B Com Exam > B Com Questions > X limited purchased machine from a vendor for...

Start Learning for Free

X limited purchased machine from a vendor for 165000 . the company allotted him equity share at premium of 10% instead of paying him in cash the vendor will be allotted equity share of 10 each?

Most Upvoted Answer

X limited purchased machine from a vendor for 165000 . the company all...

Explanation:

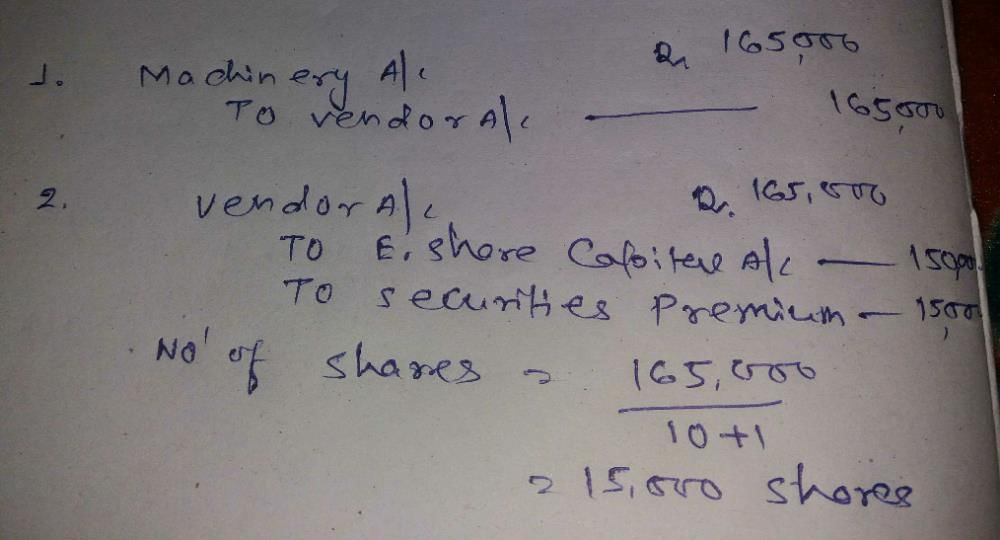

X limited has purchased a machine from a vendor for 165000. Instead of paying him in cash, the vendor will be allotted equity share at a premium of 10%. The company will allot him equity shares of 10 each. Let's understand this transaction in detail.

Equity Shares:

Equity shares are the most common type of shares that a company can issue. The holder of equity shares is a partial owner of the company and has the right to vote at the company's annual general meeting (AGM). Equity shareholders also have the right to receive dividends, which are paid out of the company's profits.

Premium on Equity Shares:

Premium on equity shares is the amount that a company charges over and above the face value of the share. It is charged when the company has a good reputation or when it is in a strong financial position. The premium on equity shares is calculated as follows:

Premium on Equity Shares = (Issue Price - Face Value) / Face Value * 100

Transaction:

In this transaction, the vendor has sold the machine to X limited for 165000. Instead of paying him in cash, the company has decided to allot him equity shares at a premium of 10%. The premium on equity shares will be calculated as follows:

Premium on Equity Shares = (10 - 10) / 10 * 100 = 0%

Therefore, the company will allot equity shares to the vendor at a price of 10 per share, which is the face value of the share. The vendor will receive 16500 equity shares (165000/10). The vendor will become a shareholder of the company and will have the right to vote at the AGM and receive dividends.

Conclusion:

In conclusion, X limited has purchased a machine from a vendor for 165000 and instead of paying him in cash, the company has decided to allot equity shares to the vendor at a premium of 10%. The vendor will be allotted equity shares at a price of 10 per share, which is the face value of the share. The vendor will become a shareholder of the company and will have the right to vote at the AGM and receive dividends.

X limited has purchased a machine from a vendor for 165000. Instead of paying him in cash, the vendor will be allotted equity share at a premium of 10%. The company will allot him equity shares of 10 each. Let's understand this transaction in detail.

Equity Shares:

Equity shares are the most common type of shares that a company can issue. The holder of equity shares is a partial owner of the company and has the right to vote at the company's annual general meeting (AGM). Equity shareholders also have the right to receive dividends, which are paid out of the company's profits.

Premium on Equity Shares:

Premium on equity shares is the amount that a company charges over and above the face value of the share. It is charged when the company has a good reputation or when it is in a strong financial position. The premium on equity shares is calculated as follows:

Premium on Equity Shares = (Issue Price - Face Value) / Face Value * 100

Transaction:

In this transaction, the vendor has sold the machine to X limited for 165000. Instead of paying him in cash, the company has decided to allot him equity shares at a premium of 10%. The premium on equity shares will be calculated as follows:

Premium on Equity Shares = (10 - 10) / 10 * 100 = 0%

Therefore, the company will allot equity shares to the vendor at a price of 10 per share, which is the face value of the share. The vendor will receive 16500 equity shares (165000/10). The vendor will become a shareholder of the company and will have the right to vote at the AGM and receive dividends.

Conclusion:

In conclusion, X limited has purchased a machine from a vendor for 165000 and instead of paying him in cash, the company has decided to allot equity shares to the vendor at a premium of 10%. The vendor will be allotted equity shares at a price of 10 per share, which is the face value of the share. The vendor will become a shareholder of the company and will have the right to vote at the AGM and receive dividends.

Community Answer

X limited purchased machine from a vendor for 165000 . the company all...

|

Explore Courses for B Com exam

|

|

Similar B Com Doubts

X limited purchased machine from a vendor for 165000 . the company allotted him equity share at premium of 10% instead of paying him in cash the vendor will be allotted equity share of 10 each?

Question Description

X limited purchased machine from a vendor for 165000 . the company allotted him equity share at premium of 10% instead of paying him in cash the vendor will be allotted equity share of 10 each? for B Com 2024 is part of B Com preparation. The Question and answers have been prepared according to the B Com exam syllabus. Information about X limited purchased machine from a vendor for 165000 . the company allotted him equity share at premium of 10% instead of paying him in cash the vendor will be allotted equity share of 10 each? covers all topics & solutions for B Com 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for X limited purchased machine from a vendor for 165000 . the company allotted him equity share at premium of 10% instead of paying him in cash the vendor will be allotted equity share of 10 each?.

X limited purchased machine from a vendor for 165000 . the company allotted him equity share at premium of 10% instead of paying him in cash the vendor will be allotted equity share of 10 each? for B Com 2024 is part of B Com preparation. The Question and answers have been prepared according to the B Com exam syllabus. Information about X limited purchased machine from a vendor for 165000 . the company allotted him equity share at premium of 10% instead of paying him in cash the vendor will be allotted equity share of 10 each? covers all topics & solutions for B Com 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for X limited purchased machine from a vendor for 165000 . the company allotted him equity share at premium of 10% instead of paying him in cash the vendor will be allotted equity share of 10 each?.

Solutions for X limited purchased machine from a vendor for 165000 . the company allotted him equity share at premium of 10% instead of paying him in cash the vendor will be allotted equity share of 10 each? in English & in Hindi are available as part of our courses for B Com.

Download more important topics, notes, lectures and mock test series for B Com Exam by signing up for free.

Here you can find the meaning of X limited purchased machine from a vendor for 165000 . the company allotted him equity share at premium of 10% instead of paying him in cash the vendor will be allotted equity share of 10 each? defined & explained in the simplest way possible. Besides giving the explanation of

X limited purchased machine from a vendor for 165000 . the company allotted him equity share at premium of 10% instead of paying him in cash the vendor will be allotted equity share of 10 each?, a detailed solution for X limited purchased machine from a vendor for 165000 . the company allotted him equity share at premium of 10% instead of paying him in cash the vendor will be allotted equity share of 10 each? has been provided alongside types of X limited purchased machine from a vendor for 165000 . the company allotted him equity share at premium of 10% instead of paying him in cash the vendor will be allotted equity share of 10 each? theory, EduRev gives you an

ample number of questions to practice X limited purchased machine from a vendor for 165000 . the company allotted him equity share at premium of 10% instead of paying him in cash the vendor will be allotted equity share of 10 each? tests, examples and also practice B Com tests.

|

Explore Courses for B Com exam

|

|

Suggested Free Tests

Signup for Free!

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.