Banking Exams Exam > Banking Exams Questions > Which of the following are the differences be...

Start Learning for Free

Which of the following are the differences between Foreign Direct Investment and Foreign Portfolio Investment?

- a)FDI is a long-term investment whereas FPI is a short term

- b)Liquidity is high in FDI whereas low in FPI

- c)Selling of FDI is difficult whereas Selling is easy in FPI

- d)Risks are stable in FDI whereas it's Volatile in FPI

- e)All the above

Correct answer is option 'E'. Can you explain this answer?

Most Upvoted Answer

Which of the following are the differences between Foreign Direct Inve...

Free Test

FREE

| Start Free Test |

Community Answer

Which of the following are the differences between Foreign Direct Inve...

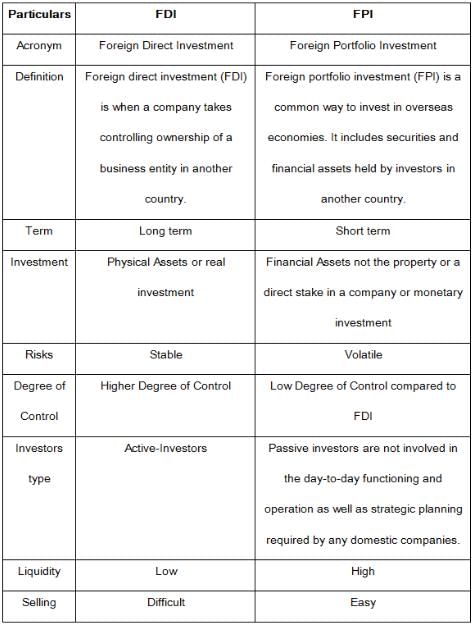

Differences between Foreign Direct Investment (FDI) and Foreign Portfolio Investment (FPI)

a) FDI is a long-term investment whereas FPI is a short term

Foreign Direct Investment (FDI) involves a long-term commitment as it entails establishing operations or acquiring a significant stake in a foreign company. On the other hand, Foreign Portfolio Investment (FPI) involves investing in financial assets such as stocks and bonds with the intention of earning a return in the short term.

b) Liquidity is high in FDI whereas low in FPI

FDI typically involves investments in physical assets like factories or infrastructure, which are less liquid compared to financial assets like stocks and bonds. FPI, on the other hand, involves investments in easily tradable securities, making it more liquid.

c) Selling of FDI is difficult whereas Selling is easy in FPI

Selling off a Foreign Direct Investment (FDI) can be a complex and time-consuming process due to the nature of the assets involved. In contrast, selling Foreign Portfolio Investment (FPI) assets like stocks and bonds can be done quickly and easily on the financial markets.

d) Risks are stable in FDI whereas it's Volatile in FPI

Foreign Direct Investment (FDI) tends to be more stable in terms of risks as it involves a long-term commitment and ownership of physical assets. Foreign Portfolio Investment (FPI), on the other hand, is subject to market volatility and fluctuations in asset prices, leading to higher risk levels.

Therefore, all the above options are correct in highlighting the key differences between Foreign Direct Investment (FDI) and Foreign Portfolio Investment (FPI).

|

Explore Courses for Banking Exams exam

|

|

Question Description

Which of the following are the differences between Foreign Direct Investment and Foreign Portfolio Investment?a)FDI is a long-term investment whereas FPI is a short termb)Liquidity is high in FDI whereas low in FPIc)Selling of FDI is difficult whereas Selling is easy in FPId)Risks are stable in FDI whereas its Volatile in FPIe)All the aboveCorrect answer is option 'E'. Can you explain this answer? for Banking Exams 2025 is part of Banking Exams preparation. The Question and answers have been prepared according to the Banking Exams exam syllabus. Information about Which of the following are the differences between Foreign Direct Investment and Foreign Portfolio Investment?a)FDI is a long-term investment whereas FPI is a short termb)Liquidity is high in FDI whereas low in FPIc)Selling of FDI is difficult whereas Selling is easy in FPId)Risks are stable in FDI whereas its Volatile in FPIe)All the aboveCorrect answer is option 'E'. Can you explain this answer? covers all topics & solutions for Banking Exams 2025 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for Which of the following are the differences between Foreign Direct Investment and Foreign Portfolio Investment?a)FDI is a long-term investment whereas FPI is a short termb)Liquidity is high in FDI whereas low in FPIc)Selling of FDI is difficult whereas Selling is easy in FPId)Risks are stable in FDI whereas its Volatile in FPIe)All the aboveCorrect answer is option 'E'. Can you explain this answer?.

Which of the following are the differences between Foreign Direct Investment and Foreign Portfolio Investment?a)FDI is a long-term investment whereas FPI is a short termb)Liquidity is high in FDI whereas low in FPIc)Selling of FDI is difficult whereas Selling is easy in FPId)Risks are stable in FDI whereas its Volatile in FPIe)All the aboveCorrect answer is option 'E'. Can you explain this answer? for Banking Exams 2025 is part of Banking Exams preparation. The Question and answers have been prepared according to the Banking Exams exam syllabus. Information about Which of the following are the differences between Foreign Direct Investment and Foreign Portfolio Investment?a)FDI is a long-term investment whereas FPI is a short termb)Liquidity is high in FDI whereas low in FPIc)Selling of FDI is difficult whereas Selling is easy in FPId)Risks are stable in FDI whereas its Volatile in FPIe)All the aboveCorrect answer is option 'E'. Can you explain this answer? covers all topics & solutions for Banking Exams 2025 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for Which of the following are the differences between Foreign Direct Investment and Foreign Portfolio Investment?a)FDI is a long-term investment whereas FPI is a short termb)Liquidity is high in FDI whereas low in FPIc)Selling of FDI is difficult whereas Selling is easy in FPId)Risks are stable in FDI whereas its Volatile in FPIe)All the aboveCorrect answer is option 'E'. Can you explain this answer?.

Solutions for Which of the following are the differences between Foreign Direct Investment and Foreign Portfolio Investment?a)FDI is a long-term investment whereas FPI is a short termb)Liquidity is high in FDI whereas low in FPIc)Selling of FDI is difficult whereas Selling is easy in FPId)Risks are stable in FDI whereas its Volatile in FPIe)All the aboveCorrect answer is option 'E'. Can you explain this answer? in English & in Hindi are available as part of our courses for Banking Exams.

Download more important topics, notes, lectures and mock test series for Banking Exams Exam by signing up for free.

Here you can find the meaning of Which of the following are the differences between Foreign Direct Investment and Foreign Portfolio Investment?a)FDI is a long-term investment whereas FPI is a short termb)Liquidity is high in FDI whereas low in FPIc)Selling of FDI is difficult whereas Selling is easy in FPId)Risks are stable in FDI whereas its Volatile in FPIe)All the aboveCorrect answer is option 'E'. Can you explain this answer? defined & explained in the simplest way possible. Besides giving the explanation of

Which of the following are the differences between Foreign Direct Investment and Foreign Portfolio Investment?a)FDI is a long-term investment whereas FPI is a short termb)Liquidity is high in FDI whereas low in FPIc)Selling of FDI is difficult whereas Selling is easy in FPId)Risks are stable in FDI whereas its Volatile in FPIe)All the aboveCorrect answer is option 'E'. Can you explain this answer?, a detailed solution for Which of the following are the differences between Foreign Direct Investment and Foreign Portfolio Investment?a)FDI is a long-term investment whereas FPI is a short termb)Liquidity is high in FDI whereas low in FPIc)Selling of FDI is difficult whereas Selling is easy in FPId)Risks are stable in FDI whereas its Volatile in FPIe)All the aboveCorrect answer is option 'E'. Can you explain this answer? has been provided alongside types of Which of the following are the differences between Foreign Direct Investment and Foreign Portfolio Investment?a)FDI is a long-term investment whereas FPI is a short termb)Liquidity is high in FDI whereas low in FPIc)Selling of FDI is difficult whereas Selling is easy in FPId)Risks are stable in FDI whereas its Volatile in FPIe)All the aboveCorrect answer is option 'E'. Can you explain this answer? theory, EduRev gives you an

ample number of questions to practice Which of the following are the differences between Foreign Direct Investment and Foreign Portfolio Investment?a)FDI is a long-term investment whereas FPI is a short termb)Liquidity is high in FDI whereas low in FPIc)Selling of FDI is difficult whereas Selling is easy in FPId)Risks are stable in FDI whereas its Volatile in FPIe)All the aboveCorrect answer is option 'E'. Can you explain this answer? tests, examples and also practice Banking Exams tests.

|

Explore Courses for Banking Exams exam

|

|

Signup for Free!

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.