GMAT Exam > GMAT Questions > STOCKS CLASSIFICATIONHoly Faith Broking Compa...

Start Learning for Free

STOCKS CLASSIFICATION

Holy Faith Broking Company classifies stocks of listed companies on the basis of two parameters.

Stock Valuation Classification

TOP – ‘TOP’ is termed as the mean of daily values of “highest percentage increase in the stock price over last day’s closing price” over a period.

BOTTOM - ‘BOTTOM’ is termed as the mean of daily values of “lowest percentage increase or highest percent decrease, as the case may be, in the stock price over last day’s closing price” over a period.

Stable Cow - A stock whose TOP is less than 15% and BOTTOM is more than 8%.

Volatile Bull - A stock whose TOP is more than 30% and BOTTOM is less than 10%.

Volatile Bear - A stock whose TOP is less than 10% and BOTTOM is less than -10%.

Profit Generation Capability

Struggler - A stock whose issuing company makes a profit between 1% to 5% of its revenue. (Both inclusive)

Dessert - A stock whose issuing company makes a loss of more than 1% of its revenue.

Rain Maker - A stock whose issuing company makes a profit of more than 10% of its revenue.

Stock Valuation Classification

TOP – ‘TOP’ is termed as the mean of daily values of “highest percentage increase in the stock price over last day’s closing price” over a period.

BOTTOM - ‘BOTTOM’ is termed as the mean of daily values of “lowest percentage increase or highest percent decrease, as the case may be, in the stock price over last day’s closing price” over a period.

Stable Cow - A stock whose TOP is less than 15% and BOTTOM is more than 8%.

Volatile Bull - A stock whose TOP is more than 30% and BOTTOM is less than 10%.

Volatile Bear - A stock whose TOP is less than 10% and BOTTOM is less than -10%.

Profit Generation Capability

Struggler - A stock whose issuing company makes a profit between 1% to 5% of its revenue. (Both inclusive)

Dessert - A stock whose issuing company makes a loss of more than 1% of its revenue.

Rain Maker - A stock whose issuing company makes a profit of more than 10% of its revenue.

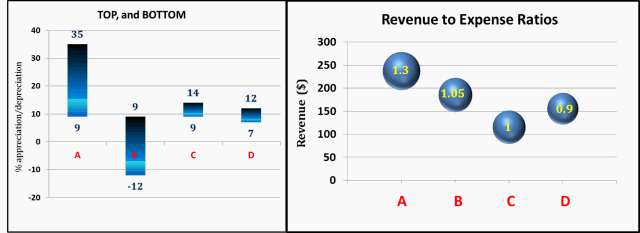

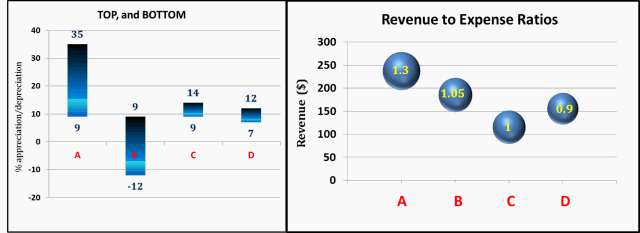

CHARTS

The two graphs given below are for stocks of companies A, B, C, and D. The first graph shows mean of daily values of “percentage increase or decrease in the stock price over last day’s closing price” over a period. The second graph represents revenue to expense ratio (data label on the bubble) & revenue for these four companies. Centers of bubbles represent revenue of the company (on Y axis).

The two graphs given below are for stocks of companies A, B, C, and D. The first graph shows mean of daily values of “percentage increase or decrease in the stock price over last day’s closing price” over a period. The second graph represents revenue to expense ratio (data label on the bubble) & revenue for these four companies. Centers of bubbles represent revenue of the company (on Y axis).

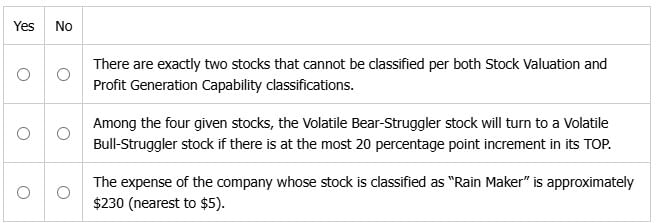

For each of the following statements, select yes if, based on the given information, it must be true, otherwise select no.

- a)No: There are exactly two stocks that cannot be classified per both Stock Valuation and Profit Generation Capability classifications.

No: Among the four given stocks, the Volatile Bear-Struggler stock will turn to a Volatile Bull-Struggler stock if there is at the most 20 percentage point increment in its TOP.

No: The expense of the company whose stock is classified as “Rain Maker” is approximately $230 (nearest to $5). - b)Yes: There are exactly two stocks that cannot be classified per both Stock Valuation and Profit Generation Capability classifications.

No: Among the four given stocks, the Volatile Bear-Struggler stock will turn to a Volatile Bull-Struggler stock if there is at the most 20 percentage point increment in its TOP.

No: The expense of the company whose stock is classified as “Rain Maker” is approximately $230 (nearest to $5). - c)Yes: There are exactly two stocks that cannot be classified per both Stock Valuation and Profit Generation Capability classifications.

Yes: Among the four given stocks, the Volatile Bear-Struggler stock will turn to a Volatile Bull-Struggler stock if there is at the most 20 percentage point increment in its TOP.

No: The expense of the company whose stock is classified as “Rain Maker” is approximately $230 (nearest to $5). - d)Yes: There are exactly two stocks that cannot be classified per both Stock Valuation and Profit Generation Capability classifications.

Yes: Among the four given stocks, the Volatile Bear-Struggler stock will turn to a Volatile Bull-Struggler stock if there is at the most 20 percentage point increment in its TOP.

Yes: The expense of the company whose stock is classified as “Rain Maker” is approximately $230 (nearest to $5).

Correct answer is option 'A'. Can you explain this answer?

Most Upvoted Answer

STOCKS CLASSIFICATIONHoly Faith Broking Company classifies stocks of l...

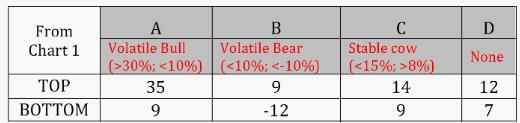

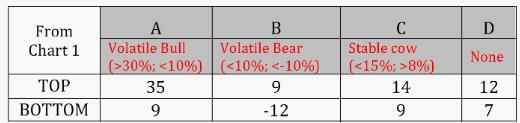

This question needs classification of stocks, so we first read the relevant data from the charts and classify the stocks.

For Stock Valuation Classification (SV Classification), we read the data from chart 1. The data is given below. We find that stock D cannot be classified per any category of SV Classification.

From Chart 1

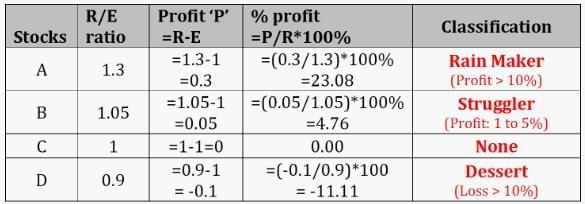

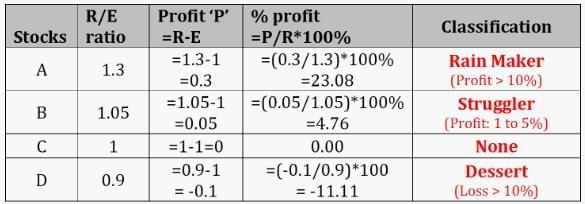

For Profit Generation Capability (PGC) classification, we read the data from chart 2.

The percentage of profit is given as (profit/revenue)*100%.

Let’s take stock A first.

R/E ratio for A is 1.3 or 1.3/1. It means that for a revenue of $1.3, expense is $1, and profit is R-E=1.3-1=0.3. So % profit would be (P/R)*100 = (0.3/1.3)*100% =23.08%.

Similarly, for other companies, profit percentages are calculated given below.

From Chart 2

1. a.There is no stock that is not classified for both the categories. In the SV classification, stock D is not classified, whereas in the PGC classification, stock C is not classified. But both these stocks are classified per at least one of the categories, so the answer is NO.

1. b. B stock is Volatile Bear-Struggler. Let’s look at the criterion of Volatile Bull.

Volatile Bull - A stock whose TOP is more than 30% and BOTTOM is less than 10%.

Presently, TOP of stock B is 9% and BOTTOM is -12%. B only qualifies for the BOTTOM criterion of Volatile Bull.

To turn it to Volatile Bull, we need to increase its TOP by more than 30% -9% = 21 percentage points. It is more than 20 percent point increment. So the answer is no. No.

1. c.From the table, we know that A stock is the Rain Maker stock. The revenue of the company of stock A is approximately $230, and R/E ratio is 1.3. This gives expenses as 230/1.3 = $176.92. The value is not approximately $230, hence the answer is No.

For Stock Valuation Classification (SV Classification), we read the data from chart 1. The data is given below. We find that stock D cannot be classified per any category of SV Classification.

From Chart 1

For Profit Generation Capability (PGC) classification, we read the data from chart 2.

The percentage of profit is given as (profit/revenue)*100%.

Let’s take stock A first.

R/E ratio for A is 1.3 or 1.3/1. It means that for a revenue of $1.3, expense is $1, and profit is R-E=1.3-1=0.3. So % profit would be (P/R)*100 = (0.3/1.3)*100% =23.08%.

Similarly, for other companies, profit percentages are calculated given below.

From Chart 2

1. a.There is no stock that is not classified for both the categories. In the SV classification, stock D is not classified, whereas in the PGC classification, stock C is not classified. But both these stocks are classified per at least one of the categories, so the answer is NO.

1. b. B stock is Volatile Bear-Struggler. Let’s look at the criterion of Volatile Bull.

Volatile Bull - A stock whose TOP is more than 30% and BOTTOM is less than 10%.

Presently, TOP of stock B is 9% and BOTTOM is -12%. B only qualifies for the BOTTOM criterion of Volatile Bull.

To turn it to Volatile Bull, we need to increase its TOP by more than 30% -9% = 21 percentage points. It is more than 20 percent point increment. So the answer is no. No.

1. c.From the table, we know that A stock is the Rain Maker stock. The revenue of the company of stock A is approximately $230, and R/E ratio is 1.3. This gives expenses as 230/1.3 = $176.92. The value is not approximately $230, hence the answer is No.

|

Explore Courses for GMAT exam

|

|

Question Description

STOCKS CLASSIFICATIONHoly Faith Broking Company classifies stocks of listed companies on the basis of two parameters.Stock Valuation ClassificationTOP– ‘TOP’ is termed as the mean of daily values of “highest percentage increase in the stock price over last day’s closing price” over a period.BOTTOM- ‘BOTTOM’ is termed as the mean of daily values of “lowest percentage increase or highest percent decrease, as the case may be, in the stock price over last day’s closing price” over a period.Stable Cow- A stock whose TOP is less than 15% and BOTTOM is more than 8%.Volatile Bull- A stock whose TOP is more than 30% and BOTTOM is less than 10%.Volatile Bear- A stock whose TOP is less than 10% and BOTTOM is less than -10%.Profit Generation CapabilityStruggler- A stock whose issuing company makes a profit between 1% to 5% of its revenue. (Both inclusive)Dessert- A stock whose issuing company makes a loss of more than 1% of its revenue.Rain Maker- A stock whose issuing company makes a profit of more than 10% of its revenue.CHARTSThe two graphs given below are for stocks of companies A, B, C, and D. The first graph shows mean of daily values of “percentage increase or decrease in the stock price over last day’s closing price” over a period. The second graph represents revenue to expense ratio (data label on the bubble) & revenue for these four companies. Centers of bubbles represent revenue of the company (on Y axis).For each of the following statements, select yes if, based on the given information, it must be true, otherwise select no.a)No: There are exactly two stocks that cannot be classified per both Stock Valuation and Profit Generation Capability classifications.No: Among the four given stocks, the Volatile Bear-Struggler stock will turn to a Volatile Bull-Struggler stock if there is at the most 20 percentage point increment in its TOP.No: The expense of the company whose stock is classified as “Rain Maker” is approximately $230 (nearest to $5).b)Yes: There are exactly two stocks that cannot be classified per both Stock Valuation and Profit Generation Capability classifications.No: Among the four given stocks, the Volatile Bear-Struggler stock will turn to a Volatile Bull-Struggler stock if there is at the most 20 percentage point increment in its TOP.No: The expense of the company whose stock is classified as “Rain Maker” is approximately $230 (nearest to $5).c)Yes: There are exactly two stocks that cannot be classified per both Stock Valuation and Profit Generation Capability classifications.Yes: Among the four given stocks, the Volatile Bear-Struggler stock will turn to a Volatile Bull-Struggler stock if there is at the most 20 percentage point increment in its TOP.No: The expense of the company whose stock is classified as “Rain Maker” is approximately $230 (nearest to $5).d)Yes: There are exactly two stocks that cannot be classified per both Stock Valuation and Profit Generation Capability classifications.Yes: Among the four given stocks, the Volatile Bear-Struggler stock will turn to a Volatile Bull-Struggler stock if there is at the most 20 percentage point increment in its TOP.Yes: The expense of the company whose stock is classified as “Rain Maker” is approximately $230 (nearest to $5).Correct answer is option 'A'. Can you explain this answer? for GMAT 2025 is part of GMAT preparation. The Question and answers have been prepared according to the GMAT exam syllabus. Information about STOCKS CLASSIFICATIONHoly Faith Broking Company classifies stocks of listed companies on the basis of two parameters.Stock Valuation ClassificationTOP– ‘TOP’ is termed as the mean of daily values of “highest percentage increase in the stock price over last day’s closing price” over a period.BOTTOM- ‘BOTTOM’ is termed as the mean of daily values of “lowest percentage increase or highest percent decrease, as the case may be, in the stock price over last day’s closing price” over a period.Stable Cow- A stock whose TOP is less than 15% and BOTTOM is more than 8%.Volatile Bull- A stock whose TOP is more than 30% and BOTTOM is less than 10%.Volatile Bear- A stock whose TOP is less than 10% and BOTTOM is less than -10%.Profit Generation CapabilityStruggler- A stock whose issuing company makes a profit between 1% to 5% of its revenue. (Both inclusive)Dessert- A stock whose issuing company makes a loss of more than 1% of its revenue.Rain Maker- A stock whose issuing company makes a profit of more than 10% of its revenue.CHARTSThe two graphs given below are for stocks of companies A, B, C, and D. The first graph shows mean of daily values of “percentage increase or decrease in the stock price over last day’s closing price” over a period. The second graph represents revenue to expense ratio (data label on the bubble) & revenue for these four companies. Centers of bubbles represent revenue of the company (on Y axis).For each of the following statements, select yes if, based on the given information, it must be true, otherwise select no.a)No: There are exactly two stocks that cannot be classified per both Stock Valuation and Profit Generation Capability classifications.No: Among the four given stocks, the Volatile Bear-Struggler stock will turn to a Volatile Bull-Struggler stock if there is at the most 20 percentage point increment in its TOP.No: The expense of the company whose stock is classified as “Rain Maker” is approximately $230 (nearest to $5).b)Yes: There are exactly two stocks that cannot be classified per both Stock Valuation and Profit Generation Capability classifications.No: Among the four given stocks, the Volatile Bear-Struggler stock will turn to a Volatile Bull-Struggler stock if there is at the most 20 percentage point increment in its TOP.No: The expense of the company whose stock is classified as “Rain Maker” is approximately $230 (nearest to $5).c)Yes: There are exactly two stocks that cannot be classified per both Stock Valuation and Profit Generation Capability classifications.Yes: Among the four given stocks, the Volatile Bear-Struggler stock will turn to a Volatile Bull-Struggler stock if there is at the most 20 percentage point increment in its TOP.No: The expense of the company whose stock is classified as “Rain Maker” is approximately $230 (nearest to $5).d)Yes: There are exactly two stocks that cannot be classified per both Stock Valuation and Profit Generation Capability classifications.Yes: Among the four given stocks, the Volatile Bear-Struggler stock will turn to a Volatile Bull-Struggler stock if there is at the most 20 percentage point increment in its TOP.Yes: The expense of the company whose stock is classified as “Rain Maker” is approximately $230 (nearest to $5).Correct answer is option 'A'. Can you explain this answer? covers all topics & solutions for GMAT 2025 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for STOCKS CLASSIFICATIONHoly Faith Broking Company classifies stocks of listed companies on the basis of two parameters.Stock Valuation ClassificationTOP– ‘TOP’ is termed as the mean of daily values of “highest percentage increase in the stock price over last day’s closing price” over a period.BOTTOM- ‘BOTTOM’ is termed as the mean of daily values of “lowest percentage increase or highest percent decrease, as the case may be, in the stock price over last day’s closing price” over a period.Stable Cow- A stock whose TOP is less than 15% and BOTTOM is more than 8%.Volatile Bull- A stock whose TOP is more than 30% and BOTTOM is less than 10%.Volatile Bear- A stock whose TOP is less than 10% and BOTTOM is less than -10%.Profit Generation CapabilityStruggler- A stock whose issuing company makes a profit between 1% to 5% of its revenue. (Both inclusive)Dessert- A stock whose issuing company makes a loss of more than 1% of its revenue.Rain Maker- A stock whose issuing company makes a profit of more than 10% of its revenue.CHARTSThe two graphs given below are for stocks of companies A, B, C, and D. The first graph shows mean of daily values of “percentage increase or decrease in the stock price over last day’s closing price” over a period. The second graph represents revenue to expense ratio (data label on the bubble) & revenue for these four companies. Centers of bubbles represent revenue of the company (on Y axis).For each of the following statements, select yes if, based on the given information, it must be true, otherwise select no.a)No: There are exactly two stocks that cannot be classified per both Stock Valuation and Profit Generation Capability classifications.No: Among the four given stocks, the Volatile Bear-Struggler stock will turn to a Volatile Bull-Struggler stock if there is at the most 20 percentage point increment in its TOP.No: The expense of the company whose stock is classified as “Rain Maker” is approximately $230 (nearest to $5).b)Yes: There are exactly two stocks that cannot be classified per both Stock Valuation and Profit Generation Capability classifications.No: Among the four given stocks, the Volatile Bear-Struggler stock will turn to a Volatile Bull-Struggler stock if there is at the most 20 percentage point increment in its TOP.No: The expense of the company whose stock is classified as “Rain Maker” is approximately $230 (nearest to $5).c)Yes: There are exactly two stocks that cannot be classified per both Stock Valuation and Profit Generation Capability classifications.Yes: Among the four given stocks, the Volatile Bear-Struggler stock will turn to a Volatile Bull-Struggler stock if there is at the most 20 percentage point increment in its TOP.No: The expense of the company whose stock is classified as “Rain Maker” is approximately $230 (nearest to $5).d)Yes: There are exactly two stocks that cannot be classified per both Stock Valuation and Profit Generation Capability classifications.Yes: Among the four given stocks, the Volatile Bear-Struggler stock will turn to a Volatile Bull-Struggler stock if there is at the most 20 percentage point increment in its TOP.Yes: The expense of the company whose stock is classified as “Rain Maker” is approximately $230 (nearest to $5).Correct answer is option 'A'. Can you explain this answer?.

STOCKS CLASSIFICATIONHoly Faith Broking Company classifies stocks of listed companies on the basis of two parameters.Stock Valuation ClassificationTOP– ‘TOP’ is termed as the mean of daily values of “highest percentage increase in the stock price over last day’s closing price” over a period.BOTTOM- ‘BOTTOM’ is termed as the mean of daily values of “lowest percentage increase or highest percent decrease, as the case may be, in the stock price over last day’s closing price” over a period.Stable Cow- A stock whose TOP is less than 15% and BOTTOM is more than 8%.Volatile Bull- A stock whose TOP is more than 30% and BOTTOM is less than 10%.Volatile Bear- A stock whose TOP is less than 10% and BOTTOM is less than -10%.Profit Generation CapabilityStruggler- A stock whose issuing company makes a profit between 1% to 5% of its revenue. (Both inclusive)Dessert- A stock whose issuing company makes a loss of more than 1% of its revenue.Rain Maker- A stock whose issuing company makes a profit of more than 10% of its revenue.CHARTSThe two graphs given below are for stocks of companies A, B, C, and D. The first graph shows mean of daily values of “percentage increase or decrease in the stock price over last day’s closing price” over a period. The second graph represents revenue to expense ratio (data label on the bubble) & revenue for these four companies. Centers of bubbles represent revenue of the company (on Y axis).For each of the following statements, select yes if, based on the given information, it must be true, otherwise select no.a)No: There are exactly two stocks that cannot be classified per both Stock Valuation and Profit Generation Capability classifications.No: Among the four given stocks, the Volatile Bear-Struggler stock will turn to a Volatile Bull-Struggler stock if there is at the most 20 percentage point increment in its TOP.No: The expense of the company whose stock is classified as “Rain Maker” is approximately $230 (nearest to $5).b)Yes: There are exactly two stocks that cannot be classified per both Stock Valuation and Profit Generation Capability classifications.No: Among the four given stocks, the Volatile Bear-Struggler stock will turn to a Volatile Bull-Struggler stock if there is at the most 20 percentage point increment in its TOP.No: The expense of the company whose stock is classified as “Rain Maker” is approximately $230 (nearest to $5).c)Yes: There are exactly two stocks that cannot be classified per both Stock Valuation and Profit Generation Capability classifications.Yes: Among the four given stocks, the Volatile Bear-Struggler stock will turn to a Volatile Bull-Struggler stock if there is at the most 20 percentage point increment in its TOP.No: The expense of the company whose stock is classified as “Rain Maker” is approximately $230 (nearest to $5).d)Yes: There are exactly two stocks that cannot be classified per both Stock Valuation and Profit Generation Capability classifications.Yes: Among the four given stocks, the Volatile Bear-Struggler stock will turn to a Volatile Bull-Struggler stock if there is at the most 20 percentage point increment in its TOP.Yes: The expense of the company whose stock is classified as “Rain Maker” is approximately $230 (nearest to $5).Correct answer is option 'A'. Can you explain this answer? for GMAT 2025 is part of GMAT preparation. The Question and answers have been prepared according to the GMAT exam syllabus. Information about STOCKS CLASSIFICATIONHoly Faith Broking Company classifies stocks of listed companies on the basis of two parameters.Stock Valuation ClassificationTOP– ‘TOP’ is termed as the mean of daily values of “highest percentage increase in the stock price over last day’s closing price” over a period.BOTTOM- ‘BOTTOM’ is termed as the mean of daily values of “lowest percentage increase or highest percent decrease, as the case may be, in the stock price over last day’s closing price” over a period.Stable Cow- A stock whose TOP is less than 15% and BOTTOM is more than 8%.Volatile Bull- A stock whose TOP is more than 30% and BOTTOM is less than 10%.Volatile Bear- A stock whose TOP is less than 10% and BOTTOM is less than -10%.Profit Generation CapabilityStruggler- A stock whose issuing company makes a profit between 1% to 5% of its revenue. (Both inclusive)Dessert- A stock whose issuing company makes a loss of more than 1% of its revenue.Rain Maker- A stock whose issuing company makes a profit of more than 10% of its revenue.CHARTSThe two graphs given below are for stocks of companies A, B, C, and D. The first graph shows mean of daily values of “percentage increase or decrease in the stock price over last day’s closing price” over a period. The second graph represents revenue to expense ratio (data label on the bubble) & revenue for these four companies. Centers of bubbles represent revenue of the company (on Y axis).For each of the following statements, select yes if, based on the given information, it must be true, otherwise select no.a)No: There are exactly two stocks that cannot be classified per both Stock Valuation and Profit Generation Capability classifications.No: Among the four given stocks, the Volatile Bear-Struggler stock will turn to a Volatile Bull-Struggler stock if there is at the most 20 percentage point increment in its TOP.No: The expense of the company whose stock is classified as “Rain Maker” is approximately $230 (nearest to $5).b)Yes: There are exactly two stocks that cannot be classified per both Stock Valuation and Profit Generation Capability classifications.No: Among the four given stocks, the Volatile Bear-Struggler stock will turn to a Volatile Bull-Struggler stock if there is at the most 20 percentage point increment in its TOP.No: The expense of the company whose stock is classified as “Rain Maker” is approximately $230 (nearest to $5).c)Yes: There are exactly two stocks that cannot be classified per both Stock Valuation and Profit Generation Capability classifications.Yes: Among the four given stocks, the Volatile Bear-Struggler stock will turn to a Volatile Bull-Struggler stock if there is at the most 20 percentage point increment in its TOP.No: The expense of the company whose stock is classified as “Rain Maker” is approximately $230 (nearest to $5).d)Yes: There are exactly two stocks that cannot be classified per both Stock Valuation and Profit Generation Capability classifications.Yes: Among the four given stocks, the Volatile Bear-Struggler stock will turn to a Volatile Bull-Struggler stock if there is at the most 20 percentage point increment in its TOP.Yes: The expense of the company whose stock is classified as “Rain Maker” is approximately $230 (nearest to $5).Correct answer is option 'A'. Can you explain this answer? covers all topics & solutions for GMAT 2025 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for STOCKS CLASSIFICATIONHoly Faith Broking Company classifies stocks of listed companies on the basis of two parameters.Stock Valuation ClassificationTOP– ‘TOP’ is termed as the mean of daily values of “highest percentage increase in the stock price over last day’s closing price” over a period.BOTTOM- ‘BOTTOM’ is termed as the mean of daily values of “lowest percentage increase or highest percent decrease, as the case may be, in the stock price over last day’s closing price” over a period.Stable Cow- A stock whose TOP is less than 15% and BOTTOM is more than 8%.Volatile Bull- A stock whose TOP is more than 30% and BOTTOM is less than 10%.Volatile Bear- A stock whose TOP is less than 10% and BOTTOM is less than -10%.Profit Generation CapabilityStruggler- A stock whose issuing company makes a profit between 1% to 5% of its revenue. (Both inclusive)Dessert- A stock whose issuing company makes a loss of more than 1% of its revenue.Rain Maker- A stock whose issuing company makes a profit of more than 10% of its revenue.CHARTSThe two graphs given below are for stocks of companies A, B, C, and D. The first graph shows mean of daily values of “percentage increase or decrease in the stock price over last day’s closing price” over a period. The second graph represents revenue to expense ratio (data label on the bubble) & revenue for these four companies. Centers of bubbles represent revenue of the company (on Y axis).For each of the following statements, select yes if, based on the given information, it must be true, otherwise select no.a)No: There are exactly two stocks that cannot be classified per both Stock Valuation and Profit Generation Capability classifications.No: Among the four given stocks, the Volatile Bear-Struggler stock will turn to a Volatile Bull-Struggler stock if there is at the most 20 percentage point increment in its TOP.No: The expense of the company whose stock is classified as “Rain Maker” is approximately $230 (nearest to $5).b)Yes: There are exactly two stocks that cannot be classified per both Stock Valuation and Profit Generation Capability classifications.No: Among the four given stocks, the Volatile Bear-Struggler stock will turn to a Volatile Bull-Struggler stock if there is at the most 20 percentage point increment in its TOP.No: The expense of the company whose stock is classified as “Rain Maker” is approximately $230 (nearest to $5).c)Yes: There are exactly two stocks that cannot be classified per both Stock Valuation and Profit Generation Capability classifications.Yes: Among the four given stocks, the Volatile Bear-Struggler stock will turn to a Volatile Bull-Struggler stock if there is at the most 20 percentage point increment in its TOP.No: The expense of the company whose stock is classified as “Rain Maker” is approximately $230 (nearest to $5).d)Yes: There are exactly two stocks that cannot be classified per both Stock Valuation and Profit Generation Capability classifications.Yes: Among the four given stocks, the Volatile Bear-Struggler stock will turn to a Volatile Bull-Struggler stock if there is at the most 20 percentage point increment in its TOP.Yes: The expense of the company whose stock is classified as “Rain Maker” is approximately $230 (nearest to $5).Correct answer is option 'A'. Can you explain this answer?.

Solutions for STOCKS CLASSIFICATIONHoly Faith Broking Company classifies stocks of listed companies on the basis of two parameters.Stock Valuation ClassificationTOP– ‘TOP’ is termed as the mean of daily values of “highest percentage increase in the stock price over last day’s closing price” over a period.BOTTOM- ‘BOTTOM’ is termed as the mean of daily values of “lowest percentage increase or highest percent decrease, as the case may be, in the stock price over last day’s closing price” over a period.Stable Cow- A stock whose TOP is less than 15% and BOTTOM is more than 8%.Volatile Bull- A stock whose TOP is more than 30% and BOTTOM is less than 10%.Volatile Bear- A stock whose TOP is less than 10% and BOTTOM is less than -10%.Profit Generation CapabilityStruggler- A stock whose issuing company makes a profit between 1% to 5% of its revenue. (Both inclusive)Dessert- A stock whose issuing company makes a loss of more than 1% of its revenue.Rain Maker- A stock whose issuing company makes a profit of more than 10% of its revenue.CHARTSThe two graphs given below are for stocks of companies A, B, C, and D. The first graph shows mean of daily values of “percentage increase or decrease in the stock price over last day’s closing price” over a period. The second graph represents revenue to expense ratio (data label on the bubble) & revenue for these four companies. Centers of bubbles represent revenue of the company (on Y axis).For each of the following statements, select yes if, based on the given information, it must be true, otherwise select no.a)No: There are exactly two stocks that cannot be classified per both Stock Valuation and Profit Generation Capability classifications.No: Among the four given stocks, the Volatile Bear-Struggler stock will turn to a Volatile Bull-Struggler stock if there is at the most 20 percentage point increment in its TOP.No: The expense of the company whose stock is classified as “Rain Maker” is approximately $230 (nearest to $5).b)Yes: There are exactly two stocks that cannot be classified per both Stock Valuation and Profit Generation Capability classifications.No: Among the four given stocks, the Volatile Bear-Struggler stock will turn to a Volatile Bull-Struggler stock if there is at the most 20 percentage point increment in its TOP.No: The expense of the company whose stock is classified as “Rain Maker” is approximately $230 (nearest to $5).c)Yes: There are exactly two stocks that cannot be classified per both Stock Valuation and Profit Generation Capability classifications.Yes: Among the four given stocks, the Volatile Bear-Struggler stock will turn to a Volatile Bull-Struggler stock if there is at the most 20 percentage point increment in its TOP.No: The expense of the company whose stock is classified as “Rain Maker” is approximately $230 (nearest to $5).d)Yes: There are exactly two stocks that cannot be classified per both Stock Valuation and Profit Generation Capability classifications.Yes: Among the four given stocks, the Volatile Bear-Struggler stock will turn to a Volatile Bull-Struggler stock if there is at the most 20 percentage point increment in its TOP.Yes: The expense of the company whose stock is classified as “Rain Maker” is approximately $230 (nearest to $5).Correct answer is option 'A'. Can you explain this answer? in English & in Hindi are available as part of our courses for GMAT.

Download more important topics, notes, lectures and mock test series for GMAT Exam by signing up for free.

Here you can find the meaning of STOCKS CLASSIFICATIONHoly Faith Broking Company classifies stocks of listed companies on the basis of two parameters.Stock Valuation ClassificationTOP– ‘TOP’ is termed as the mean of daily values of “highest percentage increase in the stock price over last day’s closing price” over a period.BOTTOM- ‘BOTTOM’ is termed as the mean of daily values of “lowest percentage increase or highest percent decrease, as the case may be, in the stock price over last day’s closing price” over a period.Stable Cow- A stock whose TOP is less than 15% and BOTTOM is more than 8%.Volatile Bull- A stock whose TOP is more than 30% and BOTTOM is less than 10%.Volatile Bear- A stock whose TOP is less than 10% and BOTTOM is less than -10%.Profit Generation CapabilityStruggler- A stock whose issuing company makes a profit between 1% to 5% of its revenue. (Both inclusive)Dessert- A stock whose issuing company makes a loss of more than 1% of its revenue.Rain Maker- A stock whose issuing company makes a profit of more than 10% of its revenue.CHARTSThe two graphs given below are for stocks of companies A, B, C, and D. The first graph shows mean of daily values of “percentage increase or decrease in the stock price over last day’s closing price” over a period. The second graph represents revenue to expense ratio (data label on the bubble) & revenue for these four companies. Centers of bubbles represent revenue of the company (on Y axis).For each of the following statements, select yes if, based on the given information, it must be true, otherwise select no.a)No: There are exactly two stocks that cannot be classified per both Stock Valuation and Profit Generation Capability classifications.No: Among the four given stocks, the Volatile Bear-Struggler stock will turn to a Volatile Bull-Struggler stock if there is at the most 20 percentage point increment in its TOP.No: The expense of the company whose stock is classified as “Rain Maker” is approximately $230 (nearest to $5).b)Yes: There are exactly two stocks that cannot be classified per both Stock Valuation and Profit Generation Capability classifications.No: Among the four given stocks, the Volatile Bear-Struggler stock will turn to a Volatile Bull-Struggler stock if there is at the most 20 percentage point increment in its TOP.No: The expense of the company whose stock is classified as “Rain Maker” is approximately $230 (nearest to $5).c)Yes: There are exactly two stocks that cannot be classified per both Stock Valuation and Profit Generation Capability classifications.Yes: Among the four given stocks, the Volatile Bear-Struggler stock will turn to a Volatile Bull-Struggler stock if there is at the most 20 percentage point increment in its TOP.No: The expense of the company whose stock is classified as “Rain Maker” is approximately $230 (nearest to $5).d)Yes: There are exactly two stocks that cannot be classified per both Stock Valuation and Profit Generation Capability classifications.Yes: Among the four given stocks, the Volatile Bear-Struggler stock will turn to a Volatile Bull-Struggler stock if there is at the most 20 percentage point increment in its TOP.Yes: The expense of the company whose stock is classified as “Rain Maker” is approximately $230 (nearest to $5).Correct answer is option 'A'. Can you explain this answer? defined & explained in the simplest way possible. Besides giving the explanation of

STOCKS CLASSIFICATIONHoly Faith Broking Company classifies stocks of listed companies on the basis of two parameters.Stock Valuation ClassificationTOP– ‘TOP’ is termed as the mean of daily values of “highest percentage increase in the stock price over last day’s closing price” over a period.BOTTOM- ‘BOTTOM’ is termed as the mean of daily values of “lowest percentage increase or highest percent decrease, as the case may be, in the stock price over last day’s closing price” over a period.Stable Cow- A stock whose TOP is less than 15% and BOTTOM is more than 8%.Volatile Bull- A stock whose TOP is more than 30% and BOTTOM is less than 10%.Volatile Bear- A stock whose TOP is less than 10% and BOTTOM is less than -10%.Profit Generation CapabilityStruggler- A stock whose issuing company makes a profit between 1% to 5% of its revenue. (Both inclusive)Dessert- A stock whose issuing company makes a loss of more than 1% of its revenue.Rain Maker- A stock whose issuing company makes a profit of more than 10% of its revenue.CHARTSThe two graphs given below are for stocks of companies A, B, C, and D. The first graph shows mean of daily values of “percentage increase or decrease in the stock price over last day’s closing price” over a period. The second graph represents revenue to expense ratio (data label on the bubble) & revenue for these four companies. Centers of bubbles represent revenue of the company (on Y axis).For each of the following statements, select yes if, based on the given information, it must be true, otherwise select no.a)No: There are exactly two stocks that cannot be classified per both Stock Valuation and Profit Generation Capability classifications.No: Among the four given stocks, the Volatile Bear-Struggler stock will turn to a Volatile Bull-Struggler stock if there is at the most 20 percentage point increment in its TOP.No: The expense of the company whose stock is classified as “Rain Maker” is approximately $230 (nearest to $5).b)Yes: There are exactly two stocks that cannot be classified per both Stock Valuation and Profit Generation Capability classifications.No: Among the four given stocks, the Volatile Bear-Struggler stock will turn to a Volatile Bull-Struggler stock if there is at the most 20 percentage point increment in its TOP.No: The expense of the company whose stock is classified as “Rain Maker” is approximately $230 (nearest to $5).c)Yes: There are exactly two stocks that cannot be classified per both Stock Valuation and Profit Generation Capability classifications.Yes: Among the four given stocks, the Volatile Bear-Struggler stock will turn to a Volatile Bull-Struggler stock if there is at the most 20 percentage point increment in its TOP.No: The expense of the company whose stock is classified as “Rain Maker” is approximately $230 (nearest to $5).d)Yes: There are exactly two stocks that cannot be classified per both Stock Valuation and Profit Generation Capability classifications.Yes: Among the four given stocks, the Volatile Bear-Struggler stock will turn to a Volatile Bull-Struggler stock if there is at the most 20 percentage point increment in its TOP.Yes: The expense of the company whose stock is classified as “Rain Maker” is approximately $230 (nearest to $5).Correct answer is option 'A'. Can you explain this answer?, a detailed solution for STOCKS CLASSIFICATIONHoly Faith Broking Company classifies stocks of listed companies on the basis of two parameters.Stock Valuation ClassificationTOP– ‘TOP’ is termed as the mean of daily values of “highest percentage increase in the stock price over last day’s closing price” over a period.BOTTOM- ‘BOTTOM’ is termed as the mean of daily values of “lowest percentage increase or highest percent decrease, as the case may be, in the stock price over last day’s closing price” over a period.Stable Cow- A stock whose TOP is less than 15% and BOTTOM is more than 8%.Volatile Bull- A stock whose TOP is more than 30% and BOTTOM is less than 10%.Volatile Bear- A stock whose TOP is less than 10% and BOTTOM is less than -10%.Profit Generation CapabilityStruggler- A stock whose issuing company makes a profit between 1% to 5% of its revenue. (Both inclusive)Dessert- A stock whose issuing company makes a loss of more than 1% of its revenue.Rain Maker- A stock whose issuing company makes a profit of more than 10% of its revenue.CHARTSThe two graphs given below are for stocks of companies A, B, C, and D. The first graph shows mean of daily values of “percentage increase or decrease in the stock price over last day’s closing price” over a period. The second graph represents revenue to expense ratio (data label on the bubble) & revenue for these four companies. Centers of bubbles represent revenue of the company (on Y axis).For each of the following statements, select yes if, based on the given information, it must be true, otherwise select no.a)No: There are exactly two stocks that cannot be classified per both Stock Valuation and Profit Generation Capability classifications.No: Among the four given stocks, the Volatile Bear-Struggler stock will turn to a Volatile Bull-Struggler stock if there is at the most 20 percentage point increment in its TOP.No: The expense of the company whose stock is classified as “Rain Maker” is approximately $230 (nearest to $5).b)Yes: There are exactly two stocks that cannot be classified per both Stock Valuation and Profit Generation Capability classifications.No: Among the four given stocks, the Volatile Bear-Struggler stock will turn to a Volatile Bull-Struggler stock if there is at the most 20 percentage point increment in its TOP.No: The expense of the company whose stock is classified as “Rain Maker” is approximately $230 (nearest to $5).c)Yes: There are exactly two stocks that cannot be classified per both Stock Valuation and Profit Generation Capability classifications.Yes: Among the four given stocks, the Volatile Bear-Struggler stock will turn to a Volatile Bull-Struggler stock if there is at the most 20 percentage point increment in its TOP.No: The expense of the company whose stock is classified as “Rain Maker” is approximately $230 (nearest to $5).d)Yes: There are exactly two stocks that cannot be classified per both Stock Valuation and Profit Generation Capability classifications.Yes: Among the four given stocks, the Volatile Bear-Struggler stock will turn to a Volatile Bull-Struggler stock if there is at the most 20 percentage point increment in its TOP.Yes: The expense of the company whose stock is classified as “Rain Maker” is approximately $230 (nearest to $5).Correct answer is option 'A'. Can you explain this answer? has been provided alongside types of STOCKS CLASSIFICATIONHoly Faith Broking Company classifies stocks of listed companies on the basis of two parameters.Stock Valuation ClassificationTOP– ‘TOP’ is termed as the mean of daily values of “highest percentage increase in the stock price over last day’s closing price” over a period.BOTTOM- ‘BOTTOM’ is termed as the mean of daily values of “lowest percentage increase or highest percent decrease, as the case may be, in the stock price over last day’s closing price” over a period.Stable Cow- A stock whose TOP is less than 15% and BOTTOM is more than 8%.Volatile Bull- A stock whose TOP is more than 30% and BOTTOM is less than 10%.Volatile Bear- A stock whose TOP is less than 10% and BOTTOM is less than -10%.Profit Generation CapabilityStruggler- A stock whose issuing company makes a profit between 1% to 5% of its revenue. (Both inclusive)Dessert- A stock whose issuing company makes a loss of more than 1% of its revenue.Rain Maker- A stock whose issuing company makes a profit of more than 10% of its revenue.CHARTSThe two graphs given below are for stocks of companies A, B, C, and D. The first graph shows mean of daily values of “percentage increase or decrease in the stock price over last day’s closing price” over a period. The second graph represents revenue to expense ratio (data label on the bubble) & revenue for these four companies. Centers of bubbles represent revenue of the company (on Y axis).For each of the following statements, select yes if, based on the given information, it must be true, otherwise select no.a)No: There are exactly two stocks that cannot be classified per both Stock Valuation and Profit Generation Capability classifications.No: Among the four given stocks, the Volatile Bear-Struggler stock will turn to a Volatile Bull-Struggler stock if there is at the most 20 percentage point increment in its TOP.No: The expense of the company whose stock is classified as “Rain Maker” is approximately $230 (nearest to $5).b)Yes: There are exactly two stocks that cannot be classified per both Stock Valuation and Profit Generation Capability classifications.No: Among the four given stocks, the Volatile Bear-Struggler stock will turn to a Volatile Bull-Struggler stock if there is at the most 20 percentage point increment in its TOP.No: The expense of the company whose stock is classified as “Rain Maker” is approximately $230 (nearest to $5).c)Yes: There are exactly two stocks that cannot be classified per both Stock Valuation and Profit Generation Capability classifications.Yes: Among the four given stocks, the Volatile Bear-Struggler stock will turn to a Volatile Bull-Struggler stock if there is at the most 20 percentage point increment in its TOP.No: The expense of the company whose stock is classified as “Rain Maker” is approximately $230 (nearest to $5).d)Yes: There are exactly two stocks that cannot be classified per both Stock Valuation and Profit Generation Capability classifications.Yes: Among the four given stocks, the Volatile Bear-Struggler stock will turn to a Volatile Bull-Struggler stock if there is at the most 20 percentage point increment in its TOP.Yes: The expense of the company whose stock is classified as “Rain Maker” is approximately $230 (nearest to $5).Correct answer is option 'A'. Can you explain this answer? theory, EduRev gives you an

ample number of questions to practice STOCKS CLASSIFICATIONHoly Faith Broking Company classifies stocks of listed companies on the basis of two parameters.Stock Valuation ClassificationTOP– ‘TOP’ is termed as the mean of daily values of “highest percentage increase in the stock price over last day’s closing price” over a period.BOTTOM- ‘BOTTOM’ is termed as the mean of daily values of “lowest percentage increase or highest percent decrease, as the case may be, in the stock price over last day’s closing price” over a period.Stable Cow- A stock whose TOP is less than 15% and BOTTOM is more than 8%.Volatile Bull- A stock whose TOP is more than 30% and BOTTOM is less than 10%.Volatile Bear- A stock whose TOP is less than 10% and BOTTOM is less than -10%.Profit Generation CapabilityStruggler- A stock whose issuing company makes a profit between 1% to 5% of its revenue. (Both inclusive)Dessert- A stock whose issuing company makes a loss of more than 1% of its revenue.Rain Maker- A stock whose issuing company makes a profit of more than 10% of its revenue.CHARTSThe two graphs given below are for stocks of companies A, B, C, and D. The first graph shows mean of daily values of “percentage increase or decrease in the stock price over last day’s closing price” over a period. The second graph represents revenue to expense ratio (data label on the bubble) & revenue for these four companies. Centers of bubbles represent revenue of the company (on Y axis).For each of the following statements, select yes if, based on the given information, it must be true, otherwise select no.a)No: There are exactly two stocks that cannot be classified per both Stock Valuation and Profit Generation Capability classifications.No: Among the four given stocks, the Volatile Bear-Struggler stock will turn to a Volatile Bull-Struggler stock if there is at the most 20 percentage point increment in its TOP.No: The expense of the company whose stock is classified as “Rain Maker” is approximately $230 (nearest to $5).b)Yes: There are exactly two stocks that cannot be classified per both Stock Valuation and Profit Generation Capability classifications.No: Among the four given stocks, the Volatile Bear-Struggler stock will turn to a Volatile Bull-Struggler stock if there is at the most 20 percentage point increment in its TOP.No: The expense of the company whose stock is classified as “Rain Maker” is approximately $230 (nearest to $5).c)Yes: There are exactly two stocks that cannot be classified per both Stock Valuation and Profit Generation Capability classifications.Yes: Among the four given stocks, the Volatile Bear-Struggler stock will turn to a Volatile Bull-Struggler stock if there is at the most 20 percentage point increment in its TOP.No: The expense of the company whose stock is classified as “Rain Maker” is approximately $230 (nearest to $5).d)Yes: There are exactly two stocks that cannot be classified per both Stock Valuation and Profit Generation Capability classifications.Yes: Among the four given stocks, the Volatile Bear-Struggler stock will turn to a Volatile Bull-Struggler stock if there is at the most 20 percentage point increment in its TOP.Yes: The expense of the company whose stock is classified as “Rain Maker” is approximately $230 (nearest to $5).Correct answer is option 'A'. Can you explain this answer? tests, examples and also practice GMAT tests.

|

Explore Courses for GMAT exam

|

|

Signup for Free!

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.