B Com Exam > B Com Questions > Nayak printers purchased on 1st April ,2013 a...

Start Learning for Free

Nayak printers purchased on 1st April ,2013 a machine for rs 1,00,000 on 1st October in the same year,second machine costing rs 50,000 was purchased. Depreciation was provided on 31st march annually at 10% per annum by fixed instalment method give the machinery account for 2013-2014 and 2014-2015.?

Most Upvoted Answer

Nayak printers purchased on 1st April ,2013 a machine for rs 1,00,000 ...

Community Answer

Nayak printers purchased on 1st April ,2013 a machine for rs 1,00,000 ...

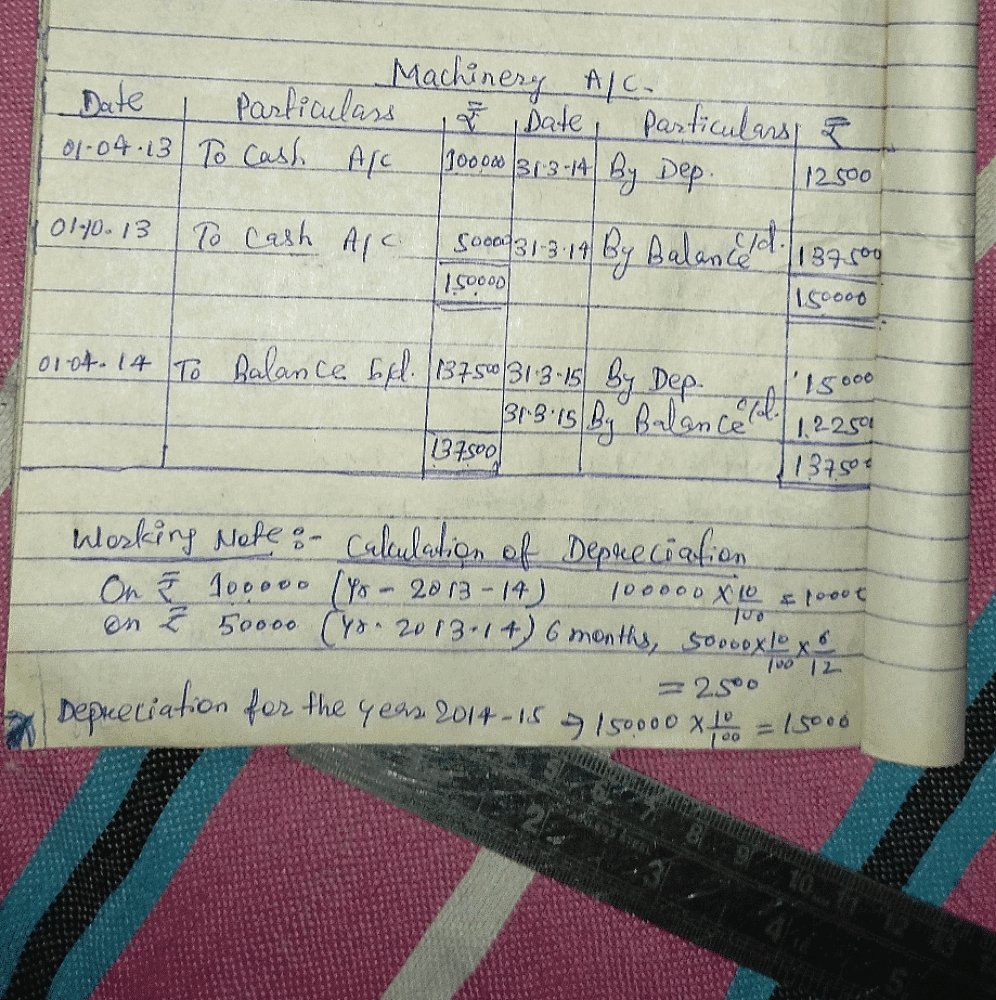

Machinery Account for 2013-2014 and 2014-2015

Introduction:

Depreciation is the reduction in the value of an asset over time due to wear and tear, obsolescence, or any other reason. Depreciation can be calculated in different ways, such as straight-line method, reducing balance method, sum-of-years' digits method, and fixed instalment method. In this question, we are required to calculate the machinery account for 2013-2014 and 2014-2015 using the fixed instalment method.

Fixed Instalment Method:

Under the fixed instalment method, the depreciation amount remains constant for each year of the asset's useful life. The depreciation amount is calculated by dividing the cost of the asset by its useful life. In this method, the amount of depreciation charged to the machinery account is the same every year.

Calculation of Depreciation:

The cost of the first machine is Rs 1,00,000, and the cost of the second machine is Rs 50,000. The useful life of both machines is assumed to be 10 years. Therefore, the annual depreciation rate is 10% (100/10). The depreciation amount for each machine is calculated as follows:

First machine: Rs 1,00,000/10 = Rs 10,000 per year

Second machine: Rs 50,000/10 = Rs 5,000 per year

Machinery Account for 2013-2014:

The first machine was purchased on 1st April, 2013, and therefore, it was in use for only six months in the financial year 2013-2014. The depreciation charged for this machine for the year 2013-2014 is Rs 5,000 (Rs 10,000/2). The machinery account for 2013-2014 is as follows:

Machinery Account

Particulars Amount (Rs)

To Bank Account 1,00,000

To Depreciation Account 5,000

1,05,000

Machinery Account for 2014-2015:

For the financial year 2014-2015, both machines were in use for the full year. Therefore, the total depreciation charged for the year is Rs 15,000 (Rs 10,000 for the first machine and Rs 5,000 for the second machine). The machinery account for 2014-2015 is as follows:

Machinery Account

Particulars Amount (Rs)

To Bank Account 1,50,000

To Depreciation Account 15,000

1,65,000

Conclusion:

The fixed instalment method of depreciation is a simple and easy method of calculating depreciation. It assumes that the asset depreciates by a fixed amount every year. In this question, we have calculated the machinery account for 2013-2014 and 2014-2015 using the fixed instalment method. The machinery account shows the cost of the machines and the depreciation charged for each year.

Introduction:

Depreciation is the reduction in the value of an asset over time due to wear and tear, obsolescence, or any other reason. Depreciation can be calculated in different ways, such as straight-line method, reducing balance method, sum-of-years' digits method, and fixed instalment method. In this question, we are required to calculate the machinery account for 2013-2014 and 2014-2015 using the fixed instalment method.

Fixed Instalment Method:

Under the fixed instalment method, the depreciation amount remains constant for each year of the asset's useful life. The depreciation amount is calculated by dividing the cost of the asset by its useful life. In this method, the amount of depreciation charged to the machinery account is the same every year.

Calculation of Depreciation:

The cost of the first machine is Rs 1,00,000, and the cost of the second machine is Rs 50,000. The useful life of both machines is assumed to be 10 years. Therefore, the annual depreciation rate is 10% (100/10). The depreciation amount for each machine is calculated as follows:

First machine: Rs 1,00,000/10 = Rs 10,000 per year

Second machine: Rs 50,000/10 = Rs 5,000 per year

Machinery Account for 2013-2014:

The first machine was purchased on 1st April, 2013, and therefore, it was in use for only six months in the financial year 2013-2014. The depreciation charged for this machine for the year 2013-2014 is Rs 5,000 (Rs 10,000/2). The machinery account for 2013-2014 is as follows:

Machinery Account

Particulars Amount (Rs)

To Bank Account 1,00,000

To Depreciation Account 5,000

1,05,000

Machinery Account for 2014-2015:

For the financial year 2014-2015, both machines were in use for the full year. Therefore, the total depreciation charged for the year is Rs 15,000 (Rs 10,000 for the first machine and Rs 5,000 for the second machine). The machinery account for 2014-2015 is as follows:

Machinery Account

Particulars Amount (Rs)

To Bank Account 1,50,000

To Depreciation Account 15,000

1,65,000

Conclusion:

The fixed instalment method of depreciation is a simple and easy method of calculating depreciation. It assumes that the asset depreciates by a fixed amount every year. In this question, we have calculated the machinery account for 2013-2014 and 2014-2015 using the fixed instalment method. The machinery account shows the cost of the machines and the depreciation charged for each year.

|

Explore Courses for B Com exam

|

|

Similar B Com Doubts

Nayak printers purchased on 1st April ,2013 a machine for rs 1,00,000 on 1st October in the same year,second machine costing rs 50,000 was purchased. Depreciation was provided on 31st march annually at 10% per annum by fixed instalment method give the machinery account for 2013-2014 and 2014-2015.?

Question Description

Nayak printers purchased on 1st April ,2013 a machine for rs 1,00,000 on 1st October in the same year,second machine costing rs 50,000 was purchased. Depreciation was provided on 31st march annually at 10% per annum by fixed instalment method give the machinery account for 2013-2014 and 2014-2015.? for B Com 2024 is part of B Com preparation. The Question and answers have been prepared according to the B Com exam syllabus. Information about Nayak printers purchased on 1st April ,2013 a machine for rs 1,00,000 on 1st October in the same year,second machine costing rs 50,000 was purchased. Depreciation was provided on 31st march annually at 10% per annum by fixed instalment method give the machinery account for 2013-2014 and 2014-2015.? covers all topics & solutions for B Com 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for Nayak printers purchased on 1st April ,2013 a machine for rs 1,00,000 on 1st October in the same year,second machine costing rs 50,000 was purchased. Depreciation was provided on 31st march annually at 10% per annum by fixed instalment method give the machinery account for 2013-2014 and 2014-2015.?.

Nayak printers purchased on 1st April ,2013 a machine for rs 1,00,000 on 1st October in the same year,second machine costing rs 50,000 was purchased. Depreciation was provided on 31st march annually at 10% per annum by fixed instalment method give the machinery account for 2013-2014 and 2014-2015.? for B Com 2024 is part of B Com preparation. The Question and answers have been prepared according to the B Com exam syllabus. Information about Nayak printers purchased on 1st April ,2013 a machine for rs 1,00,000 on 1st October in the same year,second machine costing rs 50,000 was purchased. Depreciation was provided on 31st march annually at 10% per annum by fixed instalment method give the machinery account for 2013-2014 and 2014-2015.? covers all topics & solutions for B Com 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for Nayak printers purchased on 1st April ,2013 a machine for rs 1,00,000 on 1st October in the same year,second machine costing rs 50,000 was purchased. Depreciation was provided on 31st march annually at 10% per annum by fixed instalment method give the machinery account for 2013-2014 and 2014-2015.?.

Solutions for Nayak printers purchased on 1st April ,2013 a machine for rs 1,00,000 on 1st October in the same year,second machine costing rs 50,000 was purchased. Depreciation was provided on 31st march annually at 10% per annum by fixed instalment method give the machinery account for 2013-2014 and 2014-2015.? in English & in Hindi are available as part of our courses for B Com.

Download more important topics, notes, lectures and mock test series for B Com Exam by signing up for free.

Here you can find the meaning of Nayak printers purchased on 1st April ,2013 a machine for rs 1,00,000 on 1st October in the same year,second machine costing rs 50,000 was purchased. Depreciation was provided on 31st march annually at 10% per annum by fixed instalment method give the machinery account for 2013-2014 and 2014-2015.? defined & explained in the simplest way possible. Besides giving the explanation of

Nayak printers purchased on 1st April ,2013 a machine for rs 1,00,000 on 1st October in the same year,second machine costing rs 50,000 was purchased. Depreciation was provided on 31st march annually at 10% per annum by fixed instalment method give the machinery account for 2013-2014 and 2014-2015.?, a detailed solution for Nayak printers purchased on 1st April ,2013 a machine for rs 1,00,000 on 1st October in the same year,second machine costing rs 50,000 was purchased. Depreciation was provided on 31st march annually at 10% per annum by fixed instalment method give the machinery account for 2013-2014 and 2014-2015.? has been provided alongside types of Nayak printers purchased on 1st April ,2013 a machine for rs 1,00,000 on 1st October in the same year,second machine costing rs 50,000 was purchased. Depreciation was provided on 31st march annually at 10% per annum by fixed instalment method give the machinery account for 2013-2014 and 2014-2015.? theory, EduRev gives you an

ample number of questions to practice Nayak printers purchased on 1st April ,2013 a machine for rs 1,00,000 on 1st October in the same year,second machine costing rs 50,000 was purchased. Depreciation was provided on 31st march annually at 10% per annum by fixed instalment method give the machinery account for 2013-2014 and 2014-2015.? tests, examples and also practice B Com tests.

|

Explore Courses for B Com exam

|

|

Suggested Free Tests

Signup for Free!

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.