Commerce Exam > Commerce Questions > Read the following hypothetical Case Study a...

Start Learning for Free

Read the following hypothetical Case Study and answer the given questions:

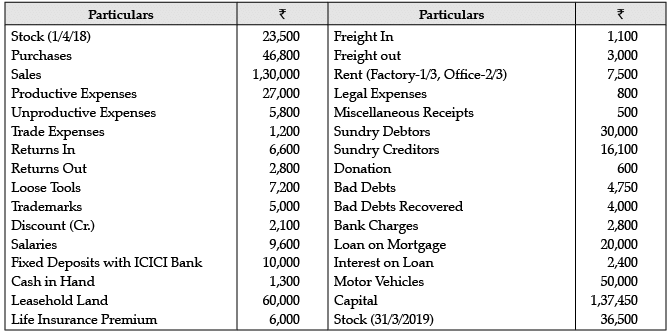

The accountant of M/s Rakhi Enterprises wrote the following balance on 31st March 2019. She wants to prepare the final accounts, but she has certain doubts in her mind.

Q. The Returns Inwards will be recorded in ______________.

- a)Debit side of the Trading Account.

- b)Credit side of the Trading Account.

- c)Added to Purchases in the debit side of the Trading Account.

- d)Subtracted from Sales in the credit side of the Trading Account.

Correct answer is option 'D'. Can you explain this answer?

| FREE This question is part of | Download PDF Attempt this Test |

Verified Answer

Read the following hypothetical Case Study and answer the given quest...

Returns Inwards are items returned TO the company, leading to a reduction (Cr) in Receivable or Cash and an Increase (Dr) in a Returns Inwards Account( which is not an income account – on the Statement of profit or loss it is subtracted from sales (sales is a credit balance).

View all questions of this test

|

Explore Courses for Commerce exam

|

|

Read the following hypothetical Case Study and answer the given questions:The accountant of M/s Rakhi Enterprises wrote the following balance on 31st March 2019. She wants to prepare the final accounts, but she has certain doubts in her mind.Q. The Returns Inwards will be recorded in ______________.a)Debit side of the Trading Account.b)Credit side of the Trading Account.c)Added to Purchases in the debit side of the Trading Account.d)Subtracted from Sales in the credit side of the Trading Account.Correct answer is option 'D'. Can you explain this answer?

Question Description

Read the following hypothetical Case Study and answer the given questions:The accountant of M/s Rakhi Enterprises wrote the following balance on 31st March 2019. She wants to prepare the final accounts, but she has certain doubts in her mind.Q. The Returns Inwards will be recorded in ______________.a)Debit side of the Trading Account.b)Credit side of the Trading Account.c)Added to Purchases in the debit side of the Trading Account.d)Subtracted from Sales in the credit side of the Trading Account.Correct answer is option 'D'. Can you explain this answer? for Commerce 2024 is part of Commerce preparation. The Question and answers have been prepared according to the Commerce exam syllabus. Information about Read the following hypothetical Case Study and answer the given questions:The accountant of M/s Rakhi Enterprises wrote the following balance on 31st March 2019. She wants to prepare the final accounts, but she has certain doubts in her mind.Q. The Returns Inwards will be recorded in ______________.a)Debit side of the Trading Account.b)Credit side of the Trading Account.c)Added to Purchases in the debit side of the Trading Account.d)Subtracted from Sales in the credit side of the Trading Account.Correct answer is option 'D'. Can you explain this answer? covers all topics & solutions for Commerce 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for Read the following hypothetical Case Study and answer the given questions:The accountant of M/s Rakhi Enterprises wrote the following balance on 31st March 2019. She wants to prepare the final accounts, but she has certain doubts in her mind.Q. The Returns Inwards will be recorded in ______________.a)Debit side of the Trading Account.b)Credit side of the Trading Account.c)Added to Purchases in the debit side of the Trading Account.d)Subtracted from Sales in the credit side of the Trading Account.Correct answer is option 'D'. Can you explain this answer?.

Read the following hypothetical Case Study and answer the given questions:The accountant of M/s Rakhi Enterprises wrote the following balance on 31st March 2019. She wants to prepare the final accounts, but she has certain doubts in her mind.Q. The Returns Inwards will be recorded in ______________.a)Debit side of the Trading Account.b)Credit side of the Trading Account.c)Added to Purchases in the debit side of the Trading Account.d)Subtracted from Sales in the credit side of the Trading Account.Correct answer is option 'D'. Can you explain this answer? for Commerce 2024 is part of Commerce preparation. The Question and answers have been prepared according to the Commerce exam syllabus. Information about Read the following hypothetical Case Study and answer the given questions:The accountant of M/s Rakhi Enterprises wrote the following balance on 31st March 2019. She wants to prepare the final accounts, but she has certain doubts in her mind.Q. The Returns Inwards will be recorded in ______________.a)Debit side of the Trading Account.b)Credit side of the Trading Account.c)Added to Purchases in the debit side of the Trading Account.d)Subtracted from Sales in the credit side of the Trading Account.Correct answer is option 'D'. Can you explain this answer? covers all topics & solutions for Commerce 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for Read the following hypothetical Case Study and answer the given questions:The accountant of M/s Rakhi Enterprises wrote the following balance on 31st March 2019. She wants to prepare the final accounts, but she has certain doubts in her mind.Q. The Returns Inwards will be recorded in ______________.a)Debit side of the Trading Account.b)Credit side of the Trading Account.c)Added to Purchases in the debit side of the Trading Account.d)Subtracted from Sales in the credit side of the Trading Account.Correct answer is option 'D'. Can you explain this answer?.

Solutions for Read the following hypothetical Case Study and answer the given questions:The accountant of M/s Rakhi Enterprises wrote the following balance on 31st March 2019. She wants to prepare the final accounts, but she has certain doubts in her mind.Q. The Returns Inwards will be recorded in ______________.a)Debit side of the Trading Account.b)Credit side of the Trading Account.c)Added to Purchases in the debit side of the Trading Account.d)Subtracted from Sales in the credit side of the Trading Account.Correct answer is option 'D'. Can you explain this answer? in English & in Hindi are available as part of our courses for Commerce.

Download more important topics, notes, lectures and mock test series for Commerce Exam by signing up for free.

Here you can find the meaning of Read the following hypothetical Case Study and answer the given questions:The accountant of M/s Rakhi Enterprises wrote the following balance on 31st March 2019. She wants to prepare the final accounts, but she has certain doubts in her mind.Q. The Returns Inwards will be recorded in ______________.a)Debit side of the Trading Account.b)Credit side of the Trading Account.c)Added to Purchases in the debit side of the Trading Account.d)Subtracted from Sales in the credit side of the Trading Account.Correct answer is option 'D'. Can you explain this answer? defined & explained in the simplest way possible. Besides giving the explanation of

Read the following hypothetical Case Study and answer the given questions:The accountant of M/s Rakhi Enterprises wrote the following balance on 31st March 2019. She wants to prepare the final accounts, but she has certain doubts in her mind.Q. The Returns Inwards will be recorded in ______________.a)Debit side of the Trading Account.b)Credit side of the Trading Account.c)Added to Purchases in the debit side of the Trading Account.d)Subtracted from Sales in the credit side of the Trading Account.Correct answer is option 'D'. Can you explain this answer?, a detailed solution for Read the following hypothetical Case Study and answer the given questions:The accountant of M/s Rakhi Enterprises wrote the following balance on 31st March 2019. She wants to prepare the final accounts, but she has certain doubts in her mind.Q. The Returns Inwards will be recorded in ______________.a)Debit side of the Trading Account.b)Credit side of the Trading Account.c)Added to Purchases in the debit side of the Trading Account.d)Subtracted from Sales in the credit side of the Trading Account.Correct answer is option 'D'. Can you explain this answer? has been provided alongside types of Read the following hypothetical Case Study and answer the given questions:The accountant of M/s Rakhi Enterprises wrote the following balance on 31st March 2019. She wants to prepare the final accounts, but she has certain doubts in her mind.Q. The Returns Inwards will be recorded in ______________.a)Debit side of the Trading Account.b)Credit side of the Trading Account.c)Added to Purchases in the debit side of the Trading Account.d)Subtracted from Sales in the credit side of the Trading Account.Correct answer is option 'D'. Can you explain this answer? theory, EduRev gives you an

ample number of questions to practice Read the following hypothetical Case Study and answer the given questions:The accountant of M/s Rakhi Enterprises wrote the following balance on 31st March 2019. She wants to prepare the final accounts, but she has certain doubts in her mind.Q. The Returns Inwards will be recorded in ______________.a)Debit side of the Trading Account.b)Credit side of the Trading Account.c)Added to Purchases in the debit side of the Trading Account.d)Subtracted from Sales in the credit side of the Trading Account.Correct answer is option 'D'. Can you explain this answer? tests, examples and also practice Commerce tests.

|

Explore Courses for Commerce exam

|

|

Suggested Free Tests

Signup for Free!

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.