Commerce Exam > Commerce Questions > Based on the below information, answer the gi...

Start Learning for Free

Based on the below information, answer the given questions:

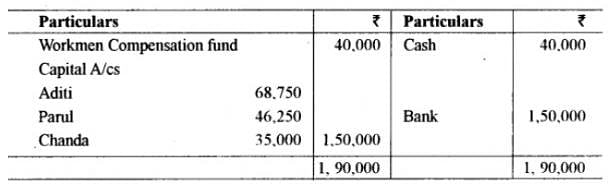

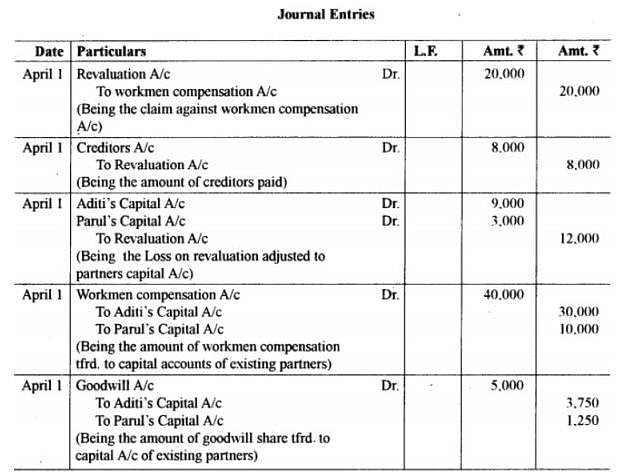

Aditi and Parul are partners in a firm with capitals of ₹ 35,000 each. They shared profits and losses in the ratio of 3 : 1. On 1st April, 2017, they admitted Chanda into their partnership with 1/5th share in the profits. Chanda brings in ₹40,000 as her capital and her share of goodwill in cash. Her share of goodwill is calculated on the basis of her capital contribution and her share of profits in the firm. At the time of Chanda’s admission :

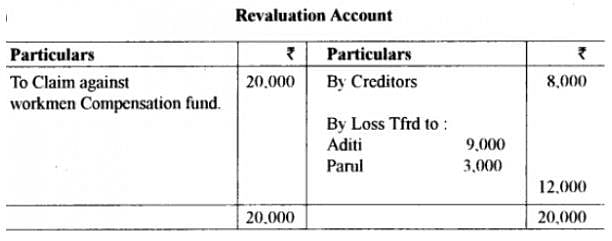

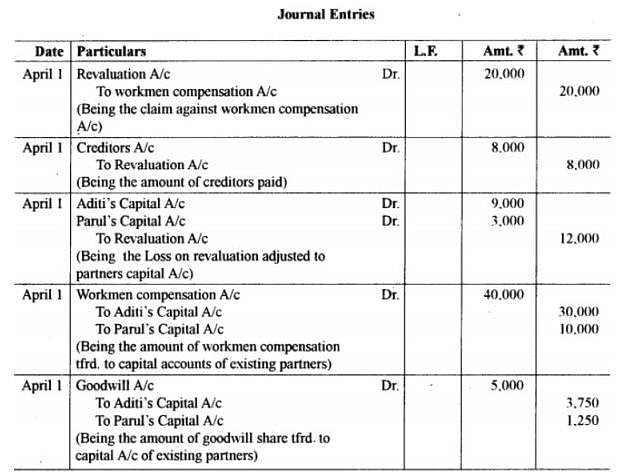

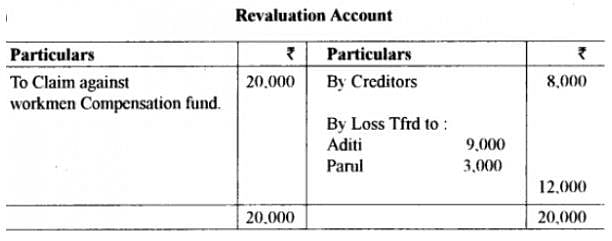

(a) The firm had a Workmen Compensation Reserve of ₹ 60,000 against which there was a claim of ₹ 20,000.

(b) Creditors of ₹ 8,000 were paid by Aditi privately for which she is not to be reimbursed.

(c) There was no change in the value of other assets and liabilities.

What is the amount of goodwill to be transferred to Aditi’s Capital Account?

- a)₹2,100

- b)₹6,300

- c)₹8,400

- d)None of these

Correct answer is option 'B'. Can you explain this answer?

| FREE This question is part of | Download PDF Attempt this Test |

Verified Answer

Based on the below information, answer the given questions:Aditi and P...

3/4 of ₹8400 = ₹6,300

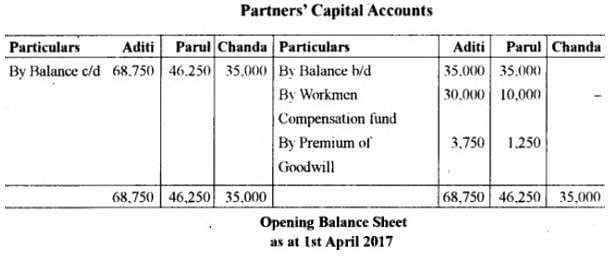

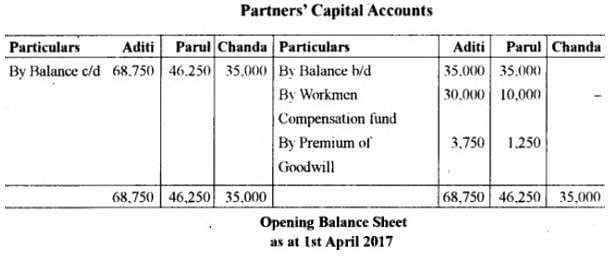

Working Notes: Assuming the capital of Chanda = Rs 35,000 (equal to Capital of both existing partners) Calculation of Goodwill Old Profit Sharing Ratio of Aditi and Parul = 3 : 1 New Profit Sharing Ratio = 3/5 : 1/5 = 1/5 = 3 : 1 = 1 Sacrifice of Aditi = 3/4 - 3/5 = 3/20 Sacrifice of Parul = 1/4 - 1/5 = 1/20 Gain of Chanda = 1/5 The amount of goodwill of Chanda = Rs 5,000 Total Goodwill of the firm = 5/1 × 5,000 Rs 25,000

Working Notes: Assuming the capital of Chanda = Rs 35,000 (equal to Capital of both existing partners) Calculation of Goodwill Old Profit Sharing Ratio of Aditi and Parul = 3 : 1 New Profit Sharing Ratio = 3/5 : 1/5 = 1/5 = 3 : 1 = 1 Sacrifice of Aditi = 3/4 - 3/5 = 3/20 Sacrifice of Parul = 1/4 - 1/5 = 1/20 Gain of Chanda = 1/5 The amount of goodwill of Chanda = Rs 5,000 Total Goodwill of the firm = 5/1 × 5,000 Rs 25,000

Most Upvoted Answer

Based on the below information, answer the given questions:Aditi and P...

Calculation of Goodwill

- Aditi and Parul’s capitals = ₹35,000 each

- Total capital = ₹70,000

- Profit sharing ratio = 3:1

- Chanda’s share in profits = 1/5

- Chanda’s capital = ₹40,000

- Chanda’s share of goodwill = (Chanda’s capital/Total capital) x (Chanda’s share in profits) = (40,000/1,10,000) x (1/5) = ₹800

Adjustments at the time of Chanda’s admission

- Workmen Compensation Reserve = ₹60,000

- Claim against WCR = ₹20,000

- WCR after claim = ₹40,000

- Creditors paid by Aditi privately = ₹8,000

Calculation of new profit sharing ratio

- Old ratio = Aditi : Parul = 3 : 1

- New ratio = (Aditi + Parul + Chanda) : Chanda = (70,000 + 70,000 + 40,000) : 40,000 = 4 : 1

Distribution of goodwill

- Aditi’s share = (Aditi’s old capital/Total old capital) x Total goodwill = (35,000/70,000) x 800 = ₹400

- Parul’s share = (Parul’s old capital/Total old capital) x Total goodwill = (35,000/70,000) x 800 = ₹400

- Chanda’s share = ₹800

Adjustment of WCR and creditor’s payment

- Aditi paid the creditors privately, so she should be reimbursed for the same.

- The WCR should be adjusted by transferring the excess amount to the partners’ capital accounts in their profit sharing ratio.

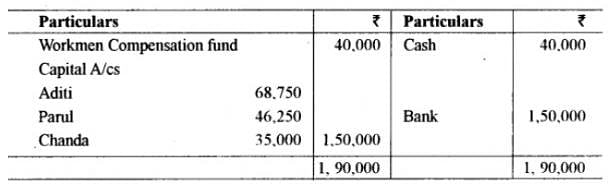

Calculation of final capital balances

- Aditi’s capital = Aditi’s old capital + Aditi’s share of goodwill + reimbursement for creditor’s payment - adjustment in WCR = 35,000 + 400 + 4,000 - 12,000 = ₹27,400

- Parul’s capital = Parul’s old capital + Parul’s share of goodwill - adjustment in WCR = 35,000 + 400 - 12,000 = ₹23,400

- Chanda’s capital = Chanda’s contribution + Chanda’s share of goodwill = 40,000 + 800 = ₹40,800

Answer: The amount of goodwill to be transferred to Aditi’s Capital Account is ₹6,300 (Aditi’s share of goodwill).

- Aditi and Parul’s capitals = ₹35,000 each

- Total capital = ₹70,000

- Profit sharing ratio = 3:1

- Chanda’s share in profits = 1/5

- Chanda’s capital = ₹40,000

- Chanda’s share of goodwill = (Chanda’s capital/Total capital) x (Chanda’s share in profits) = (40,000/1,10,000) x (1/5) = ₹800

Adjustments at the time of Chanda’s admission

- Workmen Compensation Reserve = ₹60,000

- Claim against WCR = ₹20,000

- WCR after claim = ₹40,000

- Creditors paid by Aditi privately = ₹8,000

Calculation of new profit sharing ratio

- Old ratio = Aditi : Parul = 3 : 1

- New ratio = (Aditi + Parul + Chanda) : Chanda = (70,000 + 70,000 + 40,000) : 40,000 = 4 : 1

Distribution of goodwill

- Aditi’s share = (Aditi’s old capital/Total old capital) x Total goodwill = (35,000/70,000) x 800 = ₹400

- Parul’s share = (Parul’s old capital/Total old capital) x Total goodwill = (35,000/70,000) x 800 = ₹400

- Chanda’s share = ₹800

Adjustment of WCR and creditor’s payment

- Aditi paid the creditors privately, so she should be reimbursed for the same.

- The WCR should be adjusted by transferring the excess amount to the partners’ capital accounts in their profit sharing ratio.

Calculation of final capital balances

- Aditi’s capital = Aditi’s old capital + Aditi’s share of goodwill + reimbursement for creditor’s payment - adjustment in WCR = 35,000 + 400 + 4,000 - 12,000 = ₹27,400

- Parul’s capital = Parul’s old capital + Parul’s share of goodwill - adjustment in WCR = 35,000 + 400 - 12,000 = ₹23,400

- Chanda’s capital = Chanda’s contribution + Chanda’s share of goodwill = 40,000 + 800 = ₹40,800

Answer: The amount of goodwill to be transferred to Aditi’s Capital Account is ₹6,300 (Aditi’s share of goodwill).

Attention Commerce Students!

To make sure you are not studying endlessly, EduRev has designed Commerce study material, with Structured Courses, Videos, & Test Series. Plus get personalized analysis, doubt solving and improvement plans to achieve a great score in Commerce.

|

Explore Courses for Commerce exam

|

|

Similar Commerce Doubts

Based on the below information, answer the given questions:Aditi and Parul are partners in a firm with capitals of 35,000 each. They shared profits and losses in the ratio of 3 : 1. On 1st April, 2017, they admitted Chanda into their partnership with 1/5th share in the profits. Chanda brings in 40,000 as her capital and her share of goodwill in cash. Her share of goodwill is calculated on the basis of her capital contribution and her share of profits in the firm. At the time of Chanda’s admission :(a) The firm had a Workmen Compensation Reserve of 60,000 against which there was a claim of 20,000.(b) Creditors of 8,000 were paid by Aditi privately for which she is not to be reimbursed.(c) There was no change in the value of other assets and liabilities.What is the amount of goodwill to be transferred to Aditi’s Capital Account?a)2,100b)6,300c)8,400d)None of theseCorrect answer is option 'B'. Can you explain this answer?

Question Description

Based on the below information, answer the given questions:Aditi and Parul are partners in a firm with capitals of 35,000 each. They shared profits and losses in the ratio of 3 : 1. On 1st April, 2017, they admitted Chanda into their partnership with 1/5th share in the profits. Chanda brings in 40,000 as her capital and her share of goodwill in cash. Her share of goodwill is calculated on the basis of her capital contribution and her share of profits in the firm. At the time of Chanda’s admission :(a) The firm had a Workmen Compensation Reserve of 60,000 against which there was a claim of 20,000.(b) Creditors of 8,000 were paid by Aditi privately for which she is not to be reimbursed.(c) There was no change in the value of other assets and liabilities.What is the amount of goodwill to be transferred to Aditi’s Capital Account?a)2,100b)6,300c)8,400d)None of theseCorrect answer is option 'B'. Can you explain this answer? for Commerce 2024 is part of Commerce preparation. The Question and answers have been prepared according to the Commerce exam syllabus. Information about Based on the below information, answer the given questions:Aditi and Parul are partners in a firm with capitals of 35,000 each. They shared profits and losses in the ratio of 3 : 1. On 1st April, 2017, they admitted Chanda into their partnership with 1/5th share in the profits. Chanda brings in 40,000 as her capital and her share of goodwill in cash. Her share of goodwill is calculated on the basis of her capital contribution and her share of profits in the firm. At the time of Chanda’s admission :(a) The firm had a Workmen Compensation Reserve of 60,000 against which there was a claim of 20,000.(b) Creditors of 8,000 were paid by Aditi privately for which she is not to be reimbursed.(c) There was no change in the value of other assets and liabilities.What is the amount of goodwill to be transferred to Aditi’s Capital Account?a)2,100b)6,300c)8,400d)None of theseCorrect answer is option 'B'. Can you explain this answer? covers all topics & solutions for Commerce 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for Based on the below information, answer the given questions:Aditi and Parul are partners in a firm with capitals of 35,000 each. They shared profits and losses in the ratio of 3 : 1. On 1st April, 2017, they admitted Chanda into their partnership with 1/5th share in the profits. Chanda brings in 40,000 as her capital and her share of goodwill in cash. Her share of goodwill is calculated on the basis of her capital contribution and her share of profits in the firm. At the time of Chanda’s admission :(a) The firm had a Workmen Compensation Reserve of 60,000 against which there was a claim of 20,000.(b) Creditors of 8,000 were paid by Aditi privately for which she is not to be reimbursed.(c) There was no change in the value of other assets and liabilities.What is the amount of goodwill to be transferred to Aditi’s Capital Account?a)2,100b)6,300c)8,400d)None of theseCorrect answer is option 'B'. Can you explain this answer?.

Based on the below information, answer the given questions:Aditi and Parul are partners in a firm with capitals of 35,000 each. They shared profits and losses in the ratio of 3 : 1. On 1st April, 2017, they admitted Chanda into their partnership with 1/5th share in the profits. Chanda brings in 40,000 as her capital and her share of goodwill in cash. Her share of goodwill is calculated on the basis of her capital contribution and her share of profits in the firm. At the time of Chanda’s admission :(a) The firm had a Workmen Compensation Reserve of 60,000 against which there was a claim of 20,000.(b) Creditors of 8,000 were paid by Aditi privately for which she is not to be reimbursed.(c) There was no change in the value of other assets and liabilities.What is the amount of goodwill to be transferred to Aditi’s Capital Account?a)2,100b)6,300c)8,400d)None of theseCorrect answer is option 'B'. Can you explain this answer? for Commerce 2024 is part of Commerce preparation. The Question and answers have been prepared according to the Commerce exam syllabus. Information about Based on the below information, answer the given questions:Aditi and Parul are partners in a firm with capitals of 35,000 each. They shared profits and losses in the ratio of 3 : 1. On 1st April, 2017, they admitted Chanda into their partnership with 1/5th share in the profits. Chanda brings in 40,000 as her capital and her share of goodwill in cash. Her share of goodwill is calculated on the basis of her capital contribution and her share of profits in the firm. At the time of Chanda’s admission :(a) The firm had a Workmen Compensation Reserve of 60,000 against which there was a claim of 20,000.(b) Creditors of 8,000 were paid by Aditi privately for which she is not to be reimbursed.(c) There was no change in the value of other assets and liabilities.What is the amount of goodwill to be transferred to Aditi’s Capital Account?a)2,100b)6,300c)8,400d)None of theseCorrect answer is option 'B'. Can you explain this answer? covers all topics & solutions for Commerce 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for Based on the below information, answer the given questions:Aditi and Parul are partners in a firm with capitals of 35,000 each. They shared profits and losses in the ratio of 3 : 1. On 1st April, 2017, they admitted Chanda into their partnership with 1/5th share in the profits. Chanda brings in 40,000 as her capital and her share of goodwill in cash. Her share of goodwill is calculated on the basis of her capital contribution and her share of profits in the firm. At the time of Chanda’s admission :(a) The firm had a Workmen Compensation Reserve of 60,000 against which there was a claim of 20,000.(b) Creditors of 8,000 were paid by Aditi privately for which she is not to be reimbursed.(c) There was no change in the value of other assets and liabilities.What is the amount of goodwill to be transferred to Aditi’s Capital Account?a)2,100b)6,300c)8,400d)None of theseCorrect answer is option 'B'. Can you explain this answer?.

Solutions for Based on the below information, answer the given questions:Aditi and Parul are partners in a firm with capitals of 35,000 each. They shared profits and losses in the ratio of 3 : 1. On 1st April, 2017, they admitted Chanda into their partnership with 1/5th share in the profits. Chanda brings in 40,000 as her capital and her share of goodwill in cash. Her share of goodwill is calculated on the basis of her capital contribution and her share of profits in the firm. At the time of Chanda’s admission :(a) The firm had a Workmen Compensation Reserve of 60,000 against which there was a claim of 20,000.(b) Creditors of 8,000 were paid by Aditi privately for which she is not to be reimbursed.(c) There was no change in the value of other assets and liabilities.What is the amount of goodwill to be transferred to Aditi’s Capital Account?a)2,100b)6,300c)8,400d)None of theseCorrect answer is option 'B'. Can you explain this answer? in English & in Hindi are available as part of our courses for Commerce.

Download more important topics, notes, lectures and mock test series for Commerce Exam by signing up for free.

Here you can find the meaning of Based on the below information, answer the given questions:Aditi and Parul are partners in a firm with capitals of 35,000 each. They shared profits and losses in the ratio of 3 : 1. On 1st April, 2017, they admitted Chanda into their partnership with 1/5th share in the profits. Chanda brings in 40,000 as her capital and her share of goodwill in cash. Her share of goodwill is calculated on the basis of her capital contribution and her share of profits in the firm. At the time of Chanda’s admission :(a) The firm had a Workmen Compensation Reserve of 60,000 against which there was a claim of 20,000.(b) Creditors of 8,000 were paid by Aditi privately for which she is not to be reimbursed.(c) There was no change in the value of other assets and liabilities.What is the amount of goodwill to be transferred to Aditi’s Capital Account?a)2,100b)6,300c)8,400d)None of theseCorrect answer is option 'B'. Can you explain this answer? defined & explained in the simplest way possible. Besides giving the explanation of

Based on the below information, answer the given questions:Aditi and Parul are partners in a firm with capitals of 35,000 each. They shared profits and losses in the ratio of 3 : 1. On 1st April, 2017, they admitted Chanda into their partnership with 1/5th share in the profits. Chanda brings in 40,000 as her capital and her share of goodwill in cash. Her share of goodwill is calculated on the basis of her capital contribution and her share of profits in the firm. At the time of Chanda’s admission :(a) The firm had a Workmen Compensation Reserve of 60,000 against which there was a claim of 20,000.(b) Creditors of 8,000 were paid by Aditi privately for which she is not to be reimbursed.(c) There was no change in the value of other assets and liabilities.What is the amount of goodwill to be transferred to Aditi’s Capital Account?a)2,100b)6,300c)8,400d)None of theseCorrect answer is option 'B'. Can you explain this answer?, a detailed solution for Based on the below information, answer the given questions:Aditi and Parul are partners in a firm with capitals of 35,000 each. They shared profits and losses in the ratio of 3 : 1. On 1st April, 2017, they admitted Chanda into their partnership with 1/5th share in the profits. Chanda brings in 40,000 as her capital and her share of goodwill in cash. Her share of goodwill is calculated on the basis of her capital contribution and her share of profits in the firm. At the time of Chanda’s admission :(a) The firm had a Workmen Compensation Reserve of 60,000 against which there was a claim of 20,000.(b) Creditors of 8,000 were paid by Aditi privately for which she is not to be reimbursed.(c) There was no change in the value of other assets and liabilities.What is the amount of goodwill to be transferred to Aditi’s Capital Account?a)2,100b)6,300c)8,400d)None of theseCorrect answer is option 'B'. Can you explain this answer? has been provided alongside types of Based on the below information, answer the given questions:Aditi and Parul are partners in a firm with capitals of 35,000 each. They shared profits and losses in the ratio of 3 : 1. On 1st April, 2017, they admitted Chanda into their partnership with 1/5th share in the profits. Chanda brings in 40,000 as her capital and her share of goodwill in cash. Her share of goodwill is calculated on the basis of her capital contribution and her share of profits in the firm. At the time of Chanda’s admission :(a) The firm had a Workmen Compensation Reserve of 60,000 against which there was a claim of 20,000.(b) Creditors of 8,000 were paid by Aditi privately for which she is not to be reimbursed.(c) There was no change in the value of other assets and liabilities.What is the amount of goodwill to be transferred to Aditi’s Capital Account?a)2,100b)6,300c)8,400d)None of theseCorrect answer is option 'B'. Can you explain this answer? theory, EduRev gives you an

ample number of questions to practice Based on the below information, answer the given questions:Aditi and Parul are partners in a firm with capitals of 35,000 each. They shared profits and losses in the ratio of 3 : 1. On 1st April, 2017, they admitted Chanda into their partnership with 1/5th share in the profits. Chanda brings in 40,000 as her capital and her share of goodwill in cash. Her share of goodwill is calculated on the basis of her capital contribution and her share of profits in the firm. At the time of Chanda’s admission :(a) The firm had a Workmen Compensation Reserve of 60,000 against which there was a claim of 20,000.(b) Creditors of 8,000 were paid by Aditi privately for which she is not to be reimbursed.(c) There was no change in the value of other assets and liabilities.What is the amount of goodwill to be transferred to Aditi’s Capital Account?a)2,100b)6,300c)8,400d)None of theseCorrect answer is option 'B'. Can you explain this answer? tests, examples and also practice Commerce tests.

|

Explore Courses for Commerce exam

|

|

Suggested Free Tests

Signup for Free!

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.