CA Foundation Exam > CA Foundation Questions > What is difference between reserve and provis...

Start Learning for Free

What is difference between reserve and provision?

Most Upvoted Answer

What is difference between reserve and provision?

Community Answer

What is difference between reserve and provision?

Reserve vs Provision: Understanding the Difference

Reserve and provision are two accounting terms that are often used interchangeably. However, they have distinct meanings and implications in financial reporting. Let's delve deeper into the difference between reserve and provision.

Reserve:

A reserve is an appropriation of profit that is set aside for a specific purpose or to strengthen the financial position of a company. It represents a portion of a company's retained earnings that is retained rather than distributed as dividends to shareholders. Reserves can be classified into different types based on their purpose:

1. General Reserve: It is created to strengthen the financial position of the company and acts as a cushion against unexpected losses or contingencies.

2. Specific Reserve: These reserves are created for a specific purpose, such as the replacement of assets or future expansion projects.

3. Capital Reserve: Capital reserves are created from the proceeds of the sale of fixed assets or through the revaluation of assets and liabilities. They cannot be distributed as dividends and are utilized to meet capital expenditure or to write off capital losses.

4. Revenue Reserve: Revenue reserves are created from the retained earnings of a company and can be used for any purpose, including the payment of dividends or expansion projects.

Provision:

A provision, on the other hand, is a liability that is created to cover an anticipated or known future expense. It is an estimated amount that a company sets aside to meet a specific liability or loss. Provisions are recognized when there is a probable obligation, and the amount can be reasonably estimated. Some common types of provisions include:

1. Provision for Bad Debts: This is created to cover potential losses from customers who may default on their payments.

2. Provision for Inventory Obsolescence: It is created to account for potential losses due to the obsolescence of inventory.

3. Provision for Legal Claims: Companies create provisions to cover legal claims or disputes that are likely to result in financial obligations.

4. Provision for Employee Benefits: Companies set aside provisions for employee benefits such as gratuity, pensions, or medical benefits that will be paid in the future.

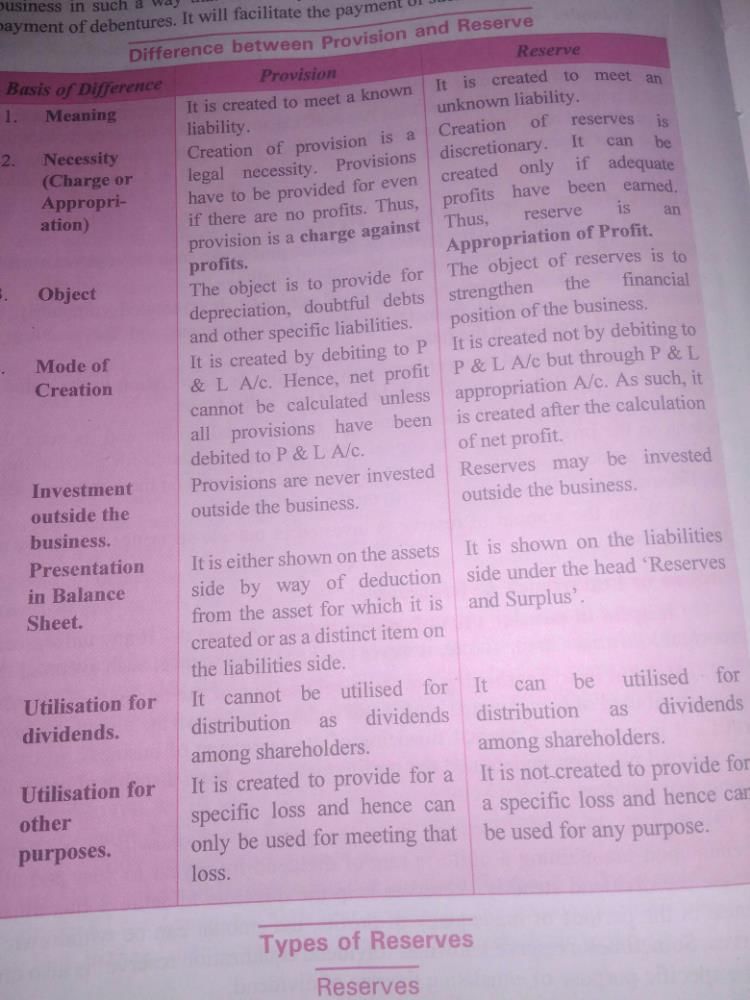

Difference between Reserve and Provision:

The key differences between reserves and provisions can be summarized as follows:

1. Nature: Reserves represent an appropriation of profits, while provisions represent estimated future liabilities.

2. Purpose: Reserves are created to strengthen the financial position of the company or for a specific purpose, while provisions are set aside to cover anticipated or known future expenses.

3. Treatment: Reserves are shown on the liabilities side of the balance sheet, while provisions are shown as liabilities.

4. Flexibility: Reserves can be used for any purpose deemed necessary by the company, while provisions can only be used for the specific liability they were created for.

In conclusion, reserves and provisions serve different purposes in accounting. Reserves are retained earnings set aside for strengthening the financial position of a company, while provisions are estimated future liabilities that are created to cover specific expenses. Understanding the distinction between the two is essential for accurate financial reporting and decision-making.

Reserve and provision are two accounting terms that are often used interchangeably. However, they have distinct meanings and implications in financial reporting. Let's delve deeper into the difference between reserve and provision.

Reserve:

A reserve is an appropriation of profit that is set aside for a specific purpose or to strengthen the financial position of a company. It represents a portion of a company's retained earnings that is retained rather than distributed as dividends to shareholders. Reserves can be classified into different types based on their purpose:

1. General Reserve: It is created to strengthen the financial position of the company and acts as a cushion against unexpected losses or contingencies.

2. Specific Reserve: These reserves are created for a specific purpose, such as the replacement of assets or future expansion projects.

3. Capital Reserve: Capital reserves are created from the proceeds of the sale of fixed assets or through the revaluation of assets and liabilities. They cannot be distributed as dividends and are utilized to meet capital expenditure or to write off capital losses.

4. Revenue Reserve: Revenue reserves are created from the retained earnings of a company and can be used for any purpose, including the payment of dividends or expansion projects.

Provision:

A provision, on the other hand, is a liability that is created to cover an anticipated or known future expense. It is an estimated amount that a company sets aside to meet a specific liability or loss. Provisions are recognized when there is a probable obligation, and the amount can be reasonably estimated. Some common types of provisions include:

1. Provision for Bad Debts: This is created to cover potential losses from customers who may default on their payments.

2. Provision for Inventory Obsolescence: It is created to account for potential losses due to the obsolescence of inventory.

3. Provision for Legal Claims: Companies create provisions to cover legal claims or disputes that are likely to result in financial obligations.

4. Provision for Employee Benefits: Companies set aside provisions for employee benefits such as gratuity, pensions, or medical benefits that will be paid in the future.

Difference between Reserve and Provision:

The key differences between reserves and provisions can be summarized as follows:

1. Nature: Reserves represent an appropriation of profits, while provisions represent estimated future liabilities.

2. Purpose: Reserves are created to strengthen the financial position of the company or for a specific purpose, while provisions are set aside to cover anticipated or known future expenses.

3. Treatment: Reserves are shown on the liabilities side of the balance sheet, while provisions are shown as liabilities.

4. Flexibility: Reserves can be used for any purpose deemed necessary by the company, while provisions can only be used for the specific liability they were created for.

In conclusion, reserves and provisions serve different purposes in accounting. Reserves are retained earnings set aside for strengthening the financial position of a company, while provisions are estimated future liabilities that are created to cover specific expenses. Understanding the distinction between the two is essential for accurate financial reporting and decision-making.

|

Explore Courses for CA Foundation exam

|

|

Similar CA Foundation Doubts

Question Description

What is difference between reserve and provision? for CA Foundation 2025 is part of CA Foundation preparation. The Question and answers have been prepared according to the CA Foundation exam syllabus. Information about What is difference between reserve and provision? covers all topics & solutions for CA Foundation 2025 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for What is difference between reserve and provision?.

What is difference between reserve and provision? for CA Foundation 2025 is part of CA Foundation preparation. The Question and answers have been prepared according to the CA Foundation exam syllabus. Information about What is difference between reserve and provision? covers all topics & solutions for CA Foundation 2025 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for What is difference between reserve and provision?.

Solutions for What is difference between reserve and provision? in English & in Hindi are available as part of our courses for CA Foundation.

Download more important topics, notes, lectures and mock test series for CA Foundation Exam by signing up for free.

Here you can find the meaning of What is difference between reserve and provision? defined & explained in the simplest way possible. Besides giving the explanation of

What is difference between reserve and provision?, a detailed solution for What is difference between reserve and provision? has been provided alongside types of What is difference between reserve and provision? theory, EduRev gives you an

ample number of questions to practice What is difference between reserve and provision? tests, examples and also practice CA Foundation tests.

|

Explore Courses for CA Foundation exam

|

|

Signup to solve all Doubts

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.