Class 11 Exam > Class 11 Questions > Goods given as charity 5,000 journal entry?

Start Learning for Free

Goods given as charity 5,000 journal entry?

Most Upvoted Answer

Goods given as charity 5,000 journal entry?

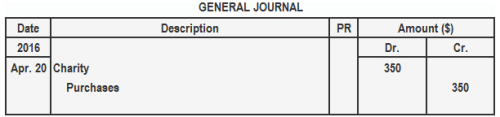

Journal Entry

When goods are given as charity, charity account is debited and purchases account is credited. The journal entry is given below:

Example

On April 20, 2016, the Metro Trading Company gives away merchandise amounting to $350 to a charitable institution.

Required: How would the company record above transaction in its general journal?

Solution

Community Answer

Goods given as charity 5,000 journal entry?

Goods Given as Charity - Journal Entry

When a business donates goods as charity, it is important to record this transaction in the accounting records. This allows for proper documentation and tracking of the charitable contributions. The journal entry to record goods given as charity involves debiting the "Charitable Contributions" expense account and crediting the appropriate inventory account.

Step-by-Step Explanation:

- Identify the Nature of the Goods: Determine the type of goods that are being donated. This could range from inventory items to supplies or other assets.

- Determine the Fair Value: Assess the fair value of the goods being donated. This is the amount that the goods could be sold for in their current condition.

- Create the Journal Entry: Prepare the journal entry to record the donation:

Journal Entry:

| Account | Debit | Credit |

|---|---|---|

| Charitable Contributions | XXXX | |

| Inventory | XXXX |

Explanation:

- Charitable Contributions: Debit the "Charitable Contributions" expense account for the fair value of the goods donated. This represents the amount of the donation and will be reported as an expense on the income statement.

- Inventory: Credit the appropriate inventory account to reduce the quantity and value of the goods in inventory. This recognizes the fact that the goods have been donated and are no longer available for sale.

It is important to consult with a professional accountant or tax advisor to ensure compliance with any specific regulations or reporting requirements related to charitable contributions. Additionally, proper documentation, such as receipts or acknowledgment letters from the charitable organization, should be maintained for audit and tax purposes.

By properly recording goods given as charity, businesses can accurately reflect their contribution to the community and receive any applicable tax benefits.

|

Explore Courses for Class 11 exam

|

|

Question Description

Goods given as charity 5,000 journal entry? for Class 11 2025 is part of Class 11 preparation. The Question and answers have been prepared according to the Class 11 exam syllabus. Information about Goods given as charity 5,000 journal entry? covers all topics & solutions for Class 11 2025 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for Goods given as charity 5,000 journal entry?.

Goods given as charity 5,000 journal entry? for Class 11 2025 is part of Class 11 preparation. The Question and answers have been prepared according to the Class 11 exam syllabus. Information about Goods given as charity 5,000 journal entry? covers all topics & solutions for Class 11 2025 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for Goods given as charity 5,000 journal entry?.

Solutions for Goods given as charity 5,000 journal entry? in English & in Hindi are available as part of our courses for Class 11.

Download more important topics, notes, lectures and mock test series for Class 11 Exam by signing up for free.

Here you can find the meaning of Goods given as charity 5,000 journal entry? defined & explained in the simplest way possible. Besides giving the explanation of

Goods given as charity 5,000 journal entry?, a detailed solution for Goods given as charity 5,000 journal entry? has been provided alongside types of Goods given as charity 5,000 journal entry? theory, EduRev gives you an

ample number of questions to practice Goods given as charity 5,000 journal entry? tests, examples and also practice Class 11 tests.

|

Explore Courses for Class 11 exam

|

|

Signup for Free!

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.