B Com Exam > B Com Questions > Differentiate between internal and external r...

Start Learning for Free

Differentiate between internal and external reconstruction.?

Most Upvoted Answer

Differentiate between internal and external reconstruction.?

Internal and External Reconstruction

Internal and external reconstruction are two methods used by companies to restructure their finances and operations. While both approaches aim to address financial difficulties, they differ in terms of their scope, purpose, and process.

Internal Reconstruction

Internal reconstruction involves the reorganization of a company's financial structure without changing its legal status or ownership. This method is usually adopted when a company is facing financial difficulties but is still considered viable in the long term. Internal reconstruction involves the following steps:

The main objective of internal reconstruction is to improve the company's financial health and stability while preserving its legal status and ownership structure.

External Reconstruction

External reconstruction involves the complete or partial transfer of a company's business and assets to a new legal entity. This method is usually adopted when a company is facing severe financial difficulties or is insolvent. External reconstruction involves the following steps:

The main objective of external reconstruction is to rescue the company's business and assets from insolvency and preserve their value for the benefit of stakeholders.

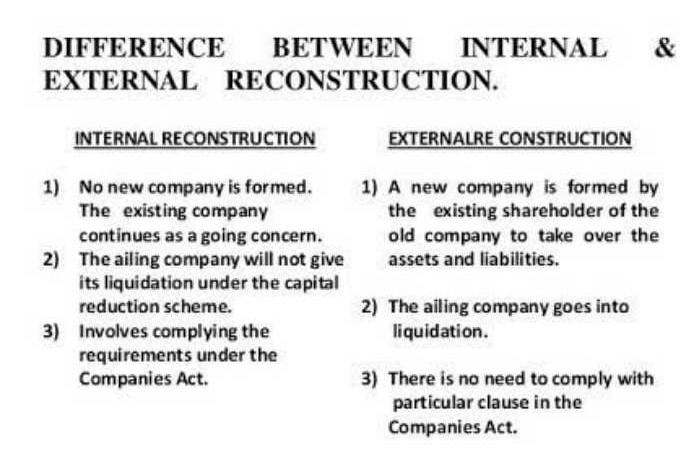

Key Differences between Internal and External Reconstruction

In conclusion, internal and external reconstruction are two methods that companies can use to address financial difficulties. Internal reconstruction involves the reorganization of a company's financial structure without changing its legal status or ownership, while external reconstruction involves the complete or partial transfer of a company's business and assets to a new legal entity. Companies can choose the method that best suits their needs and objectives.

Internal and external reconstruction are two methods used by companies to restructure their finances and operations. While both approaches aim to address financial difficulties, they differ in terms of their scope, purpose, and process.

Internal Reconstruction

Internal reconstruction involves the reorganization of a company's financial structure without changing its legal status or ownership. This method is usually adopted when a company is facing financial difficulties but is still considered viable in the long term. Internal reconstruction involves the following steps:

- Identifying the root causes of financial difficulties

- Reviewing the company's assets and liabilities

- Writing off bad debts and reducing unnecessary expenses

- Revaluing assets and liabilities to reflect their true value

- Creating new reserves and using them to offset losses

- Issuing new shares or debentures to raise capital

- Redistributing profits and losses among shareholders

- Preparing new financial statements and reports

The main objective of internal reconstruction is to improve the company's financial health and stability while preserving its legal status and ownership structure.

External Reconstruction

External reconstruction involves the complete or partial transfer of a company's business and assets to a new legal entity. This method is usually adopted when a company is facing severe financial difficulties or is insolvent. External reconstruction involves the following steps:

- Identifying the root causes of financial difficulties

- Reviewing the company's assets and liabilities

- Valuing the company's business and assets

- Negotiating with creditors and stakeholders

- Transferring the company's business and assets to a new legal entity

- Issuing new shares or debentures to raise capital

- Compensating shareholders and creditors of the old company

- Preparing new financial statements and reports

The main objective of external reconstruction is to rescue the company's business and assets from insolvency and preserve their value for the benefit of stakeholders.

Key Differences between Internal and External Reconstruction

- Scope: Internal reconstruction involves the reorganization of a company's financial structure, while external reconstruction involves the transfer of a company's business and assets to a new legal entity.

- Purpose: Internal reconstruction aims to improve the company's financial health and stability, while external reconstruction aims to rescue the company's business and assets from insolvency.

- Legal status: Internal reconstruction preserves the company's legal status and ownership structure, while external reconstruction creates a new legal entity.

- Process: Internal reconstruction involves a series of financial and accounting measures, while external reconstruction involves negotiations with creditors and stakeholders, as well as legal and regulatory procedures.

In conclusion, internal and external reconstruction are two methods that companies can use to address financial difficulties. Internal reconstruction involves the reorganization of a company's financial structure without changing its legal status or ownership, while external reconstruction involves the complete or partial transfer of a company's business and assets to a new legal entity. Companies can choose the method that best suits their needs and objectives.

Community Answer

Differentiate between internal and external reconstruction.?

|

Explore Courses for B Com exam

|

|

Similar B Com Doubts

Differentiate between internal and external reconstruction.?

Question Description

Differentiate between internal and external reconstruction.? for B Com 2025 is part of B Com preparation. The Question and answers have been prepared according to the B Com exam syllabus. Information about Differentiate between internal and external reconstruction.? covers all topics & solutions for B Com 2025 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for Differentiate between internal and external reconstruction.?.

Differentiate between internal and external reconstruction.? for B Com 2025 is part of B Com preparation. The Question and answers have been prepared according to the B Com exam syllabus. Information about Differentiate between internal and external reconstruction.? covers all topics & solutions for B Com 2025 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for Differentiate between internal and external reconstruction.?.

Solutions for Differentiate between internal and external reconstruction.? in English & in Hindi are available as part of our courses for B Com.

Download more important topics, notes, lectures and mock test series for B Com Exam by signing up for free.

Here you can find the meaning of Differentiate between internal and external reconstruction.? defined & explained in the simplest way possible. Besides giving the explanation of

Differentiate between internal and external reconstruction.?, a detailed solution for Differentiate between internal and external reconstruction.? has been provided alongside types of Differentiate between internal and external reconstruction.? theory, EduRev gives you an

ample number of questions to practice Differentiate between internal and external reconstruction.? tests, examples and also practice B Com tests.

|

Explore Courses for B Com exam

|

|

Signup to solve all Doubts

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.