income of individuals and entities.

- It is calculated on various income sources, such as salaries, profits, and capital gains.

- Income tax laws define the rates, exemptions, and deductions applicable, ensuring compliance and fairness in taxation.

Income Tax Laws:

- Governed by national legislation, income tax laws vary by country but generally aim to ensure equitable tax collection.

- They include provisions for filing returns, penalties for evasion, and specific regulations for different income categories.

- Understanding these laws is essential for taxpayers to navigate their obligations and optimize their tax liabilities.

In conclusion, both direct and indirect taxes play a significant role in a country's economy, influencing fiscal policies and individual financial planning.

Direct taxes and indirect taxes are the two primary types of taxes levied by governments. Understanding their differences is crucial for grasping basic concepts of income tax and its laws.

Direct Tax:

- Direct taxes are taxes paid directly by individuals or organizations to the government.

- Examples include income tax, corporate tax, and wealth tax.

- The burden of direct taxes cannot be transferred; the taxpayer bears the full responsibility.

- Direct taxes are usually progressive, meaning the tax rate increases as the taxable amount increases.

Indirect Tax:

- Indirect taxes are levied on goods and services and are paid indirectly by consumers.

- Examples include Goods and Services Tax (GST), sales tax, and excise duty.

- The burden of indirect taxes can be passed on to consumers; businesses typically include these taxes in the price of goods/services.

- Indirect taxes are generally regressive, affecting lower-income individuals disproportionately compared to their income levels.

Basic Concepts of Income Tax:

- Income tax is a direct tax imposed on the income of individuals and entities.

- It is calculated on various income sources, such as salaries, profits, and capital gains.

- Income tax laws define the rates, exemptions, and deductions applicable, ensuring compliance and fairness in taxation.

Income Tax Laws:

- Governed by national legislation, income tax laws vary by country but generally aim to ensure equitable tax collection.

- They include provisions for filing returns, penalties for evasion, and specific regulations for different income categories.

- Understanding these laws is essential for taxpayers to navigate their obligations and optimize their tax liabilities.

In conclusion, both direct and indirect taxes play a significant role in a country's economy, influencing fiscal policies and individual financial planning.

|

Explore Courses for B Com exam

|

|

Similar B Com Doubts

Question Description

difference between direct tax And indirect tax Related: Basic Concepts of Income Tax - Introduction, Income Tax Laws? for B Com 2025 is part of B Com preparation. The Question and answers have been prepared according to the B Com exam syllabus. Information about difference between direct tax And indirect tax Related: Basic Concepts of Income Tax - Introduction, Income Tax Laws? covers all topics & solutions for B Com 2025 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for difference between direct tax And indirect tax Related: Basic Concepts of Income Tax - Introduction, Income Tax Laws?.

difference between direct tax And indirect tax Related: Basic Concepts of Income Tax - Introduction, Income Tax Laws? for B Com 2025 is part of B Com preparation. The Question and answers have been prepared according to the B Com exam syllabus. Information about difference between direct tax And indirect tax Related: Basic Concepts of Income Tax - Introduction, Income Tax Laws? covers all topics & solutions for B Com 2025 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for difference between direct tax And indirect tax Related: Basic Concepts of Income Tax - Introduction, Income Tax Laws?.

Solutions for difference between direct tax And indirect tax Related: Basic Concepts of Income Tax - Introduction, Income Tax Laws? in English & in Hindi are available as part of our courses for B Com.

Download more important topics, notes, lectures and mock test series for B Com Exam by signing up for free.

Here you can find the meaning of difference between direct tax And indirect tax Related: Basic Concepts of Income Tax - Introduction, Income Tax Laws? defined & explained in the simplest way possible. Besides giving the explanation of

difference between direct tax And indirect tax Related: Basic Concepts of Income Tax - Introduction, Income Tax Laws?, a detailed solution for difference between direct tax And indirect tax Related: Basic Concepts of Income Tax - Introduction, Income Tax Laws? has been provided alongside types of difference between direct tax And indirect tax Related: Basic Concepts of Income Tax - Introduction, Income Tax Laws? theory, EduRev gives you an

ample number of questions to practice difference between direct tax And indirect tax Related: Basic Concepts of Income Tax - Introduction, Income Tax Laws? tests, examples and also practice B Com tests.

|

Explore Courses for B Com exam

|

|

Signup to solve all Doubts

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.